The DEEP Ecosystem Community publishes a Strategy White Paper on how to foster the role of Business Angels for thriving startup ecosystems

The 2021 DEEP Ecosystems Conference brought together 175 practitioners and experts from the startup scenes of more than 45 countries to have data-driven discussions on the most pressing challenges their ecosystems face. In a series of Strategy White Papers, we publish the conference´s key findings and recommendations on building more transnational, inclusive, entrepreneur-driven, and impactful ecosystems. To get access to all publications, make sure to sign up to our newsletter.

Angel investors are a key source of early-stage capital as well as skills, knowledge and business contacts for small and mid-size companies when they make the push for scaling up. They also operate as hunting grounds for VCs looking for funding targets and often hand over the baton to them for the next phase of growth.

Strategy White Paper: Business Angels’ Changed Role in Today’s Startup World

An active marketplace for Business Angels and their Networks makes for an invigorating investment climate and their absence would pose great challenges for startup ecosystems. “If angel investments were to slow down, it would have a massive impact on the startup economy in Europe,” says Luigi Amati, Chairman and President of Business Angels Europe. “Indeed, if angel investing breaks down, you break down the whole pipeline of development.”

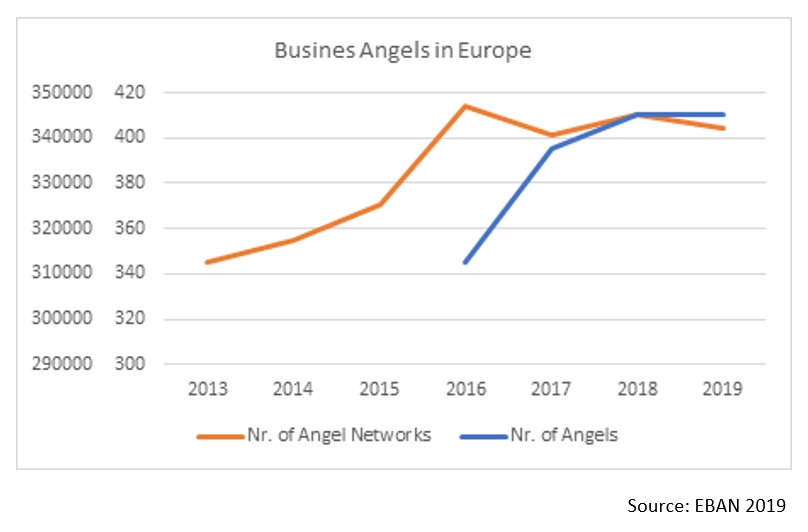

Trends in Business Angel Activity in Europe

- Business Angel investment is growing 5x slower than total startup investment but faster than Seed investments over the last three years.

- Business Angel investments have not been dampened by the Covid-19 pandemic. In UK alone, there were 324 angel investments, a record, in 2020, with volume growing 19%.

- The number of Business Angels and Networks have stayed flat over the last 3 to 5 years.

- Growth rates vary significantly from country to country within Europe, with mid-size markets like Sweden, Italy and Finland catching up fast with traditional leaders like Germany and France.

- International investments continue to be limited, despite efforts by angel networks and associations, with 75% taking place in the same or a neighboring country.

The Impact of Changing Market Conditions on Business Angels

One recent development in the European Business Angels ecosystem has been Equity Crowdfunding, which has emerged as a viable option for investments. This is especially true in markets like UK, Finland, Spain and Germany that have a regulatory framework that supports this channel.

Leading countries by volume:

Equity-Based Crowdfunding 2018 | |

United Kingdom | $642.2mn |

Finland | $67.9mn |

Spain | $48.4mn |

Germany | $37mn |

This goes hand in hand with other trends that we have observed:

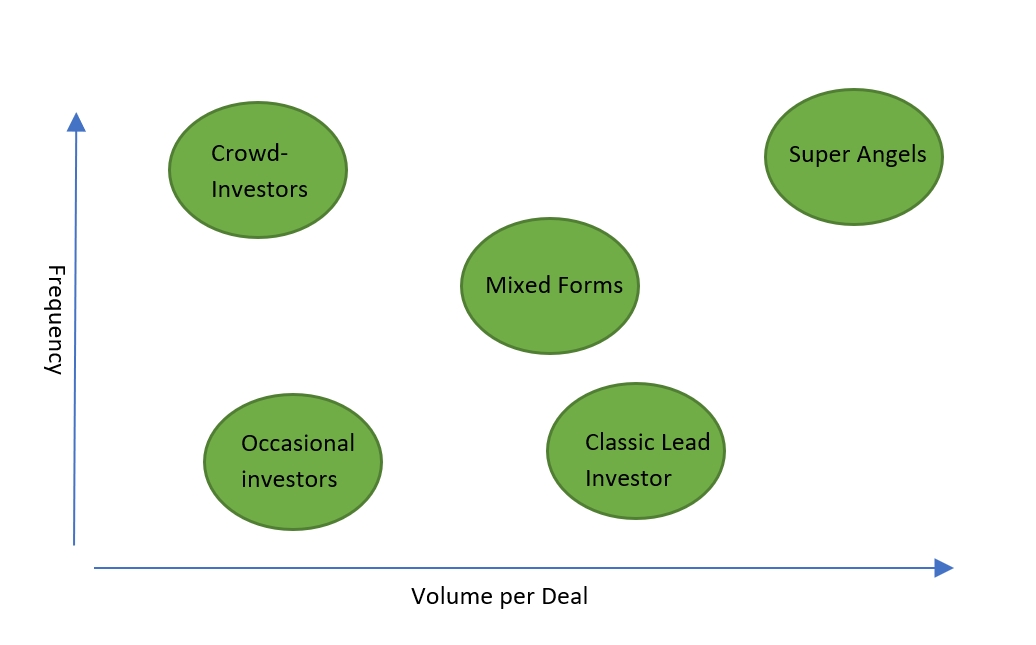

- Increasing professionalism in the ranks of Business Angels: Experienced angels are making the move to create funds with professional investment managers that have the potential to significantly improve portfolio performance. At the same time, entry barriers for newcomers are increasing, leading to a reduction in the one-off Angel investors.

- Business Angels have to compete with Grants for attention of startups: According to Dealroom, Grants, often in the form of early-stage accelerators, accounted for 80% of total investment growth in EU startups in 2020. What is more striking, however, is that there was a 230% increase in Grants from 2019 to 2020.

- Super Angels are getting support via Co-Investment Schemes: Several co-investment schemes are in operation, like The European Angels Fund (EAF) by the European Investment Fund, and The EIC Accelerator by the European Commission. Besides, several nations have co-investment schemes in place, or plan to put them in place.

No matter the type, the regulatory environment affects the activity of Business Angels. In general, governments are attempting to promote angel activity through tax incentives. Three main lines can be identified:

- Upfront relief on amount invested

- Tax reliefs on returns

- Loss relief

Overall, it is challenging for governments, market participants, ecosystem builders to measure the activity of Business Angels and the amount of angel investments. The structured networks, clubs and platforms where much of the known activity takes place represent only a part of the ecosystem. There is a large ‘invisible market’ outside these ‘visible’ structures.

Our recommendations

Based on the data presented and exchanges between experts during the DEEP Startup Ecosystem Conference, the DEEP Ecosystem Leaders have evolved a set of recommendations for invigorating the marketplace for Business Angels and Networks in Europe:

- Business Angel activity is highly under reported. Ecosystem builders should highlight the work being done by Angels, and the difference they are making to startups as well as late-stage investors.

- A transparent and standardized process of measurement is the bedrock of any modern business process and needs to be created for Angel activity.

- Angel investing is moving from an informal to a professional activity with prominent Angels setting up vehicles with a professional management team. Introduction of educational and training programs, can expand the scope of work done by Angels in isolation.

- Ecosystem builders need to become smart and leverage the appeal of modern tools and media such as the Shark Tank show. The process should begin with an analysis on the impact such shows have, and their real impact.

- Tax incentives are a big driver of Angel investments. Many countries have recognized the need and have created taxation structures that incentivize Angel investing. Ecosystem builders need to lobby for regulatory changes.

- Ecosystem builders need to show Angels the opportunities that exist beyond political boundaries and establish a method of understanding and mitigating the challenges faced in cross-border investing.

- Defining the role of Business Angels in a rapidly changing marketplace for investors is required, as well as of Ecosystem Builders. This includes setting up goals against which their performance can be evaluated.

Strategy White Paper: Business Angels’ Changed Role in Today’s Startup World

Image credit: Gerald Schömbs / Unsplash