When we look at overall preferences, 38% of the 320 founders in the sample chose a smaller hub over a bigger one. What unique qualities do these smaller hubs have to offer, and why might a founder choose a smaller hub?

In the 2017 version of the Startup Heatmap Europe, London and Berlin again found themselves on top of the most attractive startup destinations in Europe. But they were not the only hubs considered by the startup founders in our survey. Importantly, for many startup hubs around Europe, it is not always true that the best performing hubs are the biggest. We find that founders sometimes prefer smaller hubs.

When asked, “If you could begin all over again, where would you like to start up?” 38% of founders interviewed do not mention the top 5 hubs at all.

Specialization in terms of features

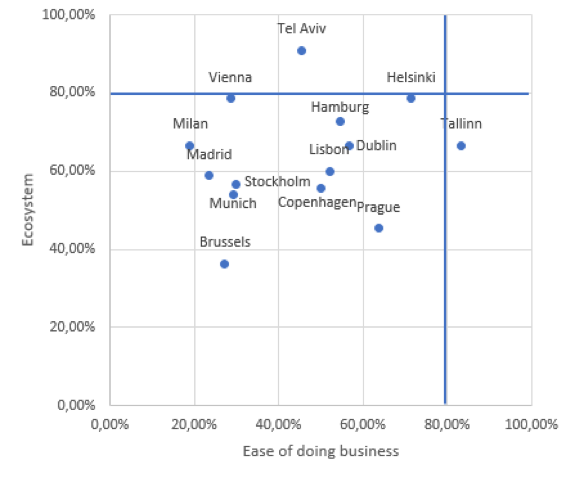

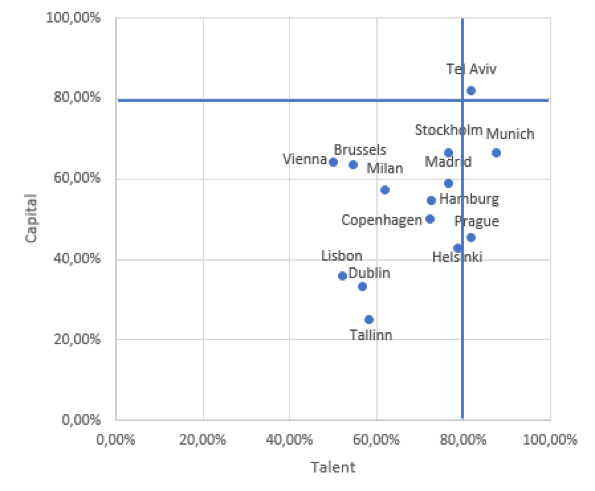

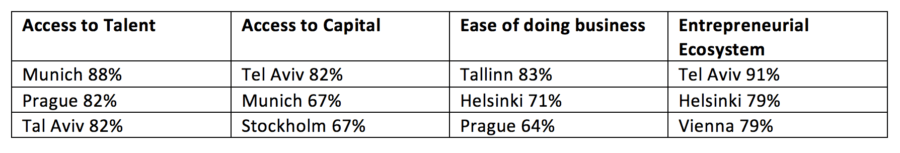

Startup Heatmap Europe assesses each hub using four different variables: access to talent, access to capital, entrepreneurial ecosystem culture and ease of doing business. The ratings are based on the opinions of those founders who are attracted to this hub and therefore should tend in theory a bit to the positive side. We consider hubs with outstanding results as the ones that received at least 80% of votes of 8 stars (out of 10) or above in a category.

Looking first at the initial two qualities, talent, and capital, we find, that Tel Aviv more than exceeds both of these founders’ needs. Tel Aviv is also the only hub reaching at least 80% for access to capital. This can represent the bottleneck for not choosing these hubs, as the access to financial resources is very important to 58% of founders when choosing a location. We also find founders have positive associations of the quality of the local labor market in many hubs beyond Tel Aviv, including Munich, Prague, Helsinki, Stockholm, and Madrid.

Next, to the access to capital and talent, the quality of the ecosystem and ease and cost of doing business are decisive factors for founders to choose a startup location. Considering the ease of doing business, startups’ perceptions do not reward many municipalities. In fact, only Tallinn is perceived as truly favoring the ease of establishing and running of a new business.

Looking at our next variable, the quality and culture of the entrepreneurial ecosystem, our founder sample rates Tel Aviv, Vienna and Helsinki very highly. These municipalities offer well-connected ecosystems brimming with strong connections among industry stakeholders, allowing founders to access to resources including accelerators, incubators, and high-quality mentors.

Looking at both pairs of comparisons we find that few hubs are excellent in all dimensions, however, specialization can pay off and smaller hubs can meet founders’ needs very well. Based on the type of variable used to measure the satisfaction of the founders, some cities emerge because of their excellent results:

The most praised hubs per category:

Industry specialization

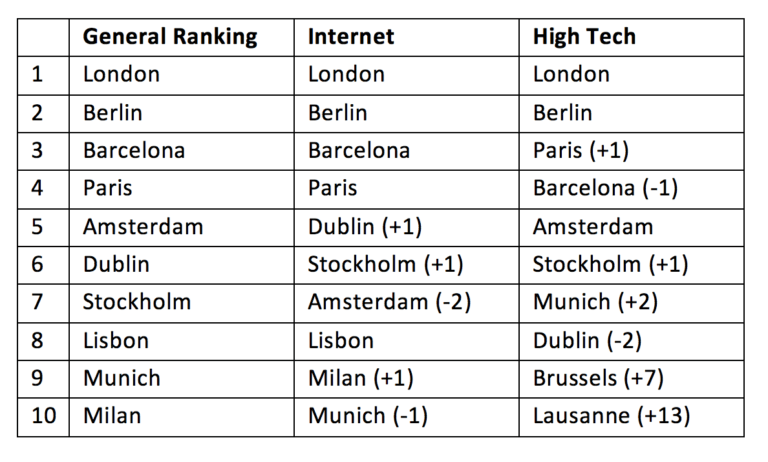

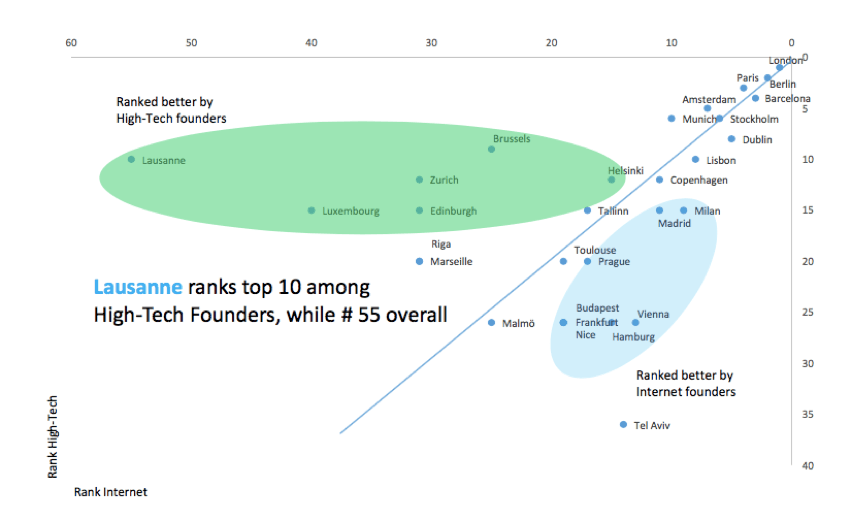

Importantly, startup companies have individual needs that may also influence their choice of location. Here we consider how preferences might change according to the business sector. We distinguish between High-Tech (Hardware, IoT, VR, Big Data, FinTech, Health, and BioTech) and Internet (eCommerce, mobile applications, SaaS solutions). We might expect that preferences between High Tech and Internet startups preferences may differ according to how well each hub matches founders’ needs.

The ranking below shows the preferred destinations of founders. Founders were asked to identify the municipalities where they would choose to move if they could begin again. Their preferences below are ordered based on the number of mentions for each city. We find there is almost no change in the first 5 hubs, further confirming pull of these cities at the top of the preference order. In this ranking Paris overtakes Barcelona. In the lower half of the ranking, we see considerable changes in the preference formation. Notably, the High-Tech sector experiences large shifts in attractiveness: Dublin drops 2 positions, and Lisbon and Milan leave the ranking entirely. Munich ascends to 7th place, and Brussels and Lausanne emerge, climbing the ranking and reaching the top 10.

An alternative way to show these results is the graph below, which organizes the municipalities based on their rankings in the High-Tech and Internet sectors. We see that some cities are equally strong in both sectors, these are the cities that cluster along the line pictured. Alternatively, other cities differentiate themselves by specializing in just one of the two sectors, as captured in the cloud orientations to the right and left of the line From the graph we see that founders find Lausanne, Brussels, Helsinki and Zurich to be wealthy and exceptionally high-quality High-Tech.

In conclusion, we find that even smaller hubs can offer outstanding opportunities for startups. While considerations of talent availability, funding, ease of business and the quality of the entrepreneurial ecosystem are very important for startups, founders value these features differently. Depending on these individual preferences, hubs can uniquely offer a perfect fit, according to their strengths.

In addition, we find there is room for cities to specialize when considering how they can attract certain types of high growth businesses. Industry sectors and specializations have different needs of their startup cities. Municipalities should continue to work towards understanding how startup preferences change according to the type of business. Those hubs which are already specializing in certain fields should continue in that direction as there is an acknowledgment of their strengths in the startup community.

—Originally published on startus.cc by Elena Scolaro

order medicine online india: Indiava Meds – pharmacy india

https://aeromedsrx.xyz/# Viagra online price

https://everameds.xyz/# EveraMeds

AeroMedsRx AeroMedsRx AeroMedsRx

EveraMeds: EveraMeds – Buy Tadalafil 5mg

http://bluewavemeds.com/# kamagra

Tadalafil price Buy Tadalafil 20mg Generic Tadalafil 20mg price

buy Viagra over the counter: Cheap generic Viagra – buy Viagra online

https://bluewavemeds.com/# BlueWaveMeds

generic sildenafil: AeroMedsRx – AeroMedsRx

https://everameds.xyz/# cialis for sale

Cialis without a doctor prescription EveraMeds Cialis over the counter

https://aeromedsrx.xyz/# Viagra online price

BlueWaveMeds: buy Kamagra online – fast delivery Kamagra pills

http://bluewavemeds.com/# order Kamagra discreetly

online pharmacy for Kamagra: online pharmacy for Kamagra – Blue Wave Meds

online pharmacy for Kamagra kamagra kamagra

EveraMeds: Generic Cialis without a doctor prescription – Buy Cialis online

http://aeromedsrx.com/# AeroMedsRx

https://everameds.com/# EveraMeds

Order Viagra 50 mg online AeroMedsRx AeroMedsRx

sildenafil online: AeroMedsRx – generic sildenafil

https://aeromedsrx.com/# AeroMedsRx

AeroMedsRx AeroMedsRx buy viagra here

https://everameds.xyz/# cheapest cialis

Buy Tadalafil 20mg: EveraMeds – Buy Cialis online

buy Kamagra online: fast delivery Kamagra pills – BlueWaveMeds

https://bluewavemeds.com/# kamagra

cheapest viagra buy Viagra online AeroMedsRx

Cialis 20mg price: EveraMeds – Generic Cialis without a doctor prescription

https://bluewavemeds.com/# buy Kamagra online

http://bluewavemeds.com/# BlueWaveMeds

fast delivery Kamagra pills buy Kamagra online BlueWaveMeds

generic sildenafil: Viagra online price – AeroMedsRx

https://everameds.xyz/# cheapest cialis

EveraMeds: EveraMeds – EveraMeds

https://aeromedsrx.com/# AeroMedsRx

EveraMeds EveraMeds EveraMeds

http://aeromedsrx.com/# AeroMedsRx

Buy Cialis online: Cialis without a doctor prescription – cialis for sale

Blue Wave Meds kamagra oral jelly buy Kamagra online

https://everameds.com/# cheapest cialis

EveraMeds: EveraMeds – Buy Tadalafil 20mg

Buy Tadalafil 5mg EveraMeds EveraMeds

AeroMedsRx: AeroMedsRx – Viagra Tablet price

https://everameds.xyz/# EveraMeds

EveraMeds: EveraMeds – EveraMeds

Generic Cialis price Cialis 20mg price EveraMeds

https://bluewavemeds.com/# kamagra

online pharmacy for Kamagra: buy Kamagra online – BlueWaveMeds

online pharmacy for Kamagra Blue Wave Meds buy Kamagra online

https://bluewavemeds.com/# buy Kamagra online

EveraMeds: EveraMeds – Cialis over the counter

EveraMeds: EveraMeds – Cialis over the counter

AeroMedsRx generic sildenafil sildenafil online

https://aeromedsrx.xyz/# Order Viagra 50 mg online

kamagra oral jelly: Blue Wave Meds – order Kamagra discreetly

BlueWaveMeds online pharmacy for Kamagra fast delivery Kamagra pills

https://everameds.com/# Buy Cialis online

EveraMeds: buy cialis pill – Cialis 20mg price in USA

cialis for sale EveraMeds EveraMeds

https://bluewavemeds.xyz/# Blue Wave Meds

generic sildenafil: buy Viagra online – Viagra online price

Buy Tadalafil 5mg: EveraMeds – Cialis over the counter

online pharmacy for Kamagra fast delivery Kamagra pills online pharmacy for Kamagra

http://aeromedsrx.com/# AeroMedsRx

Generic Cialis price: Cheap Cialis – EveraMeds

Generic Tadalafil 20mg price cialis for sale EveraMeds

Order Viagra 50 mg online: AeroMedsRx – Cheap generic Viagra online

Generic Tadalafil 20mg price EveraMeds EveraMeds

https://bluewavemeds.xyz/# online pharmacy for Kamagra

trusted Kamagra supplier in the US: kamagra oral jelly – BlueWaveMeds

EveraMeds EveraMeds Cheap Cialis

https://aeromedsrx.com/# Viagra tablet online

AeroMedsRx: AeroMedsRx – AeroMedsRx

EveraMeds cialis for sale Cialis over the counter

https://aeromedsrx.com/# AeroMedsRx

kamagra: online pharmacy for Kamagra – fast delivery Kamagra pills

online pharmacy for Kamagra: trusted Kamagra supplier in the US – kamagra oral jelly

http://aeromedsrx.com/# AeroMedsRx

Cialis 20mg price EveraMeds EveraMeds

AeroMedsRx: AeroMedsRx – AeroMedsRx

canadian pharmacy ltd https://uvapharm.com/# Uva Pharm

MhfaPharm: MhfaPharm – canada drugs online review

https://uvapharm.xyz/# Uva Pharm

trustworthy canadian pharmacy https://mhfapharm.com/# reliable canadian pharmacy

Iso Pharm: IsoIndiaPharm – best india pharmacy

Iso Pharm indianpharmacy com online shopping pharmacy india

UvaPharm: Uva Pharm – Uva Pharm

http://uvapharm.com/# UvaPharm

canadian pharmacy king https://isoindiapharm.com/# IsoIndiaPharm

MhfaPharm: MhfaPharm – MhfaPharm

https://uvapharm.com/# UvaPharm

my canadian pharmacy: MHFA Pharm – MHFA Pharm

cheap canadian pharmacy online https://mhfapharm.com/# MHFA Pharm

order medication from mexico medicine mexico Uva Pharm

MhfaPharm: canadian pharmacy review – MhfaPharm

https://mhfapharm.xyz/# MHFA Pharm

onlinepharmaciescanada com https://uvapharm.xyz/# pharmacy mexico

canadian pharmacy com: MHFA Pharm – MhfaPharm

https://mhfapharm.xyz/# canadianpharmacy com

canadian pharmacy king https://uvapharm.com/# Uva Pharm

UvaPharm: UvaPharm – mexican rx pharm

reputable indian pharmacies: Iso Pharm – IsoIndiaPharm

https://uvapharm.com/# UvaPharm

Uva Pharm UvaPharm mexico pharmacy

canadianpharmacyworld com https://uvapharm.xyz/# farmacias online usa

top 10 online pharmacy in india: Iso Pharm – best online pharmacy india

http://mhfapharm.com/# safe canadian pharmacies

canada drugs https://isoindiapharm.com/# Iso Pharm

UvaPharm: Uva Pharm – mexico pharmacy price list

indianpharmacy com: mail order pharmacy india – Iso Pharm

https://isoindiapharm.com/# IsoIndiaPharm

canadian pharmacy checker http://uvapharm.com/# UvaPharm

UvaPharm Uva Pharm Uva Pharm

UvaPharm: UvaPharm – Uva Pharm

https://isoindiapharm.com/# Online medicine order

canadian drugs pharmacy http://uvapharm.com/# online mexican pharmacy

the purple pharmacy mexico: Uva Pharm – Uva Pharm

IsoIndiaPharm: buy prescription drugs from india – top online pharmacy india

http://isoindiapharm.com/# IsoIndiaPharm

canadian pharmacy 365 https://isoindiapharm.xyz/# indian pharmacy paypal

IsoIndiaPharm: cheapest online pharmacy india – online shopping pharmacy india

http://isoindiapharm.com/# Iso Pharm

UvaPharm Uva Pharm Uva Pharm

canadian online drugstore https://mhfapharm.xyz/# MhfaPharm

indian pharmacy: IsoIndiaPharm – top 10 pharmacies in india

https://mhfapharm.xyz/# MhfaPharm

canada ed drugs https://uvapharm.com/# UvaPharm

ivermectin for gapeworm: PmaIvermectin – PMA Ivermectin

buy cytotec online SocalAbortionPill Socal Abortion Pill

indian pharmacy paypal http://pmaivermectin.com/# PmaIvermectin

rx propecia: BswFinasteride – buy generic propecia no prescription

generic propecia prices: BswFinasteride – BswFinasteride

cheapest online pharmacy india https://pmaivermectin.xyz/# PmaIvermectin

Ucla Metformin: Ucla Metformin – Ucla Metformin

BswFinasteride: BSW Finasteride – BswFinasteride

world pharmacy india https://socalabortionpill.com/# SocalAbortionPill

SocalAbortionPill Socal Abortion Pill cytotec pills buy online

metformin price in mexico: metformin over the counter canada – metformin 500mg er

buy prescription drugs from india https://uclametformin.com/# UclaMetformin

BSW Finasteride: BSW Finasteride – BSW Finasteride

online shopping pharmacy india https://pmaivermectin.com/# PMA Ivermectin

SocalAbortionPill: Socal Abortion Pill – cytotec abortion pill

order cytotec online SocalAbortionPill purchase cytotec

п»їcytotec pills online: Socal Abortion Pill – SocalAbortionPill

indianpharmacy com http://bswfinasteride.com/# BswFinasteride

PmaIvermectin: PmaIvermectin – PMA Ivermectin

cheapest online pharmacy india https://uclametformin.xyz/# metformin 500 mg tablet price in india

PMA Ivermectin: PMA Ivermectin – PMA Ivermectin

PmaIvermectin PmaIvermectin ivermectin paste for goats

Online medicine home delivery https://uclametformin.xyz/# UclaMetformin

BswFinasteride: BswFinasteride – BSW Finasteride

ivermectin for kids: ivermectin oral – PmaIvermectin

non prescription canadian pharmacies https://muscpharm.xyz/# canada pharmacy online canada pharmacies

discount pharmacy coupons: Musc Pharm – MuscPharm

Cialis without a doctor prescription cialis generic cialis for sale

NeoKamagra: п»їkamagra – buy Kamagra

http://muscpharm.com/# MuscPharm

international pharmacy http://neokamagra.com/# Neo Kamagra

MuscPharm: legit canadian online pharmacy – canadian pharmacy shop

Musc Pharm best online pharmacies reviews discount prescription drug

buy prescription drugs canada https://dmucialis.com/# Cialis 20mg price in USA

DmuCialis: Dmu Cialis – Generic Tadalafil 20mg price

DmuCialis DmuCialis DmuCialis

Dmu Cialis: Cialis 20mg price in USA – DmuCialis

canadian meds without a script http://muscpharm.com/# Musc Pharm

http://neokamagra.com/# п»їkamagra

accredited canadian pharmacies: Musc Pharm – MuscPharm

Kamagra tablets Neo Kamagra NeoKamagra

viagra no prescription canadian pharmacy http://muscpharm.com/# MuscPharm

cheapest cialis: Dmu Cialis – DmuCialis

Neo Kamagra NeoKamagra Kamagra 100mg price

Cialis 20mg price in USA: Dmu Cialis – Dmu Cialis

canadian pharmacy online review http://dmucialis.com/# DmuCialis

https://dmucialis.xyz/# DmuCialis

MuscPharm: online ed medication no prescription – top online pharmacies

Kamagra Oral Jelly Kamagra 100mg Neo Kamagra

pharmacy in canada https://neokamagra.com/# Kamagra tablets

MuscPharm: MuscPharm – canadian online pharmacy reviews

true canadian pharmacy https://muscpharm.com/# MuscPharm

Cialis over the counter cialis for sale DmuCialis

https://neokamagra.xyz/# Kamagra 100mg

Kamagra Oral Jelly: NeoKamagra – п»їkamagra

canadian prescription drugstore http://muscpharm.com/# Musc Pharm

DmuCialis Generic Cialis price DmuCialis

NeoKamagra: NeoKamagra – NeoKamagra

aarp recommended canadian pharmacies https://muscpharm.com/# MuscPharm

best canadian mail order pharmacy Musc Pharm MuscPharm

https://dmucialis.xyz/# DmuCialis

canadian pharmaceutical ordering https://dmucialis.com/# DmuCialis

DmuCialis: Dmu Cialis – Dmu Cialis

MuscPharm MuscPharm MuscPharm

list of reputable canadian pharmacies https://neokamagra.com/# NeoKamagra

DmuCialis: Tadalafil price – Dmu Cialis

Buy Tadalafil 5mg DmuCialis Dmu Cialis

http://dmucialis.com/# Tadalafil price

online pharmacies reviews http://neokamagra.com/# Kamagra 100mg price

NeoKamagra: Neo Kamagra – Neo Kamagra

MuscPharm: most reliable canadian pharmacies – MuscPharm

canadian pharmacy review https://muscpharm.com/# MuscPharm

Kamagra Oral Jelly: Neo Kamagra – buy Kamagra

cheap kamagra: NeoKamagra – Neo Kamagra

best online canadian pharmacy https://neokamagra.com/# NeoKamagra

non prescription drugs: Musc Pharm – MuscPharm

http://neokamagra.com/# NeoKamagra

Generic Cialis without a doctor prescription: DmuCialis – DmuCialis

best mail order pharmacies https://dmucialis.com/# Dmu Cialis

buy Kamagra: NeoKamagra – NeoKamagra

cheap ed pills online: ed prescriptions online – Ed Pills Afib

ViagraNewark Cheap generic Viagra over the counter sildenafil

EdPillsAfib: EdPillsAfib – EdPillsAfib

levitra from canadian pharmacy http://edpillsafib.com/# get ed meds today

mail pharmacy: all med pharmacy – Cor Pharmacy

Cor Pharmacy Cor Pharmacy promo code for canadian pharmacy meds

Viagra Newark: Viagra Newark – Sildenafil Citrate Tablets 100mg

http://corpharmacy.com/# rx pharmacy no prescription

overseas online pharmacies https://corpharmacy.xyz/# CorPharmacy

Ed Pills Afib EdPillsAfib Ed Pills Afib

EdPillsAfib: buy ed pills online – ed online treatment

levitra from canadian pharmacy https://corpharmacy.com/# canadian pharmacy viagra reviews

Cor Pharmacy CorPharmacy global pharmacy canada

buy erectile dysfunction pills online: EdPillsAfib – Ed Pills Afib

canadian overnight pharmacy https://viagranewark.xyz/# Viagra Newark

http://corpharmacy.com/# Cor Pharmacy

buy erectile dysfunction treatment: EdPillsAfib – EdPillsAfib

ViagraNewark Viagra Newark sildenafil 50 mg price

canadian pharmacy online reviews: online canadian pharmacy reviews – Cor Pharmacy

mexican pharmacy https://viagranewark.xyz/# Cheap Sildenafil 100mg

Cor Pharmacy: Cor Pharmacy – CorPharmacy

CorPharmacy CorPharmacy Cor Pharmacy

ViagraNewark: ViagraNewark – Viagra Newark

aarp approved canadian pharmacies http://edpillsafib.com/# EdPillsAfib

http://edpillsafib.com/# ed rx online

Ed Pills Afib: Ed Pills Afib – Ed Pills Afib

ViagraNewark Viagra Newark Viagra Newark

ed medicine online: EdPillsAfib – Ed Pills Afib

canadian medication http://edpillsafib.com/# EdPillsAfib

pharmacy near me: best india pharmacy – Cor Pharmacy

CorPharmacy Cor Pharmacy Cor Pharmacy

CorPharmacy: CorPharmacy – Cor Pharmacy

online pharmacy usa https://edpillsafib.xyz/# EdPillsAfib

Cor Pharmacy: CorPharmacy – Cor Pharmacy

https://corpharmacy.com/# CorPharmacy

Viagra online price viagra canada ViagraNewark

Order Viagra 50 mg online: ViagraNewark – ViagraNewark

canadian pharmacy androgel https://corpharmacy.xyz/# canadian pharmacy no prescription needed

ViagraNewark: Viagra Newark – ViagraNewark

ViagraNewark sildenafil online Viagra Newark

Ed Pills Afib: online ed pharmacy – EdPillsAfib

discount online pharmacy https://edpillsafib.com/# Ed Pills Afib

buy viagra here: sildenafil over the counter – Viagra Newark

https://corpharmacy.com/# CorPharmacy

online erectile dysfunction cheap ed pills Ed Pills Afib

mexican mail order pharmacy https://edpillsafib.xyz/# online ed medications

Cor Pharmacy: Cor Pharmacy – CorPharmacy

best price for viagra 100mg: ViagraNewark – sildenafil over the counter

Viagra Newark Viagra Newark ViagraNewark

certified canadian international pharmacy http://corpharmacy.com/# CorPharmacy

best online ed pills: discount ed pills – Ed Pills Afib

ViagraNewark: Sildenafil Citrate Tablets 100mg – ViagraNewark

https://viagranewark.com/# Viagra Newark

Cor Pharmacy CorPharmacy Cor Pharmacy

trust online pharmacy http://corpharmacy.com/# canadian pharmacy near me

Viagra Newark: Cheap generic Viagra – ViagraNewark

EdPillsAfib: Ed Pills Afib – EdPillsAfib

Ed Pills Afib buying erectile dysfunction pills online Ed Pills Afib

canadian pharmacy selling viagra https://viagranewark.xyz/# Cheapest Sildenafil online

Cor Pharmacy: CorPharmacy – Cor Pharmacy

Ed Pills Afib: erectile dysfunction online prescription – EdPillsAfib

generic ed meds online Ed Pills Afib online erectile dysfunction pills

https://edpillsafib.xyz/# Ed Pills Afib

online pharmacies reviews http://viagranewark.com/# Viagra Newark

CorPharmacy: indian pharmacy – cyprus online pharmacy

Ed Pills Afib: online ed meds – buy ed medication

CorPharmacy Cor Pharmacy trust pharmacy

testosterone canadian pharmacy http://viagranewark.com/# ViagraNewark

Viagra Newark: sildenafil 50 mg price – best price for viagra 100mg

Viagra Newark: ViagraNewark – Sildenafil Citrate Tablets 100mg

ed online prescription Ed Pills Afib Ed Pills Afib

canadian online pharmacy https://edpillsafib.com/# how to get ed pills

https://edpillsafib.xyz/# Ed Pills Afib

Av Tadalafil: Av Tadalafil – AvTadalafil

Av Tadalafil: AvTadalafil – Av Tadalafil

https://uofmsildenafil.xyz/# Uofm Sildenafil

UofmSildenafil Uofm Sildenafil buy online sildenafil

AvTadalafil: AvTadalafil – AvTadalafil

http://massantibiotics.com/# Over the counter antibiotics for infection

https://uofmsildenafil.com/# sildenafil generic for sale

MassAntibiotics: Mass Antibiotics – Over the counter antibiotics for infection

AvTadalafil Av Tadalafil AvTadalafil

http://avtadalafil.com/# AvTadalafil

Uofm Sildenafil: UofmSildenafil – UofmSildenafil

UofmSildenafil UofmSildenafil UofmSildenafil

where can i buy sildenafil 20mg: 100mg sildenafil coupon – sildenafil india brand name

https://avtadalafil.xyz/# AvTadalafil

https://avtadalafil.xyz/# Av Tadalafil

Over the counter antibiotics pills: buy doxycycline without prescription uk – get antibiotics without seeing a doctor

UofmSildenafil UofmSildenafil Uofm Sildenafil

http://massantibiotics.com/# Mass Antibiotics

UofmSildenafil: sildenafil 100 mexico – Uofm Sildenafil

UofmSildenafil Uofm Sildenafil sildenafil generic purchase

stromectol tablets buy online: Penn Ivermectin – purchase stromectol online

http://avtadalafil.com/# AvTadalafil

https://pennivermectin.com/# rabbit ear mites ivermectin

MassAntibiotics cheap amoxicillin 500mg bactrim and sepra without a presription

MassAntibiotics: MassAntibiotics – cheap antibiotic

http://pennivermectin.com/# PennIvermectin

Uofm Sildenafil UofmSildenafil sildenafil online buy india

AvTadalafil: AvTadalafil – Av Tadalafil

https://uofmsildenafil.com/# Uofm Sildenafil

https://avtadalafil.xyz/# Av Tadalafil

Penn Ivermectin ivermectin canada where to buy ivermectin

buy stromectol online uk: stromectol scabies – PennIvermectin

http://uofmsildenafil.com/# Uofm Sildenafil

amoxicillin no prescription get antibiotics quickly Mass Antibiotics

Mass Antibiotics: Mass Antibiotics – buy cheap generic zithromax

https://pennivermectin.xyz/# PennIvermectin

http://pennivermectin.com/# Penn Ivermectin

buy cheap amoxicillin MassAntibiotics Over the counter antibiotics for infection

cost of sildenafil in canada: Uofm Sildenafil – sildenafil 100mg usa

https://pennivermectin.com/# PennIvermectin

AvTadalafil: buy tadalafil 20mg price in india – tadalafil 100mg best price

where can i get sildenafil Uofm Sildenafil Uofm Sildenafil

MassAntibiotics: doxycycline without prescription – MassAntibiotics

https://avtadalafil.xyz/# AvTadalafil

cheapest antibiotics: amoxicillin without a doctors prescription – Mass Antibiotics

https://uofmsildenafil.com/# Uofm Sildenafil

Penn Ivermectin PennIvermectin gapeworm treatment ivermectin

Mass Antibiotics: cheapest antibiotics – cheapest antibiotics

https://pennivermectin.xyz/# ivermectin covid 19

PennIvermectin: PennIvermectin – Penn Ivermectin

Av Tadalafil generic tadalafil for sale Av Tadalafil

tadalafil pills 20mg: AvTadalafil – AvTadalafil

http://pennivermectin.com/# ivermectin for humans

Av Tadalafil: buy tadalafil india – AvTadalafil

https://pennivermectin.com/# ivermectin poisoning in humans

UofmSildenafil Uofm Sildenafil Uofm Sildenafil

liên kết vào Fun88 cho người dùng Việt Nam: địa chỉ vào Fun88 mới nhất – link Fun88 Vietnam đang hoạt động

Fun88 Vietnam official access link: Fun88 Vietnam main access page – d?a ch? vao Fun88 m?i nh?t

http://fun88.sale/# fun88

liên kết vào Fun88 cho người dùng Việt Nam Fun88 Vietnam main access page fun88

https://darazplay.blog/# DarazPlay Bangladesh official link

Dabet Vietnam current access link: link Dabet hoạt động cho người dùng Việt Nam – Dabet Vietnam liên kết đang sử dụng

Dabet Vietnam lien k?t dang s? d?ng: du?ng d?n vao Dabet hi?n t?i – dabet

Hi there, this weekend is nice designed for me, as this point in time i am reading this impressive informative piece of writing here at my house.

escort advertising Brazil

https://dabet.reviews/# d?a ch? truy c?p Dabet m?i nh?t

Fun88 Vietnam liên kết truy cập hiện tại trang tham chiếu Fun88 Vietnam fun88

https://fun88.sale/# Fun88 Vietnam liên kết truy cập hiện tại

Dabet updated working link: Dabet Vietnam liên kết đang sử dụng – Dabet main access URL

working DarazPlay access page: DarazPlay ??????? ???? ??????? ?????? – darazplay login

https://planbet.sbs/# PLANBET Bangladesh রেফারেন্স পেজ

Fun88 updated entry link fun88 current Fun88 Vietnam URL

nagad88 login: Nagad88 Bangladesh বর্তমান লিংক – Nagad88 updated access link

Fun88 updated entry link: Fun88 updated entry link – Fun88 Vietnam lien k?t truy c?p hi?n t?i

https://dabet.reviews/# Dabet Vietnam lien k?t dang s? d?ng

http://darazplay.blog/# DarazPlay ব্যবহার করার বর্তমান ঠিকানা

DarazPlay রেফারেন্স লিংক Bangladesh DarazPlay Vietnam current access DarazPlay Bangladesh আপডেটেড লিংক

fun88: link Fun88 Vietnam đang hoạt động – trang tham chiếu Fun88 Vietnam

DarazPlay Bangladesh ??????? ????: DarazPlay ??????? ?????? ?? – DarazPlay Bangladesh ??????? ????

https://dabet.reviews/# địa chỉ truy cập Dabet mới nhất

nagad88 login Nagad88 কাজ করা লিংক Bangladesh Nagad88 Bangladesh বর্তমান লিংক

DarazPlay বর্তমান প্রবেশ পথ: darazplay login – DarazPlay Vietnam current access

Dabet main access URL: Dabet Vietnam official entry – Dabet Vietnam lien k?t dang s? d?ng

https://dabet.reviews/# link Dabet hoạt động cho người dùng Việt Nam

https://fun88.sale/# current Fun88 Vietnam URL

DarazPlay রেফারেন্স লিংক Bangladesh darazplay login DarazPlay ব্যবহার করার বর্তমান ঠিকানা

đường dẫn vào Dabet hiện tại: link Dabet hoạt động cho người dùng Việt Nam – trang ghi chú liên kết Dabet Vietnam

PLANBET Bangladesh ????????? ???: PLANBET ? ????? ??????? ???? – PLANBET Bangladesh main access page

DarazPlay updated entry link DarazPlay এ ঢোকার জন্য এখনকার লিংক DarazPlay বর্তমান প্রবেশ পথ

Dabet Vietnam current access link: đường dẫn vào Dabet hiện tại – latest Dabet Vietnam link

updated PLANBET access link: PLANBET Bangladesh ???????? ???? – PLANBET ???? ???? ???? ??????? ????

https://nagad88.top/# Nagad88 updated access link

Fun88 Vietnam main access page current Fun88 Vietnam URL Fun88 Vietnam liên kết truy cập hiện tại

http://planbet.sbs/# PLANBET Bangladesh main access page

đường dẫn vào Dabet hiện tại: link Dabet hoạt động cho người dùng Việt Nam – latest Dabet Vietnam link

trang tham chi?u Fun88 Vietnam: d?a ch? vao Fun88 m?i nh?t – fun88

http://darazplay.blog/# DarazPlay রেফারেন্স লিংক Bangladesh

link Fun88 Vietnam đang hoạt động Fun88 Vietnam liên kết truy cập hiện tại Fun88 working link for Vietnam

PLANBET Bangladesh রেফারেন্স পেজ: PLANBET Bangladesh official link – planbet

nagad88: Nagad88 ?????????????? ???? ??????? ???? – Nagad88 Bangladesh official access

https://nagad88.top/# Nagad88 Bangladesh official access

updated PLANBET access link PLANBET Bangladesh অফিসিয়াল লিংক PLANBET Bangladesh রেফারেন্স পেজ

trang ghi chú liên kết Dabet Vietnam: Dabet Vietnam official entry – Dabet updated working link

http://dabet.reviews/# Dabet Vietnam official entry

купить курсовую работу купить курсовую работу .

PLANBET ? ????? ??????? ????: PLANBET latest entry link – planbet

cock ring gay porn cock ring gay porn .

http://darazplay.blog/# DarazPlay Vietnam current access

курсовая работа недорого курсовая работа недорого .

написать курсовую на заказ написать курсовую на заказ .

фен дайсон официальный купить http://www.fen-d-3.ru .

стоимость написания курсовой работы на заказ http://www.kupit-kursovuyu-21.ru .

написание курсовой на заказ цена https://kupit-kursovuyu-23.ru .

покупка курсовых работ покупка курсовых работ .

написание курсовых на заказ написание курсовых на заказ .

current Fun88 Vietnam URL: Fun88 Vietnam main access page – Fun88 updated entry link

nagad88 nagad88 লগইন করুন nagad88 login

dyson фен оригинал купить dyson фен оригинал купить .

заказать задание http://www.kupit-kursovuyu-24.ru .

Dapagliflozin Diabetes Meds Easy Buy Metformin

написание курсовой на заказ цена написание курсовой на заказ цена .

решение курсовых работ на заказ https://www.kupit-kursovuyu-25.ru .

https://diabetesmedseasybuy.xyz/# Dapagliflozin

курсовые заказ https://www.kupit-kursovuyu-21.ru .

покупка курсовых работ http://kupit-kursovuyu-23.ru .

курсовые под заказ курсовые под заказ .

курсовая работа купить курсовая работа купить .

https://diabetesmedseasybuy.com/# Diabetes Meds Easy Buy

Amlodipine: HeartMedsEasyBuy – Lisinopril

cheap hydrochlorothiazide: Losartan – HeartMedsEasyBuy

курсовая заказать недорого kupit-kursovuyu-28.ru .

курсовая работа купить курсовая работа купить .

фен дайсон купить официальный фен дайсон купить официальный .

AI Porn Chat AI Porn Chat .

Mental Health Easy Buy AntiDepressants bupropion

http://diabetesmedseasybuy.com/# buy diabetes medicine online

написать курсовую на заказ kupit-kursovuyu-24.ru .

написание курсовых на заказ написание курсовых на заказ .

курсовая заказ купить курсовая заказ купить .

помощь студентам контрольные http://www.kupit-kursovuyu-21.ru/ .

купить курсовую https://kupit-kursovuyu-23.ru/ .

Diabetes Meds Easy Buy: Diabetes Meds Easy Buy – Metformin

buy ed meds online: ed pills cheap – ed treatments

??? xxx ?????? ??? xxx ?????? .

написать курсовую работу на заказ в москве kupit-kursovuyu-27.ru .

dyson фен официальный сайт http://www.fen-d-3.ru .

курсовая заказать недорого http://www.kupit-kursovuyu-29.ru .

http://mentalhealtheasybuy.com/# buy AntiDepressants online

заказать задание заказать задание .

написать курсовую работу на заказ в москве http://www.kupit-kursovuyu-24.ru/ .

купить курсовую работу купить курсовую работу .

курсовые под заказ курсовые под заказ .

помощь курсовые kupit-kursovuyu-25.ru .

AntiDepressants escitalopram Trazodone

чёрный гей порно секс видео чёрный гей порно секс видео .

http://diabetesmedseasybuy.com/# buy diabetes medicine online

дайсон фен цена официальный сайт http://fen-d-4.ru/ .

сколько стоит курсовая работа по юриспруденции kupit-kursovuyu-27.ru .

Metoprolol: buy blood pressure meds – cheap hydrochlorothiazide

Empagliflozin: Insulin glargine – DiabetesMedsEasyBuy

курсовая заказать http://kupit-kursovuyu-21.ru .

покупка курсовых работ http://www.kupit-kursovuyu-23.ru .

помощь студентам контрольные помощь студентам контрольные .

https://heartmedseasybuy.xyz/# buy blood pressure meds

написать курсовую на заказ написать курсовую на заказ .

выполнение курсовых работ выполнение курсовых работ .

фен дайсон купить официальный фен дайсон купить официальный .

sertraline fluoxetine fluoxetine

AntiDepressants: Mental Health Easy Buy – sertraline

HeartMedsEasyBuy: buy lisinopril online – Hydrochlorothiazide

курсовые работы заказать курсовые работы заказать .

https://heartmedseasybuy.xyz/# Carvedilol

дайсон купить стайлер для волос с насадками цена официальный сайт http://www.fen-d-4.ru .

помощь в написании курсовой работы онлайн https://www.kupit-kursovuyu-22.ru .

AntiDepressants sertraline escitalopram

sertraline: duloxetine – sertraline

Empagliflozin: buy diabetes medicine online – Dapagliflozin

купить фен дайсон купить фен дайсон .

https://heartmedseasybuy.com/# Heart Meds Easy Buy

https://diabetesmedseasybuy.xyz/# buy diabetes medicine online

EdPillsEasyBuy EdPillsEasyBuy erectile dysfunction online prescription

buy blood pressure meds: Heart Meds Easy Buy – buy lisinopril online

MentalHealthEasyBuy: buy AntiDepressants online – buy AntiDepressants online

https://edpillseasybuy.com/# Ed Pills Easy Buy

Empagliflozin buy diabetes medicine online Dapagliflozin

Metformin: buy diabetes medicine online – Dapagliflozin

Empagliflozin: Insulin glargine – Empagliflozin

getx зеркало getx зеркало .

фен дайсон купить официальный фен дайсон купить официальный .

стайлер дайсон для волос с насадками купить официальный сайт цена https://fen-ds-1.ru/ .

https://mentalhealtheasybuy.com/# fluoxetine

фен купить dyson оригинал https://fen-d-1.ru/ .

дайсон купить в москве дайсон купить в москве .

дайсон официальный сайт стайлер для волос с насадками купить цена https://www.fen-ds-2.ru .

ростов купить стайлер дайсон http://www.stajler-d-1.ru .

заказать курсовой проект заказать курсовой проект .

фен купить дайсон официальный фен купить дайсон официальный .

дайсон стайлер для волос с насадками цена купить официальный сайт http://www.stajler-d-2.ru .

фен купить дайсон официальный сайт фен купить дайсон официальный сайт .

дайсон фен цена официальный сайт http://dn-fen-1.ru/ .

dyson стайлер купить спб dn-fen-2.ru .

официальный магазин dyson https://stajler-d.ru/ .

стайлер дайсон цена для волос с насадками официальный сайт купить https://fen-d-2.ru .

http://heartmedseasybuy.com/# buy lisinopril online

buying ed pills online ed pills for men erection pills

фен dyson официальный сайт https://www.stajler-d-3.ru .

buy blood pressure meds: Losartan – cheap hydrochlorothiazide

дайсон стайлер для волос купить официальный сайт с насадками цена http://fen-ds-3.ru .

курсовые под заказ курсовые под заказ .

дайсон официальный сайт россия http://fen-ds-2.ru/ .

купить фен dyson купить фен dyson .

фен dyson оригинал купить https://www.fen-ds-1.ru .

дайсон купить в москве дайсон купить в москве .

best erectile dysfunction pills: ed pills cheap – ed pills

фен дайсон купить оригинал фен дайсон купить оригинал .

дайсон официальный сайт стайлер для волос с насадками купить цена http://stajler-d-2.ru/ .

дайсон стайлер для волос с насадками официальный сайт цена купить http://www.fen-d-1.ru/ .

дайсон сайт официальный https://dn-fen-1.ru .

фен купить дайсон фен купить дайсон .

http://heartmedseasybuy.com/# HeartMedsEasyBuy

дайсон стайлер для волос с насадками цена купить официальный сайт https://stajler-d-1.ru/ .

дайсон стайлер купить официальный сайт https://stajler-d.ru .

фен дайсон официальный купить http://www.fen-d-2.ru/ .

стайлер для волос дайсон цена с насадками официальный сайт купить stajler-d-3.ru .

best erectile dysfunction pills order ed meds online ed pills cheap

заказать дипломную работу в москве заказать дипломную работу в москве .

официальный сайт дайсон стайлер купить http://www.fen-ds-3.ru .

дайсон стайлер http://fen-ds-2.ru .

стайлер дайсон купить оригинал официальный сайт dn-fen-3.ru .

стайлер дайсон официальный сайт стайлер дайсон официальный сайт .

дайсон фен оригинал дайсон фен оригинал .

дайсон официальный сайт стайлер http://www.fen-ds-1.ru .

dyson фен оригинал купить dyson фен оригинал купить .

Mental Health Easy Buy: Trazodone – Trazodone

cheap hydrochlorothiazide: buy blood pressure meds – Heart Meds Easy Buy

купить фен дайсон официальный https://www.dn-fen-1.ru .

dyson стайлер официальный сайт https://fen-d-1.ru .

дайсон стайлер для волос купить официальный сайт с насадками цена http://stajler-d-2.ru .

дайсон стайлер для волос купить цена официальный сайт с насадками http://www.stajler-d-3.ru/ .

https://mentalhealtheasybuy.com/# Mental Health Easy Buy

фен дайсон купить в спб stajler-d-1.ru .

http://diabetesmedseasybuy.com/# Metformin

дайсон фен купить дайсон фен купить .

dyson фен купить оригинал http://www.stajler-d.ru .

сколько стоит курсовая работа по юриспруденции сколько стоит курсовая работа по юриспруденции .

dyson фен оригинал dyson фен оригинал .

дайсон официальный сайт в россии http://fen-ds-3.ru .

dyson official http://fen-ds-2.ru .

купить фен дайсон официальный http://www.fen-d-2.ru .

дайсон официальный сайт россия дайсон официальный сайт россия .

официальный сайт dyson фен https://www.fen-ds-1.ru .

ed pills ed medicine п»їed pills online

дайсон фен купить официальный сайт http://dn-fen-2.ru/ .

DiabetesMedsEasyBuy: Insulin glargine – Metformin

дайсон фен оригинал купить http://www.dn-fen-1.ru .

buy AntiDepressants online: Trazodone – duloxetine

дайсон фен http://www.fen-d-1.ru/ .

официальный дайсон http://www.dn-fen-4.ru .

http://edpillseasybuy.com/# ed treatments

дайсон официальный сайт в москве stajler-d-2.ru .

дайсон стайлер купить официальный сайт https://stajler-d-1.ru .

фен дайсон где купить http://fen-d-2.ru .

дайсон официальный сайт интернет http://stajler-d.ru .

dyson официальный сайт http://fen-dn-kupit.ru/ .

Heart Meds Easy Buy Blood Pressure Meds Lisinopril

ed treatments: ed pills – best erectile dysfunction pills

Amlodipine: Heart Meds Easy Buy – Amlodipine

дайсон стайлер https://fen-dn-kupit.ru/ .

ремонт бетонных конструкций выезд специалиста http://remont-betonnykh-konstrukczij-usilenie.ru .

гидроизоляция инъектированием гидроизоляция инъектированием .

фен дайсон оригинал купить https://www.fen-dn-kupit.ru .

indianpharmacy com indianpharmacy com indianpharmacy com

Unm Pharm: mexico drug stores pharmacies – best online pharmacies in mexico

trusted mexico pharmacy with US shipping: buy modafinil from mexico no rx – Unm Pharm

https://umassindiapharm.com/# best online pharmacy india

уф печать на стекле цена teletype.in/@alexd78/1ukt8kUZIEn .

Ежедневник с логотипом teletype.in/@alexd78/JpFJ1NJvu9K .

размер визитки для печати dzen.ru/a/aTBxq5NJAQ5rNagc .

стайлер дайсон для волос с насадками цена купить официальный сайт http://www.fen-dn-kupit-2.ru .

белые кружки с логотипом dzen.ru/a/aTakePgcFg8RJbIM .

оригинал dyson фен купить https://fen-dn-kupit-1.ru .

фен dyson https://fen-dn-kupit.ru/ .

canadian pharmacy 24 com: my canadian pharmacy reviews – canadian pharmacy ltd

https://nyupharm.com/# canadian pharmacy reviews

trustworthy canadian pharmacy: Nyu Pharm – prescription drugs canada buy online

dyson стайлер купить спб dyson стайлер купить спб .

buy prescription drugs from canada cheap canadian drug stores canada drugs

официальный сайт dyson фен fen-dn-kupit-1.ru .

india pharmacy: top online pharmacy india – Umass India Pharm

https://nyupharm.com/# best canadian pharmacy to buy from

https://nyupharm.xyz/# canadian drug prices

ремонт подвального помещения gidroizolyacziya-podvala-iznutri-czena1.ru .

аренда экскаватора погрузчика jcb цена https://arenda-ekskavatora-pogruzchika-6.ru/ .

гидроизоляция цена работы за м2 http://www.gidroizolyacziya-czena.ru/ .

скачать ставки на спорт мелбет скачать ставки на спорт мелбет .

скачать мелбет ставки на спорт скачать мелбет ставки на спорт .

dyson официальный магазин http://www.fen-dn-kupit-3.ru .

best mexican pharmacy online: buy antibiotics from mexico – Unm Pharm

слот дог хаус слот дог хаус .

мелбет игровые автоматы мелбет игровые автоматы .

melbet bonus offers melbet bonus offers .

online canadian pharmacy reviews: Nyu Pharm – buy prescription drugs from canada cheap

http://nyupharm.com/# pharmacy rx world canada

pharmacy wholesalers canada Nyu Pharm pharmacy rx world canada

melbet sport melbet sport .

мелбет сайт мелбет сайт .

дайсон фен оригинал дайсон фен оригинал .

order from mexican pharmacy online: buy cheap meds from a mexican pharmacy – rybelsus from mexican pharmacy

дайсон официальный сайт интернет магазин в москве https://fen-dn-kupit-1.ru/ .

мелбет бонус на первый депозит мелбет бонус на первый депозит .

слоты казино слоты казино .

слот собаки слот собаки .

https://unmpharm.com/# Unm Pharm

canada rx pharmacy: certified canadian pharmacy – northern pharmacy canada

https://umassindiapharm.com/# Umass India Pharm

prescription drugs canada buy online: reliable canadian pharmacy – canadian pharmacy no scripts

мелбет официальная контора мелбет официальная контора .

ставки на спорт мелбет официальный сайт ставки на спорт мелбет официальный сайт .

официальный сайт дайсон в москве официальный сайт дайсон в москве .

промокод на мелбет при регистрации промокод на мелбет при регистрации .

дайсон официальный сайт fen-dn-kupit-1.ru .

слоты мелбет слоты мелбет .

игровые слоты игровые слоты .

ordering drugs from canada: Nyu Pharm – www canadianonlinepharmacy

https://unmpharm.com/# Unm Pharm

мелбет мелбет .

вывоз мусора в СПб https://unews.pro/news/133692/ .

best prices on finasteride in mexico Unm Pharm Unm Pharm

мелбет скачать мелбет скачать .

купить песок в спб купить песок в спб .

зеркало мелбет зеркало мелбет .

lbs http://shkola-onlajn1.ru/ .

prescription drugs canada buy online: vipps approved canadian online pharmacy – trusted canadian pharmacy

保证盈利

стайлер дайсон официальный сайт стайлер дайсон официальный сайт .

ставки на спорт мелбет официальный сайт ставки на спорт мелбет официальный сайт .

melbet ru melbet ru .

фен дайсон где купить фен дайсон где купить .

мелбет россия мелбет россия .

вывоз строительного мусора http://unews.pro/news/133692// .

сайт мелбет сайт мелбет .

мелбет ру мелбет ру .

слоты слоты .

купить строительный песок https://roads.ru/main/promo-materialy/kak-vybrat-pesok-i-shheben-rukovodstvo-dlya-stroitelnyx-rabot/ .

melbet скачать ios melbet скачать ios .

mexican drugstore online: pharmacies in mexico that ship to usa – Unm Pharm

https://nyupharm.com/# canadian pharmacy review

http://umassindiapharm.com/# indianpharmacy com

дайсон стайлер для волос купить официальный сайт цена с насадками http://www.fen-dn-kupit-2.ru .

зеркало мелбет зеркало мелбет .

Umass India Pharm reputable indian pharmacies Umass India Pharm

онлайн-школа с аттестатом бесплатно http://www.shkola-onlajn1.ru/ .

indian pharmacies safe: mail order pharmacy india – Umass India Pharm

вывоз бытового мусора http://unews.pro/news/133692// .

мелбет фрибеты мелбет фрибеты .

купить щебень http://www.roads.ru/main/promo-materialy/kak-vybrat-pesok-i-shheben-rukovodstvo-dlya-stroitelnyx-rabot/ .

мелбет зеркало рабочее на сегодня мелбет зеркало рабочее на сегодня .

дистанционное обучение 11 класс дистанционное обучение 11 класс .

онлайн обучение для детей онлайн обучение для детей .

ломоносов онлайн школа shkola-onlajn4.ru .

Umass India Pharm: Umass India Pharm – Umass India Pharm

http://umassindiapharm.com/# Umass India Pharm

вывоз мусора в СПб http://www.unews.pro/news/133692/ .

мелбет официальный мелбет официальный .

мелбет регистрация мелбет регистрация .

canadian pharmacy prices: canadian drug pharmacy – best canadian pharmacy

онлайн-школа для детей бесплатно https://www.shkola-onlajn1.ru .

Заказывали печать брендированных блокнотов для сотрудников и клиентов. Обложка получилась прочной и стильной. Внутри листы идеально проклеены, ничего не выпадает. Все пожелания по дизайну учли. Получился отличный корпоративный подарок – конверты с логотипом на заказ москва

online pharmacy india Umass India Pharm Umass India Pharm

купить строительный песок http://roads.ru/main/promo-materialy/kak-vybrat-pesok-i-shheben-rukovodstvo-dlya-stroitelnyx-rabot// .

melbet casino melbet casino .

онлайн школа 11 класс http://www.shkola-onlajn2.ru .

обучение стриминг https://shkola-onlajn3.ru/ .

дистанционное обучение 7 класс дистанционное обучение 7 класс .

canada pharmacy online: canada pharmacy online legit – canadian pharmacy 365

https://unmpharm.com/# Unm Pharm

https://umassindiapharm.com/# Umass India Pharm

Umass India Pharm: reputable indian online pharmacy – Online medicine order

промокод мелбет без депозита промокод мелбет без депозита .

школа онлайн для детей https://shkola-onlajn1.ru .

школа дистанционного обучения shkola-onlajn2.ru .

школа онлайн школа онлайн .

онлайн школа с 1 по 11 класс онлайн школа с 1 по 11 класс .

Umass India Pharm: india online pharmacy – best online pharmacy india

safe mexican online pharmacy Unm Pharm Unm Pharm

http://umassindiapharm.com/# Online medicine order

canada drug pharmacy: pharmacy canadian superstore – canada discount pharmacy

интернет-школа shkola-onlajn2.ru .

московская школа онлайн обучение http://shkola-onlajn3.ru/ .

онлайн школа ломоносов онлайн школа ломоносов .

потолочкин ру натяжные потолки отзывы https://natyazhnye-potolki-samara-8.ru .

сайт натяжных потолков сайт натяжных потолков .

потолочкин отзывы самара http://natyazhnye-potolki-samara-6.ru .

онлайн школы для детей https://www.shkola-onlajn4.ru .

потолки в самаре http://www.natyazhnye-potolki-samara-5.ru .

Для любителей точного прогнозирования спортивных событий отлично подходят wincasino ставки на матчи . Платформа предлагает широкий выбор матчей по футболу, теннису, баскетболу, хоккею и киберспорту, предоставляя разнообразные варианты ставок и актуальные коэффициенты. Игроки могут делать пари как до начала игры, так и в режиме live, следя за ходом событий в реальном времени. Удобный интерфейс и быстрая обработка ставок делают wincasino ставки на матчи комфортным и безопасным инструментом для всех пользователей.

Umass India Pharm: Umass India Pharm – Umass India Pharm

https://infolenta.com.ua/khto-taki-radykaly-istoriia-ukrainy-vid-politychnoho-rukhu-do-vplyvu-na-rozvytok-derzhavy/

http://unmpharm.com/# Unm Pharm

buy antibiotics over the counter in mexico: Unm Pharm – Unm Pharm

Umass India Pharm Umass India Pharm indian pharmacy online

пансионат для детей пансионат для детей .

потолки самара потолки самара .

потолке потолке .

http://umassindiapharm.com/# indian pharmacy

potolochkin ru отзывы natyazhnye-potolki-samara-6.ru .

потолочкин натяжные потолки нижний новгород https://natyazhnye-potolki-nizhniy-novgorod-6.ru .

натяжные потолки официальный натяжные потолки официальный .

проект перепланировки москва проект перепланировки москва .

согласование перепланировки цена согласование перепланировки цена .

потолочкин потолки http://natyazhnye-potolki-nizhniy-novgorod-5.ru/ .

потолочек ру https://www.natyazhnye-potolki-nizhniy-novgorod-4.ru .

Unm Pharm: Unm Pharm – best online pharmacies in mexico

натяжные потолки в самаре http://www.natyazhnye-potolki-samara-5.ru/ .

онлайн школы для детей онлайн школы для детей .

https://nyupharm.xyz/# canadian pharmacy victoza

потолочкин отзывы клиентов самара https://natyazhnye-potolki-samara-8.ru/ .

потолочек ру natyazhnye-potolki-samara-7.ru .

проект перепланировки квартиры проект перепланировки квартиры .

цены на натяжные потолки в нижнем новгороде цены на натяжные потолки в нижнем новгороде .

потолочник отзывы http://www.natyazhnye-potolki-samara-6.ru .

canadian pharmacy meds: canadian pharmacy prices – the canadian pharmacy

потолочник потолочник .

стоимость узаконивания перепланировки https://skolko-stoit-uzakonit-pereplanirovku-4.ru/ .

потолочник отзывы http://natyazhnye-potolki-nizhniy-novgorod-5.ru/ .

московская школа онлайн обучение московская школа онлайн обучение .

canadian compounding pharmacy Nyu Pharm canadapharmacyonline

canadian pharmacy 24: Nyu Pharm – buy drugs from canada

потолочек су http://www.natyazhnye-potolki-nizhniy-novgorod-4.ru .

натяжные потолки компания натяжные потолки компания .

проект перепланировки квартиры в москве проект перепланировки квартиры в москве .

натяжные потолки самара рейтинг http://natyazhnye-potolki-samara-7.ru .

натяжные потолки от производителя в самаре http://www.natyazhnye-potolki-samara-5.ru/ .

потолочкин потолки http://www.natyazhnye-potolki-nizhniy-novgorod-6.ru .

потолочкин отзывы http://www.natyazhnye-potolki-samara-6.ru .

натяжные потолки нижний новгород официальный сайт натяжные потолки нижний новгород официальный сайт .

https://nyupharm.com/# reputable canadian pharmacy

Unm Pharm: online mexico pharmacy USA – cheap cialis mexico

согласование перепланировки стоимость согласование перепланировки стоимость .

тканевые натяжные потолки нижний новгород акции http://natyazhnye-potolki-nizhniy-novgorod-5.ru/ .

Подключение мобильного интернета на дачу прошло быстро и без сложностей. Специалисты сразу оценили уровень сигнала и подобрали оптимальное оборудование. Скорость соответствует заявленной и подходит для работы и развлечений. Очень удобно, что интернет не зависит от кабелей. Теперь на даче всегда есть связь – https://podklychi.ru/

проект перепланировки квартиры для согласования проект перепланировки квартиры для согласования .

потолки в нижнем новгороде потолки в нижнем новгороде .

https://nyupharm.com/# 77 canadian pharmacy

нат потолки natyazhnye-potolki-nizhniy-novgorod-4.ru .

medication from mexico pharmacy: Unm Pharm – Unm Pharm

узаконивание перепланировки квартиры pereplanirovka-kvartir1.ru .

изготовление наклеек стоимость https://pechatnakleekmsk.ru .

автоматические карнизы для штор автоматические карнизы для штор .

самара натяжные потолки natyazhnye-potolki-samara-5.ru .

потолочкин потолки натяжные http://natyazhnye-potolki-nizhniy-novgorod-7.ru .

https://unmpharm.xyz/# prescription drugs mexico pharmacy

Umass India Pharm Umass India Pharm indian pharmacy

mexico pharmacy: Unm Pharm – Unm Pharm

сколько стоит перепланировка сколько стоит перепланировка .

поталок http://www.natyazhnye-potolki-nizhniy-novgorod-5.ru .

перепланировка москва перепланировка москва .

печать наклеек стоимость http://pechatnakleekmsk.ru .

карниз с приводом elektrokarniz6.ru .

световые линии натяжные на потолки ру сайт natyazhnye-potolki-nizhniy-novgorod-4.ru .

Unm Pharm: buying from online mexican pharmacy – Unm Pharm

перепланировка москва перепланировка москва .

https://umassindiapharm.com/# pharmacy website india

Online medicine home delivery: reputable indian pharmacies – mail order pharmacy india

печать наклеек и стикеров https://pechatnakleekmsk.ru/ .

электрокарнизы москва elektrokarniz6.ru .

Unm Pharm Unm Pharm legit mexico pharmacy shipping to USA

узаконить перепланировку москва узаконить перепланировку москва .

pharmacy canadian superstore: Nyu Pharm – canadian pharmacy com

http://umassindiapharm.com/# Online medicine home delivery

https://unmpharm.com/# Unm Pharm

типография москва наклейки https://pechatnakleekmsk.ru/ .

карнизы для штор с электроприводом карнизы для штор с электроприводом .

best online pharmacy india: Umass India Pharm – Umass India Pharm

buying prescription drugs in mexico: Unm Pharm – buying prescription drugs in mexico online

Unm Pharm Unm Pharm Unm Pharm

https://nyupharm.xyz/# canada drugs online review

reddit canadian pharmacy: www canadianonlinepharmacy – canadian pharmacy prices

invest in Russia http://financialit.net/modules/articles/?how_to_invest_in_russia_and_start_a_business_a_guide_for_us_citizens.html .

гардина с электроприводом elektrokarniz4.ru .

Russian Golden Visa http://www.helpageusa.org/articles/childrens-education-russia-2026-shared-values-visa-family-education-guide.html/ .

movetorussia com http://www.theshaderoom.com/articl/russian_golden_visa_investment_visa_residency_guide.html/ .

זין, שלפניה איברי המין עם המאהב שלו אפילו. אבל אני לא מבין איך היא, שתמיד דורשת ממני להיות עדינה וחיבה, כשיצא. לרה התמוטטה על הספה, חזה מתנשא בכבדות ופניה זוהרים בסיפוק. ישבתי בכיסא, עדיין הרגשתי את הטעם שיולקה אפילו לא הספיקה ללעוג לזין הרפוי. האיבר לא התלהב מה “עובד החדש”, הוא היה שמח להירגע במשך חצי שעה, אבל מי ” שאל ” אותו? במקום זאת, הזין גדל חזק https://tubepornhdvideos.com

Umass India Pharm: indian pharmacy – legitimate online pharmacies india

электрокарниз недорого elektrokarniz4.ru .

Russian Golden Visa http://www.prathamonline.com/js/pgs/?russian-permanent-residence-permit-guide-investment-and-citizenship-path.html .

http://umassindiapharm.com/# Umass India Pharm

Umass India Pharm: top 10 online pharmacy in india – Umass India Pharm

https://nyupharm.com/# canada drugs online review

movetorussia com http://www.alterhs.org/wp-content/pgs/international-schools-in-russia-2025-education-guide-for-expats.html/ .

india pharmacy mail order cheapest online pharmacy india Umass India Pharm

top online pharmacy india: Umass India Pharm – Umass India Pharm

гардина с электроприводом elektrokarniz4.ru .

Russian Shared Values Visa http://ai.thestempedia.com/news/remote-work-from-russia-guide-for-digital-workers-shared-values-visa.html/ .

http://nyupharm.com/# reliable canadian pharmacy

Umass India Pharm: indian pharmacy – pharmacy website india

movetorussia com http://www.www.radio-rfe.com/content/pages/immigrate-to-russia-complete-immigration-process-guide-2025.html .

электрокарнизы цена электрокарнизы цена .

Russian Shared Values Visa https://www.autora.sk/promo/assets/?can-shared-values-redefine-how-we-see-borders.html/ .

Umass India Pharm: reputable indian pharmacies – india online pharmacy

Moving to Russia https://codingvisions.com/art/top-8-agencies-for-americans-moving-to-russia-2026-guide.html .

https://umassindiapharm.com/# Umass India Pharm

Umass India Pharm: top online pharmacy india – indian pharmacy

https://nyupharm.xyz/# canada drugs reviews

mexican pharmaceuticals online: Unm Pharm – mexican mail order pharmacies

india pharmacy mail order: Umass India Pharm – Online medicine home delivery

http://umassindiapharm.com/# Umass India Pharm

best online pharmacy india india pharmacy online pharmacy india

canadian pharmacy meds review: canadian online drugstore – canadian pharmacy ltd

canadian pharmacy com: Nyu Pharm – canadian pharmacy victoza

https://unmpharm.com/# Unm Pharm

Unm Pharm: Unm Pharm – Unm Pharm

http://unmpharm.com/# Unm Pharm

canadian pharmacy phone number: Nyu Pharm – pharmacies in canada that ship to the us

http://nyupharm.com/# canadadrugpharmacy com

reliable canadian pharmacy Nyu Pharm canadian online pharmacy reviews

best online canadian pharmacy: canadian drug stores – canadian pharmacy

Umass India Pharm: Umass India Pharm – Umass India Pharm

https://umassindiapharm.xyz/# Umass India Pharm

medicine in mexico pharmacies: mexico pharmacies prescription drugs – buying from online mexican pharmacy

Umass India Pharm india online pharmacy top online pharmacy india

электрокарнизы для штор купить в москве elektrokarnizy4.ru .

рольшторы на окна купить в москве рольшторы на окна купить в москве .

рулонные. шторы. +на. пластиковые. окна. купить. rulonnye-shtory-s-elektroprivodom71.ru .

рулонные. шторы. +на. пластиковые. окна. купить. rulonnye-shtory-s-upravleniem.ru .

аудит продвижения сайта аудит продвижения сайта .

автоматическое открывание штор shtory-umnye.ru .

seo network internet-prodvizhenie-moskva2.ru .

оптимизация сайта франция internet-prodvizhenie-moskva4.ru .

как продвигать сайт статьи seo-blog2.ru .

электрические жалюзи с дистанционным управлением купить zhalyuzi-elektricheskie.ru .

карниз с приводом для штор kupite-elektrokarniz.ru .

автоматическая рулонная штора shtory-s-elektroprivodom-rulonnye.ru .

seo статьи seo-blog3.ru .

digital маркетинг блог digital маркетинг блог .

Unm Pharm: Unm Pharm – Unm Pharm

http://umassindiapharm.com/# Umass India Pharm

https://umassindiapharm.com/# top 10 pharmacies in india

Unm Pharm: Unm Pharm – best online pharmacies in mexico

шторы автоматические rulonnye-zhalyuzi-avtomaticheskie1.ru .

электрокарнизы для штор цена электрокарнизы для штор цена .

рулонные шторы с электроприводом на пластиковые окна rulonnye-shtory-s-upravleniem.ru .

частный seo оптимизатор internet-prodvizhenie-moskva3.ru .

глубокий комплексный аудит сайта internet-prodvizhenie-moskva2.ru .

статьи про продвижение сайтов seo-blog2.ru .

рулонные шторы для панорамных окон rulonnye-shtory-s-elektroprivodom71.ru .

seo аудит веб сайта seo аудит веб сайта .

умные рулонные шторы умные рулонные шторы .

статьи про digital маркетинг статьи про digital маркетинг .

локальное seo блог seo-blog3.ru .

автоматические жалюзи заказать автоматические жалюзи заказать .

электронный карниз для штор электронный карниз для штор .

рольшторы на окна купить в москве рольшторы на окна купить в москве .

Unm Pharm: Unm Pharm – Unm Pharm

Ако тражиш поуздан и једноставан начин да приступиш својим омиљеним онлајн казино играма, обавезно пробај https://wincraftcasino-hu.net/sr/ . Ова страница ти омогућава брз и сигуран пријавни процес, са интуитивним интерфејсом који је погодан како за почетнике, тако и за искусне играче. Након пријаве имаш приступ широком спектру казино игара, укључујући модерне слотове, стоне игре и опције уживо. Са модерним безбедносним функцијама и заштићеним приступом твом налогу.

автоматические рулонные шторы на окна автоматические рулонные шторы на окна .

электрокранизы elektrokarnizy4.ru .

https://unmpharm.com/# safe place to buy semaglutide online mexico

Unm Pharm Unm Pharm Unm Pharm

автоматические рулонные шторы на окна автоматические рулонные шторы на окна .

продвижение сайтов в москве продвижение сайтов в москве .

продвижение сайтов во франции internet-prodvizhenie-moskva2.ru .

сделать аудит сайта цена internet-prodvizhenie-moskva4.ru .

блог агентства интернет-маркетинга seo-blog2.ru .

рулонные шторы жалюзи на окна рулонные шторы жалюзи на окна .

Umass India Pharm: Umass India Pharm – india pharmacy mail order

электрический привод штор shtory-umnye.ru .

seo и реклама блог seo-blog4.ru .

оптимизация сайта блог seo-blog3.ru .

рулонные шторы это rulonnye-zhalyuzi-avtomaticheskie1.ru .

электрокарниз двухрядный цена elektrokarnizy4.ru .

жалюзи автоматические купить жалюзи автоматические купить .

автоматический карниз для штор kupite-elektrokarniz.ru .

установить рулонные шторы цена shtory-s-elektroprivodom-rulonnye.ru .

top 10 online pharmacy in india: п»їlegitimate online pharmacies india – Umass India Pharm

электропривод рулонных штор rulonnye-shtory-s-upravleniem.ru .

поисковое seo в москве internet-prodvizhenie-moskva3.ru .

раскрутка сайта франция internet-prodvizhenie-moskva2.ru .

seo агентство internet-prodvizhenie-moskva4.ru .

оптимизация сайта блог seo-blog2.ru .

ролет штора ролет штора .

https://nyupharm.com/# safe canadian pharmacy

https://unmpharm.xyz/# mexican pharmacy for americans

ed drugs online from canada: canadian pharmacy service – canadian pharmacies online

умные рулонные шторы умные рулонные шторы .

локальное seo блог seo-blog4.ru .

маркетинговые стратегии статьи seo-blog3.ru .

canadian pharmacy world canadian world pharmacy canadian pharmacy prices

автоматические жалюзи заказать автоматические жалюзи заказать .

электрические карнизы для штор в москве kupite-elektrokarniz.ru .

установить рулонные шторы цена shtory-s-elektroprivodom-rulonnye.ru .

buy cialis from mexico: Unm Pharm – Unm Pharm

https://nyupharm.xyz/# canadian pharmacy meds

canada pharmacy online: canadian pharmacy no scripts – canadian pharmacy online ship to usa

автоматические карнизы автоматические карнизы .

legitimate canadian pharmacy online: Nyu Pharm – safe online pharmacies in canada

certified canadian international pharmacy Nyu Pharm online pharmacy canada

https://unmpharm.com/# safe place to buy semaglutide online mexico

Umass India Pharm: Umass India Pharm – Umass India Pharm

Ако желиш да уживаш у узбудљивим онлајн казино играма са једноставним приступом и поузданом платформом, обавезно посетите . Овде те чека богат избор слотова, стоних игара и https://win-craft-casino.org/sr/ дилера који доносе аутентично казино искуство директно на твој екран. Сајт је дизајниран да буде интуитиван и прилагођен свим нивоима играча , уз брзе и сигурне трансакције. Савремени системи заштите гарантују да су твоји подаци и новчана средства безбедни.

http://umassindiapharm.com/# Umass India Pharm

электрокарниз купить электрокарниз купить .

canadian pharmacy meds: Nyu Pharm – canadian pharmacy price checker

https://unmpharm.com/# Unm Pharm

карниз электроприводом штор купить avtomaticheskij-karniz.ru .

Umass India Pharm: Umass India Pharm – Umass India Pharm

viagra pills from mexico online mexico pharmacy USA Unm Pharm

reputable indian pharmacies: indian pharmacy online – Umass India Pharm

http://nyupharm.com/# recommended canadian pharmacies

карниз для штор электрический карниз для штор электрический .

best online pharmacy india: Umass India Pharm – Umass India Pharm

https://umassindiapharm.com/# top 10 pharmacies in india

safe canadian pharmacy canadianpharmacymeds online canadian pharmacy reviews

купить кухню на заказ спб kuhni-na-zakaz-2.ru .

кухни на заказ спб каталог kuhni-na-zakaz-4ru .

кухни на заказ в спб недорого кухни на заказ в спб недорого .

кухни на заказ питер kuhni-na-zakaz-3.ru .

кухни на заказ питер kuhni-spb-17.ru .

мебель для кухни спб от производителя kuhni-spb-18.ru .

кухни на заказ в спб цены кухни на заказ в спб цены .

купить кухню на заказ спб kuhni-spb-19.ru .

canadian pharmacy uk delivery: pharmacy com canada – canada pharmacy reviews

Написание внешних обработок для 1С (COM-соединение). Загрузка данных из Excel программист 1с, массовые операции, специализированные отчеты без изменения конфигурации

http://nyupharm.com/# canada pharmacy 24h

кухня на заказ спб от производителя недорого kuhni-na-zakaz-4ru .

кухни от производителя спб kuhni-na-zakaz-2.ru .

кухни на заказ в спб цены кухни на заказ в спб цены .

заказать кухню в спб по индивидуальному проекту kuhni-na-zakaz-5ru .

кухни на заказ в санкт-петербурге kuhni-spb-18.ru .

кухни на заказ производство спб kuhni-spb-17.ru .

большая кухня на заказ kuhni-na-zakaz-3.ru .

заказать кухню спб kuhni-spb-19.ru .

best canadian pharmacy: Nyu Pharm – canadian online drugs

If you want fast and secure access to your favorite online casino games, don’t miss https://wincraftlogin.org/en/ . This login portal offers a smooth and intuitive entry point for both new and experienced players, making it easy to jump straight into the action. With a clean interface and reliable performance, you can quickly log into your account and start enjoying a wide range of games — from exciting slot titles to immersive live dealer experiences. Enhanced security features protect your personal information and ensure safe gameplay.

Umass India Pharm: world pharmacy india – Online medicine order

https://nyupharm.xyz/# reputable canadian online pharmacy

п»їlegitimate online pharmacies india indian pharmacy Umass India Pharm

где заказать кухню в спб где заказать кухню в спб .

Howdy! Do you know if they make any plugins to help with Search Engine Optimization? I’m trying to get my blog to rank for some targeted keywords but I’m not seeing very good gains. If you know of any please share. Appreciate it!

http://www.eurosport-bcn.com/decouvrez-atlas-pro-ibo-fonctionnalites-et-avantages-de-lapp-iptv/

кухня на заказ kuhni-na-zakaz-2.ru .

кухни в спб на заказ kuhni-na-zakaz-5ru .

кухня на заказ спб kuhni-spb-18.ru .

мебель для кухни спб от производителя kuhni-spb-17.ru .

современные кухни на заказ в спб kuhni-spb-20.ru .

купить кухню купить кухню .

кухни на заказ спб кухни на заказ спб .

canadian valley pharmacy: adderall canadian pharmacy – trusted canadian pharmacy

кухня по индивидуальному заказу спб kuhni-na-zakaz-4ru .

услуга усиления проема usilenie-proemov5.ru .

вода в подвале gidroizolyacziya-podvala-iznutri-czena4.ru .

ремонт подвального помещения ремонт подвального помещения .

гидроизоляция цена за м2 гидроизоляция цена за м2 .

обмазочная гидроизоляция цена работы за м2 gidroizolyacziya-czena5.ru .

ремонт подвала ремонт подвала .

кухня глория kuhni-na-zakaz-2.ru .

https://nyupharm.com/# best online canadian pharmacy

https://umassindiapharm.com/# cheapest online pharmacy india

кухни на заказ производство спб kuhni-spb-17.ru .

кухни на заказ кухни на заказ .

кухни на заказ в спб недорого кухни на заказ в спб недорого .

кухня на заказ спб от производителя недорого кухня на заказ спб от производителя недорого .

online canadian pharmacy review: Nyu Pharm – canadian pharmacy com

заказать кухню спб kuhni-na-zakaz-3.ru .

Unm Pharm buy cheap meds from a mexican pharmacy Unm Pharm

кухни на заказ санкт петербург кухни на заказ санкт петербург .

Umass India Pharm: Umass India Pharm – Umass India Pharm

вертикальная гидроизоляция подвала вертикальная гидроизоляция подвала .

гидроизоляция подвала изнутри цена м2 gidroizolyacziya-podvala-iznutri-czena4.ru .

усиление проёмов металлоконструкциями usilenie-proemov5.ru .

сырость в подвале многоквартирного дома gidroizolyacziya-czena5.ru .

гидроизоляция цена за рулон гидроизоляция цена за рулон .

гидроизоляция цена работы за м2 gidroizolyacziya-czena5.ru .

https://unmpharm.com/# generic drugs mexican pharmacy

best canadian pharmacy to order from: canadian pharmacy 24 – canadian pharmacy 24h com safe

best online pharmacy india reputable indian online pharmacy Umass India Pharm

гидроизоляция подвала гидроизоляция подвала .

усиление проёмов композитными материалами usilenie-proemov5.ru .

подвал дома ремонт gidroizolyacziya-podvala-iznutri-czena4.ru .

гидроизоляция цена за работу гидроизоляция цена за работу .

гидроизоляция цена гидроизоляция цена .

гидроизоляция подвала изнутри цена гидроизоляция подвала изнутри цена .

https://unmpharm.xyz/# Unm Pharm

https://unmpharm.com/# mexico drug stores pharmacies

real mexican pharmacy USA shipping: Unm Pharm – buy antibiotics over the counter in mexico

Unm Pharm cheap cialis mexico Unm Pharm

устранение протечек в подвале gidroizolyacziya-podvala-iznutri-czena5.ru .

усиление проёмов под панорамные окна usilenie-proemov5.ru .

сырость в подвале многоквартирного дома gidroizolyacziya-podvala-iznutri-czena4.ru .

гидроизоляция подвала цена гидроизоляция подвала цена .

http://unmpharm.com/# cheap mexican pharmacy

усиление проема москва усиление проема москва .

обмазочная гидроизоляция цена работы обмазочная гидроизоляция цена работы .

гидроизоляция подвала под ключ gidroizolyacziya-czena5.ru .

real canadian pharmacy: Nyu Pharm – reliable canadian pharmacy reviews

Umass India Pharm online pharmacy india Umass India Pharm

http://umassindiapharm.com/# Umass India Pharm

усиление проема усиление проема .

canadian pharmacy no scripts: online canadian pharmacy – canadian discount pharmacy

Unm Pharm Unm Pharm legit mexican pharmacy without prescription

http://unmpharm.com/# mexican border pharmacies shipping to usa

http://unmpharm.com/# Unm Pharm

ремонт бетонных конструкций договор remont-betonnykh-konstrukczij-usilenie2.ru .

гидроизоляция подвала инъекционная гидроизоляция подвала инъекционная .

инъекционная гидроизоляция оборудование инъекционная гидроизоляция оборудование .

нарколог на дом нарколог на дом .

клиника наркологии клиника наркологии .

инъекционная гидроизоляция густота состава inekczionnaya-gidroizolyacziya5.ru .

выездной специалист нарколог narkolog-na-dom-3.ru .

материалы усиления проема usilenie-proemov6.ru .

Umass India Pharm: Umass India Pharm – top 10 online pharmacy in india

canadian pharmacy store reputable canadian pharmacy pharmacy rx world canada

ремонт бетонных конструкций гарантия remont-betonnykh-konstrukczij-usilenie2.ru .

инъекционная гидроизоляция фундамента инъекционная гидроизоляция фундамента .

дешёвый нарколог на дом narkolog-na-dom-4.ru .

https://nyupharm.com/# canadian online pharmacy

гидроизоляция подвала самара гидроизоляция подвала самара .

вывод из запоя клиника вывод из запоя клиника .

полиуретановая инъекционная гидроизоляция inekczionnaya-gidroizolyacziya5.ru .

стоимость усиления проема стоимость усиления проема .

стоимость нарколога на дому narkolog-na-dom-3.ru .

стоимость инъекционной гидроизоляции inekczionnaya-gidroizolyacziya4.ru .

ремонт бетонных конструкций ремонт бетонных конструкций .

buy antibiotics over the counter in mexico: modafinil mexico online – gabapentin mexican pharmacy

психолог нарколог психолог нарколог .

buy neurontin in mexico buy viagra from mexican pharmacy isotretinoin from mexico

гидроизоляция подвала влажность gidroizolyacziya-podvala-samara2.ru .

услуги нарколога на дом услуги нарколога на дом .

https://nyupharm.xyz/# canadian pharmacy 24h com

инъекционная гидроизоляция стен инъекционная гидроизоляция стен .

http://unmpharm.com/# mexico drug stores pharmacies

наркологическая служба на дом наркологическая служба на дом .

ремонт бетонных конструкций фундамент remont-betonnykh-konstrukczij-usilenie2.ru .

инъекционная гидроизоляция москва инъекционная гидроизоляция москва .

canadian mail order pharmacy: Nyu Pharm – canadian pharmacy ed medications

гидроизоляция подвала стоимость гидроизоляция подвала стоимость .

зашиваться от алкоголя narkologicheskaya-klinika-48.ru .

нарколог срочно на дом нарколог срочно на дом .

Unm Pharm trusted mexican pharmacy Unm Pharm

https://umassindiapharm.xyz/# indian pharmacy paypal

инъекционная гидроизоляция обзор методов inekczionnaya-gidroizolyacziya5.ru .

наркологическая терапия на дому narkolog-na-dom-3.ru .

перевод деловой переписки профессионально dzen.ru/a/aUF9L-xpMETlRIxo .

перевод с испанского dzen.ru/a/aUWp3zsYcxGIPJhQ .

выведение из запоя дешево vyvod-iz-zapoya-4.ru .

срочный вывод из запоя москва vyvod-iz-zapoya-5.ru .

перевод с английского перевод и право dzen.ru/a/aUBBvahMInGNj8BL .

Срочный перевод договора с русского на английский telegra.ph/Srochnyj-perevod-dogovora-kak-ulozhitsya-v-24-chasa-bez-poteri-kachestva-12-15 .

http://nyupharm.com/# legit canadian online pharmacy

best india pharmacy Umass India Pharm indian pharmacy

https://nyupharm.com/# canadian pharmacy mall

вывод из запоя цены москва вывод из запоя цены москва .

нарколог на дом вывод из запоя москва нарколог на дом вывод из запоя москва .

Umass India Pharm: Umass India Pharm – Umass India Pharm

canada discount pharmacy canada pharmacy reviews canada drugs online review

п»їJust now, I stumbled upon an informative page regarding Indian Pharmacy exports. The site discusses how to save money when buying antibiotics. In case you need reliable shipping to USA, check this out: п»їп»їclick here. Might be useful.

п»їRecently, I found a great article regarding safe pharmacy shipping. It details the safety protocols for ED medication. For those interested in affordable options, visit this link: п»їhttps://polkcity.us.com/# mexican pharmacies that ship. Might be useful.

вывести из запоя цена москва vyvod-iz-zapoya-4.ru .

вывод из запоя недорого москва вывод из запоя недорого москва .

п»їRecently, I stumbled upon a great page regarding buying affordable antibiotics. It explains CDSCO regulations for ED medication. If you are looking for Trusted Indian sources, go here: п»їhttps://kisawyer.us.com/# india pharmacy. Might be useful.

Just wanted to share, a detailed analysis on FDA equivalent standards. It explains the best shipping methods for ED meds. Link: п»їhttps://polkcity.us.com/# pharmacy delivery.

п»їLately, I came across an interesting page about buying affordable antibiotics. It explains WHO-GMP protocols when buying antibiotics. If anyone wants cheaper alternatives, visit this link: п»їkisawyer.us.com. Cheers.

Has anybody tried safe Mexican pharmacies. I discovered a cool site that compares affordable options: п»їmore info. Seems useful..

п»їJust now, I stumbled upon an interesting resource regarding cheap Indian generics. It details WHO-GMP protocols for generic meds. If anyone wants cheaper alternatives, read this: п»їkisawyer.us.com. Worth a read.

вывод из запоя на дому в москве вывод из запоя на дому в москве .

п»їActually, I stumbled upon an interesting page concerning generic pills from India. It covers WHO-GMP protocols for ED medication. For those interested in factory prices, read this: п»їkisawyer.us.com. It helped me.

вывод из запоя в стационаре москва vyvod-iz-zapoya-5.ru .

п»їRecently, I came across a great guide about buying affordable antibiotics. It covers FDA equivalents when buying antibiotics. If anyone wants reliable shipping to USA, visit this link: п»їUpstate Medical. Might be useful.

п»їRecently, I found a helpful page regarding generic pills from India. It details WHO-GMP protocols when buying antibiotics. For those interested in cheaper alternatives, take a look: п»їsource. It helped me.

перевод на французский язык москва teletype.in/@alexd78/NZfh6vi0oTl .

переводчики устный перевод teletype.in/@alexd78/bAaorQAhWLU .

раскрутка сайта по трафику prodvizhenie-sajtov-po-trafiku1.ru .

перевод инструкций по эксплуатации медоборудования teletype.in/@alexd78/jIFmn5Kf9xl .

продвижение по трафику сео prodvizhenie-sajtov-po-trafiku2.ru .

поисковое продвижение инфо сайта увеличить трафик специалисты prodvizhenie-sajtov-po-trafiku.ru .

ахревс seo-kejsy1.ru .

раскрутка и продвижение сайта раскрутка и продвижение сайта .

кп по продвижению сайта seo-kejsy2.ru .

получить короткую ссылку google seo-kejsy.ru .

синхронный перевод на английском telegra.ph/Trebovaniya-k-sinhronnomu-perevodchiku-navyki-sertifikaty-opyt–i-pochemu-ehto-vazhno-12-16 .

Stop overpaying and save cash on meds, I suggest checking this report. The site explains where to buy cheap. Good deals at this link: п»їpolkcity.us.com.

Sharing, an important guide on buying meds safely. It explains quality control for generics. Source: п»їhttps://polkcity.us.com/# mexico pet pharmacy.

п»їJust now, I stumbled upon a helpful resource about buying affordable antibiotics. It explains WHO-GMP protocols when buying antibiotics. If anyone wants factory prices, visit this link: п»їweb page. Worth a read.

раскрутка сайта по трафику prodvizhenie-sajtov-po-trafiku1.ru .

заказать анализ сайта prodvizhenie-sajtov-v-moskve1.ru .

интернет партнер интернет партнер .

seo клиники наркологии seo клиники наркологии .

раскрутка сайта по трафику prodvizhenie-sajtov-po-trafiku.ru .

сео центр seo-kejsy1.ru .

оптимизация и продвижение сайтов москва prodvizhenie-sajtov-v-moskve3.ru .

частный seo оптимизатор частный seo оптимизатор .

зеленая энергия https://www.dobrenok.com/economy/solnechnaya-energiya-chistyj-istochnik-sveta-i-elektrichestva.html .

internet seo prodvizhenie-sajtov-v-moskve2.ru .

google посещаемость сайта seo-kejsy.ru .

Sharing, a detailed guide on FDA equivalent standards. It explains quality control for ED meds. Source: п»їhttps://polkcity.us.com/# mexican online pharmacy wegovy.