To make a startup successful a mix of ingredients is necessary. Two of the most important components are talent and capital. In contrast to Silicon Valley, where both largely concentrate in the same place, Europe has to wonder if it can bring both together in one location.

With the Startup Heatmap Europe Survey we have shown some of the hotbeds of entrepreneurial activity around Europe. While the high mobility of Europe’s founders shows a number of personal connections between these hubs are building, it does not necessarily mean that capital follows this trend (just yet).

To look closer at these trends, we worked with Pitchbook to analyze the cross-border activities of venture capital investors in Europe. We found that 73% of all investments came from domestic investors. When deducting the impact of non-European investors, on average, European investors make roughly 17% of their deals in other European countries.

To compare the spatial distribution of investor activities and startup mobility, we went on to examine two main questions:

-

Are founders moving where there is the highest investor activity?

- What do founders say about how important capital is for their location choice?

- Compare ranking of founders and investment activities

-

Is foreign capital following talent flows?

- Are the big players investing in regional champions?

- Are investors from the periphery investing in big hubs?

To understand if founders follow capital, we first of all asked them: Strikingly, only 58% consider access to capital a very important factor when deciding where to startup. In our sample, we find that 14% of founders say they access to capital is not important at all (www.startupheatmap.eu/download-report). This places Access to Capital in third position behind Access to Talent (77%) and Ease/Cost of Doing Business (62%).

With this ambiguity, we need to go a step further and compare whether founders are actually more likely to choose locations with higher investor activities. Therefore, we ranked the 10 cities that have the most investment deals within the last 3 years according to Pitchbook and compare those to founders’ choices:

Interestingly, the top 10 cities with the greatest investor activity looks fairly different from the top 10 cities chosen by founders. From the investor data, it is clear that Helsinki is a top hub for investments, but founders still do not vote it into the top 10. On the contrary, Barcelona is strong on talent, but less favored by investors. Most strikingly, cities like Cambridge, Edinburgh and Moscow do not figure on the radar of founders at all in our survey. There may be a diverse set of reasons for this, but it shows that the presence of capital does not necessarily bring talent. Additionally, when looking at the perception of founders on the availability of capital in each of the respective cities differs can differ drastically from the impression we have from the actual investments. This suggests that founders either do not know the actual situation well, or they know more than this ranking implies.

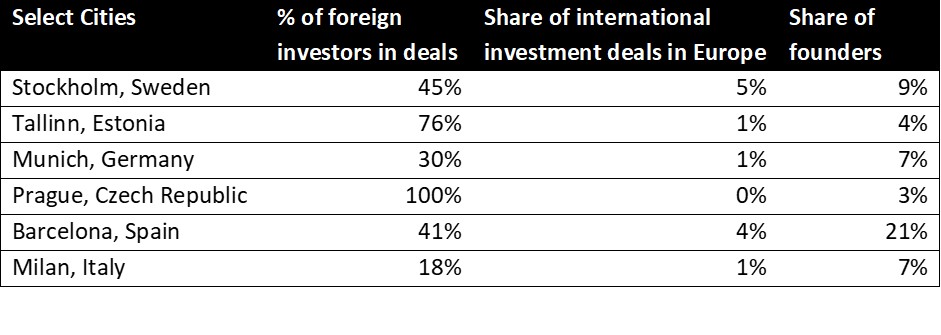

The second question we examined was whether capital is following talent flows to capture the most promising startups all around Europe. For this, we look at a select group of emerging regional champions in the battle for startup talent and check what extent their startups are able to attract foreign investment. We also examine the cross border total investments, and check to see how big of a share these cities capture this “mobile” capital.

According to our survey results, in the Nordics and Baltics Stockholm captures 22% of regional founders’ attention and Tallinn grabs 15%. Western Europe finds Munich with 17% of the regional cohort and in the CEE, Prague garners 23%. In the South, Barcelona reaches 35%, and Milan follows with 30%.

According to our survey results, in the Nordics and Baltics Stockholm captures 22% of regional founders’ attention and Tallinn grabs 15%. Western Europe finds Munich with 17% of the regional cohort and in the CEE, Prague garners 23%. In the South, Barcelona reaches 35%, and Milan follows with 30%.

What we can see is that foreign capital plays an important role in all ecosystems (importantly – more than a third of London deals are foreign), but hubs with high regional concentrations of founders do not capture international capital to an extent as the popularity with founders would suggest. Barcelona shows the largest discrepancy with 21% of founders imagining to startup there, but only 4% of international investment deals happening there.

Stockholm attracts 9% of founders, but only 5 % of international investments.

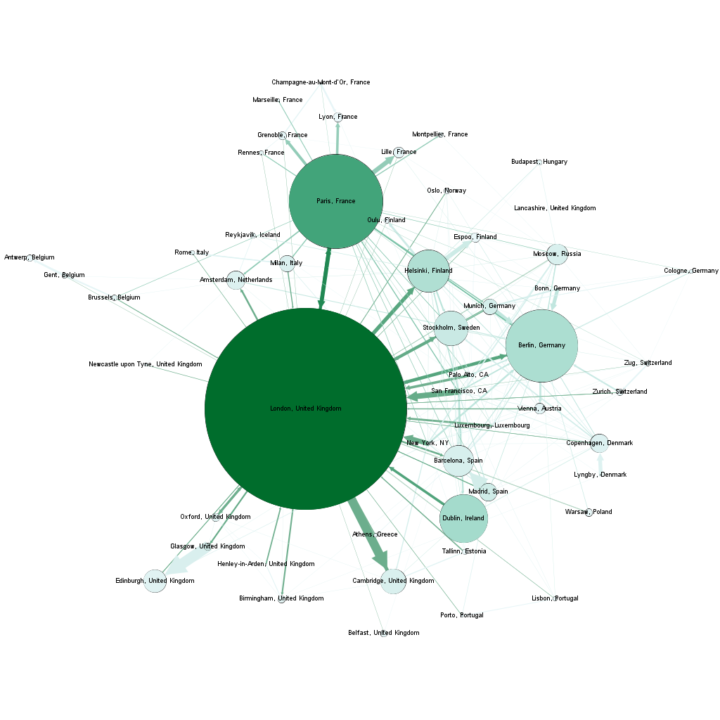

When looking at which cities benefit the most from international capital flows, we sort the list by the magnitude of international investments found in each city.

This list indicates that capital follows capital, and not talent. The US, the UK and Germany are responsible for over 50% of all international investments in Europe and they mostly stay within existing high capital markets. Investors from the periphery also tend to follow these trends: The countries that export the most of their capital are Luxembourg (94%), Czech Republic (73%), Austria (67%), Estonia (56%). The majority of these countries do most of their foreign deals in the UK.

This list indicates that capital follows capital, and not talent. The US, the UK and Germany are responsible for over 50% of all international investments in Europe and they mostly stay within existing high capital markets. Investors from the periphery also tend to follow these trends: The countries that export the most of their capital are Luxembourg (94%), Czech Republic (73%), Austria (67%), Estonia (56%). The majority of these countries do most of their foreign deals in the UK.

While some might argue that concentration is necessary and if capital availability is limited to few hubs, competition for it will increase and only the best startups will receive it. However, our findings suggest otherwise: Entrepreneurial talent is not moving to where the capital is, but is dispersed around the continent for a number of reasons. But early stage venture capital remains largely local or at least within its comfort zone. By not sourcing on a large scale, European venture capital firms miss out on opportunities and create an unnecessary shortage of supply of promising startups for themselves. While, in Europe’s periphery founders are turning away from VCs, betting on organic but slow growth paths. Overall this boils down to a simple conclusion: Europe has less unicorns than it could have.

Dear Mr. Koesters;

I applaud your analytically driven effort. I would add some insights I gleaned from a pro bono research study I conducted for the Joint Venture Silicon Valley in 2000. click here for a copy https://jointventure.org/publications/joint-venture-publications/307-internet-cluster-analysis

We found that several elements were required to be present to support the effective construct of an internet cluster (ecosystem) such as that in Silicon Valley and several other regions of the world. The presence of capital was and is certainly (from our findings necessary; however, not sufficient. As you point out, access to talent is also critical, but not just technical talent, but entrepreneurial talent, or one might even call it entrepreneurial “willingness”. Which brings me to the point that I hope might be helpful:

Entrepreneurial “willingness” is not only present in the technical aspirations of disrupters, but maybe even more important in the ability and “willingness” of companies with market gravitas (both capitalization, but also market position) to assist/drive the nurturing, growth and financial liquidity of willing entrepreneurs. And, just to be sure…conventional incubators are not sufficient either. What is necessary, and unfortunately missing in many regions are what we call “pillar companies. As such, the Cisco example is paramount. Cisco realized early that growth was only possible through disruption, and that disruption was only possible through spinning off key talent, and bringing them back into the fold through acquisition. Many others such as Hewlett Packard, Microsoft (in the Washington cluster), Oracle, Intel have also found that along with Cisco that spinoffs also created entrepreneurial dynamics of there own. One dynamic is that of the “successful entrepreneur” who may go to IPO or open market sale of his/her company. The other, far more frequent is the “first/second/third… failure entrepreneur” who must be brought back into a “safe” pillar environment to ‘recharge’. The Pillar company is invaluable in this sense, and Silicon Valley, and other successful clusters are full of examples of this kind of behavior in support of entrepreneurial “willingness”.

This brings me around to my observations with respect to Europe, and maybe even Germany in specific. And it is simply this, you are quite right in your observations about the insufficiency of capital alone to nurture entrepreneurial activity. But where are the pillars in this? Is the “deutsche Mittelstand” even capable of playing this role, given private capitalization predominates, and technical “Fortschritt” is critical to survival…Who will spin out critical talent? And, who will nurture those willing to walk the difficult road as entrepreneurs when they fail (3, 4, and 5 times before they might succeed)?

I think that working this angle will be critical to accelerating European/German entrepreneurial speed.

Regards

B