The 3rd edition of the DEEP Startup Ecosystem Conference that took place on 23-24 June, 2022 in Ludwigsburg (Stuttgart), Germany co-organized by the City of Ludwigsburg and Innovation Network brought together 90 international and local startup ecosystem leaders, innovation managers, governments, and entrepreneurs from 22 countries to stimulate discussions around the current startup ecosystems development topics and challenges, such as impact, corporate innovation, investments, and emerging ecosystems.

Is It Time to Go East? How CEE Hubs are Building Thriving Startup Ecosystems

Eastern European countries are overtaking the “old” European economies in the West in terms of innovativeness and digitalization. VC investments cumulatively reached over 4bn EUR in 2021 in CEE states with Estonia leading the whole Europe in terms of VC investments per capita. Yet, we still see that corporate innovation scouts and investors from Western Europe are shying away to fully include CEE into their scouting routine. During the conference we came together with experts from CEE to learn about the opportunities and challenges to the full integration of CEE into Europe’s startup market.

Top 5 Facts

- Since 2016, the CEE region had a growth of 11.6% in IT outsourcing into the CEE region.

- The number of exits in CEE region rose despite shrinkage in the European region.

- In the last 10 years CEE region outperformed the EU average consistently in terms of GDP growth.

- Estonia and Romania are overtaking the “old” European economies in the West in terms of innovativeness and digitalization.

- Warsaw, Bucharest and Vilnius have become home to more meetups than other CEE cities.

CEE countries are growing much faster than the rest of Europe in terms of VC funding. VC Investments in OECD members of the CEE region (all CEE members except Albania and Croatia ) increased from USD 50 million in 2009 to USD 370 million in 2020, while VC investments for European OECD members grew from 4.5 billion USD to almost 14 billion in the same timeframe. This shows that CEE grew 3x as fast as the rest of Europe (640% vs. 211%), (OECD, 2020). Poznan, Riga, Vilnius and Tallinn have become the leading cities in terms of growth in the CEE region since 2019. At the same time, (overall) investments in select CEE cities increased from approx. € 150 million in 2016 to € 2.5 billion in 2021, an increase of 1566%.

Approximately 10,000 CEE companies raised funds in the last five years. The companies which attracted most investments were from such sectors as ICT, consumer goods and services, Business products and services and biotech and healthcare. These sectors are particularly strong in the CEE region and continuously raised more funding in the recent years.

The CEE region shows stronger recovery than expected according to estimates, with 4.8% economic growth estimated in 2022. Real GDP growth is forecast to be 4-5% for CEE over the next 2 years. While there are no quantitative startup ecosystem growth estimates, the current trend of startup growth exceeding economic growth proportions could plausibly continue.

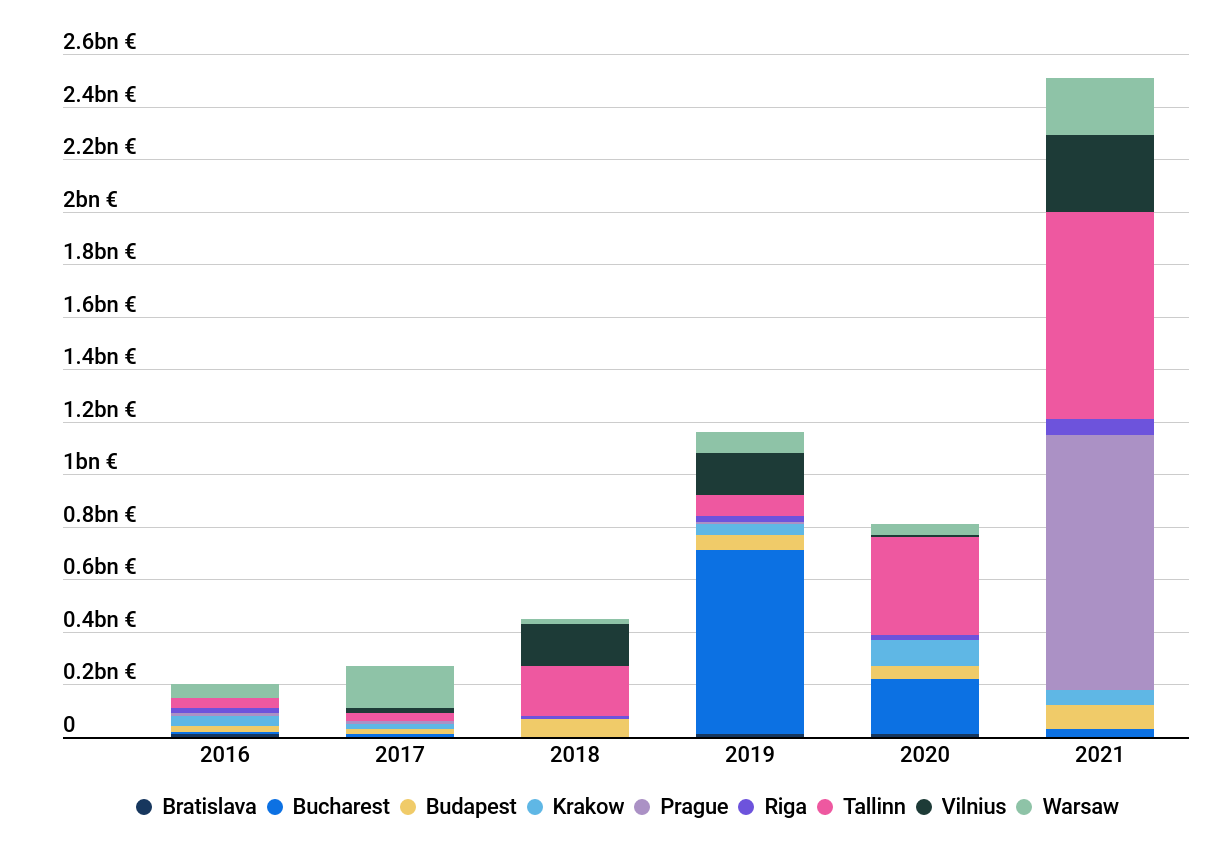

Timeline of investments in CEE cities

Investments in selected CEE cities 2016-2021

The attention and interest in CEE cities led to more than double the comparative growth in investment. Tallinn and Prague were two prominent cities where startups raised a considerable amount of investments in 2021. In just 5 years, investments increased from approx. € 150 million in 2016 to € 2,5 billion in 2021, an increase of 1566%.

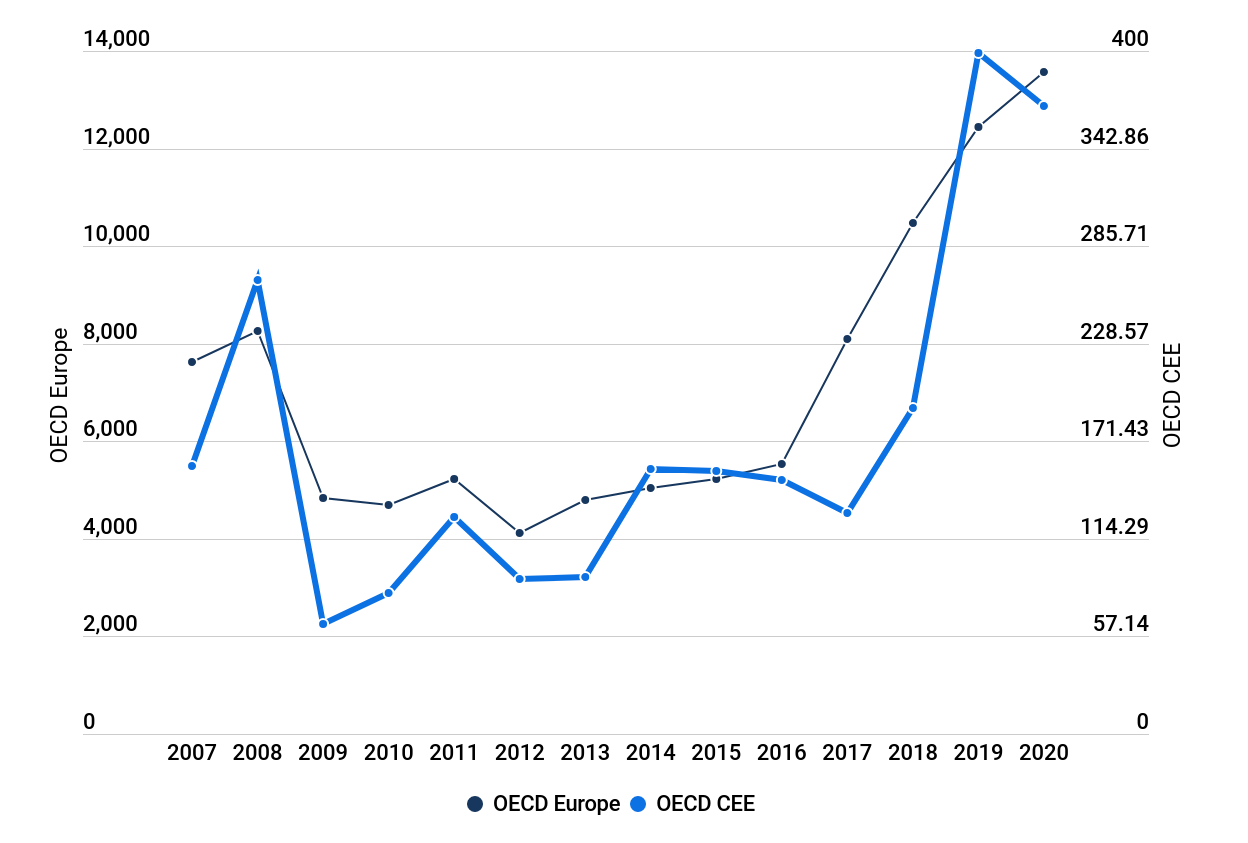

VC Investment 2007-2020 (in mn USD)

VC Investments in OECD members of the CEE region (all CEE members except Albania and Croatia) increased from 50 million USD in 2009 to 370 million USD in 2020, while VC investments for European OECD members grew from 4,5 billion USD to almost 14 billion in the same time frame. The percentual increase is 640% and 211%, respectively.

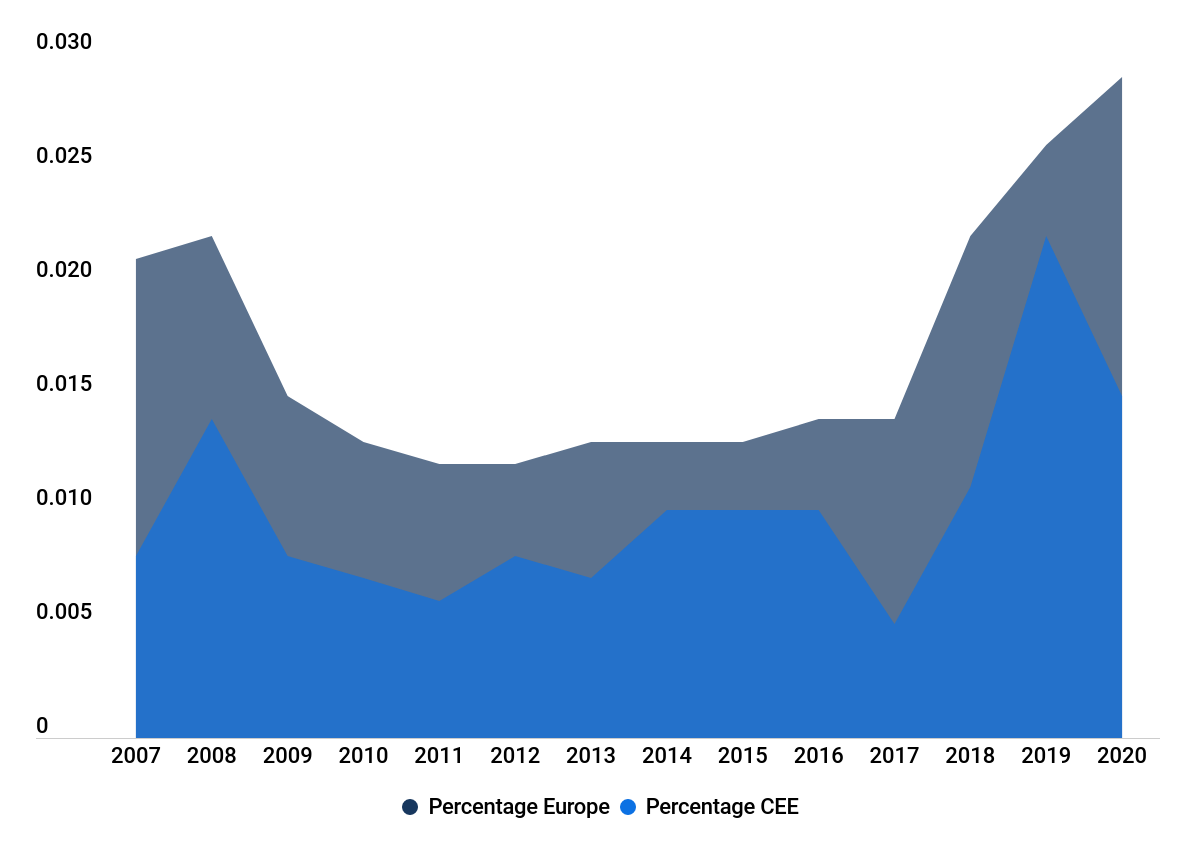

VC Investments as percentage of GDP

In terms of percentage of GDP, VC investment in CEE countries increased from 0,008% in 2007 to 0,015% in 2020, while the same number grew from 0,02% to 0,029% for European OECD countries during the same time. The percentage of VC investments of the GDP grew by 87,5% for CEE, and by 45% for all European OECD countries.

Find the full publication here.

Join Our Community!

Become the DEEP member and amongst various opportunities, you would receive:

- Free access to all upcoming DEEP Ecosystems Conferences

- Tracking of >8,000 startups in the Heatmap Startup List (4x per year)

- Annual list of Who is Who of European Ecosystem Leaders

- Full Access to Premium Publications and Analysis on Ecosystem Trends

- Quarterly Expert sessions with our Data Experts on Ecosystem Trends in your City compared to Europe

- Tailor-made Data Extracts and Analysis on Demand

You can also find our strategic recommendations from previous editions in the following Strategy White Papers:

- From Farm to Fork – Revolutionizing Food Systems

- Business Angels’ Changed Role in Today’s Startup World

- Cultural & Creative Industries After COVID-19

- Female Entrepreneurship Support

- Scaling Startups Globally

- World in Crisis: Where Will Venture Capital Go

- Tech Saves the World: Instruments to Tackle Societal Problems

About DEEP Ecosystems

DEEP Ecosystems is a global community of startup ecosystem builders, dedicated to supporting grassroot innovation projects and fostering interconnectivity among startup ecosystems globally.

We believe in entrepreneurs to build ecosystems that solve the biggest challenges of our times. We help to grow and connect ecosystems through our DEEP Startup Ecosystem Accelerator (DEEPSEA), with over 200 alumni since 2018, one of the biggest ecosystem builder communities in the world that gathers twice a year in our DEEP Startup Ecosystem Conference. Both are backed by our data-driven insights and reports on startup ecosystems through our open Startup Heatmap Europe data platform.