To make a startup successful a mix of ingredients is necessary. Two of the most important components are talent and capital. In contrast to Silicon Valley, where both largely concentrate in the same place, Europe has to wonder if it can bring both together in one location.

With the Startup Heatmap Europe Survey we have shown some of the hotbeds of entrepreneurial activity around Europe. While the high mobility of Europe’s founders shows a number of personal connections between these hubs are building, it does not necessarily mean that capital follows this trend (just yet).

To look closer at these trends, we worked with Pitchbook to analyze the cross-border activities of venture capital investors in Europe. We found that 73% of all investments came from domestic investors. When deducting the impact of non-European investors, on average, European investors make roughly 17% of their deals in other European countries.

To compare the spatial distribution of investor activities and startup mobility, we went on to examine two main questions:

- Are founders moving where there is the highest investor activity?

- What do founders say about how important capital is for their location choice?

- Compare ranking of founders and investment activities

- Is foreign capital following talent flows?

- Are the big players investing in regional champions?

- Are investors from the periphery investing in big hubs?

To understand if founders follow capital, we first of all asked them: Strikingly, only 58% consider access to capital a very important factor when deciding where to startup. In our sample, we find that 14% of founders say they access to capital is not important at all (www.startupheatmap.eu/download-report). This places Access to Capital in third position behind Access to Talent (77%) and Ease/Cost of Doing Business (62%).

With this ambiguity, we need to go a step further and compare whether founders are actually more likely to choose locations with higher investor activities. Therefore, we ranked the 10 cities that have the most investment deals within the last 3 years according to Pitchbook and compare those to founders’ choices:

Interestingly, the top 10 cities with the greatest investor activity looks fairly different from the top 10 cities chosen by founders. From the investor data, it is clear that Helsinki is a top hub for investments, but founders still do not vote it into the top 10. On the contrary, Barcelona is strong on talent, but less favored by investors. Most strikingly, cities like Cambridge, Edinburgh and Moscow do not figure on the radar of founders at all in our survey. There may be a diverse set of reasons for this, but it shows that the presence of capital does not necessarily bring talent. Additionally, when looking at the perception of founders on the availability of capital in each of the respective cities differs can differ drastically from the impression we have from the actual investments. This suggests that founders either do not know the actual situation well, or they know more than this ranking implies.

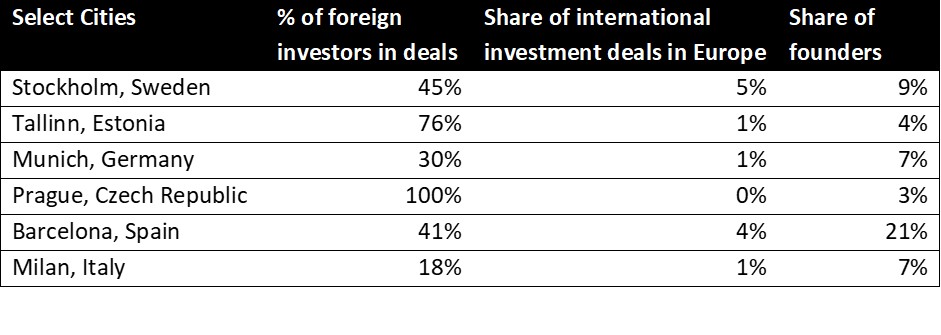

The second question we examined was whether capital is following talent flows to capture the most promising startups all around Europe. For this, we look at a select group of emerging regional champions in the battle for startup talent and check what extent their startups are able to attract foreign investment. We also examine the cross border total investments, and check to see how big of a share these cities capture this “mobile” capital.

According to our survey results, in the Nordics and Baltics Stockholm captures 22% of regional founders’ attention and Tallinn grabs 15%. Western Europe finds Munich with 17% of the regional cohort and in the CEE, Prague garners 23%. In the South, Barcelona reaches 35%, and Milan follows with 30%.

According to our survey results, in the Nordics and Baltics Stockholm captures 22% of regional founders’ attention and Tallinn grabs 15%. Western Europe finds Munich with 17% of the regional cohort and in the CEE, Prague garners 23%. In the South, Barcelona reaches 35%, and Milan follows with 30%.

What we can see is that foreign capital plays an important role in all ecosystems (importantly – more than a third of London deals are foreign), but hubs with high regional concentrations of founders do not capture international capital to an extent as the popularity with founders would suggest. Barcelona shows the largest discrepancy with 21% of founders imagining to startup there, but only 4% of international investment deals happening there.

Stockholm attracts 9% of founders, but only 5 % of international investments.

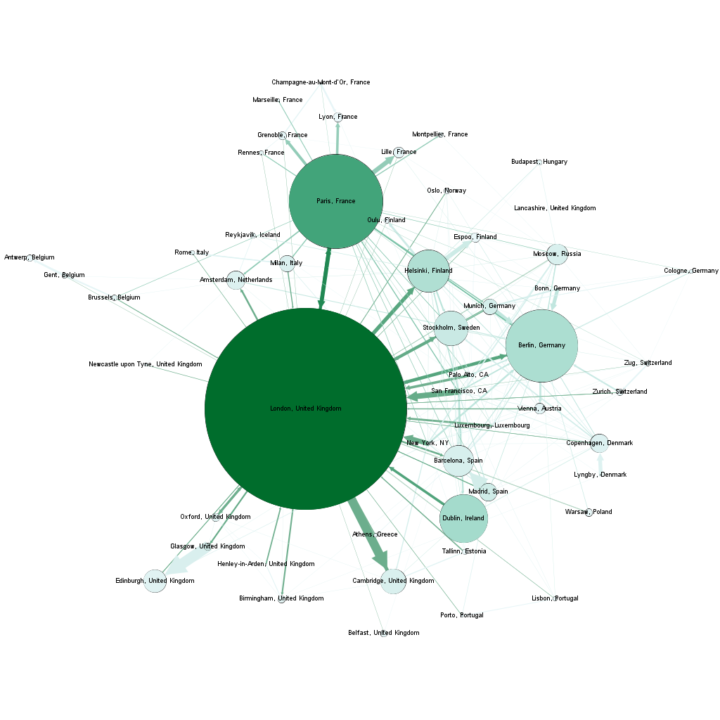

When looking at which cities benefit the most from international capital flows, we sort the list by the magnitude of international investments found in each city.

This list indicates that capital follows capital, and not talent. The US, the UK and Germany are responsible for over 50% of all international investments in Europe and they mostly stay within existing high capital markets. Investors from the periphery also tend to follow these trends: The countries that export the most of their capital are Luxembourg (94%), Czech Republic (73%), Austria (67%), Estonia (56%). The majority of these countries do most of their foreign deals in the UK.

This list indicates that capital follows capital, and not talent. The US, the UK and Germany are responsible for over 50% of all international investments in Europe and they mostly stay within existing high capital markets. Investors from the periphery also tend to follow these trends: The countries that export the most of their capital are Luxembourg (94%), Czech Republic (73%), Austria (67%), Estonia (56%). The majority of these countries do most of their foreign deals in the UK.

While some might argue that concentration is necessary and if capital availability is limited to few hubs, competition for it will increase and only the best startups will receive it. However, our findings suggest otherwise: Entrepreneurial talent is not moving to where the capital is, but is dispersed around the continent for a number of reasons. But early stage venture capital remains largely local or at least within its comfort zone. By not sourcing on a large scale, European venture capital firms miss out on opportunities and create an unnecessary shortage of supply of promising startups for themselves. While, in Europe’s periphery founders are turning away from VCs, betting on organic but slow growth paths. Overall this boils down to a simple conclusion: Europe has less unicorns than it could have.

Dear Mr. Koesters;

I applaud your analytically driven effort. I would add some insights I gleaned from a pro bono research study I conducted for the Joint Venture Silicon Valley in 2000. click here for a copy https://jointventure.org/publications/joint-venture-publications/307-internet-cluster-analysis

We found that several elements were required to be present to support the effective construct of an internet cluster (ecosystem) such as that in Silicon Valley and several other regions of the world. The presence of capital was and is certainly (from our findings necessary; however, not sufficient. As you point out, access to talent is also critical, but not just technical talent, but entrepreneurial talent, or one might even call it entrepreneurial “willingness”. Which brings me to the point that I hope might be helpful:

Entrepreneurial “willingness” is not only present in the technical aspirations of disrupters, but maybe even more important in the ability and “willingness” of companies with market gravitas (both capitalization, but also market position) to assist/drive the nurturing, growth and financial liquidity of willing entrepreneurs. And, just to be sure…conventional incubators are not sufficient either. What is necessary, and unfortunately missing in many regions are what we call “pillar companies. As such, the Cisco example is paramount. Cisco realized early that growth was only possible through disruption, and that disruption was only possible through spinning off key talent, and bringing them back into the fold through acquisition. Many others such as Hewlett Packard, Microsoft (in the Washington cluster), Oracle, Intel have also found that along with Cisco that spinoffs also created entrepreneurial dynamics of there own. One dynamic is that of the “successful entrepreneur” who may go to IPO or open market sale of his/her company. The other, far more frequent is the “first/second/third… failure entrepreneur” who must be brought back into a “safe” pillar environment to ‘recharge’. The Pillar company is invaluable in this sense, and Silicon Valley, and other successful clusters are full of examples of this kind of behavior in support of entrepreneurial “willingness”.

This brings me around to my observations with respect to Europe, and maybe even Germany in specific. And it is simply this, you are quite right in your observations about the insufficiency of capital alone to nurture entrepreneurial activity. But where are the pillars in this? Is the “deutsche Mittelstand” even capable of playing this role, given private capitalization predominates, and technical “Fortschritt” is critical to survival…Who will spin out critical talent? And, who will nurture those willing to walk the difficult road as entrepreneurs when they fail (3, 4, and 5 times before they might succeed)?

I think that working this angle will be critical to accelerating European/German entrepreneurial speed.

Regards

B

Покупка дипломов ВУЗов в Москве — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы даем гарантию, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 3830 клиентов воспользовались услугой — теперь ваша очередь.

По ссылке — ответим быстро, без лишних формальностей.

mostbet официальный сайт вход http://mostbet11011.ru

мостбет ком вход https://www.mostbet11009.ru

скачать мостбет кг https://www.mostbet11012.ru

Мы предлагаем оформление дипломов ВУЗов в Москве — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы даем гарантию, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 2333 клиентов воспользовались услугой — теперь ваша очередь.

http://inforepetitor9.ru/ — ответим быстро, без лишних формальностей.

скачать приложение mostbet http://www.mostbet11010.ru

Мы предлагаем оформление дипломов ВУЗов по всей России и СНГ — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы даем гарантию, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 2260 клиентов воспользовались услугой — теперь ваша очередь.

Открыть — ответим быстро, без лишних формальностей.

Оформиление дипломов ВУЗов в Москве — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы даем гарантию, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 1710 клиентов воспользовались услугой — теперь ваша очередь.

Перейти — ответим быстро, без лишних формальностей.

mostbet com официальный сайт mostbet11005.ru

Приобрести диплом об образовании!

Мы готовы предложить дипломы любой профессии по приятным ценам— v2003.ru

отите|Желаете|Мечтаете] получить есплатный|даровой|халявный] NFT? ?? Участвуйте в озыгрыше|акции|лотерее] от LoveShop “Shop1-biz”! ?? Подробнее

https://snop1.biz

#loveshop1300-biz # shop1-biz #loveshop13 #loveshop15 #loveshop16 #loveshop17 #loveshop18

Мы предлагаем оформление дипломов ВУЗов по всей России и СНГ — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы даем гарантию, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 3829 клиентов воспользовались услугой — теперь ваша очередь.

Диплом цена — ответим быстро, без лишних формальностей.

Мы предлагаем оформление дипломов ВУЗов в Москве — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы даем гарантию, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 1132 клиентов воспользовались услугой — теперь ваша очередь.

http://inforepetitor8.ru/ — ответим быстро, без лишних формальностей.

Купить документ ВУЗа можно в нашей компании в Москве. Мы предлагаем документы об окончании любых ВУЗов РФ. Гарантируем, что в случае проверки документа работодателями, подозрений не появится. beaverbook.ca/read-blog/3992_skolko-stoit-kupit-attestat-11-klassa.html

Приобрести диплом ВУЗа по невысокой стоимости можно, обращаясь к проверенной специализированной компании. Заказать диплом о высшем образовании: collie.fatbb.ru/ucp.php?mode=login

Мы предлагаем документы учебных заведений, которые находятся в любом регионе России. Документы выпускаются на “правильной” бумаге высшего качества: zador.flybb.ru/viewtopic.php?f=1&t=4094

Компания предлагает полный спектр услуг по ритуальные услуги в москве и московской области

Перейти – https://dostavkaedypegas.ru/news/ritualnye-uslugi-v-moskve-i-moskovskoy-oblasti/

第一借錢

https://168cash.com.tw/

водопонижение для строительства водопонижение для строительства .

Мы предлагаем документы об окончании любых университетов РФ. Документы производят на настоящих бланках государственного образца. pitstopwheels.ru/forum/?PAGE_NAME=profile_view&UID=3771

строительное водопонижение строительное водопонижение .

Приобрести диплом ВУЗа по невысокой цене вы можете, обращаясь к проверенной специализированной компании. Купить документ о получении высшего образования можно у нас в столице. orikdok-4v-gorode-krasnodar-23.ru

1win зеркало сейчас online https://1win11003.ru/

диплом купить ргсу диплом купить ргсу .

Заказать диплом под заказ вы сможете через сайт компании. orikdok-2v-gorode-kemerovo-42.online

мостбет скачать казино мостбет скачать казино

1win argentina https://1win3002.com

1vin зеркало http://1win11001.ru/

Пронедра https://www.85goelro.ru .

Народные приметы https://actprom.ru/ .

Запреты дня https://tti-sfedu.ru/ .

Календарь стрижек http://www.allizmalkovo.ru .

Оформиление дипломов ВУЗов в Москве — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы гарантируем, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 1443 клиентов воспользовались услугой — теперь ваша очередь.

Купить диплом Россия — ответим быстро, без лишних формальностей.

Лунные день сегодня https://www.congress-st.ru .

Воспользоваться промокодом Mostbet можно при регистрации в Mostbet. БК Мостбет дарит до 125% на первый депозит при помощи промокода Mostbet. Максимальная сумма бонуса по промокоду Мостбет достигает 35000 рублей. Предлагаем использовать рабочий промокод Mostbet на сегодня (бесплатно). Вводить промокод Мостбет следует строго при регистрации. Куда вводить промокод Mostbet при регистрации? Выбираете страну и валюту. В окно “Введите промокод” (при наличии), вводите рабочий промокод. Как активировать промокод Мостбет. Промокод Mostbet активируется при первом пополнении игрового счета. Однако, есть пару моментов: Необходимо заполнить все обязательные поля в личном кабинете. Как получить промокод Mostbet на сегодня? Бесплатные купоны для повышения бонуса посетителям сайта. Читайте подробнее про условия получения, проверку и правила ввода бонусного кода Мостбет на сайте букмекерской конторы. Еще один вид промокодов Mostbet.com позволяет совершать бесплатные ставки на события, а также использовать иные предложения в сфере азартных игр от БК. Получить их бесплатно от букмекерской конторы можно в качестве подарка на свой день рождения или в годовщину регистрации в Mostbet. ввести промокод. Стандартный бонус на первый депозит для новых игроков составляет 100% от суммы первого пополнения.

установка вакуумного водопонижения установка вакуумного водопонижения .

mostbet сайт регистрация mostbet11015.ru

1win скачать на пк 1win скачать на пк

Календарь стрижек 85goelro.ru .

1winkg 1winkg

mostbet com вход mostbet com вход

Календарь огородника tti-sfedu.ru .

Приобрести диплом ВУЗа по невысокой цене возможно, обращаясь к надежной специализированной фирме. Мы оказываем услуги по производству и продаже документов об окончании любых университетов России. Приобрести диплом любого ВУЗа– dentisthome.ir/read-blog/372_kupit-diplom-o-srednem-obrazovanii.html

pristennyj-drenazh-812.ru .

купить диплом в белгороде купить диплом в белгороде .

Мы изготавливаем дипломы любых профессий по доступным тарифам. Мы готовы предложить документы ВУЗов, расположенных на территории всей РФ. Документы выпускаются на бумаге высшего качества. Это позволяет делать государственные дипломы, которые невозможно отличить от оригинала. orikdok-3v-gorode-khabarovsk-27.online

mostbet sitio oficial https://mostbet11001.ru/

новости дня http://www.actprom.ru .

сайт mostbet https://www.mostbet11001.ru

Какой сегодня праздник http://congress-st.ru .

mostbet bet mostbet bet

Thanks you…

https://www.youtube.com/@SupremeAudiobooks

мостбет казино войти http://mostbet11014.ru/

skachat mostbet mostbet11008.ru

301 Moved Permanently Show more!..

Погода http://www.allizmalkovo.ru/ .

небольшие угловые кухни фото и цены небольшие угловые кухни фото и цены .

Запреты дня https://inforigin.ru/ .

Мы готовы предложить дипломы любой профессии по приятным тарифам. Приобретение документа, который подтверждает обучение в ВУЗе, – это рациональное решение. Приобрести диплом университета: creationsmanpower.com/employer/diplomy-grup-24

Гороскоп https://dorogi34.ru/ .

Погода istoriamashin.ru .

Лунный календарь topoland.ru .

Мы можем предложить документы институтов, расположенных в любом регионе России. Приобрести диплом любого университета:

avto.rx22.ru/viewtopic.php?f=2&t=1465

купить диплом о среднем образовании 11 классов http://arus-diplom4.ru .

Наши специалисты предлагают быстро приобрести диплом, который выполняется на оригинальном бланке и заверен печатями, штампами, подписями официальных лиц. Документ пройдет лубую проверку, даже с использованием профессиональных приборов. northland.forumex.ru/viewtopic.php?f=3&t=1448

мостбет официальный сайт вход букмекерская контора https://www.mostbet11022.ru

мостбет скачать приложение мостбет скачать приложение

Смотреть здесь https://vodkacasino.net

подробнее https://vodkacasino.net/

Покупка дипломов ВУЗов по всей России и СНГ — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы гарантируем, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 1151 клиентов воспользовались услугой — теперь ваша очередь.

Открыть — ответим быстро, без лишних формальностей.

Производство и поставка – сварная металлическая сетка производства Северсталь метиз ОСПАЗ со склада в г.Орел.

Продажа куплю сварную сетку оптом и в розницу по низким ценам.

Полный каталог всей метизной продукции, описания, характеристики, ГОСТы и технические условия.

Офоррление заказа и доставка в сжатые сроки. Возможна отгрузка железнодорожным транспортом. Цены производителя.

узнать больше https://vodkacasino.net/

ссылка на сайт https://vodkacasino.net

mostber http://mostbet11026.ru/

новости дня https://inforigin.ru/ .

выберите ресурсы https://vodkacasino.net/

1win lucky jet 1win3002.com

психиатрическая помощь психиатрическая помощь .

перейдите на этот сайт https://vodkawin.com/

Лунные день сегодня http://www.topoland.ru .

Мы предлагаем дипломы любой профессии по выгодным тарифам. Цена будет зависеть от выбранной специальности, года выпуска и образовательного учреждения: book.hootz.com.br/read-blog/10492_kupit-diplom-s-zaneseniem-v-reestr-rossiya.html

мостбет официальный сайт регистрация https://www.mostbet11022.ru

Мы предлагаем дипломы психологов, юристов, экономистов и прочих профессий по приятным тарифам. Для нас очень важно, чтобы дипломы были доступными для большого количества наших граждан. Приобрести диплом о высшем образовании hillshawkesburyhirecars.com.au/poluchite-diplom-bez-lishnih-hlopot-180-2

mostbet yukle apk mostbet yukle apk .

купить аттестат в москве купить аттестат в москве .

It’s not my first time to pay a visit this site, i am browsing this web page dailly and take pleasant facts from here daily. http://boyarka-inform.com/

It’s not my fijrst time to pay a visit this site, i am

browsing this web page dailly and take pleasant facts from hdre daily. http://boyarka-inform.com/

Запреты дня https://www.istoriamashin.ru .

Какой сегодня праздник http://inforigin.ru/ .

Оформиление дипломов ВУЗов по всей России и СНГ — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы гарантируем, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 2486 клиентов воспользовались услугой — теперь ваша очередь.

Узнать подробнее — ответим быстро, без лишних формальностей.

An intense discussion in which everyone found something to complement the overall picture. It is thanks to such meetings of like-minded people that one can come to the really necessary conclusions.

By the way, in any business it is important to take care not only of the results, but also of yourself. Maintain this balance professional cosmetics help me — a great tool to feel confident and great.

Приобрести документ института можно у нас. Приобрести диплом университета по выгодной стоимости вы можете, обращаясь к проверенной специализированной компании. ru-book.ru/blogs/new

Купить диплом об образовании!

Мы можем предложить дипломы любой профессии по выгодным ценам— pr0.ru

Мы предлагаем оформление дипломов ВУЗов в Москве — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы гарантируем, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 1258 клиентов воспользовались услугой — теперь ваша очередь.

На этой странице — ответим быстро, без лишних формальностей.

Мы предлагаем оформление дипломов ВУЗов по всей России и СНГ — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы гарантируем, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 3472 клиентов воспользовались услугой — теперь ваша очередь.

Перейти — ответим быстро, без лишних формальностей.

Лунные день сегодня https://topoland.ru .

скачать мостбет официальный сайт https://www.mostbet11028.ru

скачать мостбет на андроид бесплатно старая версия скачать мостбет на андроид бесплатно старая версия

new casinos online maryvaleqld.com.au/new-online-casinos/ .

iflow камеры видеонаблюдения http://www.citadel-trade.ru .

Календарь стрижек http://www.inforigin.ru .

mental health ai chatbot http://www.mental-health5.com/ .

скачать мостбет официальный http://mostbet11027.ru/

нажмите retrocasino

Гороскоп istoriamashin.ru .

mostbet com вход http://www.mostbet11025.ru

best online casino in australia http://www.maryvaleqld.com.au .

Погода https://inforigin.ru/ .

Какой сегодня праздник https://www.topoland.ru .

mostbet app https://www.mostbet11026.ru

мостбет войти в личный кабинет http://mostbet11028.ru

Заказать диплом на заказ в Москве можно через официальный портал компании. orikdok-4v-gorode-smolensk-67.online

Мы предлагаем оформление дипломов ВУЗов по всей России и СНГ — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы даем гарантию, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 1677 клиентов воспользовались услугой — теперь ваша очередь.

Посмотреть информацию — ответим быстро, без лишних формальностей.

Календарь огородника https://www.dorogi34.ru .

Гороскоп http://www.topoland.ru .

Запреты дня https://istoriamashin.ru/ .

Народные приметы http://inforigin.ru .

Календарь огородника http://www.inforigin.ru/ .

новости дня http://novorjev.ru/ .

новости дня http://www.pechory-online.ru/ .

Пронедра istoriamashin.ru .

новости дня https://topoland.ru .

Народные приметы http://inforigin.ru .

мостбет кыргызстан скачать мостбет кыргызстан скачать

История дня http://www.topoland.ru/ .

Какой сегодня праздник http://www.istoriamashin.ru .

История дня http://www.topoland.ru .

Какой сегодня церковный праздник https://istoriamashin.ru/ .

купить аттестат в москве купить аттестат в москве .

Despite its inconspicuous appearance, pumps for homes occupy an important place in the life support system of any tenant. They provide reliable water supply and protection from flooding, which makes them indispensable in everyday life. It is thanks to these devices that we can safely turn on the faucet, knowing that the water will arrive at the right time and in the right amount.

parimatch app ios parimatch app ios .

займы под 0 процентов на карту займы под 0 процентов на карту .

Какой сегодня церковный праздник http://istoriamashin.ru .

подробнее https://progearph.org/deu/potency/erox-plus/

more https://shopvitality.space/kot_divuar/potency/black-active/

Этот бот поможет получить информацию по заданному профилю.

Достаточно ввести имя, фамилию , чтобы сформировать отчёт.

Система анализирует публичные данные и цифровые следы.

глаз бога информация о человеке

Информация обновляется мгновенно с фильтрацией мусора.

Оптимален для проверки партнёров перед сотрудничеством .

Анонимность и точность данных — гарантированы.

Вы приобретаете диплом через надежную фирму. Приобрести диплом университета– http://alldirectorys.ru/kupit-diplom-s-reestrom-v-rossii-bistro-i-nadezhno-2/ – alldirectorys.ru/kupit-diplom-s-reestrom-v-rossii-bistro-i-nadezhno-2/

диплом спб купить https://arus-diplom1.ru .

Заказ официального диплома через проверенную и надежную компанию дарит ряд преимуществ. Заказать диплом: youhomie.com/read-blog/7624_attestaty-za-11-klass-kupit.html

Запреты дня https://novorjev.ru .

Оформиление дипломов ВУЗов по всей России и СНГ — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы гарантируем, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 1673 клиентов воспользовались услугой — теперь ваша очередь.

На этой странице — ответим быстро, без лишних формальностей.

download mostbet download mostbet

1mostbet https://www.mostbet11023.ru

Мы предлагаем оформление дипломов ВУЗов в Москве — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы гарантируем, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 3691 клиентов воспользовались услугой — теперь ваша очередь.

Купить диплом о среднем профессиональном образовании — ответим быстро, без лишних формальностей.

Погода http://www.pechory-online.ru .

Приобрести диплом института по выгодной цене возможно, обращаясь к надежной специализированной фирме. Приобрести документ о получении высшего образования можно у нас в столице. orikdok-3v-gorode-yoshkar-ola-12.ru

мостбет ставки на спорт http://www.mostbet11024.ru

Мы предлагаем оформление дипломов ВУЗов в Москве — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы гарантируем, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 2159 клиентов воспользовались услугой — теперь ваша очередь.

Обращайтесь — ответим быстро, без лишних формальностей.

Покупка дипломов ВУЗов в Москве — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы даем гарантию, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 1650 клиентов воспользовались услугой — теперь ваша очередь.

Мы поможем — ответим быстро, без лишних формальностей.

мостбет скачать казино http://mostbet11029.ru

купить диплом медсестры купить диплом медсестры .

ставки на спорт бишкек mostbet11025.ru

you can try this out https://zdravsklad.space/belarus/biomanix/

prodache

Thanks for the article. Here’s more on the topic https://artcet.ru/

кашпо для цветов напольное высокое декор http://www.kashpo-napolnoe-spb.ru – кашпо для цветов напольное высокое декор .

Website https://pharmfriend.net/est/leptigen-meridian-diet/

find out this here https://vitapoint.space/nigeria/potency/order-longjack/

Website uberprufen https://shopluckyonline.net/otovitalor/

новости дня http://novorjev.ru .

mostbet app download for android (apk) mostbet app download for android (apk) .

Пронедра http://pechory-online.ru/ .

browse around this web-site https://nutramed.health/bulgaria/slimming/leptigen-meridian-diet-slimming-capsules/

Оформиление дипломов ВУЗов в Москве — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы гарантируем, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 2018 клиентов воспользовались услугой — теперь ваша очередь.

Дипломы о высшем образовании купить — ответим быстро, без лишних формальностей.

Мы предлагаем оформление дипломов ВУЗов в Москве — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы даем гарантию, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 2160 клиентов воспользовались услугой — теперь ваша очередь.

Купить диплом Россия — ответим быстро, без лишних формальностей.

сколько стоит купить диплом о высшем образовании https://www.arus-diplom3.ru .

Приобрести диплом на заказ можно используя сайт компании. orikdok-3v-gorode-vologda-35.ru

Приобрести диплом о высшем образовании. Покупка документа о высшем образовании через проверенную и надежную компанию дарит ряд преимуществ для покупателя. Такое решение помогает сберечь время и значительные финансовые средства. orikdok-v-gorode-izhevsk-18.online

Календарь огородника http://topoland.ru/ .

Магнитные бури inforigin.ru .

Пронедра https://novorjev.ru/ .

скачать parimatch на андроид скачать parimatch на андроид .

Пронедра pechory-online.ru .

Мы изготавливаем дипломы любой профессии по приятным тарифам. Приобретение диплома, который подтверждает окончание университета, – это выгодное решение. Купить диплом любого университета: itisenglish.maxbb.ru/viewtopic.php?f=7&t=1922

best payout casino online best payout casino online .

real pokies no deposit bonus https://www.maryvaleqld.com.au/real-money-pokies/no-deposit-bonus/ .

safe online gambling http://www.maryvaleqld.com.au/safe-online-casinos/ .

Календарь огородника http://www.topoland.ru .

Календарь огородника inforigin.ru .

Запреты дня http://novorjev.ru .

Народные приметы https://istoriamashin.ru .

Мы можем предложить дипломы любой профессии по разумным ценам. Мы можем предложить документы ВУЗов, расположенных на территории всей России. Дипломы и аттестаты печатаются на “правильной” бумаге высшего качества. Это дает возможности делать государственные дипломы, не отличимые от оригинала. orikdok-v-gorode-izhevsk-18.online

Где купить диплом специалиста?

Приобрести диплом института по невысокой стоимости возможно, обращаясь к проверенной специализированной компании.: diplommy.ru

Какой сегодня церковный праздник http://www.pechory-online.ru .

Мы предлагаем документы ВУЗов, которые находятся в любом регионе РФ. Заказать диплом любого ВУЗа:

bikeadventure.ru/forum/?PAGE_NAME=topic_new&FID=3&tags=

Народные приметы https://www.topoland.ru .

Запреты дня https://inforigin.ru .

Выгодно приобрести диплом о высшем образовании!

Покупка документа о высшем образовании через проверенную и надежную компанию дарит массу плюсов для покупателя. Приобрести диплом об образовании у проверенной компании: doks-v-gorode-tula-71.ru

Мы можем предложить дипломы любой профессии по невысоким тарифам. Дипломы производят на настоящих бланках Быстро заказать диплом любого института dip-lom-rus.ru

Календарь стрижек https://novorjev.ru .

Купить диплом ВУЗа по невысокой цене можно, обращаясь к проверенной специализированной компании. Мы можем предложить документы престижных ВУЗов, расположенных на территории всей Российской Федерации. a-diplom.ru/otzivi-o-diplome-s-provodkoj-prakticheskix-znanij/

Лунные день сегодня novorjev.ru .

Лунный календарь https://topoland.ru .

Гороскоп http://inforigin.ru/ .

Лунные день сегодня http://www.pechory-online.ru .

mostbet kg регистрация mostbet kg регистрация

Пронедра http://pechory-online.ru/ .

История дня http://www.novorjev.ru .

Календарь стрижек http://istoriamashin.ru/ .

Магнитные бури http://topoland.ru .

Гороскоп https://www.inforigin.ru .

Thanks for the article. Here’s more on the topic https://fotonons.ru/

Заказать диплом любого института!

Мы предлагаем дипломы психологов, юристов, экономистов и любых других профессий по доступным тарифам— aifprint.ru

Мы предлагаем оформление дипломов ВУЗов в Москве — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы даем гарантию, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 966 клиентов воспользовались услугой — теперь ваша очередь.

Купить государственный диплом — ответим быстро, без лишних формальностей.

Заказать документ о получении высшего образования вы имеете возможность у нас. Купить диплом университета по невысокой стоимости вы можете, обращаясь к проверенной специализированной компании. autoclub.getbb.ru/viewtopic.phpf=2&t=1688

Приобрести диплом ВУЗа по невысокой стоимости вы сможете, обращаясь к надежной специализированной компании. Заказать документ института вы можете у нас. orikdok-3v-gorode-kazan-16.online

Наши специалисты предлагают быстро и выгодно купить диплом, который выполнен на оригинальном бланке и заверен мокрыми печатями, водяными знаками, подписями официальных лиц. Документ способен пройти лубую проверку, даже с применением специально предназначенного оборудования. amkenah.co.uk/2025/06/11/ne-upustite-shans-kupite-diplom-prjamo-sejchas-63

Народные приметы http://www.pechory-online.ru/ .

dragon slots online dragon slots online .

Какой сегодня церковный праздник http://www.inforigin.ru/ .

Календарь огородника topoland.ru .

www mostbet com https://www.mostbet11017.ru

dragon slots online real money dragonslotscasinos.net .

Гороскоп http://novorjev.ru/ .

try this web-site jaxx crypto wallet

как скачать 1win как скачать 1win

Магнитные бури http://www.pechory-online.ru/ .

Лунные день сегодня https://novorjev.ru/ .

Запреты дня https://istoriamashin.ru/ .

устройство дренажа спб .

Какой сегодня праздник pechory-online.ru .

Запреты дня https://www.novorjev.ru .

мостбет онлайн http://www.mostbet11029.ru

История дня http://novorjev.ru/ .

Календарь стрижек http://www.istoriamashin.ru/ .

Гороскоп https://pechory-online.ru .

аттестат за 11 класс купить аттестат за 11 класс купить .

мостбет онлайн http://mostbet11018.ru/

Календарь стрижек http://pechory-online.ru/ .

мостбет сайт мостбет сайт

скачать мостбет на андроид http://mostbet11030.ru

купить педагогический диплом http://www.arus-diplom2.ru/ .

мостбет скачать приложение https://www.mostbet11018.ru

1win прямой эфир 1win прямой эфир

dragon slots dragon slots .

Календарь стрижек istoriamashin.ru .

dragon slots https://dragonslotscasinos.net/ .

1win приложение ios 1win приложение ios

Андрей Вебер и его музыка, что лечит раны прошлого

Мы можем предложить дипломы любых профессий по разумным ценам. Мы готовы предложить документы ВУЗов, которые находятся на территории всей РФ. Документы выпускаются на бумаге высшего качества. Это позволяет делать настоящие дипломы, не отличимые от оригиналов. orikdok-v-gorode-kaliningrad-39.online

Лунный календарь novorjev.ru .

Какой сегодня церковный праздник http://pechory-online.ru/ .

диплом о среднем техническом образовании купить arus-diplom4.ru .

pokiesnet pokiesnet .

Магнитные бури https://istoriamashin.ru/ .

диплом психолога купить диплом психолога купить .

1win как вывести деньги 1win1106.ru

мостбет казино скачать мостбет казино скачать

888 app download 888 app download .

???? 888starz https://www.egypt888starz.net .

dragon slots dragon slots .

dragon slot https://www.dragonslotscasinos.net .

thepokies250 http://www.pokiesnet250.com .

1win бонусы казино 1win бонусы казино

dragon slots dragon slots .

The Pokies Australia https://thepokiesau.org/ .

thepokies net250 thepokies net250 .

Заказать диплом института!

Мы предлагаем дипломы любых профессий по приятным ценам— movieworld.ru

The Pokies Australia thepokiesnet101.com .

mostbet история компании https://www.mostbet11016.ru

dragonslots http://dragonslotscasinos.net/ .

Мы предлагаем документы об окончании любых университетов Российской Федерации. Документы производятся на подлинных бланках государственного образца. lgbtqia.network/read-blog/356130_kupit-podlinnyj-diplom-s-zaneseniem-v-reestr.html

dragon slots online dragon slots online .

Заказать документ о получении высшего образования вы можете в нашей компании в столице. Мы предлагаем документы об окончании любых ВУЗов РФ. Гарантируем, что при проверке документов работодателем, каких-либо подозрений не возникнет. severka.flybb.ru/viewtopic.php?f=6&t=924

pokies pokies .

Thanks for the article. Here is a website on the topic – https://40-ka.ru/

thepokies250.net http://www.pokiesnet250.com .

dragon slots casino https://dragonslotscasinos.net .

the pokies http://thepokiesnet250.com .

pokiesnet pokiesnet .

dragonslot http://www.dragonslotscasinos.mobi .

dragon casino casinosdragonslots.eu .

dragonslots casino http://www.dragonslotscasinos.net/ .

Приобрести диплом ВУЗа по доступной стоимости вы сможете, обратившись к надежной специализированной компании. Заказать диплом: v69-3.flybb.ru/viewtopic.php?f=8&t=1178

Мы предлагаем оформление дипломов ВУЗов в Москве — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы даем гарантию, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 2546 клиентов воспользовались услугой — теперь ваша очередь.

Узнать условия — ответим быстро, без лишних формальностей.

1вин официальное зеркало на сегодня http://www.1win1108.ru

thepokies.net pokies106.com .

the pokies net 111 http://www.pokies11.com .

1win https://1win11002.com/

pokiesnet https://pokiesnet250.com .

Оформиление дипломов ВУЗов по всей России и СНГ — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы гарантируем, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 2750 клиентов воспользовались услугой — теперь ваша очередь.

Купить диплом о среднем образовании — ответим быстро, без лишних формальностей.

автоматические карнизы для штор http://www.elektrokarnizy50.ru/ .

the pokies net the pokies net .

1вин верификация http://www.1win1110.ru

dragon slots online real money http://www.dragonslotscasinos.net .

цветочный горшок высокий напольный купить http://www.kashpo-napolnoe-msk.ru – цветочный горшок высокий напольный купить .

цветочный горшок для напольных цветов kashpo-napolnoe-msk.ru – kashpo-napolnoe-msk.ru .

pokies net 250 https://www.thepokiesnet250.com .

Continued https://aviator-game-play.com/en/aviator-in-1xbet/

1win apk 1win apk

как играть на бонусный счет 1win http://1win1105.ru/

dragonslots casino http://www.casinosdragonslots.eu .

Мы готовы предложить документы ВУЗов, которые расположены на территории всей России. Дипломы и аттестаты выпускаются на бумаге самого высшего качества: jobfair.bu.ac.th/employer/frees-diplom

1win верификация http://www.1win1105.ru

dragonslots dragonslots .

pokies101 pokies101 .

the pokies net http://pokiesnet250.com .

The Pokies net Australia login https://thepokiesau.org/ .

download 888 apk download 888 apk .

dragon slots https://dragonslotscasinos.net/ .

pokies 250 pokies 250 .

Приобрести диплом можно используя официальный сайт компании. orikdok-2v-gorode-cheboksary-21.ru

dragonslots dragonslots .

?????? 888starz ?????? 888starz .

Оформиление дипломов ВУЗов по всей России и СНГ — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы даем гарантию, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 4966 клиентов воспользовались услугой — теперь ваша очередь.

Ознакомиться здесь — ответим быстро, без лишних формальностей.

1win промокод официальный сайт букмекерская контора https://www.1win1108.ru

pokies250 http://www.pokiesnet250.com .

pokies.net https://www.pokies106.com .

dragon link slots online real money http://www.dragonslotscasinos.mobi .

pokies 250 pokies 250 .

Мы предлагаем оформление дипломов ВУЗов в Москве — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы гарантируем, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 988 клиентов воспользовались услугой — теперь ваша очередь.

На этой странице — ответим быстро, без лишних формальностей.

Мы предлагаем оформление дипломов ВУЗов по всей России и СНГ — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы гарантируем, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 4536 клиентов воспользовались услугой — теперь ваша очередь.

По ссылке — ответим быстро, без лишних формальностей.

dragon slots http://dragonslotscasinos.net .

dragonslots dragonslots .

dragon casino http://dragonslotscasinos.mobi/ .

pokies.net https://thepokiesnet101.com/ .

диплом спо купить http://www.arus-diplom3.ru .

pokiesnet http://www.pokiesnet250.com/ .

dragonslot http://casinosdragonslots.eu/ .

the pokies https://www.thepokiesnet250.com .

thepokies250 pokiesnet250.com .

dragon link slots online real money dragonslotscasinos.net .

dragonslot https://dragonslotscasinos.mobi/ .

1win sign up https://1win11003.com

thepokies net106 thepokies net106 .

The Pokies Australia http://www.pokies11.com/ .

the pokies https://thepokiesnet101.com .

автоматический карниз для штор http://elektrokarnizy50.ru .

1win app download apk 1win app download apk

прогнозы lucky jet 1win1106.ru

Оформиление дипломов ВУЗов в Москве — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы гарантируем, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 4566 клиентов воспользовались услугой — теперь ваша очередь.

Перейти — ответим быстро, без лишних формальностей.

dragonslots dragonslots .

1win id number search https://www.1win11003.com

aviator game 1win https://www.1win11001.com

The Pokies net Australia https://pokies106.com .

The Pokies net Australia thepokiesnet101.com .

букмекерская контора кыргызстан букмекерская контора кыргызстан

dragonslots casino dragonslotscasinos.mobi .

Here’s more on the topic https://upsskirt.ru/

the pokies net 106 the pokies net 106 .

Оформиление дипломов ВУЗов по всей России и СНГ — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы гарантируем, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 2351 клиентов воспользовались услугой — теперь ваша очередь.

Здесь — ответим быстро, без лишних формальностей.

pokies101 pokies101 .

Оформиление дипломов ВУЗов в Москве — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы даем гарантию, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 2552 клиентов воспользовались услугой — теперь ваша очередь.

Уточнить здесь — ответим быстро, без лишних формальностей.

dragon slots online real money dragon slots online real money .

dragonslots dragonslots .

The Pokies net Australia https://pokies11.com .

The Pokies Australia http://www.thepokiesnet101.com .

thepokies net250 thepokies net250 .

thepokies.net thepokies.net .

thepokies106 thepokies106 .

pokies.net https://pokiesnet250.com/ .

dragon link slots online real money http://dragonslotscasinos.net/ .

электрические карнизы купить https://elektrokarnizy50.ru .

dragon slots online real money dragon slots online real money .

888starz apk 888starz apk .

Мы предлагаем оформление дипломов ВУЗов в Москве — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы гарантируем, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 1093 клиентов воспользовались услугой — теперь ваша очередь.

Звоните — ответим быстро, без лишних формальностей.

1win русский https://1win1109.ru/

1win мобильная версия 1win мобильная версия

pokies101 pokies101 .

смотреть здесь тирзепатид лиофилизат

pokies pokies .

pokiesnet http://www.thepokiesnet250.com/ .

dragon link slots online real money dragon link slots online real money .

The Pokies Australia http://www.pokies11.com .

thepokies.net pokiesnet250.com .

dragon link slots online real money dragon link slots online real money .

pokies net pokies net .

dragonslots https://dragonslotscasinos.net .

the pokies net 250 http://thepokiesnet250.com .

the pokies net 111 login pokies11.com .

thepokies net250 pokiesnet250.com .

Покупка дипломов ВУЗов в Москве — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы гарантируем, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 4100 клиентов воспользовались услугой — теперь ваша очередь.

Доступ по ссылке — ответим быстро, без лишних формальностей.

Thanks for the article. Here’s more on the topic https://imgtube.ru/

гардина с электроприводом http://www.elektrokarnizy50.ru .

Сервис Kraken – лучшая торговая площадка в Darknet

Торговая площадка Кракен – одно из крупнейших сообществ в Даркнете, где продаются разные психоактивные вещества, поддельные банкноты, паспорта и удостоверения, предлагается взлом сайтов и пробив информации. Покупателям обеспечивается полная анонимность, а число продавцов постоянно увеличивается.

Товары и услуги на сайте Kraken

На сайте можно найти такие товары и услуги:

• Несколько видов наркотиков – от марихуаны и стимуляторов до опиатов и психоделиков.

• Обналичка криптовалют.

• Взломанные аккаунты VPN.

• Услуги хакеров.

• Разные виды документов.

• Банковские карты и симки.

• Фальшивые деньги – обычно – от 1000 до 5000 рублей.

• Оборудование и приборы – камеры, жучки, электронные ключи.

Кракен поможет и найти работу. В том числе, устроиться курьером или кладменом, варщиком или гровером. Есть возможность самому продавать препараты и другие товары.

Преимущества Кракена

Основные преимущества покупок на Кракене:

• Высокий уровень конфиденциальности всех участников сделки за счёт расположения в Даркнете.

• Использование BTC для совершения сделок. Оплата Биткойнами обеспечивает дополнительную безопасность.

• Возможность забрать товар сразу после оплаты. Клады уже доставлены – нужно только забрать.

• Минимальный риск стать жертвой мошенников. Проблемы можно решить обратившись в поддержку сайта, которая работает круглосуточно.

• Рейтинговая система, которая позволяет быстро найти лучшие магазины.

• Обслуживание России и СНГ. Перечень городов включает сотни наименований.

Пользователям Кракена можно бесплатно использовать службы. Круглосуточно можно получить консультацию у юриста или нарколога. А при появлении проблем – связаться с поддержкой, которая тоже отвечает в любое время.

Дополнительный плюс Кракена – собственный форум. Перейти к нему можно по ссылке в верхней части сайта. На форуме есть основные правила, новости и информация от других посетителей. А ещё исследования площадки и школа кладменов для обмена опытом доставщиков товара.

Как перейти на Кракен

Площадка, который продаёт запрещённые препараты и фальшивки всех видов, запрещён контролирующими организациями. И зайти на него, просто перейдя по ссылке не получится. Для доступа следует использовать зеркальные версии, браузер Тор или VPN-сервис.

Сервисы VPN – способ, который даёт возможность заходить на заблокированный ресурс. В том числе – на площадки в Darknet. Преимущество способа – защита связи, возможность изменения данных входа только в браузере или для ПК. Минусы – замедление скорости и небольшой размер бесплатного трафика.

Второй способ – веб-обозреватель Tor. Чтобы зайти на Кракен нужно пользоваться ссылкой, с доменом «.onion». Достоинства программы – отсутствие оплаты и луковичная маршрутизация, скрытый IP и стирание истории. Минус – сравнительно медленный доступ.

Зеркала сайта – аналог страницы, но расположенный в другом месте. Нет отличий от основной страницы. Есть возможность запуска в обычном браузере. Зеркала будут работать, даже если временно недоступен официальный сайт. Недостаток зеркал – трафик не скрывается, а пользователь в поисках зеркала может попасть на фейковые страницы. Потому список зеркальных версий следует брать на надёжных сайтах. Есть такой перечень на площадке Кракен и тематических форумах.

Регистрация

Чтобы пользоваться сайтом необходима регистрация. после этого можно совершать покупки, использовать форум и дополнительные услуги. Для регистрации от пользователя требуются несколько несложных действий:

1. Перейти по правильной ссылке на сайт и указать проверочный код.

2. В регистрационной форме указать все идентификаторы для входа. Login – английскими литерами. Имя можно вводить на русском.

3. Завершить регистрацию и согласиться с правилами площадки.

Зарегистрированному пользователю идентификаторами можно пользоваться для входа в кабинет. Здесь показываются данные о поданных пользователям заявках, предложениях скидки, настройки аутентификации.

Как совершить покупку на Кракен

Купить товар на Кракене получится при выполнении несложных действий:

1. Выбрать город в перечне вверху. По умолчанию там стоит место, выбранное при первом входе. Дополнительно можно выбрать метро и район города.

2. Найти нужную категорию в расположенном слева меню. Указать вариант размещения товара – например, закладку или прикоп.

3. Познакомиться со списком доступных магазинов. Найти подходящий вариант и зайти на его карточку.

4. Прочитать описание и отзывы. Если всё нормально – нажать на кнопку «Купить».

5. Перейдя на страницу оформления указать способ оплаты. Это может быть Биткоин, карту или телефон или рулетка.

6. Получить адрес клада и взять товар в указанном городе и районе.

7. Написать отзыв, показав другим клиентам, что товар качественный – или наоборот.

8. Запомнить продавца в «Избранное» для быстрого доступа из личного кабинета.

Покупая товар, стоит знать несколько правил. При появлении проблем клиент может открывать с продавцами споры с участием администрации. Правда, в первый раз купить можно только за Bitcoin. При выборе рулетки, открывается доступ к игре. Это даёт шанс заплатить меньше, делая ставки на квадратном поле 10х10. Другой способ уменьшить сумму к оплате – купон. Он подходит чтобы оплатить не больше половины цены покупки.

Гарантии отсутствия обмана

Обращение на Кракен позволяет рассчитывать на качество продукта. Убедить покупателей, что вещества соответствуют требованиям сайта, магазины могут, получив сертификат. Если средство сертифицировано данные об этом показываются в карточке.

Ещё одна гарантия – возможность подтвердить заказ в течение суток. Если клад на месте, он закрывает сделку. Если возникли проблемы – можно открыть спор. Когда виноват продавец, деньги возвращаются покупателю. У владельца товара снижается рейтинг, а постоянное мошенничество может привести уходу с ресурса. Поэтому мошенников на Кракене практически нет

pokiesnet pokiesnet .

dragon slot http://casinosdragonslots.eu .

thepokies250 thepokies250 .

pokies111 https://pokies11.com .

1win онлайн 1win онлайн

the pokies net 250 http://pokiesnet250.com .

Быстро и просто купить диплом об образовании. Заказ диплома ВУЗа через надежную компанию дарит ряд плюсов для покупателя. Такое решение помогает сберечь как личное время, так и значительные финансовые средства. orikdok-2v-gorode-chelyabinsk-74.ru

dragon casino https://casinosdragonslots.eu/ .

pokies.net https://www.pokies11.com .

The Pokies net Australia login http://www.thepokiesnet250.com .

Мы предлагаем оформление дипломов ВУЗов по всей России и СНГ — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы гарантируем, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 2994 клиентов воспользовались услугой — теперь ваша очередь.

Купить диплом Москва — ответим быстро, без лишних формальностей.

бк 1 вин официальный сайт http://1win1113.ru

где можно заказать муравьиную ферму где можно заказать муравьиную ферму .

thepokies250.net https://pokiesnet250.com/ .

thepokies106 thepokies106 .

dragon slots dragon slots .

Купить диплом ВУЗа по выгодной цене возможно, обратившись к проверенной специализированной фирме. Мы предлагаем документы об окончании любых университетов РФ. Заказать диплом о высшем образовании– nadom-dedamoroza.ru/forum/?PAGE_NAME=profile_view&UID=16874

thepokies.net pokies11.com .

карниз с приводом для штор elektrokarnizy50.ru .

The Pokies net Australia The Pokies net Australia .

pokies250 pokies250 .

the pokies net http://www.thepokiesnet101.com/ .

диплом мед колледжа купить https://arus-diplom3.ru/ .

dragonslot https://www.dragonslotscasinos.net .

dragon slots dragon slots .

1win app download iphone https://1win-in1.com/ .

кашпо для напольных цветов недорого http://kashpo-napolnoe-msk.ru – кашпо для напольных цветов недорого .

The Pokies Australia https://pokies106.com .

pokiesnet http://pokiesnet250.com/ .

dragon casino http://www.dragonslotscasinos.mobi/ .

dragon slots dragon slots .

the pokies http://www.thepokiesau.org .

pokies250 pokies250 .

The Pokies net Australia login https://pokies11.com .

карниз для штор электрический http://elektrokarnizy50.ru .

отите|Желаете|Мечтаете] получить есплатный|даровой|халявный] NFT? ?? Участвуйте в озыгрыше|акции|лотерее] от LoveShop “Shop1-biz”! ?? Подробнее

https://shop1300.top/blog/index.htm

#loveshop1300-biz # shop1-biz #loveshop13 #loveshop15 #loveshop16 #loveshop17 #loveshop18

thepokies250.net https://pokiesnet250.com .

Покупка дипломов ВУЗов по всей России и СНГ — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы гарантируем, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 1143 клиентов воспользовались услугой — теперь ваша очередь.

Пишите — ответим быстро, без лишних формальностей.

электрокарнизы цена https://elektrokarnizy50.ru/ .

The Pokies net Australia The Pokies net Australia .

thepokies net106 thepokies net106 .

thepokies250 thepokies250 .

the pokies http://www.pokies11.com .

Покупка дипломов ВУЗов по всей России и СНГ — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы гарантируем, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 2519 клиентов воспользовались услугой — теперь ваша очередь.

Купить диплом о среднем профессиональном образовании — ответим быстро, без лишних формальностей.

скачать игру лаки джет http://1win1111.ru

1xBet—крупный букмекерский сервис,предлагающийразнообразные функцииипривлекательные бонусыдля своих пользователей.Неважно,вы только начали делать ставкиилиопытным игроком,промокоды 1xBet—это отличный способповысить свои шансы на выигрыш.промокоды фриспины — этосекретный промокод,дающая бонус до 32 500 рублей.Действует это предложениетолько для новых игроковипосле регистрацииможно получить 130% на первый депозит.Активируя промокод от 1xBet, вы открываете для себя ряд бонусов.Они позволяют вам получить дополнительные средства для ставок,что дает вам больше возможностей для выигрыша.Эти бонусные средства можно использовать на любые ставки,на спорт, казино, покер и другие игры, предлагаемые 1xBet.Таким образом, вы можете наслаждаться игрой и одновременно увеличивать свои шансы на успех.

Покупка дипломов ВУЗов по всей России и СНГ — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы гарантируем, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 2841 клиентов воспользовались услугой — теперь ваша очередь.

Ознакомиться здесь — ответим быстро, без лишних формальностей.

электрокарниз недорого http://elektrokarnizy50.ru .

mostbet скачать бесплатно http://mostbet11019.ru

pokies net 106 pokies net 106 .

linked here https://vapeheart.shop/

dragon slots http://dragonslotscasinos.net/ .

thepokies111 pokies11.com .

1вин сайт официальный вход 1вин сайт официальный вход

thepokies101.net thepokies101.net .

download mostbet download mostbet

прокарниз http://www.elektrokarnizy50.ru/ .

The Pokies net Australia http://pokies11.com .

thepokies net106 thepokies net106 .

Мы предлагаем документы ВУЗов, которые находятся на территории всей России. Заказать диплом любого ВУЗа:

highdavockmarking.copiny.com/question/details/id/1113316

как активировать бонусы 1win https://1win1114.ru/

pokies106 pokies106 .

электрокарнизы цена https://www.elektrokarnizy50.ru .

авиатор ставки https://www.1win1113.ru

1win app official website http://1win-in1.com .

pokies net 106 pokies net 106 .

карниз с приводом https://www.elektrokarnizy50.ru .

1win букмекерская контора мобильная версия 1win букмекерская контора мобильная версия

the pokies net http://www.thepokiesnet101.com .

Наша компания предлагает максимально быстро купить диплом, который выполняется на оригинальной бумаге и заверен мокрыми печатями, водяными знаками, подписями должностных лиц. Данный документ способен пройти лубую проверку, даже с применением специальных приборов. toptrendyfeed.com/companies/diplomirovans

1win voucher code http://1win11005.com/

thepokies net106 thepokies net106 .

гардина с электроприводом http://www.elektrokarnizy50.ru/ .

заказать пластиковые окна недорого заказать пластиковые окна недорого .

1 win промокод http://1win1112.ru/

официальные букмекеры http://1win1109.ru/

thepokies net101 thepokies net101 .

окна rehau окна rehau .

The Pokies net Australia thepokiesnet101.com .

скачать мостбет казино на андроид http://www.mostbet-download-app-apk.com/ .

thepokies.net http://thepokiesnet101.com/ .

the pokies http://pokies11.com .

кашпо высокое напольное купить http://kashpo-napolnoe-spb.ru – кашпо высокое напольное купить .

1win стать партнером 1win стать партнером

мелбет вход мобильная версия http://mostbet11020.ru/

1win сайт скачать http://1win22096.ru/

melbet казино слоты скачать http://www.mostbet11021.ru

скачать 1win на телефон http://1win22096.ru

опубликовано здесь история дтп по vin

the pokies net 111 login https://www.pokies11.com .

здесь Мега даркнет

Купить документ университета вы можете в нашем сервисе. Заказать диплом ВУЗа по доступной стоимости возможно, обратившись к проверенной специализированной фирме. odnopolchane.net/forum/member.phpu=546804

drenazhnye-sistemy-812.ru .

карнизы с электроприводом купить карнизы с электроприводом купить .

электрокарнизы для штор цена электрокарнизы для штор цена .

автоматические гардины для штор https://karnizy-s-elektroprivodom77.ru .

how to put booking code on 1win http://www.1win11005.com

отзывы о melbet http://mostbet11020.ru

сочетание рулонных рулонные шторы и тюль фото http://www.elektricheskie-rulonnye-shtory77.ru .

айфлоу видеонаблюдение https://citadel-trade.ru .

диплом купить в алматы диплом купить в алматы .

mostbet uz.com скачать mostbet uz.com скачать .

На данном сайте доступна информация по запросу, включая исчерпывающие сведения.

Архивы содержат персон разного возраста, мест проживания.

Сведения формируются из открытых источников, подтверждая точность.

Нахождение производится по фамилии, что делает процесс эффективным.

глаз бога узнать номер

Помимо этого предоставляются места работы и другая полезная информация.

Все запросы выполняются с соблюдением норм права, что исключает утечек.

Воспользуйтесь этому сайту, в целях получения нужные сведения без лишних усилий.

скачать 1вин https://www.1win11002.ru

электрокарнизы для штор купить в москве электрокарнизы для штор купить в москве .

карниз для штор с электроприводом http://karnizy-s-elektroprivodom77.ru/ .

электрокарниз двухрядный http://www.elektrokarniz-nedorogo77.ru .

Thanks for the article. Here’s more on the topic https://great-galaxy.ru/

рулонная штора электро https://elektricheskie-rulonnye-shtory99.ru .

1800/mo profit, listed at 270. Take it now.

Website address: https://blogbaster.org

Death to invaders

карниз с электроприводом карниз с электроприводом .

рулонные шторы с электроприводом на окна http://rulonnye-shtory-s-elektroprivodom15.ru/ .

1win как заработать https://1win11002.ru/

lucky jet как выиграть https://1win22096.ru

айфлоу камеры http://www.citadel-trade.ru/ .

parimatch betting app parimatch betting app .

электрокарнизы для штор купить в москве электрокарнизы для штор купить в москве .

карниз с приводом http://karnizy-s-elektroprivodom77.ru .

Купить диплом под заказ возможно через сайт компании. orikdok-4v-gorode-kazan-16.online

карниз с приводом для штор https://elektrokarniz-nedorogo77.ru/ .

Быстро заказать диплом об образовании. Приобретение документа о высшем образовании через надежную компанию дарит много достоинств для покупателя. Данное решение помогает сберечь время и существенные финансовые средства. orikdok-4v-gorode-perm-59.online

зеркало 1win http://1win22096.ru

рулонные электрошторы elektricheskie-rulonnye-shtory77.ru .

электрокарниз недорого http://elektrokarniz90.ru .

электрокарнизы в москве http://karnizy-s-elektroprivodom77.ru .

электрокарнизы цена электрокарнизы цена .

iflow f ic http://citadel-trade.ru .

sportbets http://www.sportbets14.ru/ .

карнизы с электроприводом карнизы с электроприводом .

купить диплом беларусь купить диплом беларусь .

автоматические гардины для штор karnizy-s-elektroprivodom77.ru .

электрические карнизы купить https://karniz-motorizovannyj77.ru .

iflow домофон http://citadel-trade.ru/ .

электрокарниз двухрядный цена http://www.elektrokarniz-nedorogo77.ru .

ролет штора http://www.elektricheskie-rulonnye-shtory99.ru/ .

автоматический карниз для штор https://www.elektrokarniz90.ru .

рулонные шторы автоматические rulonnye-shtory-s-elektroprivodom15.ru .

купить старый диплом техникума http://www.arus-diplom4.ru/ .

диплом купить во владивостоке диплом купить во владивостоке .

1win букмекерская контора приложение 1win букмекерская контора приложение

карнизы с электроприводом карнизы с электроприводом .

электрокарнизы электрокарнизы .

iflow http://www.citadel-trade.ru .

электрокарнизы в москве http://www.elektrokarniz-nedorogo77.ru/ .

рулонные шторы в москве elektricheskie-rulonnye-shtory77.ru .

карнизы с электроприводом купить карнизы с электроприводом купить .

карнизы для штор купить в москве карнизы для штор купить в москве .

электрокарнизы для штор купить elektrokarniz90.ru .

автоматический карниз для штор elektrokarniz-nedorogo77.ru .

роликовые шторы роликовые шторы .

iflow регистратор citadel-trade.ru .

шторы автоматические http://www.rulonnye-shtory-s-elektroprivodom15.ru .

электрокарнизы для штор цена http://karnizy-s-elektroprivodom77.ru/ .

карнизы с электроприводом карнизы с электроприводом .

электрический карниз для штор купить https://www.elektrokarniz90.ru .

iflow http://www.citadel-trade.ru .

автоматические карнизы для штор автоматические карнизы для штор .

информация в информатике это определение https://homsreti.com информация в информатике это кратко

sportbets http://www.sportbets15.ru/ .

Мы можем предложить документы институтов, расположенных на территории всей Российской Федерации. Купить диплом университета:

formfinance.ru/vash-shans-na-uspeh-diplom-bez-usiliy

рулонные шторы автоматические рулонные шторы автоматические .

рулонные шторы виды механизмов rulonnye-shtory-s-elektroprivodom15.ru .

рулонные жалюзи на окна цена elektricheskie-rulonnye-shtory77.ru .

iflow вызывная панель citadel-trade.ru .

электрокарнизы купить в москве электрокарнизы купить в москве .

melbet партнерская программа melbet партнерская программа

parimatch.in download http://www.parimatch-app-download.com/ .

песни скачать песни скачать .

электрокарниз двухрядный https://www.elektrokarniz90.ru .

mostbet qeydiyyat bonus mostbet qeydiyyat bonus

купить рольшторы цены купить рольшторы цены .

рулонные шторы на пластиковые окна с электроприводом http://www.rulonnye-shtory-s-elektroprivodom15.ru .

Наши специалисты предлагают выгодно заказать диплом, который выполняется на оригинальном бланке и заверен мокрыми печатями, водяными знаками, подписями. Данный диплом способен пройти лубую проверку, даже с применением специально предназначенного оборудования. forum.atel76.ru/viewforum.php?f=24

высокое кашпо для цветов напольное из пластика http://www.kashpo-napolnoe-msk.ru – высокое кашпо для цветов напольное из пластика .

вазон для цветов высокий напольный купить https://www.kashpo-napolnoe-spb.ru – вазон для цветов высокий напольный купить .

wan win http://www.1win22095.ru

карнизы с электроприводом карнизы с электроприводом .

бонусный счет 1win https://www.1win22095.ru

рулонные шторки на окна рулонные шторки на окна .

sportbets http://sportbets15.ru/ .

рулонные. шторы. +на. пластиковые. окна. купить. http://www.rulonnye-shtory-s-elektroprivodom15.ru/ .

It is interesting to observe how each area has its own trends and approaches to solving complex problems. People are united by the desire to increase efficiency and achieve maximum results, even in difficult situations. It is often the right choice of components that becomes the key to stable operation.

For example, in industry and construction, the reliability of equipment largely depends on the parts used. The use of professional hydraulic lines for special equipment allows you to ensure a long service life and reduce the likelihood of breakdowns, which is important for any business.

рулонные шторы на окна недорого http://elektricheskie-rulonnye-shtory77.ru .

рулонные шторы на окна недорого рулонные шторы на окна недорого .

1вин бонусы казино 1вин бонусы казино

рулонные шторы виды механизмов rulonnye-shtory-s-elektroprivodom15.ru .

sportbets https://sportbets14.ru/ .

автоматические рулонные шторы с электроприводом на окна http://www.elektricheskie-rulonnye-shtory99.ru .

mostbet qeydiyyat bonusu http://www.mostbet4042.ru

электрические рулонные шторы купить москва rulonnye-shtory-s-elektroprivodom15.ru .

бк 1 win бк 1 win

1хставка лайв 1хставка лайв

mostbet az canlı dəstək https://www.mostbet4041.ru

sportbets http://sportbets15.ru .

кашпо напольное высокое http://kashpo-napolnoe-msk.ru – кашпо напольное высокое .

Thanks for the article. Here’s more on the topic https://shvejnye.ru/

кашпо для цветов напольное пластик http://www.kashpo-napolnoe-spb.ru – кашпо для цветов напольное пластик .

купить рольшторы цены купить рольшторы цены .

mostbet hesab yaratmaq http://mostbet4042.ru/

рулонные шторы с автоматическим управлением http://www.elektricheskie-rulonnye-shtory77.ru .

mostbet aviator oyunu https://mostbet4043.ru

888 starz tanzania 888 starz tanzania .

sportbets https://sportbets15.ru .

Покупка дипломов ВУЗов в Москве — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы даем гарантию, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 1378 клиентов воспользовались услугой — теперь ваша очередь.

Обращайтесь — ответим быстро, без лишних формальностей.

Купить диплом на заказ можно используя официальный портал компании. orikdok-1v-gorode-voronezh-36.online

Заказать диплом о высшем образовании. Заказ подходящего диплома через качественную и надежную компанию дарит немало плюсов для покупателя. Такое решение помогает сэкономить как личное время, так и значительные деньги. orikdok-2v-gorode-saratov-64.online

напольное кашпо для цветов высокое пластик https://kashpo-napolnoe-msk.ru/ – напольное кашпо для цветов высокое пластик .

Покупка дипломов ВУЗов по всей России и СНГ — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы гарантируем, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 2187 клиентов воспользовались услугой — теперь ваша очередь.

Ознакомиться здесь — ответим быстро, без лишних формальностей.

Покупка дипломов ВУЗов в Москве — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы гарантируем, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 2012 клиентов воспользовались услугой — теперь ваша очередь.

Здесь — ответим быстро, без лишних формальностей.

sportbets http://sportbets14.ru/ .

Заказать диплом института по выгодной стоимости возможно, обратившись к проверенной специализированной фирме. Заказать документ о получении высшего образования можно у нас в Москве. orikdok-5v-gorode-mahachkala-5.ru

sportbets https://www.sportbets15.ru .

купить в казани диплом купить в казани диплом .

рулонные шторы с электроприводом на пластиковые окна http://www.elektricheskie-rulonnye-shtory77.ru .

Мы можем предложить дипломы любых профессий по выгодным ценам. Купить диплом СССР — kyc-diplom.com/diplom-sssr.html

Мы изготавливаем дипломы психологов, юристов, экономистов и любых других профессий по доступным ценам. Мы предлагаем документы техникумов, которые расположены на территории всей России. Документы делаются на бумаге высшего качества. Это позволяет делать настоящие дипломы, не отличимые от оригинала. orikdok-2v-gorode-perm-59.ru

this contact form https://web-jaxxwallet.io

sportbets http://www.sportbets14.ru/ .

sportbets https://sportbets15.ru .

read review jaxx wallet

сайт мостбет mostbet33010.ru

888starz bonus https://888starzz.site .

sportbets http://sportbets15.ru/ .

здесь kraken зеркало рабочее

sportbets sportbets14.ru .

mostbet promo kod http://www.mostbet4041.ru

Мы готовы предложить дипломы психологов, юристов, экономистов и прочих профессий по приятным ценам. Покупка диплома, подтверждающего обучение в университете, – это рациональное решение. Заказать диплом любого университета: o2cloudsystems.com/kupit-diplom-legko-i-bystro-80

Заказать диплом об образовании!

Мы изготавливаем дипломы любой профессии по выгодным тарифам— good-diplom.ru

диплом купить медсестры диплом купить медсестры .

888starz 888starz .

sportbets http://sportbets14.ru/ .

mostbet.com mostbet.com

рулонные шторы на окна цена https://elektricheskie-rulonnye-shtory77.ru .

sportbets http://www.sportbets14.ru .

888starz вход 888starz вход .

1xwin официальный сайт http://1win1132.ru/

скачать 888 starz ру скачать 888 starz ру .

blog here jax wallet

ван вин казино 1win1115.ru

888starz partners 888starz partners .

Hello .

Hi. A 18 fine website 1 that I found on the Internet.