After 25 years of existence, political and cultural fragmentations have prevented Europe from successfully achieving it’s ambitions for forming a single market. Despite this challenge, entrepreneurs have risen to the occasion to grow global companies. In recent articles, we have shown that Europe’s most popular startup hubs Berlin and London are truly transnational with over 50% foreign-born founders. Across the continent, over 60% of startups in Europe have legal entities, employees or investors abroad.

With Brexit looming and the worldwide rise of populist nationalism, Europe’s startup ecosystem faces a tough test. While still in its infancy, the network of hubs must quickly grow stronger together before conditions get worse. We have been tracking the connections of startup hubs in Europe for several years and we were curious to find which European startup hubs are actually part of the network flows of capital, talent and opportunities and which remain excluded?

The Locations of Europe’s Top Startups

To begin, we have analyzed where Europe’s top 100 startups (identified by the Startup Europe Partnership), have their international offices. Initially, we see that 63% of these companies have established offices abroad, which shows not all startups have a need to establish legal entities to grow and access international resources. Only 37% of all the 2nd offices are in Europe. However, this subset tells an interesting story: First of all, the top 10 locations capture 47% of all 2nd offices of Europe’s top startups. London and Berlin are leading with 12% and 6%. However, around 12% of the 2nd offices are established in the same city and 23% in the same country of the company’s headquarters. When we look at only the international subsidiaries, we find Amsterdam leads with 8.15% of all international startup offices before London with 7% and Milan with 6%.

The location choice for a 2nd office is apparently a quite different one from choosing the headquarters. This choice seems to reflect the important need to connect to other markets. Milan can be interpreted as a location which opens companies to Southern Europe, whereas Amsterdam is at the crossroads of the large Western industrial nations. This is reflected in the Netherland’s official government ICT strategy, marketing itself as the “digital gateway to Europe”.

When you look at the preferences of companies from different countries, some interesting trends begin to emerge. For example, when you consider the preferences of the top companies from France, you find that they have a strong connection to Munich with 15% of their 2nd offices being established there. The Germans in contrast, favor Amsterdam and Milan as their top locations for second offices.

We can therefore see that the network of top startups is much more distributed across European startup hubs than it might appear at first glance, and by no means concentrated only in the top hubs.

How do entrepreneurs connect across cities?

From this analysis, we can see some correlation with the office locations and how founders rank their most preferred startup hubs founders. Based on the perception founders have of other startup hubs, we can begin to extrapolate their relations to these places. Simply put: If I think highly of another startup hub, I have likely been in touch or at least been influenced by its startup ecosystem.

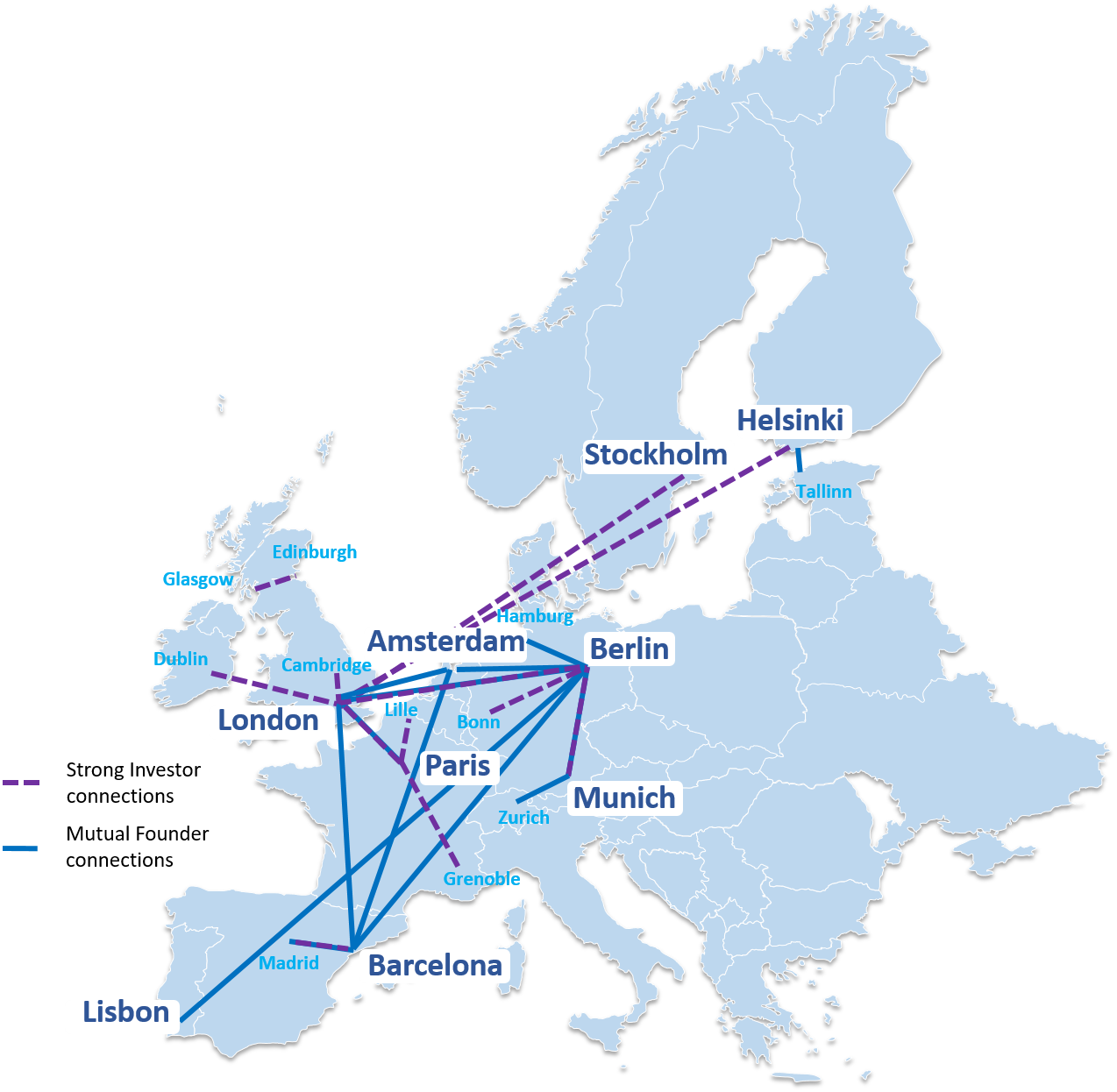

In an attempt to visualize how the startup community connects across borders, we have mapped the connections between hubs based on their mutual recognition by founders. If we define a strong founder connection as where at least 5% of the founders of each place endorsed the other location in our survey, 22 can be considered mutually strong. These mutual connections show a clear networking effect between 11 cities.

The most networked city with 6 mutually strong connections of founders is Berlin, followed by London with 4 mutually strong connections.

| Startup Hub | Mutually Strong Founder Connections | With |

| Berlin | 6 | Amsterdam, Barcelona, Hamburg, Lisbon, London, Munich |

| London | 4 | Amsterdam, Barcelona, Berlin, Paris |

| Amsterdam | 3 | Barcelona, Berlin, London |

| Barcelona | 3 | Amsterdam, Berlin, London |

| Munich | 2 | Berlin, Zurich |

| Paris | 1 | London |

| Lisbon | 1 | Berlin |

| Hamburg | 1 | Berlin |

| Zurich | 1 | Munich |

| Madrid | 1 | Barcelona |

| Helsinki | 1 | Tallinn |

The strongest network between hubs is found between Berlin, London, Amsterdam and Barcelona. These cities seem to function as highly effective exchange platforms, attracting more local resources via further exclusive 1:1 connections with 2nd tier hubs.

Looking positively at these findings, they show that this network is in principle open for newcomers. One example is Lisbon, who has gained a prominent connection with Berlin and might soon become more integrated in the circle. However, across the continent, the European network of entrepreneurs still remains uneven. Clear gaps exist as we find a lack of mutual connections between the remainder of startup hubs, most notably from CEE and the South.

Where do investments flow?

Some of Europe’s most vibrant and successful startup hubs also remain disconnected from one another, as seen in the Nordics. One might assume that founders from the Nordics and the UK are exchanging vividly. But this can be seen neither in terms of establishment 2nd offices nor in mutual recognition by founders.

Adding to our analysis of the network the flows of investment, we find that there is not necessarily a complete alignment with founder networks. We are basing our analysis again on the dataset provided by Pitchbook showing origins and destinations of investment deals in Europe between 2014 and 2017. Deal sizes were between 0.1mn and 5mn € only.

Here, we identify a strong investor connection between two hubs, if more than 1% of total rounds originating in one place go to same location and more than 9 investment rounds have taken place in this connection. Given this definition, only 23 out of over 1500 city connections can be classified as “strong”, showing repeated flows of investments from one place to another. These 23 represent roughly 15% of intercity deals done in Europe. Fascinatingly, only 8 of the 23 strong investor connections are mutual and all of these are within the same national ecosystems, e.g. between London and Cambridge. Venture Capital is, as we have shown before, still not yet very international in Europe.

Source | Target | weight | % weight | vice-versa | % vice-versa | Mutual |

Glasgow, United Kingdom | Edinburgh, United Kingdom | 42 | 58% | 1 | 3% | x |

Madrid, Spain | Barcelona, Spain | 36 | 47% | 11 | 19% | x |

Cambridge, United Kingdom | London, United Kingdom | 14 | 27% | 35 | 5% | x |

Munich, Germany | Berlin, Germany | 15 | 23% | 6 | 3% | x |

Barcelona, Spain | Madrid, Spain | 11 | 19% | 36 | 47% | x |

Helsinki, Finland | Espoo, Finland | 17 | 11% | 1 | 17% | x |

Dublin, Ireland | London, United Kingdom | 10 | 5% | 4 | 1% | |

London, United Kingdom | Cambridge, United Kingdom | 35 | 5% | 14 | 27% | x |

Paris, France | Lille, France | 18 | 4% | 2 | 13% | x |

Paris, France | London, United Kingdom | 16 | 3% | 12 | 2% | |

Paris, France | Grenoble, France | 11 | 2% | 2 | 11% | |

London, United Kingdom | Helsinki, Finland | 15 | 2% | 5 | 3% | |

London, United Kingdom | Berlin, Germany | 13 | 2% | 8 | 5% | |

London, United Kingdom | Paris, France | 12 | 2% | 16 | 3% | |

London, United Kingdom | Stockholm, Sweden | 12 | 2% | 7 | 7% |

However, adding the strong investor connections onto the map of the entrepreneurial network in Europe, we find that it matches the founders’ channels only within the network between Munich, Berlin, London and Paris. On the other side, it stretches from London to the Nordics, connecting Stockholm, Helsinki and in a way Tallinn to the network.

Looking at the final picture of connections in Europe, we see a still fragmented network of founder communities, growing scale-ups and venture capital relations. While Berlin and London are well connected in all domains, Amsterdam, Paris, Barcelona and Munich are not yet fully integrated in a strong core. Amsterdam and Barcelona both lack the investor attention they deserve. Stronger ties between these hubs to Munich and Paris would close the circle. Europe’s 2nd tier hubs like Munich, Hamburg, Lisbon and Stockholm as well as Helsinki should work on more lateral connections to stabilize their role in the network.

Looking at the immediate future, the lack of integration of startup ecosystems in Europe will be a major factor in fending off external shocks like the Brexit. It is high-time for Europe to interconnect.

By Thomas Kösters

Hello

Need Help Managing Your Social Media?

Social Media Manager keeps your brand active across all platforms: Facebook, Instagram, TikTok, LinkedIn, YouTube, Pinterest, and X.

Increases visibility, and saves you time. More engagement, more growth without the daily hassle.

Do you need this service for your business? Try it now and see the difference.

Reply to this email, and I’ll be happy to share more details with you.

Best regards,

Tony

Austria, BURGENLAND, Schorgendorf, 8605, Grazer Bundesstrasse 89

To stop any further communication through your website form, Please reply with subject: Unsubscribe !startupsandplaces.com

Hello

Need Help Managing Your Social Media?

Social Media Manager keeps your brand active across all platforms: Facebook, Instagram, TikTok, LinkedIn, YouTube, Pinterest, and X.

Increases visibility, and saves you time. More engagement, more growth without the daily hassle.

Do you need this service for your business? Try it now and see the difference.

Reply to this email, and I’ll be happy to share more details with you.

Best regards,

Dedra

France, CENTRE, Metz, 57070, 68 Rue St Ferreol

To stop any further communication through your website form, Please reply with subject: Unsubscribe !startupsandplaces.com

Hi,

I just visited startupsandplaces.com and wondered if you’d ever thought about having an engaging video to explain what you do?

Our prices start from just $195 (USD).

Let me know if you’re interested in seeing samples of our previous work. If you are not interested, just use the link at the bottom.

Regards,

Joanna

Unsubscribe: https://removeme.live/unsubscribe.php?d=startupsandplaces.com

Hello

Boost Sales Fast with Rapid Traffic Flow

Want more traffic and real buyers? Rapid Traffic Flow sends high-converting traffic straight to your site-fast, easy, and hands-free.

Perfect for boosting product visibility and increasing sales without extra effort.

Start getting real results now: https://rb.gy/bx4rvz

Best regards

Thad

If you wish to unsubscribe, please reply to this email.

Hi,

We manage a substantial online presence, including a Twitter (X) audience of over 3 million and an email marketing audience of over 32 million.

I’m reaching out because I believe your website’s focus, as seen at startupsandplaces.com, could significantly benefit from exposure to this vast and diverse audience. We specialize in helping website owners like you maximize your online visibility and achieve unparalleled reach for your content, services, or products.

We offer flexible promotional opportunities across our email and Twitter (X) channels. Our unique selling proposition is simple: unmatched scale and direct access to over 35 million potential customers.

If you’re looking to expand your reach, please reply with a brief description of what you’d like to promote, whether that be a product, service, or blog etc. We can then discuss how our promotional packages can align with your goals and provide pricing options.

If this isn’t of interest, no action is needed; simply delete this email.

Looking forward to the possibility of helping you grow.

Best regards,

Ellie

Hello

Need Help Managing Your Social Media?

Social Media Manager keeps your brand active across all platforms: Facebook, Instagram, TikTok, LinkedIn, YouTube, Pinterest, and X.

Increases visibility, and saves you time. More engagement, more growth without the daily hassle.

Do you need this service for your business? Try it now and see the difference.

Reply to this email, and I’ll be happy to share more details with you.

Best regards,

Lorie

Australia, NSW, Wamban, 2537, 28 Shamrock Avenue

To stop any further communication through your website form, Please reply with subject: Unsubscribe !startupsandplaces.com