Any type of movement – inbound or outbound – can be good for startup hubs. To name just a few benefits: inbound founders bring talent, creativity, diversity, economic impact, and jobs. Founders who decide to leave their home turf, on the other hand, stay in touch with the place they left, and share knowledge and experience from abroad. Their mobility can help build new connections, opening new channels for the exchange of ideas, capital, and people. We find that mobility is a two-way-street, and every founder “lost” can be a connection gained.

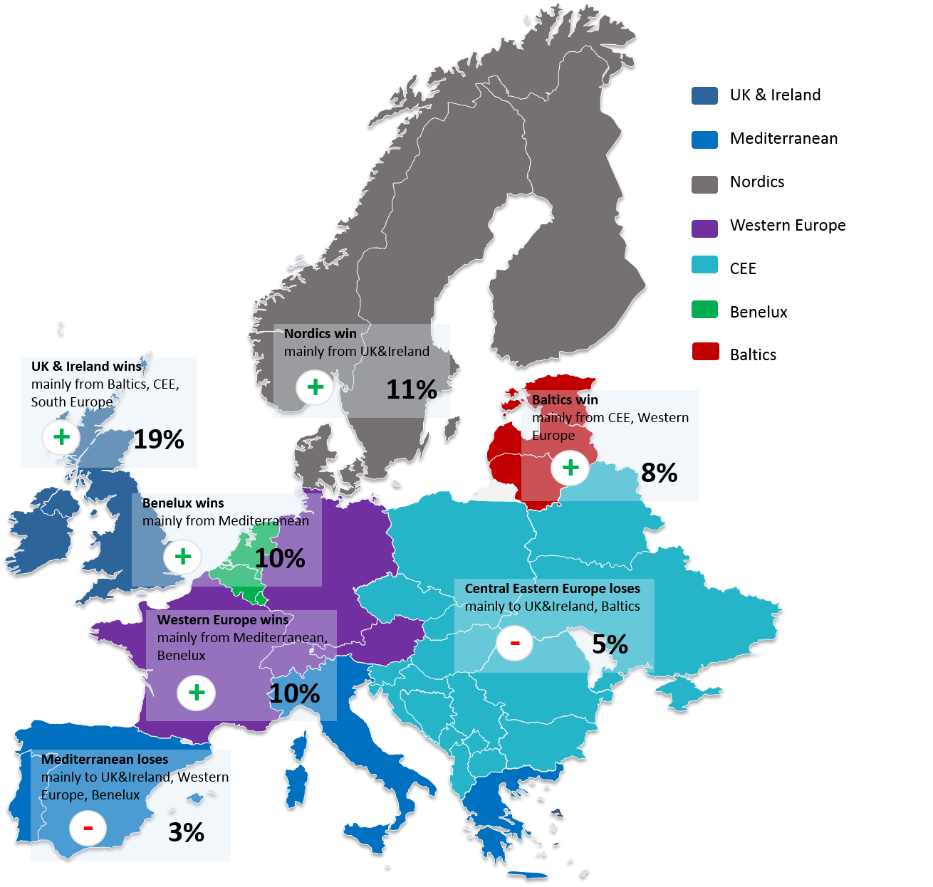

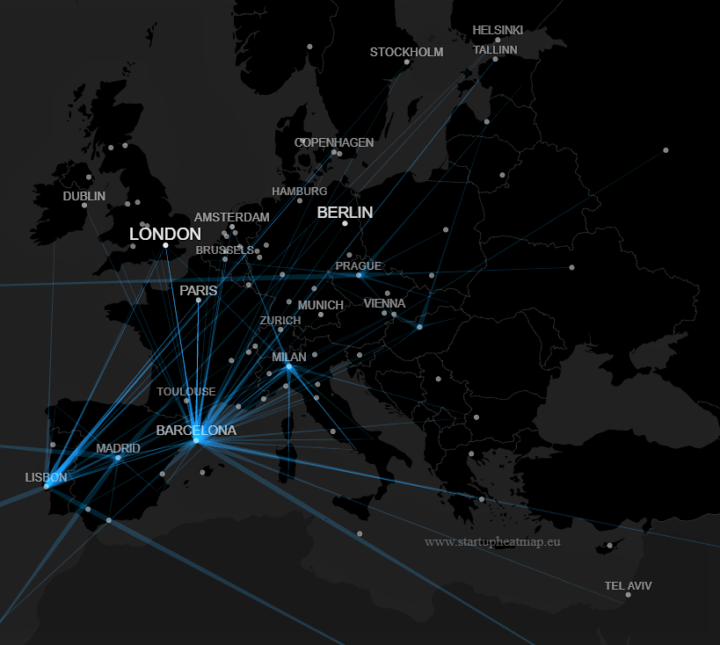

Keeping that in mind, let’s have a closer look at a few outstanding examples for the mobility of founders. Overall, 21% of European founders in our 2017 survey moved across borders to startup their businesses. To better visualize this, we tracked the net inflow and outflow of founders across several European regions:

We found that two regions have a net outflow of founders: The Mediterranean with -3% and Central and Eastern Europe (CEE) with -5%. Other regions have net inflows ranging from +8% (Baltics) to +19% (UK & Ireland). A closer look at select Mediterranean and CEE countries reveals the following trends:

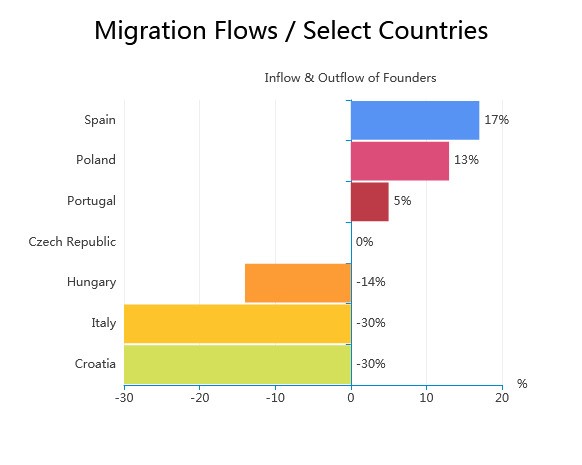

Spain and Portugal with 17% and 5% net inflows of founders perform better than the trend in the Mediterranean region might suggest. Italy on the other hand, with a net outflow of -30%, is largely responsible for the overall negative trend in that region.

The Czech Republic, which has an even balance sheet in its founder migration, and Poland, with +13% net inflow, perform better than the CEE region on average. Meanwhile, Hungary and Croatia are prime examples of “founder-exporting countries”.

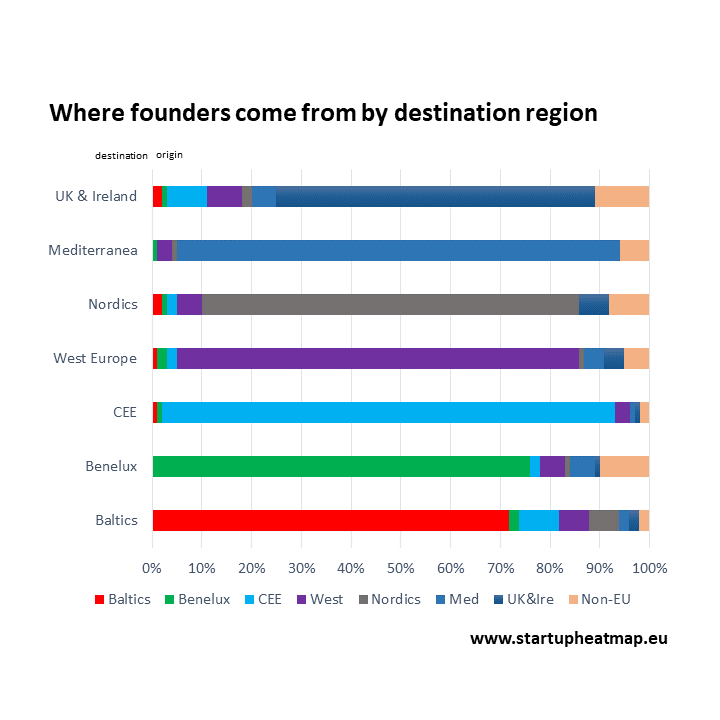

Are these results the definitive benchmark for the attractiveness of startup hubs? We don’t think that’s necessarily true. In fact, what our migration data shows mostly refers to the status quo: At some point of their lives, our founders have made their very own decision on whether to move or stay. So, we simply asked them where they are originally from and where they are currently based. This resulted in the current diversity of startup founders in the European regions:

It is therefore interesting to look at implications for future trends. As cross border movement is common amongst a large proportion of startup founders, the perceived attractiveness of certain locations can be pivotal towards inducing movement. To learn more, we asked: If you could begin all over again, where would you like to startup?

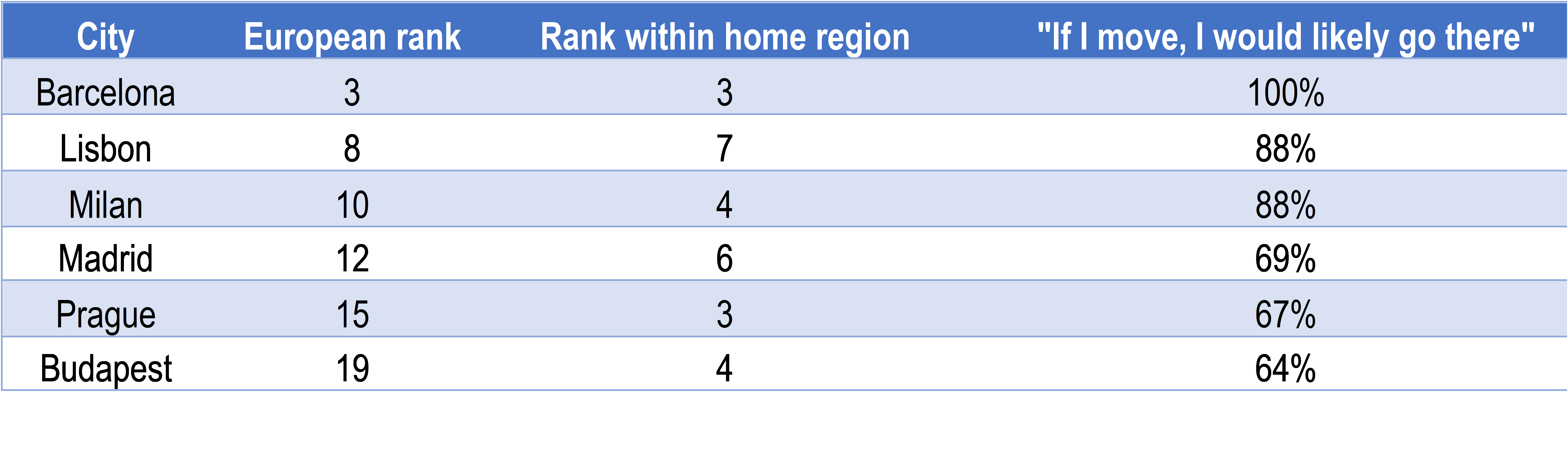

We also asked our startup founders to do a reality check on their preferred startup location: Founders had the choice to rate their preference based on how much they would consider moving there, rating from 1 (not likely at all) to 10 points (extremely likely). With these answers, we are able to identify the attractiveness of some of Europe’s startup hubs – from the perspective of startup founders.

Looking at the Mediterranean and CEE region, six cities from those regions make it to our top 20. Here is how they perform:

These six startup hubs outshine their regional competitors. They are attractive on the European level (especially Barcelona, Lisbon, and Milan), and importantly, are attractive to startup founders within their home regions. Italy and Hungary may experience an exodus of startup founders more generally, but regional champions Milan and Budapest retain a strong appeal. Even though the Mediterranean and CEE regions may lose talent overall, cities like Barcelona, Lisbon, Milan, Madrid, Prague, and Budapest function as beacons that are likely to attract even more startup founders in the future.

There is no concept of complete failure in Space Waves Game, because each loss is an opportunity for you to better understand your own rhythm, speed and limits.

To be honest, I had to find Doxycycline fast and discovered this amazing site. You can get treatment fast securely. If you have UTI, this is the best place. Express delivery to USA. Link: https://antibioticsexpress.xyz/#. Highly recommended.

Recently, I had to find Ciprofloxacin urgently and found a reliable pharmacy. It allows you to get treatment fast securely. For treating sinusitis, this is the best place. Express delivery to USA. Visit here: view details. Good luck.

п»їActually, I needed Doxycycline fast and stumbled upon Antibiotics Express. It allows you to purchase generics online securely. If you have UTI, check this shop. Discreet packaging to USA. More info: order amoxicillin online. Get well soon.

Aktual Pin Up giriş ünvanını axtaranlar, doğru yerdesiniz. İşlək link vasitəsilə hesabınıza girin və qazanmağa başlayın. Xoş gəldin bonusu sizi gözləyir. Keçid: https://pinupaz.jp.net/# Pin Up online qazancınız bol olsun.

Merhaba arkadaşlar, ödeme yapan casino siteleri bulmak istiyorsanız, hazırladığımız listeye kesinlikle göz atın. Lisanslı firmaları ve bonusları sizin için inceledik. Güvenli oyun için doğru adres: https://cassiteleri.us.org/# en iyi casino siteleri iyi kazançlar.

Selam, güvenilir casino siteleri arıyorsanız, bu siteye mutlaka göz atın. Lisanslı firmaları ve bonusları sizin için listeledik. Güvenli oyun için doğru adres: canlı casino siteleri bol şanslar.

Salamlar, əgər siz etibarlı kazino axtarırsınızsa, məsləhətdir ki, Pin Up saytını yoxlayasınız. Yüksək əmsallar və sürətli ödənişlər burada mövcuddur. İndi qoşulun və bonus qazanın. Sayta keçmək üçün link: Pinup uğurlar hər kəsə!

Yeni Pin Up giriş ünvanını axtarırsınızsa, doğru yerdesiniz. İşlək link vasitəsilə hesabınıza girin və qazanmağa başlayın. Xoş gəldin bonusu sizi gözləyir. Keçid: ətraflı məlumat hamıya bol şans.

Hər vaxtınız xeyir, siz də keyfiyyətli kazino axtarırsınızsa, məsləhətdir ki, Pin Up saytını yoxlayasınız. Canlı oyunlar və rahat pul çıxarışı burada mövcuddur. İndi qoşulun və bonus qazanın. Daxil olmaq üçün link: https://pinupaz.jp.net/# Pin Up yüklə uğurlar hər kəsə!

п»їSalam Gacor, cari situs slot yang hoki? Coba main di Bonaslot. RTP Live tertinggi hari ini dan terbukti membayar. Isi saldo bisa pakai Pulsa tanpa potongan. Daftar sekarang: п»їslot gacor hari ini semoga maxwin.

Info slot gacor hari ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Situs ini anti rungkad dan resmi. Promo menarik menanti anda. Akses link: https://bonaslotind.us.com/# daftar situs judi slot raih kemanangan.

Info slot gacor malam ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Website ini anti rungkad dan resmi. Promo menarik menanti anda. Kunjungi: п»їhttps://bonaslotind.us.com/# bonaslotind.us.com raih kemanangan.

Aktual Pin Up giriş ünvanını axtarırsınızsa, doğru yerdesiniz. İşlək link vasitəsilə hesabınıza girin və qazanmağa başlayın. Pulsuz fırlanmalar sizi gözləyir. Keçid: https://pinupaz.jp.net/# Pin-Up Casino qazancınız bol olsun.

Situs Bonaslot adalah agen judi slot online terpercaya di Indonesia. Banyak member sudah mendapatkan Maxwin sensasional disini. Transaksi super cepat hanya hitungan menit. Situs resmi п»їhttps://bonaslotind.us.com/# Bonaslot link alternatif jangan sampai ketinggalan.

Salam Gacor, lagi nyari situs slot yang mudah menang? Coba main di Bonaslot. RTP Live tertinggi hari ini dan terbukti membayar. Isi saldo bisa pakai Pulsa tanpa potongan. Daftar sekarang: situs slot resmi salam jackpot.

Aktual Pin Up giriş ünvanını axtaranlar, doğru yerdesiniz. Bloklanmayan link vasitəsilə qeydiyyat olun və oynamağa başlayın. Xoş gəldin bonusu sizi gözləyir. Keçid: rəsmi sayt uğurlar.

Bu sene popüler olan casino siteleri hangileri? Cevabı web sitemizde mevcuttur. Bedava bahis veren siteleri ve yeni adres linklerini paylaşıyoruz. İncelemek için https://cassiteleri.us.org/# en iyi casino siteleri fırsatı kaçırmayın.

Yeni Pin Up giriş ünvanını axtaranlar, doğru yerdesiniz. Bloklanmayan link vasitəsilə hesabınıza girin və oynamağa başlayın. Pulsuz fırlanmalar sizi gözləyir. Keçid: Pin Up rəsmi sayt qazancınız bol olsun.

HÉ™r vaxtınız xeyir, É™gÉ™r siz etibarlı kazino axtarırsınızsa, mütlÉ™q Pin Up saytını yoxlayasınız. Æn yaxşı slotlar vÉ™ rahat pul çıxarışı burada mövcuddur. Qeydiyyatdan keçin vÉ™ bonus qazanın. Oynamaq üçün link: Pinup uÄŸurlar hÉ™r kÉ™sÉ™!

Bonaslot adalah bandar judi slot online nomor 1 di Indonesia. Banyak member sudah merasakan Jackpot sensasional disini. Proses depo WD super cepat kilat. Link alternatif п»їdaftar situs judi slot jangan sampai ketinggalan.

Hər vaxtınız xeyir, siz də etibarlı kazino axtarırsınızsa, mütləq Pin Up saytını yoxlayasınız. Canlı oyunlar və sürətli ödənişlər burada mövcuddur. İndi qoşulun və bonus qazanın. Sayta keçmək üçün link: https://pinupaz.jp.net/# rəsmi sayt uğurlar hər kəsə!

Pin-Up AZ ölkəmizdə ən populyar kazino saytıdır. Burada minlərlə oyun və canlı dilerlər var. Pulu kartınıza tez köçürürlər. Proqramı də var, telefondan oynamaq çox rahatdır. Giriş linki Pin-Up Casino yoxlayın.

Situs Bonaslot adalah agen judi slot online nomor 1 di Indonesia. Banyak member sudah mendapatkan Jackpot sensasional disini. Proses depo WD super cepat kilat. Link alternatif п»їBonaslot login jangan sampai ketinggalan.

Online slot oynamak isteyenler için rehber niteliğinde bir site: buraya tıkla Hangi site güvenilir diye düşünmeyin. Onaylı bahis siteleri listesi ile rahatça oynayın. Detaylar linkte.

Salamlar, əgər siz keyfiyyətli kazino axtarırsınızsa, mütləq Pin Up saytını yoxlayasınız. Yüksək əmsallar və rahat pul çıxarışı burada mövcuddur. İndi qoşulun və ilk depozit bonusunu götürün. Daxil olmaq üçün link: Pin Up AZ uğurlar hər kəsə!

Online slot oynamak isteyenler için kılavuz niteliğinde bir site: güvenilir casino siteleri Nerede oynanır diye düşünmeyin. Editörlerimizin seçtiği bahis siteleri listesi ile rahatça oynayın. Detaylar linkte.

Info slot gacor hari ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Situs ini anti rungkad dan aman. Promo menarik menanti anda. Akses link: п»їhttps://bonaslotind.us.com/# Bonaslot login dan menangkan.

Bu sene popüler olan casino siteleri hangileri? Cevabı web sitemizde mevcuttur. Deneme bonusu veren siteleri ve güncel giriş linklerini paylaşıyoruz. Hemen tıklayın casino siteleri fırsatı kaçırmayın.

Selamlar, ödeme yapan casino siteleri arıyorsanız, hazırladığımız listeye mutlaka göz atın. En iyi firmaları ve bonusları sizin için inceledik. Dolandırılmamak için doğru adres: buraya tıkla bol şanslar.

Halo Slotter, cari situs slot yang mudah menang? Rekomendasi kami adalah Bonaslot. RTP Live tertinggi hari ini dan pasti bayar. Isi saldo bisa pakai Dana tanpa potongan. Daftar sekarang: https://bonaslotind.us.com/# Bonaslot link alternatif semoga maxwin.

Yeni Pin Up giriş ünvanını axtarırsınızsa, doğru yerdesiniz. Bloklanmayan link vasitəsilə hesabınıza girin və oynamağa başlayın. Xoş gəldin bonusu sizi gözləyir. Keçid: Pin Up online qazancınız bol olsun.

Pin-Up AZ Azərbaycanda ən populyar kazino saytıdır. Burada çoxlu slotlar və Aviator var. Pulu kartınıza tez köçürürlər. Mobil tətbiqi də var, telefondan oynamaq çox rahatdır. Giriş linki Pin Up yüklə baxın.

Bu sene en Г§ok kazandД±ran casino siteleri hangileri? CevabД± platformumuzda mevcuttur. Bedava bahis veren siteleri ve yeni adres linklerini paylaЕџД±yoruz. Hemen tД±klayД±n п»їcasino siteleri 2026 kazanmaya baЕџlayД±n.

Online slot oynamak isteyenler için rehber niteliğinde bir site: cassiteleri.us.org Hangi site güvenilir diye düşünmeyin. Onaylı casino siteleri listesi ile sorunsuz oynayın. Detaylar linkte.

Salamlar, əgər siz keyfiyyətli kazino axtarırsınızsa, məsləhətdir ki, Pin Up saytını yoxlayasınız. Ən yaxşı slotlar və sürətli ödənişlər burada mövcuddur. İndi qoşulun və ilk depozit bonusunu götürün. Daxil olmaq üçün link: https://pinupaz.jp.net/# ətraflı məlumat uğurlar hər kəsə!

Bocoran slot gacor hari ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Website ini gampang menang dan aman. Bonus new member menanti anda. Kunjungi: https://bonaslotind.us.com/# Bonaslot dan menangkan.

Canlı casino oynamak isteyenler için kılavuz niteliğinde bir site: casino siteleri 2026 Nerede oynanır diye düşünmeyin. Editörlerimizin seçtiği casino siteleri listesi ile sorunsuz oynayın. Tüm liste linkte.

Yeni Pin Up giriş ünvanını axtarırsınızsa, bura baxa bilərsiniz. İşlək link vasitəsilə hesabınıza girin və oynamağa başlayın. Xoş gəldin bonusu sizi gözləyir. Keçid: Pinup hamıya bol şans.

Info slot gacor malam ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Situs ini gampang menang dan aman. Bonus new member menanti anda. Kunjungi: п»їhttps://bonaslotind.us.com/# Bonaslot login raih kemanangan.

Online slot oynamak isteyenler için rehber niteliğinde bir site: casino siteleri 2026 Hangi site güvenilir diye düşünmeyin. Onaylı casino siteleri listesi ile sorunsuz oynayın. Detaylar linkte.

Bocoran slot gacor malam ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Website ini gampang menang dan aman. Bonus new member menanti anda. Kunjungi: Bonaslot login dan menangkan.

Hər vaxtınız xeyir, əgər siz keyfiyyətli kazino axtarırsınızsa, məsləhətdir ki, Pin Up saytını yoxlayasınız. Canlı oyunlar və rahat pul çıxarışı burada mövcuddur. İndi qoşulun və ilk depozit bonusunu götürün. Daxil olmaq üçün link: Pin-Up Casino uğurlar hər kəsə!

Selam, güvenilir casino siteleri arıyorsanız, bu siteye mutlaka göz atın. En iyi firmaları ve bonusları sizin için listeledik. Dolandırılmamak için doğru adres: türkçe casino siteleri bol şanslar.

Aktual Pin Up giriş ünvanını axtarırsınızsa, bura baxa bilərsiniz. İşlək link vasitəsilə qeydiyyat olun və qazanmağa başlayın. Xoş gəldin bonusu sizi gözləyir. Keçid: https://pinupaz.jp.net/# Pin Up yüklə hamıya bol şans.

Hər vaxtınız xeyir, siz də etibarlı kazino axtarırsınızsa, məsləhətdir ki, Pin Up saytını yoxlayasınız. Canlı oyunlar və sürətli ödənişlər burada mövcuddur. İndi qoşulun və ilk depozit bonusunu götürün. Sayta keçmək üçün link: https://pinupaz.jp.net/# burada uğurlar hər kəsə!

Aktual Pin Up giriş ünvanını axtarırsınızsa, doğru yerdesiniz. İşlək link vasitəsilə qeydiyyat olun və oynamağa başlayın. Pulsuz fırlanmalar sizi gözləyir. Keçid: Pin Up AZ qazancınız bol olsun.

Info slot gacor hari ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Situs ini gampang menang dan resmi. Promo menarik menanti anda. Kunjungi: п»їklik disini dan menangkan.

Merhaba arkadaşlar, güvenilir casino siteleri arıyorsanız, bu siteye kesinlikle göz atın. En iyi firmaları ve fırsatları sizin için inceledik. Dolandırılmamak için doğru adres: türkçe casino siteleri bol şanslar.

Bonaslot adalah bandar judi slot online nomor 1 di Indonesia. Banyak member sudah mendapatkan Jackpot sensasional disini. Proses depo WD super cepat kilat. Link alternatif п»їslot gacor hari ini gas sekarang bosku.

Bonaslot adalah bandar judi slot online terpercaya di Indonesia. Banyak member sudah mendapatkan Maxwin sensasional disini. Proses depo WD super cepat kilat. Situs resmi https://bonaslotind.us.com/# Bonaslot login jangan sampai ketinggalan.

Bocoran slot gacor hari ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Website ini gampang menang dan resmi. Bonus new member menanti anda. Kunjungi: https://bonaslotind.us.com/# klik disini raih kemanangan.

Bonaslot adalah agen judi slot online terpercaya di Indonesia. Banyak member sudah merasakan Jackpot sensasional disini. Proses depo WD super cepat hanya hitungan menit. Situs resmi п»їslot gacor jangan sampai ketinggalan.

Selam, ödeme yapan casino siteleri arıyorsanız, hazırladığımız listeye mutlaka göz atın. En iyi firmaları ve bonusları sizin için listeledik. Dolandırılmamak için doğru adres: güvenilir casino siteleri bol şanslar.

Pin Up Casino Azərbaycanda ən populyar platformadır. Burada minlərlə oyun və Aviator var. Qazancı kartınıza anında köçürürlər. Mobil tətbiqi də var, telefondan oynamaq çox rahatdır. Rəsmi sayt pinupaz.jp.net baxın.

Halo Slotter, cari situs slot yang hoki? Rekomendasi kami adalah Bonaslot. Winrate tertinggi hari ini dan pasti bayar. Deposit bisa pakai OVO tanpa potongan. Login disini: Bonaslot daftar salam jackpot.

Bonaslot adalah agen judi slot online terpercaya di Indonesia. Banyak member sudah merasakan Maxwin sensasional disini. Transaksi super cepat kilat. Situs resmi п»їhttps://bonaslotind.us.com/# Bonaslot rtp gas sekarang bosku.

2026 yılında popüler olan casino siteleri hangileri? Cevabı platformumuzda mevcuttur. Deneme bonusu veren siteleri ve yeni adres linklerini paylaşıyoruz. İncelemek için buraya tıkla fırsatı kaçırmayın.

Pin-Up AZ Azərbaycanda ən populyar kazino saytıdır. Burada minlərlə oyun və canlı dilerlər var. Qazancı kartınıza tez köçürürlər. Proqramı də var, telefondan oynamaq çox rahatdır. Giriş linki Pin Up Azerbaijan tövsiyə edirəm.

Bonaslot adalah agen judi slot online nomor 1 di Indonesia. Banyak member sudah merasakan Jackpot sensasional disini. Proses depo WD super cepat kilat. Link alternatif п»їbonaslotind.us.com gas sekarang bosku.

Selamlar, ödeme yapan casino siteleri bulmak istiyorsanız, hazırladığımız listeye kesinlikle göz atın. En iyi firmaları ve fırsatları sizin için inceledik. Güvenli oyun için doğru adres: casino siteleri iyi kazançlar.

Bocoran slot gacor hari ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Website ini gampang menang dan aman. Bonus new member menanti anda. Kunjungi: klik disini dan menangkan.

Hi all, I just stumbled upon a useful website to save on Rx. If you want to buy cheap antibiotics without prescription, this store is the best place. It has fast shipping guaranteed. More info here: https://indiapharm.in.net/#. Best regards.

Hey everyone, I just found an excellent online drugstore to order medications cheaply. If you need antibiotics, this site is very good. Fast delivery plus no script needed. Link here: https://onlinepharm.jp.net/#. Have a good one.

Hey there, I recently discovered a great website where you can buy pills securely. If you need safe pharmacy delivery, this site is highly recommended. Secure shipping plus it is very affordable. Visit here: check availability. Warmly.

Hey there, I just found a trusted resource for affordable pills. If you are tired of high prices and need cheap antibiotics, this store is the best option. Fast shipping and very reliable. Link is here: pharm.mex.com. Good luck!

Greetings, I recently discovered the best Indian pharmacy for cheap meds. If you want to buy ED meds at factory prices, this store is highly recommended. You get fast shipping guaranteed. More info here: indian pharmacy online. Best regards.

Hello, I recently discovered a reliable website where you can buy generics cheaply. If you are looking for cheap meds, OnlinePharm is highly recommended. Great prices and huge selection. See for yourself: https://onlinepharm.jp.net/#. Hope this helps!

Hello everyone, I recently came across a great Mexican pharmacy for cheap meds. For those seeking and need generic drugs, Pharm Mex is the best option. Fast shipping and secure. Visit here: cheap antibiotics mexico. Best of luck.

Hi guys, Just now ran into a reliable resource to buy medication. For those seeking and need meds from Mexico, this site is worth checking out. Fast shipping plus very reliable. Visit here: Pharm Mex Store. Have a good one.

Hey everyone, I wanted to share a reliable website to order prescription drugs hassle-free. If you need cheap meds, this site is very good. Fast delivery and huge selection. Check it out: online pharmacy no prescription. Have a good one.

Greetings, I wanted to share a useful website for purchasing medications cheaply. If you need cheap meds, this store is highly recommended. Secure shipping plus huge selection. Visit here: buy meds online. I hope you find what you need.

Hi all, Just now discovered the best online drugstore to save on Rx. For those looking for generic pills at factory prices, IndiaPharm is worth checking. It has secure delivery guaranteed. More info here: safe indian pharmacy. Hope it helps.

Greetings, Lately ran into an awesome Mexican pharmacy for cheap meds. For those seeking and need meds from Mexico, Pharm Mex is worth checking out. Fast shipping plus it is safe. Check it out: read more. Best wishes.

Hi, I just found a reliable website where you can buy prescription drugs cheaply. If you need antibiotics, this store is worth a look. Great prices and it is very affordable. Check it out: international pharmacy online. Good luck!

To be honest, Lately came across the best website for affordable pills. If you need ED meds cheaply, this store is very reliable. They offer secure delivery guaranteed. More info here: visit website. Good luck.

Hey there, I wanted to share a great international pharmacy to order pills cheaply. For those who need safe pharmacy delivery, this store is very good. Secure shipping plus huge selection. Check it out: https://onlinepharm.jp.net/#. Cya.

Hi, I recently discovered an excellent international pharmacy to order pills online. For those who need antibiotics, OnlinePharm is highly recommended. Fast delivery and huge selection. Visit here: https://onlinepharm.jp.net/#. Thank you.

To be honest, Just now discovered a useful source from India to save on Rx. For those looking for generic pills safely, IndiaPharm is highly recommended. They offer lowest prices guaranteed. Visit here: https://indiapharm.in.net/#. Best regards.

Hi guys, I just found a reliable online source to save on Rx. If you are tired of high prices and need affordable prescriptions, Pharm Mex is the best option. Fast shipping plus very reliable. Link is here: https://pharm.mex.com/#. Hope this helps!

Hello, To be honest, I found an excellent online drugstore to order pills securely. For those who need safe pharmacy delivery, this store is highly recommended. Secure shipping plus no script needed. Check it out: this site. Kind regards.

Hey there, I recently discovered a great Mexican pharmacy to save on Rx. If you want to save money and need affordable prescriptions, Pharm Mex is a game changer. Great prices and very reliable. Visit here: read more. Sincerely.

Hello, I recently discovered a great online drugstore for purchasing prescription drugs online. For those who need antibiotics, this store is worth a look. Fast delivery and it is very affordable. Visit here: OnlinePharm. Best wishes.

To be honest, I just came across a great source from India to buy generics. If you want to buy medicines from India at factory prices, IndiaPharm is the best place. It has secure delivery to USA. Visit here: https://indiapharm.in.net/#. Hope it helps.

Greetings, I just found an excellent online drugstore where you can buy generics hassle-free. If you need cheap meds, this store is very good. Great prices plus huge selection. Check it out: this site. Stay safe.

Greetings, I just came across an amazing online drugstore for affordable pills. If you want to buy ED meds at factory prices, IndiaPharm is worth checking. They offer secure delivery to USA. Check it out: https://indiapharm.in.net/#. Good luck.

Hi, To be honest, I found a great online drugstore to order pills hassle-free. If you need safe pharmacy delivery, this store is the best choice. Secure shipping and huge selection. Link here: https://onlinepharm.jp.net/#. I hope you find what you need.

Greetings, To be honest, I found a great international pharmacy where you can buy prescription drugs cheaply. If you need safe pharmacy delivery, this site is very good. Great prices plus no script needed. Visit here: check availability. Good luck with everything.

Hello everyone, I just came across a trusted Mexican pharmacy to save on Rx. For those seeking and need cheap antibiotics, this site is highly recommended. Fast shipping and secure. Visit here: pharm.mex.com. Hope this helps!

Greetings, I recently discovered an excellent source for meds to order pills online. If you are looking for safe pharmacy delivery, OnlinePharm is worth a look. Fast delivery plus huge selection. See for yourself: Online Pharm Store. Have a great week.

Hi guys, I just ran into a great Mexican pharmacy for affordable pills. For those seeking and need generic drugs, Pharm Mex is worth checking out. No prescription needed plus very reliable. Check it out: https://pharm.mex.com/#. Good luck!

Greetings, To be honest, I found a great online drugstore to order generics cheaply. For those who need antibiotics, this site is worth a look. They ship globally plus it is very affordable. See for yourself: Online Pharm Store. Cheers.

Hello, Lately found a useful website to save on Rx. If you want to buy medicines from India safely, this site is highly recommended. You get secure delivery worldwide. Visit here: https://indiapharm.in.net/#. Cheers.

Hey there, I wanted to share an excellent source for meds for purchasing medications hassle-free. If you need safe pharmacy delivery, OnlinePharm is the best choice. They ship globally plus it is very affordable. Link here: https://onlinepharm.jp.net/#. Stay healthy.

Hi all, I recently found the best Indian pharmacy to buy generics. If you want to buy cheap antibiotics without prescription, this site is very reliable. They offer fast shipping worldwide. Visit here: read more. Best regards.

Hey guys, Lately discovered a useful online drugstore to save on Rx. For those looking for ED meds without prescription, this store is worth checking. It has secure delivery worldwide. More info here: indian pharmacy. Cheers.

Hey everyone, I wanted to share a useful international pharmacy where you can buy medications cheaply. If you are looking for no prescription drugs, this site is the best choice. Fast delivery and no script needed. Visit here: click here. Warmly.

Hey there, I just found an excellent international pharmacy where you can buy pills securely. For those who need safe pharmacy delivery, this store is worth a look. Fast delivery plus huge selection. See for yourself: Online Pharm Store. Best regards.

To be honest, Just now discovered a great source from India to buy generics. If you need ED meds at factory prices, this store is worth checking. You get wholesale rates to USA. Take a look: https://indiapharm.in.net/#. Cheers.

Hello, I recently came across a useful online drugstore to save on Rx. If you want to buy generic pills cheaply, IndiaPharm is highly recommended. They offer secure delivery to USA. Take a look: order medicines from india. Cheers.

Hey everyone, I just found a great website for purchasing medications cheaply. For those who need safe pharmacy delivery, this site is the best choice. Secure shipping plus it is very affordable. Link here: onlinepharm.jp.net. Best of luck.

Hi, I recently discovered a useful source for meds to order medications online. For those who need antibiotics, OnlinePharm is worth a look. Fast delivery and it is very affordable. Check it out: international pharmacy online. Be well.

Hey there, Lately ran into a reliable website for affordable pills. For those seeking and need meds from Mexico, Pharm Mex is highly recommended. Great prices plus secure. Take a look: Pharm Mex. Best of luck.

Hello, I wanted to share a useful website to order medications hassle-free. If you are looking for no prescription drugs, this store is worth a look. Secure shipping plus huge selection. Visit here: online pharmacy no prescription. Best regards.

Hey guys, I just stumbled upon a useful Indian pharmacy to buy generics. For those looking for generic pills without prescription, this store is the best place. You get fast shipping worldwide. More info here: IndiaPharm. Cheers.

Greetings, I just found a useful source for meds where you can buy pills cheaply. For those who need antibiotics, this site is highly recommended. They ship globally and it is very affordable. See for yourself: buy meds online. Thanks!

Hi guys, I just came across a trusted online source for affordable pills. If you are tired of high prices and want affordable prescriptions, this store is the best option. They ship to USA plus very reliable. Link is here: buy meds from mexico. Warmly.

Hey there, I wanted to share a useful website where you can buy prescription drugs securely. If you need no prescription drugs, this site is highly recommended. Secure shipping and it is very affordable. Visit here: international pharmacy online. Good luck with everything.

Hey everyone, I just found a great website where you can buy prescription drugs securely. If you need safe pharmacy delivery, OnlinePharm is highly recommended. Secure shipping plus it is very affordable. See for yourself: cheap pharmacy online. Stay healthy.

To be honest, Lately ran into a great resource to save on Rx. If you want to save money and want cheap antibiotics, Pharm Mex is the best option. Great prices and it is safe. Take a look: pharm.mex.com. Appreciate it.

Hi, I recently discovered an excellent website where you can buy prescription drugs cheaply. For those who need safe pharmacy delivery, this site is highly recommended. They ship globally and no script needed. Check it out: international pharmacy online. Thanks!

Greetings, Just now discovered a trusted online source for affordable pills. For those seeking and want generic drugs, this site is worth checking out. No prescription needed and very reliable. Check it out: visit website. Take care.

Hello everyone, I recently ran into a trusted resource for affordable pills. If you are tired of high prices and need meds from Mexico, Pharm Mex is worth checking out. They ship to USA and very reliable. Check it out: https://pharm.mex.com/#. Many thanks.

Hey everyone, I wanted to share a great source for meds to order prescription drugs securely. For those who need safe pharmacy delivery, this site is highly recommended. Great prices and no script needed. Check it out: https://onlinepharm.jp.net/#. Hope this helps!

Hi all, Lately found a great online drugstore for affordable pills. If you want to buy medicines from India without prescription, this store is worth checking. You get lowest prices worldwide. More info here: https://indiapharm.in.net/#. Cheers.

Hi, I just found an excellent website to order generics cheaply. For those who need antibiotics, this store is very good. Great prices plus it is very affordable. Check it out: online pharmacy usa. Have a nice day.

Greetings, To be honest, I found a reliable website where you can buy medications online. For those who need no prescription drugs, this store is very good. Great prices and it is very affordable. Visit here: https://onlinepharm.jp.net/#. Appreciate it.

Greetings, Just now came across a useful source from India for cheap meds. If you need medicines from India safely, this store is the best place. They offer lowest prices worldwide. More info here: https://indiapharm.in.net/#. Best regards.

Greetings, I wanted to share a useful online drugstore where you can buy pills online. For those who need cheap meds, this store is very good. Fast delivery plus no script needed. Check it out: this site. Thx.

Greetings, I just came across a great website for affordable pills. If you want to buy ED meds without prescription, IndiaPharm is highly recommended. They offer secure delivery guaranteed. Visit here: https://indiapharm.in.net/#. Best regards.

Hey everyone, I wanted to share an excellent source for meds for purchasing medications securely. For those who need cheap meds, this site is highly recommended. Great prices and huge selection. See for yourself: online pharmacy usa. Peace.

Hey there, I wanted to share a reliable source for meds to order pills hassle-free. If you are looking for safe pharmacy delivery, this store is the best choice. Secure shipping and huge selection. Link here: Online Pharm Store. Have a good one.

Hey guys, I just came across a great online drugstore to save on Rx. For those looking for medicines from India at factory prices, IndiaPharm is worth checking. They offer secure delivery worldwide. Check it out: indian pharmacy online. Best regards.

Hey everyone, I recently discovered an excellent international pharmacy to order medications securely. For those who need no prescription drugs, this site is worth a look. Great prices and it is very affordable. Check it out: safe online drugstore. Best of luck.

Hey guys, I recently came across a great Indian pharmacy to buy generics. If you want to buy cheap antibiotics cheaply, this store is very reliable. It has secure delivery to USA. Visit here: https://indiapharm.in.net/#. Hope it helps.

Hello, I just found a great website to order pills online. For those who need cheap meds, this site is highly recommended. They ship globally and it is very affordable. Link here: check availability. Hope this was useful.

Hey guys, Lately discovered an amazing Indian pharmacy to save on Rx. If you want to buy cheap antibiotics safely, this store is very reliable. You get secure delivery worldwide. More info here: https://indiapharm.in.net/#. Best regards.

Hey there, I wanted to share a reliable source for meds where you can buy generics online. For those who need no prescription drugs, this store is worth a look. Fast delivery and no script needed. Check it out: https://onlinepharm.jp.net/#. I hope you find what you need.

Hello everyone, I recently came across a reliable website to save on Rx. If you want to save money and need generic drugs, this store is worth checking out. They ship to USA plus very reliable. Visit here: https://pharm.mex.com/#. I hope you find what you need.

Hey everyone, I wanted to share a reliable international pharmacy where you can buy generics securely. If you are looking for no prescription drugs, this site is very good. Great prices and no script needed. Link here: https://onlinepharm.jp.net/#. Have a great week.

Hey there, I recently ran into a trusted online source for affordable pills. If you are tired of high prices and need affordable prescriptions, this store is the best option. Great prices and very reliable. Check it out: https://pharm.mex.com/#. Have a good one.

Hello, I just found a reliable international pharmacy to order medications cheaply. If you need cheap meds, OnlinePharm is very good. They ship globally and it is very affordable. Link here: cheap pharmacy online. Be well.

Greetings, Lately came across a useful Indian pharmacy for cheap meds. For those looking for generic pills cheaply, this site is worth checking. It has lowest prices to USA. Visit here: indiapharm.in.net. Best regards.

Hey everyone, I just found a useful online drugstore where you can buy prescription drugs cheaply. If you need antibiotics, OnlinePharm is highly recommended. Great prices plus it is very affordable. Visit here: Online Pharm Store. Be well.

Dostlar selam, Casibom oyuncuları için kısa bir paylaşım yapmak istiyorum. Herkesin bildiği üzere Casibom domain adresini BTK engeli yüzünden tekrar değiştirdi. Siteye ulaşım sorunu varsa link aşağıda. Güncel Casibom giriş adresi artık aşağıdadır https://casibom.mex.com/# Paylaştığım bağlantı ile vpn kullanmadan hesabınıza girebilirsiniz. Ayrıca yeni üyelere sunulan yatırım bonusu kampanyalarını mutlaka kaçırmayın. Lisanslı bahis deneyimi sürdürmek için Casibom tercih edebilirsiniz. Herkese bol şans dilerim.

Matbet TV guncel linki laz?msa dogru yerdesiniz. Sorunsuz icin: Matbet Kay?t Yuksek oranlar burada. Gencler, Matbet yeni adresi ac?kland?.

Herkese merhaba, Casibom sitesi kullanıcıları için önemli bir bilgilendirme paylaşıyorum. Bildiğiniz gibi Casibom giriş linkini erişim kısıtlaması nedeniyle tekrar taşıdı. Siteye ulaşım hatası varsa doğru yerdesiniz. Son Casibom giriş bağlantısı artık burada https://casibom.mex.com/# Paylaştığım bağlantı üzerinden doğrudan hesabınıza erişebilirsiniz. Ek olarak yeni üyelere sunulan freespin kampanyalarını da inceleyin. Güvenilir bahis keyfi için Casibom doğru adres. Tüm forum üyelerine bol kazançlar dilerim.

Gençler, Grandpashabet Casino yeni adresi belli oldu. Giremeyenler şu linkten devam edebilir Tıkla Git

Grandpashabet giriş adresi lazımsa doğru yerdesiniz. Hızlı erişim için Grandpashabet Kayıt Yüksek oranlar bu sitede.

Arkadaslar, Grandpashabet yeni adresi belli oldu. Giremeyenler su linkten devam edebilir Grandpashabet Sorunsuz Giris

Grandpashabet guncel adresi laz?msa iste burada. H?zl? erisim icin Grandpashabet Yeni Adres Yuksek oranlar bu sitede.

Arkadaşlar selam, Vay Casino kullanıcıları için önemli bir duyuru yapmak istiyorum. Bildiğiniz gibi site adresini tekrar güncelledi. Erişim sorunu varsa panik yapmayın. Güncel siteye erişim adresi şu an aşağıdadır: https://vaycasino.us.com/# Paylaştığım bağlantı üzerinden vpn kullanmadan siteye girebilirsiniz. Güvenilir bahis deneyimi sürdürmek için Vaycasino tercih edebilirsiniz. Herkese bol kazançlar temenni ederim.

Herkese merhaba, Casibom kullan?c?lar? icin onemli bir bilgilendirme yapmak istiyorum. Bildiginiz gibi site domain adresini erisim k?s?tlamas? nedeniyle surekli guncelledi. Giris problemi yas?yorsan?z dogru yerdesiniz. Resmi siteye erisim adresi su an asag?dad?r Casibom Sorunsuz Giris Bu link uzerinden direkt siteye baglanabilirsiniz. Ek olarak yeni uyelere verilen hosgeldin bonusu kampanyalar?n? da inceleyin. Lisansl? bahis keyfi icin Casibom dogru adres. Herkese bol sans dilerim.

Arkadaşlar, Grandpashabet son linki açıklandı. Giremeyenler şu linkten giriş yapabilir Grandpashabet Üyelik

Arkadaşlar selam, Vaycasino kullanıcıları için kısa bir duyuru paylaşıyorum. Malum platform giriş linkini yine güncelledi. Giriş hatası varsa panik yapmayın. Yeni Vaycasino giriş linki artık aşağıdadır: https://vaycasino.us.com/# Bu link ile doğrudan hesabınıza girebilirsiniz. Güvenilir bahis keyfi sürdürmek için Vay Casino tercih edebilirsiniz. Herkese bol şans temenni ederim.

Herkese selam, Vay Casino kullan?c?lar? icin k?sa bir bilgilendirme paylas?yorum. Bildiginiz gibi Vaycasino giris linkini yine guncelledi. Giris sorunu yas?yorsan?z panik yapmay?n. Yeni siteye erisim adresi su an burada: Buraya T?kla Bu link ile vpn kullanmadan siteye erisebilirsiniz. Lisansl? bahis keyfi icin Vay Casino tercih edebilirsiniz. Herkese bol kazanclar dilerim.

Arkadaslar selam, Vaycasino kullan?c?lar? icin onemli bir bilgilendirme yapmak istiyorum. Bildiginiz gibi Vaycasino adresini yine degistirdi. Giris sorunu varsa endise etmeyin. Son Vay Casino giris adresi art?k asag?dad?r: Buraya T?kla Bu link ile vpn kullanmadan siteye erisebilirsiniz. Lisansl? casino keyfi icin Vay Casino tercih edebilirsiniz. Herkese bol sans temenni ederim.

Arkadaşlar, Grandpashabet Casino son linki açıklandı. Giremeyenler buradan devam edebilir Grandpashabet Üyelik

Arkadaşlar, Grandpashabet Casino son linki belli oldu. Giremeyenler şu linkten giriş yapabilir https://grandpashabet.in.net/#

Dostlar selam, bu site oyuncuları için kısa bir duyuru paylaşıyorum. Malum Vaycasino adresini tekrar güncelledi. Giriş sorunu varsa panik yapmayın. Yeni siteye erişim linki artık burada: Resmi Site Paylaştığım bağlantı üzerinden direkt siteye girebilirsiniz. Lisanslı casino deneyimi için Vay Casino doğru adres. Herkese bol kazançlar temenni ederim.

Arkadaşlar, Grandpashabet Casino son linki açıklandı. Giremeyenler buradan devam edebilir https://grandpashabet.in.net/#

Matbet giris adresi ar?yorsan?z dogru yerdesiniz. Mac izlemek icin: Matbet Mobil Yuksek oranlar burada. Gencler, Matbet yeni adresi belli oldu.

Arkadaşlar, Grandpashabet yeni adresi belli oldu. Adresi bulamayanlar şu linkten devam edebilir https://grandpashabet.in.net/#

Matbet güncel linki arıyorsanız işte burada. Sorunsuz için tıkla: Matbet İndir Canlı maçlar burada. Gençler, Matbet yeni adresi açıklandı.

Gençler, Grandpashabet Casino son linki açıklandı. Giremeyenler buradan giriş yapabilir Resmi Site

Gencler, Grandpashabet son linki ac?kland?. Adresi bulamayanlar buradan devam edebilir https://grandpashabet.in.net/#

Arkadaslar selam, bu populer site kullan?c?lar? ad?na k?sa bir bilgilendirme paylas?yorum. Herkesin bildigi uzere bahis platformu adresini BTK engeli yuzunden surekli degistirdi. Giris problemi yas?yorsan?z link asag?da. Son siteye erisim adresi su an asag?dad?r Siteye Git Bu link ile direkt siteye baglanabilirsiniz. Ek olarak kay?t olanlara sunulan yat?r?m bonusu f?rsatlar?n? da kac?rmay?n. Lisansl? bahis keyfi surdurmek icin Casibom tercih edebilirsiniz. Tum forum uyelerine bol sans dilerim.

Herkese selam, bu site oyuncuları için önemli bir bilgilendirme yapmak istiyorum. Malum Vaycasino giriş linkini tekrar güncelledi. Giriş hatası varsa panik yapmayın. Yeni Vaycasino giriş adresi artık burada: Giriş Yap Bu link üzerinden doğrudan siteye girebilirsiniz. Güvenilir bahis deneyimi için Vaycasino tercih edebilirsiniz. Herkese bol şans dilerim.

Dostlar selam, bu popüler site kullanıcıları adına önemli bir duyuru yapmak istiyorum. Herkesin bildiği üzere bahis platformu domain adresini BTK engeli yüzünden sürekli değiştirdi. Erişim hatası varsa doğru yerdesiniz. Güncel siteye erişim linki şu an burada Casibom Bonus Bu link üzerinden vpn kullanmadan siteye girebilirsiniz. Ayrıca kayıt olanlara verilen hoşgeldin bonusu fırsatlarını da kaçırmayın. Lisanslı casino deneyimi için Casibom doğru adres. Herkese bol şans dilerim.

Grandpasha giris linki ar?yorsan?z iste burada. H?zl? erisim icin https://grandpashabet.in.net/# Yuksek oranlar burada.

Matbet güncel linki arıyorsanız doğru yerdesiniz. Sorunsuz için tıkla: Matbet İzle Canlı maçlar burada. Gençler, Matbet bahis yeni adresi belli oldu.

Herkese selam, Vaycasino oyuncuları için önemli bir duyuru paylaşıyorum. Bildiğiniz gibi platform giriş linkini yine güncelledi. Erişim sorunu yaşıyorsanız endişe etmeyin. Yeni siteye erişim linki artık aşağıdadır: Vay Casino Paylaştığım bağlantı üzerinden doğrudan siteye erişebilirsiniz. Güvenilir bahis keyfi için Vaycasino tercih edebilirsiniz. Tüm forum üyelerine bol şans temenni ederim.

Dostlar selam, bu popüler site kullanıcıları için önemli bir paylaşım paylaşıyorum. Bildiğiniz gibi site domain adresini erişim kısıtlaması nedeniyle tekrar taşıdı. Siteye ulaşım hatası çekenler için çözüm burada. Resmi Casibom güncel giriş bağlantısı artık burada https://casibom.mex.com/# Paylaştığım bağlantı üzerinden direkt hesabınıza erişebilirsiniz. Ek olarak kayıt olanlara verilen yatırım bonusu fırsatlarını da kaçırmayın. Lisanslı bahis deneyimi için Casibom tercih edebilirsiniz. Tüm forum üyelerine bol kazançlar dilerim.

Grandpashabet guncel adresi ar?yorsan?z dogru yerdesiniz. Sorunsuz giris yapmak icin Grandpasha Giris Yuksek oranlar bu sitede.

Arkadaslar, Grandpashabet son linki ac?kland?. Adresi bulamayanlar buradan devam edebilir Grandpashabet Guvenilir mi

Arkadaşlar, Grandpashabet Casino yeni adresi belli oldu. Giremeyenler buradan devam edebilir https://grandpashabet.in.net/#

Arkadaşlar, Grandpashabet son linki belli oldu. Adresi bulamayanlar buradan devam edebilir https://grandpashabet.in.net/#

Herkese merhaba, Casibom sitesi oyuncuları için önemli bir bilgilendirme yapmak istiyorum. Bildiğiniz gibi bahis platformu giriş linkini BTK engeli yüzünden sürekli taşıdı. Giriş hatası çekenler için doğru yerdesiniz. Resmi Casibom güncel giriş linki artık aşağıdadır Casibom Giriş Paylaştığım bağlantı üzerinden direkt hesabınıza erişebilirsiniz. Ayrıca yeni üyelere sunulan freespin kampanyalarını da kaçırmayın. En iyi slot keyfi için Casibom tercih edebilirsiniz. Tüm forum üyelerine bol şans dilerim.

Matbet TV giris adresi laz?msa dogru yerdesiniz. H?zl? icin t?kla: Matbet Apk Yuksek oranlar burada. Arkadaslar, Matbet bahis yeni adresi belli oldu.

Matbet TV güncel adresi arıyorsanız işte burada. Hızlı için: Giriş Yap Canlı maçlar bu sitede. Gençler, Matbet son linki açıklandı.

**mitolyn official**

Mitolyn is a carefully developed, plant-based formula created to help support metabolic efficiency and encourage healthy, lasting weight management.

Grandpasha güncel linki arıyorsanız doğru yerdesiniz. Hızlı giriş yapmak için tıkla Grandpashabet Deneme bonusu bu sitede.

Matbet TV guncel adresi laz?msa dogru yerdesiniz. H?zl? icin: https://matbet.jp.net/# Yuksek oranlar bu sitede. Gencler, Matbet bahis son linki belli oldu.

Herkese merhaba, Casibom üyeleri adına önemli bir paylaşım paylaşıyorum. Bildiğiniz gibi bahis platformu domain adresini erişim kısıtlaması nedeniyle tekrar taşıdı. Siteye ulaşım hatası yaşıyorsanız doğru yerdesiniz. Güncel siteye erişim linki artık aşağıdadır Casibom Üyelik Paylaştığım bağlantı üzerinden direkt siteye girebilirsiniz. Ek olarak kayıt olanlara verilen hoşgeldin bonusu fırsatlarını mutlaka kaçırmayın. En iyi slot keyfi sürdürmek için Casibom doğru adres. Tüm forum üyelerine bol şans dilerim.

Gençler, Grandpashabet Casino yeni adresi açıklandı. Giremeyenler buradan devam edebilir Grandpashabet Bonus

Grandpashabet giris linki laz?msa iste burada. Sorunsuz giris yapmak icin t?kla https://grandpashabet.in.net/# Yuksek oranlar bu sitede.

Gençler, Grandpashabet yeni adresi belli oldu. Giremeyenler şu linkten giriş yapabilir Grandpashabet

Grandpasha guncel linki laz?msa iste burada. H?zl? giris yapmak icin Siteye Git Yuksek oranlar burada.

Herkese selam, bu popüler site kullanıcıları için önemli bir paylaşım yapmak istiyorum. Herkesin bildiği üzere bahis platformu giriş linkini BTK engeli yüzünden sürekli değiştirdi. Siteye ulaşım hatası yaşıyorsanız link aşağıda. Çalışan siteye erişim bağlantısı artık paylaşıyorum https://casibom.mex.com/# Paylaştığım bağlantı ile vpn kullanmadan hesabınıza bağlanabilirsiniz. Ek olarak kayıt olanlara verilen freespin kampanyalarını mutlaka inceleyin. En iyi bahis keyfi için Casibom doğru adres. Tüm forum üyelerine bol şans dilerim.

Matbet TV giriş adresi arıyorsanız doğru yerdesiniz. Maç izlemek için: Matbet TV Giriş Canlı maçlar bu sitede. Gençler, Matbet yeni adresi açıklandı.

Herkese selam, bu site kullan?c?lar? ad?na onemli bir duyuru yapmak istiyorum. Malum platform adresini yine degistirdi. Erisim hatas? yas?yorsan?z endise etmeyin. Yeni Vay Casino giris adresi su an asag?dad?r: Vaycasino Mobil Bu link ile direkt siteye erisebilirsiniz. Guvenilir bahis keyfi icin Vaycasino tercih edebilirsiniz. Tum forum uyelerine bol kazanclar dilerim.

Arkadaşlar selam, Vay Casino kullanıcıları için önemli bir duyuru paylaşıyorum. Malum site adresini tekrar güncelledi. Erişim sorunu varsa endişe etmeyin. Son siteye erişim adresi şu an burada: Vay Casino Güncel Adres Bu link üzerinden doğrudan siteye girebilirsiniz. Güvenilir casino keyfi için Vay Casino tercih edebilirsiniz. Herkese bol şans temenni ederim.

Grandpasha güncel adresi lazımsa doğru yerdesiniz. Hızlı giriş yapmak için https://grandpashabet.in.net/# Deneme bonusu bu sitede.

Matbet TV giriş adresi arıyorsanız doğru yerdesiniz. Sorunsuz için tıkla: Buraya Tıkla Yüksek oranlar burada. Arkadaşlar, Matbet son linki açıklandı.

Grandpashabet giris adresi laz?msa dogru yerdesiniz. Sorunsuz giris yapmak icin t?kla Grandpashabet Guncel Deneme bonusu burada.

Matbet TV guncel adresi laz?msa dogru yerdesiniz. Sorunsuz icin: Matbet Yeni Adres Yuksek oranlar burada. Gencler, Matbet yeni adresi belli oldu.

Arkadaşlar selam, Vaycasino oyuncuları adına önemli bir duyuru yapmak istiyorum. Malum site giriş linkini tekrar güncelledi. Giriş sorunu yaşıyorsanız panik yapmayın. Son Vay Casino giriş linki şu an aşağıdadır: Vaycasino Bonus Bu link ile direkt siteye girebilirsiniz. Lisanslı casino keyfi sürdürmek için Vaycasino doğru adres. Herkese bol şans dilerim.

Matbet TV giriş adresi arıyorsanız doğru yerdesiniz. Maç izlemek için: https://matbet.jp.net/# Canlı maçlar burada. Arkadaşlar, Matbet bahis yeni adresi belli oldu.

Bahis severler selam, Casibom sitesi oyuncular? icin k?sa bir duyuru yapmak istiyorum. Bildiginiz gibi site domain adresini erisim k?s?tlamas? nedeniyle surekli tas?d?. Siteye ulas?m problemi yas?yorsan?z link asag?da. Guncel siteye erisim linki art?k asag?dad?r Casibom Guncel Bu link ile vpn kullanmadan hesab?n?za erisebilirsiniz. Ayr?ca yeni uyelere verilen yat?r?m bonusu kampanyalar?n? da inceleyin. Guvenilir slot keyfi surdurmek icin Casibom tercih edebilirsiniz. Herkese bol kazanclar dilerim.

Gençler, Grandpashabet Casino yeni adresi açıklandı. Giremeyenler şu linkten devam edebilir Grandpashabet Apk

Dostlar selam, Vaycasino kullan?c?lar? icin k?sa bir bilgilendirme paylas?yorum. Malum Vaycasino giris linkini tekrar degistirdi. Giris sorunu yas?yorsan?z endise etmeyin. Son Vay Casino giris adresi art?k burada: Vaycasino Giris Bu link ile vpn kullanmadan hesab?n?za erisebilirsiniz. Lisansl? bahis keyfi icin Vaycasino tercih edebilirsiniz. Tum forum uyelerine bol kazanclar dilerim.

Grandpashabet güncel linki lazımsa işte burada. Hızlı erişim için tıkla https://grandpashabet.in.net/# Deneme bonusu bu sitede.

Gencler, Grandpashabet son linki ac?kland?. Adresi bulamayanlar su linkten giris yapabilir Grandpashabet 2026

Matbet TV güncel adresi lazımsa işte burada. Hızlı için: https://matbet.jp.net/# Canlı maçlar burada. Gençler, Matbet son linki açıklandı.

Hi cac bac, n?u anh em dang ki?m c?ng game khong b? ch?n d? gi?i tri Game bai d?ng b? qua trang nay nhe. Uy tin luon: https://pacebhadrak.org.in/#. Chuc anh em may m?n.

Hi các bác, ai đang tìm trang chơi xanh chín để giải trí Casino thì xem thử trang này nhé. Tốc độ bàn thờ: Dola789 đăng nhập. Về bờ thành công.

Hello mọi người, nếu anh em đang kiếm trang chơi xanh chín để gỡ gạc Game bài thì tham khảo con hàng này. Uy tín luôn: sun win. Chúc anh em may mắn.

Hello mọi người, người anh em nào cần trang chơi xanh chín để cày cuốc Nổ Hũ đừng bỏ qua chỗ này. Nạp rút 1-1: Link tải Sunwin. Chúc các bác rực rỡ.

Chao c? nha, n?u anh em dang ki?m c?ng game khong b? ch?n d? cay cu?c Tai X?u thi vao ngay d?a ch? nay. N?p rut 1-1: T?i app Dola789. V? b? thanh cong.

Chào cả nhà, bác nào muốn tìm cổng game không bị chặn để cày cuốc Nổ Hũ thì tham khảo trang này nhé. Uy tín luôn: Dola789. Chúc anh em may mắn.

Xin chao 500 anh em, ai dang tim nha cai uy tin d? cay cu?c Da Ga thi tham kh?o ch? nay. Khong lo l?a d?o: nha cai dola789. Chuc cac bac r?c r?.

Hi các bác, bác nào muốn tìm chỗ nạp rút nhanh để cày cuốc Tài Xỉu thì xem thử con hàng này. Nạp rút 1-1: Tải Sunwin. Về bờ thành công.

Chao anh em, ai dang tim c?ng game khong b? ch?n d? gi?i tri Game bai thi tham kh?o trang nay nhe. N?p rut 1-1: https://homemaker.org.in/#. Chuc cac bac r?c r?.

Chào cả nhà, người anh em nào cần sân chơi đẳng cấp để chơi Đá Gà đừng bỏ qua trang này nhé. Không lo lừa đảo: https://gramodayalawcollege.org.in/#. Húp lộc đầy nhà.

Chào cả nhà, nếu anh em đang kiếm chỗ nạp rút nhanh để chơi Đá Gà thì xem thử trang này nhé. Không lo lừa đảo: Link vào Dola789. Về bờ thành công.

Chào cả nhà, nếu anh em đang kiếm sân chơi đẳng cấp để giải trí Nổ Hũ thì vào ngay địa chỉ này. Đang có khuyến mãi: Link tải Sunwin. Chiến thắng nhé.

Hello m?i ngu?i, ngu?i anh em nao c?n nha cai uy tin d? choi N? Hu d?ng b? qua ch? nay. Dang co khuy?n mai: https://gramodayalawcollege.org.in/#. Chuc anh em may m?n.

Xin chào 500 anh em, người anh em nào cần cổng game không bị chặn để chơi Nổ Hũ đừng bỏ qua chỗ này. Uy tín luôn: BJ88. Về bờ thành công.

Xin chao 500 anh em, n?u anh em dang ki?m ch? n?p rut nhanh d? g? g?c Game bai thi vao ngay ch? nay. Uy tin luon: https://homemaker.org.in/#. Hup l?c d?y nha.

Hello mọi người, nếu anh em đang kiếm cổng game không bị chặn để cày cuốc Nổ Hũ đừng bỏ qua chỗ này. Không lo lừa đảo: sunwin. Húp lộc đầy nhà.

Chao anh em, n?u anh em dang ki?m trang choi xanh chin d? gi?i tri Tai X?u thi xem th? con hang nay. N?p rut 1-1: https://homemaker.org.in/#. Chuc cac bac r?c r?.

Chào cả nhà, bác nào muốn tìm sân chơi đẳng cấp để chơi Tài Xỉu thì tham khảo địa chỉ này. Không lo lừa đảo: Nhà cái Dola789. Chiến thắng nhé.

Chào cả nhà, bác nào muốn tìm chỗ nạp rút nhanh để gỡ gạc Game bài thì tham khảo địa chỉ này. Không lo lừa đảo: Link vào BJ88. Chúc anh em may mắn.

Chao anh em, ai dang tim nha cai uy tin d? cay cu?c Game bai thi vao ngay d?a ch? nay. N?p rut 1-1: bj88. Chi?n th?ng nhe.

Hello mọi người, ai đang tìm trang chơi xanh chín để cày cuốc Đá Gà đừng bỏ qua chỗ này. Nạp rút 1-1: https://gramodayalawcollege.org.in/#. Chúc anh em may mắn.

Chào anh em, người anh em nào cần chỗ nạp rút nhanh để chơi Casino thì tham khảo con hàng này. Không lo lừa đảo: Nhà cái BJ88. Chúc các bác rực rỡ.

Xin chào 500 anh em, nếu anh em đang kiếm cổng game không bị chặn để gỡ gạc Casino thì vào ngay chỗ này. Uy tín luôn: https://gramodayalawcollege.org.in/#. Chúc anh em may mắn.

Hi cac bac, ai dang tim nha cai uy tin d? cay cu?c Game bai thi xem th? d?a ch? nay. Khong lo l?a d?o: https://pacebhadrak.org.in/#. Chi?n th?ng nhe.

Xin chào 500 anh em, người anh em nào cần trang chơi xanh chín để cày cuốc Nổ Hũ thì xem thử con hàng này. Đang có khuyến mãi: https://pacebhadrak.org.in/#. Húp lộc đầy nhà.

Chào cả nhà, nếu anh em đang kiếm sân chơi đẳng cấp để cày cuốc Game bài thì tham khảo địa chỉ này. Uy tín luôn: Dola789. Húp lộc đầy nhà.

Xin chào 500 anh em, người anh em nào cần sân chơi đẳng cấp để cày cuốc Tài Xỉu thì tham khảo con hàng này. Nạp rút 1-1: https://homemaker.org.in/#. Về bờ thành công.

Chao c? nha, bac nao mu?n tim c?ng game khong b? ch?n d? choi Tai X?u thi xem th? trang nay nhe. Dang co khuy?n mai: Dola789. Hup l?c d?y nha.

Chào anh em, bác nào muốn tìm sân chơi đẳng cấp để giải trí Tài Xỉu thì vào ngay địa chỉ này. Đang có khuyến mãi: https://homemaker.org.in/#. Chúc các bác rực rỡ.

Hi các bác, người anh em nào cần chỗ nạp rút nhanh để chơi Nổ Hũ thì xem thử chỗ này. Không lo lừa đảo: Đăng nhập BJ88. Chiến thắng nhé.

Hi các bác, ai đang tìm cổng game không bị chặn để cày cuốc Game bài thì xem thử địa chỉ này. Tốc độ bàn thờ: nhà cái dola789. Chúc các bác rực rỡ.

Hello m?i ngu?i, ai dang tim trang choi xanh chin d? g? g?c Casino d?ng b? qua d?a ch? nay. Dang co khuy?n mai: https://gramodayalawcollege.org.in/#. Chuc anh em may m?n.

Hello mọi người, ai đang tìm sân chơi đẳng cấp để gỡ gạc Casino thì tham khảo chỗ này. Nạp rút 1-1: https://gramodayalawcollege.org.in/#. Húp lộc đầy nhà.

Chao anh em, ai dang tim nha cai uy tin d? g? g?c N? Hu thi vao ngay con hang nay. N?p rut 1-1: T?i app BJ88. Chi?n th?ng nhe.

Xin chào 500 anh em, nếu anh em đang kiếm cổng game không bị chặn để giải trí Đá Gà thì xem thử trang này nhé. Tốc độ bàn thờ: Game bài đổi thưởng. Chiến thắng nhé.

Hello mọi người, bác nào muốn tìm trang chơi xanh chín để cày cuốc Tài Xỉu đừng bỏ qua địa chỉ này. Nạp rút 1-1: https://gramodayalawcollege.org.in/#. Chiến thắng nhé.

Hello m?i ngu?i, n?u anh em dang ki?m c?ng game khong b? ch?n d? g? g?c Game bai thi tham kh?o con hang nay. Uy tin luon: https://pacebhadrak.org.in/#. V? b? thanh cong.

Hi các bác, nếu anh em đang kiếm trang chơi xanh chín để gỡ gạc Casino đừng bỏ qua trang này nhé. Không lo lừa đảo: sun win. Chúc anh em may mắn.

Chào cả nhà, nếu anh em đang kiếm nhà cái uy tín để cày cuốc Tài Xỉu thì tham khảo chỗ này. Tốc độ bàn thờ: https://homemaker.org.in/#. Chúc anh em may mắn.

Chao anh em, ngu?i anh em nao c?n san choi d?ng c?p d? g? g?c Da Ga thi xem th? ch? nay. Khong lo l?a d?o: https://pacebhadrak.org.in/#. V? b? thanh cong.

Hello mọi người, nếu anh em đang kiếm chỗ nạp rút nhanh để giải trí Game bài thì vào ngay con hàng này. Nạp rút 1-1: Dola789. Chúc các bác rực rỡ.

Xin chào 500 anh em, bác nào muốn tìm sân chơi đẳng cấp để chơi Tài Xỉu đừng bỏ qua địa chỉ này. Uy tín luôn: Dola789. Chiến thắng nhé.

Xin chao 500 anh em, ai dang tim nha cai uy tin d? choi N? Hu thi tham kh?o ch? nay. N?p rut 1-1: T?i app Dola789. Hup l?c d?y nha.

Xin chào 500 anh em, nếu anh em đang kiếm cổng game không bị chặn để giải trí Casino đừng bỏ qua trang này nhé. Đang có khuyến mãi: Game bài đổi thưởng. Chúc anh em may mắn.

fertility pct guide: order clomid without a prescription – can i purchase generic clomid pill

fertility pct guide: clomid for sale – get generic clomid tablets

https://fertilitypctguide.us.com/# can i purchase generic clomid pills

Follicle Insight: Follicle Insight – cost of generic propecia without prescription

https://amitrip.us.com/# Amitriptyline

https://iver.us.com/# Iver Protocols Guide

Iver Protocols Guide: stromectol medication – stromectol order online

stromectol buy stromectol cvs Iver Protocols Guide

buying cheap propecia no prescription: cost generic propecia for sale – Follicle Insight

https://follicle.us.com/# get propecia online

https://fertilitypctguide.us.com/# fertility pct guide

stromectol 0.5 mg: ivermectin for humans – Iver Protocols Guide

cost clomid: where buy generic clomid prices – fertility pct guide

https://iver.us.com/# stromectol in canada

fertility pct guide can i purchase clomid tablets fertility pct guide

Follicle Insight: Follicle Insight – buy propecia prices

https://amitrip.us.com/# Amitriptyline

https://amitrip.us.com/# buy Elavil

Iver Protocols Guide: stromectol order – Iver Protocols Guide

AmiTrip Relief Store: AmiTrip – Amitriptyline

https://iver.us.com/# Iver Protocols Guide

https://iver.us.com/# ivermectin usa price

ivermectin 3mg tablets price: Iver Protocols Guide – Iver Protocols Guide

where can i buy clomid without insurance fertility pct guide fertility pct guide

Iver Protocols Guide: Iver Protocols Guide – ivermectin 3mg

https://follicle.us.com/# Follicle Insight

Amitriptyline: Elavil – Amitriptyline

how to buy clomid no prescription: buying clomid tablets – fertility pct guide

https://amitrip.us.com/# buy Elavil

buying generic propecia pills: Follicle Insight – Follicle Insight

https://fertilitypctguide.us.com/# fertility pct guide

https://fertilitypctguide.us.com/# fertility pct guide

fertility pct guide: fertility pct guide – fertility pct guide

AmiTrip: buy Elavil – Elavil

https://follicle.us.com/# cost generic propecia no prescription

fertility pct guide: clomid generics – get generic clomid without prescription

ivermectin pill cost: ivermectin lotion cost – Iver Protocols Guide

https://iver.us.com/# Iver Protocols Guide

https://iver.us.com/# stromectol online

Amitriptyline AmiTrip Elavil

buy Elavil: Elavil – Generic Elavil

Follicle Insight: buy cheap propecia without rx – generic propecia without insurance

https://iver.us.com/# Iver Protocols Guide

AmiTrip: AmiTrip Relief Store – Generic Elavil

Iver Protocols Guide: Iver Protocols Guide – ivermectin for sale

https://iver.us.com/# stromectol covid

Follicle Insight Follicle Insight Follicle Insight

fertility pct guide: fertility pct guide – fertility pct guide

https://fertilitypctguide.us.com/# can i order generic clomid pill

https://amitrip.us.com/# Generic Elavil

can you get clomid without a prescription: fertility pct guide – fertility pct guide

https://iver.us.com/# Iver Protocols Guide

Hello, if anyone needs detailed information regarding prescription drugs, I recommend this health wiki. It explains usage and risks in detail. Source: https://magmaxhealth.com/Toradol. Good info.

Hi guys, if you need a trusted drugstore to order health products online. I found this pharmacy: lipitor. They offer high quality drugs at the best prices. Best regards.

Hi guys, I wanted to share a great source for meds to purchase prescription drugs hassle-free. Take a look at MagMaxHealth: clomid. They offer a wide range of meds and huge discounts. Hope this helps.

Hello, I recently found dosage instructions on health treatments, check out this health wiki. You can read about drug interactions very well. Link: https://magmaxhealth.com/Toradol. Good info.

For a complete overview of proper usage instructions, you can consult the detailed guide on: https://magmaxhealth.com/naltrexone.html which covers clinical details.

Hey everyone, if you are looking for side effects info on prescription drugs, take a look at this health wiki. It explains usage and risks clearly. Read more here: https://magmaxhealth.com/Lamictal. Hope this is useful.

Hi, I wanted to share a trusted drugstore to purchase prescription drugs online. I recommend this pharmacy: MagMaxHealth. They offer high quality drugs and huge discounts. Hope this helps.

To start saving, visit this reliable site pharmacy online usa to order now. Stop overpaying hassle-free.

Hey everyone, if anyone needs dosage instructions about prescription drugs, take a look at this medical reference. You can read about how to take meds clearly. Reference: https://magmaxhealth.com/Lamictal. Hope this is useful.

If you are looking for I recommend this service international online pharmacy for fast USA shipping. Take control of your health and save big.

Greetings, I wanted to share a reliable drugstore to order medicines online. I found this pharmacy: flonase. Selling high quality drugs and huge discounts. Hope this helps.

Hello, for those searching for a medical guide about various medications, I found this health wiki. You can read about how to take meds clearly. Link: https://magmaxhealth.com/Allopurinol. Hope this is useful.

In terms of medical specifications, data is available at the medical directory at: https://magmaxhealth.com/clomid.html for clinical details.

regarding the safety protocols, data is available at the medical directory at: https://magmaxhealth.com/clarinex.html for correct administration.

Hi guys, if you need an affordable source for meds to order pills online. Take a look at MagMaxHealth: clomid. Selling high quality drugs and huge discounts. Hope this helps.

Greetings, if anyone needs dosage instructions on various medications, take a look at this health wiki. It explains safety protocols very well. Source: https://magmaxhealth.com/Clomid. Thanks.

Hello, for those searching for a medical guide on prescription drugs, take a look at this drug database. You can read about how to take meds in detail. Source: https://magmaxhealth.com/Clarinex. Very informative.

regarding the medical specifications, it is recommended to check this resource: https://magmaxhealth.com/ which covers risk management.

Greetings, for those searching for side effects info about various medications, I found this useful resource. It covers usage and risks very well. See details: https://magmaxhealth.com/Meclizine. Hope it helps.

Hey everyone, if you need a trusted online pharmacy to purchase pills online. I found this site: buspar. They offer high quality drugs at the best prices. Cheers.

Hey everyone, if you are looking for dosage instructions about prescription drugs, I recommend this medical reference. It explains drug interactions clearly. Link: https://magmaxhealth.com/Clomid. Thanks.

For a complete overview of safety protocols, please review this resource: https://magmaxhealth.com/ to ensure risk management.

Gastro Health Monitor: prilosec medication – prilosec side effects

https://nauseacareus.shop/# buy zofran online

zofran over the counter: ondansetron medication – generic zofran

buy methocarbamol: Spasm Relief Protocols – robaxin

muscle relaxers over the counter: robaxin generic – tizanidine medication

http://nauseacareus.com/# Nausea Care US

https://gastrohealthmonitor.com/# Gastro Health Monitor

zofran medication: Nausea Care US – Nausea Care US

Nausea Care US: п»їondansetron otc – buy zofran

omeprazole generic: omeprazole brand name – Gastro Health Monitor

omeprazole brand name: Gastro Health Monitor – omeprazole medication

Gastro Health Monitor prilosec medication buy prilosec

https://gastrohealthmonitor.shop/# Gastro Health Monitor

tizanidine hcl: Spasm Relief Protocols – antispasmodic medication

prilosec medication: prilosec otc – Gastro Health Monitor

prilosec medication: prilosec otc – Gastro Health Monitor

Gastro Health Monitor: Gastro Health Monitor – Gastro Health Monitor

https://gastrohealthmonitor.shop/# omeprazole

Nausea Care US: ondansetron – ondansetron medication

generic for zofran: Nausea Care US – buy zofran online

omeprazole over the counter: Gastro Health Monitor – buy prilosec online

methocarbamol dosing: otc muscle relaxer – over the counter muscle relaxers that work

https://nauseacareus.shop/# Nausea Care US

tizanidine zanaflex: buy tizanidine without prescription – methocarbamol medication

Nausea Care US: zofran generic – Nausea Care US

omeprazole prilosec medication buy prilosec online

ondestranon zofran: Nausea Care US – ondansetron medication

omeprazole generic: buy prilosec – omeprazole prilosec

https://spasmreliefprotocols.com/# tizanidine muscle relaxer

muscle relaxers for back pain: tizanidine generic – antispasmodic medication

buy tizanidine without prescription: robaxin generic – over the counter muscle relaxers that work

ondansetron: zofran generic – Nausea Care US

Gastro Health Monitor: Gastro Health Monitor – Gastro Health Monitor

https://spasmreliefprotocols.shop/# muscle relaxers for back pain

prilosec dosage: buy prilosec – omeprazole

tizanidine hydrochloride: muscle relaxer tizanidine – muscle relaxant drugs

generic for zofran: Nausea Care US – ondansetron medication

otc muscle relaxer: robaxin generic – muscle relaxant drugs

Gastro Health Monitor Gastro Health Monitor prilosec dosage

This post offers a refreshing perspective on weight loss. I like that you didn’t promote extreme diets or unrealistic workouts. Instead, you focused on habits that people can actually stick to long term. This kind of advice is especially helpful for beginners who want to make lasting changes.

https://gastrohealthmonitor.com/# omeprazole over the counter

ondansetron otc: Nausea Care US – Nausea Care US

Nausea Care US: Nausea Care US – ondestranon zofran

robaxin: Spasm Relief Protocols – buy methocarbamol without prescription

https://nauseacareus.com/# generic zofran

http://spasmreliefprotocols.com/# buy methocarbamol without prescription

robaxin generic: muscle relaxers for back pain – methocarbamol dosing

buy methocarbamol muscle relaxers for back pain muscle relaxant drugs

http://spasmreliefprotocols.com/# tizanidine hydrochloride

prilosec side effects: omeprazole brand name – prilosec otc

https://nauseacareus.com/# buy zofran

buy methocarbamol without prescription: Spasm Relief Protocols – tizanidine medication

https://nauseacareus.shop/# Nausea Care US

Nausea Care US Nausea Care US ondansetron

Nausea Care US: Nausea Care US – zofran side effects

http://spasmreliefprotocols.com/# buy methocarbamol without prescription

https://gastrohealthmonitor.com/# Gastro Health Monitor

india online pharmacy: india online pharmacy – buy medicines online in india

http://usmedsoutlet.com/# US Meds Outlet

http://indogenericexport.com/# pharmacy website india

meds from mexico mexican pharmacies that ship to us mexican meds

BajaMed Direct: mexican pharmacies that ship to the united states – BajaMed Direct

https://indogenericexport.shop/# robaxin generic

https://indogenericexport.com/# online pharmacy india

https://indogenericexport.com/# buy methocarbamol without prescription

Online medicine home delivery: cheapest online pharmacy india – top 10 pharmacies in india

Excellent post! The information you shared is practical and easy to apply in daily life. I appreciate the positive tone and the emphasis on healthy habits instead of extreme methods. Looking forward to reading more of your content.

Great article! I appreciate how you addressed common weight loss mistakes and explained how to avoid them. Many people struggle because of misinformation, and posts like this help clear things up. The tone is encouraging and informative, which makes it enjoyable to read.

US Meds Outlet US Meds Outlet US Meds Outlet

https://bajameddirect.shop/# BajaMed Direct

https://bajameddirect.shop/# mexican pharmacy near me

online pharmacy canada: US Meds Outlet – US Meds Outlet

https://bajameddirect.com/# BajaMed Direct

buy methocarbamol: over the counter muscle relaxers that work – otc muscle relaxer

indian pharmacy online: mail order pharmacy india – best india pharmacy

https://indogenericexport.shop/# robaxin

indian pharmacy online Indo-Generic Export п»їlegitimate online pharmacies india

This is a very well-structured post with practical tips anyone can follow. I especially liked the advice about making small changes instead of trying to overhaul everything at once. That approach feels much more sustainable and realistic for long-term success.

US Meds Outlet: US Meds Outlet – online pharmacy no prescription

https://indogenericexport.shop/# buy tizanidine without prescription

pharmacy in mexico that ships to us: BajaMed Direct – BajaMed Direct

Very insightful article! I agree that quick weight loss methods often lead to burnout or weight regain. Your focus on balance and sustainability makes a lot of sense. The practical tips you shared can easilybe applied in everyday life, which is something I always look for in health-related content.

http://bajameddirect.com/# BajaMed Direct

buy prescription drugs from india: Indo-Generic Export – online pharmacy india

mexico farmacia mexico drug store BajaMed Direct

BajaMed Direct: mexico farmacia – BajaMed Direct

https://bajameddirect.com/# BajaMed Direct

BajaMed Direct: pharma mexicana – BajaMed Direct

https://bajameddirect.com/# BajaMed Direct

cheapest online pharmacy india: Indo-Generic Export – best india pharmacy

order pharmacy online egypt: canadian pharmacy no scripts – US Meds Outlet

http://bajameddirect.com/# BajaMed Direct

is mexipharmacy legit: BajaMed Direct – mexican drug store

US Meds Outlet: US Meds Outlet – US Meds Outlet

https://usmedsoutlet.shop/# pharmacy today

worldwide pharmacy: mexipharmacy reviews – BajaMed Direct

https://bajameddirect.shop/# BajaMed Direct

canadian pharmacy without prescription: US Meds Outlet – canadapharmacyonline

india online pharmacy: Indo-Generic Export – best online pharmacy india

https://usmedsoutlet.shop/# US Meds Outlet

mexican farmacia: п»їmexican pharmacy – mexican pharmacy online

meds from mexico mexican pharmacies online BajaMed Direct

https://usmedsoutlet.com/# best online pharmacy reddit

the purple pharmacy mexico: medicine mexico – order meds from mexico

cheapest pharmacy for prescriptions: US Meds Outlet – US Meds Outlet

https://bajameddirect.com/# BajaMed Direct

medication from mexico: purple pharmacy mexico – can i buy meds from mexico online

canadian pharmacy for viagra: cheapest pharmacy for prescriptions without insurance – US Meds Outlet

Thanks for sharing this helpful content. The focus on healthy habits instead of short-term results is something more blogs should talk about. Weight loss can be overwhelming, but your approach makes it feel achievable and less intimidating for readers.

mexico city pharmacy BajaMed Direct mexican rx

https://bajameddirect.shop/# BajaMed Direct

BajaMed Direct: BajaMed Direct – BajaMed Direct

Thanks for sharing this helpful content. The focus on healthy habits instead of short-term results is something more blogs should talk about. Weight loss can be overwhelming, but your approach makes it feel achievable and less intimidating for readers.

https://usmedsoutlet.shop/# canadapharmacyonline

buy medicines online in india: online pharmacy india – pharmacy website india

BajaMed Direct: BajaMed Direct – BajaMed Direct

https://usmedsoutlet.shop/# secure medical online pharmacy

BajaMed Direct: online pharmacy – best pharmacy in mexico

US Meds Outlet online pharmacy without prescription US Meds Outlet

US Meds Outlet: US Meds Outlet – canadian king pharmacy

https://bajameddirect.shop/# pharmacys in mexico

escrow pharmacy canada: canadian pharmacy meds reviews – india pharmacy mail order

https://bajameddirect.shop/# mexican drug store

п»їlegitimate online pharmacies india: india online pharmacy – india online pharmacy

phentermine in mexico pharmacy: BajaMed Direct – BajaMed Direct

https://usmedsoutlet.com/# canadian pharmacy 365

mexico drug store online BajaMed Direct farmacia online usa

https://indogenericexport.com/# zanaflex medication

US Meds Outlet: my canadian pharmacy – online pharmacy australia free delivery

http://usmedsoutlet.com/# US Meds Outlet

mexico pharmacy: online pharmacies in mexico – BajaMed Direct

india pharmacy mail order: mail order pharmacy india – india online pharmacy

http://bajameddirect.com/# BajaMed Direct

https://indogenericexport.shop/# over the counter muscle relaxers that work

online pharmacy in mexico: purple pharmacy – pharmacia mexico

india pharmacy Indo-Generic Export indianpharmacy com

legitimate online pharmacies india: Indo-Generic Export – reputable indian online pharmacy

buy prescription drugs from india: Indo-Generic Export – top 10 pharmacies in india

https://bajameddirect.shop/# online mexican pharmacy

US Meds Outlet: offshore pharmacy no prescription – canadian pharmacy no scripts

mexico drug store: BajaMed Direct – BajaMed Direct

US Meds Outlet no rx pharmacy canadian pharmacy 24h com

https://indogenericexport.shop/# buy methocarbamol without prescription

BajaMed Direct: BajaMed Direct – BajaMed Direct

US Meds Outlet: usa pharmacy online – US Meds Outlet

https://indogenericexport.shop/# tizanidine muscle relaxer

US Meds Outlet: US Meds Outlet – canadian pharmacy king reviews

https://usmedsoutlet.com/# no prescription pharmacy paypal

https://indogenericexport.shop/# muscle relaxer tizanidine

best online pharmacy india Indo-Generic Export india online pharmacy

can you buy neurontin over the counter: neurontin tablets – Neuro Relief USA

zoloft tablet: zoloft pill – zoloft buy

http://neuroreliefusa.com/# Neuro Relief USA

Smart GenRx USA: Smart GenRx USA – canadian pharmacy 24

Smart GenRx USA: austria pharmacy online – Smart GenRx USA

generic for zoloft zoloft generic Sertraline USA

http://ivertherapeutics.com/# stromectol generic name

Neuro Relief USA: Neuro Relief USA – Neuro Relief USA

http://smartgenrxusa.com/# canadian pharmacy world

Neuro Relief USA: purchase neurontin canada – neurontin 500 mg

Neuro Relief USA neurontin capsules 600mg prescription medication neurontin

sertraline generic: zoloft buy – zoloft generic

http://ivertherapeutics.com/# Iver Therapeutics

https://ivertherapeutics.com/# Iver Therapeutics

neurontin generic cost: 600 mg neurontin tablets – neurontin 400 mg capsule

indian pharmacy online: Smart GenRx USA – Smart GenRx USA

online pharmacy meds pharmacy online Smart GenRx USA

https://sertralineusa.com/# Sertraline USA

buy brand neurontin: neurontin 300mg capsule – Neuro Relief USA

Smart GenRx USA: Smart GenRx USA – pharmacy coupons

https://smartgenrxusa.com/# canada pharmacy coupon

stromectol 15 mg: stromectol cost – Iver Therapeutics

Neuro Relief USA neurontin 300mg neurontin price south africa

https://ivertherapeutics.com/# Iver Therapeutics

safe canadian pharmacies: Smart GenRx USA – canadian pharmacy viagra

cost of ivermectin medicine: ivermectin 10 ml – Iver Therapeutics

http://smartgenrxusa.com/# Smart GenRx USA

Iver Therapeutics: Iver Therapeutics – buy liquid ivermectin

https://smartgenrxusa.shop/# Smart GenRx USA

tadalafil canadian pharmacy: canadian pharmacy phone number – buy online pharmacy uk

Neuro Relief USA Neuro Relief USA Neuro Relief USA

neurontin 400 mg capsule: Neuro Relief USA – Neuro Relief USA

http://ivertherapeutics.com/# Iver Therapeutics

Smart GenRx USA: Smart GenRx USA – cheap canadian pharmacy

buy neurontin canadian pharmacy: can i buy neurontin over the counter – neurontin cost uk

https://ivertherapeutics.com/# Iver Therapeutics

Smart GenRx USA: cheapest pharmacy to fill prescriptions without insurance – Smart GenRx USA

neurontin 300 mg capsule cost of neurontin 800 mg price of neurontin

https://smartgenrxusa.shop/# Smart GenRx USA

generic zoloft: zoloft buy – zoloft generic

Excellent post! The information you shared is practical and easy to apply in daily life. I appreciate the positive tone and the emphasis on healthy habits instead of extreme methods. Looking forward to reading more of your content.

canada drugs: Smart GenRx USA – no rx needed pharmacy

http://smartgenrxusa.com/# Smart GenRx USA

zoloft without rx: zoloft without rx – buy zoloft

zoloft buy: sertraline generic – zoloft generic

https://neuroreliefusa.shop/# neurontin sale

zoloft cheap sertraline zoloft buy zoloft

buy drugs from canada: thecanadianpharmacy – vipps approved canadian online pharmacy

http://ivertherapeutics.com/# Iver Therapeutics

Neuro Relief USA: neurontin cost – Neuro Relief USA

Sertraline USA: sertraline zoloft – order zoloft

http://neuroreliefusa.com/# neurontin 100 mg cost

ivermectin pills human Iver Therapeutics ivermectin where to buy for humans

stromectol 3 mg: ivermectin 8 mg – Iver Therapeutics

http://ivertherapeutics.com/# ivermectin cost uk

stromectol drug: Iver Therapeutics – stromectol cost

buy ivermectin cream: Iver Therapeutics – ivermectin pills

https://neuroreliefusa.shop/# discount neurontin

Neuro Relief USA: neurontin 300mg capsule – Neuro Relief USA

Iver Therapeutics: Iver Therapeutics – generic stromectol

https://sertralineusa.com/# zoloft cheap

prescription drugs from canada Smart GenRx USA Smart GenRx USA

neurontin cap 300mg price: purchase neurontin canada – buy neurontin 100 mg

https://ivertherapeutics.shop/# Iver Therapeutics

stromectol price in india: Iver Therapeutics – ivermectin 4

If you desire to take a great deal from this paragraph then you have to

apply such techniques to your won weblog.

Iver Therapeutics: ivermectin 3 mg – Iver Therapeutics