The 4th edition of the DEEP Startup Ecosystem Conference has been hosted by the National Innovation Agency of Hungary and Obuda University in Budapest, on 5-6 July 2023. The 2-day event brought together over a hundred international and local startup ecosystem leaders, innovation managers, governments, and entrepreneurs from 30 countries to discuss developments and challenges of startup ecosystems around the world.

The conference featured 4 data-driven workshops, aka DEEP Dives, on raising funds & diversity, university startup accelerators, impact ecosystems & investing and communities of future.

Leyla Karaha, Founder at Your Y Network and DEEP Startup Ecosystem Accelerator alumna, has facilitated one of the workshops on “Raising Funds and Diversity: Financing Gender Gap.” In this article she shares her insights on this topic and conclusions after the DEEP Dive discussion.

We have seen so many initiatives trying to solve this problem over the years without moving the needle. Together with workshop participants, we have explored what are the roots of this problem and how we can make a sustainable impact.

Problem overview

Worldwide 70% of female entrepreneurs don’t have access to financial services and there is a $1.7 Trillion financing gap for women entrepreneurs. Research proves that women-founded businesses deliver a higher return to investors and catalyzing them could add up to $5 trillion to the global economy annually.

Let’s look at the pipeline in Europe

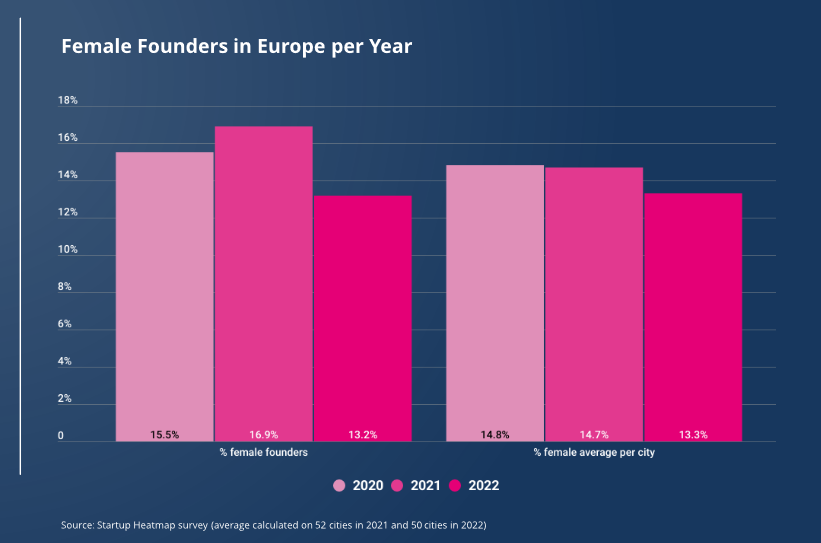

In 2022, the share of female founders among the total founders is 13.2%. It represents a drop of -3.7% in comparison to 2021. Also the average of female founders per city amounts to 13.3%, decreasing by 1.4%. Therefore, the female founders in Europe are not even close to the gender equality of 50%.

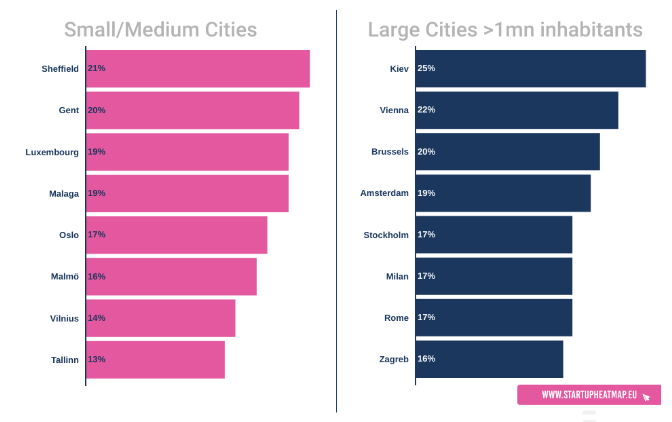

The highest share of female founders in Europe is registered in Kiev (25.5%), followed by Vienna (22.7%) and Brussels (20.6%) for large ecosystems. Regarding small-medium ecosystems, Sheffield (21.3%), Gent (20%) and Luxembourg (19.9%) are the top 3 cities in Europe for women entrepreneurs. Diversity in the founders’ population is a key factor for openness to new and multifaceted ideas. And the presence of female founders in startups is a good indicator for a more inclusive and gender-balanced society.

Let’s go beyond gender

In the UK, 31% of the total funding is raised by white founders with an elite university education between 2009 and 2019. Whereas only 9.3% of investments have been raised by non-white founders (Extend Ventures, 2019). Therefore, non-elite educational background and ethnicity are a barrier to VCs’ investments.

It shows that race and elite education play a big role in who gets funded. Because most of VCs they went to these elite universities. And at the end of the day, we all have unconscious bias. We trust and like people who look like us and connect with people who went to the same school.

The numbers for women of colours is even way low (Diversity Beyond Gender).

Other key factors that impact access to finance for female founders:

- Limited access to formal financial services: Women, particularly in developing countries, often face barriers in accessing formal financial institutions such as banks. They may lack the necessary identification documents, collateral, or financial literacy to engage with these institutions. This limited access restricts their ability to secure loans, open bank accounts, or invest in financial products.

- Gender bias and discrimination: Gender bias and discrimination play a significant role in the financing gender gap. Women may face biased lending practices or discriminatory policies that result in limited access to credit or capital. Additionally, societal norms and stereotypes can shape attitudes towards women’s financial capabilities, leading to unequal treatment and opportunities.

- Gender pay gap and occupational segregation: The gender pay gap and occupational segregation contribute to the financing gender gap. Women, on average, earn less than men for comparable work. This disparity reduces their ability to save, invest, and build wealth, limiting their financial opportunities.

- Cultural and social norms: Societal expectations and cultural norms can reinforce traditional gender roles and expectations, limiting women’s economic opportunities. These norms may discourage women from pursuing entrepreneurial ventures, accessing financial resources, or participating in the formal financial sector.

However, we are not letting these obstacles stop us from raising funds. We just have to be smart about it and have some strategy.

Strategies to mitigate the gender financing gap

Addressing the gender gap in startup financing requires collaborative efforts from various stakeholders. Some promising strategies include:

- Raising Awareness and Changing Perceptions: Initiatives aimed at dispelling gender biases and stereotypes surrounding entrepreneurship are vital. Encouraging media portrayals of successful women entrepreneurs, highlighting their achievements, and promoting diversity in entrepreneurial ecosystems can help challenge prevailing perceptions.

- Providing Mentorship and Networking Opportunities: Mentorship programs that connect experienced entrepreneurs, both male and female, with aspiring women entrepreneurs can provide guidance, advice, and access to networks and resources. Establishing women-focused entrepreneurship networks can also foster peer support, collaboration, and opportunities for knowledge sharing.

- Encouraging Gender Diversity in Investment Decision-Making: Encouraging and supporting the inclusion of more women in venture capital firms, angel investor networks, and accelerator programs can help mitigate gender biases in funding decisions. Increasing diversity in these decision-making bodies brings a broader range of perspectives and reduces unconscious bias.

- Creating Gender-Inclusive Funding Mechanisms: Financial institutions and investors should develop gender-inclusive funding mechanisms that acknowledge and address the unique challenges faced by women entrepreneurs. This may include providing flexible collateral requirements, creating funds specifically dedicated to supporting women-led ventures, and implementing gender-lens investing strategies.

- Fostering Financial Literacy and Entrepreneurial Education: Equipping women entrepreneurs with financial literacy skills and entrepreneurial education can enhance their ability to navigate funding opportunities, negotiate investment terms, and develop robust business models. This can be achieved through training programs, workshops, and educational initiatives targeting women entrepreneurs at different stages of their startup journey.

- Gender-Inclusive Venture Capital Funds: These funds are specifically dedicated to investing in startups founded or led by women. They provide capital and support to women entrepreneurs who may face barriers in accessing traditional funding sources.

- Gender Lens Investing: This approach involves considering gender-related factors when making investment decisions. Investors use gender lens investing to identify and support startups that prioritize gender equality, have a positive impact on women, or serve women-centric markets.

Examples of bridging the financing gender gap

Building on the mentioned strategy of gender-inclusive funding mechanisms, some examples emerge:

- TymeBank, a South African lender launched in 2015 that operates a national network of kiosks in grocery stores and supermarkets. The aim is to find people who may want to open a bank account but feel hindered in some way from doing so. In South Africa, that group invariably comprises a lot of women.

- Ellevest, a robo-advisor investment platform and financial literacy program primarily for women, founded by Sallie Krawcheck, a former Wall Street executive.

- The Asian Development Bank’s (ADB) “Women Finance Exchange,” an initiative aimed at helping significantly expand access to financing for women and women-led businesses around the world.

Join Our Community!

DEEP conducts in depth analysis of each workshop topic and produces Strategy briefs with data insights. Join our community to access our premium publications including the strategy brief for the raising funds & diversity.

Become the DEEP member and amongst various opportunities, you would receive:

- Free access to the upcoming DEEP Ecosystems Conference

- Tracking of >12,000 startups in the Heatmap Startup List (4x per year)

- Full Access to Startup Heatmap database, Premium Publications and Analysis on Ecosystem Trends

You can also find our strategic recommendations from previous editions in the following Strategy White Papers:

About DEEP Ecosystems

DEEP Ecosystems is a global community of startup ecosystem builders, dedicated to supporting grassroot innovation projects and fostering interconnectivity among startup ecosystems globally.

We believe in entrepreneurs to build ecosystems that solve the biggest challenges of our times. We help to grow and connect ecosystems through our DEEP Startup Ecosystem Accelerator (DEEPSEA), with over 250 alumni since 2018, and one of the biggest ecosystem builder communities in the world that gathers at our DEEP Startup Ecosystem Conference. Both are backed by our data-driven insights and reports on startup ecosystems through our open Startup Heatmap Europe data platform.