In our 2017 survey, we asked 320 startups CEOs why they decided to set up their businesses in a certain location and what are their preferred ingredients for a successful startup city. Here, I analyze their results alongside additional macroeconomic factors, to examine if they may play a role in the location choice. Is there a correlation between GDP, unemployment rate, economic freedom in a country and how attractive these locations are for startups?

In order to answer to this question, we looked at the net migration flows between countries, the difference between the amount of startups that moved to a country from abroad and those that have left. In some countries such as the UK, Finland, Germany, Portugal, and Denmark, this figure is positive: the number of startups that have decided to move there is greater than those that have left. In other countries, including, Belgium, the Netherlands and Sweden the two flows balance one another, so we do not observe a net surplus or a deficit. Alternatively, in our survey we find France, Italy and Spain experiencing negative net flows. In these cases, more startups have left these countries than have been replenished.

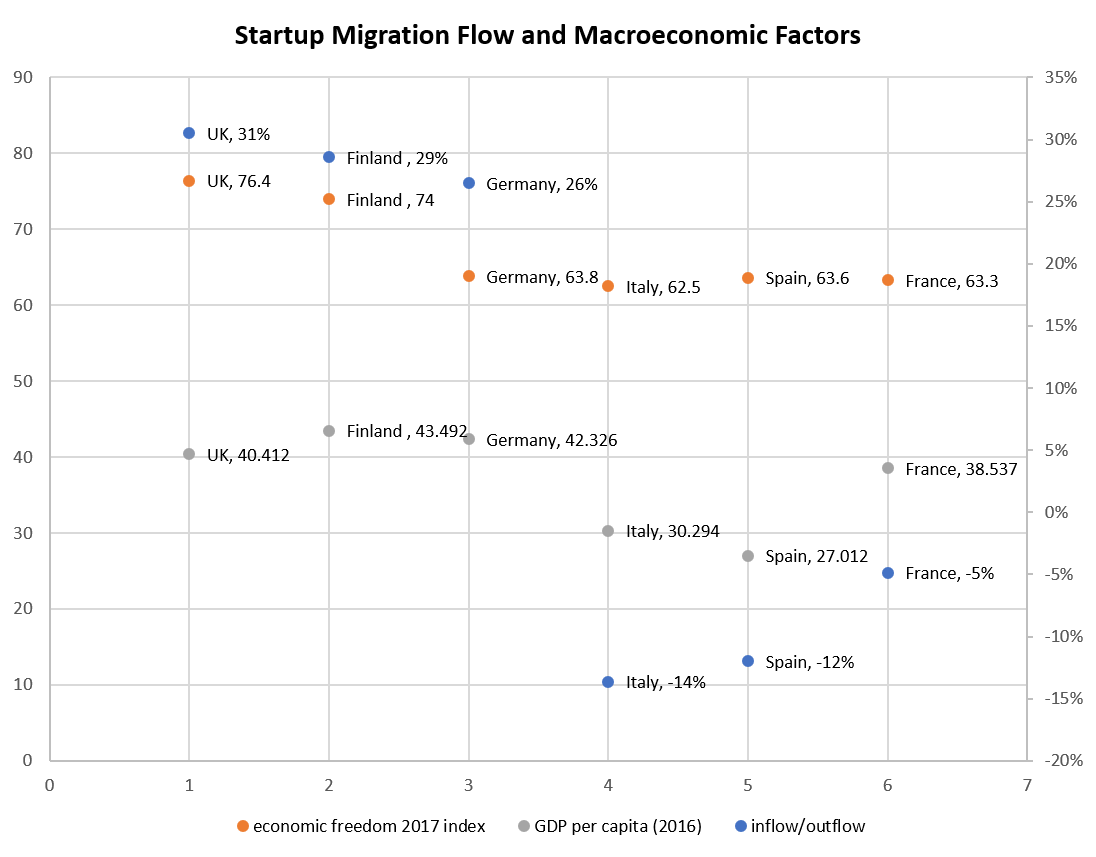

In the graph below, we visualize the correlation between the net flows and two important economic drivers: economic freedom and GDP per capita. The first measure, economic freedom, is comprised of an index based on 12 quantitative and qualitative factors grouped in four broad categories: rule of law, government size, regulatory efficiency and open markets (click here for more information on this index). The GDP data refer to 2016 (Eurostat).

As we can observe, there is a correlation between the attractiveness of these countries for startups and the economic freedom index and a weaker, but still consistent, correlation with GDP per capita. For example the UK, that has experienced the highest surplus with a 31% net inflow, ranks also first in Economic Freedom (76.4) and it has one of the highest GDP per capita (40,412€). Alternatively, Italy, that in 2017 has witnessed the lowest negative flow among the countries selected (-14%), has also the lowest economic freedom score (62.5) and one of the lowest GDP per capita (30,294€), only higher than Spain. While these correlations have limited explanatory power, they indicate a relationship between the country’s economic strength and openness and its attraction for startups.

Other macroeconomic factors analyzed were the 2017 unemployment rate and the GDP growth rate calculated over the time span 2006 — 2016 (source: Eurostat). The net flows and these variables experience a weaker correlation, in comparison to the previous measures tested. For example, Finland, has a quite high unemployment rate of 8.8% (higher than the EU-28 average of 7.7%) and a low GDP growth of 0.1, even lower than the 0.3 of Spain. However, it has been able to sustain a 29% inflow of startups, second only to the UK. These relationships indicate that multiple economic factors may contribute towards how founders evaluate opportunities to startup around Europe.

Does this mean that European CEOs look at the economic freedom index or GDP per capita data before choosing their startup location? Not likely, however these correlations present an interesting finding and suggest avenues for further investigation.

Hello, unfortunately the link to the 2017 survey is not working anymore. Could you please share a new one? I couldn’t find it using google. Thank you so much, this article is very interesting

Buy OnlyFans Accounts

Buy Hacked OnlyFans

OnlyFans Accounts W Balance

Cracked OnlyFans Accounts

OnlyFans Accounts With Balance – https://urbancrocspot.org/product-tag/only-fans-account/

OnlyFans Accounts With Balance

OnlyFans Account With Balance

Buy OnlyFans Accounts

Buy OnlyFans Accounts – https://urbancrocspot.org/product-tag/only-fans-account/

OnlyFans Accounts For Sale

OnlyFans Account Seller

OnlyFans Account With Balance

OnlyFans Account With Balance

Buy OnlyFans Accounts – https://urbancrocspot.org/product-tag/only-fans-account/

Buy OnlyFans Accounts – https://urbancrocspot.org/accounts/

OnlyFans Accounts W Balance – https://urbancrocspot.org/product-tag/only-fans-account/

Buy OnlyFans Creator Account – https://urbancrocspot.org/accounts/

OF Accounts With Balance

OF Accounts With Balance

Buy OnlyFans Creator Account

Buy Hacked OnlyFans

Buy OnlyFans Accounts

Buy OnlyFans Creator Account – https://urbancrocspot.org/accounts/

Cracked OnlyFans Accounts – https://urbancrocspot.org/accounts/

Buy OnlyFans Creator Account

Cracked OnlyFans Accounts

Buy OnlyFans Accounts – https://urbancrocspot.org/accounts/

Cracked OnlyFans Accounts

OF Accounts With Balance – https://urbancrocspot.org/product-tag/only-fans-account/

OnlyFans Accounts With Balance – https://urbancrocspot.org/product-tag/only-fans-account/

Cracked OnlyFans Accounts – https://urbancrocspot.org/accounts/

Buy Hacked OnlyFans

OnlyFans Account Seller – https://urbancrocspot.org/product-tag/only-fans-account/

OnlyFans Accounts For Sale

OF Creator Account Fully Verified

OnlyFans Account Seller – https://urbancrocspot.org/product-tag/only-fans-account/

OnlyFans Account With Balance – https://urbancrocspot.org/product-tag/only-fans-account/

OnlyFans Account Seller – https://urbancrocspot.org/product-tag/only-fans-account/

Buy OnlyFans Accounts – https://urbancrocspot.org/accounts/

Buy Hacked OnlyFans

Buy Hacked OnlyFans – https://urbancrocspot.org/product-tag/only-fans-account/

OF Accounts With Balance – https://urbancrocspot.org/product-tag/only-fans-account/

Buy OnlyFans Accounts

OnlyFans Account Seller

Buy OnlyFans Accounts – https://urbancrocspot.org/product-tag/only-fans-account/

OF Accounts With Balance

OnlyFans Accounts For Sale

OnlyFans Account With Balance – https://urbancrocspot.org/product-tag/only-fans-account/

Buy Hacked OnlyFans – https://urbancrocspot.org/product-tag/only-fans-account/

Buy OnlyFans Accounts – https://urbancrocspot.org/product-tag/only-fans-account/

Cracked OnlyFans Accounts

OnlyFans Accounts W Balance – https://urbancrocspot.org/product-tag/only-fans-account/

OnlyFans Account Seller

Buy OnlyFans Accounts

Buy Hacked OnlyFans – https://urbancrocspot.org/product-tag/only-fans-account/

OnlyFans Account With Balance – https://urbancrocspot.org/product-tag/only-fans-account/

Buy OnlyFans Accounts

OnlyFans Account With Balance – https://urbancrocspot.org/product-tag/only-fans-account/

OnlyFans Accounts W Balance

Cracked OnlyFans Accounts

OnlyFans Accounts With Balance

OnlyFans Accounts W Balance – https://urbancrocspot.org/product-tag/only-fans-account/

OnlyFans Account Seller – https://urbancrocspot.org/product-tag/only-fans-account/

Buy OnlyFans Accounts – https://urbancrocspot.org/accounts/

OnlyFans Accounts With Balance

Buy OnlyFans Accounts

OF Creator Account Fully Verified

OnlyFans Account With Balance – https://urbancrocspot.org/product-tag/only-fans-account/

Buy OnlyFans Accounts – https://urbancrocspot.org/product-tag/only-fans-account/

Buy Hacked OnlyFans – https://urbancrocspot.org/product-tag/only-fans-account/

OF Creator Account Fully Verified

OnlyFans Accounts W Balance

Buy OnlyFans Accounts – https://urbancrocspot.org/product-tag/only-fans-account/

Buy OnlyFans Accounts

Buy OnlyFans Accounts

Buy OnlyFans Creator Account

OF Accounts With Balance – https://urbancrocspot.org/product-tag/only-fans-account/

Buy OnlyFans Accounts

Buy Hacked OnlyFans

OnlyFans Accounts W Balance

OnlyFans Accounts W Balance – https://urbancrocspot.org/product-tag/only-fans-account/

OnlyFans Accounts With Balance

Cracked OnlyFans Accounts

Buy Hacked OnlyFans – https://urbancrocspot.org/product-tag/only-fans-account/

OnlyFans Accounts With Balance – https://urbancrocspot.org/product-tag/only-fans-account/

Buy OnlyFans Accounts

OnlyFans Account With Balance – https://urbancrocspot.org/product-tag/only-fans-account/

Buy Hacked OnlyFans – https://urbancrocspot.org/product-tag/only-fans-account/

Buy Hacked OnlyFans

OnlyFans Account With Balance

Buy OnlyFans Creator Account

Cracked OnlyFans Accounts

Cracked OnlyFans Accounts

OnlyFans Account Seller

OF Creator Account Fully Verified

OnlyFans Accounts For Sale – https://urbancrocspot.org/accounts/

Cracked OnlyFans Accounts – https://urbancrocspot.org/accounts/

Buy Hacked OnlyFans – https://urbancrocspot.org/product-tag/only-fans-account/

OF Accounts With Balance – https://urbancrocspot.org/product-tag/only-fans-account/

OnlyFans Accounts For Sale – https://urbancrocspot.org/accounts/

OnlyFans Account Seller

OF Accounts With Balance – https://urbancrocspot.org/product-tag/only-fans-account/

OnlyFans Accounts W Balance – https://urbancrocspot.org/product-tag/only-fans-account/

Buy OnlyFans Creator Account

OF Accounts With Balance

OnlyFans Accounts For Sale – https://urbancrocspot.org/accounts/

Buy OnlyFans Creator Account

Buy OnlyFans Creator Account

Buy Hacked OnlyFans – https://urbancrocspot.org/product-tag/only-fans-account/

Cracked OnlyFans Accounts – https://urbancrocspot.org/accounts/

OnlyFans Accounts W Balance – https://urbancrocspot.org/product-tag/only-fans-account/

OnlyFans Accounts For Sale

Cracked OnlyFans Accounts

Buy OnlyFans Accounts – https://urbancrocspot.org/accounts/

Cracked OnlyFans Accounts – https://urbancrocspot.org/accounts/

Cracked OnlyFans Accounts – https://urbancrocspot.org/accounts/

Buy OnlyFans Accounts – https://urbancrocspot.org/accounts/

OnlyFans Accounts With Balance

OnlyFans Accounts W Balance – https://urbancrocspot.org/product-tag/only-fans-account/

OnlyFans Accounts W Balance

OF Accounts With Balance

Buy OnlyFans Accounts – https://urbancrocspot.org/accounts/

Buy OnlyFans Creator Account – https://urbancrocspot.org/accounts/

OF Accounts With Balance – https://urbancrocspot.org/product-tag/only-fans-account/

Semaj Media FANSLY Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Amira X Evans Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Kim Velez Oficial Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

LotusBombb Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Love Bug Chanel Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Jojo Uncut Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Fire Violet Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Sasha Stallion Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Jolene Canada Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

SheSoThixk Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Lovely Adriana Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Delly The Dream Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Delly The Dream Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Juliana x Ferrara Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Chrissy K Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Aurorita Marie Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Lee_ Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Shiroktsne FANSLY Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Gabrielle The Goddesss Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Semaj Media FANSLY Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Professor Gaia Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Mara Santiago Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Wavy Ting Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

The Nudes Bank FANSLY Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Arabelle Raphael Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Livv A Little Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Brunette Dulce Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Gabrielle The Goddesss Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Lee Lee Zilla Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Anita Isabella Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Red Rose La Cubana Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Caramel Kitten Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Miaa Diorr Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

iWant Judyyy Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Brown Bodii Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Korina Kova Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Defiant Panda Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Amarachiayoki – Amarachi Agate Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Envy Kells x Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

The Real Britt Fitt Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Nadia Palik Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Voulez J Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Gabriella_ Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Malibu Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Thick n Lite Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Envy Kells x Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Livv A Little Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Empress Elfiie – Little Elfiie Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Envy Kells x Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Princess So Seductive Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

NyyJjaae – FANSLY Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

MrsHawtCakes Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Leah Meow Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Ms Thick Overload Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Miaa Diorr Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Princess So Seductive Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Only Boddy Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Ricky Behavior Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Pyteee Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Que Diaz Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Codename Jas Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Lexi Doll xXx Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Jojo Uncut Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Violet Got Cake – BaddGalSteph Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Yasmin Estrada_ Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Amarachiayoki – Amarachi Agate Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

NyyJjaae – FANSLY Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Jus a Teasee – Naomi Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Minx Millz Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Defiant Panda Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Lexi Soriya Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Juicy Lips Goddess Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Sunnyy Tha Goat Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Jolene Canada Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Stormii D Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Sarah Mariee FANSLY Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Defiant Panda Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Thick Lana Love Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Cinnabus Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Juicy Lips Goddess Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Tiahnie Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Arabelle Raphael Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Shez a Druq Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Empress Elfiie – Little Elfiie Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Juliana x Ferrara Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

The Real Muvad Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Scandinavian Anna – FANSLY Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

uDream of Jordan VIP Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Que Diaz Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Thick n Lite Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Juicyyyyy E – Ebony Mariaaaa Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

KoKo Kay Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Astr Girll Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Chrissy K Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Coco Fantasia Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Natalie Turner Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Lil Booty Plug Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Moxie Powers Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Foxy Roxie Vaught Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Kayla G Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Janie Fit Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Paola Rosalina Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Lil Milky Bun – FANSLY Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

The Throat Bully Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Scarlett Jasminn – FANSLY Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Mandy Lee Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Zuribella Rose Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Gabrielle The Goddesss Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Zuribella Rose Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Jade x Jamal Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Natalie Turner Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Missus Blu Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

That Honey Dip Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Anelisa Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Cindy Gets Naughty Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Lee Lee Zilla Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Vinny Ballerina Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Baddiee Babe Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Caramel Kitten Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Naomi Gets Nasty Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Amarachiayoki – Amarachi Agate Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Tiny Doll Tasia Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Ken Brazy Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

KoKo Kay Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

All Charged Up Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Curvy Mommy Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Lunita Skye Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

NikkiBaby Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Nikki Stone Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Sarita Natividad Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Dab of Kya Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Livv A Little Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Flower Bombbbb Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Naomi Gets Nasty Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

SheSoThixk Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Sarah Mariee FANSLY Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Lanzii Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Stormii D Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Tiny Doll Tasia Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Lovely Adriana Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Kara J Lee Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

RissaCute Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Anita Isabella Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Karla James Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

All Charged Up Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Baddiee Babe Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

SazonDePuertoRicoINC Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

ElvaSnaps FANSLY Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Jay The Creatorr Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Fire Violet Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Wuta Booty Fulashh Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

BBY Anni Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Tiffy Monroe X Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Fine Ass Shanice Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Sammyyk VIP Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Nadia Palik Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Yasmin Estrada_ Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Sexxy Jaimie Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Sugarr Spiceee FANSLY Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Krissy Taylor VIP Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Sarah Roomie Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Lexi Doll xXx Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Real Princess Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Coco Fantasia Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

ur Fav Kittty Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Voulez J Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Dab of Kya Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Krissy Kummins VIP Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Juliana x Ferrara Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Officially Seni Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Only Boddy Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Defiant Panda Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Paradis Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Afro Sunshine Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Breckie Hill Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Mati VIP Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Queen Kalin xXx Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

RiahBear Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Krissy Kummins VIP Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Anelisa Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Only Boddy Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )

Coco Fantasia Only Fans Leaked Fansly Leaks Mega Folder Download Link ( https://UrbanCrocSpot.org )