From copilots to coordinated, autonomous systems, agentic AI is emerging as a major driver of productivity, investment, and competitive advantage across Europe.

Tag: venture capital

When One Technology Serves Two Worlds: AI and Europe’s Dual-Use Challenge

Artificial intelligence is increasingly operating in a dual-use context, where the same capabilities support both civilian innovation and security applications. This article explores how AI is reshaping Europe’s dual-use technology landscape—and what it will take to turn innovation momentum into strategic capability.

How Institutional Investors Can Power the Next Wave of Innovation: Pension Funds and Sovereign Wealth Funds

A new StepUp StartUps report, Untapped Opportunities for European Venture Capital: Pension Funds and Sovereign Wealth Funds, highlights how Europe can bridge its scale-up financing gap by unlocking institutional investment. The study reveals that EU pension and sovereign wealth funds—managing trillions in assets—remain underrepresented in venture capital. Through smarter regulation, stronger integration, and cross-border collaboration, Europe can mobilize its own wealth to fund the next generation of innovative companies.

World in Crisis: Where Will Venture Capital Go

Geopolitical tensions, the war in Ukraine, inflation, pandemic, and supply chain disruptions are starting to affect the markets. The pandemic led to a large surge of investments in health tech; the chip shortage revives large scale plant developments like Intel’s 1bn EUR investment in Germany and the Ukraine crisis accelerates interest in cybersecurity. Explore how geopolitical tensions and market uncertainties affect venture capital and review challenges for ecosystems to adapt and grasp emerging opportunities.

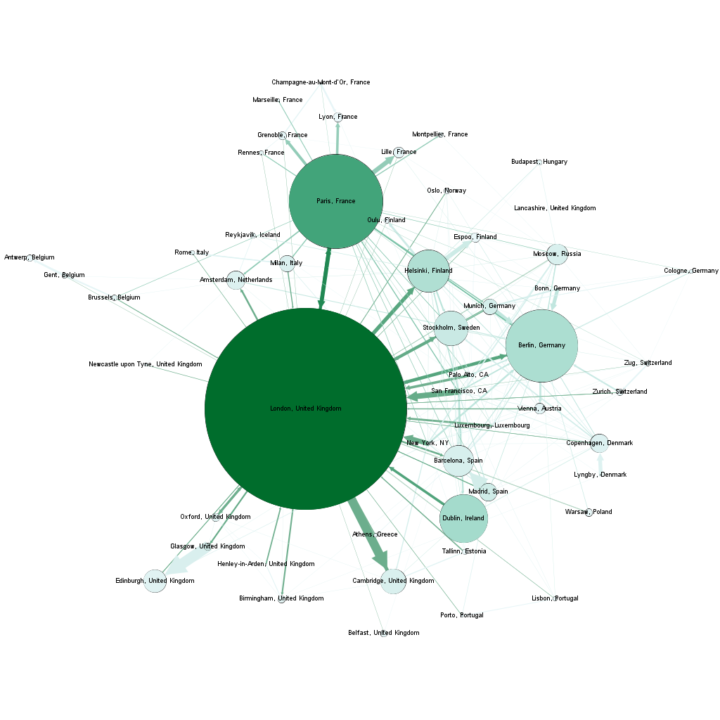

Capital follows Capital – not Talent: Europe’s Spatial Mismatch of Talent and Capital

To make a startup successful a mix of ingredients is necessary. Two of the most important components are talent and capital. In contrast to Silicon Valley, where both largely concentrate in the same place, Europe has to wonder if it can bring both together in one location. With the Startup Heatmap Europe Survey we have shown

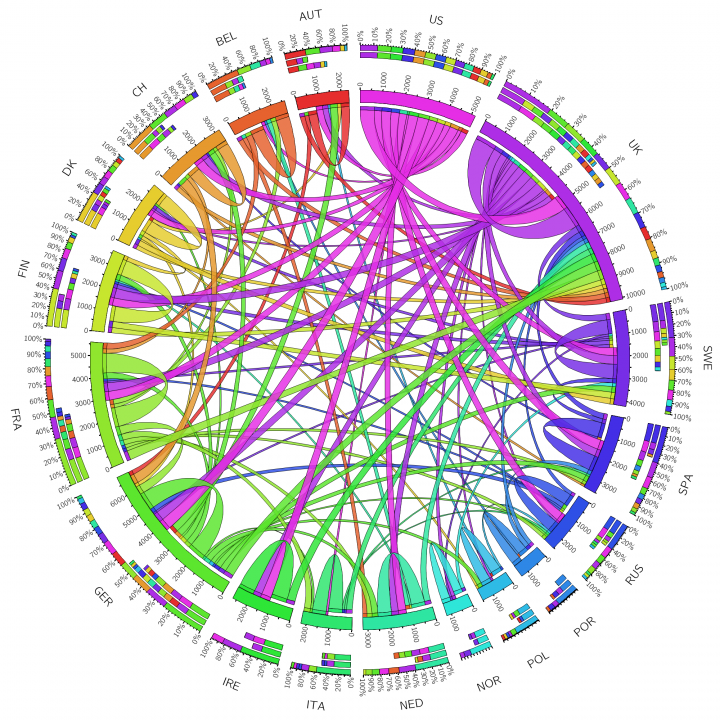

Where are startup investments in the EU coming from?

Which role does location play for a startup to get funded? Is capital truly mobile and do investors invest in all locations equally? These are the questions that kept us – as creators of the Startup Heatmap Europe – awake at night. Well, we thought, why not start having a look! Armed with access to

Continue reading Where are startup investments in the EU coming from?