After 25 years of existence, political and cultural fragmentations have prevented Europe from successfully achieving it’s ambitions for forming a single market. Despite this challenge, entrepreneurs have risen to the occasion to grow global companies. In recent articles, we have shown that Europe’s most popular startup hubs Berlin and London are truly transnational with over 50% foreign-born founders. Across the continent, over 60% of startups in Europe have legal entities, employees or investors abroad.

With Brexit looming and the worldwide rise of populist nationalism, Europe’s startup ecosystem faces a tough test. While still in its infancy, the network of hubs must quickly grow stronger together before conditions get worse. We have been tracking the connections of startup hubs in Europe for several years and we were curious to find which European startup hubs are actually part of the network flows of capital, talent and opportunities and which remain excluded?

The Locations of Europe’s Top Startups

To begin, we have analyzed where Europe’s top 100 startups (identified by the Startup Europe Partnership), have their international offices. Initially, we see that 63% of these companies have established offices abroad, which shows not all startups have a need to establish legal entities to grow and access international resources. Only 37% of all the 2nd offices are in Europe. However, this subset tells an interesting story: First of all, the top 10 locations capture 47% of all 2nd offices of Europe’s top startups. London and Berlin are leading with 12% and 6%. However, around 12% of the 2nd offices are established in the same city and 23% in the same country of the company’s headquarters. When we look at only the international subsidiaries, we find Amsterdam leads with 8.15% of all international startup offices before London with 7% and Milan with 6%.

The location choice for a 2nd office is apparently a quite different one from choosing the headquarters. This choice seems to reflect the important need to connect to other markets. Milan can be interpreted as a location which opens companies to Southern Europe, whereas Amsterdam is at the crossroads of the large Western industrial nations. This is reflected in the Netherland’s official government ICT strategy, marketing itself as the “digital gateway to Europe”.

When you look at the preferences of companies from different countries, some interesting trends begin to emerge. For example, when you consider the preferences of the top companies from France, you find that they have a strong connection to Munich with 15% of their 2nd offices being established there. The Germans in contrast, favor Amsterdam and Milan as their top locations for second offices.

We can therefore see that the network of top startups is much more distributed across European startup hubs than it might appear at first glance, and by no means concentrated only in the top hubs.

How do entrepreneurs connect across cities?

From this analysis, we can see some correlation with the office locations and how founders rank their most preferred startup hubs founders. Based on the perception founders have of other startup hubs, we can begin to extrapolate their relations to these places. Simply put: If I think highly of another startup hub, I have likely been in touch or at least been influenced by its startup ecosystem.

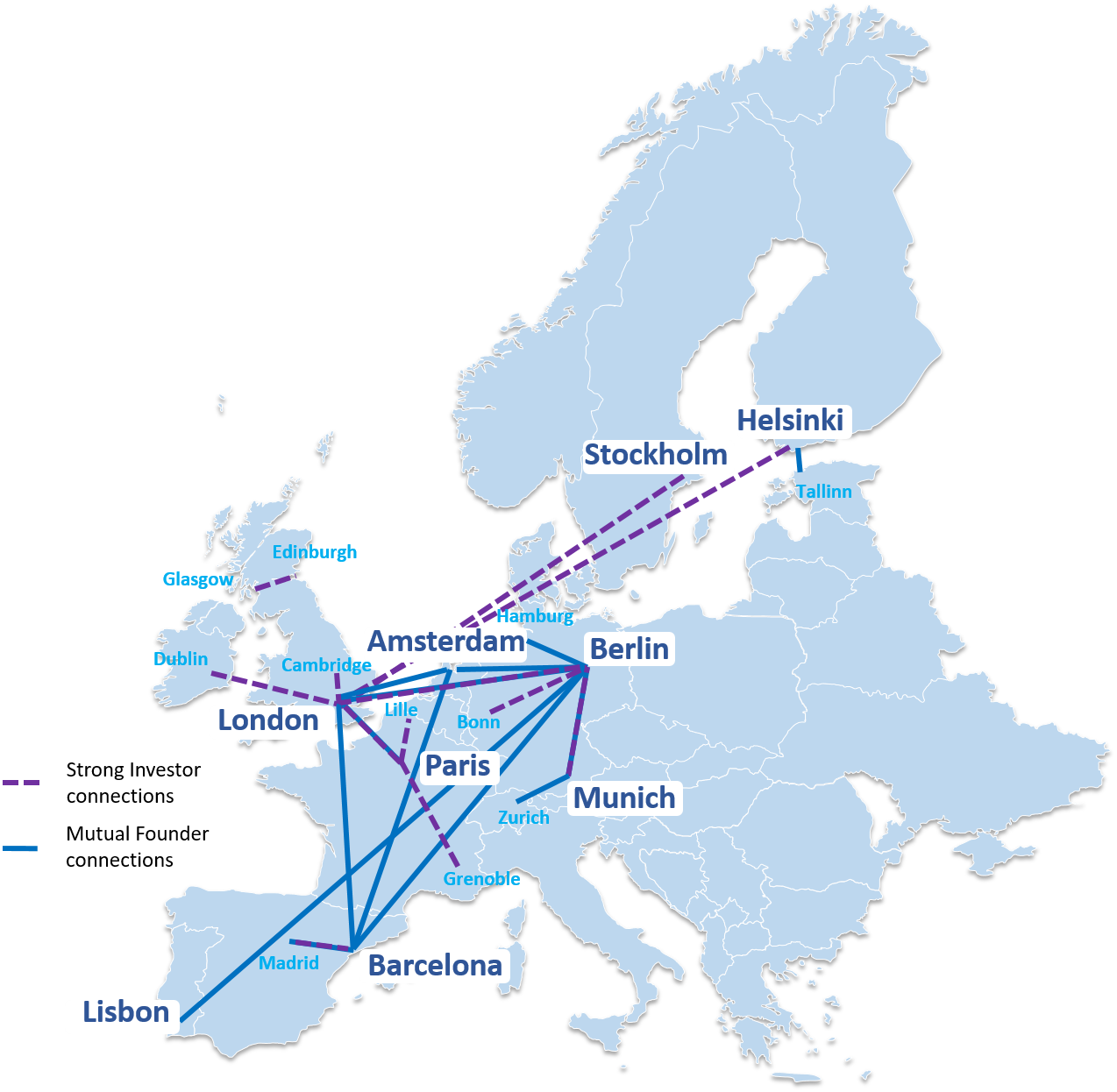

In an attempt to visualize how the startup community connects across borders, we have mapped the connections between hubs based on their mutual recognition by founders. If we define a strong founder connection as where at least 5% of the founders of each place endorsed the other location in our survey, 22 can be considered mutually strong. These mutual connections show a clear networking effect between 11 cities.

The most networked city with 6 mutually strong connections of founders is Berlin, followed by London with 4 mutually strong connections.

| Startup Hub | Mutually Strong Founder Connections | With |

| Berlin | 6 | Amsterdam, Barcelona, Hamburg, Lisbon, London, Munich |

| London | 4 | Amsterdam, Barcelona, Berlin, Paris |

| Amsterdam | 3 | Barcelona, Berlin, London |

| Barcelona | 3 | Amsterdam, Berlin, London |

| Munich | 2 | Berlin, Zurich |

| Paris | 1 | London |

| Lisbon | 1 | Berlin |

| Hamburg | 1 | Berlin |

| Zurich | 1 | Munich |

| Madrid | 1 | Barcelona |

| Helsinki | 1 | Tallinn |

The strongest network between hubs is found between Berlin, London, Amsterdam and Barcelona. These cities seem to function as highly effective exchange platforms, attracting more local resources via further exclusive 1:1 connections with 2nd tier hubs.

Looking positively at these findings, they show that this network is in principle open for newcomers. One example is Lisbon, who has gained a prominent connection with Berlin and might soon become more integrated in the circle. However, across the continent, the European network of entrepreneurs still remains uneven. Clear gaps exist as we find a lack of mutual connections between the remainder of startup hubs, most notably from CEE and the South.

Where do investments flow?

Some of Europe’s most vibrant and successful startup hubs also remain disconnected from one another, as seen in the Nordics. One might assume that founders from the Nordics and the UK are exchanging vividly. But this can be seen neither in terms of establishment 2nd offices nor in mutual recognition by founders.

Adding to our analysis of the network the flows of investment, we find that there is not necessarily a complete alignment with founder networks. We are basing our analysis again on the dataset provided by Pitchbook showing origins and destinations of investment deals in Europe between 2014 and 2017. Deal sizes were between 0.1mn and 5mn € only.

Here, we identify a strong investor connection between two hubs, if more than 1% of total rounds originating in one place go to same location and more than 9 investment rounds have taken place in this connection. Given this definition, only 23 out of over 1500 city connections can be classified as “strong”, showing repeated flows of investments from one place to another. These 23 represent roughly 15% of intercity deals done in Europe. Fascinatingly, only 8 of the 23 strong investor connections are mutual and all of these are within the same national ecosystems, e.g. between London and Cambridge. Venture Capital is, as we have shown before, still not yet very international in Europe.

Source | Target | weight | % weight | vice-versa | % vice-versa | Mutual |

Glasgow, United Kingdom | Edinburgh, United Kingdom | 42 | 58% | 1 | 3% | x |

Madrid, Spain | Barcelona, Spain | 36 | 47% | 11 | 19% | x |

Cambridge, United Kingdom | London, United Kingdom | 14 | 27% | 35 | 5% | x |

Munich, Germany | Berlin, Germany | 15 | 23% | 6 | 3% | x |

Barcelona, Spain | Madrid, Spain | 11 | 19% | 36 | 47% | x |

Helsinki, Finland | Espoo, Finland | 17 | 11% | 1 | 17% | x |

Dublin, Ireland | London, United Kingdom | 10 | 5% | 4 | 1% | |

London, United Kingdom | Cambridge, United Kingdom | 35 | 5% | 14 | 27% | x |

Paris, France | Lille, France | 18 | 4% | 2 | 13% | x |

Paris, France | London, United Kingdom | 16 | 3% | 12 | 2% | |

Paris, France | Grenoble, France | 11 | 2% | 2 | 11% | |

London, United Kingdom | Helsinki, Finland | 15 | 2% | 5 | 3% | |

London, United Kingdom | Berlin, Germany | 13 | 2% | 8 | 5% | |

London, United Kingdom | Paris, France | 12 | 2% | 16 | 3% | |

London, United Kingdom | Stockholm, Sweden | 12 | 2% | 7 | 7% |

However, adding the strong investor connections onto the map of the entrepreneurial network in Europe, we find that it matches the founders’ channels only within the network between Munich, Berlin, London and Paris. On the other side, it stretches from London to the Nordics, connecting Stockholm, Helsinki and in a way Tallinn to the network.

Looking at the final picture of connections in Europe, we see a still fragmented network of founder communities, growing scale-ups and venture capital relations. While Berlin and London are well connected in all domains, Amsterdam, Paris, Barcelona and Munich are not yet fully integrated in a strong core. Amsterdam and Barcelona both lack the investor attention they deserve. Stronger ties between these hubs to Munich and Paris would close the circle. Europe’s 2nd tier hubs like Munich, Hamburg, Lisbon and Stockholm as well as Helsinki should work on more lateral connections to stabilize their role in the network.

Looking at the immediate future, the lack of integration of startup ecosystems in Europe will be a major factor in fending off external shocks like the Brexit. It is high-time for Europe to interconnect.

By Thomas Kösters

Hello

Need Help Managing Your Social Media?

Social Media Manager keeps your brand active across all platforms: Facebook, Instagram, TikTok, LinkedIn, YouTube, Pinterest, and X.

Increases visibility, and saves you time. More engagement, more growth without the daily hassle.

Do you need this service for your business? Try it now and see the difference.

Reply to this email, and I’ll be happy to share more details with you.

Best regards,

Tony

Austria, BURGENLAND, Schorgendorf, 8605, Grazer Bundesstrasse 89

To stop any further communication through your website form, Please reply with subject: Unsubscribe !startupsandplaces.com

Hello

Need Help Managing Your Social Media?

Social Media Manager keeps your brand active across all platforms: Facebook, Instagram, TikTok, LinkedIn, YouTube, Pinterest, and X.

Increases visibility, and saves you time. More engagement, more growth without the daily hassle.

Do you need this service for your business? Try it now and see the difference.

Reply to this email, and I’ll be happy to share more details with you.

Best regards,

Dedra

France, CENTRE, Metz, 57070, 68 Rue St Ferreol

To stop any further communication through your website form, Please reply with subject: Unsubscribe !startupsandplaces.com

Hi,

I just visited startupsandplaces.com and wondered if you’d ever thought about having an engaging video to explain what you do?

Our prices start from just $195 (USD).

Let me know if you’re interested in seeing samples of our previous work. If you are not interested, just use the link at the bottom.

Regards,

Joanna

Unsubscribe: https://removeme.live/unsubscribe.php?d=startupsandplaces.com

Hello

Boost Sales Fast with Rapid Traffic Flow

Want more traffic and real buyers? Rapid Traffic Flow sends high-converting traffic straight to your site-fast, easy, and hands-free.

Perfect for boosting product visibility and increasing sales without extra effort.

Start getting real results now: https://rb.gy/bx4rvz

Best regards

Thad

If you wish to unsubscribe, please reply to this email.

Hi,

We manage a substantial online presence, including a Twitter (X) audience of over 3 million and an email marketing audience of over 32 million.

I’m reaching out because I believe your website’s focus, as seen at startupsandplaces.com, could significantly benefit from exposure to this vast and diverse audience. We specialize in helping website owners like you maximize your online visibility and achieve unparalleled reach for your content, services, or products.

We offer flexible promotional opportunities across our email and Twitter (X) channels. Our unique selling proposition is simple: unmatched scale and direct access to over 35 million potential customers.

If you’re looking to expand your reach, please reply with a brief description of what you’d like to promote, whether that be a product, service, or blog etc. We can then discuss how our promotional packages can align with your goals and provide pricing options.

If this isn’t of interest, no action is needed; simply delete this email.

Looking forward to the possibility of helping you grow.

Best regards,

Ellie

Hello

Need Help Managing Your Social Media?

Social Media Manager keeps your brand active across all platforms: Facebook, Instagram, TikTok, LinkedIn, YouTube, Pinterest, and X.

Increases visibility, and saves you time. More engagement, more growth without the daily hassle.

Do you need this service for your business? Try it now and see the difference.

Reply to this email, and I’ll be happy to share more details with you.

Best regards,

Lorie

Australia, NSW, Wamban, 2537, 28 Shamrock Avenue

To stop any further communication through your website form, Please reply with subject: Unsubscribe !startupsandplaces.com

Hello

Need Help Managing Your Social Media?

Social Media Manager keeps your brand active across all platforms: Facebook, Instagram, TikTok, LinkedIn, YouTube, Pinterest, and X.

Increases visibility, and saves you time. More engagement, more growth without the daily hassle.

Do you need this service for your business? Try it now and see the difference.

Reply to this email, and I’ll be happy to share more details with you.

Best regards,

Nannette

Belgium, VOV, Ouwegem, 9750, Rue De La Brasserie 125

To stop any further communication through your website form, Please reply with subject: Unsubscribe !startupsandplaces.com

I do not even understand how I ended up here, but I assumed this publish used to be great

You’re so awesome! I don’t believe I have read a single thing like that before. So great to find someone with some original thoughts on this topic. Really.. thank you for starting this up. This website is something that is needed on the internet, someone with a little originality!

Hello

Need Help Managing Your Social Media?

Social Media Manager keeps your brand active across all platforms: Facebook, Instagram, TikTok, LinkedIn, YouTube, Pinterest, and X.

Increases visibility, and saves you time. More engagement, more growth without the daily hassle.

Do you need this service for your business? Try it now and see the difference.

Reply to this email, and I’ll be happy to share more details with you.

Best regards,

Carlota

Italy, NU, Su Pinu, 8048, Via Croce Rossa 75

To stop any further communication through your website form, Please reply with subject: Unsubscribe !startupsandplaces.com

Hello

Are you looking to rank higher, get more traffic, and turn visitors into paying customers?

We help businesses like yours grow through powerful and results-driven digital marketing services, including:

– Google Ranking Optimization

– Google Maps Ranking

– YouTube Video Ranking

– SEO Backlinks & Link Diversity

– Website Traffic Campaigns

– High-Quality Content Creation

– Professional Video Production

– Social Media Manager (all major platforms)

– Lead Generation (Get Customers)

– White-Label SEO for Agencies

Whether you’re just starting out or looking to scale, we offer custom SEO plans and hands-on support all focused on helping you achieve visible, lasting results.

Simply reply to this email and we’ll recommend the best package for your goals.

Best regards,

Your SEO & Digital Marketing Expert

Italy, CO, Acquaseria, 22010, Via Torre Di Mezzavia 148

To stop any further communication from us, please reply to this email with subject: Unsubscribe !startupsandplaces.com

Hi,

I just visited startupsandplaces.com and wondered if you’ve ever considered an impactful video to advertise your business? Our videos can generate impressive results on both your website and across social media.

Our videos cost just $195 (USD) for a 30 second video ($239 for 60 seconds) and include a full script, voice-over and video.

I can show you some previous videos we’ve done if you want me to send some over. Let me know if you’re interested in seeing samples of our previous work.

Regards,

Joanna

Unsubscribe: https://unsubscribe.video/unsubscribe.php?d=startupsandplaces.com

Hello

This message is intended for the owner of startupsandplaces.com. If you are not the person responsible for managing the site, please redirect this email to the right contact.

We are a company that provides high-quality SEO services. We can help your website improve its rankings and attract more clients. Here are some of the services we offer:

– Google Ranking Optimization

– Google Maps Ranking

– YouTube Video Ranking

– Authority Link Building

– Website Traffic Campaigns

– SEO-Optimized Articles

– Professional Video Production

– Full Social Media Management

– Lead Generation (Get Customers)

– White-Label SEO for Agencies

If you are the site owner, we would be glad to provide more details and discuss how we can assist your business in achieving better rankings and more sales.

Just get back to us and we’ll suggest the ideal SEO plan for your needs.

Best regards,

Your SEO & Digital Marketing Expert

Germany, BW, Villingen-Schwenningen Weilersbach, 78052, Schonhauser Allee 88

To stop any further communication from us, please reply to this email with subject: Unsubscribe !startupsandplaces.com

Hello

Transform your smartphone into a $100/day money maker

I generate $more than $100 just by emailing with *Email Cash Machine* — done-for-you pre-written emails, no-cost autoresponder, exclusive affiliate deals inside. No need to create products, run ads, or have experience. Get paid via phone or laptop.

Claim your one-time access now for just $17 — risk-free with 180-day refund ==> https://rb.gy/uxe0l2

Best regards

Faye

If you wish to unsubscribe, please reply to this email.

Hello

Use your phone as a $100/day cash machine

I pocket $over 100 whenever I email my list with *Email Cash Machine* — done-for-you pre-written emails, complimentary autoresponder, hidden profit offers included. No need to create products, run ads, or have experience. Works from your phone or computer.

Claim your permanent access now for just $seventeen dollars — 180-day money-back guarantee ==> https://rb.gy/uxe0l2

Best regards

Angelina

If you wish to unsubscribe, please reply to this email.

Hello

This message is intended for the administrator of startupsandplaces.com. If you are not the person responsible for maintaining the site, please forward this email to the right contact.

Our agency that provides professional SEO services. We can help your website grow in search engines and get more customers. Here are some of the services we offer:

– Google Ranking Optimization

– Google Maps Ranking

– YouTube Video Ranking

– SEO Backlinks & Link Diversity

– Website Traffic Campaigns

– SEO-Optimized Articles

– Professional Video Production

– Social Media Manager (all major platforms)

– Lead Generation (Get Customers)

– SEO Outsourcing Solutions

If you are the site owner, we would be pleased to provide more details and show you how we can support your business in achieving better rankings and increased conversions.

Simply reply to this email and we’ll recommend the best package for your goals.

Best regards,

Your SEO & Digital Marketing Expert

Norway, NA, Hylkje, 5109, Gandalen 106

To stop any further communication from us, please reply to this email with subject: Unsubscribe !startupsandplaces.com

I made $100/day with this simple system

Done-for-you system, instant commissions, no tech skills needed.

Start today before the price rises: https://rb.gy/uxe0l2

If you wish to unsubscribe, please reply to this email.

Hi,

I noticed a few issues on your website startupsandplaces.com

Would you like me to show you what they are?

Regards,

Blondell

Australia, NSW, Nullamanna, 2360, 15 Plug Street, 267330612

Don’t want to receive messages like this in the future? Just reply to this email.

Hi,

This guy is earning a lot, check out what he’s doing:

https://youtube.com/shorts/B7I9HL8dtuE

Regards,

Lonnie

123 Maple St, Apt 4B, Springfield, IL 62704, USA

Don’t want to receive messages like this in the future? Just reply to this email.

online medicine: online medicine – online medicine india

https://everameds.xyz/# Cialis over the counter

https://everameds.xyz/# EveraMeds

fast delivery Kamagra pills: kamagra oral jelly – online pharmacy for Kamagra

AeroMedsRx sildenafil 50 mg price AeroMedsRx

https://aeromedsrx.xyz/# Generic Viagra for sale

AeroMedsRx: sildenafil online – AeroMedsRx

trusted Kamagra supplier in the US: kamagra oral jelly – BlueWaveMeds

Cialis over the counter EveraMeds buy cialis pill

https://aeromedsrx.xyz/# AeroMedsRx

http://bluewavemeds.com/# Blue Wave Meds

kamagra oral jelly: order Kamagra discreetly – BlueWaveMeds

EveraMeds EveraMeds Cialis 20mg price in USA

http://bluewavemeds.com/# buy Kamagra online

https://aeromedsrx.com/# Buy Viagra online cheap

buy Viagra over the counter: AeroMedsRx – Viagra online price

AeroMedsRx: Viagra Tablet price – Cheap generic Viagra online

https://bluewavemeds.xyz/# fast delivery Kamagra pills

kamagra oral jelly online pharmacy for Kamagra BlueWaveMeds

https://everameds.xyz/# EveraMeds

fast delivery Kamagra pills: online pharmacy for Kamagra – online pharmacy for Kamagra

https://bluewavemeds.com/# online pharmacy for Kamagra

AeroMedsRx AeroMedsRx AeroMedsRx

kamagra: order Kamagra discreetly – kamagra

http://everameds.com/# Buy Tadalafil 10mg

generic sildenafil: Generic Viagra for sale – AeroMedsRx

EveraMeds EveraMeds EveraMeds

http://bluewavemeds.com/# fast delivery Kamagra pills

Cialis over the counter: Buy Tadalafil 10mg – EveraMeds

https://bluewavemeds.com/# order Kamagra discreetly

AeroMedsRx AeroMedsRx viagra canada

http://aeromedsrx.com/# AeroMedsRx

https://aeromedsrx.com/# AeroMedsRx

EveraMeds: Generic Cialis without a doctor prescription – buy cialis pill

cheap viagra Buy generic 100mg Viagra online sildenafil 50 mg price

Cheap Cialis: cialis for sale – п»їcialis generic

https://bluewavemeds.com/# kamagra oral jelly

trusted Kamagra supplier in the US: fast delivery Kamagra pills – kamagra oral jelly

EveraMeds EveraMeds EveraMeds

https://everameds.com/# Cialis without a doctor prescription

kamagra: BlueWaveMeds – order Kamagra discreetly

kamagra oral jelly order Kamagra discreetly kamagra oral jelly

http://bluewavemeds.com/# BlueWaveMeds

AeroMedsRx: Generic Viagra for sale – Generic Viagra online

order Kamagra discreetly: trusted Kamagra supplier in the US – kamagra oral jelly

BlueWaveMeds order Kamagra discreetly order Kamagra discreetly

https://aeromedsrx.xyz/# Viagra online price

best price for viagra 100mg: Cheapest Sildenafil online – AeroMedsRx

EveraMeds EveraMeds EveraMeds

https://everameds.com/# Buy Tadalafil 10mg

AeroMedsRx: Viagra online price – Viagra online price

EveraMeds Generic Cialis price Tadalafil Tablet

trusted Kamagra supplier in the US: online pharmacy for Kamagra – trusted Kamagra supplier in the US

https://everameds.xyz/# EveraMeds

Blue Wave Meds: fast delivery Kamagra pills – fast delivery Kamagra pills

EveraMeds EveraMeds Tadalafil price

https://aeromedsrx.xyz/# AeroMedsRx

fast delivery Kamagra pills: fast delivery Kamagra pills – trusted Kamagra supplier in the US

BlueWaveMeds kamagra online pharmacy for Kamagra

http://bluewavemeds.com/# Blue Wave Meds

EveraMeds: EveraMeds – Buy Cialis online

AeroMedsRx Cheap Sildenafil 100mg AeroMedsRx

Generic Cialis price: Cheap Cialis – Generic Cialis without a doctor prescription

https://bluewavemeds.xyz/# buy Kamagra online

Cheapest Sildenafil online: AeroMedsRx – AeroMedsRx

Buy Tadalafil 5mg EveraMeds Cialis 20mg price in USA

https://everameds.com/# EveraMeds

kamagra: Blue Wave Meds – order Kamagra discreetly

Buy generic 100mg Viagra online sildenafil 50 mg price Buy generic 100mg Viagra online

https://bluewavemeds.com/# buy Kamagra online

Cialis 20mg price: EveraMeds – Cialis without a doctor prescription

trusted Kamagra supplier in the US: order Kamagra discreetly – Blue Wave Meds

AeroMedsRx AeroMedsRx AeroMedsRx

https://bluewavemeds.com/# online pharmacy for Kamagra

cheapest cialis: Cialis without a doctor prescription – Tadalafil Tablet

EveraMeds EveraMeds Tadalafil price

https://aeromedsrx.xyz/# Viagra generic over the counter

Cheap Viagra 100mg: AeroMedsRx – AeroMedsRx

AeroMedsRx AeroMedsRx AeroMedsRx

AeroMedsRx: AeroMedsRx – AeroMedsRx

https://aeromedsrx.xyz/# best price for viagra 100mg

fast delivery Kamagra pills: online pharmacy for Kamagra – buy Kamagra online

Blue Wave Meds kamagra oral jelly BlueWaveMeds

canadian pharmacy 24 https://isoindiapharm.xyz/# Iso Pharm

MhfaPharm: MHFA Pharm – pharmacy in canada

http://uvapharm.com/# UvaPharm

canadian pharmacy: vipps approved canadian online pharmacy – MhfaPharm

certified canadian pharmacy https://isoindiapharm.com/# top 10 pharmacies in india

UvaPharm UvaPharm best mexican pharmacy online

https://uvapharm.com/# UvaPharm

MHFA Pharm: canadian online pharmacy – MHFA Pharm

Uva Pharm: UvaPharm – Uva Pharm

buying drugs from canada https://mhfapharm.com/# MHFA Pharm

https://uvapharm.com/# tijuana pharmacy online

canadian pharmacy no scripts https://mhfapharm.com/# MHFA Pharm

IsoIndiaPharm: online shopping pharmacy india – Online medicine order

pharmacy rx world canada canadian online pharmacy MhfaPharm

https://mhfapharm.com/# canadian compounding pharmacy

MhfaPharm: MhfaPharm – MHFA Pharm

online canadian drugstore http://mhfapharm.com/# MHFA Pharm

Iso Pharm: Online medicine order – IsoIndiaPharm

http://uvapharm.com/# Uva Pharm

canadian pharmacy online http://mhfapharm.com/# MhfaPharm

canada pharmacy online legit: MHFA Pharm – MhfaPharm

https://isoindiapharm.xyz/# IsoIndiaPharm

canadian pharmacy antibiotics https://mhfapharm.xyz/# canadianpharmacymeds

MhfaPharm: MhfaPharm – best canadian pharmacy

order medication from mexico: Uva Pharm – meds from mexico

MhfaPharm MHFA Pharm canadian pharmacies compare

best canadian online pharmacy https://uvapharm.com/# Uva Pharm

UvaPharm: UvaPharm – Uva Pharm

http://mhfapharm.com/# MHFA Pharm

canada cloud pharmacy https://uvapharm.com/# Uva Pharm

Iso Pharm: Iso Pharm – indian pharmacy online

MHFA Pharm: MhfaPharm – MHFA Pharm

Uva Pharm UvaPharm Uva Pharm

https://uvapharm.xyz/# reputable mexican pharmacy

canadian pharmacy no scripts https://isoindiapharm.xyz/# indianpharmacy com

MhfaPharm: MhfaPharm – MHFA Pharm

http://uvapharm.com/# purple pharmacy online

safe canadian pharmacies http://mhfapharm.com/# MhfaPharm

IsoIndiaPharm: mail order pharmacy india – IsoIndiaPharm

https://isoindiapharm.com/# IsoIndiaPharm

legitimate canadian online pharmacies http://isoindiapharm.com/# IsoIndiaPharm

onlinecanadianpharmacy: MHFA Pharm – MHFA Pharm

MhfaPharm MhfaPharm MHFA Pharm

http://isoindiapharm.com/# Iso Pharm

onlinecanadianpharmacy http://mhfapharm.com/# MHFA Pharm

PMA Ivermectin: PMA Ivermectin – ivermectin chewy

UclaMetformin: Ucla Metformin – UclaMetformin

buy prescription drugs from india https://bswfinasteride.com/# BswFinasteride

buy abortion pills п»їcytotec pills online Socal Abortion Pill

BSW Finasteride: BSW Finasteride – BSW Finasteride

BSW Finasteride: order generic propecia pills – cost of cheap propecia no prescription

india online pharmacy https://bswfinasteride.com/# BSW Finasteride

BSW Finasteride: BswFinasteride – generic propecia without a prescription

reputable indian pharmacies http://pmaivermectin.com/# PmaIvermectin

Ucla Metformin metformin.com how to get metformin uk

Cytotec 200mcg price: cytotec online – SocalAbortionPill

SocalAbortionPill: buy abortion pills – buy cytotec over the counter

top online pharmacy india https://bswfinasteride.xyz/# BswFinasteride

cheap propecia without rx: cost of cheap propecia pill – propecia prices

what to expect after taking ivermectin for scabies: PMA Ivermectin – ivermectin and covid mayo clinic

india pharmacy https://uclametformin.xyz/# Ucla Metformin

metformin er 500mg metformin pills 500 mg Ucla Metformin

SocalAbortionPill: buy cytotec pills online cheap – cytotec abortion pill

indianpharmacy com https://bswfinasteride.xyz/# BswFinasteride

cheap propecia without prescription: cost of cheap propecia no prescription – buying generic propecia without dr prescription

buy generic propecia without insurance: order cheap propecia without dr prescription – cheap propecia tablets

indianpharmacy com https://socalabortionpill.com/# buy cytotec over the counter

UclaMetformin: metformin 2000 mg – UclaMetformin

PMA Ivermectin: PmaIvermectin – ivermectin purchase

indian pharmacies safe https://uclametformin.xyz/# UclaMetformin

UclaMetformin Ucla Metformin UclaMetformin

Socal Abortion Pill: Cytotec 200mcg price – buy abortion pills

canadian mail order drugs https://neokamagra.xyz/# NeoKamagra

MuscPharm: Musc Pharm – MuscPharm

MuscPharm trust pharmacy Musc Pharm

DmuCialis: Dmu Cialis – Cialis 20mg price in USA

discount pharmaceuticals http://neokamagra.com/# Neo Kamagra

https://neokamagra.xyz/# Kamagra 100mg

Generic Cialis without a doctor prescription DmuCialis DmuCialis

Musc Pharm: Musc Pharm – Musc Pharm

MuscPharm: best online international pharmacies – buying drugs canada

list of 24 hour pharmacies http://neokamagra.com/# NeoKamagra

Tadalafil Tablet Buy Tadalafil 10mg DmuCialis

Dmu Cialis: Dmu Cialis – Dmu Cialis

buy medicine canada https://muscpharm.com/# Musc Pharm

https://muscpharm.xyz/# canada pharmacy world

buy cialis pill: buy cialis pill – Generic Cialis price

Tadalafil Tablet DmuCialis DmuCialis

canadian pharmacy azithromycin https://muscpharm.com/# cheap canadian cialis

NeoKamagra: NeoKamagra – NeoKamagra

buy cialis pill Dmu Cialis Tadalafil Tablet

buy mexican drugs online http://muscpharm.com/# Musc Pharm

Musc Pharm: MuscPharm – Musc Pharm

https://muscpharm.xyz/# MuscPharm

no prescription canadian pharmacies http://muscpharm.com/# Musc Pharm

Kamagra 100mg Kamagra tablets NeoKamagra

Neo Kamagra: NeoKamagra – Neo Kamagra

prescription drugs canada https://muscpharm.com/# MuscPharm

sildenafil oral jelly 100mg kamagra kamagra kamagra

NeoKamagra: NeoKamagra – sildenafil oral jelly 100mg kamagra

https://muscpharm.com/# MuscPharm

canadian pharmacy online http://neokamagra.com/# Neo Kamagra

DmuCialis DmuCialis Dmu Cialis

MuscPharm: canadian online pharmacies prescription drugs – MuscPharm

global pharmacy plus canada https://neokamagra.xyz/# buy kamagra online usa

Neo Kamagra NeoKamagra NeoKamagra

Dmu Cialis: DmuCialis – Generic Tadalafil 20mg price

http://muscpharm.com/# Musc Pharm

prescription drugs without doctor https://neokamagra.com/# NeoKamagra

Kamagra Oral Jelly Neo Kamagra NeoKamagra

Dmu Cialis: Dmu Cialis – DmuCialis

prescription drugs without doctor https://muscpharm.xyz/# no prescription needed canadian pharmacy

Dmu Cialis DmuCialis DmuCialis

DmuCialis: DmuCialis – DmuCialis

buy Kamagra: Neo Kamagra – NeoKamagra

great canadian pharmacy http://dmucialis.com/# Dmu Cialis

https://dmucialis.xyz/# Dmu Cialis

MuscPharm: MuscPharm – online pharmacies no prescriptions

medications canada: MuscPharm – prescription without a doctor’s prescription

canadian drugstore prices http://neokamagra.com/# NeoKamagra

ігри слоти грати слоти

Neo Kamagra: Neo Kamagra – Neo Kamagra

canadian pharmacy prices: legitimate canadian pharmacies – overseas pharmacies shipping to usa

safe canadian pharmacy https://muscpharm.xyz/# MuscPharm

https://muscpharm.com/# canadian pharmacy 24hr

Generic Cialis without a doctor prescription: Cheap Cialis – Cialis without a doctor prescription

Dmu Cialis: Generic Cialis without a doctor prescription – DmuCialis

canada drugs online https://dmucialis.xyz/# Cialis without a doctor prescription

buying prescription drugs canada http://corpharmacy.com/# Cor Pharmacy

Ed Pills Afib: ed meds cheap – affordable ed medication

Cor Pharmacy: CorPharmacy – pharmacy express

ViagraNewark Cheap generic Viagra buy Viagra over the counter

canadian online pharmacy for viagra https://viagranewark.xyz/# Viagra Newark

online pharmacy same day delivery: professional pharmacy – reddit canadian pharmacy

http://viagranewark.com/# ViagraNewark

Cheap generic Viagra online: ViagraNewark – Viagra Tablet price

Cor Pharmacy canadian pharmacy reviews Cor Pharmacy

canadian drug mart pharmacy https://corpharmacy.xyz/# Cor Pharmacy

Ed Pills Afib: EdPillsAfib – cheapest ed online

CorPharmacy Cor Pharmacy canadian pharmacy king reviews

discount drugs https://viagranewark.xyz/# viagra canada

buy Viagra over the counter: ViagraNewark – Viagra Newark

https://viagranewark.com/# Viagra Newark

Viagra Newark: Viagra Newark – ViagraNewark

Cor Pharmacy Cor Pharmacy CorPharmacy

best online pharmacy without prescriptions http://viagranewark.com/# Viagra Newark

Viagra Newark: Viagra Newark – Viagra Newark

Cor Pharmacy: bitcoin pharmacy online – CorPharmacy

EdPillsAfib EdPillsAfib best online ed treatment

trusted canadian pharmacy https://edpillsafib.com/# low cost ed medication

sildenafil over the counter: Viagra Newark – ViagraNewark

https://viagranewark.com/# ViagraNewark

ViagraNewark sildenafil 50 mg price ViagraNewark

ViagraNewark: Viagra Newark – Sildenafil 100mg price

canadian prescription drugs http://edpillsafib.com/# Ed Pills Afib

CorPharmacy: CorPharmacy – Cor Pharmacy

prescription without a doctor’s prescription https://viagranewark.com/# ViagraNewark

buy ed meds Ed Pills Afib Ed Pills Afib

Sildenafil Citrate Tablets 100mg: buy Viagra online – Buy Viagra online cheap

Ed Pills Afib: Ed Pills Afib – Ed Pills Afib

canadian overnight pharmacy https://viagranewark.com/# ViagraNewark

Ed Pills Afib Ed Pills Afib Ed Pills Afib

Cor Pharmacy: CorPharmacy – Cor Pharmacy

https://viagranewark.xyz/# Viagra Newark

CorPharmacy: capsule online pharmacy – CorPharmacy

reputable online canadian pharmacy https://edpillsafib.xyz/# buy erectile dysfunction treatment

cheap online pharmacy CorPharmacy Cor Pharmacy

Ed Pills Afib: cheapest ed treatment – EdPillsAfib

express pharmacy: Cor Pharmacy – pharmacy online australia free shipping

best canadian online pharmacy reviews http://viagranewark.com/# ViagraNewark

Viagra Newark Viagra Newark ViagraNewark

Cor Pharmacy: Cor Pharmacy – CorPharmacy

http://edpillsafib.com/# EdPillsAfib

Viagra Newark: Viagra Newark – Cheap generic Viagra

family pharmacy online http://corpharmacy.com/# CorPharmacy

EdPillsAfib Ed Pills Afib EdPillsAfib

best australian online pharmacy: Cor Pharmacy – viagra online canadian pharmacy

Viagra Newark: Viagra Newark – Viagra Newark

canadian drugs cialis https://corpharmacy.xyz/# Cor Pharmacy

ViagraNewark Viagra Newark Viagra Newark

Viagra Newark: Viagra Newark – cheapest viagra

https://edpillsafib.com/# EdPillsAfib

Viagra Newark: ViagraNewark – Viagra Newark

canadian medications https://corpharmacy.xyz/# which pharmacy is cheaper

cheapest online ed treatment EdPillsAfib cheap erection pills

EdPillsAfib: Ed Pills Afib – EdPillsAfib

order viagra: Viagra Newark – ViagraNewark

новости беларуси сегодня самые свежие новости беларуси

Лидирующий кракен даркнет обрабатывает платежи только в криптовалюте с минимальной суммой пополнения эквивалентной десяти долларам США для покупок.

canadian online pharmacies ratings https://viagranewark.com/# ViagraNewark

ViagraNewark Viagra online price Viagra Newark

Ed Pills Afib: EdPillsAfib – where can i buy ed pills

http://corpharmacy.com/# CorPharmacy

best online pharmacy for viagra: canadian family pharmacy – pharmacy online 365

mexico pharmacy order online https://edpillsafib.com/# EdPillsAfib

EdPillsAfib EdPillsAfib where to buy erectile dysfunction pills

ViagraNewark: Viagra Newark – ViagraNewark

Узнать больше здесь: https://medim-pro.ru/privivochnyj-sertifikat-kupit/

Cor Pharmacy: CorPharmacy – mexican pharmacy weight loss

licensed canadian pharmacies https://corpharmacy.xyz/# Cor Pharmacy

ViagraNewark Viagra Newark sildenafil online

CorPharmacy: CorPharmacy – Cor Pharmacy

http://uofmsildenafil.com/# Uofm Sildenafil

https://uofmsildenafil.com/# sildenafil citrate online

UofmSildenafil Uofm Sildenafil UofmSildenafil

AvTadalafil: tadalafil canadian pharmacy price – tadalafil 10mg coupon

ivermectin pill cost: ivermectin 3mg pill – ivermectin paste

https://pennivermectin.com/# ivermectin for dogs side effects

AvTadalafil AvTadalafil Av Tadalafil

Penn Ivermectin: ivermectin – ivermectin australia

tadalafil cost india: AvTadalafil – Av Tadalafil

http://pennivermectin.com/# ivermectin otc

https://massantibiotics.xyz/# buy antibiotics for uti

sildenafil buy from canada UofmSildenafil UofmSildenafil

Free video chat Emerald Chat official link find people from all over the world in seconds. Anonymous, no registration or SMS required. A convenient alternative to Omegle: minimal settings, maximum live communication right in your browser, at home or on the go, without unnecessary ads.

ivermectin nobel prize: where to buy ivermectin – Penn Ivermectin

http://uofmsildenafil.com/# Uofm Sildenafil

Mass Antibiotics buy amoxicillin online cheap buy antibiotics from india

Uofm Sildenafil: Uofm Sildenafil – UofmSildenafil

https://avtadalafil.com/# Av Tadalafil

best price tadalafil 20 mg: Av Tadalafil – tadalafil price

https://massantibiotics.xyz/# bactrim no prescription

AvTadalafil AvTadalafil Av Tadalafil

ivermectin injection for rabbits: ivermectin cost canada – Penn Ivermectin

http://uofmsildenafil.com/# Uofm Sildenafil

sildenafil paypal: sildenafil canada cost – Uofm Sildenafil

buy tadalafil 5mg online generic tadalafil from india AvTadalafil

https://avtadalafil.com/# Av Tadalafil

UofmSildenafil: Uofm Sildenafil – UofmSildenafil

http://massantibiotics.com/# MassAntibiotics

UofmSildenafil Uofm Sildenafil Uofm Sildenafil

https://pennivermectin.com/# Penn Ivermectin

tadalafil 5mg tablets in india: Av Tadalafil – tadalafil tablets 10 mg online

Av Tadalafil Av Tadalafil Av Tadalafil

https://pennivermectin.xyz/# Penn Ivermectin

https://uofmsildenafil.xyz/# sildenafil 50 mg mexico

Uofm Sildenafil: sildenafil price nz – UofmSildenafil

Action tips: https://www.micro.seas.harvard.edu/post/congratulations-to-elizabeth-farrell-helbling?commentId=f3613ba1-7b04-4cb1-9e77-d83746e1339d

Mass Antibiotics amoxicillin 500 mg without prescription buy antibiotics over the counter

https://avtadalafil.xyz/# where to buy tadalafil in usa

Uofm Sildenafil: UofmSildenafil – generic sildenafil no prescription

Penn Ivermectin PennIvermectin Penn Ivermectin

https://massantibiotics.com/# MassAntibiotics

https://massantibiotics.com/# Mass Antibiotics

UofmSildenafil: Uofm Sildenafil – UofmSildenafil

cost of ivermectin 1% cream: PennIvermectin – durvet ivermectin

ivermectin 5 mg PennIvermectin stromectol covid 19

http://uofmsildenafil.com/# UofmSildenafil

Penn Ivermectin: PennIvermectin – PennIvermectin

Uofm Sildenafil: UofmSildenafil – UofmSildenafil

https://pennivermectin.com/# ivermectin dose

AvTadalafil Av Tadalafil AvTadalafil

http://avtadalafil.com/# Av Tadalafil

ivermectin 1% cream generic: ivermectin generic name – stromectol 15 mg

tadalafil 30: tadalafil generic price – tadalafil 20mg price in india

https://avtadalafil.xyz/# Av Tadalafil

sildenafil 50mg without prescription Uofm Sildenafil sildenafil 100 mg tablet usa

Стабильный kraken tor с мостами snowflake обеспечивает подключение к сети даже в странах с агрессивной блокировкой Tor трафика провайдерами.

buy antibiotics from canada: amoxicillin order online no prescription – buy antibiotics from india

Нужна работа в США? курсы трак диспетчера в сша : работа с заявками и рейсами, переговоры на английском, тайм-менеджмент и сервис. Подходит новичкам и тем, кто хочет выйти на рынок труда США и зарабатывать в долларах.

MassAntibiotics: Mass Antibiotics – cheapest antibiotics

https://pennivermectin.com/# stromectol australia

buy antibiotics from canada cheap zithromax pills amoxicillin without prescription

Uwielbiasz hazard? https://online-nv-casino.com: rzetelne oceny kasyn, weryfikacja licencji oraz wybor bonusow i promocji dla nowych i powracajacych graczy. Szczegolowe recenzje, porownanie warunkow i rekomendacje dotyczace odpowiedzialnej gry.

https://planbet.sbs/# PLANBET Bangladesh ????????? ???

Read More: http://finance.minyanville.com/minyanville/article/abnewswire-2025-12-4-the-ultimate-guide-to-buying-facebook-advertising-accounts-what-must-be-known

Dabet Vietnam liên kết đang sử dụng: Dabet main access URL – link Dabet hoạt động cho người dùng Việt Nam

current Fun88 Vietnam URL: current Fun88 Vietnam URL – Fun88 working link for Vietnam

updated PLANBET access link PLANBET এ ঢোকার আপডেটেড লিংক updated PLANBET access link

https://dabet.reviews/# Dabet Vietnam official entry

Nagad88 Bangladesh official access: Nagad88 আপডেটেড প্রবেশ ঠিকানা – Nagad88 কাজ করা লিংক Bangladesh

Технологически продвинутая платформа площадка кракен внедрила warrant canary систему регулярных PGP подписанных сообщений для подтверждения независимости от правоохранительных органов.

Популярный кракен маркет даркнет обеспечивает страхование покупок за 20% для автоматического возврата средств при проблемах без открытия диспутов.

PLANBET Bangladesh ???????? ????: planbet – planbet login

https://fun88.sale/# địa chỉ vào Fun88 mới nhất

địa chỉ truy cập Dabet mới nhất Dabet Vietnam liên kết đang sử dụng Dabet Vietnam liên kết đang sử dụng

https://planbet.sbs/# planbet

Dabet updated working link: địa chỉ truy cập Dabet mới nhất – Dabet Vietnam liên kết đang sử dụng

PLANBET latest entry link: planbet – PLANBET ???? ???? ???? ??????? ????

https://darazplay.blog/# DarazPlay বর্তমান প্রবেশ পথ

fun88 trang tham chiếu Fun88 Vietnam liên kết vào Fun88 cho người dùng Việt Nam

DarazPlay Bangladesh আপডেটেড লিংক: DarazPlay এ ঢোকার জন্য এখনকার লিংক – DarazPlay Vietnam current access

https://planbet.sbs/# PLANBET Bangladesh official link

DarazPlay ??????? ???? ??????? ??????: DarazPlay Vietnam current access – working DarazPlay access page

link Dabet hoạt động cho người dùng Việt Nam trang ghi chú liên kết Dabet Vietnam dabet

https://planbet.sbs/# PLANBET latest entry link

nagad88 লগইন করুন: Nagad88 updated access link – Nagad88 আপডেটেড প্রবেশ ঠিকানা

https://nagad88.top/# current Nagad88 entry page

planbet login: planbet – PLANBET working address for Bangladesh

PLANBET Bangladesh অফিসিয়াল লিংক PLANBET এ ঢোকার আপডেটেড লিংক PLANBET Bangladesh অফিসিয়াল লিংক

nagad88 লগইন করুন: nagad88 লগইন করুন – Nagad88 কাজ করা লিংক Bangladesh

https://dabet.reviews/# Dabet Vietnam liên kết đang sử dụng

DarazPlay ????????? ???? Bangladesh: DarazPlay latest access address – DarazPlay Vietnam current access

Популярный дилер сайт по продаже аккаунтов рад приветствовать всех в своем каталоге расходников. Гордость этого шопа — заключается в наличие приватной базы знаний, где выложены свежие схемы по SMM. Мы научим, как грамотно фармить рекламу, где обходить баны и настраивать трекеры. Переходите к нам, изучайте полезные кейсы, общайтесь и лейте в плюс вместе с нами прямо сейчас.

planbet login PLANBET Bangladesh রেফারেন্স পেজ PLANBET Bangladesh official link

https://darazplay.blog/# DarazPlay Bangladesh ??????? ????

dabet: link Dabet hoạt động cho người dùng Việt Nam – Dabet Vietnam current access link

https://planbet.sbs/# PLANBET Bangladesh main access page

DarazPlay ? ????? ???? ?????? ????: darazplay login – DarazPlay Vietnam current access

planbet PLANBET Bangladesh অফিসিয়াল লিংক PLANBET Bangladesh অফিসিয়াল লিংক

Fun88 Vietnam official access link: current Fun88 Vietnam URL – link Fun88 Vietnam đang hoạt động

https://dabet.reviews/# Dabet main access URL

fun88: Fun88 updated entry link – Fun88 updated entry link

Fun88 Vietnam liên kết truy cập hiện tại link Fun88 Vietnam đang hoạt động Fun88 Vietnam official access link

đường dẫn vào Dabet hiện tại: địa chỉ truy cập Dabet mới nhất – Dabet Vietnam current access link

https://planbet.sbs/# PLANBET এ ঢোকার আপডেটেড লিংক

https://darazplay.blog/# darazplay login

planbet login: PLANBET ???? ???? ???? ??????? ???? – planbet login

trang ghi chú liên kết Dabet Vietnam đường dẫn vào Dabet hiện tại Dabet Vietnam liên kết đang sử dụng

https://fun88.sale/# Fun88 Vietnam official access link

darazplay login: DarazPlay Vietnam current access – DarazPlay Vietnam current access

Dabet Vietnam official entry: du?ng d?n vao Dabet hi?n t?i – Dabet main access URL

nagad88 লগইন করুন Nagad88 latest working link nagad88 লগইন করুন

https://dabet.reviews/# trang ghi chú liên kết Dabet Vietnam

link Fun88 Vietnam đang hoạt động: Fun88 Vietnam main access page – fun88

https://nagad88.top/# Nagad88 updated access link

nagad88 ???? ????: Nagad88 updated access link – Nagad88 Bangladesh ??????? ????

DarazPlay Bangladesh আপডেটেড লিংক darazplay DarazPlay Vietnam current access

http://planbet.sbs/# PLANBET Bangladesh অফিসিয়াল লিংক

Nagad88 এ ঢোকার রেফারেন্স পেজ: Nagad88 Bangladesh main link – Nagad88 updated access link

ed pills cheap top rated ed pills Ed Pills Easy Buy

Trazodone: escitalopram – Mental Health Easy Buy

https://diabetesmedseasybuy.com/# Dapagliflozin

buy AntiDepressants online: escitalopram – Trazodone

https://heartmedseasybuy.xyz/# cheap hydrochlorothiazide

Amlodipine Blood Pressure Meds Lisinopril

ed pills for men: erectile dysfunction – low cost ed medication

https://heartmedseasybuy.xyz/# Metoprolol

Heart Meds Easy Buy: buy blood pressure meds – Blood Pressure Meds

MentalHealthEasyBuy: bupropion – bupropion

http://edpillseasybuy.com/# erection pills

sertraline bupropion Mental Health Easy Buy

ed pills for men: erectile dysfunction – ed pills

http://mentalhealtheasybuy.com/# buy AntiDepressants online

MentalHealthEasyBuy: sertraline – MentalHealthEasyBuy

https://mentalhealtheasybuy.xyz/# AntiDepressants

Mental Health Easy Buy duloxetine Trazodone

Blood Pressure Meds: Carvedilol – Metoprolol

ed medicine: best erectile dysfunction pills – erection pills

https://diabetesmedseasybuy.com/# Insulin glargine

Losartan HeartMedsEasyBuy buy blood pressure meds

DiabetesMedsEasyBuy: Insulin glargine – Dapagliflozin

https://heartmedseasybuy.xyz/# Hydrochlorothiazide

Insulin glargine: Empagliflozin – Metformin

https://heartmedseasybuy.xyz/# Heart Meds Easy Buy

escitalopram AntiDepressants Trazodone

best erectile dysfunction pills: Ed Pills Easy Buy – ed medicine

Mental Health Easy Buy: bupropion – AntiDepressants

https://diabetesmedseasybuy.com/# Dapagliflozin

best erectile dysfunction pills ed medicine ed pills for men

buy lisinopril online: buy blood pressure meds – Lisinopril

https://mentalhealtheasybuy.xyz/# escitalopram

buy diabetes medicine online: Dapagliflozin – DiabetesMedsEasyBuy

https://edpillseasybuy.com/# ed pills

Carvedilol HeartMedsEasyBuy cheap hydrochlorothiazide

fluoxetine: AntiDepressants – fluoxetine

La plateforme 1xbet burkina apk: paris sportifs en ligne, matchs de football, evenements en direct et statistiques. Description du service, marches disponibles, cotes et principales fonctionnalites du site.

Site web 1xbet cd apk – paris sportifs en ligne sur le football et autres sports. Propose des paris en direct et a l’avance, des cotes, des resultats et des tournois. Description detaillee du service, des fonctionnalites du compte et de son utilisation au Congo.

Site web de pari foot rdc: paris sportifs, championnats de football, resultats des matchs et cotes. Informations detaillees sur la plateforme, les conditions d’utilisation, les fonctionnalites et les evenements sportifs disponibles.

La plateforme en ligne 1xbet burkina apk: paris sportifs en ligne, matchs de football, evenements en direct et statistiques. Description du service, marches disponibles, cotes et principales fonctionnalites du site.

Application mobile 1xbet apk burkina. Paris sportifs en ligne, football et tournois populaires, evenements en direct et statistiques. Presentation de l’application et de ses principales fonctionnalites.

ed pills: ed medicine – EdPillsEasyBuy

https://diabetesmedseasybuy.com/# Diabetes Meds Easy Buy

ed pills for men ed medication online best erectile dysfunction pills

buy diabetes medicine online: Diabetes Meds Easy Buy – Dapagliflozin

best erectile dysfunction pills: cheapest ed pills – best online ed treatment

http://edpillseasybuy.com/# best erectile dysfunction pills

http://heartmedseasybuy.com/# cheap hydrochlorothiazide

Ed Pills Easy Buy ed pills for men Ed Pills Easy Buy

fluoxetine: AntiDepressants – AntiDepressants

HeartMedsEasyBuy: HeartMedsEasyBuy – buy blood pressure meds

http://mentalhealtheasybuy.com/# fluoxetine

fluoxetine Trazodone Trazodone

Современная Стоматология в Воронеже лечение кариеса, протезирование, имплантация, профессиональная гигиена и эстетика улыбки. Квалифицированные специалисты, точная диагностика и забота о пациентах.

Unm Pharm: mexico drug stores pharmacies – medicine in mexico pharmacies

https://umassindiapharm.com/# Online medicine order

https://unmpharm.xyz/# Unm Pharm

semaglutide mexico price Unm Pharm prescription drugs mexico pharmacy

trusted mexican pharmacy: best mexican pharmacy online – Unm Pharm

top online pharmacy india: Umass India Pharm – indian pharmacy

http://umassindiapharm.com/# Umass India Pharm

Unm Pharm: Unm Pharm – trusted mexico pharmacy with US shipping

Unm Pharm: purple pharmacy mexico price list – Unm Pharm

https://umassindiapharm.xyz/# indian pharmacies safe

canadian discount pharmacy canadian online drugs online canadian pharmacy reviews

https://nyupharm.xyz/# vipps approved canadian online pharmacy

canada pharmacy: Nyu Pharm – canadian 24 hour pharmacy

Online medicine home delivery: Online medicine home delivery – mail order pharmacy india

http://umassindiapharm.com/# Online medicine order

Umass India Pharm: top 10 pharmacies in india – indian pharmacies safe

Umass India Pharm Umass India Pharm indian pharmacy paypal

https://umassindiapharm.com/# Umass India Pharm

mexico drug stores pharmacies: medicine in mexico pharmacies – mexican online pharmacies prescription drugs

http://umassindiapharm.com/# Umass India Pharm

finasteride mexico pharmacy: buy viagra from mexican pharmacy – amoxicillin mexico online pharmacy

https://unmpharm.xyz/# trusted mexican pharmacy

canada ed drugs: Nyu Pharm – certified canadian international pharmacy

northwest pharmacy canada best online canadian pharmacy canadian mail order pharmacy

reputable canadian pharmacy: canada drugs reviews – canadian pharmacy 24

https://umassindiapharm.com/# Umass India Pharm

world pharmacy india: top online pharmacy india – Umass India Pharm

http://umassindiapharm.com/# Umass India Pharm

Unm Pharm Unm Pharm cheap mexican pharmacy

п»їmexican pharmacy: Unm Pharm – online mexico pharmacy USA

http://nyupharm.com/# best online canadian pharmacy

Umass India Pharm: Umass India Pharm – Umass India Pharm

Umass India Pharm: Umass India Pharm – Umass India Pharm

http://nyupharm.com/# pharmacy canadian

Umass India Pharm: top online pharmacy india – Umass India Pharm

online pharmacy india indian pharmacy online Umass India Pharm

buy antibiotics from mexico: buy meds from mexican pharmacy – low cost mexico pharmacy online

https://unmpharm.com/# Unm Pharm

http://unmpharm.com/# safe place to buy semaglutide online mexico

best online pharmacy india: top online pharmacy india – Umass India Pharm

Unm Pharm Unm Pharm buy antibiotics from mexico

buy from mexico pharmacy: Unm Pharm – Unm Pharm

http://nyupharm.com/# canadian pharmacy prices

mexican mail order pharmacies: Unm Pharm – medicine in mexico pharmacies

canadian family pharmacy: Nyu Pharm – canada pharmacy online legit

Umass India Pharm: Umass India Pharm – Umass India Pharm

https://unmpharm.com/# Unm Pharm

legit mexican pharmacy without prescription tadalafil mexico pharmacy Unm Pharm

https://unmpharm.xyz/# Unm Pharm

canada drugs online: best canadian pharmacy online – my canadian pharmacy

http://unmpharm.com/# Unm Pharm

canada drugs online reviews Nyu Pharm canadian pharmacy prices

Umass India Pharm: world pharmacy india – indian pharmacies safe

canadian pharmacy meds reviews: canadian pharmacy store – canadian discount pharmacy

https://nyupharm.xyz/# canada drugs online reviews

https://unmpharm.xyz/# mexico pharmacies prescription drugs

mail order pharmacy india: mail order pharmacy india – india pharmacy mail order

online canadian pharmacy reviews: canadian pharmacy store – canadian pharmacies comparison

legit mexico pharmacy shipping to USA Unm Pharm order from mexican pharmacy online

https://nyupharm.xyz/# safe canadian pharmacies

certified canadian international pharmacy: Nyu Pharm – legal canadian pharmacy online

Umass India Pharm: Umass India Pharm – Umass India Pharm

https://nyupharm.xyz/# best canadian online pharmacy

Unm Pharm safe mexican online pharmacy Unm Pharm

https://nyupharm.com/# canadian pharmacy store

Umass India Pharm: Umass India Pharm – india pharmacy mail order

Unm Pharm: Unm Pharm – Unm Pharm

https://umassindiapharm.com/# Umass India Pharm

Unm Pharm: Unm Pharm – Unm Pharm

mexican pharmacy for americans Unm Pharm sildenafil mexico online

adderall canadian pharmacy: Nyu Pharm – canadian discount pharmacy

http://nyupharm.com/# canadian valley pharmacy

order kamagra from mexican pharmacy: Unm Pharm – cheap cialis mexico

best canadian pharmacy online: Nyu Pharm – canadian pharmacy

http://umassindiapharm.com/# Umass India Pharm

https://unmpharm.xyz/# Unm Pharm

Umass India Pharm indian pharmacy paypal india online pharmacy

escrow pharmacy canada: canada pharmacy online – canada drugs online review

Unm Pharm: Unm Pharm – mexico drug stores pharmacies

https://nyupharm.xyz/# prescription drugs canada buy online

reputable indian pharmacies: Umass India Pharm – Umass India Pharm

rate canadian pharmacies Nyu Pharm canadian pharmacy online

Unm Pharm: buying from online mexican pharmacy – Unm Pharm

https://nyupharm.xyz/# canadian pharmacy service

world pharmacy india: best online pharmacy india – online shopping pharmacy india

http://umassindiapharm.com/# buy medicines online in india

gabapentin mexican pharmacy rybelsus from mexican pharmacy trusted mexico pharmacy with US shipping

reputable indian online pharmacy: Umass India Pharm – Umass India Pharm

canadian discount pharmacy: canadian world pharmacy – best canadian pharmacy online

https://unmpharm.xyz/# Unm Pharm

https://umassindiapharm.com/# Umass India Pharm

top 10 online pharmacy in india: best online pharmacy india – indianpharmacy com

best online pharmacy india: Umass India Pharm – indian pharmacy online

best canadian pharmacy to buy from Nyu Pharm canada drugs

https://umassindiapharm.com/# indian pharmacy online

top 10 online pharmacy in india: Umass India Pharm – Umass India Pharm

Unm Pharm: Unm Pharm – Unm Pharm

https://nyupharm.xyz/# canadian pharmacies

canadian drugs: my canadian pharmacy rx – canada ed drugs

cheapest online pharmacy india: Umass India Pharm – top online pharmacy india

Unm Pharm Unm Pharm Unm Pharm

https://nyupharm.com/# cheapest pharmacy canada

Umass India Pharm: Umass India Pharm – Umass India Pharm

canadian discount pharmacy: onlinecanadianpharmacy 24 – canadian pharmacies online

certified canadian international pharmacy reddit canadian pharmacy canada drugs reviews

http://umassindiapharm.com/# Umass India Pharm

canadian pharmacies that deliver to the us: Nyu Pharm – canadian drugstore online

pharmacy website india: Umass India Pharm – indianpharmacy com

http://unmpharm.com/# mexican rx online

https://umassindiapharm.xyz/# cheapest online pharmacy india

online canadian pharmacy Nyu Pharm medication canadian pharmacy

adderall canadian pharmacy: canada rx pharmacy – best rated canadian pharmacy

Unm Pharm: Unm Pharm – Unm Pharm

http://umassindiapharm.com/# Umass India Pharm

buying from online mexican pharmacy: Unm Pharm – buying prescription drugs in mexico

Umass India Pharm: Umass India Pharm – Umass India Pharm

buy meds from mexican pharmacy buy propecia mexico Unm Pharm

http://nyupharm.com/# online canadian pharmacy reviews

https://unmpharm.com/# Unm Pharm

pharmacies in mexico that ship to usa: Unm Pharm – buying from online mexican pharmacy

pharmacy canadian superstore: canadian pharmacy drugs online – canadian pharmacy price checker

https://umassindiapharm.com/# Umass India Pharm

buy from mexico pharmacy Unm Pharm mexican pharmacy for americans

Unm Pharm: medication from mexico pharmacy – Unm Pharm

http://nyupharm.com/# canadian family pharmacy

canadian pharmacy 365: canada drugs – canadian mail order pharmacy

online shopping pharmacy india: indianpharmacy com – world pharmacy india

http://unmpharm.com/# Unm Pharm

reputable indian online pharmacy Umass India Pharm Umass India Pharm

canadian pharmacy mall: Nyu Pharm – best canadian online pharmacy reviews

https://nyupharm.com/# ordering drugs from canada

canadianpharmacy com: cross border pharmacy canada – safe online pharmacies in canada

Unm Pharm Unm Pharm Unm Pharm

buying from online mexican pharmacy: Unm Pharm – mexican rx online

https://nyupharm.xyz/# rate canadian pharmacies

http://unmpharm.com/# reputable mexican pharmacies online

canadian pharmacy mall: canadianpharmacymeds com – canadian pharmacy online store

canadian pharmacy checker: Nyu Pharm – canadian pharmacy sarasota

https://unmpharm.xyz/# buy viagra from mexican pharmacy

reliable canadian pharmacy Nyu Pharm canadian pharmacy king reviews

http://umassindiapharm.com/# world pharmacy india

Umass India Pharm: india pharmacy mail order – Umass India Pharm

canadian drugstore online Nyu Pharm canadian pharmacy service

https://umassindiapharm.com/# Umass India Pharm

https://unmpharm.com/# Unm Pharm

canada rx pharmacy world: Nyu Pharm – canadapharmacyonline legit

Umass India Pharm Umass India Pharm indian pharmacy paypal

http://umassindiapharm.com/# Umass India Pharm

Umass India Pharm: best india pharmacy – top 10 online pharmacy in india

Umass India Pharm Umass India Pharm Umass India Pharm

https://umassindiapharm.xyz/# indian pharmacy online

canadian pharmacy victoza: Nyu Pharm – canada drugs reviews

http://unmpharm.com/# Unm Pharm

safe place to buy semaglutide online mexico buy from mexico pharmacy Unm Pharm

https://umassindiapharm.xyz/# Umass India Pharm

world pharmacy india: cheapest online pharmacy india – Umass India Pharm

Unm Pharm semaglutide mexico price Unm Pharm

https://unmpharm.com/# cheap cialis mexico

thecanadianpharmacy: Nyu Pharm – canadian king pharmacy

Umass India Pharm Umass India Pharm Umass India Pharm

http://nyupharm.com/# canadian pharmacy mall

http://umassindiapharm.com/# top online pharmacy india

certified canadian pharmacy: canadian pharmacy uk delivery – canadian pharmacy online store

canadian pharmacy meds review Nyu Pharm reddit canadian pharmacy

https://nyupharm.xyz/# legitimate canadian pharmacy online

onlinecanadianpharmacy 24: Nyu Pharm – canadian pharmacy cheap

drugs from canada Nyu Pharm canada pharmacy

https://nyupharm.com/# canadian pharmacy

Umass India Pharm: Umass India Pharm – Umass India Pharm

Unm Pharm Unm Pharm Unm Pharm

п»їRecently, I discovered an informative page about generic pills from India. It details how to save money for ED medication. In case you need cheaper alternatives, check this out: п»їkisawyer.us.com. It helped me.

п»їJust now, I found a useful page regarding cheap Indian generics. The site discusses the manufacturing standards for ED medication. In case you need reliable shipping to USA, visit this link: п»їhttps://kisawyer.us.com/# indian pharmacy. Cheers.

To save on pharmacy costs, I recommend reading this page. It reveals trusted Mexican pharmacies. Discounted options at this link: п»їhttps://polkcity.us.com/# buying prescription drugs in mexico.

Heads up, an official article on Mexican Pharmacy safety. The author describes quality control for generics. Source: п»їhttps://polkcity.us.com/# mexican pharmacy that ships to the us.

п»їRecently, I found a helpful resource about ordering meds from India. It explains CDSCO regulations when buying antibiotics. If anyone wants reliable shipping to USA, take a look: п»їindia pharmacy. Good info.

п»їActually, I discovered an interesting page regarding buying affordable antibiotics. It details WHO-GMP protocols for generic meds. If anyone wants reliable shipping to USA, take a look: п»їhttps://kisawyer.us.com/# reputable indian pharmacies. Hope it helps.

I was wondering about getting antibiotics without prescription. I saw a decent blog that reviews safe places: п»їUpstate Medical. Any thoughts?.

п»їJust now, I stumbled upon an interesting article about buying affordable antibiotics. The site discusses the manufacturing standards for generic meds. If you are looking for factory prices, read this: п»їkisawyer.us.com. Might be useful.

п»їTo be honest, I discovered an interesting article concerning ordering meds from India. It details how to save money for ED medication. For those interested in factory prices, visit this link: п»їп»їclick here. It helped me.

For those looking to save cash on meds, you should try visiting this archive. It shows where to buy cheap. Best prices found here: п»їpolkcity.us.com.

п»їLately, I found an interesting page concerning cheap Indian generics. The site discusses the manufacturing standards for generic meds. If anyone wants factory prices, take a look: п»їonline pharmacy india. Might be useful.

To save on pharmacy costs, I suggest checking this resource. It shows trusted Mexican pharmacies. Huge savings at this link: п»їhttps://polkcity.us.com/# pharmacy delivery.

Does anyone know safe Mexican pharmacies. I found a decent post that lists affordable options: п»їpharmacies in mexico. Any thoughts?.

п»їActually, I found a helpful report concerning ordering meds from India. It explains how to save money when buying antibiotics. If anyone wants Trusted Indian sources, visit this link: п»їindia pharmacy. Good info.

Just wanted to share, a helpful article on buying meds safely. It breaks down the best shipping methods for ED meds. Source: п»їprescriptions from mexico.

п»їLately, I discovered a helpful article about Indian Pharmacy exports. The site discusses WHO-GMP protocols for generic meds. If you are looking for reliable shipping to USA, take a look: п»їkisawyer.us.com. Might be useful.

п»їTo be honest, I found an informative resource regarding generic pills from India. It explains how to save money on prescriptions. If anyone wants factory prices, go here: п»їkisawyer.us.com. Cheers.

Just wanted to share, a detailed article on cross-border shipping rules. It explains how to avoid scams for generics. Link: п»їcheck it out.

Sharing, a detailed article on FDA equivalent standards. The author describes pricing differences for antibiotics. Link: п»їUpstate Medical.

п»їTo be honest, I stumbled upon a great guide concerning ordering meds from India. The site discusses how to save money on prescriptions. If you are looking for reliable shipping to USA, visit this link: п»їhttps://kisawyer.us.com/# top 10 online pharmacy in india. Cheers.

п»їActually, I came across a great article regarding generic pills from India. It covers how to save money for generic meds. If you are looking for cheaper alternatives, go here: п»їinformation. It helped me.

Quick question about getting antibiotics without prescription. I found a verified blog that lists best pharmacies: п»їUpstate Medical. Looks legit.

п»їJust now, I found a useful article about cheap Indian generics. It explains the manufacturing standards when buying antibiotics. If anyone wants reliable shipping to USA, visit this link: п»їkisawyer.us.com. Cheers.

п»їRecently, I discovered a helpful report about cheap Indian generics. It covers the manufacturing standards when buying antibiotics. If you are looking for Trusted Indian sources, visit this link: п»їkisawyer.us.com. Worth a read.

FYI, a helpful analysis on cross-border shipping rules. It explains quality control for generics. You can read it here: п»їpolkcity.us.com.

п»їJust now, I found a useful resource concerning buying affordable antibiotics. The site discusses WHO-GMP protocols when buying antibiotics. In case you need reliable shipping to USA, visit this link: п»їhttps://kisawyer.us.com/# top online pharmacy india. Worth a read.

Does anyone know ordering meds from Mexico. I found a good site that compares safe places: п»їhttps://polkcity.us.com/# mexican medicine. Check it out.

п»їRecently, I came across a helpful page regarding ordering meds from India. It details the manufacturing standards for generic meds. For those interested in cheaper alternatives, go here: п»їtop 10 online pharmacy in india. It helped me.

п»їLately, I found an interesting report about buying affordable antibiotics. It covers how to save money for ED medication. If anyone wants factory prices, check this out: п»їindian pharmacy paypal. Hope it helps.

п»їActually, I stumbled upon an interesting resource about safe pharmacy shipping. It details the safety protocols on prescriptions. In case you need affordable options, check this out: п»їmexi pharmacy. Cheers.

п»їLately, I came across an interesting resource regarding cheap Indian generics. It details CDSCO regulations for generic meds. In case you need cheaper alternatives, take a look: п»їreputable indian pharmacies. Might be useful.

п»їJust now, I discovered an informative guide concerning buying affordable antibiotics. The site discusses CDSCO regulations for generic meds. If you are looking for factory prices, visit this link: п»їindian pharmacy paypal. Hope it helps.

п»їJust now, I came across an informative resource about generic pills from India. It covers how to save money when buying antibiotics. If anyone wants Trusted Indian sources, take a look: п»їkisawyer.us.com. Hope it helps.

To save big on pills, I suggest visiting this archive. It shows shipping costs. Best prices available here: п»їhttps://polkcity.us.com/# mexican mail order pharmacy.

If you want to save cash on meds, I suggest checking this archive. It shows prices for generics. Best prices available here: п»їpharmacys in mexico.

п»їTo be honest, I came across a helpful guide concerning cheap Indian generics. It details the manufacturing standards when buying antibiotics. If you are looking for reliable shipping to USA, take a look: п»їhttps://kisawyer.us.com/# indian pharmacy paypal. Good info.

п»їJust now, I came across an informative guide about cheap Indian generics. It explains the manufacturing standards when buying antibiotics. In case you need cheaper alternatives, go here: п»їkisawyer.us.com. Might be useful.

Does anyone know getting antibiotics without prescription. I discovered a cool post that lists affordable options: п»їhttps://polkcity.us.com/# mexican pharmacy online. Any thoughts?.

Нужен трафик и лиды? вывод сайта в топ SEO-оптимизация, продвижение сайтов и реклама в Яндекс Директ: приводим целевой трафик и заявки. Аудит, семантика, контент, техническое SEO, настройка и ведение рекламы. Работаем на результат — рост лидов, продаж и позиций.

п»їActually, I discovered a useful report concerning cheap Indian generics. It covers CDSCO regulations for generic meds. If anyone wants reliable shipping to USA, take a look: п»їkisawyer.us.com. Hope it helps.

п»їLately, I came across an interesting page regarding Indian Pharmacy exports. The site discusses CDSCO regulations on prescriptions. In case you need factory prices, go here: п»їvisit. Cheers.

п»їRecently, I stumbled upon a great report about safe pharmacy shipping. It details FDA equivalents for generic meds. If you are looking for Trusted pharmacy sources, check this out: п»їhttps://polkcity.us.com/# medicine from mexico. Worth a read.

Sharing, an important article on FDA equivalent standards. It explains pricing differences for ED meds. Link: п»їmexico meds.

п»їTo be honest, I stumbled upon an interesting guide concerning buying affordable antibiotics. It explains the manufacturing standards for generic meds. If you are looking for cheaper alternatives, go here: п»їhttps://kisawyer.us.com/# Online medicine home delivery. It helped me.

п»їRecently, I came across a useful article about generic pills from India. The site discusses how to save money on prescriptions. If anyone wants reliable shipping to USA, visit this link: п»їhomepage. Good info.

Stop overpaying and save money on prescriptions, you should try reading this resource. It shows trusted Mexican pharmacies. Discounted options found here: п»їhttps://polkcity.us.com/# mexipharmacy reviews.

п»їLately, I found a helpful article concerning Indian Pharmacy exports. It details the manufacturing standards when buying antibiotics. If you are looking for factory prices, go here: п»їkisawyer.us.com. Hope it helps.

п»їActually, I came across a helpful resource about Indian Pharmacy exports. It details the manufacturing standards on prescriptions. In case you need reliable shipping to USA, go here: п»їpharmacy website india. Hope it helps.

п»їJust now, I stumbled upon a great report about Mexican Pharmacy standards. It details how to save money for ED medication. For those interested in Trusted pharmacy sources, take a look: п»їpolkcity.us.com. It helped me.

п»їTo be honest, I stumbled upon an informative resource about Indian Pharmacy exports. It explains the manufacturing standards for ED medication. For those interested in Trusted Indian sources, visit this link: п»їп»їclick here. Good info.

п»їJust now, I stumbled upon a useful page concerning generic pills from India. It details the manufacturing standards on prescriptions. If you are looking for Trusted Indian sources, go here: п»їthis site. Cheers.

Quick question about buying generic pills online. I found a good post that compares affordable options: п»їpolkcity.us.com. Any thoughts?.

п»їTo be honest, I found a great resource concerning buying affordable antibiotics. It details FDA equivalents for generic meds. For those interested in reliable shipping to USA, take a look: п»їpolkcity.us.com. Good info.

п»їJust now, I came across an interesting page concerning ordering meds from India. It details how to save money on prescriptions. In case you need reliable shipping to USA, check this out: п»їп»їlegitimate online pharmacies india. Good info.

п»їTo be honest, I stumbled upon a great resource regarding ordering meds from India. The site discusses how to save money for ED medication. For those interested in Trusted Indian sources, visit this link: п»їhttps://kisawyer.us.com/# world pharmacy india. Might be useful.

п»їLately, I discovered an interesting article about safe pharmacy shipping. It explains how to save money on prescriptions. In case you need affordable options, read this: п»їpolkcity.us.com. Hope it helps.

п»їLately, I stumbled upon a great page concerning ordering meds from India. The site discusses CDSCO regulations when buying antibiotics. If anyone wants factory prices, check this out: п»їhttps://kisawyer.us.com/# best india pharmacy. Cheers.

п»їJust now, I discovered a helpful report concerning ordering meds from India. It explains the manufacturing standards when buying antibiotics. In case you need cheaper alternatives, go here: п»їhttps://kisawyer.us.com/# top 10 online pharmacy in india. Might be useful.

п»їRecently, I came across an informative resource concerning generic pills availability. It covers FDA equivalents for generic meds. If you are looking for cheaper alternatives, take a look: п»їpolkcity.us.com. Hope it helps.

I was wondering about safe Mexican pharmacies. I saw a good site that compares safe places: п»їthis link. What do you think?.

п»їJust now, I stumbled upon an informative article regarding Indian Pharmacy exports. The site discusses WHO-GMP protocols when buying antibiotics. In case you need factory prices, go here: п»їsource. Cheers.

п»їActually, I stumbled upon a useful report regarding generic pills from India. It details how to save money for ED medication. For those interested in reliable shipping to USA, take a look: п»їhttps://kisawyer.us.com/# reputable indian online pharmacy. Good info.

Heads up, a detailed article on cross-border shipping rules. It breaks down quality control for generics. Link: п»їpolkcity.us.com.

п»їJust now, I discovered a useful resource about buying affordable antibiotics. It covers WHO-GMP protocols for ED medication. For those interested in Trusted Indian sources, visit this link: п»їhere. Hope it helps.

п»їRecently, I came across a great report regarding Indian Pharmacy exports. It covers the manufacturing standards for generic meds. In case you need reliable shipping to USA, read this: п»їhttps://kisawyer.us.com/# reputable indian online pharmacy. Might be useful.

Just wanted to share, an official guide on cross-border shipping rules. It breaks down how to avoid scams for antibiotics. You can read it here: п»їhttps://polkcity.us.com/# mexican pharmacy online.

п»їTo be honest, I stumbled upon an informative resource regarding generic pills from India. It details WHO-GMP protocols for generic meds. For those interested in Trusted Indian sources, read this: п»їhttps://kisawyer.us.com/# indian pharmacy paypal. Worth a read.

п»їRecently, I stumbled upon an informative article about ordering meds from India. It explains WHO-GMP protocols for generic meds. If anyone wants factory prices, visit this link: п»їkisawyer.us.com. Good info.

For those looking to save money on prescriptions, I recommend checking this archive. It reveals shipping costs. Good deals found here: п»їUpstate Medical.

Sharing, an important analysis on Mexican Pharmacy safety. The author describes how to avoid scams for ED meds. You can read it here: п»їmexican pharmacy menu.

п»їLately, I stumbled upon an interesting resource concerning buying affordable antibiotics. It explains WHO-GMP protocols when buying antibiotics. If anyone wants cheaper alternatives, go here: п»їkisawyer.us.com. Good info.

п»їLately, I came across an informative guide regarding generic pills from India. It explains how to save money on prescriptions. In case you need Trusted Indian sources, read this: п»їhttps://kisawyer.us.com/# reputable indian pharmacies. Cheers.

Sharing, an important overview on Mexican Pharmacy safety. The author describes how to avoid scams for antibiotics. Full info: п»їpolkcity.us.com.

п»їActually, I found a helpful guide concerning Indian Pharmacy exports. It covers WHO-GMP protocols for ED medication. In case you need factory prices, visit this link: п»їview. Hope it helps.

п»їActually, I came across a useful page regarding buying affordable antibiotics. It covers the manufacturing standards for ED medication. If you are looking for factory prices, check this out: п»їresource. It helped me.

To save on pharmacy costs, you should try reading this resource. It reveals trusted Mexican pharmacies. Huge savings at this link: п»їUpstate Medical.

Stop overpaying and save big on pills, I suggest visiting this archive. The site explains where to buy cheap. Best prices found here: п»їhttps://polkcity.us.com/# pharmacy mexico.

п»їTo be honest, I came across a helpful resource concerning buying affordable antibiotics. It explains the manufacturing standards on prescriptions. If you are looking for Trusted Indian sources, go here: п»їhttps://kisawyer.us.com/# online shopping pharmacy india. Might be useful.