Switch Dataset:

Startup News

We are collecting the most relevant tech news and provide you with a handy archive. Use the search to find mentions of your city, accelerator or favorite startup in the last 1,000 news items. If you’d like to do a more thorough search, please contact us for help.

Search for any keyword to filter the database with >10,000 news articles

Filter

Filter search

Results

| id | date | title | slug | Date | link | content | created_at | feed_id |

|---|---|---|---|---|---|---|---|---|

| 51,989 | 19/01/2026 12:15 PM | TeamFeePay announces £9M funding round and European expansion plans | teamfeepay-announces-pound9m-funding-round-and-european-expansion-plans | 19/01/2026 | Belfast-based sports technology company TeamFeePay has completed a £9 million equity funding round to support expansion into new markets and planned recruitment. The round was led by investments from YFM Equity Partners and the Investment Fund for Northern Ireland (IFNI), managed by Clarendon Fund Managers. Additional participation came from Techstart and a group of private investors. TeamFeePay was founded in 2021 by Liam McStravick, drawing on more than two decades of experience in grassroots coaching at clubs including Cliftonville, Linfield, and Ballyclare Comrades. The company was established in response to the administrative demands faced by coaches, such as managing player fees, which can reduce time available for coaching. The company has developed a software platform that supports grassroots football clubs and coaches with fixture planning, training sessions, event management, attendance tracking, and administrative tasks, helping teams stay organised while allowing coaches to focus on on-field activities. Commenting on the investment, Liam McStravick, CEO and co-founder of TeamFeePay, said the funding will support the company’s plans to modernise the operational side of grassroots football across the UK, Ireland, and Europe by reducing administrative workloads and helping clubs operate more sustainably.

McStravick added. TeamFeePay plans to use the new investment to support growth across the UK, expand further into Europe, and advance product development. The strategy also includes the creation of up to 75 new roles over the next two years across the UK and Europe, spanning sales, marketing, and product development functions. |

19/01/2026 01:10 PM | 1 | |

| 51,990 | 19/01/2026 12:00 PM | The EU-Startups Podcast | Interview with Ryan Luke Johns, Co-founder & CEO of Gravis Robotics | the-eu-startups-podcast-or-interview-with-ryan-luke-johns-co-founder-and-ceo-of-gravis-robotics | 19/01/2026 | In this special episode of the EU-Startups Podcast, we kick off a five-part interview series recorded during Leonard Launch Day in Paris, in partnership with Leonard, the innovation and foresight platform of the VINCI Group that supports startups and internal projects shaping the future of construction, infrastructure, energy, and mobility! During the event, we sat down with five companies from its 2026 cohort for in-depth conversations. This first interview in the series features Ryan Luke Johns, CEO of Gravis Robotics, a Swiss ConTech company founded in 2022, enabling autonomy in heavy machinery. We explore why autonomy is becoming increasingly important in construction, the challenges of deploying robotics in complex environments, why retrofitting existing equipment is key to real-world adoption, and much more! Key Takeaways:

The post The EU-Startups Podcast | Interview with Ryan Luke Johns, Co-founder & CEO of Gravis Robotics appeared first on EU-Startups. |

19/01/2026 01:10 PM | 6 | |

| 51,986 | 19/01/2026 12:00 PM | Only Two Days Left to Secure Super Early Bird Tickets for the Tech.eu Summit London 2026 | only-two-days-left-to-secure-super-early-bird-tickets-for-the-techeu-summit-london-2026 | 19/01/2026 | The Tech.eu Summit London 2026 is set to take place on 21–22 April at the Queen Elizabeth II Centre, bringing together leaders from the global startup and investment ecosystem. Over two days, the event will host in-depth discussions, high-level networking opportunities and collaborative sessions, placing London once again at the centre of Europe’s technology landscape. There are only two days left to secure Super Early Bird tickets for the Tech.eu Summit London 2026. This discounted ticket tier is approaching its deadline, after which pricing will move to the next phase. Super Early Bird Tickets Available Until 21 January 2026On 21 January 2026, Super Early Bird tickets will transition to the Early Bird ticket phase. Currently, Super Early Bird tickets are available for £375 + VAT. After 21 January, the price will increase to £400 + VAT under the Early Bird category. Planning to attend with colleagues or friends? Group ticket options are also available during the Super Early Bird phase, offering reduced per-person pricing compared to individual tickets. These group rates will be updated in line with the new Early Bird pricing after 21 January. The Tech.eu Summit London 2026 will bring together founders, investors, executives and policymakers from across Europe and beyond. The programme will feature keynote sessions, panel discussions and curated networking opportunities focused on topics such as artificial intelligence, fintech, SaaS, sustainability and emerging technologies. Attendees can also download the Tech.eu Events app via the App Store and Google Play to start connecting ahead of the summit. The app enables participants to browse attendee profiles, arrange meetings, explore the full agenda and manage their schedule in advance. It will also be used for fast and easy on-site access through QR code check-in. Get your tickets today!Secure your ticket today and take advantage of the current pricing while it lasts. Prices will increase after 21 January, so now is the best time to confirm your attendance. Join us at the Queen Elizabeth II Centre on 21–22 April for two days of insight, networking and collaboration with some of the most influential voices in technology and investment. We look forward to welcoming you in London. |

19/01/2026 12:10 PM | 1 | |

| 51,987 | 19/01/2026 11:34 AM | Munich’s Vanagon Ventures secures €20 million to target Europe’s pre-Seed DeepTech and AI gap | munichs-vanagon-ventures-secures-euro20-million-to-target-europes-pre-seed-deeptech-and-ai-gap | 19/01/2026 | Vanagon Ventures, a German DeepTech VC firm, has announced the final closing of its €20 million Fund I to back B2B startups from pre-Seed tackling fundamental system-level challenges and creating entirely new categories enabled by AI and DeepTech. The fund is backed by Allocator One. Further LPs include family offices and HNWIs, senior tech executives from companies such as Apple and Google. Vanagon writes initial tickets of up to €500k in teams building solutions that advance Europe’s sovereignty and sustainability, with a focus on spatial and AI, quantum computing, robotics and frontier software. “Most early-stage funds aren’t built for pre-Seed. They talk conviction but wait for proof. We didn’t start Vanagon just to be like an old VC firm. We built Vanagon from the ground up to back relentless founders on their life’s mission from day one,” says Sandro Stark, GP at Vanagon. In a broader European context, Vanagon Ventures’ Fund I closes against a backdrop of continued early-stage activity in AI and DeepTech across 2025 and early 2026. In Germany, U2V, a spin-off from Earlybird-X, launched a €60 million fund to support pre-Seed and Seed DeepTech startups emerging from European technical universities. Also in Germany, Munich-based yasp raised €4.2 million to advance its agentic AI compiler, signalling ongoing investor interest in foundational AI tooling. Beyond Germany, Paris-based Arago secured €22.1 million to develop photonic chips aimed at reducing the energy consumption of AI workloads. On the fund side, Munich-based Ananda Impact Ventures announced a €73 million first close to back European impact and DeepTech startups. Taken together, these disclosed rounds and fundraises represent roughly €160 million flowing into AI- and DeepTech-adjacent activity during this period, situating Vanagon Ventures’ new fund within a wider trend of European capital increasingly targeting pre-Seed and early-stage technologies that fall outside traditional SaaS scaling models, with Germany featuring prominently among both fund managers and funded companies. “AI changes everything – also VC investing: the steepest value creation is shifting to the earliest stages, our sweet spot. Yet many VCs shy away from pre-Seed as they still rely on SaaS playbooks that don’t fit the scaling logic of DeepTech and AI-native disruption in B2B,” adds Susanne Fromm, GP at Vanagon. Vanagon Ventures was founded in 2023 on the conviction that the next generation of highly impactful technology companies will not emerge from traditional SaaS playbooks. Instead, that they will be built by founders with deep domain expertise in ‘old-world’ industries who leverage advanced technologies to re-architect these systems from the ground up. The fund looks to address a structural gap in the venture market: the lack of dedicated capital and conviction at the pre-Seed stage for AI-native and DeepTech companies that, due to disruption, have massive economic potential but different scaling logics than traditional software companies. Vanagon Ventures is led by its three General Partners, who combine venture experience with exposure to technology-driven transformation across industries:

“DeepTech, long a European strength, now stands as a cornerstone of sovereignty and the driving force behind the next wave of innovation. Half of the world’s top innovation clusters are in Europe and venture capital is the fastest way to turn that innovation into economic power. Going all-in is a no-brainer,” says Axel Roitzsch, GP at Vanagon. Fund I targets a portfolio of approximately 30 companies and has already invested in several companies, including:

Other notable investments include glass-based data storage enabling immutable sustainable archiving, AI visual inspection for zero-defect manufacturing, and AI demand forecasting for the chemical and textile industries. The post Munich’s Vanagon Ventures secures €20 million to target Europe’s pre-Seed DeepTech and AI gap appeared first on EU-Startups. |

19/01/2026 12:10 PM | 6 | |

| 51,984 | 19/01/2026 11:00 AM | Ananda Impact Ventures secures €73M first close for fifth Core Impact Fund | ananda-impact-ventures-secures-euro73m-first-close-for-fifth-core-impact-fund | 19/01/2026 | Ananda Impact Ventures has completed a €73 million first close of its fifth Core Impact Fund, exceeding its €50 million target and representing the largest first close in the firm’s 16-year history. The fund is backed by a mix of returning and new investors, including the European Investment Fund (EIF), NRW.BANK, Investcorp-Tages, Mercator Foundation, and more than 40 family offices across Europe. Founded in 2009, Ananda Impact Ventures is a European impact venture capital firm focused on early-stage, technology-driven startups addressing social and environmental challenges. The firm manages €270 million across five funds and invests in areas such as climate, healthcare, biodiversity, and social inclusion. Ananda V continues this strategy, focusing on early-stage technologies aimed at addressing long-term societal and environmental challenges across Europe. Over sixteen years and four prior funds, Ananda has established a track record in impact investing, including the successful return of its first fund to investors. The fifth fund builds on this experience with a long-term investment perspective. Ananda’s investment strategy emphasises systems-level thinking rather than a narrow sector focus. Drawing on its experience since 2009, the firm views major human, social, and environmental challenges as interconnected and more effectively addressed through integrated approaches rather than isolated solutions. This perspective underpins Ananda’s focus on interdisciplinary business models designed to deliver both long-term impact and sustainable returns. This approach is reflected in Ananda’s portfolio, which includes European founders addressing structural societal and environmental challenges. The firm has backed companies such as OroraTech, IESO, and NatureMetrics, as well as investments spanning biology-enabled industry, nature-informed healthcare, and education-driven entrepreneurship through Differential Bio, Resistomap, and OneDay. Commenting on the fundraise, co-founder Johannes Weber said that Ananda’s strategy reflects a commitment to independent thinking and alignment with founder values, noting that consistency in approach has helped differentiate the firm amid shifting venture capital trends. Co-founder Florian Erber added that Ananda has built a multidisciplinary team with expertise spanning science, engineering, and entrepreneurship, enabling the firm to assess challenges at a systems level and engage deeply with founders. Through its fifth fund, Ananda Impact Ventures aims to continue supporting European founders developing scalable, technology-driven solutions to interconnected social and environmental challenges. |

19/01/2026 11:10 AM | 1 | |

| 51,985 | 19/01/2026 10:59 AM | Sequoia’s big bet on Anthropic | sequoias-big-bet-on-anthropic | 19/01/2026 |  Venture capital powerhouse Sequoia Capital is preparing to invest in Anthropic, the AI startup best known for its Claude family of large language models, in one of the largest private funding rounds in tech this year. The deal is being led by Singapore’s GIC and U.S. investor Coatue, each contributing roughly $1.5 billion, as part of a planned raise of $25 billion or more at a staggering $350 billion valuation. This move stands out for two reasons: the size and speed of the valuation surge and the fact that Sequoia, already an investor in rival AI builders such as OpenAI… This story continues at The Next Web |

19/01/2026 11:10 AM | 3 | |

| 51,988 | 19/01/2026 10:57 AM | German VC Ananda Impact Ventures completes €73 million first close to back European impact startups | german-vc-ananda-impact-ventures-completes-euro73-million-first-close-to-back-european-impact-startups | 19/01/2026 | Munich-based VC Ananda Impact Ventures has secured €73 million in the first close of its fifth Core Impact Fund, well above its €50 million target and securing the largest first close in the firm’s 16-year history in order to invest in frontier tech from the next-generation of European impact unicorns. Returning and new investors include the European Investment Fund (EIF), NRW.BANK, Investcorp-Tages, Mercator Foundation, and over 40 family offices across Europe. Co-founder Johannes Weber says: “We went out with the thesis that we should reflect the values of our founders – anti-consensus, anti-group think. We have seen venture capital follow the geopolitical zeitgeist into isolationism, division, and defence – simply by staying true to our core values, we become differentiated in the market. We become outliers. This is Impact Investing 3.0 – the era when impact ceases to be a word of convenience, and starts to be a word of conviction.” In the context of recent European impact and DeepTech fund activity in 2025 and early 2026, Ananda Impact Ventures’ €73 million close sits alongside several sizeable raises in adjacent segments of the market. Amsterdam-based Rubio Impact Ventures secured a €70 million close for its third fund to back startups addressing climate and social inequality, while fellow Dutch firm PureTerra Ventures launched Fund II targeting €150 million for water-focused technologies. In adjacent DeepTech and energy segments, Armilar raised €120 million for its fourth fund focused on DeepTech and digital transformation, and Germany-based Future Energy Ventures closed a €205 million second fund to scale energy transition technologies. Taken together, these announcements represent approximately €548 million committed or targeted for impact-led, climate and frontier technology investing, indicating that despite broader market caution, significant capital continues to be allocated to purpose-driven and technically specialised European venture strategies during 2025–2026. Florian Erber, Founding Partner at Ananda, adds, “To change systems, you need a team that thinks in systems. We have built Ananda around biologists, engineers, chemists and entrepreneurs – people who think in molecules, ecosystems and lines of code. We are full of builders, and that is how you go truly deep. That is why we can tell founders to skip the problem slide.” At a time when many investors are retreating from impact, Ananda claims to be doing the opposite: doubling down on European founders building companies indispensable for the future of people and planet, such as OroraTech (global wildfire intelligence), IESO (AI-driven mental health technology) and NatureMetrics (biodiversity data). Just this year, OroraTech extended their Series B to over €37 million and NatureMetrics raised a $25 million Series B. Zoe Peden, Partner at Ananda, says: “When we first backed NatureMetrics, biodiversity wasn’t a VC category – it was a regulatory footnote. We saw that nature risk would become financial risk, and that the companies building the data infrastructure would become inevitable. Three years later, Just Climate is leading their Series B, and the company has become the world leader in biodiversity data. That’s what research-driven investing looks like.” Founded in 2009, Ananda Impact Ventures backs early-stage, tech-driven startups across Europe that tackle urgent social and environmental challenges. With €270 million under management across five funds, Ananda supports visionary founders building scalable solutions in areas such as climate, healthcare, biodiversity, and social inclusion. Their investment strategy has been built over four fund generations:

Christian Mueller, Member of the Board of the Mercator Foundation Switzerland adds: “The Mercator Foundation Switzerland supports democracy, education, diversity, and climate. We were looking for established VC impact funds that are deeply committed to driving systemic change within our areas of work, realising both financial returns and real social and ecological impact. Ananda was a perfect match. We were especially impressed by the team’s ability to spot emerging trends and their balance of rigorous analysis with a deep investment in the people behind the companies.” EU-Startups has previously covered Ananda Impact Ventures on several occasions. This includes an interview with co-founder Johannes Weber, published in 2023, which explored Ananda’s thesis-driven approach to impact investing and its focus on technically complex, mission-led founders. Earlier coverage dates back to 2018, when EU-Startups reported on Ananda’s €50 million fundraise to back around 20 European impact startups, highlighting the firm’s early commitment to the sector. The post German VC Ananda Impact Ventures completes €73 million first close to back European impact startups appeared first on EU-Startups. |

19/01/2026 12:10 PM | 6 | |

| 51,982 | 19/01/2026 10:03 AM | Europe’s €307 million AI funding call | europes-euro307-million-ai-funding-call | 19/01/2026 |  When the European Commission announced on 15th of January a €307.3 million funding call for AI and related tech under Horizon Europe earlier this year, the press materials presented it as a strategic push toward trustworthy AI and European digital autonomy. The funding targets trustworthy AI, data services, robotics, quantum, photonics, and what Brussels calls “open strategic autonomy.” Viewed in isolation, the number itself isn’t eye-popping. By global standards, where the private sector alone pours hundreds of billions into AI, €307 million is barely a rounding error. Yet this sum matters less for its scale and more for what it… This story continues at The Next Web |

19/01/2026 10:10 AM | 3 | |

| 51,981 | 19/01/2026 09:30 AM | Anzen Industries raises $2.2M for chemical production innovation | anzen-industries-raises-dollar22m-for-chemical-production-innovation | 19/01/2026 | UK-based deeptech startup Anzen Industries has raised $2.2 million in pre-seed funding, led by LocalGlobe and Creator Fund, with participation from strategic angel investors across the UK, EU, and US, including Konstantin von Unger and early-stage investor Cory Levy. Founded by scientists Amy Locks and Pedro Lovatt Garcia, Anzen Industries is a biomanufacturing company focused on producing high-value chemicals using cell-free enzyme systems. The company develops reusable, low-infrastructure enzyme reactors designed to manufacture complex molecules more efficiently than traditional chemical synthesis, plant extraction, or fermentation-based methods. Its goal is to improve the resilience, scalability, and economic viability of global supply chains for critical chemicals across multiple industries. Anzen’s platform combines proprietary enzyme reactor technology, enzyme immobilisation techniques, and AI-driven design to enable biochemical reactions outside living cells. This first-principles approach allows highly specific and tunable enzymes to operate within small, modular reactors, supporting more flexible and cost-effective scaling while reducing reliance on capital-intensive infrastructure. Co-founder and CTO Pedro Lovatt Garcia outlined the company’s technical vision, saying:

Existing approaches to manufacturing complex chemicals face several constraints. Organic synthesis can be difficult to scale, plant extraction depends on variable agricultural supply, and fermentation typically requires significant infrastructure and downstream processing, leading to high capital costs. Anzen’s cell-free system is designed to address these limitations by improving efficiency and shortening time to market. Commenting on the investment, Julia Hawkins, General Partner at LocalGlobe, said Anzen is rethinking how critical molecules are produced from first principles, to improve speed, resilience, and control across global supply chains. CEO and co-founder Amy Locks highlighted the role of Europe’s scientific ecosystem in the company’s early development, noting:

She added that the United States offers an environment well-suited to the company’s next phase of growth, as Anzen looks to scale its technology globally. The company plans to use the funding to relocate operations to the United States, establish its first manufacturing facility, and expand industrial collaborations and partnerships as it scales its biomanufacturing platform. |

19/01/2026 10:10 AM | 1 | |

| 51,983 | 19/01/2026 09:08 AM | Engineering the future: 10 Promising German startups to watch in 2026 and beyond! | engineering-the-future-10-promising-german-startups-to-watch-in-2026-and-beyond | 19/01/2026 | Over the past few years, Germany has continued to strengthen its position as one of Europe’s most important startup ecosystems, building on its industrial heritage while embracing new technologies across AI, energy, defence and advanced manufacturing. Strong research institutions, a skilled engineering workforce and close links between industry and innovation continue to support the country’s role as a key driver of European technology development. In recent funding cycles, Germany has also seen a growing share of large investment rounds flowing into reference and resilience technologies. Capital has increasingly backed areas such as defence systems, energy security, critical infrastructure, climate resilience and industrial AI, reflecting both market demand and a broader shift towards technologies that support long-term stability and strategic autonomy. This week, in our country-by-country series highlighting some of the most promising startups across Europe, we turn our focus to the German startup ecosystem. All founded between 2024 and 2025, these 10 startups reflect the depth and direction of innovation emerging from Germany today!

Leipzig-based Aevoloop develops plastics designed to be recycled again and again. The company works with end-of-life plastic waste that would otherwise be incinerated, turning it into chemical building blocks that can be reused to create new materials. These plastics are designed for industrial use and can be produced at scale, without increasing costs compared to conventional plastics. Aevoloop designs its polymers at a molecular level, allowing them to break down easily during recycling without losing performance. The materials match the properties of widely used plastics such as polyolefins, while avoiding microplastic pollution and remaining fully recyclable over multiple cycles. Founded in 2024, they have raised €8.25 million, including seed funding and public grants, to move their technology towards commercial production.

Founded in 2024 in Freiburg im Breisgau, Black Forest Labs is an AI research company focused on visual intelligence. The company develops generative models that can create and edit images from text and image inputs, supporting tasks such as image generation, transformation and visual control. Its FLUX model family is designed for production use and is already used by developers and product teams building creative and media applications. Black Forest Labs offers its models through both APIs and open-weight releases, allowing companies and researchers to run, customise and fine-tune them on their own infrastructure. The models are built to deliver high-quality visual output with fast performance and are being expanded towards broader visual and video capabilities. To date, the company has raised close to €387 million, including a large Series B round, to scale its research, infrastructure and product offering.

Duisburg-based Factor2 Energy develops geothermal power plants that use CO₂ instead of water to generate electricity. By using CO₂ as a working fluid, the company aims to produce clean, baseload energy around the clock while avoiding fracking, ultra-deep drilling and water-intensive processes. Its approach allows geothermal power to be deployed in a wider range of geological sites, including locations already used for carbon capture and storage. Factor2 Energy’s system takes advantage of the thermodynamic properties of CO₂ to extract heat more efficiently, enabling higher energy output with fewer system components and lower environmental impact. The technology is designed to deliver emission-free, dispatchable power while permanently storing CO₂ underground. Founded in 2025, the company has secured around €7.8 million to advance development of its geothermal systems and support the transition towards scalable, low-carbon energy infrastructure.

Founded in 2024 and headquartered in Pocking, feld.energy develops agri-photovoltaic systems that allow farmers to produce solar power while continuing agricultural use of their land. The company designs PV systems that work alongside crops or livestock, enabling the dual use of farmland without sealing soil or displacing farming activity. Its solutions are tailored to different use cases, including arable land, pasture and mixed farming operations. feld.energy manages the full project process, from site assessment and permitting to construction and operation, offering farmers different income models such as fixed leases, revenue sharing or self-operated systems. The goal is to provide long-term, predictable additional income without relying on subsidies, while supporting the energy transition in rural areas. The company has landed €11.7 million to expand its agri-PV projects and scale deployment across Germany.

Berlin-based Integral provides a digital tax advisory platform designed for startups and small and medium-sized enterprises. The company combines tax advice, bookkeeping, payroll and financial reporting in a single service, allowing businesses to manage their tax obligations through one central platform. Integral pairs automation with personal support, giving clients access to a dedicated tax advisor alongside digital tools. Integral’s platform integrates accounting processes, document management and communication with tax authorities, helping companies stay compliant while reducing administrative effort. The service is built to be secure and GDPR-compliant, with transparent pricing and fast response times from advisors. Founded in 2024, Integral has raised €12 million to further develop its platform and expand its offering for growing companies across Germany.

Founded in 2024 in Cologne, Octonomy develops an artificial intelligence platform designed to automate complex support tasks for specialised professionals. The system is built for use cases such as technical support and field service, where employees typically need to search across manuals, technical documentation, emails and enterprise systems to resolve issues. Octonomy uses intelligent multi-agent technology to retrieve, understand and act on information across these sources in real time. Octonomy integrates securely with existing enterprise systems such as ERP and CRM platforms, allowing it to automate full processes including warranty checks, product exchanges and customer follow-ups across all communication channels. The platform is developed and hosted in Germany, with a strong focus on GDPR and EU AI Act compliance. The company has secured €23.5 million to scale its platform and expand adoption among enterprises looking to improve support efficiency without increasing headcount.

Berlin-based Peec AI, develops an analytics platform that helps marketing teams understand how their brands appear in AI-driven search environments. As tools like ChatGPT and Perplexity increasingly shape discovery, Peec AI tracks key metrics such as visibility, position and sentiment, showing how often a brand is mentioned, how it ranks and how it is framed in AI-generated answers. The platform allows teams to monitor specific prompts, compare performance against competitors and identify which sources influence AI search results. Peec AI also provides recommendations to help brands improve their presence in AI conversations and turn insights into action through reports, dashboards and API access. Founded in 2025, the company has raised around €25 million to date and is scaling its platform as AI search becomes a core channel for digital marketing.

Founded in 2024 and headquartered in Munich, Pulsetrain develops battery management and inverter technology for electric vehicles and industrial applications. The company builds systems that sit on top of existing batteries, combining hardware and software to improve performance, safety and control. Its technology is designed to work across different vehicle types, including passenger vehicles, two- and three-wheelers and non-road machinery. Pulsetrain’s platform uses software-driven intelligence to manage charging, discharging and thermal behaviour, helping extend battery lifetime and support reuse. By optimising energy flow and reducing thermal stress, the company aims to increase efficiency without requiring changes to battery hardware. To date, Pulsetrain has raised €14.34 million to further develop its technology and expand partnerships within the mobility and industrial sectors.

Berlin-based STARK is a defence technology company developing unmanned systems for military and security applications. The company focuses on AI-enabled and software-defined platforms designed to meet current operational needs and to be produced at scale. Its systems are built with affordability and rapid deployment in mind, reflecting the realities of modern defence environments. STARK works closely with NATO and partner forces, testing its technology under real operational conditions and using direct user feedback to guide development. This approach allows the company to iterate quickly and align its systems with the practical requirements of the armed forces. Founded in 2024, STARK has raised more than €66 million to accelerate product development, expand manufacturing capacity and support deployments with defence partners across Europe.

Founded in 2024 and based in Kassel, SWARM Biotactics creates bio-robotic systems designed to operate in environments where conventional sensors and machines reach their limits. The company combines living insects with custom-built control, sensing and communication modules, creating swarms that can enter tight, cluttered or high-risk areas and transmit real-time data. These systems are intended for use cases such as defence, security and search and rescue operations. SWARM Biotactics’ approach leverages the natural mobility and persistence of biological organisms, enhanced with AI, sensors and swarm intelligence. This allows for silent access, close-range intelligence gathering and scalable deployment without exposing human operators to danger. The company has raised €13 million to advance its technology and develop bio-robotic systems suited for contested and denied environments. The post Engineering the future: 10 Promising German startups to watch in 2026 and beyond! appeared first on EU-Startups. |

19/01/2026 10:10 AM | 6 | |

| 51,979 | 19/01/2026 09:00 AM | PROTOTYPE Capital launches Fund III and hits 5.6x returns by backing "crazy ideas" | prototype-capital-launches-fund-iii-and-hits-56x-returns-by-backing-andquotcrazy-ideasandquot | 19/01/2026 | It’s not often I meet an early-stage investor who tells me that they are looking for “weird and crazy ideas.” But Andreas Klinger, founder of PROTOTYPE, is not just any investor. He is deeply embedded in Europe’s tech ecosystem as an early-stage investor and former founder and operator, having served as CTO at Product Hunt, VP Engineering at CoinList, Head of Remote at AngelList, and CTO at On Deck — and as a tireless advocate for Europe’s startup ecosystem through EU-Inc. But for Klinger, investing in people with crazy ideas has paid off. PROTOTYPE enters 2026 with strong momentum across its funds and the launch of Fund III. First-round bets power $1B+ in portfolio funding in 2025. All of PROTOTYPE’s current vehicles rank in the global top 1–5 per cent by performance, with:

(the latter two figures representing lower-bound estimates as several rounds are currently closing). In 2025 alone, PROTOTYPE’s first-round-focused portfolio raised well over $1 billion, with the firm backing 15 European startups, primarily in robotics, automation, and physical or frontier AI. Against this backdrop, Fund III closed in record time and was upsized by 25 per cent due to strong demand from a predominantly European LP base of family offices, founders, and operators. “I only invest if I want to talk about this problem for 10 years”Fund III embodies a portfolio situated at the frontier of automation, robotics and deeptech. So, where does Klinger place his bets? Simply put, he’s looking for founders obsessed with their ideas, not people who spreadsheet their way into a market.” He asserts:

According to Klinger, some of their most interesting investments came from people who were just obsessively building something "because it had to exist,” not because the market spreadsheet said it should."

Prototype Capital’s portfolio comprises a broad set of early-stage technology startups pushing the frontier of automation, deep tech, developer tools, and hardware-enabled innovation. It includes: Hyperdrives, a deeptech company developing mass-producible, high-performance electric drive systems with advanced cooling technology for industrial-scale electrification applications and the autonomous tractor market, Voltrac. Check out our earlier interview with Hyperdrives' CEO Robin Renz. There’s robotics and autonomy startups like Sunrise Robotics, Rollo Robotics, Isembard, and Sensmore autonomous mining machines, and HIGHCAT reconnaissance drones. On the software and AI side, the fund backs multimodal and AI tooling ventures like LUMA, Dust, and DX, as well as developer and infrastructure platforms such as ZED, Fly.io, and Cal.com. There’s also connectivity innovation like Willo wireless charging technology. The value of thematic focusKlinger attributes part of the firm’s success to being thematically focused, not just in investment strategy, but also in branding around that theme to create a synergistic effect between the portfolio companies:

It's a practice he recommends to smaller VCs; however, he notes, “You need genuine competence in the theme. The focus has to be real.” Luma AI was the standout performer in PROTOTYPE’s portfolio over the past year, marking the second company in the fund’s history to cross a billion-dollar valuation. “They started with video AI models and are now building multimodal world models – video combined with other sensors, text, and physics. They’re basically creating systems that can ingest any kind of data. It’s a true frontier lab,” he said. What particularly impresses Klinger is the founding team's mindset.

From a performance perspective, Klinger describes Luma as “easily the biggest success of last year” for the fund. At the same time, he notes that rapid scale can be a double-edged sword. He admits that, as an early-stage investor, he's always a bit nervous when companies grow very big, very fast.

However, he is confident that Luma’s growth has been both measured and sustainable. “They’ve grown into this scale over several years and are actually very capital-disciplined compared to other AI frontier labs. For some of those, a billion dollars is basically a seed round. So with Luma, I’m actually quite confident.” Why robotics, automation, and simulation now define the cutting edgeThe last few years have seen a shift in terms of frontier tech. Klinger asserts that in 2019, developer tooling was leading frontier tech.

When it comes to robotics, Klonger cites the importance of breakthroughs in perception and reasoning.

The result is robots that can deal with variation: slightly different objects, slightly different positions, and dynamic environments. They can learn tasks, generalise, and repeat them. According to Klinger, this enables something that was previously basically impossible: small-batch manufacturing automation. He sees this as critical for Europe because most European manufacturing is not mass automotive production:

An example in the Prototype portfolio is Sunrise Robotics, a Ljubljana-based industrial robotics startup founded in 2023. The company builds intelligent, autonomous robotic cells that combine dual robot arms, advanced perception, and AI trained through simulation rather than hand programming. This enables rapid deployment and flexibility across diverse manufacturing environments. Unlike traditional factory robots, which take months to install and only work in high-volume production lines. The startup emerged from stealth in 2025 with a significant seed round led by Plural, with participation from Seedcamp, Tapestry, Tiny.vc and PROTOTYPE, and has already deployed early units with partners across Europe. An activist investor for Europe’s tech sovereigntyKlinger’s role as an investor is underpinned by a relentless commitment to scrutinise the state of European tech. I won’t mention too much about EU-Inc, as you can check out some of our earlier commentary, He celebrates European tech, champions its startups, and lobbies politicians. He’s outspoken about Europe’s opportunity and the need for technological sovereignty. When it comes to robotics, Klinger contends that Europe has made a massive strategic mistake by selling core industrial assets and supply chains, especially in robotics, to China.

It's a timely warning. Last year marked a major blow to European independence with ABB selling its Robotics division to SoftBank Group and Arduino acquired by Qualcomm. That’s why Fund III is so focused on vertical robotics, automation, and their supplier ecosystems. Not just software, but motors, sensors, power electronics, manufacturing processes – the whole stack. He warns that if those capabilities leave Europe, “then even European startups will have to build in Asia because that’s where the networks are. And once that happens, you’re done.” Beyond the hype of humanoid roboticsWhen asked about the surge of interest in humanoid robotics, Klinger offers both a bear case and a bull case. On the downside, he argues, “if I know exactly what task I want to solve, a purpose-built machine will almost always be cheaper, more reliable, and better. I don’t want a humanoid in my bathroom washing my clothes with two hands – I want a washing machine. Building an artificial human just to replicate a single appliance is insane in terms of complexity and cost.” For most stable, clearly defined tasks, he adds, specialised machines will continue to win. The upside, however, lies in flexibility and scale. The first element is what Klinger calls the “last-step problem.”

The second argument is an analogy with consumer technology. “A digital camera is better than the camera in my phone. A walkie-talkie is better at communication. A GPS device is better at navigation. But I already have an iPhone. It’s good enough at all of them, and it benefits from massive economies of scale. So you build apps on top of it.” Hacker houses, real hardware, failing fast, and next-gen foundersKlinger sees hacker culture as critical to building a frontier-tech pipeline in Europe. He asserts that Europe needs more self-selecting spaces for “highly technical, slightly crazy people: hacker houses, robotics clubs, student labs, informal research groups.”

Backing makers of tech that “shouldn’t exist but must exist”In terms of outreach, PROTOTYPE, like most investors, prefers warm introductions, but his public presence means it's easier to get on his radar compared to some other investors. Klinger stressed:

PROTOTYPE wants to change the innovation narrative. Klinger asserts that while Europe has talent, science, and the requisite industrial base, it often lacks the confidence and coherent storytelling around frontier technology.

|

19/01/2026 09:10 AM | 1 | |

| 51,980 | 19/01/2026 08:00 AM | Hamburg-based one.five raises €14 million to solve the product-market-fit problem in packaging | hamburg-based-onefive-raises-euro14-million-to-solve-the-product-market-fit-problem-in-packaging | 19/01/2026 | one.five, a Hamburg-based company building AI-powered solutions for packaging product development, has raised €14 million in Series A funding to scale its proprietary AI platform and data foundation. The round was led by Dr Hans Riegel Holding (shareholder HARIBO), with participation from 212 NexT, Symbia VC (Family Office), Btomorrow Ventures, KIMPA Impact (multi-family office), Zubi Capital and existing investors Speedinvest, Planet A, Green Generation Fund, Climentum Capital, Revent, and WEPA. Martin Weber, co-founder and Managing Director of one.five, noted, “Too many packaging products fail before they ever reach the market. New funding allows us to further expand our AI-powered Co-Pilot and scale our first platform product, the “Product Market Fit Compass”, which was specifically designed for technology providers such as paper manufacturers. “It has been validated already as our customers have used the platform to approach brand owners more strategically and make internal material development significantly more efficient without having to build large in-house R&D teams.” one.five was founded in 2020 by Martin Weber, former CFO of vertical indoor farming unicorn Infarm, and Claire Hae-Min Gusko, previously Head of Business Strategy at Infarm. It aims to accelerate the transformation of the global packaging supply chain through AI-driven innovation. According to the company, its proprietary platform applies AI to packaging product development, thereby shortening time to market and enabling packaging players to launch more solutions faster and more efficiently. The company aims to solve the product-market-fit problem in packaging. It notes that global reliance on plastic is still significantly high, despite increased climate commitments. It reported that only an estimated 15-20% of global packaging can be classified as sustainable, while less than 15% of plastic packaging is recycled, and nearly half continues to be disposed of in landfills. The German startup also notes that on average, around 60% of R&D spending in the packaging industry is utilised towards products that never achieve commercial success. This challenge is more prevalent in the primary packaging for fast-moving consumer goods (FMCG), due to low margins, high volumes, volatile consumer preferences, and regulatory changes. One.five aims to address this problem by embedding product-market fit directly into the development process. The company claims that its AI-driven platform optimises this process by translating all success-critical factors, from technical performance and regulatory compliance to cost targets and consumer acceptance at the point of sale, into data-driven requirement profiles. This enables R&D teams to develop products that are market-ready by design. The company’s core offering is the Product Market Fit Compass, a platform product that allows paper and coating manufacturers to benchmark their product portfolios against real brand requirements. This helps them identify and assess the products that have the highest chances of market success. The platform also defines concrete development targets, enabling teams to develop new products aligned with customer demand. “Our platform helps companies focus on solutions that have a clear path to market and revenue. In early pilot projects with paper manufacturers, we’ve seen customers engage with brands faster, reduce failed developments and shorten time-to-market significantly. In these cases, we’re expecting a return on investment of around five times of the invested capital within the first year. This is exactly the kind of commercial impact we want to scale with this round,” added Claire Hae-Min Gusko, co-founder of one.five. The company plans to use this capital to scale its platform, generate additional proprietary data through experiments and commercial material deployments, and expand to new customer groups. In 2025, the company introduced two alternative packaging solutions developed using its own AI platform: Bluemorph, a recyclable high-barrier packaging solution for freshness and protection requirements, and Glassleaf, a transparent, recyclable packaging made from bio-based materials. The company notes that early customers, including BioSun (in collaboration with Lorentzen & Sievers as distribution partner), foodie & friends, Rawito, Tactic Games, Nature Cosmétique, JUNG, and UPM Raflatac, have launched these materials in real market applications. It is also planning to launch platform products for packaging converters and brand owners in the second half of 2026. Currently, one.five works with paper manufacturers, including clients such as Starkraft, a business unit of Zellstoff Pöls AG (Austria), and Grünperga Papier (Germany). It is also engaged with packaging converters and global FMCG brands. The post Hamburg-based one.five raises €14 million to solve the product-market-fit problem in packaging appeared first on EU-Startups. |

19/01/2026 09:10 AM | 6 | |

| 51,978 | 19/01/2026 07:59 AM | Sinpex raises €10M Series A to redefine KYB automation for Europe’s AML era | sinpex-raises-euro10m-series-a-to-redefine-kyb-automation-for-europes-aml-era | 19/01/2026 | Sinpex, an AI-powered platform for KYB / KYC lifecycle management, today announced its €10 million Series A financing round. Sinpex streamlines business client onboarding and continuous KYB compliance, empowering companies to meet the regulatory demands of the 2027 EU Anti-Money Laundering (EU AML) Regulation. Sinpex is an all-in-one platform that unifies every stage of the customer and regulatory lifecycle. The SaaS solution is recognised for redefining digital client onboarding for businesses, including document acquisition, UBO identification, risk assessment, AML screening, ID&V, and ongoing reviews. It combines an extensible KYB data model across multiple jurisdictions with AI-driven register and ownership analysis, resulting in fully audit-ready reporting and gold-standard compliance outcomes. I spoke to the CEO and founder, Dr Camillo Werdich, to learn more. Werdich founded Sinpex in 2019 after seeing first-hand the limits of existing compliance technology while working as a project lead in financial services at Deloitte. Involved in selecting KYC tools for large banks, he found that most solutions failed to address the core problem: institutions were still burdened with highly manual, document-heavy processes, from ownership verification to data extraction. Poor data quality, slow workflows, and repetitive work left both banks and compliance teams frustrated.

Financial institutions such as Otto Payments, Enpal, IKB, Bybit, Scayle Payments and KfW rely on Sinpex. Turning fragmented corporate data into audit-proof compliance

|

19/01/2026 08:10 AM | 1 | |

| 51,976 | 19/01/2026 07:00 AM | The Race to Build the DeepSeek of Europe Is On | the-race-to-build-the-deepseek-of-europe-is-on | 19/01/2026 | As Europe’s longstanding alliance with the US falters, its push to become a self-sufficient AI superpower has become more urgent. | 19/01/2026 07:10 AM | 4 | |

| 51,977 | 19/01/2026 06:00 AM | YC-backed UK startup Elyos AI raises €11.1 million to build AI agents for trades and field services | yc-backed-uk-startup-elyos-ai-raises-euro111-million-to-build-ai-agents-for-trades-and-field-services | 19/01/2026 | Elyos AI, a London-based startup building AI agents for the trades and field services industry, today announced it has raised €11.1 million ($13 million) in Series A funding to accelerate product development and international expansion. The round was led by Blackbird Ventures, with participation from Y Combinator and Pi Labs. Elyos AI has raised a total of €13.7 million ($16 million) in funding. Adrian Johnston, co-founder of Elyos AI, said, “Trades businesses are overwhelmed by calls, emails, and admin – and that friction directly costs them revenue. We’re building AI agents that work like effective front-office staff: answering every call, booking every job, and integrating deeply into the systems trades already use.” Elyos AI was founded in 2023 by Adrian Johnston, Philippa Brown, and Panos Stravopodis as part of the Y Combinator programme. It provides AI agents for trades businesses, including plumbers, electricians, HVAC, and facilities operators, to automate customer communications, booking, dispatch, and follow-ups. These AI agents can integrate with industry-standard systems and can handle inbound calls, outbound follow-ups, missed calls, and email workflows, allowing businesses to capture more jobs while reducing operational overhead. The company claims to have witnessed rapid adoption. According to Elyos AI, its customers reported higher booking rates, faster response times, and significant reductions in missed calls after deploying Elyos AI’s agents. “Elyos is going after a massive vertical market, and their deep understanding of trades businesses is evident in how well their voice agents perform in the real world. Their growing traction and genuine customer love are powerful signals of product quality and the speed of the product and engineering team. We think Elyos is well-positioned to define the AI category for field services and trades,” said James Palmer from Blackbird Ventures. The fresh capital will be used to expand Elyos AI’s engineering and go-to-market teams, deepen integrations with field-service CRMs, and launch new AI agent capabilities across voice, email, and messaging. The company plans to expand internationally in 2026. The post YC-backed UK startup Elyos AI raises €11.1 million to build AI agents for trades and field services appeared first on EU-Startups. |

19/01/2026 07:10 AM | 6 | |

| 51,975 | 18/01/2026 04:10 PM | How YC-backed Bucket Robotics survived its first CES | how-yc-backed-bucket-robotics-survived-its-first-ces | 18/01/2026 | 18/01/2026 05:10 PM | 7 | ||

| 51,974 | 18/01/2026 01:37 PM | TNW Weekly Briefing | tnw-weekly-briefing | 18/01/2026 |  Legislation and digital policy European Commission opens call for evidence on Open Digital Ecosystems Signal: The EU is preparing a structural shift toward open, interoperable digital infrastructure. This marks a move from regulating dominant platforms to actively shaping alternatives and reducing strategic dependency. DMA and DSA enter an enforcement-heavy phase in 2026 Signal: Europe’s digital laws have moved from principle to execution. Compliance, fines, litigation, and operational constraints are now the central risk factors for large technology companies in the EU. Intellectual property and market structure EUIPO reports record trademark and design filings in 2025 Signal: European technology and business… This story continues at The Next Web |

18/01/2026 02:10 PM | 3 | |

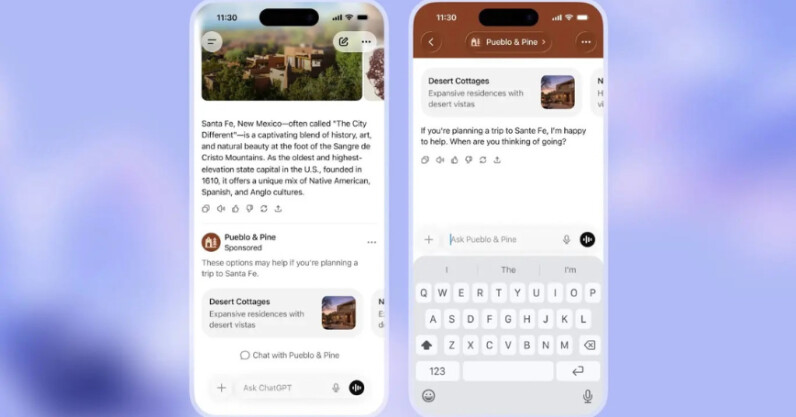

| 51,973 | 17/01/2026 10:12 AM | ChatGPT’s Ads era is here | chatgpts-ads-era-is-here | 17/01/2026 |  OpenAI’s decision to introduce advertisements inside ChatGPT for free users and its new $8 “Go” tier is already shaping up to be one of the most consequential pivots in generative AI’s short history. It’s not a simple business tweak. It’s a reframing of where digital intent, attention, and commercial influence intersect in an age where conversations increasingly replace search bars. OpenAI has not yet started showing ads in ChatGPT, but it plans to begin testing ads in the coming weeks. The first tests will target adult users in the United States on the Free tier and the new $8 ChatGPT… This story continues at The Next Web |

17/01/2026 11:10 AM | 3 | |

| 51,972 | 17/01/2026 12:40 AM | Thinking Machines Cofounder’s Office Relationship Preceded His Termination | thinking-machines-cofounders-office-relationship-preceded-his-termination | 17/01/2026 | Leaders at Mira Murati’s startup believe Barret Zoph engaged in an incident of “serious misconduct.” The details are now coming to light. | 17/01/2026 01:10 AM | 4 | |

| 51,971 | 16/01/2026 11:46 PM | AI cloud startup Runpod hits $120M in ARR — and it started with a Reddit post | ai-cloud-startup-runpod-hits-dollar120m-in-arr-and-it-started-with-a-reddit-post | 16/01/2026 | 17/01/2026 12:10 AM | 7 | ||

| 51,970 | 16/01/2026 10:05 PM | Snowflake, Databricks challenger Clickhouse hits $15B valuation | snowflake-databricks-challenger-clickhouse-hits-dollar15b-valuation | 16/01/2026 | 16/01/2026 10:10 PM | 7 | ||

| 51,969 | 16/01/2026 08:02 PM | BizzyNow opens Mamacrowd equity round to fund “micro-meetings” for business professionals | bizzynow-opens-mamacrowd-equity-round-to-fund-micro-meetings-for-business-professionals | 16/01/2026 |  Italian startup BizzyNow has launched an equity crowdfunding round on Mamacrowd to finance the next phase of its networking app, built around quick, in-person meetups it calls “Bizzy Moments.” The campaign targets €150k–€400k at a €3m pre-money valuation, with a €500 minimum ticket. BizzyNow says proceeds will support go-to-market validation, product upgrades, and the operational groundwork needed to scale. The problem BizzyNow solves Professional networking has a timing problem. The most valuable introductions often happen in the gaps: 40 minutes before a flight, a pause between conference sessions, an unscheduled evening in a new city, or the lull after a… This story continues at The Next Web |

16/01/2026 08:10 PM | 3 | |

| 51,968 | 16/01/2026 06:57 PM | The AI healthcare gold rush is here | the-ai-healthcare-gold-rush-is-here | 16/01/2026 | 16/01/2026 07:10 PM | 7 | ||

| 51,967 | 16/01/2026 06:00 PM | Ads Are Coming to ChatGPT. Here’s How They’ll Work | ads-are-coming-to-chatgpt-heres-how-theyll-work | 16/01/2026 | OpenAI says ads will not influence ChatGPT’s responses, and that it won’t sell user data to advertisers. | 16/01/2026 06:10 PM | 4 | |

| 51,965 | 16/01/2026 04:40 PM | Weekly funding round-up! All of the European startup funding rounds we tracked this week (Jan. 12-16) | weekly-funding-round-up-all-of-the-european-startup-funding-rounds-we-tracked-this-week-jan-12-16 | 16/01/2026 | This article is visible for CLUB members only. If you are already a member but don’t see the content of this article, please login here. If you’re not a CLUB member yet, but you’d like to read members-only content like this one, have unrestricted access to the site and benefit from many additional perks, you can sign up here. The post Weekly funding round-up! All of the European startup funding rounds we tracked this week (Jan. 12-16) appeared first on EU-Startups. |

16/01/2026 05:10 PM | 6 |

This episode of the EU-Startups Podcast is brought to you by Vanta. The trust management platform helps more than 12k companies, including Nando’s, Allica Bank and Granola, start and scale their security programmes while building trust with buyers. It saves security teams time and improves programme visibility by automating over 35 compliance frameworks, such as SOC 2 and ISO 27001, as well as GRC workflows like risk management.

This episode of the EU-Startups Podcast is brought to you by Vanta. The trust management platform helps more than 12k companies, including Nando’s, Allica Bank and Granola, start and scale their security programmes while building trust with buyers. It saves security teams time and improves programme visibility by automating over 35 compliance frameworks, such as SOC 2 and ISO 27001, as well as GRC workflows like risk management.