Switch Dataset:

Startup News

We are collecting the most relevant tech news and provide you with a handy archive. Use the search to find mentions of your city, accelerator or favorite startup in the last 1,000 news items. If you’d like to do a more thorough search, please contact us for help.

Search for any keyword to filter the database with >10,000 news articles

Filter

Filter search

Results

| id | date | title | slug | Date | link | content | created_at | feed_id |

|---|---|---|---|---|---|---|---|---|

| 51,975 | 18/01/2026 04:10 PM | How YC-backed Bucket Robotics survived its first CES | how-yc-backed-bucket-robotics-survived-its-first-ces | 18/01/2026 | 18/01/2026 05:10 PM | 7 | ||

| 51,974 | 18/01/2026 01:37 PM | TNW Weekly Briefing | tnw-weekly-briefing | 18/01/2026 |  Legislation and digital policy European Commission opens call for evidence on Open Digital Ecosystems Signal: The EU is preparing a structural shift toward open, interoperable digital infrastructure. This marks a move from regulating dominant platforms to actively shaping alternatives and reducing strategic dependency. DMA and DSA enter an enforcement-heavy phase in 2026 Signal: Europe’s digital laws have moved from principle to execution. Compliance, fines, litigation, and operational constraints are now the central risk factors for large technology companies in the EU. Intellectual property and market structure EUIPO reports record trademark and design filings in 2025 Signal: European technology and business… This story continues at The Next Web |

18/01/2026 02:10 PM | 3 | |

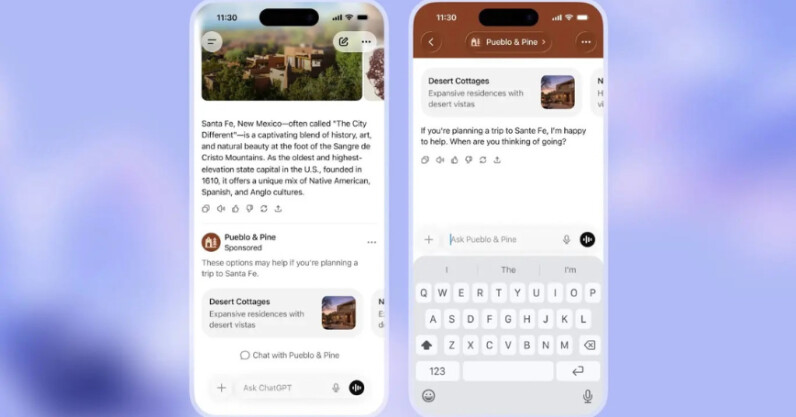

| 51,973 | 17/01/2026 10:12 AM | ChatGPT’s Ads era is here | chatgpts-ads-era-is-here | 17/01/2026 |  OpenAI’s decision to introduce advertisements inside ChatGPT for free users and its new $8 “Go” tier is already shaping up to be one of the most consequential pivots in generative AI’s short history. It’s not a simple business tweak. It’s a reframing of where digital intent, attention, and commercial influence intersect in an age where conversations increasingly replace search bars. OpenAI has not yet started showing ads in ChatGPT, but it plans to begin testing ads in the coming weeks. The first tests will target adult users in the United States on the Free tier and the new $8 ChatGPT… This story continues at The Next Web |

17/01/2026 11:10 AM | 3 | |

| 51,972 | 17/01/2026 12:40 AM | Thinking Machines Cofounder’s Office Relationship Preceded His Termination | thinking-machines-cofounders-office-relationship-preceded-his-termination | 17/01/2026 | Leaders at Mira Murati’s startup believe Barret Zoph engaged in an incident of “serious misconduct.” The details are now coming to light. | 17/01/2026 01:10 AM | 4 | |

| 51,971 | 16/01/2026 11:46 PM | AI cloud startup Runpod hits $120M in ARR — and it started with a Reddit post | ai-cloud-startup-runpod-hits-dollar120m-in-arr-and-it-started-with-a-reddit-post | 16/01/2026 | 17/01/2026 12:10 AM | 7 | ||

| 51,970 | 16/01/2026 10:05 PM | Snowflake, Databricks challenger Clickhouse hits $15B valuation | snowflake-databricks-challenger-clickhouse-hits-dollar15b-valuation | 16/01/2026 | 16/01/2026 10:10 PM | 7 | ||

| 51,969 | 16/01/2026 08:02 PM | BizzyNow opens Mamacrowd equity round to fund “micro-meetings” for business professionals | bizzynow-opens-mamacrowd-equity-round-to-fund-micro-meetings-for-business-professionals | 16/01/2026 |  Italian startup BizzyNow has launched an equity crowdfunding round on Mamacrowd to finance the next phase of its networking app, built around quick, in-person meetups it calls “Bizzy Moments.” The campaign targets €150k–€400k at a €3m pre-money valuation, with a €500 minimum ticket. BizzyNow says proceeds will support go-to-market validation, product upgrades, and the operational groundwork needed to scale. The problem BizzyNow solves Professional networking has a timing problem. The most valuable introductions often happen in the gaps: 40 minutes before a flight, a pause between conference sessions, an unscheduled evening in a new city, or the lull after a… This story continues at The Next Web |

16/01/2026 08:10 PM | 3 | |

| 51,968 | 16/01/2026 06:57 PM | The AI healthcare gold rush is here | the-ai-healthcare-gold-rush-is-here | 16/01/2026 | 16/01/2026 07:10 PM | 7 | ||

| 51,967 | 16/01/2026 06:00 PM | Ads Are Coming to ChatGPT. Here’s How They’ll Work | ads-are-coming-to-chatgpt-heres-how-theyll-work | 16/01/2026 | OpenAI says ads will not influence ChatGPT’s responses, and that it won’t sell user data to advertisers. | 16/01/2026 06:10 PM | 4 | |

| 51,965 | 16/01/2026 04:40 PM | Weekly funding round-up! All of the European startup funding rounds we tracked this week (Jan. 12-16) | weekly-funding-round-up-all-of-the-european-startup-funding-rounds-we-tracked-this-week-jan-12-16 | 16/01/2026 | This article is visible for CLUB members only. If you are already a member but don’t see the content of this article, please login here. If you’re not a CLUB member yet, but you’d like to read members-only content like this one, have unrestricted access to the site and benefit from many additional perks, you can sign up here. The post Weekly funding round-up! All of the European startup funding rounds we tracked this week (Jan. 12-16) appeared first on EU-Startups. |

16/01/2026 05:10 PM | 6 | |

| 51,966 | 16/01/2026 04:02 PM | Former radio presenter behind gut-health podcast raises €2 million to scale microbiome-friendly toothpaste brand Gutology | former-radio-presenter-behind-gut-health-podcast-raises-euro2-million-to-scale-microbiome-friendly-toothpaste-brand-gutology | 16/01/2026 | A former radio presenter who launched a gut-friendly toothpaste after suffering health problems, has raised €2 million (£1.8 million) to expand international sales of the Alcester-based Gutology and its Oral Biome+ toothpaste. Ollie Gallant, who also runs the Gutology Podcast, has secured funding from the Midlands Engine Investment Fund II through fund manager Mercia Ventures, alongside Active Partners and existing angel investors. Ollie, founder of Gutology, says: “For decades, toothpaste has been designed to sterilise the mouth and kill bacteria, but we now know the important role that microorganisms play. This funding enables us to accelerate innovation in oral care while building products that deliver performance and integrate seamlessly into daily routines.” Gutology’s funding round positions the oral-care startup within a wider set of microbiome-focused funding announcements covered by EU-Startups in 2025, spanning both consumer health and clinical applications. In the UK, BoobyBiome raised €2.8 million to scale infant health solutions based on breast-milk microbiome research, with the funding earmarked for product development and international expansion. Elsewhere in Europe, Belgium-based MRM Health secured a substantially larger €55 million Series B to advance its microbiome-derived biotherapeutic pipeline targeting inflammatory and immune-related diseases. Taken together, these rounds account for approximately €58 million of disclosed funding moving through the microbiome and adjacent health sector in this period, highlighting continued investor interest across a spectrum ranging from consumer-facing health products to late-stage therapeutic platforms. Within this context, Gutology’s raise reflects a smaller UK-based bet on microbiome science, focused specifically on oral care and gut health rather than clinical drug development. Rafael Joseph of Mercia Ventures adds: “Consumers are increasingly aware of the link between the gut microbiome and overall health and are actively seeking credible alternative products. Gutology has emerged as a thought leader in this space, building a strong brand that is rapidly gaining traction. “We were particularly attracted to the authenticity of their story and the strength of their engaged social media and podcast audience. This funding will help the company accelerate its international expansion and further establish itself as a leader in its category.” Gutology was founded when Ollie, a former breakfast host on Touch FM and Capital Radio, recognised the role of ‘good bacteria’ in maintaining health after years of digestive problems. He started the podcast in 2019 with his practitioner, nutritional expert Julia Davies, and launched his first product in 2024. Oral Biome+ toothpaste uses hydroxyapatite (HAP), a naturally occurring mineral in tooth enamel, and Truebiotic parabiotics, and is designed to support rather than disrupt the microbiome, the delicate balance of organisms within the mouth and the gut. Bethan Bannister, Senior Investment Manager at the British Business Bank, says: “We are pleased to be investing in a business like Gutology, which is leveraging its brand to support people with gut health issues in a truly distinctive way. It is encouraging to see the Midlands Engine Investment Fund II backing a company that is addressing a gap in the market and delivering solutions to customers who need them the most. “We look forward to working with Ollie and the team and wish them every success as the business grows and expands.” According to the company, the toothpaste now ranks in the top 10 on Amazon UK and is the best-selling toothpaste at Planet Organic. Gutology currently employs ten staff, offers a full oral care range, and sells direct to customers online and through specialist health stores. The funding will enable it to develop partnerships with major retailers, expand into the US and German markets and step up clinical research to develop new and improved products. It plans to expand its range to include other healthcare and home cleaning products and expects to create five new jobs in the year ahead. Anna Sweetman of Active Partners, adds: “We believe Gutology is well-positioned to lead the shift towards personal care products designed to better align with the microbiome, from what we use on our bodies to what we bring into our homes, and we’re excited to support the company as it enters its next phase of growth.” The post Former radio presenter behind gut-health podcast raises €2 million to scale microbiome-friendly toothpaste brand Gutology appeared first on EU-Startups. |

16/01/2026 05:10 PM | 6 | |

| 51,963 | 16/01/2026 04:00 PM | Former USDS Leaders Launch Tech Reform Project to Fix What DOGE Broke | former-usds-leaders-launch-tech-reform-project-to-fix-what-doge-broke | 16/01/2026 | The plan, which is still in its early stages, is spearheaded by former USDS administrator Mikey Dickerson. | 16/01/2026 04:10 PM | 4 | |

| 51,962 | 16/01/2026 03:44 PM | What's next for European tech, Parloa raises $350M, and two new unicorns | whats-next-for-european-tech-parloa-raises-dollar350m-and-two-new-unicorns | 16/01/2026 | A big week for European tech, with two new unicorns and a deep dive into one of the continent’s most promising ecosystems: Armenia. Alongside the week’s top funding rounds, we’ve also curated the most important industry stories you need to know. Our 2025 Annual Report is live, a fast, data-driven deep dive into the deals, sectors, and forces that defined Europe’s tech ecosystem this year. Full of commentary from VCs, startupsm and ecosystem players, it’s the essential snapshot of where Europe is accelerating next. If you like to listen to the news, check out our latest podcast where we revisit some of the most-read Tech.eu stories of 2025, told by the people behind them. If email is more your thing, you can always subscribe to our newsletter and receive a more robust version of this round-up delivered to your inbox. Either way, let's get you up to speed. ? Notable and big funding rounds?? Parloa raises $350M, tripling valuation to $3BN ?? Harmattan AI hits unicorn status after raising $200M, as it strikes deal with French aerospace group ?? Sustainability software outfit osapiens becomes unicorn, following $100M raise ???? Noteworthy acquisitions and mergers?? Haydale acquires SaveMoneyCutCarbon in £24 million deal ?? Choice31 acquires online school IAMPM ??. Helsing’s Keybotic acquisition signals Europe’s push for defence autonomy ?? FAB STUDIO acquired by influencer marketing world leader YKONE ??. Haemonetics acquires Vivasure Medical <br

|

16/01/2026 04:10 PM | 1 | |

| 51,964 | 16/01/2026 03:19 PM | Ionech raises €2.3 million to move air-to-electricity technology into pilots with Coca-Cola Europacific Partners | ionech-raises-euro23-million-to-move-air-to-electricity-technology-into-pilots-with-coca-cola-europacific-partners | 16/01/2026 | Oxfordshire-based Ionech, a clean-energy tech company developing a process to harness thermal energy from ambient air to generate electricity, has received a €2.3 million (£2 million) Seed investment ClimateTech investor Elbow Beach. This investment is combined with a €807k (£700k) Innovate UK Grant, will enable the company to advance its Air Voltaic Cell technology from lab-scale development into real-world pilots over the next 24 months, and progress joint development agreements with early-adopting partners. Thomas Kirk, co-founder of Ionech, shares with EU-Startups: “Energy sits at the foundation of the technology stack. At Ionech we’re building a platform energy technology that will fundamentally change the distribution and consumption of electricity in energy intensive industries. We’re looking forward to our partnership with Elbow Beach as we scale our energy hardware technology to enhance grid resilience, reduce transmission cost and deliver tangible cost savings for the end-user.” In the wider European clean-energy and ClimateTech landscape of 2025, Ionech’s Seed round aligns with a steady flow of early- and growth-stage capital into technologies focused on electrification, energy efficiency and grid resilience. In Sweden, Stockholm-based Aira raised €150 million to accelerate the electrification of residential heating, reflecting strong investor appetite for scaling proven clean-energy hardware. France has also seen activity at a later stage, with Paris-based Spark Cleantech securing €30 million to support cleaner energy solutions for heavy industry. At the earlier end of the market, Spain’s Clevergy raised €3.2 million to scale its smart energy platform, while Dutch startup Zympler closed a €1.5 million round focused on grid optimisation, and Italy’s Renewcast secured €1 million to develop AI-driven renewable energy forecasting. Alongside company-level rounds, dedicated capital is also being deployed via specialist funds, such as Future Energy Ventures, which closed a €205 million second fund to back energy-tech startups across Europe. Taken together, these announcements point to well over €400 million moving through adjacent clean-energy sectors during this period, positioning Ionech’s funding as part of a broader pattern of continued investment into both novel energy hardware and enabling energy technologies. Jonathan Pollock, CEO of Elbow Beach, said: “Ionech represents the kind of bold innovation we aim to support at Elbow Beach. Energy demand is growing, driven by among other things, cooling systems and AI. Ionech is developing ways to harness clean energy from ambient air. Their Air Voltaic Cell technology has the potential to reduce reliance on the grid, lower energy consumption, and deliver tangible benefits across the real economy. We are excited to partner with Ionech as they advance their technology to market.” Founded in 2016 and based in the Harwell Science and Innovation Campus, Ionech is a clean energy company turning the latent energy of ambient air into electricity with its Air Voltaic Cell. Designed for high-demand applications and scalable for the grid, their technology reportedly offers low-maintenance, sustainable power solutions that reduce energy costs and carbon emissions. Ionech’s Air Voltaic Cell technology uses high voltage pulses and field electron emission to generate superoxide ions and convert the thermal and chemical potential energy of ambient air into electrical energy. Nathan Owen, co-founder and Managing Director of Ionech, says: “We are partnering with Elbow Beach to advance the development of our Air Voltaic Cell technology. Their investment enables the transition from lab-scale development to real-world pilots, including initial work with CCEP’s cooler fleet. It also accelerates our route to market and deployment across energy-intensive applications, such as HVAC and data centres, with the potential to reduce energy consumption, emissions, and reliance on the grid at scale.” Ionech aims to integrate the technology initially into high-energy demand devices such as commercial refrigeration, air conditioning and ventilation units, which account for over a quarter of global energy consumption, and eventually at grid scale, saving megatons of CO2 and reducing energy bills. Partners include Coca-Cola Europacific Partners (CCEP), where Ionech’s technology could significantly reduce the carbon footprint of drinks coolers among other applications. CCEP was an early investor in Ionech, which plans to demonstrate its first commercial-ready system by 2027. Joe Franses, VP Sustainability at CCEP, adds: “We continue to be excited about the potential of the technology that Ionech is developing, and how it could support CCEP in accelerating towards our sustainability goals. This latest investment brings us closer to that potential.” The post Ionech raises €2.3 million to move air-to-electricity technology into pilots with Coca-Cola Europacific Partners appeared first on EU-Startups. |

16/01/2026 04:10 PM | 6 | |

| 51,961 | 16/01/2026 02:15 PM | The rise of ‘micro’ apps: non-developers are writing apps instead of buying them | the-rise-of-micro-apps-non-developers-are-writing-apps-instead-of-buying-them | 16/01/2026 | 16/01/2026 03:10 PM | 7 | ||

| 51,960 | 16/01/2026 02:00 PM | Why Everyone Is Suddenly in a ‘Very Chinese Time’ in Their Lives | why-everyone-is-suddenly-in-a-very-chinese-time-in-their-lives | 16/01/2026 | The viral meme isn’t really about China or actual Chinese people. It's a symbol of what Americans believe their own country has lost. | 16/01/2026 02:10 PM | 4 | |

| 51,959 | 16/01/2026 12:44 PM | With their new €500 million fund, Germany’s DTCP raises the bar for European defense and resilience capital | with-their-new-euro500-million-fund-germanys-dtcp-raises-the-bar-for-european-defense-and-resilience-capital | 16/01/2026 | Hamburg-based DTCP, a global investment management platform with more than €3 billion in AUM, today announced the launch of the €500 million fund ‘Project Liberty’, its eighth fund and its first dedicated exclusively to defense, security, and resilience technologies. The fund is independently managed by DTCP and targets institutional investors, family offices and corporate investors. Its objective is to support the growth of European defense and dual-use technology companies and to contribute to Europe’s technological capability and security resilience. Vicente Vento, CEO of DTCP, comments: “Project Liberty represents a highly consistent extension of our role as a specialist investment platform. Defense and resilience have been converging with technology and infrastructure investing for more than a decade – precisely where DTCP, through DTCP Growth and DTCP Infra, has deep expertise and numerous touchpoints with the defense industry. There are few areas that fit more naturally with our existing platforms.” Across 2025–2026, EU-Startups coverage shows steadily increasing capital flows into European defence, dual-use and adjacent cybersecurity technologies, albeit largely at early and mid-stage levels. Germany saw Project Q secure a €7.5 million Seed round to expand its Internet-of-Defence (IoD) platform. In Northern and Eastern Europe, Lithuania-based Repsense raised €2 million to scale its NATO-deployed threat-detection analytics, while drone developer Monopulse secured €1.12 million to expand NATO-grade UAV production. At the growth and infrastructure end of the spectrum, Dutch DefenseTech company Destinus added €50 million in bank financng to support autonomous aerospace systems, bringing its total capital raised close to €400 million. Alongside company-level rounds, EU-Startups has also reported on the emergence of dedicated defence-focused investment vehicles, including Keen Venture Partners’ defence tech fund targeting €125 million, and Expeditions Fund II, which raised over €100 million for investments spanning cybersecurity, AI, quantum and defence technologies. Taken together, these announcements account for approximately €300 million in disclosed capital and illustrate a market where most funding remains fragmented across smaller rounds and thematic funds. Against this backdrop, DTCP’s €500 million Project Liberty stands out as a materially larger, later-stage-capable vehicle, signalling a shift from predominantly Seed and early-growth financing towards more substantial pools of capital aimed at scaling European defence and dual-use technology companies. “For decades, Europe has underinvested in defense while geopolitical risks have steadily increased. In parallel, we are witnessing a profound technological transformation across the entire value chain – from surveillance and sensing to software-defined systems, advanced materials, autonomous platforms, and satellite and communications infrastructure. “As major Western governments have now embarked on a long-term and irreversible path to modernise their defense capabilities, we are highly confident in the structural growth prospects of this sector for decades to come,” adds Vicente. Founded in 2015, DTCP is a global investment management platform. The firm manages approximately €3 billion across multiple technology and infrastructure funds and has completed more than 50 investments worldwide, including over 19 successful exits. Its existing portfolio has a strong focus on cybersecurity and AI companies, including Arctic Wolf, Axonius, Zenity, Anomali and Ox Security. This is complemented by dual-use companies such as the German DefenseTech unicorn Quantum Systems. While Europe remains the clear investment focus, ‘Project Liberty’ may also selectively invest in defense and security technologies from NATO member states and close allies where such investments are strategically relevant to European security interests. This comes one year after DTCP raised €420 million for their growth fund. Thomas Preuß, Managing Partner at DTCP and Chief Investment Officer of ‘Project Liberty’: “We named the fund Project Liberty because it is about more than capital alone. Technological capability is a core prerequisite for Europe’s sovereignty, security, and democratic stability. Our objective is to support the development of a strong European security architecture through targeted investments in scalable, high-performance technologies. “At the same time, Project Liberty follows a clear, return-driven investment approach. We combine capital with deep operational expertise, an international network, and long-standing experience working with industrial partners and public-sector stakeholders. In this sector, access, governance, and the ability to scale are critical – and this is where we believe DTCP brings distinct value as a long-term, active investor.” With ‘Project Liberty’, DTCP is actively investing in European defense and dual-use technology companies across Series A to C financing stages. The fund plans to make investments in up to 30 companies, with an average investment size of approximately €20 million. The investment focus is on companies that complement existing defense and security systems or advance them through new technological approaches. Key areas of focus include software solutions, cyber defense, AI and autonomous systems. The post With their new €500 million fund, Germany’s DTCP raises the bar for European defense and resilience capital appeared first on EU-Startups. |

16/01/2026 01:10 PM | 6 | |

| 51,958 | 16/01/2026 12:15 PM | DTCP expands into defence with €20M-per-deal Fund for security and dual-use startups | dtcp-expands-into-defence-with-euro20m-per-deal-fund-for-security-and-dual-use-startups | 16/01/2026 | Global investment management platform DTCP today announced the launch of “Project Liberty”, its eighth fund and its first dedicated exclusively to defence, security, and resilience technologies. The fund is independently managed by DTCP and targets institutional investors, family offices, and corporate investors. Its objective is to support the growth of high-performing European defence and dual-use technology companies and to contribute to Europe’s long-term technological capability and security resilience. While Europe remains the clear investment focus, “Project Liberty” may also selectively invest in defence and security technologies from NATO member states and close allies where such investments are strategically relevant to European security interests. DTCP has been investing successfully in IT and security technologies for more than a decade. Its existing portfolio focuses on cybersecurity and AI companies, including Arctic Wolf, Axonius, Zenity, Anomali, and Ox Security. This is complemented by dual-use companies such as the German defence tech unicorn Quantum Systems. According to Vicente Vento, CEO of DTCP:

He cites a compelling long-term investment opportunity, sharing that for decades, Europe has underinvested in defence while geopolitical risks have steadily increased.

Up to 30 investments in defencetech planned with Project LibertyDTCP is actively investing in European defence and dual-use technology companies across Series A to C financing stages. The fund plans to invest in up to 30 companies, with average investments of approximately €20 million. The investment focus is on companies that complement existing defence and security systems or advance them through new technological approaches. Key areas of focus include software solutions, cyber defence, artificial intelligence, and autonomous systems. |

16/01/2026 01:10 PM | 1 | |

| 51,957 | 16/01/2026 10:15 AM | HOLYWATER secures $22M to expand mobile microdrama content | holywater-secures-dollar22m-to-expand-mobile-microdrama-content | 16/01/2026 | Ukraine-based HOLYWATER has closed a $22 million financing round led by Horizon Capital, with participation from US-based investors including Endeavor Catalyst and Wheelhouse. The financing follows an earlier investment from Fox Entertainment in October 2025. (check out our earlier interview with Anatolii Kasianov, co-founder and co-CEO of HOLYWATER) HOLYWATER is a technology company applying AI to content creation and distribution within the entertainment sector. Its portfolio includes several digital platforms across video and publishing, such as My Drama for vertical streaming, My Passion for digital books, My Muse for AI-assisted vertical series, and Freebits, an ad-supported streaming service offering free access to premium content. The company operates across multiple segments of the entertainment technology market. Its flagship app, My Drama, received the People’s Voice award for Best Streaming Service at the 2025 Webby Awards and recorded strong revenue growth during the year. HOLYWATER’s AI-powered app, My Muse, is also active within the AI streaming category. Commenting on the investment, co-founders and co-CEOs Bogdan Nesvit and Anatolii Kasianov said the round reflects continued momentum around premium short-form storytelling and its potential as a scalable content format. They noted that vertical series are increasingly being adopted as a long-term storytelling medium across multiple genres. The new funding will support HOLYWATER’s plans to further develop its mobile-focused vertical video streaming platform and expand its AI-driven content ecosystem. This includes exploring AI-supported formats such as comics and animation, as well as strengthening its IP development and distribution capabilities across additional content categories. |

16/01/2026 11:10 AM | 1 | |

| 51,955 | 16/01/2026 09:25 AM | How Armenia is building tech sovereignty through it's global diaspora | how-armenia-is-building-tech-sovereignty-through-its-global-diaspora | 16/01/2026 | When you can, it’s always worth taking a look outside of your comfort zone to find the next big thing in tech. I’ve been interested in Armenia for a number of years, and now it seems the rest of the world is catching up. I gained first-hand access by visiting Yerevan for the 20th annual Digitec conference. Unicorns, diaspora, and a global tech presenceAt the crossroads of Eastern Europe and Western Asia, Armenia has a population of around 3.08 million, while an estimated seven million Armenians or more live outside the country — making its global diaspora one of its greatest strategic assets. The ecosystem is anchored by unicorns Picsart and ServiceTitan. This year Gecko Robotics founded by Armenian-American entrepreneur Jake Loosararian, raised a $125 million Series D round at a $1.25 billion valuation. Armenia is also home to a dense concentration of global technology R&D and engineering operations, including major centres run by NVIDIA, Synopsys, AMD, and the Microsoft Innovation Center Armenia. Multinational companies such as National Instruments, Oracle, VMware, Cisco, Mentor Graphics, TeamViewer, and D-Link maintain substantial engineering offices in the country. Since the mid-2010s, Armenia has built one of the most attractive policy environments for tech startups in the region. The government introduced tax exemptions and reduced income tax for IT companies and employees, then reinforced this with the creation of a dedicated Ministry of High-Tech Industry in 2018. By 2025, this framework had evolved into a comprehensive package of incentives, including preferential tax regimes, grant programmes, and support for hiring both local and foreign technical talent. Armenia’s race to build sovereign AI infrastructureArmenia opened its first supercomputer centre in 2024, and also acquired an NVIDIA supercomputer for use at the Yerevan State University (YSU). AI and advanced technologies. The year opened with a cooperation agreement with France’s Mistral AI to strengthen national AI infrastructure, followed by the launch of the AI Virtual Institute, in partnership with AWS and the Ministry of High-Tech Industry, to train and upskill local practitioners. In July, AI cloud company Firebird unveiled a vision for a $500 million public-private partnership with the Armenian government, with technical support from NVIDIA, which will fuel the development and growth of AI technologies in the country. Firebird plans to launch with thousands of NVIDIA Blackwell GPUs in 2026 and will be designed with the ability to scale to over 100 megawatts of capacity. Last year also saw the launch of HyGPT, the first high-quality large language model (LLM) specifically designed for the Armenian language. The model is freely accessible online. The challenge of building Armenia’s global tech brandAddressing what Armenia’s global tech brand is today and what it is built on, Adele Tuulas, Director of Business Development at Digital Nation (Estonia), argues that while Armenia has many bright individual success stories, it still lacks a single, unified narrative that the world can immediately recognise. She sees this as critical in the context of branding as soft diplomacy.

Catherine Jurovsky, Senior Expert at Business France, believes Armenia possesses the core ingredients of a compelling tech brand, but has yet to achieve the level of international recognition required to turn those assets into a coherent and widely valued identity:

She offers the example of LeFrench Tech as a way forward: France built “La French Tech” by first creating a community, then empowering it globally. More than 100 hubs worldwide now act as volunteer ambassadors. “The key was not advertising budgets, but mobilising entrepreneurs, investors, and institutions around shared values and visibility. Armenia’s strong diaspora could play a similar ambassadorial role if equipped with a unified narrative.” From talent supplier to sovereign AI builder One of the key themes at the conference was the urgency of articulating a coherent national AI strategy.

According to Yesayan, it means sovereign-grade compute, open to startups, universities, and industry; it means research funding that allows Armenian teams to train frontier-scale models rather than just consume them.

The challenges of doing business in ArmeniaWhile Armenia is known as a place of business, especially for international companies with a local presence, building locally from the get-go is not so easy. Tigran Petrosyan, co-founder of SuperAnnotate, sees commercialisation rather than technology as the primary constraint:

The counterbalance, he says, is resilience.

Picsart co-founder Artavazd Mehrabyan sees the challenge not in talent but in proximity to global knowledge networks:

Arto Minasyan is the founder and CEO of10Web, co-founder and President at Krisp, and Partner at investment firm Big Story VC. He contends that Seed funding of €500k–€1M is increasingly available locally.

Gender parity persists, but Armenia is building education as infrastructureWomen in Armenia account for nearly 40 per cent of the tech workforce, but their voices were notably absent from the conference as the vast majority of speakers and founders were male. This surprised me, as it is usual to see women founders and investors representing smaller ecosystems such as Lithuania, Latvia, and Moldova. That said, Aremia is betting on the next generation of tech innovators through initiatives such as TUMO (he TUMO Center for Creative Technologies) a free, extracurricular educational program for teens which offers young people access to areas such as programming, robotics, game development, animation, filmmaking, graphic design, music, and AI through a mix of self-paced digital learning, workshops, and project-based labs, all focused on building real skills and portfolios rather than grades.

What makes TUMO Armenia particularly distinctive is its scale and national ambition. Through large urban hubs and a growing network of “TUMO Boxes” in smaller towns and rural communities, it aims to reach tens of thousands of students every week across the country, positioning creative technology education as a form of national infrastructure. It’s now a global network of learning centers and satellite hubs. This integration with the wider ecosystem was inherent at the conference with TUMO students showcasing their projects at the front of the venue – a location that would be hot real estate for any commercial conference –, while university students were embedded as volunteers, giving them early, hands-on exposure to founders, engineers, and investors and helping to knit education, talent, and industry into a single pipeline. Armenia is no longer just a source of strong engineers, but is laying the groundwork to become a creator of platforms, IP, and globally relevant AI systems. With sovereign compute, a deep diaspora, and a national talent pipeline, the pieces are in place. The remaining challenge is coherence: turning these strengths into a clear, recognisable global tech identity that can carry Armenian innovation onto the world stage. Armenian startups to watchAIP Scientific AIP Scientific focuses on developing orthopaedic implant technologies dedicated to supporting the end-to-end process of customised implant production, including modelling, mechanical reliability evaluation, optimisation, and fabrication of implants with complex shapes. They utilise digital 3D design, additive manufacturing (metal & resin 3D printing), 5-axis CNC milling, and more. AIP Scientific also pioneers a bio-degradable material called BioCer, which is currently in animal trials. Their services involve the production of custom maxillofacial, cranial, and orthopaedic implants made of titanium and BioCer. Argus AI Argus AI is a medtech startup developing AI-powered mixed-reality tools to support surgeons in planning and performing complex operations. The company turns MRI and CT scans into interactive 3D models that can be explored in virtual or mixed reality, giving clinicians a far more intuitive view of a patient’s anatomy than traditional 2D imaging. Using AI for image segmentation and analysis, Argus AI helps identify critical structures and plan surgical paths, with applications in pre-operative planning, intra-operative guidance, and surgical training. The platform is designed “by surgeons for surgeons,” with a particular focus on high-precision fields such as neurosurgery, where spatial understanding and accuracy are critical. BlueQubit BlueQubit aims to make quantum computing accessible and practical for researchers, developers, and enterprises. It provides a cloud-based Quantum Software-as-a-Service (QSaaS) platform that enables users to design, simulate, test, and run quantum algorithms without their own specialised quantum hardware. The platform integrates with real quantum processors from industry providers and high-fidelity GPU emulators, enabling customers to experiment, prototype, and deploy quantum computing workflows for applications such as optimisation, machine learning, and complex simulations. Havnly AI Havnly AI is building an AI-powered platform that automates the matching of temporary/insurance-related housing placements and property management for insurance carriers and relocation specialists. Foldink Foldink is a biotech startup focused on 3D bioprinting and tissue engineering. The company develops and supplies bioinks — specialised biological “inks” used in 3D bioprinting — as well as bioprinters and related materials that biomedical researchers use to fabricate living tissues and biological structures in the lab. Its products include hydrogel and freeze-dried bioinks designed to simplify and standardise bioprinting processes for scientists working in regenerative medicine, drug discovery, and other advanced life sciences research areas. Wav.am Wav.am is an AI audio platform that provides text-to-speech and speech-to-text services. Users can type or upload Armenian text and generate natural-sounding spoken audio in different voices, or record/upload speech and have it automatically transcribed into text. The platform is designed to support everyday use cases such as content creation, accessibility, and language learning. It also enables the creation of longer-form audio such as audiobooks, with options to export and download the generated files. |

16/01/2026 10:10 AM | 1 | |

| 51,956 | 16/01/2026 09:12 AM | Belgium’s Tinrate secures €1.6 million to monetise expertise, dubbed “OnlyFans for knowledge” by its founder | belgiums-tinrate-secures-euro16-million-to-monetise-expertise-dubbed-onlyfans-for-knowledge-by-its-founder | 16/01/2026 | Exactly one month, after its founding, Kortrijk-based Tinrate – a platform that enables users to seek and share advice and expertise – has raised a €1.6 million Seed round to roll out the company. The round saw participation from Steve Rousseau (World of Talents), Helena Brutsaert (Get Driven) and Arne Vandendriessche (Signpost). Other notable names include Frederik Poelman, Louis Balcaen, Filip Smet (Amotek), Thibault De Keyzer (Mobile expense), Frederik Verhelst, Matthias Vandepitte (Strada Partners) and Piet Van Waes (Tilleghem). Belfius is also backing the project. “Today, it is normal to receive an invoice from a solicitor after a call. In my view, it is just as normal to pay someone who knows everything about wine, or travel, or fashion, or music, or entrepreneurship in a particular niche. It will be important to change the way we think about obtaining and providing advice and expertise. You could compare it a bit to OnlyFans for knowledge and advice,” says founder Gunther Ghysels. (Translated) In the 2025 European funding landscape, Tinrate’s Seed round sits within a relatively small stream of capital flowing into platforms focused on expertise, professional services and AI-enabled matching. A closely adjacent example is Ethos, which secured €3 million to scale its AI-driven expert matching network, aiming to connect organisations with relevant specialists more efficiently. Beyond direct expert marketplaces, investor interest has also extended into enabling technologies and platforms supporting knowledge work and services. This includes nexos.ai, which raised €30 million to help enterprises manage and govern AI usage, and Parloa, which closed a €310 million Series D to expand its AI-based customer service agent platform. “It’s my first Seed round ever, and I believe that in 2026 it will be virtually impossible to roll out a new innovative platform without sufficient resources. Speed will be important. I am extremely grateful that many big names believe in me, but it certainly brings extra pressure,” says investor Viktor Verhulst. (Translated) Almost ten years after founding the driver platform Get Driven, Gunther has launched Tinrate to become the online solution for easily gaining or selling expertise. Users can register on the platform for free and add their profile to existing platforms such as their website, email, LinkedIn, TikTok or Instagram. The platform secures and automates bookings, payments, invoicing and feedback. In time, Tinrate says it will have a search functionality for specific sectors, profiles or segments. Gunther wants to include knowledge professions such as solicitors and tax specialists on the platform, as well as all other types of professions that have expertise in certain niches and can be shared via video call. The platform already has more than 1,000 professionals registered. According to Gunther, the company is also complementary to the exponential growth of programmes such as ChatGPT: “People are already looking for advice in all kinds of niches, and their curiosity is greatly influenced by platforms such as Instagram and Tiktok. The vision and expertise of someone who has experienced it in practice will always be more valuable than the answer you can find online. You can find the theory on ChatGPT, but in the long run, you will have to find the practice on Tinrate.” The post Belgium’s Tinrate secures €1.6 million to monetise expertise, dubbed “OnlyFans for knowledge” by its founder appeared first on EU-Startups. |

16/01/2026 10:10 AM | 6 | |

| 51,953 | 16/01/2026 08:35 AM | Spotlight on Malta: 10 startups worth keeping an eye on in 2026 | spotlight-on-malta-10-startups-worth-keeping-an-eye-on-in-2026 | 16/01/2026 | Malta has long been associated with tourism and leisure, but in recent years, the country has increasingly aligned itself with Europe’s growing tech and startup scene. Rather than lagging, Malta has steadily developed the infrastructure needed to support innovation, laying the groundwork for a more diversified and competitive economy. This evolution has been driven by a combination of consistent government backing and the growth of digital innovation hubs, which together have helped attract international talent and support the scaling of high-growth companies. The results are now visible. From 2024 to 2025, Malta earned recognition among the EU’s leading destinations for innovative startups, including a 4th-place ranking in a Europe-wide Startup Nations report, as highlighted in this article. Building on this momentum, Malta will once again host the EU-Startups Summit for its 2026 edition. Taking place on 7 and 8 May, the event is set to welcome around 2,500 attendees for two focused days of innovation, networking, and exchange, further reinforcing the country’s position within Europe’s startup ecosystem. We have compiled a list of 10 startups, all founded from 2020 onwards, that are making waves in Malta’s startup scene and pushing the country’s innovation landscape forward across multiple sectors.

BigKarma: Founded in San Gwann, this studio builds original games that extends beyond gaming into entertainment, toys, or merchandise. Its flagship project is a sports strategy video game that introduces action heroes with disabilities, addressing representation gaps in gaming for a global audience of over one billion people with disabilities. Its first major project is Phenoms, a sports strategy video game featuring over 40 licensed athletes with visible and non-visible disabilities who each have superpowers and vulnerabilities as core gameplay elements. BigKarma was launched in 2020, and since then, it has successfully secured €47k in funding.

Binderr: Launched in 2020, this Naxxar-based FinTech startup develops a digital tax management solution designed specifically for freelancers and small businesses. Its core product is a subscription-based app that simplifies tax filing and book-keeping by giving users a clear, real-time overview of their tax obligations, including upcoming returns, amounts due, and deadlines. The platform also allows users to upload receipts and automatically categorises expenses for VAT and other tax requirements, making it particularly suited to self-employed professionals with limited tax expertise. By combining tax tracking with connections to accountants, lawyers, banks, and other professionals, Binderr streamlines financial management and reduces administrative overhead through a single dashboard. The platform’s €4.73 million in funding to date highlights its strong market fit and the growing demand for streamlined business solutions.

Elantil: This Birkirkara-based startup is changing the game for online casinos and sportsbooks by offering a flexible, one-size-fits-all iGaming system. Operators get full control over their tech stack, free to pick and connect only the components they need, and adapt everything as they grow. Their core is its Operational Management System, a central dashboard where operators handle players, games, payments, compliance, and daily operations, all in one place. Launched in 2024, the early-stage startup focuses on providing the software backbone that powers gambling businesses. It equips operators with the tools and flexibility to build and scale their platforms on their own terms.

FUNNZ: Headquartered in Valletta, FUNNZ is an online casino operator founded in 2024 that develops digital gambling experiences designed to be more engaging, social, and user-friendly. The platform positions itself as a scalable operator, combining technology, data, and user-experience design to deliver tailored gaming environments. To support this approach, FUNNZ enables real-time gameplay, secure payment processing, and strict regulatory controls. The startup also relies on CRM and data-analytics systems to personalise offers, segment players, track engagement, and optimise promotions and loyalty programmes, all delivered through carefully designed interfaces, promotion engines, reward mechanics, and site layouts aimed at enhancing enjoyment and overall playtime.

Just Slots: This gaming software developer, Ta’ Xbiex-based, creates slot games for online casino operators, combining industry experience with a data-driven development approach. The startup creates game titles that are fun and varied, offering something for every kind of player. At the same time, they make it easy for operators to add these games to their platforms, thanks to flexible and simple integration. Founded in 2023, the startup raised €1.2 million in investment and released its first titles, Sugar Heaven and Shogun Skylord, in 2024. Following an initial output of around 10 games in its first year, it now plans to scale production to 18 titles in its second year, supported by partnerships with platforms such as Hub88, Rhino Entertainment, and Stake.com.

MannaEV: Launched in 2023 in Birkirkara, this startup operates an on-demand delivery platform built around electric mobility and battery-swapping technology. Its service enables same-day deliveries with real-time tracking. The platform is designed to optimise delivery routes, support multiple drop-offs and keep operational costs low without compromising speed or reliability. While funding details have not been publicly disclosed, the company works with local partners and stakeholders to scale its eco-friendly delivery operations. Positioning itself within the growing green mobility and logistics sector, MannaEV has stated an ambition to contribute to a carbon-free Malta by 2030 through the use of electric vehicles and sustainable logistics practices.

MetaverseME: Operating at the intersection of gaming, avatars and augmented reality (AR), this Is-Swieqi-based startup builds interactive experiences designed to enhance how users interact and socialise online. It primarily focuses on personalised digital identities, allowing users to create and customise realistic avatars that can be used across immersive games and AR-driven social content. Its product portfolio includes the ME! Avatar App, as well as multiplayer titles such as KickOff Evolution and United Football, which blend gameplay with digital collectables and social interaction mechanics. Launched in 2021, MetaverseME has secured €1.28 million in funding to date.

Octoplay: Launched in 2022, Octoplay focuses on building high-quality casino content for regulated markets. This game studio develops slot and smash games designed with a mobile-first mindset. They create their own proprietary Remote Gaming Server, which allows games to be delivered quickly to partners while meeting the technical and compliance requirements of across different countries. This Valletta-based game studio expanded rapidly across Europe and North America and have stablished partnerships with operators such as BetMGM, Hard Rock Bet, Kindred Group and Evoke Group. Its portfolio includes titles like Eggsponential, Pearly Shores and Lollicat, alongside custom jackpot systems such as Jackpot Hunt and operator-specific solutions like BetMGM’s Jackpot Blitz.

paytently: Headquartered in Sliema and launched in 2022, Paytently develops a payment platform designed to simplify and optimise how businesses process transactions across multiple payment providers. Their app enables companies to connect to banks and alternative payment methods through a single API, reducing technical complexity while improving payment performance and reliability. Through the use of AI and machine learning, they automate tasks such as route transactions, increasing authorisation rates and lowering payment failures. In parallel, the platform includes a built-in risk management engine that helps protect businesses from fraud while offering consumers seamless internal payment connectivity, positioning the startup as an infrastructure provider for secure and scalable digital payments. In light of these developments, Paytently has raised €2 million in funding to date.

Smart Materials: Launched in 2020, Smart Materials is establishing itself within the Maltese startup ecosystem by developing advanced materials used to manufacture auxetic foam. It is a material known for its ability to expand laterally when stretched and outperform traditional polyurethane foams. While auxetic foam has been researched for decades, large-scale production had previously proven unfeasible, even for major chemical and consumer goods groups. However, Smart Materials technology enables scalable production, opening the door to broader industrial adoption. They target the mattress industry, where their foam can deliver improved performance at a lower cost. Beyond functionality, the material also addresses sustainability challenges by reducing plastic use and simplifying end-of-life recycling, positioning the startup at the intersection of materials innovation and circular economy goals. Thanks to all its material developments, they have raised €18.9 million in funding. By the way: If you’re a corporate or investor looking for exciting startups in a specific market for a potential investment or acquisition, check out our Startup Sourcing Service! The post Spotlight on Malta: 10 startups worth keeping an eye on in 2026 appeared first on EU-Startups. |

16/01/2026 09:10 AM | 6 | |

| 51,954 | 16/01/2026 07:41 AM | Amsterdam-based Optics11 secures €25 million EIB loan to strengthen Europe’s subsea and energy security | amsterdam-based-optics11-secures-euro25-million-eib-loan-to-strengthen-europes-subsea-and-energy-security | 16/01/2026 | The European Investment Bank (EIB) has signed a €25 million venture debt financing agreement with Amsterdam-based Optics11, a DeepTech scale-up that builds advanced fibre optic sensing solutions. The Dutch company plans to use this capital for research and development on its technologies for civilian and defence applications. It aims to accelerate the productisation and Europe-wide adoption of its monitoring technology to protect critical infrastructure, particularly in underwater environments and high-voltage power grids. “Disruptions to subsea infrastructure, maritime trade or failures in high-voltage grids have immediate and far-reaching consequences on our society. With this EIB financing, Optics11 accelerates the deployment of unique fibre-optic sensing technologies that protect the infrastructure so essential to Europe’s security and energy resilience,” said Optics11 CEO Paul Heiden. Optics11 was founded in 2011 as a spin-off from Vrije Universiteit Amsterdam by experimental physics professor Davide Iannuzzi and entrepreneur Hans Brouwer. It develops advanced fibre-optic sensing systems for the world’s harshest environments. Its tech has applications in the energy sector and underwater security, the two areas relevant to European strategic autonomy. The company supports missions such as submarine monitoring, border surveillance, and structural health monitoring of naval assets and electricity networks, using technology that enables ultra-sensitive vibration and acoustic monitoring in harsh environments. According to Optics11, its fibre optic sensors eliminate issues with electromagnetic interference, offering reliability in tough environments where traditional sensors often fail. The company states that its software analyses sensor data at the speed of light, identifying potential threats to prevent costly disruptions. The company’s offerings combine fibre-optic sensing hardware with threat detection software. This, according to Optics11, enables faster detection and localisation of threats when compared to other solutions on the market, giving operators more time to respond. Its solutions include a predictive monitoring solution called OptiFender that identifies and locates partial discharge events – the earliest indicator of upcoming asset failures – within high and medium voltage electrical systems. While its OptiBarrier and OptiArray solutions provide a subsea early-warning system via precision fibre optic sensors that continuously safeguard underwater infrastructure against sabotage and unauthorised interference. Last year, in May, the company raised €17 million in a funding round led by FORWARD.one and SET Ventures. EIB Vice-President Robert de Groot said, “Our continent is working hard to make sure it can hold its own in many different fields, but we need to support the companies that can make that happen. From the energy sector to security and defence capabilities, we need to be able to have the best technology for known and unknown threats. In short, the solutions developed by Optics11 are providing Europe with critical solutions and competitive advantages for the world that is coming.” The EIB backing for Optics11 is supported under the European Commission’s InvestEU programme. The post Amsterdam-based Optics11 secures €25 million EIB loan to strengthen Europe’s subsea and energy security appeared first on EU-Startups. |

16/01/2026 09:10 AM | 6 | |

| 51,952 | 16/01/2026 05:48 AM | Amsterdam’s PureTerra Ventures launches €150 million WaterTech Fund II with €10 million backing from Invest-NL | amsterdams-pureterra-ventures-launches-euro150-million-watertech-fund-ii-with-euro10-million-backing-from-invest-nl | 16/01/2026 | PureTerra Ventures, an Amsterdam-based venture capital firm backing disruptive WaterTech startups, has launched its second fund with €10 million investment from Invest-NL, the Dutch national financing and development institution. The firm has set a €150 million target for its second fund and plans to mobilise the capital from public, private, and institutional investors. Job van Schelven, Partner at PureTerra Ventures, said, “Water is no longer a given, but a strategic prerequisite for industry. Once water availability starts to constrain operations or scaling, it quickly becomes a costly limiting factor. Across multiple sectors, we already see companies investing in solutions for water reuse and water quality. This creates a unique opportunity to generate meaningful positive impact on water quality and availability, while unlocking significant economic potential. “Invest-NL has once again proven itself to be a partner willing to step forward when it matters, and we are grateful to the Invest-NL team for their support.” Founded in 2017, PureTerra Ventures backs early-stage water startups with advanced scientific hardware or AI-driven software solutions ready for commercial scale. It focuses on technologies that make industrial water suitable for reuse while simultaneously enabling the recovery of scarce resources, such as lithium and phosphorus. The VC firm has a global investment scope and claims to have a network of distributors, utilities, government departments, blue-chip companies and other key players in the Chinese water market. According to PureTerra Ventures, it uses this network to contribute to the commercial success of its portfolio companies. PureTerra Ventures secured €73 million for its Fund I from Orange Wings (Shawn Harris), the European Investment Fund (EIF), Invest-NL, insurer a.s.r., as well as a broad group of entrepreneurs. It has already backed 14 water companies using its Fund I. For its second fund, the VC firm intends to maintain the strategy of its first fund, investing in scalable technologies aimed at improving water efficiency, cleanliness, and safety across industries such as energy, food, chemicals, and semiconductors. According to the VC firm, Invest-NL’s participation as a cornerstone investor indicates confidence in the investment strategy. Together with Invest-NL, it aims to further strengthen the Dutch water innovation ecosystem, with international impact. “Water plays a key role in the transition to a sustainable and future-proof economy. PureTerra Ventures has demonstrated that specialised expertise and active engagement are essential to successfully bring innovative water technologies to market. With this investment, we aim to stimulate further private investment in this strategic sector,” said Stefanie Landman, senior investment manager at Invest-NL. Invest-NL accelerates and finances societal transitions in the fields of agrifood, the biobased and circular economy, DeepTech, energy, and life sciences and health. The post Amsterdam’s PureTerra Ventures launches €150 million WaterTech Fund II with €10 million backing from Invest-NL appeared first on EU-Startups. |

16/01/2026 07:10 AM | 6 | |

| 51,951 | 16/01/2026 12:49 AM | AI journalism startup Symbolic.ai signs deal with Rupert Murdoch’s News Corp | ai-journalism-startup-symbolicai-signs-deal-with-rupert-murdochs-news-corp | 16/01/2026 | 16/01/2026 02:10 AM | 7 |