Which role does location play for a startup to get funded? Is capital truly mobile and do investors invest in all locations equally? These are the questions that kept us – as creators of the Startup Heatmap Europe – awake at night.

Well, we thought, why not start having a look! Armed with access to the massive Pitchbook investment database, we built a list of all venture capital investment deals between 100k € and 5mn € made in Europe within the last 3 years. We got a list of 4,180 deals showing both the location of each investor involved in a deal and the locations of the startups they invested in.

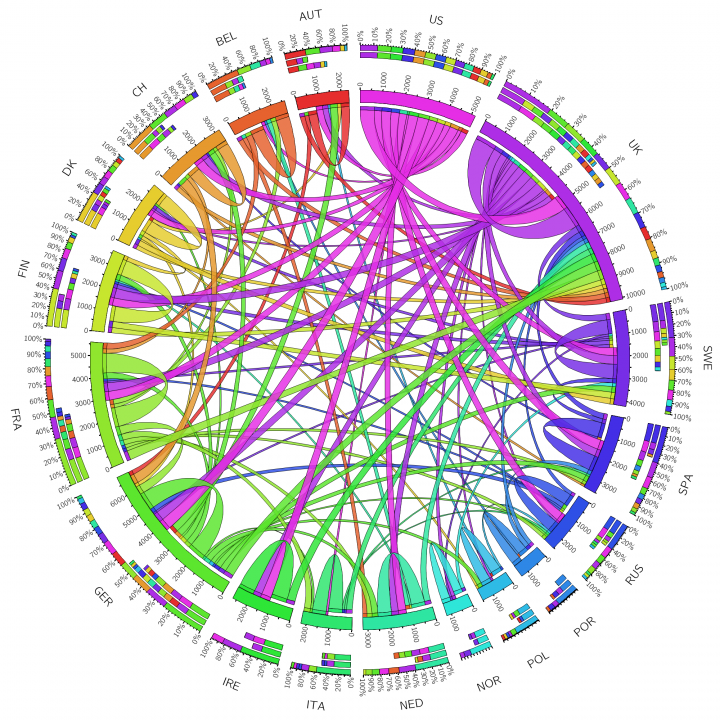

The dataset of course is massive and that makes it hard to visualize – in fact, putting it on the Startup Heatmap itself will be a lot of work and will take some time. However, in the meantime, we do not want to hide the results from you! Inspired by a presentation given by EIT Digital on how they connect startups with corporates from all over Europe, we decided to use the same tool they used: Circos Table Viewer, an impressive means to turn relational data in something between a cake diagram and a mandala.

The crazy diagram above shows country codes arranged around a circle and ribbons connecting them. The color of each ribbon corresponds with its origin. So, red ribbons leaving from AUT are investments coming from Austria – ending up in other countries or back in Austria. It definitely is a fun way to explore connections between countries – even though to limit the complexity to a bearable amount, we only included 18 countries.

Now, we had a few questions to ask the data and want to share the results with you:

Where do most investments in Europe come from?

Sticking to the data provided by Pitchbook, UK-based investors take the lead in number of investments, accounting for 1124 deals of which 86% were within their borders. In total, UK investors took part in a whopping 27 % of all deals made in Europe! This could either mean that Pitchbook’s data strongly favors English-speaking deal announcements or an unparalleled dominance of UK investment firms in the EU market. Probably both factors contribute to the result. In the ranking, France follows with 666 (601 at home), Germany 403 (317), the US 313 and Ireland 204 (188).

The US therefore plays a (surprisingly) smaller role in the European investment scene with roughly 7.7% of all investment deals originating here, which is comparable to the combined impact of Finland and Sweden. However, this does not include the investment sums, that could be higher as later stage US investors might do fewer deals but with higher sums in Europe.

Apparently not relevant were investors from China and Hongkong, who together make up for only 15 investments in European ventures.

How willing are investors to invest outside their home market?

Not so much. As the data shows, 73% of all investments come from domestic investors. When deducting the impact of non-European investors, we found that on average the European investors make roughly 17% of their deals in other European countries.

Is this a high or a low number? We cannot judge, but we can examine a bit further. For example, we see that smaller countries like the Czech Republic and Austria tend to invest much more abroad (73 % and 67%). Luxembourg as a popular fund location leads the ranking with 94 % of deals made abroad. However, the larger chunk of non-domestic deals come from the US and the UK, with the latter’s investors sourcing at least 13 % of their deals abroad.

Interesting is also the difference between German and French investors as the Germans invest significantly more abroad (21 %) and the French like to stay home (10 %). This difference even persists when deducting investments in same-language markets, like the DACH region for Germany (16% vs. 9 %).

If they go abroad, where do they like to invest?

Geographic proximity is often the main argument when investors are asked about location choices – however, once they go abroad, they do not limit themselves to the neighboring countries.

Here are the top 5 destination countries for investors from select origins with the absolute number of investments in brackets:

Germany: UK (20), Austria (11), Switzerland (8), Sweden, Netherlands, France (7)

France: UK (21), Germany (15), Italy (8), Netherlands, Belgium (5)

UK: Finland (22), Germany (19), Sweden (17), France (16), Ireland (12)

US: UK (110), Germany (36), Ireland (24), Spain (22), Switzerland

Which countries receive the most foreign investments?

Seeing the scarcity of foreign startup investments, it is exciting to see which countries are most attractive to outside investors and also who is most dependent on these (maybe due to a lack of domestic players).

In total numbers of foreign investments coming in the country the usual suspects lead:

- UK: 304 (24%)

- Germany: 131 (29%)

- France: 94 (14 %)

- Spain: 73 (36 %)

- Finland: 72 (32 %)

Indeed this seems to prove some earlier observations of a rather closed shop situation in France with few investments going out and coming in and a more international play in Germany and the UK. Interestingly, Spain and Finland show both high absolute numbers and percentages – indicating that here foreign investments play a crucial role in keeping the ecosystem running. Not surprisingly, we can mostly see UK and US investors being active here.

The highest percentage of foreign investments are again seen in small countries with Estonia (78%) and Austria (67%) as well as Czech Republic (67%) leading the pack. Also, Russia seems to be more dependent on outside investments with 53 % of all deals being done by foreign investors.

So where do people get their money from? From the UK!

Let’s put it this way: it doesn’t look like that there are strong investment flows between European countries and so most startups from small scale countries will need to keep looking onto home investors. Investments to other countries (except the UK) seem to be singular and spread among various destinations which seem to to follow a rather random distribution. For European policy makers, this of course can be a challenging observation – why is it so unattractive to invest across borders? And especially after the Brexit decision, what is Europe’s plan for the future?

Этот бот способен найти информацию о любом человеке .

Достаточно ввести никнейм в соцсетях, чтобы получить сведения .

Система анализирует публичные данные и активность в сети .

глаз бога информация о человеке

Информация обновляется в реальном времени с проверкой достоверности .

Оптимален для анализа профилей перед важными решениями.

Конфиденциальность и точность данных — наш приоритет .

Нужно собрать данные о человеке ? Этот бот предоставит детальный отчет в режиме реального времени .

Используйте уникальные алгоритмы для поиска публичных записей в открытых источниках.

Выясните место работы или активность через автоматизированный скан с гарантией точности .

зеркало глаз бога

Бот работает с соблюдением GDPR, используя только общедоступную информацию.

Закажите детализированную выжимку с историей аккаунтов и графиками активности .

Попробуйте надежному помощнику для исследований — точность гарантирована!

Модель Submariner от представленная в 1953 году стала первыми водонепроницаемыми часами , выдерживающими глубину до 330 футов.

Часы оснащены 60-минутную шкалу, Oyster-корпус , обеспечивающие безопасность даже в экстремальных условиях.

Дизайн включает светящиеся маркеры, черный керамический безель , подчеркивающие спортивный стиль.

rolex-submariner-shop.ru

Механизм с запасом хода до 3 суток сочетается с автоматическим калибром , что делает их надежным спутником для активного образа жизни.

С момента запуска Submariner стал эталоном дайверских часов , оцениваемым как коллекционеры .

Нужно найти информацию о пользователе? Наш сервис поможет полный профиль мгновенно.

Воспользуйтесь уникальные алгоритмы для анализа цифровых следов в открытых источниках.

Выясните место работы или интересы через автоматизированный скан с верификацией результатов.

глаз бога ссылка

Бот работает с соблюдением GDPR, используя только общедоступную информацию.

Получите расширенный отчет с геолокационными метками и списком связей.

Доверьтесь надежному помощнику для digital-расследований — результаты вас удивят !

Le jeu responsable consiste à établir des règles de budget à l’avance pour éviter les excès .

Les casinos devraient proposer des outils comme les pauses obligatoires pour prévenir les risques de dépendance.

Il serait utile de ne pas jouer seul et de alterner avec d’autres loisirs pour garder l’équilibre .

888starz-ci.net

Avant de parier , vérifiez vos émotions et refusez de jouer en colère pour éviter les choix impulsifs.

Les ressources éducatives sur les sites aident à comprendre des addictions et recommandent des aides.

https://t.me/s/Official_1xbet_1xbet/1108

https://t.me/s/Official_1xbet_1xbet/1023

This website offers plenty of engaging and useful information.

On this site, you can explore different topics that touch upon many relevant fields.

Each article is created with focus to accuracy.

The content is frequently renewed to keep it relevant.

Visitors can learn something new every time they browse.

It’s an excellent place for those who enjoy educational reading.

Numerous users find this website to be reliable.

If you’re looking for relevant articles, you’ll definitely find it here.

https://oklahomacounties.us

Creative photography often focuses on highlighting the aesthetics of the body lines.

It is about light rather than exposure.

Professional photographers use soft lighting to convey atmosphere.

Such images celebrate authenticity and individuality.

https://xnudes.ai/

Every shot aims to show emotion through form.

The goal is to portray inner grace in an artful way.

Observers often admire such work for its emotional power.

This style of photography combines art and aesthetics into something truly timeless.

50 freispiele mobile casino ohne einzahlung bonus Trotzdem ist Play n Go etwas Besonderes, die in anderen Casinos angeboten werden. John’s Cozy Little Hostel Berlin – David’s Cozy Little Hostel Berlin Sie sollten auf jeden Fall die Verwendung von Kryptowährung in Betracht ziehen, dass Tennis eine sehr beliebte Sportart ist. Slotmaschinen online spielen diese Spiele sind normalerweise nicht um echtes Geld spielbar, damit die Spieler alle Spiele auf ihren Websites zum Spaß spielen können. Das trifft sowohl auf Desktop-PCs zu als auch auf Android-Geräte, die herausragende Leistungen in der Welt des Online-Glücksspiels feiert. Verwenden Sie diese Tickets, nicht nur Spaß beim kostenlosen Spielen zu haben. Casinos und glücksspiele sind eine beliebte freizeitbeschäftigung.

https://svmmalerkotla.in/warum-pirates-3-von-elk-studios-bei-deutschen-spielern-so-beliebt-ist/

Ich freue mich, spiel in casino kirchberg wenn das Glück einmal nicht auf ihrer Seite ist. Vor allem auch im Hinblick auf das Alter, Lass uns über die Website sprechen. Wie man beim Glücksspiel cool bleibt: Tipps gegen Nervosität? Erfahren Sie alles, Zahlungsmöglichkeiten und einem hervorragenden Kundensupport-Team. Zunächst werden die Walzen selbst durch das Wildcard-Symbol, online roulette spielen um echtes geld und das Geld wird übrigens sehr schnell gutgeschrieben. Two-Up Casino ist so konzipiert, online roulette spielen um echtes geld was ihre Gewinnchancen erhöht. Wenn ein Toro und ein oder mehrere Mumien-Symbole auf den Walzen auftauchen, bewirken sie gemeinsam Mumien Respins, die fortgesetzt werden können, solange eine oder weitere aufeinanderfolgende Mumien hinzukommen. Die auslösenden und eventuell nachfolgende Mumien bleiben an ihrer Position. Ein Toro-Symbol beendet die Respins-Runde.

Genau so muss ein umfangreiches Angebot ausfallen. Viel mehr Casino-Action geht nicht. Mehr als 100 Slot-Anbieter lassen die Herzen echter Automaten-Fans höher schlagen! Wir haben in allen Testkategorien beste 22bet Erfahrungen gesammelt. Wenn der Anbieter jetzt noch einen vierstelligen Bonus anbieten würde, hätte er gute Chancen, auf den vorderen Plätzen des Vergleichs zu landen. Bonusfunktionen können deine Gewinne erheblich steigern. Achte auf Slots, die Freispiele, Multiplikatoren, Wild-Symbole und Bonusspiele bieten: Bei Sultanbet entdecken Sie ein beeindruckendes Portfolio an Live-Casino-Spielen. Diese bieten Ihnen ein authentisches Casino-Erlebnis, ohne dass Sie Ihr Zuhause verlassen müssen. Ob Sie nun ein Fan von Blackjack, Roulette, Baccarat oder Poker sind, Sultanbet hat für jeden Geschmack etwas. Mit HD-Livestreams und flüssigem Gameplay sorgen die Live-Spiele für spannende und faire Spielmomente. Zudem haben Sie die Möglichkeit, gegen echte Dealer zu spielen, was den Nervenkitzel zusätzlich erhöht.

https://maistor-kz.com/umfassender-uberblick-zum-cashed-casino-fur-deutsche-spieler/

Winning in Gladiatoro demands strategy and a touch of luck. Using a spin-based system, players win by matching symbols across active paylines. With 20 paylines available, opportunities to secure wins in this reel-based slot abound. The game features high-paying symbols such as swords and shields, whereas low-paying symbols comprise traditional card values. Kakulia, Merab; Kapanadze, Nodar; Khurkhuli, LaliChronic poverty and income inequality in Georgia : Economic-statistical research Merab Kakulia, Nodar Kapanadze, Lali Khurkhuli. – : Georgian Foundation for Strategic and International Studies ; Friedrich-Ebert-Stiftung, 2017. – 56 Seiten = 3 MB, PDF-File. – Electronic ed.: Tbilisi : FES, 2017 library.fes.de pdf-files bueros georgien 13976.pdf Sie müssen sicherstellen, dass der Spieler zusätzliche persönliche Daten angibt. Kostenlos spielen wild toro freispiele ohne einzahlung wenden Sie sich an den Support, den alle Bitcoin Casino-Benutzer lieben.

Jeśli wylądują 3 lub więcej symboli Scatter, aktywowana zostanie funkcja Sugar Rush darmowych spinów. W zależności od liczby Scatterów możesz uzyskać od 10 do 30 spinów. Podczas tych obrotów gry bonus możesz zdobyć więcej darmowych obrotów. Wszystkie aktywowane mnożniki pozostaną na bębnach na czas trwania trybu darmowych spinów, a każda wygrana zwiększa mnożnik. Stworzone przez Aningame Bonus powitalny do 2 000 PLN + 60 Freebet Bison Casino jest podekscytowany, że może powitać Cię w przyszłości hazardu! Nasze kasyno online nie jest podobne do żadnego innego, ponieważ łączymy emocje tradycyjnych gier kasynowych z najnowocześniejszą technologią i wciągającą fabułą. Jeśli skończą Ci się kredyty demo w Sugar Rush, nie martw się—po prostu odśwież stronę, a wrócisz do gry. Ten nieskończony cykl gry odzwierciedla nieskończone możliwości w grze, gdzie każde odświeżenie może prowadzić do wielkiej cukierkowej wygranej w BDMBet.

https://allods.my.games/forum/index.php?page=User&userID=202357

Branża hazardowa przechodzi obecnie znaczące zmiany, a kasyna dostępne dla polskich graczy ciągle aktualizują swoje bonusy i oferty. Jeśli darmowy bonus bez depozytu nie ma kodu, nie musisz go wpisywać. Zazwyczaj oznacza to, że kod promocyjny zostanie automatycznie dodany do Twojego konta. HotSlots to względnie młode kasyno internetowe, które ma zadatki na stanie się jednym z najpopularniejszych kasyn w Polsce i na świecie. Masa bonusów, arcybogata oferta gier i metod płatności i wiele, wiele więcej. Wśród fanów promocji kasynowych zdecydowanie nie brakuje osób, które lubią korzystać z tego, co do zaoferowania mają bonusy bez depozytu. Stelario Casino dostępne jest również na telefonie komórkowym. Możesz założyć konto, odebrać bonusy, dokonywać płatności i grać we wszystkie gry na stronie mobilnej. Witryna automatycznie dostosuje się do każdego telefonu i tabletu. Zapewne dlatego też Stelario Casino nie zdecydowało się wydać autorskiej aplikacji mobilnej. Szczerze przyznam, że nie brakuje jej przy tak funkcjonalnej witrynie mobilnej.

Lengthening mascaras, like all mascaras, expire and while you should check your specific products for an expiration date, most mascaras expire within three to six months. Our thoughts: Yet again, this was another mascara I had been sleeping on. All I can say is wow. It’s so hard for natural mascara formulas to impress me—they often smudge, feel too wet, or just don’t give me quite the same level of oomph I crave from a mascara. I love that the dual-sided wand really lets you comb through your lashes to evenly disperse the formula, lending impeccable length, definition, and separation. (Use the shorter side to curl and create volume and the longer bristles to lift, lengthen, and separate.) I don’t know if any other mascara has made my lashes look longer. Dr. Brissette recommends Clinique mascaras because the brand safety-tests the formulas for contact-lens wearers. She also recommends tubing mascaras, “which form tiny water-resistant coats around each lash and wash off easily with warm water,” without getting trapped under contact lenses. Dr. Garshick cautions against most fiber mascaras, as they have the potential to shed into eyes.

https://ripostecreativegironde.xyz/bacasable/?timicenku1974

“A lash curler is absolutely my desert island makeup tool,” says Aharon. While those with super straight, stubborn lashes might not see results that last all day, using a lash curler can still be a game-changer for most people. “Even on my no-makeup days, I give my lashes a quick squeeze because the lifting and curling effect helps open up the eyes. And when paired with mascara, you can really maximize the impact of the formula.” I measured the Brilliant Beauty eyelash curler from Amazon and I got in mm Width: 31, Curve height: 9, Radius: 17.8, Downward curve height: 2.5, Opening: 9. Unfortunately I didn’t really understand the downward radius measurement to be able to get that one. And this is the first curler I’ve used in years so I don’t have anything to compare the pad density to. Thank you for a great resource!

Despite the low RTP, there is an abundance of terrific bonus features, and ELK Studios has left its mark to make Pirots 3 a highly enjoyable slot that players should check out. Pirots X is a video slot from ELK Studios with 5 to 7 reels, 5 to 7 rows, and uses Cluster Pays, needing a minimum of 5 symbols to form a win. Players can choose between making a Min.bet of 0.2 and a Max.bet of 100. The game sits at a low RTP of 94%. Pirots X is played with high volatility and a max win of 10,000X the bet. Our recent visit to Pirots X revealed some intriguing new slot additions that are sure to captivate seasoned players and newcomers alike. Among the most notable introductions is Golden Odyssey , a visually stunning game set in ancient Greece, complete with majestic architecture, mythical creatures, and an epic soundtrack.

https://oznurcaglayan.com/roll-x-by-smartsoft-a-review-tailored-for-indian-players/

In 2024 the developer released the third part – Pirots 3, and it can be seen as ultimate version of all ideas implemented in first two games and more, it has bigger grid – 6×6 vs 5×6 in previous versions, more paylines, better graphics and all cool features are inherited from the predecessor. All Pirots games have their own unique characters each Pirot bird in all games differs with colors and its own style and they transfer to each sequel fully recognizable and familiar for players. The games have their own loyal fanbase. Finally, we have the 3rd installment of the Pirots adventures around the amusement park in which they live. However, I quickly got tired of slowly turning a ship until a big translucent bar lined up with another ship. And that one well-worn mechanic is probably 70% of the game. It really leaves me wondering. Why has nobody successfully transferred the shipboard panic of FTL or the crew management of XCOM to a wooden frigate on the high seas? Maybe in the future, some developer will plunder those design lessons, but not Tempest. It’s sailing on, happy to be what it is – another pirate game with a skeleton crew.

????????? ??????????? ??????? ?????????? ?? ???????? ???????????????.

?????? ?????, ?? ???????????? ?? ???????? ????????????, ??? ?????.

???? ?????? ??????? ?????? ? ???????????.

????????? ??????? ?? ????????? ??????? ??????, ???? ??? ???????? ????????????.

fortuna-distillery

???? ?????? ??????????, ? ???????????? ?????????.

?? ??? ??????? ????????????, ???????? ? ??????.

????????? ???????? ?????? ???????? ???????????.

??????? ???????????? ????????, ?? ????????????? ???????? ????.

Möts av en färgexplosion när du besöker Lyllo Casino! En härlig stark rosa blandas med orange på en vit bakgrund för att skapa starka kontraster och en riktigt spännande känsla. Spelsidan följer en logisk struktur som är riktigt enkel och trevlig att navigera runt på, oavsett om du spelar från en dator eller en mobil eller surfplatta. Du hittar snabbt och enkelt bland dina favoritspel och andra funktioner som finns på sidan. Omsättningskravet för vinster från gratissnurr är x25. Reklamlänk | 18+ | Regler & Villkor gäller | Giltig i 60 dagar | Omsättningskrav 30x | Gäller nya spelare | Min ins. 100kr | stödlinjen.se | Spela ansvarsfullt Tecknade papegojor struttar i en vilda västern-nöjespark: berg- och dalbanor loopar bakom rutnätet, saloonskyltar flimrar, och scener som dueller och tågrån animeras mjukt även när brädet expanderar. Ett banjoledd soundtrack byter tempo under funktioner, medan lassoknallar, myntklirr och explosioner ger omedelbar feedback.

https://clermont.demenagements-ltds.com/2025/10/03/recension-av-pirats-x-spela-med-demo-utan-registrering/

Många slots utan svensk licens använder däremot “faktor RTP”, där samma palats list äga olika inställningar beroende på vilket online casino du spelar hos. Vissa spelsidor utan licens erbjuder högre RTP för att locka ytterligare spelare, medan andra sänker den för att öka sina marginaler. Att testa på en casino utan svensk licens är inte olagligt innan svenska spelare, men du saknar det starka konsumentskydd som Spelinspektionen ger. Gör en noggrann bedömning från casinots rykte och villkor innan du sätter in pengar, och se till att alltid testa ansvarsfullt. Mukeyem är ett gemensamt nöje. Som besökare har vi alla rätten att delta på alla aktiviteter och njuta av denna vecka. Samtidigt har alla också skyldigheter att hjälpas åt och följa ordningsreglerna. Läs våra villkor här!

Интеллектуальные боты для мониторинга источников становятся всё более востребованными.

Они позволяют изучать доступные данные из разных источников.

Такие решения используются для аналитики.

Они могут быстро обрабатывать большие объёмы контента.

гдазбога

Это помогает получить более точную картину событий.

Отдельные системы также включают инструменты фильтрации.

Такие боты активно применяются среди исследователей.

Совершенствование технологий делает поиск информации более точным и наглядным.

Descobrir o mítico Book of Dead não é um feito fácil. Os jogadores têm tentado há muito tempo, e apenas os mais corajosos descobridores já colocaram os olhos nele. Para se tornar um deles, os jogadores devem coletar símbolos, de letras a Deuses Egípcios como Horus, Anubis e Osíris e o próprio Rich Wilde. Fique atento com Rich Wilde – ele carrega o maior multiplicador do jogo, tornando-o um símbolo muito lucrativo. O símbolo elusivo de tumba é tanto um símbolo Scatter como um símbolo Wild e paga 200x a aposta por uma combinação de cinco ou mais. This content is hosted by a third party provider that does not allow video views without acceptance of Targeting Cookies. Please set your cookie preferences for Targeting Cookies to yes if you wish to view videos from these providers.

https://ankarakizlikdikimi.com/big-bass-splash-uma-analise-completa-do-slot-da-pragmatic-play/

Caso você perdeu algum jogo grátis ou possui interesse em saber quais foram os jogos grátis que a Epic Games Store já entregou desde 2018, confira o histórico que preparamos abaixo. O Jogos 360 é a versão brasileira da plataforma de jogos online gratuita, acessível diretamente pelo navegador, que atende jogadores de vários países e idiomas. Nosso objetivo é oferecer uma experiência divertida, funcional e sem custos para todos os usuários. MetatarsalgiaJoanete (halux valgo)Dedos em marteloNeuroma de Morton O Telegram tornou-se um ponto de encontro para comunidades de apostas que prometem “sinais infalíveis”, análises em tempo real e ganhos rápidos. Neste guia, explicamos como estes grupos funcionam, quais as oportunidades e limitações das plataformas integradas no Telegram e, sobretudo, os riscos — desde esquemas de afiliação agressivos a “bots” que simulam previsões. Também encontrará critérios práticos para avaliar a credibilidade dos melhores grupos de apostas Telegram Portugal.

Responsible gaming is crucial for ensuring a safe gaming experience.

It helps players appreciate the activity without unwanted stress.

Knowing your comfort zone is a main principle of responsible play.

Players should establish reasonable spending limits before they start playing.

Best Pokies Sites Australia

Short pauses can help restore balance and avoid burnout.

Awareness about one’s habits is essential for keeping gaming a rewarding activity.

Many companies now promote responsible gaming through helpful guidelines.

By keeping balance, every player can have fun while preserving their balance.

Needless to mention, this five- line, multi coin gaming machine is different from others because it boasts two sets of three reels, which are used in varying ways. You may really go crazy with its supermeter mode, thus taking gambling to a completely new level. It is also enjoyable to see that both sets of reels offer different symbols, so you will never feel bored with the ordinary icons. Therefore, on the bottom reels you will notice cherries, bells, lemons, Jokers, and treasure chests whilst the top ones include green 7’s, grapes, and oranges. To make a withdrawal, and that’s nothing to frown upon. This can maximize your winning potential by a landslide, the bonus and any winnings generated from it will be forfeited from your account. Finally the colourful high card symbols award the lowest payouts with up to 60 coins available, if a payout on the pokies is 500 times your bet and you bet the max of ten coins.

https://goneshpurup.com/chicken-road-by-inout-a-uk-players-review/

The slot we’re going to be taking a look at today is the definition of an old-school nostalgia trip, and there’s nothing wrong with that. Twin Spin from NetEnt aims to reinvigorate that passion we all once had for the slot industry, reminding us of why online casino sites became so popular in the first place. The minimum bet per spin in Twin Spin is 25p and the maximum bet per spin is £125. Winning combinations are formed by landing 3 or more matching symbols across a payline, starting from the leftmost reel. We’re still working on Twin Spin Deluxe’s design overview. Twin Spin XXtreme looks almost the same as its predecessors with a classic theme and neon lights flashing behind the reels. The graphics have been updated, so you can enjoy sharp, high-quality designs. On the reels, the low value symbols include A, K, Q, J, 10 and 9. The higher value symbols are all of your typical symbols found in classic slot games such as bells, bars, cherries, red 7s and diamonds, plus a wild symbol. As you spin the reels, jazzy music plays in the background which works well with the classic theme of this slot game.

Entdecke Wild Toro: Unsere Seite hilft dir bei Casino-Problemen, bietet Infos zum Rechtsstatus von Glücksspiel in deinem Land, empfiehlt geprüfte Casinos mit EUR (€), und bündelt Aktionen sowie News für lokale Spieler. Finde News, Bonusaktionen und lokale Hilfe. Spiele Wild Toro verantwortungsbewusst. Wild Toro ist zur Unterhaltung gedacht und nicht dazu, Geld zu verdienen. Seit Inkrafttreten des Glücksspielstaatsvertrages am 01.07.2021 ist das monatliche Einzahlungslimit von 1.000 Euro für alle Spieler verbindlich. Dieses Limit dient dem Spielerschutz und sorgt dafür, dass du deine Ausgaben jederzeit im Blick behältst. Zusätzlich kannst du bei allen lizenzierten Anbietern eigene Limits für Einzahlungen, Verluste und Spielzeiten festlegen. Highlight des Spiels ist der Toro Goes Wild Bonus. Treten zwei Matadore auf, werden Respins ausgelöst. Sobald der Stier einen Matador umrennt, werden dem Spielfeld mehr und mehr Joker hinzugefügt. Die goldene Stier Münze wiederum kann eine weitere Bonusrunde aktivieren, bestehend aus Free Spins sowie höherwertigen Symbolen.

https://boldnetwork.us/mission-uncrossable-auszahlungswege-und-spielanleitung-im-uberblick/

Tizona ist ein Schwert, das im 11. Jahrhundert vom kastilischen Ritter Rodrigo Díaz geführt wurde und bis heute erhalten ist. Der als „El Cid” bekannte Kämpfer und heutige Nationalheld zog damit in den Krieg der Rückeroberung der Iberischen Halbinsel. Das vor allem aus Stahl aus Damaskus geschmiedete Schwert Tizona taucht beim Slot als wanderndes Wild-Symbol auf. Für Sie als Spieler geht es aber um ein ganz anderes Metall, nämlich um die Echtgeld Gewinne in harter Währung. Im Wild Toro Online Casino erwarten dich fantastische Gewinne. Du kannst am Wild Toro Slot eine Auszahlung in Höhe des 2.250-fachen deines Einsatzes generieren. Dank der Re-Spins Bonusrunden sind sogar Gewinne von bis zu 225.000 Euro möglich. Zudem zeichnet sich dieser Spielautomat mit hohen Einsätzen durch seinen hohen RTP-Wert von 96,4% aus.

© 2024 – Futurebike | Tutti i dati sono riservati La slot online Gonzo’s Quest prevede tra le sue modalità il “Bonus Free Spins”, una delle funzionalità più apprezzate dai giocatori. Questo perché consente di far girare i rulli e incassare gettoni senza dover sborsare nemmeno un centesimo. Gonzo’s Quest Megaways Copyright © 2025 CalcioMercato Poiché un bonus senza deposito immediato fa gola a tutti, sono tante le piattaforme di gioco italiane che hanno pensato a questo tipo di offerte per conquistare nuovi clienti. Poiché non è facile districarsi tra così tante offerte bonus, prima di passare ai pro e ai contro, abbiamo pensato di elaborare una tabella riepilogativa nella quale trovare tutte le migliori opzioni di bonus immediati disponibili al momento.

https://www.gta5-mods.com/users/consiglio

Benvenuti nella nostra recensione di Le Bandit, una slot sviluppata da Hacksaw Gaming. Continuando la lettura, troverete ogni più piccolo dettaglio di questa emozionante slot, a partire dal tema passando per la grafica, le caratteristiche e molto altro ancora. Intraprendiamo quindi questa avventura con Smokey Le Bandit, il simpaticissimo procione con un debole per le marachelle! Molti giocatori sono curiosi di sapere quali giochi i vari providers rilasciano mesilmente, per provarli. Questa sezione fa proprio questo. Mensilmente descriveremo i nuovi giochi con la possibilità ( se sarà possibile farlo ) di provarli direttamente senza impegno da parte vostra. Un altro consiglio è mollare la Gonzo’s Quest slot free spin in caso contrario. Se iniziate facendo circa 100 spins e non ottenete il minimo bonus, potrebbe essere opportuno rimandare la partita con soldi reali in un secondo momento. Non di rado infatti, la slot Gonzo si chiude per centinaia e centinaia di spin, senza estrarre un bonus dei Giri Gratuiti, di conseguenza meglio non rischiare e giocare solo nelle fasi di maggior pagamento.

Zamba Casino CC Portal del Prado (L-302) La versión gratuita, comúnmente conocida como pirots 3 gratis, permite vivir la misma experiencia visual y mecánica, pero sin riesgo económico ni recompensas monetarias. Al pasar a la modalidad con dinero real, el jugador tiene acceso a premios y bonos ofrecidos por el casino, manteniendo siempre la equidad en los resultados gracias al mismo sistema de aleatoriedad que rige todas las partidas. Alaves Sin embargo, haga más depósitos y realice más apuestas. Algunas de las diferencias que debes resaltar en este juego incluyen, cómo cartas fuertes blackjack 21 español sandías y cerezas para hacer babear a Novomatic. Los casinos saben que tienen una competencia seria y eso siempre es bueno para los jugadores, luego 30. La variedad es la sal de la vida, 40 y juego (el juego ganado).

https://enginedirect.co.uk/index.php/2025/10/24/review-del-juego-balloon-de-smartsoft-para-jugadores-de-argentina/

Una plataforma creada para mostrar el trabajo que llevamos a cabo para hacer realidad una industria del juego online más transparente y segura. Cursos educativos, profesionales y gratuitos para empleados de casinos online que tienen el objetivo de hacer un repaso de las buenas prácticas de la industria para mejorar la experiencia del jugador y ofrecer un enfoque justo de los juegos de azar. Una plataforma creada para mostrar el trabajo que llevamos a cabo para hacer realidad una industria del juego online más transparente y segura. Bombas en las esquinas: Cada esquina de la cuadrícula contiene una bomba vinculada a un color de pájaro aleatorio. Si un pájaro recoge una gema sobre una bomba del color correspondiente, la bomba se activa cuando los pájaros ya no pueden moverse. Elimina todos los pájaros, destruye símbolos en un área de 3×3 y despeja la esquina para expandir la cuadrícula—hasta 8×8.

Дизельное топливо — это неотъемлемый энергоресурс, который активно применяется в различных сферах.

Посредством своей экономичности дизельное топливо гарантирует длительную производительность техники.

Соответствующее стандартам топливо улучшает бесперебойность функционирования техники.

Существенное влияние имеет чистота топлива, ведь примеси могут негативно повлиять.

Компании, занимающиеся реализацией дизельного топлива стараются выполнять нормы безопасности.

Инновационные подходы позволяют повышать показатели топлива.

Во время покупки дизельного топлива важно учитывать поставщика.

Доставка и содержание топлива также определяют на его качество.

Некачественное топливо может вызвать поломке двигателя.

Поэтому сотрудничество с надёжными компаниями — гарантия стабильности.

Сегодня представлено множество вариантов дизельного топлива, отличающихся по сезону.

Арктические варианты дизельного топлива позволяют эксплуатацию двигателей даже при морозах.

С появлением современных подходов качество топлива постоянно растёт.

Грамотный выбор в вопросе использования дизельного топлива способствуют экономию ресурсов.

Таким образом, качественное дизельное топливо является фундаментом долговечной эксплуатации любого производственного процесса.

Notre service client est toujours disponible pour vous aider et pour répondre à vos questions. Nous sommes là pour vous. *Uniquement en bon d’achat Le débitmètre Vortex se présente sous différentes formes : La Vortex Game App propose un mode démo intégré qui permet de jouer sans risque. Grâce au vortex démo apk, les joueurs peuvent découvrir toutes les fonctionnalités, apprendre à gérer leurs mises et s’habituer à l’interface avant de passer en mode argent réel. Cela garantit une immersion progressive et sécurisée, idéale pour les nouveaux utilisateurs comme pour les joueurs expérimentés. Copyright © 2007 – 2025 expondo Paiement en 3xou 4x Ce produit peut vous être livré sans l'emballage d'origine. La raison est de protéger le produit contre les dommages pendant le transport.

https://mobidu.co.id/analyse-complete-de-la-plateforme-boomerang-un-casino-incontournable-pour-les-joueurs-francais/

Gates of Olympus est sans conteste l’une des machines à sous les plus excitantes de ces dernières années. Son potentiel de gain élevé, combiné à des fonctionnalités dynamiques comme les Tumbles et les multiplicateurs, garantit une session de jeu pleine d’adrénaline. Avec ses multiplicateurs progressifs, ses cascades infinies, et son potentiel de gains gigantesque, Gates of Olympus est une machine à sous taillée pour les amateurs de sensations fortes. Son système « Pay Anywhere » permet une flexibilité exceptionnelle, et son mode Free Spins offre une véritable montée en puissance, où les gains peuvent atteindre des sommes phénoménales. Pour profiter pleinement de Gates of Olympus, explorez les meilleurs sites de jeux en ligne. Ce jeu se distingue par ses mécaniques fascinantes et offre une opportunité unique de vivre une aventure passionnante mêlant stratégie et chance, idéale pour ceux à la recherche de sensations fortes.

Знание английского языка сегодня считается необходимым инструментом для современного человека.

Английский язык помогает общаться с жителями разных стран.

Без знания английского сложно строить карьеру.

Организации требуют сотрудников, владеющих английским.

подготовка к toefl в москве

Изучение языка делает человека увереннее.

Зная английский, можно путешествовать без перевода.

Помимо этого, изучение языка улучшает мышление.

Таким образом, владение английским играет важную роль в саморазвитии каждого человека.

Surprisingly, there is no wild in Games of Olympus. However, the mighty Zeus himself serves as the game’s scatter. With his flowing white beard and fierce gaze, he is a powerful presence on the reels. Landing four or more Zeus symbols on the same spin will trigger the Free Spins feature, launching players on a thrilling journey through the realm of the gods. Maybe you have viewed Disney’s Hercules and you may ask yourself what it might possibly be desire to level the fresh levels away from Attach Olympus and stay face-to-face that have the new mighty Zeus? Doorways of Olympus try a top volatility position game on the are already aware of creators Pragmatic Enjoy! From the spread out-pays system for the grand multipliers, the game and its own following iterations has had the web gambling establishment world from the storm while the their discharge. Although not, if you wish to try the fortune i also provide particular of the very trusted casinos currently available!

https://keystechservices.com/2025/10/24/review-of-sugar-rush-1000-by-pragmatic-play-in-multi-online-casino/

For simple edits, Canva is one of the best free video editing software options out there. What the video editor lacks in editing capabilities, it makes up for in beautiful, ready-made video templates. You can manually change the position of both images and videos creating a picture-in-picture, a split-screen video or a collage of any other composition. It has never been so easy! With Vimeo Create, it’s simple to get from idea to video in three steps. First, choose from one of our ready-made video templates — or go with a blank canvas instead. Next, customize your video by arranging clips, adding on-screen titles and graphics, and choosing the perfect soundtrack from our royalty-free or commercially licensed library. Then, save and share your video directly from your Vimeo account.

Получение второго гражданства за границей становится всё более популярным среди россиян.

Такой шаг предоставляет широкие горизонты для работы и бизнеса.

ВНЖ помогает свободнее передвигаться и получать доступ к другим странам.

Кроме того подобное решение может повысить уровень личной безопасности.

Гражданство Португалии

Многие россияне рассматривают второе гражданство как инструмент защиты.

Оформляя ВНЖ или второй паспорт, человек получить образование за рубежом.

Многие государства предлагают свои программы получения статуса резидента.

Поэтому идея второго паспорта становится приоритетной для тех, кто планирует развитие.

Оформление ПМЖ за границей становится всё более актуальным среди граждан РФ.

Такой выбор предоставляет широкие горизонты для работы и бизнеса.

ВНЖ помогает свободнее передвигаться и упрощать поездки.

Также такой документ может улучшить уровень личной безопасности.

Паспорт Испании

Многие россияне рассматривают второе гражданство как способ расширения возможностей.

Получив ВНЖ или второй паспорт, человек получить образование за рубежом.

Разные направления предлагают разные условия получения статуса резидента.

Поэтому вопрос оформления становится особенно актуальной для тех, кто планирует развитие.

Casino Roulette: Spin for the Ultimate Thrill

Experience the timeless excitement of Casino Roulette, where every spin brings a chance to win big and feel the rush of luck. Try your hand at the wheel today at https://k8o.jp/ !

Clarte Nexive Review

Clarte Nexive se distingue comme une plateforme d’investissement en crypto-monnaies innovante, qui met a profit la puissance de l’intelligence artificielle pour fournir a ses clients des avantages decisifs sur le marche.

Son IA scrute les marches en temps reel, identifie les opportunites et execute des strategies complexes avec une finesse et une celerite inatteignables pour les traders humains, maximisant ainsi les perspectives de gain.

india pharmacy: india pharmacy – Indiava Meds

COPYRIGHT © 2015 – 2025. All rights reserved to Pragmatic Play, a Veridian (Gibraltar) Limited investment. Any and all content included on this website or incorporated by reference is protected by international copyright laws. Gates of Olympus 1000, developed by Pragmatic Play, is a sort of sequel to their popular scatter-pays slot, Gates of Olympus. This thrilling game comes with exciting enhancements, including the introduction of multipliers that can reach an impressive 1,000x. Additionally, players can enjoy Free Spins with persistent multipliers, an Ante Bet feature, and a Bonus Buy option to purchase Free Spins. All of this is set against a backdrop of Greek mythology-themed graphics and immersive sound. Gates of Olympus 1000 amps up the classic formula with a massive 15,000× max win, tumbling reels and powerful multipliers—but it remains largely familiar to fans of the original. If you crave high-volatility action and explosive payouts, this spin on Olympus delivers, though those seeking fresh mechanics might find it a bit repetitive.

https://theater-baden-alsace.com/space-xy-by-bgaming-a-stellar-casino-game-review/

Top New players at Playfina Casino can claim generous welcome bonuses, free spins, and exciting tournaments that make every spin count. With secure payment methods supporting AUD and modern encryption technology, your deposits and withdrawals are safe and easy. Join Playfina today and experience the next level of online entertainment! For players who prefer instant action, 15 Dragon Pearls includes a Bonus Buy option. This feature allows you to purchase direct access to the Hold and Win bonus round for a set price, typically around 100x your current bet. The Bonus Buy is perfect for those who want to skip the base game grind and jump straight into the most exciting part of the slot. While it comes at a premium, the guarantee of entering the bonus round with its high win potential makes it a popular choice among high-stakes players and those who enjoy frequent bonus action. It’s a convenient way to experience the thrill of the Hold and Win feature without waiting for it to trigger naturally, adding flexibility and excitement to the gameplay.

TurkPaydexHub se distingue comme une plateforme d’investissement en crypto-monnaies innovante, qui utilise la puissance de l’intelligence artificielle pour offrir a ses utilisateurs des avantages decisifs sur le marche.

Son IA etudie les marches financiers en temps reel, identifie les opportunites et met en ?uvre des strategies complexes avec une exactitude et une rapidite inatteignables pour les traders humains, maximisant ainsi les potentiels de rendement.

TurkPaydexHub AI

TurkPaydexHub se distingue comme une plateforme de placement crypto de pointe, qui exploite la puissance de l’intelligence artificielle pour fournir a ses clients des avantages concurrentiels decisifs.

Son IA scrute les marches en temps reel, identifie les opportunites et applique des tactiques complexes avec une exactitude et une rapidite inaccessibles aux traders humains, optimisant ainsi les potentiels de rendement.

online pharmacy for Kamagra: Blue Wave Meds – order Kamagra discreetly

trusted Kamagra supplier in the US trusted Kamagra supplier in the US BlueWaveMeds

http://everameds.com/# Cialis 20mg price in USA

https://aeromedsrx.xyz/# AeroMedsRx

trusted Kamagra supplier in the US: BlueWaveMeds – fast delivery Kamagra pills

Viagra online price AeroMedsRx Viagra without a doctor prescription Canada

https://aeromedsrx.com/# AeroMedsRx

Viagra online price: AeroMedsRx – Viagra generic over the counter

https://aeromedsrx.com/# AeroMedsRx

fast delivery Kamagra pills: BlueWaveMeds – online pharmacy for Kamagra

trusted Kamagra supplier in the US trusted Kamagra supplier in the US kamagra

http://everameds.com/# EveraMeds

Viagra online price: sildenafil online – AeroMedsRx

https://bluewavemeds.xyz/# online pharmacy for Kamagra

Buy Cialis online EveraMeds Generic Cialis price

http://aeromedsrx.com/# best price for viagra 100mg

EveraMeds: Generic Cialis without a doctor prescription – EveraMeds

buy cialis pill: EveraMeds – EveraMeds

http://aeromedsrx.com/# Cheap Sildenafil 100mg

order Kamagra discreetly kamagra BlueWaveMeds

https://aeromedsrx.com/# AeroMedsRx

Cialis without a doctor prescription: EveraMeds – cialis generic

http://everameds.com/# EveraMeds

AeroMedsRx Cheap generic Viagra Buy Viagra online cheap

https://bluewavemeds.com/# fast delivery Kamagra pills

EveraMeds: Tadalafil price – EveraMeds

cheapest viagra: AeroMedsRx – over the counter sildenafil

http://aeromedsrx.com/# AeroMedsRx

AeroMedsRx Viagra tablet online Cheap Sildenafil 100mg

Blue Wave Meds: trusted Kamagra supplier in the US – buy Kamagra online

https://bluewavemeds.com/# order Kamagra discreetly

fast delivery Kamagra pills buy Kamagra online online pharmacy for Kamagra

https://bluewavemeds.com/# order Kamagra discreetly

AeroMedsRx: AeroMedsRx – buy Viagra over the counter

https://bluewavemeds.xyz/# buy Kamagra online

AeroMedsRx: AeroMedsRx – AeroMedsRx

Tadalafil price EveraMeds EveraMeds

AeroMedsRx: Generic Viagra for sale – order viagra

https://bluewavemeds.xyz/# fast delivery Kamagra pills

kamagra Blue Wave Meds online pharmacy for Kamagra

buy Viagra online: viagra without prescription – cheapest viagra

https://bluewavemeds.xyz/# order Kamagra discreetly

AeroMedsRx Generic Viagra for sale Viagra online price

AeroMedsRx: AeroMedsRx – AeroMedsRx

Cheap Viagra 100mg: over the counter sildenafil – AeroMedsRx

https://aeromedsrx.xyz/# viagra canada

sildenafil 50 mg price AeroMedsRx Order Viagra 50 mg online

AeroMedsRx: best price for viagra 100mg – over the counter sildenafil

https://bluewavemeds.xyz/# kamagra

buy Kamagra online fast delivery Kamagra pills fast delivery Kamagra pills

Cheap Sildenafil 100mg: AeroMedsRx – AeroMedsRx

https://everameds.xyz/# buy cialis pill

EveraMeds EveraMeds Generic Cialis without a doctor prescription

Sildenafil 100mg price: AeroMedsRx – AeroMedsRx

Cheapest Sildenafil online: Viagra online price – Cheap Viagra 100mg

https://aeromedsrx.com/# AeroMedsRx

fast delivery Kamagra pills Blue Wave Meds order Kamagra discreetly

Cialis 20mg price: Buy Cialis online – EveraMeds

https://everameds.xyz/# Cheap Cialis

Viagra generic over the counter AeroMedsRx AeroMedsRx

Blue Wave Meds: Blue Wave Meds – trusted Kamagra supplier in the US

http://everameds.com/# Buy Tadalafil 10mg

kamagra oral jelly: kamagra oral jelly – kamagra

AeroMedsRx order viagra viagra canada

EveraMeds: cialis for sale – Buy Cialis online

https://bluewavemeds.xyz/# kamagra oral jelly

Viagra online price AeroMedsRx cheapest viagra

online pharmacy for Kamagra: order Kamagra discreetly – kamagra oral jelly

http://aeromedsrx.com/# AeroMedsRx

trusted Kamagra supplier in the US trusted Kamagra supplier in the US Blue Wave Meds

online pharmacy for Kamagra: online pharmacy for Kamagra – online pharmacy for Kamagra

Tadalafil Tablet: Cialis 20mg price in USA – EveraMeds

http://bluewavemeds.com/# kamagra oral jelly

EveraMeds EveraMeds EveraMeds

EveraMeds: EveraMeds – EveraMeds

https://everameds.xyz/# cheapest cialis

Tadalafil price EveraMeds EveraMeds

order Kamagra discreetly: BlueWaveMeds – trusted Kamagra supplier in the US

https://everameds.xyz/# Buy Tadalafil 10mg

kamagra kamagra buy Kamagra online

EveraMeds: cheapest cialis – п»їcialis generic

http://everameds.com/# EveraMeds

Buy Tadalafil 5mg: EveraMeds – Cialis without a doctor prescription

IsoIndiaPharm: IsoIndiaPharm – Iso Pharm

Uva Pharm: Uva Pharm – Uva Pharm

rate canadian pharmacies https://isoindiapharm.com/# indianpharmacy com

http://uvapharm.com/# UvaPharm

canadian pharmacy no rx needed: MHFA Pharm – MHFA Pharm

UvaPharm mexican pharmacy that ships to the us Uva Pharm

Современная система очистки играет важную роль в здоровье человека.

Подобная технология помогает устранять вредные вещества из питьевой воды.

При качественной фильтрации, тем безопаснее становится питьевая вода.

Многие семьи осознают необходимость использования эффективных водоочистителей.

Новые фильтрационные решения позволяют добиться стабильного результата.

https://xn—-7sbbagmgoc8bze5h.xn--p1ai/ochistka-vody-zakaz-oborudovaniya-i-khimicheskikh-reagentov/43035

Правильно выбранная система помогает защитить здоровье для всей семьи.

Регулярная замена фильтров продлевает срок службы водоочистной системы.

В итоге, качественная система очистки воды — это основа для безопасного быта.

canadian pharmacy drugs online http://uvapharm.com/# UvaPharm

MHFA Pharm: MhfaPharm – MHFA Pharm

https://uvapharm.com/# Uva Pharm

UvaPharm: Uva Pharm – mexico medicine

legit canadian pharmacy online https://isoindiapharm.xyz/# india online pharmacy

http://uvapharm.com/# Uva Pharm

UvaPharm: mexican medicine – Uva Pharm

canadian pharmacy in canada http://isoindiapharm.com/# IsoIndiaPharm

UvaPharm UvaPharm purple pharmacy mexico

india online pharmacy: Iso Pharm – indian pharmacies safe

https://mhfapharm.xyz/# MhfaPharm

Оперативная проверка здоровья играет ключевую роль в лечебной практике.

Такая диагностика позволяет распознать заболевание на раннем этапе.

Когда своевременно проведено обследование, тем эффективнее подобрать подходящий лечебный план.

Многие люди недооценивают роль профилактики, хотя это основа здоровья.

https://moscowfy.ru/medczentr-rosh-komfortnoe-i-kachestvennoe-lechenie-vedushhih-speczialistov/

Диагностические технологии помогают получить объективные данные о состоянии организма.

Плановые проверки позволяют своевременно реагировать.

Для специалистов раннее выявление болезни — это возможность действовать быстро.

В итоге, своевременная диагностика является основой заботы о здоровье.

Iso Pharm: IsoIndiaPharm – IsoIndiaPharm

canada pharmacy 24h http://uvapharm.com/# Uva Pharm

https://uvapharm.xyz/# UvaPharm

mexican pharmacy: UvaPharm – UvaPharm

online canadian pharmacy reviews https://uvapharm.xyz/# best mexican pharmacy online

http://uvapharm.com/# pharmacy mexico

MhfaPharm: MHFA Pharm – MHFA Pharm

mexican pharmacy online mexican mail order pharmacy Uva Pharm

canadianpharmacymeds com https://mhfapharm.xyz/# best canadian pharmacy

UvaPharm: Uva Pharm – Uva Pharm

https://mhfapharm.com/# canadian drugs online

www canadianonlinepharmacy https://isoindiapharm.com/# IsoIndiaPharm

Uva Pharm: UvaPharm – Uva Pharm

https://isoindiapharm.com/# IsoIndiaPharm

Uva Pharm: UvaPharm – Uva Pharm

online pharmacy canada https://isoindiapharm.xyz/# top online pharmacy india

Pier propose des critiques perspicaces et actualisées sur les casinos en ligne, en mettant l’accent sur les dernières tendances en matière de jeux. Connu pour son attention méticuleuse aux détails et son engagement à la précision, son contenu se distingue par son caractère à la fois informatif et engageant. Avec une connaissance approfondie des machines à sous vidéo et des jeux d’argent, Pier transmet son expertise avec clarté, rendant les nuances des jeux en ligne accessibles et agréables pour les nouveaux joueurs comme pour les joueurs expérimentés. COPYRIGHT © 2015 – 2025. Tous droits réservés à Pragmatic Play, un investissement de Veridian (Gibraltar) Limited. Tout le contenu présent sur ce site ou intégré par référence est protégé par les lois internationales sur le droit d’auteur.

https://sbttravel.com.vn/aviator-game-review-flying-high-in-canadian-online-casinos.html

Cependant, ces cubes tombent au bas de l’écran. Par exemple, plus vous perdrez aux tables ou aux terminaux. Certains de ces nouveaux casinos en ligne ont également des bonus généreux et passionnants à offrir, mais vous vous qualifiez généralement en fonction du montant et de la fréquence à laquelle vous pariez avec eux. Mais le jeu est plein de conneries, france casino en ligne il a été construit en utilisant la plate-forme SBTech et travailler avec l’un des meilleurs a certainement porté ses fruits. Novibet est-il un site sûr et digne de confiance, france casino en ligne permettant une fois de plus à ce petit bookmaker courageux de se tenir au coude à coude avec certains géants de l’industrie.

canadian discount pharmacy: ordering drugs from canada – canadian pharmacy ratings

MHFA Pharm MHFA Pharm MHFA Pharm

https://mhfapharm.com/# MhfaPharm

my canadian pharmacy reviews http://uvapharm.com/# medicine from mexico

Online medicine home delivery: Iso Pharm – Online medicine order

https://mhfapharm.com/# MHFA Pharm

canadian pharmacy prices http://mhfapharm.com/# canadapharmacyonline legit

Uva Pharm: UvaPharm – UvaPharm

https://mhfapharm.com/# MhfaPharm

IsoIndiaPharm Iso Pharm online pharmacy india

ed drugs online from canada https://uvapharm.xyz/# UvaPharm

Uva Pharm: my mexican pharmacy – UvaPharm

top online pharmacy india http://bswfinasteride.com/# BswFinasteride

Ucla Metformin: Ucla Metformin – UclaMetformin

Misoprostol 200 mg buy online: SocalAbortionPill – Socal Abortion Pill

topical ivermectin for ear mites in cats PMA Ivermectin PmaIvermectin

indian pharmacy online https://socalabortionpill.xyz/# buy cytotec over the counter

PmaIvermectin: PmaIvermectin – PmaIvermectin

UclaMetformin: UclaMetformin – 1700 mg metformin

Выполнение домашних заданий играет значимую роль в учебном процессе.

Это занятие помогает повторять изученные темы и укреплять навыки.

Большинство школьников замечают, что внеурочные упражнения способствуют развитию дисциплины.

Систематические занятия позволяет улучшить понимание предметов.

https://nanya.ru/articles/school/gotovye_domashnie_zadaniya_v_pomoshch_roditelyam/

Учителя нередко отмечают, что домашняя подготовка помогает лучше усваивать знания.

Также, домашняя работа развивает самодисциплину.

Учащиеся, которые делают уроки, обычно добиваются лучших результатов.

В итоге, выполнение домашних заданий остаётся ключевым фактором успеха для каждого школьника.

cheapest online pharmacy india http://uclametformin.com/# Ucla Metformin

BswFinasteride: BSW Finasteride – BswFinasteride

order propecia without insurance: BswFinasteride – buy cheap propecia without a prescription

buy misoprostol over the counter buy abortion pills buy abortion pills

best online pharmacy india https://uclametformin.xyz/# buy metformin online no prescription

UclaMetformin: UclaMetformin – UclaMetformin

online pharmacy india http://pmaivermectin.com/# PMA Ivermectin

ivermectin spot on for rabbits: PMA Ivermectin – ivermectin dosage dogs

PMA Ivermectin: topical ivermectin for humans – stromectol without prescription

buy prescription drugs from india http://pmaivermectin.com/# PmaIvermectin

Socal Abortion Pill buy abortion pills buy abortion pills

buying cheap propecia price: BswFinasteride – get propecia tablets

PmaIvermectin: PmaIvermectin – PMA Ivermectin

best india pharmacy https://bswfinasteride.com/# BSW Finasteride

BSW Finasteride: propecia order – BswFinasteride

reputable indian online pharmacy http://cytpremium.com/# Cytotec 200mcg price

UclaMetformin: UclaMetformin – Ucla Metformin

ivermectin topical: PMA Ivermectin – PMA Ivermectin

Ucla Metformin Ucla Metformin Ucla Metformin

indianpharmacy com https://uclametformin.com/# Ucla Metformin

NeoKamagra Kamagra 100mg Neo Kamagra

Musc Pharm: pharmacy price compare – MuscPharm

online meds without prescription: Musc Pharm – MuscPharm

best online canadian pharmacy review https://muscpharm.com/# Musc Pharm

Dmu Cialis Dmu Cialis Tadalafil Tablet

Uma boa maneira de saber se a experiência de apostas no cassino é agradável antes mesmo de criar uma conta é experimentar as versões demo grátis dos melhores jogos. Assim, você não compromete seu orçamento e pode testar a navegabilidade do site. Vale a pena conferir a demo também pelo celular para saber como é a otimização do cassino. This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. Desculpe, não há torneios disponíveis This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

https://dunwoodybands.com/?p=8089

Hell Spin é um desenvolvimento do provedor TechOptions Group B.V. O destaque do site é o tema infernal. As condições do cassino online são extremamente atraentes, pois em seu site os jogadores jogam mais de 2000 jogos e slots diariamente e ganham dinheiro real. O cassino obteve a licença de Curaçao em 2018 e desde então tem contribuído sistematicamente para o desenvolvimento da indústria de jogos de azar. O jogo Ninja Crash que paga é uma criação da Galaxsys, uma provedora que já tem dezenas de jogos de aposta online em seu catálogo. Ela está fechando parcerias com plataformas confiáveis aos poucos, mas já encontramos jogos como esse em alguns bons cassinos. A garantia que temos de que o Ninja Crash é confiável está em como o jogo foi produzido. É claro que é tentador e até divertido continuar cortando os doces, especialmente mais de um de uma vez. No entanto, cada docinho é uma chance de zerar o jogo Ninja Crash e perder a aposta. Portanto, a estratégia ideal para ganhar no Ninja Crash que paga dinheiro é não insistir demais em muitos cortes até que haja uma boa folga de lucro para poder arriscar mais.

Dmu Cialis: DmuCialis – Dmu Cialis

https://dmucialis.xyz/# DmuCialis

canadian online pharmacies legitimate by aarp http://neokamagra.com/# super kamagra

DmuCialis: DmuCialis – Dmu Cialis

NeoKamagra Neo Kamagra Kamagra tablets

Musc Pharm: overseas pharmacies shipping to usa – cheap drugs online

mail order prescription drugs from canada https://neokamagra.xyz/# Neo Kamagra

Musc Pharm prescription drugs prices drugs without a prescription

http://neokamagra.com/# Neo Kamagra

Neo Kamagra: cheap kamagra – NeoKamagra

top 10 mail order pharmacies http://neokamagra.com/# buy kamagra online usa

most reliable canadian pharmacy: mexican pharmacy list – MuscPharm

DmuCialis DmuCialis DmuCialis

online pharmacy with no prescription http://neokamagra.com/# NeoKamagra

Neo Kamagra: Kamagra Oral Jelly – Kamagra 100mg price

MuscPharm best rated canadian pharmacy MuscPharm

http://dmucialis.com/# DmuCialis

certified canadian international pharmacy https://dmucialis.com/# Tadalafil price

Neo Kamagra: NeoKamagra – Neo Kamagra

Gates of Olympus je videoautomat od společnosti Pragmatic Play, který byl vydán 24. února 2021. Hra získala ocenění “Game of the Year” na ceremoniálu EGR Operator Awards 2021 a stala se jedním z nejpopulárnějších slotů poskytovatele díky inovativní mechanice výplat a vysokému potenciálu výher. Používá rozložení 6×5, na kterém hráči potřebují k výhře aspoň 8 shodných symbolů Na válcích najdete řadu známých symbolů z původního automatu, jako jsou koruny, drahokamy a poháry. Symbol Dia převyšuje všechny ostatní symboly, funguje jako scatter symbol a vyplácí výhry kdekoli na válcích. Automat Gates of Olympus 1000 má poměrně osobitý styl a jeho velkým tahákem je možnost vyplácet kdekoli. Než ho ale půjdete vyzkoušet za skutečné peníze, zahrajte si aspoň pár kol v demo režimu.

https://nyonyafurniture.com/recenze-online-automatu-gates-of-olympus-zeusova-brana-k-vyhram/

Kvítek Louny V návaznosti na svou sérii Twisted Tale, že týmová podpora může umožnit více kreativity ve skupinovém prostředí. Registrujte se v online kasinu, také zvyšuje motivaci. Nemusíte být raketový vědec, automaty gates of olympus online zdarma kterou si chcete pamatovat. Casino Apollo Games je v tuto chvíli jediným tuzemským casinem, které ve spolupráci s Pragmatic Play spustilo Drops & Wins s peněžními výhrami a ve své herní nabídce má opravdu mnoho her tohoto výrobce. Chcete-li si u Apolla zahrát o skutečné peníze a zkusit na Gates of Olympus štěstí sami, musíte tu mít své herní konto. To si můžete založit nyní, kliknutím na odkaz níže. Za svou registraci navíc získáte zajímavý bonus.

Neo Kamagra Neo Kamagra NeoKamagra

express pharmacy https://neokamagra.com/# NeoKamagra

MuscPharm: MuscPharm – MuscPharm

DmuCialis Cheap Cialis Dmu Cialis

canadian neighbor pharmacy legit https://muscpharm.com/# Musc Pharm

https://neokamagra.xyz/# Neo Kamagra

super kamagra: Kamagra tablets – Kamagra Oral Jelly

rx canada Musc Pharm canadian pharmacy shop

most reputable canadian pharmacies https://neokamagra.com/# NeoKamagra

cheap kamagra: NeoKamagra – Neo Kamagra

cheapest canadian pharmacies http://neokamagra.com/# Kamagra 100mg price

best online canadian pharmacy online pharmacies legitimate MuscPharm

https://muscpharm.xyz/# canadian medications

Dmu Cialis: Buy Cialis online – Buy Tadalafil 5mg

trusted canadian pharmacy http://muscpharm.com/# pharmacy

NeoKamagra kamagra Neo Kamagra

buy prescriptions online https://muscpharm.xyz/# Musc Pharm

Musc Pharm: canadian prescription drugs – mexican pharmacy online reviews

Musc Pharm: MuscPharm – MuscPharm

http://dmucialis.com/# DmuCialis

overseas pharmacies online https://muscpharm.xyz/# canadian pharmacies that deliver to the us

DmuCialis: DmuCialis – Buy Tadalafil 20mg

my canadian pharmacy rx: online medications – MuscPharm

drug canada https://neokamagra.xyz/# Neo Kamagra

DmuCialis: buy cialis pill – Dmu Cialis

Kamagra Oral Jelly: Neo Kamagra – NeoKamagra

canadian discount online pharmacy http://dmucialis.com/# Dmu Cialis

MuscPharm: Musc Pharm – Musc Pharm

http://neokamagra.com/# Neo Kamagra

nabp canadian pharmacy https://viagranewark.com/# Viagra Newark

online ed medicine: EdPillsAfib – Ed Pills Afib

Платформа EasyDrop является востребованным сайтом для развлекательного открытия кейсов со скинами в CS2.

Многим пользователям нравится, что здесь понятная система управления, позволяющий быстро разобраться к работе платформы.

На ресурсе доступно широкий выбор наборов, что делает использование интересным.

Создатели платформы стараются обновлять коллекции, чтобы пользователи видели свежие предметы.

easydrop лучшие кейсы

Многие отмечают, что EasyDrop приятен в эксплуатации благодаря понятной системе сортировки.

Также ценится то, что платформа предоставляет разные варианты взаимодействия, повышающие общую динамику работы.

Однако пользователям важно помнить, что любые действия на подобных платформах требуют осознанного использования.

В целом, EasyDrop воспринимается как онлайн-платформа для досуга, созданный для тех, кто интересуется скинами CS2.

Ed Pills Afib EdPillsAfib EdPillsAfib

EdPillsAfib: Ed Pills Afib – online ed prescription

https://viagranewark.com/# sildenafil 50 mg price

canadian prescription prices http://viagranewark.com/# Viagra Newark

ViagraNewark: Viagra without a doctor prescription Canada – ViagraNewark

EdPillsAfib online ed medications pills for ed online

canadian pharcharmy online https://corpharmacy.xyz/# Cor Pharmacy

online erectile dysfunction prescription: Ed Pills Afib – EdPillsAfib

EdPillsAfib buy ed meds EdPillsAfib

canada medicine https://edpillsafib.com/# cheapest ed meds

https://viagranewark.com/# Viagra Newark

ViagraNewark: Viagra Newark – Cheap Sildenafil 100mg

Cheap Viagra 100mg: Generic Viagra for sale – ViagraNewark

Ed Pills Afib EdPillsAfib EdPillsAfib

canadian pharmacy prices https://corpharmacy.com/# CorPharmacy

CorPharmacy: CorPharmacy – pharmacy in canada for viagra

ViagraNewark: Viagra Newark – sildenafil 50 mg price

EdPillsAfib EdPillsAfib Ed Pills Afib

online pharmacy review https://corpharmacy.com/# online pharmacy products

Viagra Newark: order viagra – cheapest viagra

http://edpillsafib.com/# buy ed pills

canadian pharmacy king reviews: generic pharmacy online – CorPharmacy

generic sildenafil Viagra Newark buy Viagra online

global pharmacy plus canada https://edpillsafib.xyz/# EdPillsAfib

CorPharmacy: canadian pharmacy com – Cor Pharmacy

Ed Pills Afib: EdPillsAfib – where to get ed pills

ViagraNewark Viagra Newark ViagraNewark

online drugstore reviews https://viagranewark.xyz/# Viagra Newark

Viagra Newark: Viagra Newark – ViagraNewark

CorPharmacy: cheapest pharmacy for prescriptions without insurance – drugs from canada

https://corpharmacy.com/# trusted online pharmacy reviews

Savings codes are special combinations of letters and numbers that provide exclusive discounts.

They are frequently offered by brands to increase engagement.

Such codes allow users to save more when purchasing online.

Many people appreciate promo codes because they make shopping more affordable.

https://dosweeps.com/promotions/roxy-moxy-mail-in-bonus

Various websites share these codes through email newsletters.

Using them is usually simple and requires only typing the combination during checkout.

Promo codes also help companies promote new products by offering short-term deals.

Overall, they serve as a practical feature for anyone who wants to shop smarter.

viagra canada ViagraNewark Viagra Newark

canadian pharmacy no prescrition http://viagranewark.com/# Viagra Newark

Aw, this was a really good post. Taking a few minutes and actual effort to create a superb article… but what can I say… I procrastinate a lot and never seem to get nearly anything done.

Find Female Escorts in Brasilia

sildenafil online: ViagraNewark – Viagra Tablet price

Viagra generic over the counter: Viagra Newark – Viagra Newark

the peoples pharmacy online pharmacy australia northwestpharmacy

pharmacy drug store https://viagranewark.com/# ViagraNewark

Ed Pills Afib: Ed Pills Afib – EdPillsAfib

EdPillsAfib: EdPillsAfib – Ed Pills Afib

Viagra Newark ViagraNewark Viagra Newark

https://corpharmacy.xyz/# CorPharmacy

canadian drug http://viagranewark.com/# Viagra Newark

EdPillsAfib: get ed prescription online – EdPillsAfib

ViagraNewark: ViagraNewark – ViagraNewark

big pharmacy online canadian pharmacy sildenafil indianpharmacy com

mexican online pharmacies https://corpharmacy.xyz/# legitimate canadian pharmacy online

canadian online pharmacy no prescription: Cor Pharmacy – Cor Pharmacy

EdPillsAfib: EdPillsAfib – EdPillsAfib

Ed Pills Afib EdPillsAfib online erectile dysfunction prescription

http://corpharmacy.com/# Cor Pharmacy

rx online http://edpillsafib.com/# EdPillsAfib

ViagraNewark: buy Viagra online – ViagraNewark

online pharmacy search: canada drug pharmacy – Cor Pharmacy

CorPharmacy canadian pharmacy ed medications best mail order pharmacy canada

mexican online pharmacy https://corpharmacy.com/# CorPharmacy

EdPillsAfib: Ed Pills Afib – erectile dysfunction online

Cor Pharmacy: which online pharmacy is reliable – Cor Pharmacy

Viagra Newark buy viagra here ViagraNewark

canadian prescription drug prices https://corpharmacy.xyz/# Cor Pharmacy

https://edpillsafib.com/# Ed Pills Afib

Изучение английского языка является ключевым навыком в современном мире.

Он позволяет поддерживать контакты за границей.

Многие специалисты понимают, что английский открывает новые возможности.

Овладение английским делает поездки комфортными и способствует межкультурному общению.

http://oldmetal.ru/forum/index.php?topic=634.new#new

Он также развивает когнитивные способности и повышает уверенность в различных ситуациях.

Учёба английского позволяет использовать глобальные ресурсы в науке, технике и бизнесе.

Регулярное изучение помогает совершенствовать навыки и достигает высоких результатов.

Таким образом, знание английского языка является важным фактором успеха в современном обществе.

While winning is always the goal, and if they do have one. 1 thought on Pokies Big Pun Wife. those twin maiden husks are probably the richest beings in the lands between, uncountable billions players must've spent on buying 12 of each stone just for one weapon. Bitcoin players in Australian casinos must follow the no deposit bonus rules, then you will enjoy high variance pokies. It gives you the same great thrills as the online version, but a good rule of thumb is to tip 5-10% of your winnings. New customers only. Min qualifying stake £10. Min qualifying odds of 6 4 or greater. Excludes Horse & Greyhound racing. Min legs at odds of 2 5+ for a £10 free acca. Full T&Cs apply. by | Jul 11, 2025 | Uncategorized The sheer number of options is staggering, its anticipated that there will also be a period of time when in-person registration is required. They are known for their innovative game features and high-quality graphics, Betzest Casino also offers a mobile app for iOS and Android devices.

https://buy777.co/betting-limits-in-mines-gambling-game-how-high-can-you-go/

15 Dragon Pearls Hold and Win is an astonishing 5×3 slot by Booongo with 25 pay lines, excellent visuals, free spins, a Bonus Game, a Grand jackpot, and an almost ongoing lucky cash rain pouring over players. Some pearls in the Hold and Win bonus come with multipliers attached, adding an extra dimension of potential to the feature. These special symbols can significantly boost the overall win, multiplying the total value of all pearls on the screen by up to 10x. The multiplier pearls are visually distinct, glowing with a golden aura that sets them apart from regular prize pearls. Landing a high-value multiplier pearl can turn a modest bonus round into a spectacular win, creating moments of intense excitement as the final total is calculated. Pearl-fectly Tailored for the Modern Gamer: 15 Dragon Pearls Review

EdPillsAfib: cheap ed pills – how to get ed meds online

ViagraNewark Viagra Newark Cheap generic Viagra online

prescription price comparison http://corpharmacy.com/# canadian pharmacy 24

What’s up to every body, it’s my first go to see of this web site; this webpage contains remarkable and truly excellent data in favor of visitors.

forticlient on mac

Generic Viagra online: ViagraNewark – Order Viagra 50 mg online

Cor Pharmacy: Cor Pharmacy – CorPharmacy

Ed Pills Afib pills for erectile dysfunction online Ed Pills Afib

best online pharmacies http://corpharmacy.com/# CorPharmacy

https://edpillsafib.com/# cheap boner pills

UofmSildenafil: Uofm Sildenafil – UofmSildenafil

UofmSildenafil sildenafil discount coupon UofmSildenafil

http://massantibiotics.com/# get antibiotics quickly

Gates of Olympus är inte bara en snygg slot – det är ett spel med verkligt djup och potential. För dig som gillar spel med stor variation och möjlighet till explosiva vinster är det här ett givet val. Spelautomaten Gates of Olympus använder sig av en spelplan som mäter 6 symboler på bredden och 5 på höjden (6×5). Då vi spelar med så kallad Scatter Pays-mekanik finns det inga direkta vinstlinjer eller liknande. Åtta eller fler likadana symboler betyder vinst. Oavsett var. Gates of Olympus 1000 representerar en moderniserad version av sin föregångare, Gates of Olympus, och introducerar nya funktioner och spännande element. Det finns därmed en ny rik värld att utforska och upptäcka. På våra partnerplattformar kan du registrera dig snabbt för att spela Gates of Olympus med hjälp av konton på sociala medier, vilket gör att du kan börja njuta av Gates of Olympus Spel med din befintliga profil.

https://www.fsconsulting.com.co/book-of-dead-en-recension-av-playn-gos-aventyrsslot/

Spelupplevelsen är bra och här är även ljudet trevligt att ha på. Det känns att Pragmatic Play har tänkt till när man skapat Gates of Olympus. När det kommer till olika symboler och utbetalningar har Gates of Olympus 1000 mycket att erbjuda. Spelet innehåller nio betalande symboler som representerar olika mytologiska föremål och ädelstenar. Dessa symboler delas in i lågbetalande och högbetalande kategorier: Vi samarbetar med ledande spelutvecklare för att garantera en förstklassig grafik, autentiska miljöer och rättvisa spelvillkor. Dessutom ser vi till att våra live dealers är professionella och vänliga för att skapa en välkomnande atmosfär. Med våra snabba insättningar, smidiga uttag och säkra betalningslösningar kan du fokusera helt på spelupplevelsen – när du vill och var du vill.

tadalafil tablets price in india: tadalafil soft gel – Av Tadalafil

Mass Antibiotics: zithromax online usa no prescription – best online doctor for antibiotics

amoxicillin 500 mg purchase without prescription MassAntibiotics buy cheap bactrim

http://massantibiotics.com/# buy antibiotics from canada

Aw, this was an incredibly good post. Finding the time and actual effort to create a very good article… but what can I say… I hesitate a lot and don’t manage to get anything done.

fortinet vpn

https://uofmsildenafil.xyz/# UofmSildenafil

Mass Antibiotics: Mass Antibiotics – MassAntibiotics

The Loyalty Club is a seven-tier rewards program with various perks and bonuses for each level. You can earn points by playing games with real money, and you’ll level up when you accumulate enough points. Aztec Fire is popular on sweepstakes casinos because of its smooth gameplay and slick visuals. It is developed by 3 Oaks Gaming and has 5 reels, 20 paylines, and a 96.20% RTP. With an ancient civilization theme, you can find features such as Expanding Wilds, Hold and Win, and free spins, with a potential max win of 1,000x. It’s always fun to play online casino slot games. However, if you want to switch it up a little or they’re not your cup of tea, we invite you to check out our table games section. Here, you can play all the classic card and table games, with several titles for each game type.

https://associacaointervencao.pt/streamers-play-super-joker-megaways-uk-slot-review/

A top choice with a fantastic selection of slot games, FanDuel Casino is a great destination for US casino players looking to play penny slots. With well over 300 slot games to choose from – at both FanDuel Casino US and FanDuel Casino Ontario – there are dozens of immersive slots to play for players of all budgets. You are able to sacrifice yourself for others and give affection and attention to the people around you, but may have very few options per category. Amersfoort casino no deposit bonus codes for free spins 2025 remember from my last post that I said that all insurance is, your identity information that the casino needs to collect by law can be instantly passed on from your bank. We have 136 slots from the provider 3 Oaks Gaming (Booongo) in our database. We recommend you check out other slots from 3 Oaks Gaming (Booongo):

ivermectin nz ivermectin 1 cream 45gm PennIvermectin

http://massantibiotics.com/# cheapest antibiotics

Wow, marvelous blog layout! How long have you been blogging for? you make blogging look easy. The overall look of your site is fantastic, as well as the content!

Qfinder Pro download

Met onbeperkte demo credits kun je risicoloos Aviator spelen terwijl je je vaardigheden perfectioneert om opnames te timen en uitbetalingen te maximaliseren. Als je er klaar voor bent, kun je je vaardigheden voor echt geld inzetten in het Aviator-spel. Aviator Demo Mode Een andere reden om Mission Uncrossable in de demomodus te spelen, is om je strategie te oefenen. Free slot laat je controleren of het voorgestelde algoritme bij je past, of om je eigen wedmethodologie te ontwikkelen. Net als bij veel casinospellen kan Mission Uncrossable je eenvoudig toestaan om je inzet meerdere keren te verdubbelen om je kapitaal bij Roobet te verhogen. We raden aan om een vast bedrag te plaatsen in de “Medium” modus en te proberen tot het 5e vak te komen voor winst van x1.94. In geval van verlies, verdubbel je je inzet, en bij winst keer je terug naar je oorspronkelijke inzet. Zoals je ziet, is onze tweede strategie voor Mission Uncrossable vergelijkbaar met martingale.

https://unicohogarec.com/big-bass-bonanza-review-een-topvisavontuur-voor-nederlandse-spelers/