Switch Dataset:

Startup News

We are collecting the most relevant tech news and provide you with a handy archive. Use the search to find mentions of your city, accelerator or favorite startup in the last 1,000 news items. If you’d like to do a more thorough search, please contact us for help.

Search for any keyword to filter the database with >10,000 news articles

Filter

Filter search

Results

| id | date | title | slug | Date | link | content | created_at | feed_id |

|---|---|---|---|---|---|---|---|---|

| 51,749 | 30/12/2025 06:00 PM | Almost 80 European deep tech university spinouts reached $1B valuations or $100M in revenue in 2025 | almost-80-european-deep-tech-university-spinouts-reached-dollar1b-valuations-or-dollar100m-in-revenue-in-2025 | 30/12/2025 | 30/12/2025 06:10 PM | 7 | ||

| 51,748 | 30/12/2025 03:30 PM | VCs predict enterprises will spend more on AI in 2026 — through fewer vendors | vcs-predict-enterprises-will-spend-more-on-ai-in-2026-through-fewer-vendors | 30/12/2025 | 30/12/2025 04:10 PM | 7 | ||

| 51,747 | 30/12/2025 03:00 PM | The top 26 consumer/edtech companies from Disrupt Startup Battlefield | the-top-26-consumeredtech-companies-from-disrupt-startup-battlefield | 30/12/2025 | 30/12/2025 03:10 PM | 7 | ||

| 51,746 | 30/12/2025 02:05 PM | How to position your startup as “the one to watch” before fundraising | how-to-position-your-startup-as-the-one-to-watch-before-fundraising | 30/12/2025 | Raising a funding round does not start when you share your deck. It starts long before that moment, with the reputation, presence, and profile you build in the months leading up to it. Investors form early impressions well before a formal process begins, and those impressions are shaped by how clearly you communicate your vision, how visible you are in your space, and how consistently you show up. In an increasingly competitive ecosystem and a challenging fundraising market, startups that manage to position themselves as the ones to watch enter their fundraising process with stronger momentum, higher trust, and significantly better odds. This article breaks down the fundamentals of how founders can position their startup as “one to watch” in the context of a funding round. From sharpening the narrative to building visibility and credibility, it is important to have a strategy and to implement it consistently. Having worked closely with founders and investors across Europe, I have seen repeatedly how early positioning can define the trajectory of a fundraise. When done well, it enables better conversations with investors, builds trust, and creates more excitement around what you are building. While this varies somewhat between B2B and B2C companies, and across different industries, some fundamentals remain the same. So how do you build that momentum before you ever send out a pitch deck? Start with clarity: sharpen your narrative before you amplify itBefore you can become the startup everyone talks about, you need to understand what you stand for. The strongest market positioning always starts with a clear, sharp, defensible narrative, one that answers three questions:

This is not about broad mission statements. It is about a positioning that is specific, repeatable, and memorable, one that investors can recall after a single conversation. A strong narrative becomes the anchor for every future touchpoint: your product messaging, PR, content, pitch, and eventually your fundraising. Founder reputation is key: people invest in peopleA founder’s personal brand is a major driver of fundraising success. Building a strong and credible personal brand matters because investors assess:

A founder’s personal presence across LinkedIn, interviews, events, or communities becomes a proxy for leadership. Particularly in the early stages, conviction is built around the founding team, not just the product.

Build early thought leadershipStartups often wait too long to show what they know. Being vocal about the problem you are solving and owning the conversation around the relevant aspects of your sector helps establish credibility. Founders who consistently articulate insights, patterns, and shifts in their market signal that they deeply understand the territory they are building in. Thought leadership is not about loud opinions. It is about consistent, value-driven commentary, such as:

This positions you not just as a founder, but as a domain expert, which helps build trust with investors. Build a playbook and execute consistentlyPositioning your startup as “one to watch” is not a campaign; it is a system. A practical visibility playbook includes:

The goal is not to be everywhere. It is to show up intentionally and consistently, in ways that align with your strengths. Consistency builds trust. Strong storytelling drives excitement. Together, they foster investor interest. Becoming “the one to watch” is not about hype or theatrics. It is about clarity, presence, consistency, and credibility. When founders invest in their positioning early, fundraising becomes an extension of a story that is already in motion, one that is consistently reflected in the pitch deck, online touchpoints, and relevant media outlets. The post How to position your startup as “the one to watch” before fundraising appeared first on EU-Startups. |

30/12/2025 03:10 PM | 6 | |

| 51,745 | 30/12/2025 11:08 AM | Octopus Energy to spin out AI utility platform Kraken at €7.3B valuation after €850M funding round | octopus-energy-to-spin-out-ai-utility-platform-kraken-at-euro73b-valuation-after-euro850m-funding-round | 30/12/2025 | Octopus Energy Group has raised €850 million ($1 billion) for its technology company, Kraken. The round is the first standalone investment into Kraken and values the business at €7.3 billion ($8.65 billion). This transaction establishes Kraken’s formal independence and demerger from Octopus. The round was led by D1 Capital Partners, with participation from Fidelity International, Durable Capital Partners and Ontario Teachers’ Pension Plan Board, via its late-stage growth business Teachers’ Venture Growth. Existing Octopus Energy investors also participated. Greg Jackson, Founder of Octopus Energy Group, said, “Kraken is in a class of its own, in terms of technology, capability, and scale. As an independent company with world-class backers and outstanding leadership, it will be free to grow even faster and is set to be a true UK-founded success story. “Having incubated Kraken, Octopus is a powerhouse of innovation and technology, and will now have even more horsepower to deliver the transformation of energy globally. With over 10 thousand staff, 11 million customers, $10bn of generation under management, and businesses from EV leasing to heat pump design and manufacture, Octopus is set for even greater things over the coming years.” According to the press release, Investors led by Octopus Capital are also injecting a further €271.7 million ($320 million) into Octopus for innovation and growth. Under the terms of the deal, Octopus Energy will retain a 13.7% stake in Kraken post-spinout. Kraken is an end-to-end, AI-powered operating system for utilities. It claims that it supports 70+ million accounts globally through licensing agreements with major utilities. The demerger enables Kraken to operate as a fully independent technology platform for utilities worldwide. It now operates as a separate company with a separate cap table, independent governance, and leadership. Amir Orad, CEO of Kraken, said, “Becoming an independent company gives Kraken the focus and freedom to scale as a neutral, global operating system for utilities, with Octopus Energy remaining a key innovation partner and forward-thinking global customer. “I’m excited to welcome our new investors, led by D1. With their backing, we can accelerate our impact on the energy transition, deepen partnerships with utilities worldwide, and help modernise the energy system at global scale – our goal being to positively impact a billion lives within a decade.” In September, Kraken also reported that its contracted annual revenues exceeded €424.5 million ($500 million) in 2025. Kraken is headquartered in London and New York, with regional centres in Paris, Tokyo and Melbourne. It works with utilities like EDF Energy, E.ON Next, Octopus Energy, Origin, Plenitude, Portsmouth Water, National Grid, and Tokyo Gas. Octopus Energy is a global clean energy and technology business operating in 27 countries and the entire energy value chain. It operates a €8 billion (£7 billion) renewables portfolio, as well as EV leasing, heat pump, and solar businesses. The post Octopus Energy to spin out AI utility platform Kraken at €7.3B valuation after €850M funding round appeared first on EU-Startups. |

30/12/2025 12:10 PM | 6 | |

| 51,743 | 30/12/2025 10:11 AM | ESA at 50: What Europe’s space agency means for startups today | esa-at-50-what-europes-space-agency-means-for-startups-today | 30/12/2025 | In 2025, the European Space Agency turned 50. Founded on 30 May 1975, when the ESA Convention was signed by ten Member States, it has since grown into a pan-European institution spanning 23 Member States, three Associate Members, and a widening network of international cooperation agreements. Anniversaries are good moments for celebration — but also for taking stock. ESA’s last five decades have been defined by scientific ambition, industrial development, and European cooperation. Its next chapter will be shaped just as much by commercial competition, geopolitics, and the very down-to-Earth reality that space is now critical infrastructure: for connectivity, navigation, climate monitoring, security, and more. To understand what this shift looks like in practice, I spoke with founders and operators working with ESA across manufacturing, sustainability, launch, Earth observation, and space traffic management. From components to full systems — and the leap to GEO

For Emile de Rijk, CEO of SWISSto12, ESA’s role is clearest when you look at how European companies move up the value chain: from specialist components to full, commercially viable systems. SWISSto12, founded in 2011 as a spin-off from Switzerland’s Federal Institute of Technology, was an early adopter of 3D printing for RF and antenna products. Over time, it expanded into complete satellite communications systems — user terminals for aircraft, ships, vehicles, and ground stations. Then came a bigger pivot: geostationary orbit. GEO is the connectivity sweet spot — satellites appear fixed from Earth and cover vast areas — but historically it has been the domain of enormous, bespoke platforms with eye-watering price tags. SWISSto12’s answer was HummingSat, a compact, lower-cost GEO platform aimed at making that orbit commercially accessible. ESA, de Rijk told me, has been part of the story for a decade. “Every time we took a step forward — towards more integrated, complex products — ESA was there to co-fund developments and provide technical expertise,” he said.

That support, he added, helped SWISSto12 win its first commercial satellite contracts — and he’s clear about how he views the relationship.

De Rijk also credits ESA with becoming more pragmatic about how different missions should be run. “If you’re launching a deep-space mission, you only get one shot — so the process must be conservative,” he said.

Making space matter on Earth: sustainability and downstream demandThat idea — that space is increasingly about real-world outcomes — sits at the centre of Daniel Smith’s work. Smith is a founding director of five space companies and Scotland’s first sector-specific Trade & Investment Envoy for Space. Through comms and marketing intelligence agency AstroAgency, he has worked with ESA on space sustainability and downstream applications. AstroAgency was the first UK commercial space company to sign ESA’s Statement for a Responsible Space Sector, and later partnered with ESA’s Space Sustainability team after delivering Scotland’s Space Sustainability Roadmap. For Smith, ESA’s influence is often most powerful in the “non-funding” category: convening, credibility, and doors opening. “Initiatives like the Responsible Space Statement open doors, promote best practice, and engage key stakeholders — including other space agencies,” he said.

AstroAgency’s mission is to shift how the sector talks about itself.

The company has supported more than 20 Earth observation businesses across ESA member states, helping them translate technical capability into language that makes sense to non-space buyers. “Often, that means leading with end-user benefits — and only later mentioning that the data comes from space,” Smith said. And in his view, that downstream market is where the real growth is. “ESA has a critical role in pushing this narrative forward,” he said.

ESA as enabler — and as an anchor customer for data

A similar point comes through from James O’Connor, Head of Imagery at SatelliteVu (SatVu) After HotSat-1 launched, ESA ran a data evaluation exercise to validate the accuracy of the pipeline, and later purchased archive imagery to make freely available to researchers through an announcement of opportunity. From O’Connor’s perspective, ESA has increasingly signalled that it wants to be part of enabling commercial EO providers — including through anchor-style contracts. “Programs like Copernicus Contributing Missions and Third Party Missions show real commitment to enabling commercial data providers,” he said, although he noted decision-making can still feel opaque or slow. He credited ESA Director General Josef Aschbacher with cutting the time from announcement to award, and wants to see commercialisation become more explicit alongside science.

Launch is different: risk, tempo, and the need for early demand. If “anchor customer” matters in data, it’s even more existential in launch.

Stella Guillen, Chief Commercial Officer at Isar Aerospace, argues that ESA support is important — but the mechanism has to match the market. “ESA’s support can be crucial for startups entering the market and scaling,” she said.

Isar Aerospace, founded in 2018 as a Technical University of Munich spin-off provides cost-efficient, flexible launch services for small and medium satellites and constellations. For Guillen, ESA’s most valuable role would be to take early, calculated risk as a customer. “Acting as an anchor customer — willing to accept higher risk in early maturation phases — is especially important for launch companies,” she said.“It helps us build credibility with other stakeholders.” And she’s blunt about where leverage sits for emerging players.

Space traffic management: credibility, validation, and a faster ESA

As orbit gets more crowded, OKAPI:Orbits sits in the infrastructure layer of the space economy: the tools that help keep satellites safe and space usable. Founded in 2018, the company uses AI-driven data fusion to predict and manage orbital risks — from collision avoidance to interference. CEO Kristina Nikolaus said ESA has played a meaningful role in both development and validation through ESA BIC, the General Support Technology Programme (GSTP), and ESA COSMIC (Competitiveness). “The processes are generally clear and transparent,” she said. That support comes amid a step change in ESA’s overall ambition. In November, ESA Member States committed a record-breaking €22.1 billion in funding, significantly expanding Europe’s space technology agenda. Central to this is the enlarged GSTP, which secured around €5 billion for technology development — a 70 per cent increase on the previous cycle — spanning everything from early-stage research to in-orbit demonstration. The programme also introduced a new Resilience and Security Component, reinforcing Europe’s focus on sovereignty and operational robustness. “GSTP can be slow — that’s expected — but COSMIC was significantly faster,” Nikolaus explained. Coordination can be a headache, Nikolaus noted, with multiple points of contact across ESA and national agencies — but the credibility payoff is real. “ESA contracts helped us build trust in the industry,” she said. “COSMIC allowed us to benchmark against ESA standards and publish our results, which were very positive.” She also sees ESA evolving. “Newer programmes like COSMIC show a real shift towards agility,” Nikolaus said.

Inside ESA: sovereignty, fragmentation, and learning from New SpaceFrom within ESA, Polyzois Kokkonis, Future Programs Officer frames the agency’s role in terms of sovereignty — not only ownership, but capability.

He also pointed to the growing “democratisation” of space, driven by New Space trends such as smaller satellites, cheaper launches, and commercial off-the-shelf components.

But he also flags Europe’s structural disadvantage: fragmentation. “The US benefits from a unified market and consistent regulation,” he said.

At 50, the European Space Agency as an organisation characterised towards impact on Earth, commercial enablement, and strategic resilience. Whether helping companies climb the value chain, acting as a first customer for data and services, or translating space capabilities into downstream applications that matter to non-space users, ESA has become a critical bridge between public ambition and commercial reality. At the same time, geopolitics has sharpened ESA’s role in resilience and security. Space is now critical infrastructure, underpinning climate monitoring, crisis response, defence, connectivity, and economic stability. The scale-up of programmes like GSTP, the creation of dedicated resilience and security components, and faster, more agile mechanisms such as COSMIC reflect a clear shift: Europe is no longer just investing in space excellence, but in space capability as sovereignty. ifty years on, ESA’s relevance is not just intact; it is increasingly grounded — in Earth’s needs, Europe’s competitiveness, and the security of the space environment itself. Image: Europe at night from space. Photo: ESA. |

30/12/2025 11:10 AM | 1 | |

| 51,744 | 30/12/2025 09:37 AM | A call for broader thinking: The dangers of narrow sovereignty in European tech | a-call-for-broader-thinking-the-dangers-of-narrow-sovereignty-in-european-tech | 30/12/2025 | There is no denying that European tech sovereignty is in vogue. After years of voices from the sidelines warning of the risks of Europe being invisible in the echelons of big tech, such warnings have gone mainstream. But what does it mean to be a European company? For every homegrown champion startup built in and for Europe, there is a Spotify, built in Europe but selling into the global market. What about the European founders who move to the US? Is their company no longer European? The answers to these questions are important. A rigid scope for what is treated and championed as a European startup risks sovereignty drives, excluding those startups with European DNA that are building to become global leaders and overlooking the contributions they can make to the overall European ecosystem. Europe’s structural barriers to scaleMany factors contribute to the contrasting sizes of the US and European tech ecosystems. One is geography, and it is especially important in the current debates around European tech sovereignty. In the US, a common language and culture across a nation of more than 300 million make it an easier market in which to scale a tech company. Europe, on the other hand, has a diverse amalgamation of languages and cultures. A successful Europe-wide GTM strategy, therefore, requires considerable relocation and localisation. This is why unicorns seen in large European countries, such as France, are often built to serve their local markets. They benefit from inflows of sovereign capital that is deployed to nurture homegrown tech as well as a regulatory landscape that favours their market access over entrants from the US and elsewhere. This does not ring true for the whole of Europe. Founders in countries with relatively small populations, such as Sweden and Estonia, have no choice but to build for a global audience. That has led to the creation of global companies like Spotify, Bolt and Lovable. Founders in the UK, Germany and France can take inspiration from this mindset. After all, founders in the Bay Area are not building tech companies to be leaders in the US. They are building companies on a global scale from day one. The same ambition should be seen when discussing European tech becoming great. Why a startup’s location does not have to be clear-cutIt is easy for European founders to be hesitant to shift focus to the US. Europe is an excellent place to retain product, talent and IP. There is, however, often a middle way. Datadog is an example. A truly global market-leading SaaS company that is Nasdaq-listed, but with two French founders and hundreds of employees based in France. The company succeeded in the US without losing its links to Europe, and the European tech ecosystem has benefited. The Datadog alumni who are building in Europe today are proof of that. The need to build a heavy presence in the US to enter that market also varies by business type. Startups selling to consumer businesses or with self-serve models find it easier to set up global distribution out of Europe. French firm Augment is an excellent example. It has succeeded in selling online MBAs to users in the US, Canada and the Middle East without moving from Paris. What it takesNone of this is to say that a pivot to the US is simple. No matter the business model, European startups need an on-the-ground team to win in the US. That means hiring support and account management teams and establishing effective product-market fit. For startups that plan on selling into Fortune 500 companies, hiring a US sales leader with experience selling to these companies is essential. To make all of this work, one of the founders typically moves to the US and drives the US expansion. US expansion, however, does not have to mean relocating headquarters to the US. This may seem straightforward for European founders who want to scale more quickly and tap into the larger pools of capital in the US, but there are disadvantages. In the US, many European companies come up against the challenge of being small fish in a large pond. Maintaining a European HQ while building a US footprint is a viable alternative. The investors that startups partner with play an important role in making this work. If an investor cannot support a portfolio company’s expansion into new global markets with on-the-ground support and introductions to in-region founders and sales prospects, for example, then their strategic value at that stage of the company’s life cycle is limited. Ambition to fuel successThe various campaigns for European tech sovereignty are a hugely positive and much-needed force. But there is nuance to consider carefully. Drives to build local ecosystems should be matched with encouragement and incentives for European founders to think big and build globally. Such founders can succeed without losing their European roots and can strengthen the overall European tech ecosystem. The post A call for broader thinking: The dangers of narrow sovereignty in European tech appeared first on EU-Startups. |

30/12/2025 11:10 AM | 6 | |

| 51,742 | 30/12/2025 08:18 AM | French chipmaker NanoXplore raises €20 million to expand into defence and strengthen Europe’s electronic sovereignty | french-chipmaker-nanoxplore-raises-euro20-million-to-expand-into-defence-and-strengthen-europes-electronic-sovereignty | 30/12/2025 | NanoXplore, a French fabless company, has secured €20 million in funding to speed up its diversification into the defence sector by developing security-focused products and to back its strategic external growth plans in Europe. The funding was raised from European defence company MBDA and the Defence Innovation Fund managed by Bpifrance. “As an independent French company, we have shown that it is possible to design and produce state-of-the-art advanced electronic chips in Europe. This funding round will allow us to go further: accelerate our diversification into defence with products specifically designed for these markets, while continuing a strategy of targeted acquisitions in Europe. Our ambition is clear: to make NanoXplore the reference player for European electronic sovereignty,” Édouard Lepape, CEO of NanoXplore noted. Founded in 2013, NanoXplore is an independent, family-owned Fabless IC design company that offers radiation-hardened components with a complete software suite. It produces FPGAs (Field Programmable Gate Arrays), programmable and reconfigurable integrated circuits that are “hardened” against radiation (“rad-hard”), making them capable of operating in extreme environments such as space or certain defence systems. The company recently launched NG-ULTRA, which it claims is the world’s most advanced rad-hard SoC FPGA (System-on-Chip Field-Programmable Gate Array). In addition to high-reliability components, the company positions itself as supporting European electronic sovereignty. NanoXplore claims to rely on a 100% European supply chain, including for chip manufacturing, thereby earning it the “ITAR-free” label. ITAR stands for International Traffic in Arms Regulations, and is a set of regulations administered by the US Department of State’s Directorate of Defence Trade Controls (DDTC) that controls the export and transfer of defence-related articles, services and technical data. Being “ITAR-free” means that NanoXplore’s products are not subject to US defence export regulations. NanoXplore also reported that its circuits are already embedded in major space programmes, including the Galileo and Copernicus missions, and provide a sovereign alternative to non-European components. “This equity investment fully aligns with the strategy of the Defence Innovation Fund. NanoXplore embodies exactly what we aim to support: an innovative French SME mastering technologies that are critical to our sovereignty. Their ‘ITAR-free’ approach with a 100% European supply chain addresses the strategic priorities of our defence technological and industrial base. By supporting the growth of this technology champion—its diversification from space into defence and its European growth strategy—we are helping strengthen Europe’s technological autonomy in a sector as sensitive as critical microelectronics,” commented Nicolas Berdou, Investment Director of the Defence Innovation Fund at Bpifrance. Regarding its investors, NanoXplore stated in the press release: “MBDA brings its industrial footprint and deep understanding of European armed forces’ operational needs. Bpifrance, through the Defence Innovation Fund, aligns this transaction with its strategy to support the French defence technological and industrial base, backing an SME that plays a key role in securing the electronic components supply chain as an essential European champion in its field.” With this fresh capital, the company aims to accelerate its diversification from space into defence by developing a new generation of components specifically designed for these uses (secured FPGAs, ultra-low power) and adapting existing technologies to the needs of land, air and naval systems. The funding will also be deployed to support a growth strategy in Europe through strategic acquisitions of companies and complementary expertise. This will help the company to broaden the product portfolio and consolidate Europe’s industrial base in critical microelectronics. The post French chipmaker NanoXplore raises €20 million to expand into defence and strengthen Europe’s electronic sovereignty appeared first on EU-Startups. |

30/12/2025 09:10 AM | 6 | |

| 51,741 | 29/12/2025 09:00 PM | How to make your startup stand out in a crowded market, according to investors | how-to-make-your-startup-stand-out-in-a-crowded-market-according-to-investors | 29/12/2025 | 29/12/2025 09:10 PM | 7 | ||

| 51,740 | 29/12/2025 03:00 PM | The 32 top enterprise tech startups from Disrupt Startup Battlefield | the-32-top-enterprise-tech-startups-from-disrupt-startup-battlefield | 29/12/2025 | 29/12/2025 03:10 PM | 7 | ||

| 51,739 | 29/12/2025 01:44 PM | Charging ahead: Why the next European electric wave will run on 18 wheels | charging-ahead-why-the-next-european-electric-wave-will-run-on-18-wheels | 29/12/2025 | Europe’s decarbonisation journey is often told through the lens of renewable generation, smart grids and electric passenger cars. Yet one of the biggest and least transformed sectors is only now shifting gears: heavy-duty road freight. Trucks are the backbone of European logistics and the arteries of modern trade. They are also among the hardest segments to decarbonise. But this is changing fast, and with it emerges what could become Europe’s next trillion-dollar market opportunity. Heavy-duty vehicles (HDVs) account for more than a quarter of all road transport emissions in the EU and over 6% of total greenhouse gas emissions. Despite this, only around 1.2% of newly registered HDVs in 2024 were fully electric across the EU-27. The gap between ambition and adoption is striking, and it signals one of the most untapped opportunities of the decade. Across Europe, roughly 6 million trucks of 3.5 tonnes and over are on the road today, representing more than two terawatt-hours of potential mobile battery capacity. To put that in perspective: the Iberian power outage in 2025 was triggered by the sudden loss of just 2.2 gigawatts, about a thousandth of that capacity, causing cascading voltage failures that brought down the entire Spanish and Portuguese grid within seconds. Even partial electrification of this fleet has the power to reshape the energy and transport system, unlocking operational flexibility and supporting decarbonisation without requiring unrealistic grid-scale interventions. Building the backbone: Depot-centric chargingFor electric trucks to scale, charging infrastructure will not necessarily need megawatt corridors across Europe. Instead, the transition is likely to be dominated by private depot charging, where fleets can recharge with 200–400 kW chargers, technology that is already proven, cost-effective, and easy to integrate with existing grid connections. Larger megawatt charging points will exist, but their utilisation may be limited due to high costs and slower deployment timelines. This depot-centric model allows companies to co-locate solar PV and battery storage, creating self-sufficient charging hubs that minimise electricity costs and maximise asset utilisation. Over time, depots can gradually open up to third-party fleets, improving utilisation and creating new business models for shared energy infrastructure. It is ultimately the software layer, optimising routes, energy flows, and TCO (total cost of ownership), that will accelerate eTruck adoption, not faster or larger chargers alone. Europe’s logistics ecosystem offers a structural advantage here. Most trucking companies own their vehicles and employ drivers directly, enabling coordinated fleet transitions and centralised charging management (ACEA). By contrast, fragmented ownership models in other markets make rapid electrification more difficult. Europe’s vertical integration provides a unique platform for scaling depot-based charging efficiently and economically. Trucks as flexible assetsA single 40-tonne electric truck carries a battery of several hundred kilowatt-hours. While vehicle-to-grid integration may eventually provide additional revenue streams, real-world adoption is limited as trucks are most valuable on the road rather than idle. The immediate economic driver for fleet operators is the total cost of ownership: comparing electric trucks with diesel, factoring in fuel savings, maintenance, toll exemptions, and regulatory incentives. Recent policy extensions, such as the continuation of eTruck toll reductions in Germany, further strengthen the business case. Electrifying freight is also accelerating battery and software innovation. Advances in high-density battery chemistry, thermal management, depot energy management, and fleet optimisation software are enabling smoother transitions and improving operational efficiency. According to Mordor Intelligence, the European electric truck market is expected to grow at a compound annual rate of over 30% through 2030. Each truck on the road represents not just a cleaner vehicle but a node in a flexible, digital, and monetisable logistics network. A European structural advantageEurope’s traditional industrial strength in commercial vehicles, its cohesive regulatory environment and its early leadership in grid digitisation create a favourable foundation for transformation. The European model, with vertically integrated fleet ownership and public policy alignment, allows the design of holistic systems where trucks, depots, chargers and the grid are treated as parts of a single ecosystem. The US, by contrast, will likely require an entirely different approach based on decentralised service providers, franchise models and financial incentives to align fragmented players. In this race, Europe has the advantage of coordination. What this means for founders and investorsSuccess in heavy freight electrification requires a systems mindset. Trucks, batteries and charging infrastructure are interconnected components of a broader energy and logistics ecosystem. Founders who align data, energy flows and fleet operations will create scalable businesses that evolve alongside grid intelligence and renewable integration. The real opportunity lies in digital platforms rather than just hardware. Predictive maintenance, energy-as-a-service and grid-responsive charging enable recurring revenue and create defensibility in a sector traditionally dominated by physical assets. Partnerships are critical: lasting collaborations with fleet operators, utilities and grid stakeholders across markets will determine who scales and who stays in demonstration mode. For investors, this transition is as much an energy and industrial opportunity as it is a transport shift. Depot electrification, integrated PV and battery systems, and software-enabled operations represent infrastructure with asset-backed returns. Policy acts as a catalyst, providing visibility and demand signals for the next decade. If Europe continues to align policy, infrastructure investment and private capital, it can become the global leader in heavy-duty electrification. Truck manufacturers, charging providers, battery startups and utilities all stand to gain from a new industrial renaissance built on clean mobility and intelligent energy integration. The electrification of heavy road freight is not merely about replacing diesel engines with batteries. It is about turning Europe’s logistics network into a flexible, digital and climate-aligned infrastructure backbone. The next trillion-dollar opportunity will roll quietly across the continent, on 18 wheels, carrying not only goods but the blueprint for a cleaner and smarter industrial economy. The post Charging ahead: Why the next European electric wave will run on 18 wheels appeared first on EU-Startups. |

29/12/2025 03:10 PM | 6 | |

| 51,737 | 29/12/2025 01:36 PM | Webrazzi GSYF invested $1M in GameByte | webrazzi-gsyf-invested-dollar1m-in-gamebyte | 29/12/2025 | GameByte, an AI-powered game creation platform, has raised $1 million at a $10 million valuation from Webrazzi GSYF, the venture arm of Tech.eu’s parent company, Webrazzi. The investment adds GameByte to the fund’s portfolio and was completed with legal support from Arıkan Law Firm, representing Webrazzi GSYF. The fund was established in partnership with İş Portföy and has previously invested in Parny and Next Big App. Founded in January 2025 by Can Erdoğan (Co-Founder & CEO), Oğuz Sandıkçı, and Fırat Gürsu, GameByte enables mobile game studios to transform text-based ideas into playable games and advertisements within minutes. By removing the need for manual coding, the platform accelerates prototyping, testing, and performance evaluation. The platform generates complete playable experiences, including in-game objects, animations, visual assets, interactions, and overall game flow, rather than limiting output to basic prototypes. This approach enables developers to achieve substantial time and cost efficiencies compared with traditional development methods. Commenting on the investment, Can Erdoğan said:

Over the long term, the company plans to enable the creation of release-ready games using text prompts while expanding support for additional genres and platforms. The platform also continuously improves output quality by analysing performance data and refining its production models. GameByte additionally plans to support live-operations management in the future, including the scalable production of post-release content such as events, new levels, quests, and seasonal updates through the same technology infrastructure. |

29/12/2025 02:10 PM | 1 | |

| 51,738 | 29/12/2025 01:30 PM | Fintech’s next chapter: The trends expected to shape 2026 | fintechs-next-chapter-the-trends-expected-to-shape-2026 | 29/12/2025 | European fintech showed resilience in 2025, recording increased investment levels compared to 2024, powered by the rise of technologies like stablecoins, embedded finance and AI. 2025 also witnessed plenty of fintech M&A activity, while excitement is growing around potential fintech IPOs in the years ahead. Here, fintech executives predict some of the themes we will likely see in 2026. Andrew Crocombe, head of embedded banking, ClearBank, said embedded finance will represent a big opportunity for businesses in 2026. He said: "Historically, firms looking to deliver embedded services have faced a compromise – work with a BaaS (Banking-as-a-Service) provider offering agility or an incumbent bank with proven governance and control frameworks but lacking the real-time APIs they need. "Next year we expect next-generation, API-based banks to become the standard for embedded account and payments services, allowing corporates to create seamless experiences that deepen engagement, increase customer loyalty and drive new revenue streams. "By building on top of a regulated bank’s proven infrastructure, businesses can deliver competitive and compliant services and features without incurring the substantial cost of obtaining a banking licence. "It also means brands don’t need to compromise the quality of their services and maintain a customer experience consistent with their brand." Chris Mason, CEO, Orbital, says interoperability will define the success of stablecoins in 2026. He says: “The big problem facing stablecoins is interoperability. That is, most coins and chains can’t talk to each other. "Many of the current launches are effectively closed-loop tokens, useful as internal ledgers but not interoperable to create a wider network that gives the scale and reach for mass adoption. “Visa and Mastercard made global interoperability work, where others failed, by standardising roles and rules, then building shared networks that let thousands of banks, processors, and merchants transact as if they were on one unified system.” Mason has called on industry collaboration for stablecoins to succeed. He added: “History speaks for itself: real scale for stablecoins will only come from the network effect we see in existing payment systems. If this is to be achieved, it will require industry collaboration at a time when different power players are jostling for market position. "Whether competition can be set aside for collaboration will define the success of stablecoins in 2026.” Amid the rise of businesses looking to leverage AI, Andy Mason, chief operating officer, NatWest Boxed, says it will be people who give businesses the AI advantage in financial services. He said: "In 2026, people will be the true AI advantage in financial services, not models or tools. The industry has a greater challenge: how to successfully develop people, providing them with the skills to successfully use AI, and in doing so, reduce apprehension. The gap is now as much a cultural issue as a technological one. "The institutions making the strongest progress are those investing in AI-ready workforce initiatives. Formal AI literacy programmes, structured tool training, and clear guidance on responsible use are giving employees confidence and reducing resistance. "Crucially, these programmes show people how AI can augment their roles by reducing friction rather than replacing them." On dealing with staff apprehension about AI, Mason said businesses should embrace transparency and open communication. Hristo Borisov, co-founder and CEO, Payhawk, said that amid the rise in AI, “autonomous finance” will occur only in certain areas. Borisov said: “Autonomous finance implies systems making decisions and executing end-to-end. That will happen in pockets, under strict constraints, and mostly in lower-stakes domains. What will actually scale is controlled delegation. Software will do more work, but inside explicit authority limits. "If a system can touch the ledger or payment rails, you need human-in-the-loop supervision that can explain what happened, intervene fast, and shut it down when conditions change.” Further tapping into the AI trend, Mark Andreev, chief operating officer, Exactly.com, said 2026 will see the continued rise of agentic commerce. He said: "We anticipate that AI will likely play a vital role in helping users research and compare, and we may even see test runs of autonomous transactions, ushering in a new era where AI is a key driver of the shopping experience.” He also urged retail businesses to keep pace with consumer expectations. He said: "Retail leadership is also undergoing a transformation: digital businesses must keep pace with AI-driven consumer expectations, while bricks-and-mortar stores need to figure out ways to integrate AI to enhance in-store experiences." He added: “Shoppers are now demanding more than just a fast checkout and convenience – they expect transparency, security and a frictionless experience across channels that doesn’t involve a trade-off between safety and convenience." |

29/12/2025 02:10 PM | 1 | |

| 51,736 | 29/12/2025 01:00 PM | The Artists Collective launches as an artist-led investment platform | the-artists-collective-launches-as-an-artist-led-investment-platform | 29/12/2025 | The Artists Collective has officially launched as the UK’s first artist-led investment collective, following a period in which it quietly backed 20 early-stage technology companies. The platform brings together established cultural figures, including Maya Jama, Daniel Kaluuya, Jack Whitehall, Roman Kemp, and Tom Grennan, alongside experienced venture investors to support early-stage businesses. Its model combines capital investment with access to professional networks to provide practical support for founders. The collective was established by brothers Fergus and Ruari Bell, founders of The Players Fund, to enable longer-term collaboration between artists and founders and to improve founders’ access to the creative and entertainment sectors. The focus is on sustained engagement rather than short-term promotional activity. Ruari Bell, Managing Partner at The Artists Collective, commented:

Investments are made through the personal portfolios of participating artists, with fund management provided by The Players Fund team. The collective typically invests between £50,000 and £300,000 in Seed and Series A companies across various sectors, including AI, B2B software, cybersecurity, fintech, healthtech, and media, with a primary focus on the UK and Europe. It has co-invested alongside firms such as Andreessen Horowitz, Accel, SV Angel, and Seedcamp. Participating artists support portfolio companies by facilitating introductions and commercial opportunities, helping to accelerate growth. The launch consolidates multiple artist investor groups into a single platform designed to support founders and promote greater artist participation in venture investing across the UK and Europe. |

29/12/2025 01:10 PM | 1 | |

| 51,735 | 29/12/2025 09:21 AM | How Europe’s food retailers are turning startup innovation into real-world impact (Sponsored) | how-europes-food-retailers-are-turning-startup-innovation-into-real-world-impact-sponsored | 29/12/2025 | European food retail remains one of the most dynamic and strategic sectors within the continental economy, with grocery sales in Europe growing by around 2.4% in 2024 and food sales volumes staying broadly stable following the post-pandemic recovery. At the same time, the sector is being reshaped by digitalisation, sustainability requirements, and changing consumer expectations around health and transparency, increasing the need for retailers to adopt innovation that is both market-ready and scalable. To address this challenge, EIT Food developed Straight2Market (S2M), an acceleration and innovation programme designed to fast-track the validation, commercialisation, and market entry of innovative food solutions. By directly connecting startups and entrepreneurs with major European retailers, the programme enables real-world consumer testing, pilot projects, and Proof of Concept collaborations that help promising ideas move closer to the shelf. How Straight2Market worksOnce startups enter Straight2Market, the focus shifts quickly from concept to validation. The programme is structured around real consumer testing and retailer-led pilots, allowing startups to assess demand, usability, and operational fit under real market conditions rather than simulated environments. For startups and entrepreneurs, it allows them to:

For retailers, it provides:

“Leading the Straight2Market programme throughout 2024 and 2025 has been a highly rewarding experience. Working closely with both retailers and startups has shown how open innovation can accelerate the adoption of market-ready solutions and strengthen the European agrifood ecosystem. In 2025 alone, the programme supported 15 startups and collaborated with four major retailers, Eroski, Migros, Ametller Origen and Sonae, enabling real-world validation, consumer testing, and scalable commercial pilots that bring innovation closer to the shelf,” said Izaskun Valle, Business Innovation Project Manager at EIT Food.

Success stories from the programmeThe impact of Straight2Market is best illustrated through the startups that have used the programme to test, refine, and strengthen their solutions in real retail environments. Across different markets and retail formats, these collaborations show how early-stage innovation can be translated into commercially relevant outcomes. Validating sustainability and local value with EroskiThrough its collaboration with Eroski, several startups were able to validate sustainability-driven business models under real retail conditions. Triwuu tested its digital platform connecting consumers with local producers through curated boxes of fresh, low-impact food products, reinforcing the value of traceability and short supply chains. Remolonas piloted its subscription model for selling seasonal fruits and vegetables that would otherwise go unsold, demonstrating how retail partnerships can contribute to food waste reduction. At the same time, Iztueta introduced its traditionally produced dairy products into a retail testing environment, gaining insight into consumer acceptance and operational requirements. Agricultural cooperative Barrenetxe validated demand for sustainably grown Basque vegetables certified with the Eusko Label, confirming the relevance of local and seasonal produce in modern retail. Circular economy innovation with SonaeSonae collaborated with Tetis Biotech to explore circular economy applications in food retail. By piloting functional ingredients derived from aquaculture by-products, including marine collagen and protein-rich snacks containing omega-3, the startup was able to test both product performance and sustainability messaging in a real retail context. Responding to health and well-being trends with Migros UpMigros Up partnered with startups addressing changing consumer preferences around health and wellbeing. Yummate tested its vegan, gluten-free, protein-rich snacks with health-conscious consumers, using feedback to refine its product positioning. Artisan Candy assessed market response to its premium confectionery made with natural ingredients and traditional processes, while Hubixos, developed by PatiLabs, piloted functional beverages enriched with vitamins and adaptogens to better understand consumer demand within the wellness segment. Functional foods and circularity with Ametller OrigenAmetller Origen worked with Genky Innovations to pilot functional foods made from wine industry by-products. The collaboration allowed Genky Innovations to validate consumer interest in antioxidant-rich products aimed at supporting healthy ageing, while demonstrating how circular production models can be integrated into established retail channels. Looking aheadAs European food retail continues to evolve, initiatives like Straight2Market play an increasingly important role in turning innovation into market-ready solutions. By connecting startups directly with retailers and real consumers, the programme helps reduce the gap between early-stage development and commercial reality, while supporting a more resilient and sustainable food system. Startups, entrepreneurs, and retail partners interested in learning more about Straight2Market and future programme editions are invited to leave their details to request further information and explore how to take part. The post How Europe’s food retailers are turning startup innovation into real-world impact (Sponsored) appeared first on EU-Startups. |

29/12/2025 10:10 AM | 6 | |

| 51,733 | 29/12/2025 09:00 AM | The tech news stories under the radar in 2025 | the-tech-news-stories-under-the-radar-in-2025 | 29/12/2025 | After a particularly spirited online conversation about whether tech media should still be covering funding rounds, I found myself reflecting on what we actually do — day in, day out — at Tech.eu. When I do workshops about talking to the media, I often talk about the story behind the news. Beyond funding, there’s a broader story of the people building tech, backing innovation, and questioning what comes next. As 2025 draws to a close, here’s a look back at some of the features you may have missed this year — the ones that go beyond the headline numbers and into the substance of Europe’s tech moment.

|

29/12/2025 09:10 AM | 1 | |

| 51,734 | 29/12/2025 08:45 AM | The pottery magic: How AI is reframing the competition in business | the-pottery-magic-how-ai-is-reframing-the-competition-in-business | 29/12/2025 | The main thing AI has done for business is fundamentally change competition. When AI is in skilled hands, it has effectively reduced the cost of feedback, which is essential for building better products, to almost zero. The rise of AI closely resembles the famous “Pottery Experiment”, an anecdote illustrating the power of quantity over perfection, popularised in James Clear’s book Atomic Habits. A ceramics professor reportedly divided students into two groups. The first group was graded solely on the quality of a single, perfect pot produced over the semester. The second group was graded purely on the quantity, measured by weight, of pots they completed. Surprisingly, the students who focused on quantity produced the highest-quality work because they learned through rapid iteration and mistakes, while the “quality” group wasted time theorising. Before AI, companies highly valued resources and well-structured processes to deliver a product. These elements kept the business afloat, enabled growth, supported new product launches, and helped attract customers. Now, the game has fundamentally pivoted. AI is not just a feature. It delivers hyper-fast market feedback, which has become the ultimate moat. That demands organisational flexibility, non-obvious thinking, and fidelity to genuine product-market fit. Processes and resources as a burdenProcesses and resources that were once essential for growth are increasingly becoming a burden. Corporations necessarily involve bureaucracy, with processes designed to preserve resources and therefore growth. These processes require multiple layers of approval, with larger decisions involving more people. This no longer makes sense. The resources required to fund product development are no longer a competitive advantage, because intelligently applied AI can deliver comparable results at a fraction of the cost in money and human hours. Crucially, these decisions can now be made swiftly by a single founder. Can you meaningfully compare an AI-developed product with one built by a large professional department and tested by another? There may be nuances and differences, but the person paying for the product is unlikely to notice a substantial gap in how well it satisfies their needs. In many cases, the quality of products built with AI tools may even be higher. The key point for competition is this: AI neutralises the advantage of resources and shifts attention to the second advantage, flexibility versus process rigidity. When a large corporation identifies a market opportunity and decides to launch a new product, it faces a bureaucratic journey that can last months. Processes are designed to manage resources carefully, and quick results are unrealistic when the human hours of development, testing, and multiple departments are at stake. To meet market demand, corporations often have to fight their own rules. Their processes do not allow them to act in ways that are not formally documented. A startup reacts very differently. Using AI, it can launch a product and test a market hypothesis as quickly as possible. It is not constrained by formalities or rigid processes. The focus is on learning fast whether people need the product, and if they do, what needs to change to make it better. This is where a small startup concentrates its resources: achieving product-market fit. In extreme cases, highly successful projects consist of just one person who is exceptionally skilled at managing AI. A third drawback of extensive resources is that they consume resources. Departments require salaries, which are reflected in the final product price. A startup using AI can significantly reduce costs, offer lower prices to customers, attract more users, and continuously improve the product based on feedback. The pottery effect for startupsIf an AI-enabled startup and a corporation identify the same market opportunity at the same time, the outcome after a year is revealing. The corporation may have tested two hypotheses using a hundred engineers, while the startup may have tested a hundred hypotheses with just two engineers. The result is that the startup’s product aligns far more closely with market demand, and in some cases even creates demand that did not previously exist. This advantage comes from exponentially greater feedback volume and the flexibility to respond to it. The natural limits of this model are capital-intensive industries such as space, defence, and medicine, where the cost of experimentation is too high to allow fast and cheap customer feedback. The same applies to B2G sales and other capital-intensive sectors. How corporations should adaptFor large corporations to compete with fast-moving, AI-backed rivals, they must emulate their approach, not the other way around. First, they must recognise that slow, traditional bureaucratic structures are a major obstacle. The corporate model must evolve to prioritise speed and experimentation. A critical step is establishing autonomous AI squads operating within governed sandboxes, meaning controlled environments with simplified compliance requirements. These teams must be fully disconnected from standard bureaucratic decision-making processes. This enables rapid iteration and deployment of AI prototypes without long approval cycles. New key performance indicators should measure learning velocity and the speed of technology implementation, signalling a clear shift away from legacy metrics tied to slow, long-cycle projects. Corporations should also create a comprehensive catalogue of internal data to ensure easy access for model training. The nature of AI-powered rivalryThe new rivalry model will not immediately collapse traditional businesses or halt their growth. The larger the organisation, the slower the decline. That is precisely the problem. Corporations fail to adapt because they do not perceive an immediate threat, as annual reports still show positive growth. Growth slows gradually, first by fractions of a per cent, then by whole percentages. Meanwhile, new businesses may grow by thousands of per cent per year, eventually challenging incumbents that are entirely unprepared to respond. This dynamic is well illustrated by the relationship between Intel and Nvidia, even though AI experimentation was not a factor at the time. “If you don’t have a microprocessor, what else do you have to sell?” Intel CEO Paul Otellini said in 2009, dismissing Nvidia’s claim that the industry was shifting towards graphics chips. Nvidia’s success was fuelled by Intel’s dominance, which allowed its rival to grow quietly and ultimately overtake it a decade later. With the added force of AI, such shifts in dominance will happen much faster. The post The pottery magic: How AI is reframing the competition in business appeared first on EU-Startups. |

29/12/2025 09:10 AM | 6 | |

| 51,732 | 28/12/2025 04:30 PM | MayimFlow wants to stop data center leaks before they happen | mayimflow-wants-to-stop-data-center-leaks-before-they-happen | 28/12/2025 | 28/12/2025 06:10 PM | 7 | ||

| 51,731 | 28/12/2025 04:00 PM | The 33 top health and wellness startups from Disrupt Startup Battlefield | the-33-top-health-and-wellness-startups-from-disrupt-startup-battlefield | 28/12/2025 | 28/12/2025 04:10 PM | 7 | ||

| 51,730 | 28/12/2025 03:00 PM | The 14 fintech, real estate, proptech startups from Disrupt Startup Battlefield | the-14-fintech-real-estate-proptech-startups-from-disrupt-startup-battlefield | 28/12/2025 | 28/12/2025 03:10 PM | 7 | ||

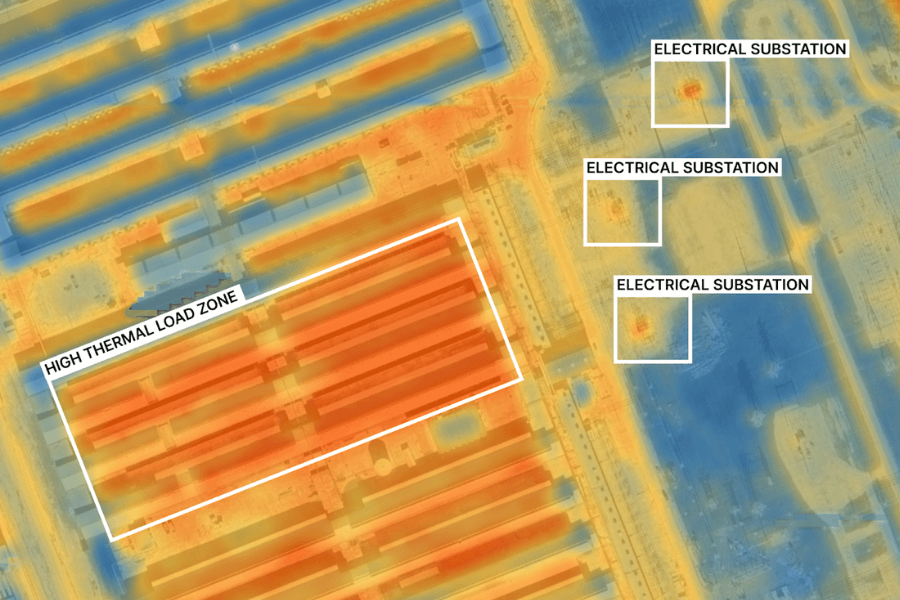

| 51,729 | 28/12/2025 11:00 AM | Billion-Dollar Data Centers Are Taking Over the World | billion-dollar-data-centers-are-taking-over-the-world | 28/12/2025 | The battle for AI dominance has left a large footprint—and it’s only getting bigger and more expensive. | 28/12/2025 11:10 AM | 4 | |

| 51,728 | 28/12/2025 10:00 AM | The Dollar Is Facing an End to Its Dominance | the-dollar-is-facing-an-end-to-its-dominance | 28/12/2025 | Questions around the reliability of the US greenback are dulling the luster of what was the world’s currency of trade. New, global alternatives are emerging. | 28/12/2025 10:10 AM | 4 | |

| 51,727 | 28/12/2025 01:00 AM | India startup funding hits $11B in 2025 as investors grow more selective | india-startup-funding-hits-dollar11b-in-2025-as-investors-grow-more-selective | 28/12/2025 | 28/12/2025 01:10 AM | 7 | ||

| 51,726 | 27/12/2025 04:00 PM | The 22 top clean tech and energy startups from Disrupt Startup Battlefield | the-22-top-clean-tech-and-energy-startups-from-disrupt-startup-battlefield | 27/12/2025 | 27/12/2025 04:10 PM | 7 | ||

| 51,725 | 27/12/2025 03:00 PM | The 7 top space and defense tech startups from Disrupt Startup Battlefield | the-7-top-space-and-defense-tech-startups-from-disrupt-startup-battlefield | 27/12/2025 | 27/12/2025 03:10 PM | 7 |