Switch Dataset:

Startup News

We are collecting the most relevant tech news and provide you with a handy archive. Use the search to find mentions of your city, accelerator or favorite startup in the last 1,000 news items. If you’d like to do a more thorough search, please contact us for help.

Search for any keyword to filter the database with >10,000 news articles

Filter

Filter search

Results

| id | date | title | slug | Date | link | content | created_at | feed_id |

|---|---|---|---|---|---|---|---|---|

| 50,496 | 14/10/2025 05:34 PM | Feds Seize Record-Breaking $15 Billion in Bitcoin From Alleged Scam Empire | feds-seize-record-breaking-dollar15-billion-in-bitcoin-from-alleged-scam-empire | 14/10/2025 | Officials in the US and UK have taken sweeping action against “one of the largest investment fraud operations in history,” confiscating a historic amount of funds in the process. | 14/10/2025 06:10 PM | 4 | |

| 50,492 | 14/10/2025 04:00 PM | ‘Sovereign AI’ Has Become a New Front in the US-China Tech War | sovereign-ai-has-become-a-new-front-in-the-us-china-tech-war | 14/10/2025 | OpenAI has announced “AI sovereignty" partnerships with governments around the world, but can proprietary models compete with Beijing’s open source offerings? | 14/10/2025 04:10 PM | 4 | |

| 50,494 | 14/10/2025 03:51 PM | Coco Robotics taps UCLA professor to lead new physical AI research lab | coco-robotics-taps-ucla-professor-to-lead-new-physical-ai-research-lab | 14/10/2025 | 14/10/2025 04:10 PM | 7 | ||

| 50,495 | 14/10/2025 03:27 PM | OpenAI and Broadcom partner on AI hardware | openai-and-broadcom-partner-on-ai-hardware | 14/10/2025 | 14/10/2025 04:10 PM | 7 | ||

| 50,493 | 14/10/2025 03:06 PM | Italian SpaceTech startup Titan4 lands €4 million to scale its Earth Intelligence platform through satellite data | italian-spacetech-startup-titan4-lands-euro4-million-to-scale-its-earth-intelligence-platform-through-satellite-data | 14/10/2025 | Rome-based SpaceTech startup Titan4 has closed a €4 million Series A round to advance its Earth Intelligence platform, which integrates satellite data, ground sensors and AI-powered analytics to monitor the condition of critical infrastructure. The round was led by CDP Venture Capital, through the Infratech sector of the Corporate Partners I fund, together with Vertis, through the Vertis Venture 6 Digital South fund – partly co-financed by the European Union, NextGenerationEU. For Giovanni Quacquarelli, Founder and CEO of Titan4, this round represents not only a financial goal, but also a step that has strengthened the company strategy: “This round represents a turning point for us: not only a financial goal, but also a path of comparison that has strengthened our strategic vision. The trust of partners such as CDP Venture Capital and Vertis allows us to accelerate technological development and aspire to an international role, building increasingly effective Earth Intelligence tools to support the security and resilience of critical infrastructures”. (Translated) Titan4’s Series A aligns with a broader 2025 European funding trend focused on Earth intelligence, satellite infrastructure, and resilience technologies. Several DeepTech peers have recently attracted investment, including Belgium’s EDGX (€2.3 million Seed for onboard AI compute), France’s UNIVITY (€31 million to advance satellite-enabled 5G), Look Up (€50 million for radar-based orbital safety), and the UK’s Spaceflux (€6.1 million to expand its satellite-tracking network). Germany’s OroraTech (€37 million for wildfire and climate monitoring) and the UK’s Messium (€3.8 million for satellite-driven precision agriculture) further illustrate investor confidence in AI-enhanced geospatial analytics. Within this context, Titan4’s raise is notable as one of the few Italian-based ventures in the SpaceTech and Earth observation sector, underscoring both national progress in the field and a Europe-wide push toward AI-enabled infrastructure safety and climate resilience. “We decided to invest in Titan4 because we believe in the solidity of their vision and in the ability of the team to translate it into a concrete industrial impact. The technology they are developing allows those who design, manage and maintain infrastructures to make more informed and timely decisions, guaranteeing a strategic contribution to the security of the territories and the competitiveness of our country,” added Claudio Bruno, Senior Investment Manager of the Corporate Partners I fund of CDP Venture Capital. Founded in 2019, Titan4 has developed an Earth Intelligence solution that integrates satellite data, information from ground sensors and climate models, processed using AI algorithms. This makes it possible to analyse the state of infrastructure – from bridges to dams, to water, energy and transport networks – and to identify anomalies, criticalities and changes. The company provides managers, institutions and operators with advanced tools to allegedly anticipate risks, optimise operational decisions, reduce costs and strengthen the security and resilience of communities. The funding follows the Seed investment made in 2023 by Galaxia, the National Aerospace Technology Transfer Pole, born on the initiative of the Technology Transfer Fund of CDP Venture Capital together with Obloo Ventures. The new resources will allow the startup to consolidate its presence on the national market, accelerate research and development activities and initiate international expansion, with the aim of positioning itself as a global leader in support of infrastructure safety and resilience. The post Italian SpaceTech startup Titan4 lands €4 million to scale its Earth Intelligence platform through satellite data appeared first on EU-Startups. |

14/10/2025 04:10 PM | 6 | |

| 50,490 | 14/10/2025 03:03 PM | Sheryl Sandberg-backed Flint wants to use AI to autonomously build and update websites | sheryl-sandberg-backed-flint-wants-to-use-ai-to-autonomously-build-and-update-websites | 14/10/2025 | 14/10/2025 03:10 PM | 7 | ||

| 50,491 | 14/10/2025 02:30 PM | Less than 4 days left: Visibility, traction, and growth start at your TechCrunch Disrupt 2025 exhibit table | less-than-4-days-left-visibility-traction-and-growth-start-at-your-techcrunch-disrupt-2025-exhibit-table | 14/10/2025 | 14/10/2025 03:10 PM | 7 | ||

| 50,489 | 14/10/2025 02:00 PM | Berlin’s TravelTech startup Swifty joins Revolut to enhance AI-driven travel and lifestyle experiences | berlins-traveltech-startup-swifty-joins-revolut-to-enhance-ai-driven-travel-and-lifestyle-experiences | 14/10/2025 | Revolut, the British FinTech leader with more than 65 million customers worldwide, today announced the strategic acquisition of Berlin’s Swifty, an AI-powered travel agent startup and 2023 FutureTravel Pitch Competition finalist. This acquisition brings Swifty’s proprietary AI technology and Co-founders to Revolut, where they will focus on enhancing the company’s loyalty and lifestyle products for its global customer base. Stanislav Bondarenko and Tomasz Przedmojski, Co-founders of Swifty commented: “We’re excited to bring the power of Swifty to tens of millions of Revolut users. Joining forces with one of the world’s leading FinTechs is a once-in-a-lifetime opportunity to scale our vision globally and enhance the lifestyle of over 65 million customers. Together, we’ll build an AI concierge that not only simplifies travel but anticipates everyday needs across all aspects of life.“ The Revolut acquisition of Swifty aligns with a broader 2025 trend across Europe where travel, mobility, and lifestyle startups are increasingly integrating AI to bridge finance and travel experiences. In 2025, Exoticca in Spain raised €25 million to enhance its AI-driven trip-planning capabilities, while WeTravel secured €78 million to automate workflows for multi-day travel operators. Denmark’s Tryp.com raised €3.1 million to refine its AI-based travel planning engine, and France’s Kolet closed €8.6 million to expand global connectivity services for travellers. In Germany, Circula secured €15 million to advance its AI-powered expense management tools, overlapping finance and travel functions. Collectively, these developments show how FinTech and TravelTech are converging – with Revolut’s integration of Swifty exemplifying how financial platforms are extending into lifestyle and travel through applied AI. Christopher Guttridge, Head of Loyalty at Revolut, says: “This acquisition strengthens our position at the intersection of finance, AI and lifestyle. Through this move we’re gaining both talent and expertise in AI driven travel solutions, which will help us deliver even more personalised and seamless experiences to our customers.” Founded in 2023 originally incubated at Lufthansa Innovation Hub (LIH), Swifty is an AI assistant that autonomously manages essential steps of business travel, encompassing planning, booking, payment, and invoicing, all within the chat interface, helping travellers book their business trips in 5 minutes via chat. This acquisition complements Revolut’s development of its AI financial assistant, building on the lifestyle offering. Swifty’s AI agent will enable a powerful customer experience that combines smart financial guidance with the automated execution of complex travel and lifestyle tasks. Swifty was also part of the 2023 FutureTravel Pitch Competition featuring 10 promising early-stage travel startups on a global scale. Swifty, along with the other nine startups, competed for the title of FutureTravel startup of the year and a prize package valued at €56k. To learn more about the FutureTravel Summit and this year’s edition, click here. The post Berlin’s TravelTech startup Swifty joins Revolut to enhance AI-driven travel and lifestyle experiences appeared first on EU-Startups. |

14/10/2025 03:10 PM | 6 | |

| 50,487 | 14/10/2025 02:00 PM | Save up to $624 on your TechCrunch Disrupt 2025 Pass before prices rise in less than 4 days | save-up-to-dollar624-on-your-techcrunch-disrupt-2025-pass-before-prices-rise-in-less-than-4-days | 14/10/2025 | 14/10/2025 02:10 PM | 7 | ||

| 50,488 | 14/10/2025 01:35 PM | FleetWorks raises $17M to match truckers with cargo faster | fleetworks-raises-dollar17m-to-match-truckers-with-cargo-faster | 14/10/2025 | 14/10/2025 02:10 PM | 7 | ||

| 50,486 | 14/10/2025 01:08 PM | Aquawise will show off its AI-driven water quality tech at TechCrunch Disrupt 2025 | aquawise-will-show-off-its-ai-driven-water-quality-tech-at-techcrunch-disrupt-2025 | 14/10/2025 | 14/10/2025 01:10 PM | 7 | ||

| 50,483 | 14/10/2025 12:45 PM | Siri inventor raises over €2M for quantum startup | siri-inventor-raises-over-euro2m-for-quantum-startup | 14/10/2025 | Christopher Savoie, one of the original inventors behind the AI system that led to Apple’s Siri, has raised over €2M for SiC Systems, a startup combining agentic AI and quantum sensing technologies for use in critical industrial and defence applications. The full amount raised has not been disclosed. The company is a spinout from the Technical University of Denmark (DTU). The round was led by Dutch quantum investment fund QDNL Participations, with additional backing from Propagator Ventures, Plug and Play, and Wavepeak Ventures. SiC Systems aims to develop intelligent, adaptive AI agents capable of orchestrating complex physical systems in real time. Its proprietary platform integrates classical and quantum sensors with agent-based AI and generative models to support decision-making in high-stakes sectors such as biomanufacturing, industrial automation, and defence. Savoie, who co-founded the company with DTU professor Seyed Soheil Monsouri, said: QDNL Participations Investment Director Kris Kaczmarek said: "SiC's fusion of agentic AI and quantum innovation represents a leap forward for mission-critical applications." Founded across Copenhagen and Nashville, SiC Systems builds on DTU research in model-based tools for dynamic, multi-scale systems. The company’s quantum-inspired virtual sensors aim to reduce reliance on costly hardware by predicting physical states with high precision, even in harsh conditions. The startup plans to use the funding to scale its platform, form strategic partnerships, and pilot deployments across the chemical, biological manufacturing, energy, and defence sectors. |

14/10/2025 01:10 PM | 1 | |

| 50,484 | 14/10/2025 12:28 PM | Oura raises over $900M, valuing it at "approximately $11BN” | oura-raises-over-dollar900m-valuing-it-at-andquotapproximately-dollar11bn | 14/10/2025 | Oura, the Finnish health tech startup known for its popular smart rings, has raised over $900m in a new funding round, valuing the startup at “approximately $11bn”, it said. The funding round was led by Fidelity Management & Research Company with participation from new investor ICONIQ and investment from Whale Rock and Atreides. |

14/10/2025 01:10 PM | 1 | |

| 50,485 | 14/10/2025 11:41 AM | London-based startup Clove launches out of stealth with €12 million to make wealth management widely available | london-based-startup-clove-launches-out-of-stealth-with-euro12-million-to-make-wealth-management-widely-available | 14/10/2025 | Clove, a new startup in personal finance and wealth management, today exited stealth and announced that it has secured a €12 million pre-Seed funding round to continue building its team and platform with a view to a full launch in 2026. The funding was led by Accel, with participation from Kindred Capital, Air Street Capital and notable angel investors, including Barney Hussey-Yeo (CEO and founder, Cleo), Patrick Pichette (former CFO, Google) via Inovia Capital, Erez Mathan (CRO, GoCardless) and Gideon Valkin (ex-Monzo and ClearScore). “A huge section of society has been failed by the financial advice industry, because it is only able to serve those that are already wealthy,” commented Christian Owens, CEO and Co-founder of Clove. “Today, less than one tenth of the UK population benefits from professional financial advice, and half of advisers have stopped servicing less wealthy clients.” Clove’s pre-Seed positions it among the more strongly backed early-stage players in Europe’s 2025 WealthTech landscape. Comparable activity this year includes Belgium-based WARREN, which secured €3 million to advance its employee financial wellness platform; UK-founded Wealthyhood, raising €3.6 million to expand its investment and savings app; and Berlin-based NAO, which added over €1 million to scale its co-investment advisory platform. Compared with these smaller rounds, Clove’s raise underscores a heightened level of investor confidence in UK-led innovation aimed at closing the financial advice gap. “We believe that everyone deserves great financial advice,” commented Alex Loizou, Chief Product Officer and Co-founder, Clove. “With Clove, we are seeking to break the traditional economics of financial advice by combining the expertise of human advisers with the efficiency of AI. Our goal is to make financial planning more accessible, affordable, and effective than ever before, for everyone from young professionals and aspiring entrepreneurs, to growing families and those starting to think about retirement.” Founded in 2025 by proven tech founders Christian Owens (UK payments unicorn Paddle; $300 million raised, valued at $1.4 billion) and Alex Loizou (e-commerce marketplace Trouva, acquired by Made.com), Clove is on a mission to close the financial advice gap, which affects hundreds of millions of people globally and can both restrict economic growth and lead to worse financial outcomes for individuals. The FCA estimates that those that receive financial advice can see an increase in wealth of up to 10% in the years following financial advice, relative to those that do not receive financial advice. It has introduced regulatory changes to help reduce the advice gap and support growth by enabling increased investment and innovation. Speaking about this issue in the UK, Chancellor of the Exchequer, Rachel Reeves, said: “Too many people are missing out on the support they need to build a more secure financial future for themselves and their families.” In the UK alone, 13 million mass‑affluent individuals hold £3.8 trillion in investable assets. This includes more than 3.7 million UK consumers who are both open to receiving professional financial advice and have more than £50,000 available to invest. The FCA estimates that there are 7 million adults in the UK with £10,000+ in cash savings who may be missing out on the benefits of investing throughout their lives. “This isn’t an abstract problem,” added Owens. “If you’re not making the most of your money then life milestones such as buying a home, starting a family, setting up a business or retiring early will feel more out of reach than they need to be.” “There is an urgent need to make financial expertise accessible to everyone,” said Matt Robinson, Partner at Accel. “The right advice could help people to buy a home sooner, invest with confidence, and retire on their own terms. Christian and Alex combine a proven track record of building and scaling businesses, with a deep passion for solving this problem. We’re thrilled to back their vision as they seek to create a new kind of financial institution and strive to empower people to take control of their financial future.” The post London-based startup Clove launches out of stealth with €12 million to make wealth management widely available appeared first on EU-Startups. |

14/10/2025 01:10 PM | 6 | |

| 50,482 | 14/10/2025 11:30 AM | Strawberry raises $6M to make advanced AI automation intuitive | strawberry-raises-dollar6m-to-make-advanced-ai-automation-intuitive | 14/10/2025 | Strawberry, an agentic browser with built-in, personalised AI companions, has raised $6 million led by General Catalyst and EQT Ventures, with participation from founders of Lovable, Supabase, and Hugging Face. While enterprises often deploy AI via large budgets and multi-year programs, freelancers, startups, and small businesses need tools that work immediately. Many existing solutions require technical expertise, disrupt workflows, or sit in standalone interfaces outside the browser. Strawberry embeds AI directly into browsing to create a no-code, adaptive workspace that automates routine digital work so people can focus on higher-value tasks. Founded in Stockholm by a technical team focused on bringing AI beyond developers, Strawberry streamlines tab switching, data movement across tools, spreadsheet population, and message drafting, while adapting to each user’s context and workflows. Early users have built custom assistants for competitive intelligence and sales prospecting, earning Product Hunt “Product of the Day” and “Product of the Week.” The platform signals a shift from generic enterprise AI toward personalised companions that make everyday work more collaborative and usable. Charles Maddock, CEO and co-founder of Strawberry, commented:

The financing will fuel Strawberry's expansion across engineering and design to support rapid iteration with its growing beta community. Alongside the financing, the company is rolling out an upgraded version with new features, offering early access to select customers and expanding onboarding monthly. |

14/10/2025 12:10 PM | 1 | |

| 50,478 | 14/10/2025 11:00 AM | Epiminds exits stealth with $6.6M to power AI-first marketing teams | epiminds-exits-stealth-with-dollar66m-to-power-ai-first-marketing-teams | 14/10/2025 | Stockholm-based Epiminds, which develops multi-agent AI systems to run marketing end-to-end, emerged from stealth with $6.6 million in funding. The funding was led by Lightspeed Venture Partners with participation from EWOR, Entourage, and high-profile angels, including the former CMO of Booking.com. Agencies face pressure from both clients and operations as clients expect greater transparency, faster reporting, and measurable ROI on tighter budgets, while internally, fragmented data slows decisions, and AI adoption is uncertain. Traditional responses like hiring more specialists, adding dashboards, or reacting after problems arise raise costs and complexity without fixing core inefficiencies or preparing for the future. Epiminds addresses these issues. Founded in 2025 by Google and Spotify alums, Elias Malm and Mo Elkhidir, respectively, the company builds multi-agent AI systems that agencies can train and evolve. Its core product is Lucy, an AI marketing manager coordinating over 20 specialised agents across reporting, optimisation, budget pacing, bidding, and creative. Agencies can onboard a client in under 30 seconds and immediately deploy an AI team to run campaigns end-to-end. Lucy and team not only surface insights but execute them, learn each agency’s playbooks, and proactively monitor accounts to flag risks before performance declines. According to Mo Elkhidir, marketers are increasingly expected to achieve more with fewer resources:

Agencies using Epiminds report faster onboarding, improved performance, reduced wasted spend, and more time for creative and strategic work. The multi-agent system manages routine tasks such as reporting and pacing, as well as audits, creative analysis, competitive insights, and strategic planning. By linking insights to execution across platforms, Lucy can increase output without additional headcount. The product targets a gap in the market. Legacy dashboards and optimisers are siloed and manual, while point AI tools address narrow problems without coordination. Epiminds’ multi-agent approach provides an integrated, adaptive system that learns and improves over time. Elias Malm added:

Looking ahead, Epiminds

plans to expand Lucy’s capabilities across more integrations, increase the level of

autonomy, and self-improving capabilities. Each new feature strengthens the

entire system, creating a network effect where every agency benefits from

smarter, more capable AI. |

14/10/2025 11:10 AM | 1 | |

| 50,480 | 14/10/2025 10:30 AM | Mark Cuban Would Still Have Dinner With Donald Trump | mark-cuban-would-still-have-dinner-with-donald-trump | 14/10/2025 | The billionaire investor campaigned for Kamala Harris, but thinks tech execs have a “moral imperative” to play nice with the president. Why? It’s good business. | 14/10/2025 11:10 AM | 4 | |

| 50,481 | 14/10/2025 10:20 AM | British HealthTech investor Spex Capital announces €30 million commitment to €100 million fund | british-healthtech-investor-spex-capital-announces-euro30-million-commitment-to-euro100-million-fund | 14/10/2025 | London’s Spex Capital, a leading early-stage investor tackling global healthcare challenges through HealthTech solutions, today announced the first €30 million commitment to its flagship €100 million Venture HealthTech Fund. The fund will invest globally in early-stage HealthTech startups, from Seed to Series A/B, with investments of up to €5 million. Spex has partnered with EIT Digital and Penn Medicine/LGH, a leading mutli-hospital health system in the US that handles over 7 million patients each year. Claudio D’Angelo, Founder and CEO of Spex Capital, said: “Healthcare faces immense challenges worldwide with ageing populations creating growing patient demand and systemic cost pressures. Our true strength is not just the volume of companies we see, but the unparalleled power of our distribution network to provide them with essential commercial and clinical validation.” Several other funds have also entered or expanded within the European healthtech investment space in 2025, indicating sustained investor appetite for early-stage digital health and medical innovation. London-based Meridian Health Ventures launched a €44.7 million transatlantic fund to back HealthTech startups scaling between the UK and the United States. Belgium’s Capricorn Partners announced a €51 million first close for its Health-Tech Fund II, targeting diagnostics, digital health, and life-science ventures. In France, M2care secured €26 million to accelerate venture studio activity in healthcare innovation. Against this backdrop, Spex Capital’s €100 million Venture HealthTech Fund sits among the largest of the current European initiatives focused on early-stage health technology, highlighting growing institutional confidence in the sector’s potential. Its partnerships with EIT Digital, Penn Medicine, and long-standing links to the NHS provide access to extensive validation networks, a factor often cited as a bottleneck in scaling health technologies. In a year where European healthtech investment surpassed €4 billion in early 2025, according to EU-Startups’ sector overview, Spex Capital’s entry signals sustained investor confidence in digital health and medical innovation. “The supply is strong, but the validation we deliver through our network is the game-changer. Digital HealthTech is key to addressing these challenges, and with this fund, our new partnerships, and a world-class advisory network, we are uniquely positioned to support visionary founders delivering transformative solutions worldwide,” added D’Angelo. Founded in 2021 by serial entrepreneur Claudio D’Angelo, Spex Capital focuses on commercialising and scaling digital health and medical technology solutions across major healthcare delivery systems worldwide. The company also announced the appointment of Lord Markham, former UK Health Minister, as Chair of the Board. He has extensive experience across the public, private and voluntary sectors, particularly in the venture space where he co-founded a HealthTech business, Cignpost, which grew from €0 to €350 million turnover in 1 year. Lord Markham, Chairman, said: ”I’m delighted to join Spex Capital at such a pivotal moment for HealthTech. This scale-up fund will unleash groundbreaking startups. I look forward to working with Claudio and the team as we accelerate the development and adoption of technologies that improve patient outcomes and reshape healthcare delivery globally. “ EU-Startups previously covered the firm in February 2023, when Spex Capital first announced plans for its €100 million HealthTech fund. The post British HealthTech investor Spex Capital announces €30 million commitment to €100 million fund appeared first on EU-Startups. |

14/10/2025 11:10 AM | 6 | |

| 50,479 | 14/10/2025 10:20 AM | Clove exits stealth with $14M pre-seed led by Accel | clove-exits-stealth-with-dollar14m-pre-seed-led-by-accel | 14/10/2025 | London-based Clove, a new challenger in personal finance and wealth management, has emerged from stealth with a $14 million pre-seed round led by Accel. The round also saw participation from Kindred Capital, Air Street Capital, and angels, including Barney Hussey-Yeo (Cleo), Patrick Pichette (via Inovia Capital), Erez Mathan (GoCardless), and Gideon Valkin (ex-Monzo, ClearScore). The FCA estimates that people who receive financial advice may be up to 10 per cent wealthier in subsequent years than those who do not. To narrow the advice gap and support market growth, it has introduced regulatory changes to encourage investment and innovation. In the UK, 13 million mass-affluent individuals hold £3.8 trillion in investable assets, including more than 3.7 million open to professional advice with over £50,000 to invest; a further 7 million adults with £10,000+ in cash savings may be missing out on long-term investing benefits. Clove is building a financial institution for how people live and work today, aiming to make money management and advice accessible, affordable, and personal. The company combines human advisers with AI to scale high-quality, personalised guidance and automate administrative work, helping to close the advice gap. Co-founder and CPO Alex Loizou said everyone should have access to high-quality financial advice. He added that Clove aims to reshape the economics of advice by combining human expertise with AI to make planning more accessible, affordable, and effective for young professionals, entrepreneurs, growing families, and those beginning to plan for retirement. Clove will use the pre-seed funding to expand its team and platform ahead of a planned full launch in 2026, subject to FCA authorisation. |

14/10/2025 11:10 AM | 1 | |

| 50,476 | 14/10/2025 10:00 AM | From student storage idea to global logistics platform: the story behind Stasher’s succes | from-student-storage-idea-to-global-logistics-platform-the-story-behind-stashers-succes | 14/10/2025 | Sometimes the most compelling startup ideas are born from simple, everyday problems that demand a tech-first fix. Take two UK founders who bootstrapped through COVID and are now the global leader in the highly competitive space of luggage storage. UK startup Stasher. During COVID, they built systems that now onboard hundreds of locations monthly without meetings. They've expanded from 1,000 to over 8,000 locations across more than 1,000 cities and 80 countries, and hit profitability during the summer and 100 per cent YoY growth, while their US competitors (like Bounce, backed by a16z) burn through much more cash. I I spoke with founders Jacob Wedderburn-Day and Anthony Collias to learn how they did it, and ultimately how UK founders can still build category leaders without following the Silicon Valley playbook. From student flat to global platformThe business started when students kept knocking on the co-founder's King's Cross door, asking to store bags for the summer holidays. According to Collias, after uni, he was living between Euston and King’s Cross, and Wedderburn-Day was still at UCL, which had a startup programme. They’d both realised they didn’t really want to go into corporate graduate schemes — Wedderburn-Day had done a stint with the government and had a job offer from the Bank of England. Collias recalled:

The duo decided to put the idea in the UCL’s Hatchery startup incubator program. Refining the model: from homes to hotelsThe duo took some time refining their idea. Wedderburn-Day shared:

So they narrowed it down to same-day storage, and saw it made more sense to work with local businesses. According to Wedderburn-Day, “they were already open, had spare space, and liked having people come in. “That’s how the business model evolved — from 'store anything anywhere' to a clear left-luggage service run through shops and hotels.”

Scaling through marketing and digital infrastructure

Left-luggage offerings are nothing new - walk through any tourist precinct and you’ll see stores offering left luggage services. But according to Collias, “a lot of those standalone locker stores — especially in places like Barcelona or Madrid — are becoming oversaturated."

Stasher has developed a platform that connects travellers with trusted storage spots — including hotels, shops, and lockers — across cities worldwide, allowing them to drop off their luggage for a few hours or several days. One thing they discovered is that 90 per cent of luggage storage is booked on the same day, making it on-demand urban logistics rather than planned infrastructure. With Stasher, users can easily search, book, and pay online for a convenient storage location for specific dates and times through the website. Once booked, travellers simply “stash” their bags at the chosen location and collect them later. In addition to short-term storage, Stasher also offers a luggage shipping service, enabling users to send their bags directly to their next destination. Collias contendst:

Further, he asserts that platforms like Slasher have the advantage because we can spread the marketing costs across hundreds of sites. For customers, that means more choice — they can compare all the nearby options instead of relying on chance.” Winning in a crowded marketWedderburn-Day shared that to win in a crowded market, “You have to nail three things: product, price, and distribution.”

Data-driven expansionStasher is now active in about a thousand towns across cities globally. Early on, it picked places based on search volumes, tourism, and common sense — “like, obviously, downtown New York will have demand.” But another metric is Airbnb density. According to Wedderburn-Day, numerous short-term rentals result in a large number of bags. With its own data, the team can now base expansion on where people are searching. He shared:

In terms of customer acquisition, Stasher’s biggest channels are partnerships and search. According to Collias, partnerships make perfect sense because travel is time-specific.

It’s a location-based query, so Maps is crucial too. In terms of revenue, hosts charge a fixed fee per bag per day. It varies by geography and partnership type, but for most major partners, it’s roughly a 50/50 revenue share. Wedderburn-Day asserts that the economics are solid:

Flywheel style growthIn terms of growth, Wedderburn-Day muses that “People assume you just pour money into ads, but that’s not how it works."

From startup to scaleupNow Stasher is at a turning point — shifting from startup to established company. Collias asserts, “When we talk about raising money now, it’s not about survival; it’s about how we can use capital to grow intelligently. There’s still huge room for expansion.” Once you know where it makes sense to invest, you can shift from a variable-cost to a fixed-cost model in key areas, which is a powerful way to scale a marketplace sustainably. Significantly, Stasher achieved its goals with less than £5 million in funding — partly by learning how to do "more with less". The duo cold-emailed their way from there to their first investor (Big Yellow Storage CEO), securing their first game-changing partnership with Premier Inn shortly after. “Too many founders build to exit”Ultimately, Collias believes that Europe needs to stop selling itself short.

Wedderburn-Day asserts that US companies have easier access to capital and higher valuations, this makes it easier for them to acquire European startups.

Collias believes: “We need to make it make sense for founders to build long-term European champions, not sell early because of the system." In many ways, Stasher’s journey offers an example to many startups. With just £2.5 million in total funding, the company built a profitable, global business in a fiercely competitive market — not by outspending rivals, but by outthinking them. It’s proof that capital efficiency can outperform capital abundance, and make it possible to turn a simple student idea into a worldwide category leader. Lead image: Stasher co-founders Anthony Collias and Jacob Wedderburn-Day. Photo: uncredited. |

14/10/2025 10:10 AM | 1 | |

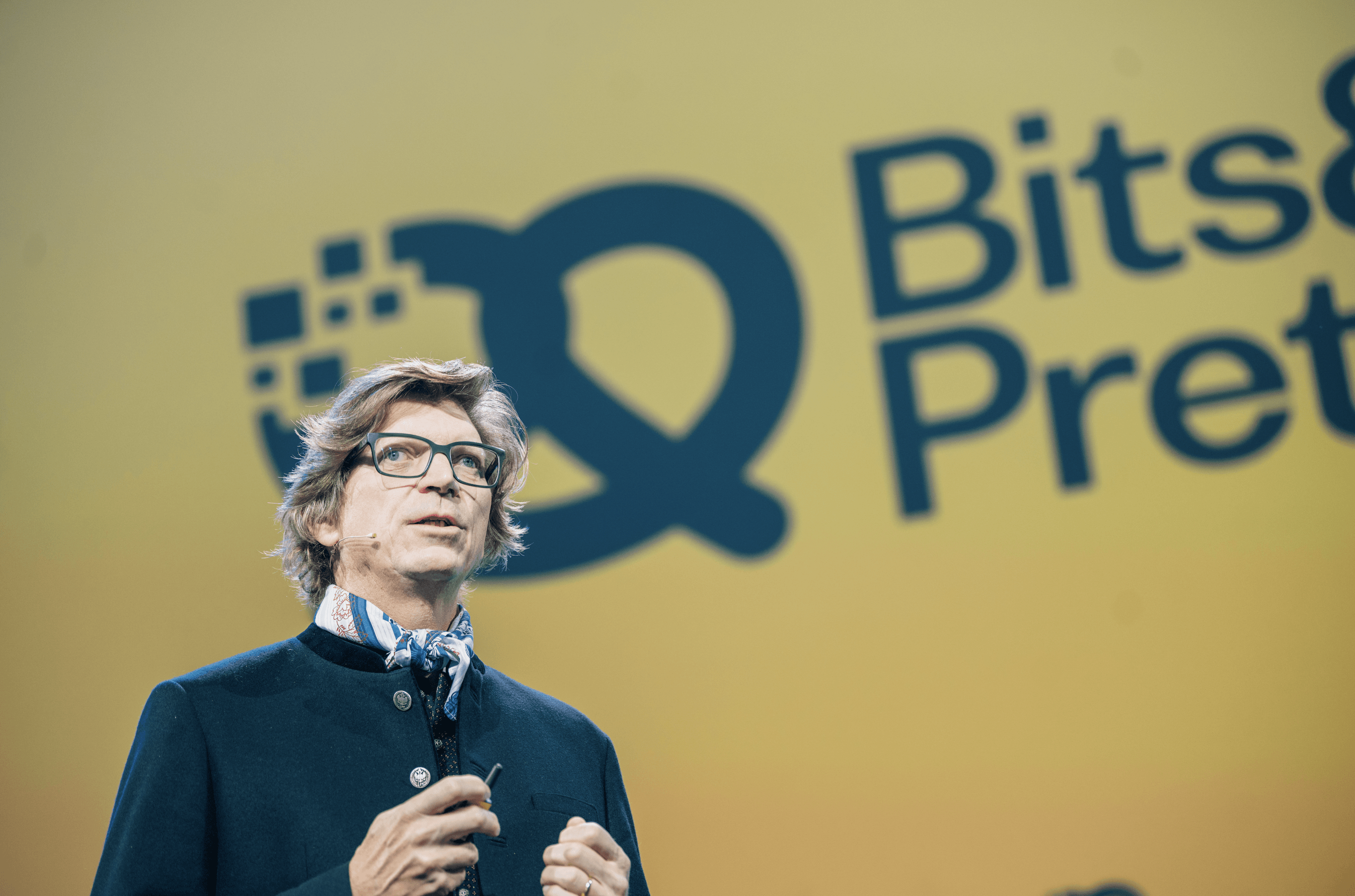

| 50,477 | 14/10/2025 09:18 AM | Europe on the Move – Bits & Pretzels 2025 Sends a Strong Signal for Entrepreneurial Spirit and Unity [Sponsored] | europe-on-the-move-bits-andamp-pretzels-2025-sends-a-strong-signal-for-entrepreneurial-spirit-and-unity-sponsored | 14/10/2025 | Under the motto “Connecting Europe”, Bits & Pretzels once again underscored its ambition to be the central platform for founders, investors, and decision-makers in Europe. Coinciding with Oktoberfest, Munich became a hotspot for innovation, networking, and entrepreneurial spirit – with over 7,500 participants from more than 70 countries, top-tier speakers from around the world, and a clear message: Europe must come closer together, become bolder, and harness its innovative power with greater determination. Europe needs more ambition, risk culture, and open marketsInternational voices shaped the debate on the future of the European startup ecosystem. “Connecting Europe was more than a motto for us – it was a promise. This year’s Bits & Pretzels has shown what’s possible when Europe’s founders work together on a shared vision,” explained Andy Bruckschlögl, co-founder of Bits & Pretzels. Skype founder and Atomico CEO Niklas Zennström called the founders the gamechangers of Europe and urged for more courage, independence, and assertiveness. Raycho Raychev, founder and CEO of space startup EnduroSat, advocated strengthening democracy through bold technologies rather than angry tweets. He also called for open market structure: “We still do not operate in a truly open market in Europe. Instead of focusing on transparent competition, many players remain stuck in outdated management structures that slow down innovation and progress.”

The time for founders and bold technologies is nowDespite ongoing economic uncertainties and global tensions, one thing was evident this year: Europe is growing closer together. Germany’s Federal Minister for Economic Affairs and Energy, Katherina Reiche, emphasized that crises offer great opportunities for startups, as the pressure for change on established companies increases and innovation becomes the key to sustainable success. “Bits & Pretzels is, more than ever, the platform for European innovation. The feedback from the community confirms it: Europe wants to – and, even more importantly – Europe can! And we will do everything we can as a platform to create even more space for collective progress,” said Bernd Storm van’s Gravesande, co-founder of Bits & Pretzels.

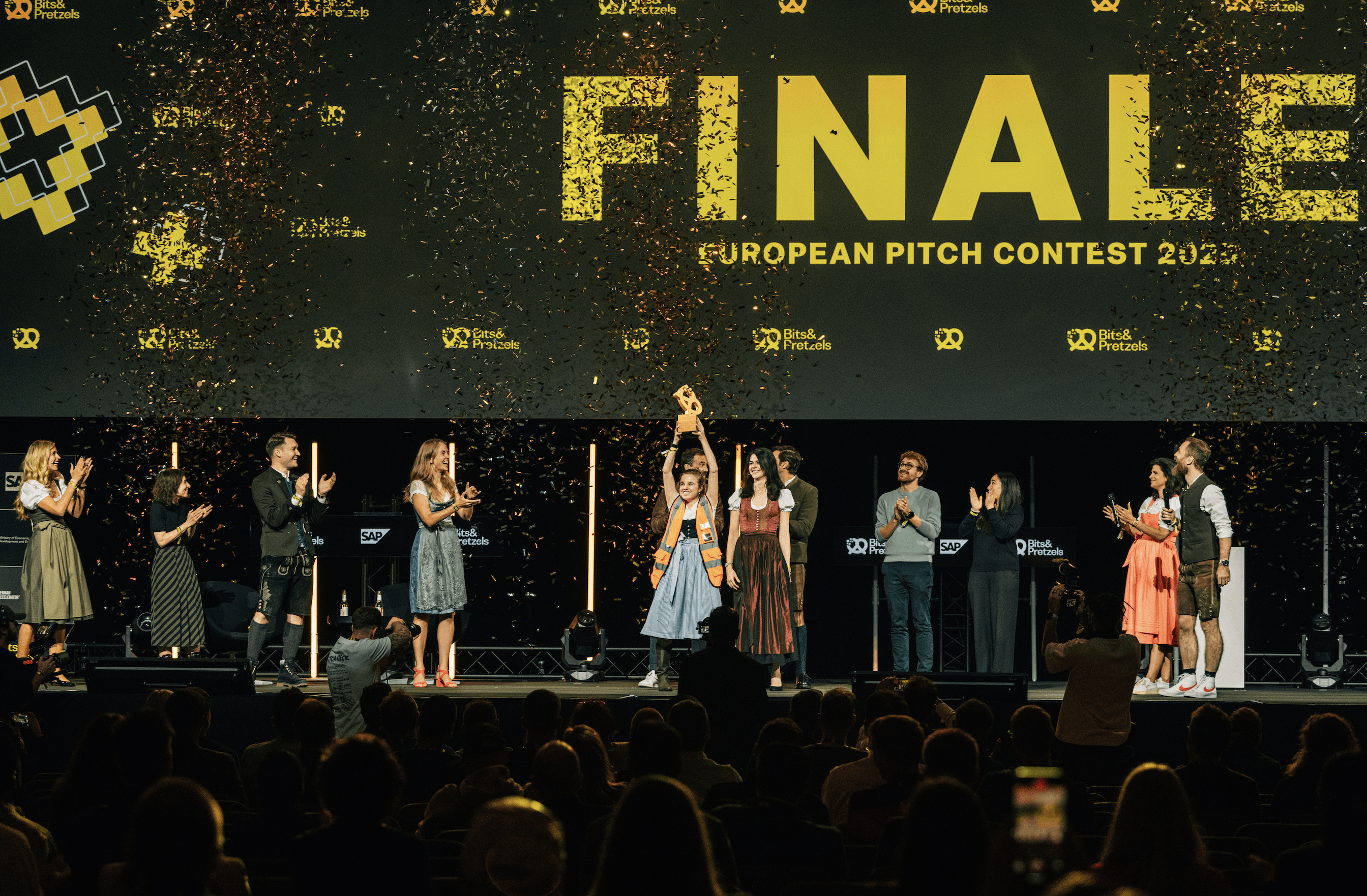

Matchmaking with impact: How Bits & Pretzels connects founders and investorsFormats such as the Startup Expo, CIO AI Summit and Investor Summit made European collaboration tangible at Bits & Pretzels. At the Startup Expo, more than 200 startups from across Europe showcased their innovative ideas and solutions. In the Matchmaking Area, founders and investors met in curated one-on-one sessions, supported by experienced networkers who acted as personal guides and fostered valuable connections. “Our mission is to build bridges – between countries, between capital and ideas, between startups, investors, and corporates,” said Felix Haas, co-founder of Bits & Pretzels. “These bridges were visible everywhere at Bits & Pretzels 2025.” European Pitch Contest: Sitegeist wins with a smart construction platformA major highlight was the final round of the European Pitch Contest. The first prize went to Munich-based robotics startup Sitegeist, which has developed an intelligent platform that automates repetitive construction site tasks – improving safety and efficiency. Founder Lena Pätzmann celebrated the win: “Our mission is clear: we want to save infrastructure. Now we have the attention, and we’re ready to get things done.”

For more information, visit the official website: www.bitsandpretzels.com |

14/10/2025 10:10 AM | 1 | |

| 50,472 | 14/10/2025 09:00 AM | Capital meets innovation: 12 investors shaping Malta’s startup ecosystem | capital-meets-innovation-12-investors-shaping-maltas-startup-ecosystem | 14/10/2025 | Venture capital is a critical driver of innovation, and in recent years, Malta has carved out a place for itself on the European map of startup investment. Its strategic location, international business links, and government-backed initiatives have made the island an increasingly attractive base for both founders and investors. The country welcomes several events throughout the year to push innovation forward, such as the Malta Startup Festival happening on 22-24 October 2025, which brings together founders, investors, and ecosystem leaders to celebrate entrepreneurship, or the EU-Startups Summit, taking place on the island for the third time in a row on 7-8 May 2026, attracting Europe’s most promising startups and venture capital firms, reinforcing Malta’s growing reputation as a Mediterranean hub for creativity, technology, and innovation. In this article, we highlight 12 investors anchored in Malta that are actively supporting local and international startups. Their approaches vary, but together they demonstrate the growing maturity and global reach of Malta’s innovation economy.

Apeiron Investment Group is the private investment firm of entrepreneur and investor Christian Angermayer. Headquartered in Sliema with teams also in New York, London, Berlin, and Abu Dhabi, the firm applies a global multi-strategy approach with a primary focus on the US. Apeiron invests both directly in innovative companies and as an anchor LP with minority GP stakes in emerging asset managers, whose funds collectively manage around $5 billion in external capital. The group has a strong emphasis on life sciences, fintech, and frontier technologies, guided by a mission to support bold founders and emerging managers shaping a future where technology enables longer, healthier, and more fulfilling lives.

GO Ventures is the corporate venture arm of GO plc, Malta’s leading telecommunications provider with over 500,000 customers. Established to back technology-driven startups, the fund provides capital and strategic support in exchange for equity, focusing on innovative solutions that extend beyond traditional telecom boundaries. With the mission of “Helping Great Ideas Grow”, GO Ventures offers startups not only financial investment but also access to deep sector expertise and an extensive network of national and international contacts. By leveraging the infrastructure and resources of GO plc, it creates unique opportunities for founders to test, scale, and connect with corporate partners across Malta and beyond.

Growth Box Ventures is a Malta-based early-stage venture capital firm with a portfolio of over 57 companies and 62 investments to date, including five successful exits. The fund primarily invests at seed and pre-Series A stages, focusing on fintech, personal finance, gaming, and lead generation sectors where Malta has global relevance. Founded by entrepreneurs with a track record of starting, building, and exiting ventures, Growth Box offers much more than capital. Its hands-on approach focuses on empowering management teams through strategic advice, performance-driven guidance, and value-adding services. By combining financial investment with commercial insight, Growth Box Ventures helps ambitious founders reduce risks, accelerate growth, and scale internationally.

Ikigai Ventures was founded by Maltese entrepreneur Eman Pulis, best known as the driving force behind SiGMA Group. The seed-stage fund invests globally, but with strong ties to Malta through its founder and LP base. Ikigai Ventures backs early-stage startups across gaming, fintech, and frontier technologies, seeking bold founders with the potential to reshape their industries. Beyond capital, Ikigai supports founders with access to tech hubs in Belgrade and Noida, a network of more than 10,000 industry contacts, and bi-annual mentorship retreats aligned with major SiGMA events. The team includes experienced operators and investors who provide strategic guidance, operating expertise, and international exposure to help startups scale.

Malta Enterprise, the country’s national economic development agency and headline sponsor of the EU-Startups Summit, operates a range of funding schemes that complement private investment. Its Start-up Finance and Business Start programmes offer non-dilutive capital to early-stage businesses, helping them develop products and reach market readiness. These instruments are designed to fill gaps in traditional venture financing and reduce risk for both founders and co-investors. While not a VC firm in the traditional sense, Malta Enterprise plays a vital role in the ecosystem by catalysing private investment. By lowering barriers for young companies, it enables more startups to reach the stage where they can attract venture funding, making it a cornerstone of Malta’s support infrastructure.

Launched in 2024, Malta Venture Capital (MVC) is a €10 million government-backed fund with offices in Sliema. Its mandate is to co-invest alongside private investors in high-growth digital and technology-driven businesses, providing the capital needed to strengthen Malta’s innovation pipeline. Backed by Malta Government Investments, MVC represents a significant step in formalising the local venture ecosystem. The fund is sector-agnostic but has a strong focus on technology-enabled solutions. By supporting startups at early stages, MVC aims to create long-term value for the Maltese economy while helping companies position themselves internationally. Its arrival has filled a gap in Malta’s funding landscape and made institutional capital more accessible to founders.

Optimizer Invest is a venture capital firm founded in Malta in 2012 by a group of Scandinavian IT entrepreneurs. The firm focuses on early-stage investments in online businesses, including fintech, digital marketplaces, and gaming-related ventures. With offices in Malta, Stockholm, and London, it combines capital with operational expertise to help founders build scalable companies. Since its launch, Optimizer Invest has made over 25 investments, achieved three IPOs, and completed more than 30 M&A transactions with over €1 billion in merger value. Its portfolio includes companies such as Skilling, The Game Day, and other fast-growing digital businesses, reflecting its focus on creating long-term value in technology-driven sectors.

PeakBridge is a Valletta-based venture capital firm focused on FoodTech, investing from seed to Series B in companies developing scalable and protectable technologies across areas such as AI, ingredients innovation, and alternative proteins. The fund targets startups addressing major challenges in the global food system, with climate and health impact at the core. With a team spread across seven countries, PeakBridge combines FoodTech investment expertise with deep operational and financial experience in the agri-food sector. As a member of the Edmond de Rothschild Private Equity partnership, it works closely with leading food corporates, investors, research institutes, and FoodTech hubs worldwide to support portfolio companies and drive systemic change in food.

PEVCA Malta (Private Equity & Venture Capital Association – Malta) is the national association representing the country’s private capital industry, bringing together fund managers, direct investors, institutional investors, family offices, and professional service firms. Acting as a central hub for Malta’s private equity and venture capital ecosystem, the association promotes collaboration, knowledge exchange, and sustainable growth while advocating for a regulatory framework that supports innovation and entrepreneurship. Its members invest across various sectors, including startups, technology, sustainable finance, and innovation, with examples such as TUM Invest, which focuses on property development, automotive, and healthcare. By fostering a stronger capital-raising culture and serving as a bridge between investors, founders, and policymakers, PEVCA Malta plays a key role in positioning the island as an attractive hub for private investment and venture capital activity.

Qamar Ventures is an investment initiative founded by Alexandre Dreyfus, the entrepreneur behind blockchain and sports pioneers Chiliz and Socios.com. Based in Malta, the firm plans to invest €10 million to boost the country’s digital landscape across media, technology, entertainment, and sports. With over two decades of experience spanning technology, gaming, and blockchain, Dreyfus brings a global perspective and a proven track record of innovation, including building the world’s first Fan Tokens and a fan engagement ecosystem through Chiliz. Qamar Ventures aims to “illuminate the future” by backing transformative ideas and fostering innovation that bridges local and global markets. Its mission centres on driving Malta’s growth in digital industries through strategic investments, acquisitions, and partnerships, empowering the island’s entrepreneurial ecosystem while promoting a digitally connected and forward-looking economy.

Ubunto Ventures is a MedTech-focused investment initiative tied to MedTech World, the Malta-based global healthtech conference. The firm invests in startups developing innovative medical technologies, aiming to improve patient outcomes while also generating strong commercial returns. Its positioning within MedTech World ensures that portfolio companies benefit from a wide international network. By combining capital with access to the broader MedTech World ecosystem, Ubunto Ventures creates visibility and growth opportunities for its startups. Its focus on health innovation makes it one of Malta’s few sector-specific investors, helping position the island as a player in global healthtech.

VentureMax Group is a Sliema-based investment firm focused on startups and disruptors in the iGaming sector. Founded in 2016, the group combines capital with industry expertise to support both early-stage ventures and established businesses aiming to scale. In addition to investing, VentureMax develops its own brands and works closely with portfolio companies to drive growth in digital entertainment and technology. Its strategy is centred on building the next generation of iGaming leaders while strengthening Malta’s position as a global hub for the industry. By the way: If you’re a corporate or investor looking for exciting startups in a specific market for a potential investment or acquisition, check out our Startup Sourcing Service! The post Capital meets innovation: 12 investors shaping Malta’s startup ecosystem appeared first on EU-Startups. |

14/10/2025 09:10 AM | 6 | |

| 50,473 | 14/10/2025 08:45 AM | German PropTech startup Arbio raises €31 million to build Europe’s first AI-native platform for holiday rentals | german-proptech-startup-arbio-raises-euro31-million-to-build-europes-first-ai-native-platform-for-holiday-rentals | 14/10/2025 | Arbio, a startup out of Berlin applying AI to the service-heavy property rental sector, is announcing its €31 million Series A funding round – bringing total funding to over €38 million. The round was led by Eurazeo, with investors including AI-focused VC OpenOcean and previous investors Atlantic Labs and leading angels Philipp Freise and Justin Reizes (KKR), Johannes Reck and Tao Tao (GetYourGuide) and Din Bisevac (Buena). Constantin Schröder, Arbio Co-founder and CEO, said: “Starting as operators ourselves, we’ve felt where the real pain for operating and managing holiday rentals lies. Therefore, at Arbio we get extremely excited about leveraging AI to change the fundamentals of a traditionally messy, service-heavy sector. “With our involvement in existing holiday property managers we’re very particular about how we believe building and rolling out our platform delivers the highest value to home owners, so that ultimately travellers have a wonderful time exploring new places.” Arbio’s Series A takes place amid a broader 2025 wave of European PropTech and travel-hospitality investments focused on automating property operations through AI. In Germany, fellow Berlin-based player Buena recently secured €49 million to expand its AI-led property management platform and acquisition pipeline, signalling strong investor appetite for technology-first management models. SCALARA added €3 million to digitalise property workflows, while viboo in Zurich raised €3.3 million to scale its AI building-management system into Germany. Arbio’s AI-native, full-stack approach to short-term rental operations stands out for integrating service automation, acquisitions, and cross-market scaling within a single system. The presence of both Arbio and Buena in Berlin, SCALARA in Brühl, and viboo expanding to Germany, highlights Germany’s growing role as a European centre for innovation in AI-enabled property management and hospitality technology. Elise Stern, Investment Director at Eurazeo, said: “Arbio is pioneering the AI-native model in one of Europe’s largest and least digitised service sectors. By combining technology, data, and operational excellence, they’re redefining what property owners and guests can expect. We believe Arbio will become the category leader in the multi-billion-euro holiday rental management space, and we are excited to support them in this ambition.” Founded in 2022 by childhood friends Constantin Schröder and Paul Bäumler, Arbio emerged from their own frustrating experiences as Airbnb travellers across the globe. What began as a mission to create consistent, high-quality guest experiences has evolved into addressing the core operational challenges facing holiday home owners and management companies across Europe, a potential $20 billion market. There are 6.5+ million alternative accommodation properties in Europe, but Arbio says managing them is stuck in the 20th century. Owners face unpredictable returns, endless hassle, and poor reviews, while guests experience increasing inconsistency. Traditional property managers claim they can help owners self-manage their properties by relying on legacy software, creating a patched-up, inefficient solution. To solve this problem, Arbio is building an AI-native operating system that acts as a full-stack property manager. Thanks to AI workflows, it automates distribution, accounting, operations, guest communications, and dynamic pricing – allegedly delivering higher revenues, lower costs, and peace of mind for owners. Guests benefit from personalised stays, faster responses, and standardised quality. This technology-first approach has enabled the following growth metrics:

With the Series A funding, Arbio plans high-speed expansion across Europe, targeting hundreds of thousands of property owners who would benefit from its AI-native management platform. The funding will also accelerate their acquisition pipeline and enhance its AI capabilities. EU-Startups previously featured Arbio in its roundup of 10 promising European startups navigating the future of travel, highlighting the Berlin-based company’s AI-driven approach to property management. The post German PropTech startup Arbio raises €31 million to build Europe’s first AI-native platform for holiday rentals appeared first on EU-Startups. |

14/10/2025 09:10 AM | 6 | |

| 50,470 | 14/10/2025 08:30 AM | Profile: The Serbian maths whizz aiming to crack voice AI | profile-the-serbian-maths-whizz-aiming-to-crack-voice-ai | 14/10/2025 | The Serbia-born CEO of Nvidia-backed UK AI voice startup PolyAI has a nice way with words. The US is the “new Rome” which “demands loyalty”, says Nikola Mrkšić; meeting his wife during a spell interning at Credit Suisse generated “very high ROI activity”; while PolyAI’s client base is “heterogeneous”. Mrkšić is talking to Tech.eu in PolyAI’s commodious and new-looking basement offices (albeit sparsely occupied as it’s Friday and WFH Friday mania persists in the UK) in London. PolyAI, which was founded in 2017 and valued at nearly $500m, is often cited in top ten lists of UK AI startups, a triumph which was given a boost last month when Nvidia’s man of the moment CEO Jensen Huang named it as one of its eight star startups (along with the likes of Wayve and Revolut), it would be investing in. Serbian heritageA namecheck by arguably the most famous businessman on the planet might have given the 30-something co-founder and CEO a moment to reflect on how his life had changed since his 1990s childhood growing up in troubled Serbia, in the aftermath of the breakup of Yugoslavia, its parent nation. Mrkšić, who is slight in stature and softly spoken, says: “Serbia has had to find its own way after stumbling for quite a long time, which meant for my parents’ generation, it was a very like jaded feeling. “And I think there was a reflex to push your kids into hardcore education so that they can rely on themselves and maybe be less dependent on the system, which had crumbled in front of their eyes.” Growing up in Serbia, Mrkšić attended a Serbian maths high school (the equivalent of a UK grammar school) and was one of seven out of eight applicants who received a full scholarship to Cambridge University. “We’re not designed to crack Cambridge interviews the way that many elite schools in Britain are”, he wryly points out. His links with Serbia, where PolyAI has an office, are still strong, returning three or four times a year to visit friends. Cambridge UniversitySerbia might be his home country, but London is where PolyAI was founded, seven years after Mrkšić came to the UK to study computer science and maths at Cambridge University. He could have quite easily pursued a banking career, interning at Credit Suisse, where he met his wife during his undergraduate years. But an encounter with Blaise Thomson, the founder of speech-related AI startup VocalIQ, a Cambridge University spinout, convinced him to join the startup as its first employee. His time at VocalIQ, which went on to be acquired by Apple 18 months later, also lit the fuse for him wanting to launch his own startup, at a time when deep learning was gathering momentum. During this time, Mrkšić also met his Taiwanese co-founders: Tsung-Hsien Wen (ex-Google), PolyAI’s CTO, and Pei-Hao Su (ex-Facebook), PolyAI’s SVP, engineering, at a Cambridge University group focused on spoken dialogue systems. He says: “We were in high demand by the research labs. What frustrated us is that we didn’t really see automated voice improving.” What PolyAI does?PolyAI has developed AI voice assistants for call centres which guide customers through enquiries, handling millions of calls, which can, some say, sound indistinguishable from human voices. PolyAI has worked with linguists to build voice assistants that reflect human speech patterns and the voices can be tailored by accent, tone and vocabulary. The tech can complete many tasks a customer service rep can, including taking payment information as well as names, addresses and account numbers. PolyAI uses its own proprietary large language models as well as frontier model companies like OpenAI and DeepSeek. The early years of PolyAI, pre ChatGPT, were tough, says Mrkšić, given they were three researchers-cum-callow-entrepreneurs trying to commercialise a product that few in the business world knew about. Back then, the scrappy startup, looking for commercial traction, speculatively approached London pub owners to experiment with its tech. Competition and challengesWhile PolyAI is making headway, automated call handling remains a turn-off for some people, partially due to historic bad experiences with rudimentary voice tech. Furthermore, complex requests often require empathy and judgment that only humans can provide, experts say. A McKinsey survey found that 71 per cent of Gen Z respondents (rising to 94 per cent for baby boomers) believe live, human calls are the quickest and easiest way to reach customer care and explain their issues. Mrkšić has previously spoken about these challenges in the Tech.eu podcast. Meanwhile, earlier this year Klarna CEO Sebastian Siemiatkowski said its AI voice approach led to “lower quality” and Klarna flipped from its AI-first policy to ensure customers always had a human to talk to. Despite these challenges, it is easy to see why tech giants such as Google, Amazon and Microsoft have tried to crack automated call handling, as the call centre software market is estimated to be worth tens of billions of dollars. Current startup competitors include the likes of Germany’s Parloa and US startup Rasa. ChatGPT momentThe ChatGPT moment was a big boon for PolyAI, says Mrkšić, quadrupling inbound leads. Now, PolyAI works with major businesses, amid growing enterprise 24/7 demand for call centre support, which suffers from high attrition rates. These include Las Vegas casinos, Hilton and Marriott hotel chains, US delivery service FedEx, and the financial institution Unicredit. Given the co-founders' stellar CVs, funding has not been a problem, says Mrkšić. Last year, PolyAI raised £50m in funding, valuing it at close to $500m. The Series C was led by investors Hedesophia and NVentures, the VC arm of Nvidia, with participation from existing investors including Khosla Ventures and Point72 Ventures. It has previously raised $66m from investors. It is understood that PolyAI will announce a fresh funding round later this year, likely to include fresh funds from Hedesophia and NVentures. Relationship with co-founders“I am the talker”, says Mrkšić, when asked how the founders divvied up the roles. He says he loves all the key functions of being CEO: fundraising, hiring and selling. That said, he admits his management skills are a work in progress. The three co-founders, he says, are still happily professionally married. “We are really close,” he says, but points out that there are clear demarcation lines. For example, he says it was decided from day one that Mrkšić, a tech aficionado, would not write a line of code or voice any strong technical opinions. He says: “I am deeply technical. I still very much enjoy the moments where I have time with product and tech teams to talk about things.” In between running PolyAI, he also hosts an AI-infused podcast, discussing news and AI breakthroughs. US footprintMrkšić has adopted a kind of second identity, as an American, as PolyAI’s revenues have grown in the US, which now accounts for roughly 80 per cent of its revenues, compared to 20 per cent in Europe. He calls the US the “new Rome” which “demands loyalty”. He says: “If you want to be successful in the US, you are going to use American spelling and work American hours.” For example, when in London, he says he works from 10am to 1am UK time to fit in with the US. He now spends a big chunk of his time in the US, where PolyAI has New York and San Francisco offices, meeting existing and new clients, meeting investors, and attending conferences. The futureAs AI becomes more commonplace and the frontier model becomes more effective, the tech, in theory, should improve. PolyAI, which employs around 270 people, reported revenues of £11.9m in the year ending January 31 2025, up 75 per cent on the year, according to Companies House figures. Revenues were boosted by snapping up new customers and expanding existing contracts. And what about PolyAI’s plans for the rest of the year? Mrkšić says: “We have been growing the team like mad. So everything from accelerating on that and platform changes and announcements which are going to come towards the end of the year, opening up the ecosystem a bit more.” |

14/10/2025 09:10 AM | 1 | |

| 50,475 | 14/10/2025 08:20 AM | India’s Airbound bags $8.65M to build rocket-like drones for one-cent deliveries | indias-airbound-bags-dollar865m-to-build-rocket-like-drones-for-one-cent-deliveries | 14/10/2025 | 14/10/2025 09:10 AM | 7 |