Switch Dataset:

Startup News

We are collecting the most relevant tech news and provide you with a handy archive. Use the search to find mentions of your city, accelerator or favorite startup in the last 1,000 news items. If you’d like to do a more thorough search, please contact us for help.

Search for any keyword to filter the database with >10,000 news articles

Filter

Filter search

Results

| id | date | title | slug | Date | link | content | created_at | feed_id |

|---|---|---|---|---|---|---|---|---|

| 52,496 | 13/02/2026 08:30 AM | Inside Hungary’s next startup wave: 10 of the most promising startups to watch in 2026 and beyond! | inside-hungarys-next-startup-wave-10-of-the-most-promising-startups-to-watch-in-2026-and-beyond | 13/02/2026 | Following our series of country articles, today we turn our attention to Hungary, a country that has quietly built a resilient and increasingly specialised startup ecosystem in Central and Eastern Europe. With strong technical education, competitive operating costs, and a growing base of internationally minded founders, Hungary continues to produce companies tackling complex, global challenges. In this article, we highlight 10 of the most promising Hungarian startups founded from 2021 onwards that are shaping the country’s next wave of innovation. Presented in alphabetical order, the selection focuses on companies that have demonstrated early momentum through product development, funding activity, and market traction as Hungary’s tech ecosystem moves toward 2026.

Founded in 2021 and based in Szentendre, ABZ Innovation is a drone technology company developing and manufacturing heavy-duty unmanned aerial vehicles for agricultural, industrial, and commercial use. The company focuses on European-built drone systems designed to support precision operations across farming, construction, logistics, and maintenance environments. Its portfolio includes agricultural spraying and seeding drones, as well as multifunctional platforms for industrial cleaning, research, and custom integrations. The systems are CE-certified and built to operate in demanding field conditions, with modular configurations and varying payload capacities. ABZ Innovation completed its latest funding round in 2026, bringing total funding to €7 million to support further product development and international expansion.

Headquartered in Budapest, Axoflow is a cybersecurity company developing a Security Data Layer designed to automate security data curation for SIEM and analytics tools. The platform collects, classifies, normalises, and routes security telemetry in real time, aiming to improve detection quality while reducing operational complexity. Built by the creators of syslog-ng, Axoflow integrates pipeline, storage, and AI capabilities into a single layer that manages ingestion, preprocessing, storage, and search. By automating parsing and data reduction, the system is designed to reduce SIEM costs and accelerate investigations while maintaining visibility across security environments. Founded in 2023, the company has raised over €8.5 million in funding.

Founded in 2021 and based in Budapest, denxpert EHS&S software provides cloud-based compliance solutions for environmental, health, safety, and sustainability professionals. The system is designed to help organisations manage regulatory obligations, streamline reporting, and centralise compliance processes across multiple sites and jurisdictions. The platform combines EHS compliance management, ESG reporting, and sustainability data collection within a single digital environment, supported by a global network of sustainability consultants. By replacing fragmented spreadsheets and manual workflows with structured, audit-ready documentation and continuously updated legal registers, denxpert aims to reduce risk and improve operational transparency. The company completed its latest funding round in 2024 and has raised over €900k.

Founded in 2023 and headquartered in Budapest, Mitzu is a warehouse-native product analytics platform designed to operate directly within a company’s existing data warehouse. The solution enables teams to analyse product usage, marketing performance, funnels, retention, and customer journeys without moving data to external systems. By processing data where it is stored, Mitzu aims to ensure accuracy, governance, and privacy while reducing infrastructure costs associated with third-party analytics tools. The platform supports self-service analytics for non-technical teams, allowing them to generate insights without SQL while maintaining full traceability to underlying data. To date, they have secured around €450k in funding.

Based in Budapest, Qneiform is a talent intelligence platform focused on financial services and investment markets. The company provides tools to help executive search firms, investors, and financial institutions identify, analyse, and track professionals across sectors such as private equity, hedge funds, investment banking, and venture capital. The platform combines AI-driven data collection with expert verification to build structured, frequently updated talent datasets. Features include natural language search, market mapping, benchmarking tools, and collaborative project management, enabling users to monitor hiring activity and analyse market dynamics in real time. Founded in 2022, they have secured €3.75 million in funding.

Founded in 2022 and headquartered in Budapest, Redmenta is an AI-powered education platform designed to support teachers in creating, evaluating, tracking, and personalising classroom activities. The system combines AI-assisted content generation with competency tracking tools to provide a structured environment for both digital and paper-based learning. Redmenta enables educators to design worksheets and lesson plans, analyse student work across multiple formats, and monitor progress through detailed competency profiles. The platform integrates with major learning management systems and complies with GDPR, allowing students to use it without mandatory registration. To date, the company has raised €466k and continues to scale its platform across international education markets.

Founded in 2025 and based in Budapest, Riptides is a cybersecurity startup developing an identity-based security platform for machine-to-machine communication and AI-driven workloads. The company focuses on replacing static credentials with short-lived, verifiable workload identities. Riptides provides a unified identity layer that issues and rotates identities automatically, enabling secure authentication and encrypted communication between services, infrastructure components, and AI agents. By enforcing identity at the operating system level and integrating with standards such as SPIFFE and cloud-native environments, the platform aims to reduce credential sprawl and improve visibility across distributed systems. To date, the company has raised over €2.7 million as it prepares for broader market rollout.

Founded in 2022 and headquartered in Budapest, scoutlabs is an agri-tech startup developing a digital insect monitoring system designed to help farmers detect pest pressure earlier and more accurately. The company provides solar-powered traps equipped with cellular connectivity that transform traditional manual trap networks into AI-supported monitoring systems. The platform uses cloud-based artificial intelligence, supported by entomological expertise, to identify and quantify pest populations and send automated alerts to farmers. By enabling more precise intervention and reducing the need for manual scouting, scoutlabs aims to support more efficient crop protection and lower input costs. To date, the company has landed €1.75 million as it expands deployment across agricultural markets.

Founded in 2022 and based in Szeged, Tengr.ai is an AI-driven image generation platform designed for creative and business use. The system enables users to generate high-resolution visuals, customise styles, edit images through text prompts, and apply tools such as face swap and background removal within a single interface. Tengr.ai positions itself as a commercially oriented AI partner, allowing users to retain ownership of generated content for business applications. The platform offers tiered subscription plans, API access, and advanced editing capabilities, supporting use cases ranging from marketing and branding to digital art production. To date, the company has raised €1 million as it continues to grow its international creative community.

Founded in 2023 and headquartered in Budapest, VRG Therapeutics is a biotechnology company focused on developing miniprotein-based therapeutics and cell and gene therapy technologies. The company combines AI-driven protein engineering with wet-lab directed evolution to design peptide-based medicines targeting mechanisms that are difficult to address with traditional small molecules or antibodies. Its proprietary platform integrates in silico scaffold selection with laboratory screening to optimise potency, selectivity, and safety. By leveraging its ISEP and CREATe technologies, VRG Therapeutics aims to accelerate the discovery of highly selective therapeutic candidates for complex disease targets. Founded in 2023, they have €5 million to advance its research pipeline and platform capabilities. By the way: If you’re a corporate or investor looking for exciting startups in a specific market for a potential investment or acquisition, check out our Startup Sourcing Service! The post Inside Hungary’s next startup wave: 10 of the most promising startups to watch in 2026 and beyond! appeared first on EU-Startups. |

13/02/2026 09:10 AM | 6 | |

| 52,497 | 13/02/2026 08:10 AM | German AI ConTech startup conmeet secures €1.3 million pre-Seed as it exits stealth mode | german-ai-contech-startup-conmeet-secures-euro13-million-pre-seed-as-it-exits-stealth-mode | 13/02/2026 | conmeet, a Borken, Germany-based AI-enabled cloud platform for process-oriented construction and trade companies, today announced the successful completion of its €1.3 million pre-Seed round as it exits stealth mode. The round was led by May Ventures under Managing Partner Maximilian Derpa. The founders have themselves contributed “substantial equity” to the financing. “The combination of a serial entrepreneur with exit experience, an AI-ready technology base, and proven traction in a fragmented market makes conmeet an exceptionally exciting investment,” commented Maximilian Derpa, Managing Partner at May Ventures. conmeet was founded in 2023 by Benedikt Kisner, Leandro Ananias, and Lennart Eckerlein. Kisner is a serial entrepreneur and founder of the netgo group, which he exited through a sale to a private equity investor. Together with Ananias (CTO) and Eckerlein (COO), Kisner built conmeet over two years in stealth mode, self-financed. According to the German startup, the market for enterprise software in the construction and skilled trades sector is highly fragmented and dominated by outdated on-premise solutions. It also states that medium-sized companies working with an average of 5-8 different tools lead to data silos, media breaks, and high administrative overhead. It adds that many modern cloud-based tools are often insufficient to address the process complexity of these businesses. conmeet claims to be the first fully cloud-native platform for this target group. The software combines CRM, ERP, project management, controlling, banking, and communication on a central database. The company states that its AI-supported workflows are designed to automate routine processes and orchestrate complex business processes. conmeet reports that this results in a 20-40% reduction in administrative effort while maintaining enterprise functionality. The company highlights its ecosystem-based approach as a strategic element of its platform. The platform enables cross-company collaboration with subcontractors, sub-contractors, and project partners through structured project hierarchies, shared construction diaries and integrated defect management. The firm states that this approach can contribute to network effects and higher switching costs for existing customers. “After two years of product development, the first customers have been working successfully with conmeet for several months. The platform’s sweet spot is process-oriented construction and craft businesses with between 10 and 500 employees – a segment with considerable market potential and a high willingness to pay for real efficiency gains,” the company mentioned in the press release. The fresh capital will be used for scaling, building up sales and marketing, and strengthening the engineering team for further development of AI capabilities. conmeet has the long-term vision of being positioned as the central AI platform for the entire real estate value chain. According to the company’s roadmap, development is planned along two strategic lines. The first focuses on the expansion of AI agents that can increasingly control entire business processes autonomously and replace manual tasks. The second involves expansion into an ecosystem that integrates architects, general contractors, facility management, and maintenance service providers in addition to trades and construction, to offer a comprehensive platform covering everything from planning and construction to operation. The post German AI ConTech startup conmeet secures €1.3 million pre-Seed as it exits stealth mode appeared first on EU-Startups. |

13/02/2026 09:10 AM | 6 | |

| 52,495 | 13/02/2026 06:37 AM | German synthetic data startup simmetry.ai secures €330k to tackle this key bottleneck holding back AI adoption | german-synthetic-data-startup-simmetryai-secures-euro330k-to-tackle-this-key-bottleneck-holding-back-ai-adoption | 13/02/2026 | simmetry.ai, an Osnabrück-based synthetic data company accelerating AI development across agriculture, food and industrial sectors, today announced it has secured €330k from NBank, the investment and development bank of the German state of Lower Saxony. The company secured this financing as part of the High-Tech Incubator (HTI) accelerator programme. Founded in 2024 as a spin-off from the German Research Centre for Artificial Intelligence (DFKI) by Kai von Szadkowski (CEO), Anton Elmiger (CTO) and Prof Dr Stefan Stiene, simmetry.ai is a simulation platform that generates photorealistic, fully-annotated synthetic data across multiple sensor modalities for training computer vision models. Its current focus areas are agriculture, food, and industrial CV applications. Anton Elmiger, CTO and co-founder of simmetry.ai, said, “We started with agriculture because it is both a highly impactful and technically demanding field for AI. Improving how crops are monitored and managed can support more efficient and sustainable farming, but building reliable computer vision systems here is extremely difficult due to the lack of diverse training data. “With this grant, we are turning our technology into a platform that makes advanced data generation accessible to more teams, helping innovation move faster not only in agriculture, but also in industrial and other real-world applications.” According to the company, the platform supports tasks such as semantic segmentation, object detection, 3D pose estimation and regression. It caters to computer vision engineers and AI developers working in robotics, autonomous machinery, quality inspection and other domains that rely on visual perception in complex, changing environments. simmetry.ai aims to address the data bottleneck hindering AI adoption. It claims that more than 80% of the effort in developing an AI model is dedicated to data collection and preparation, especially in industries like agriculture and manufacturing, where capturing all real-world scenarios can be extremely costly. This challenge is the main reason why AI remains economically unfeasible for many applications that could provide substantial value. The German startup claims to solve this by generating synthetic data that augments real-world datasets. It enables AI models to become more robust and generalisable by producing photorealistic images across a controlled range of conditions, environments and edge cases. Its applications include precision weed control with reduced pesticide use, quality inspection in food production, and AI-based monitoring in industrial settings. The company plans to use this grant to fund the development of a scalable platform that enables AI developers to generate photorealistic, fully annotated training data tailored to their specific use cases, including semantic segmentation and 3D pose estimation to regression tasks. The platform is intended to reduce the time and cost currently required to build robust computer vision models, particularly in environments where real-world data is scarce or difficult to collect. The post German synthetic data startup simmetry.ai secures €330k to tackle this key bottleneck holding back AI adoption appeared first on EU-Startups. |

13/02/2026 07:10 AM | 6 | |

| 52,494 | 12/02/2026 08:31 PM | Didero lands $30M to put manufacturing procurement on ‘agentic’ autopilot | didero-lands-dollar30m-to-put-manufacturing-procurement-on-agentic-autopilot | 12/02/2026 | 12/02/2026 09:10 PM | 7 | ||

| 52,493 | 12/02/2026 07:50 PM | A Wave of Unexplained Bot Traffic Is Sweeping the Web | a-wave-of-unexplained-bot-traffic-is-sweeping-the-web | 12/02/2026 | From small publishers to US federal agencies, websites are reporting unusual spikes in automated traffic linked to IP addresses in Lanzhou, China. | 12/02/2026 08:10 PM | 4 | |

| 52,492 | 12/02/2026 07:00 PM | OpenAI’s President Gave Millions to Trump. He Says It’s for Humanity | openais-president-gave-millions-to-trump-he-says-its-for-humanity | 12/02/2026 | In an interview with WIRED, Greg Brockman says supporting politicians who back AI is “bigger than the people that I happen to be employed with.” | 12/02/2026 07:10 PM | 4 | |

| 52,490 | 12/02/2026 03:17 PM | Stockholm-based Loovi secures €1 million to scale preventive health and longevity platform | stockholm-based-loovi-secures-euro1-million-to-scale-preventive-health-and-longevity-platform | 12/02/2026 | Loovi, a Swedish HealthTech startup, has raised €1 million to launch its digital platform for data-driven longevity and preventive health – following a year of development and pilot testing. Investors in the round include Susanne Najafi (BackingMinds), Sïmon Saneback (Wellstreet), Jarno Hottinen (Otmore), Emad Zand (Northvolt), and Benoit Falenius (Markify), as well as Ultan Miller and Charles Morel. “The challenge today is not a lack of data, but that people are often left alone with numbers that are difficult to interpret and prioritise. At the same time, longevity has become associated with extreme routines that few can realistically maintain. Our ambition is to make proactive health management more relatable, understandable, and sustainable over time,” says Joel Grajcer, Co-founder and CEO of Loovi . Alongside Loovi’s €1 million raise, EU-Startups has reported several comparable preventive HealthTech rounds across Europe in 2025 and early 2026. In Switzerland, Ahead Health secured €5.1 million to scale its preventive healthcare platform and expand clinic partnerships, while Zurich-based Aeon raised €8.2 million to develop its AI-powered preventive health and risk profiling platform. In France, Lucis closed a €7.2 million round to advance its AI-driven biomarker interpretation and preventive health checks. In Spain, Barcelona-based Holo raised €1 million to expand its personalised lab testing and wearable data integration platform, while Polish-American startup Mos Health secured approximately €920k to build its AI-powered preventive health and wellness solution. Combined, these rounds represent over €21 million in funding, indicating sustained investor interest in platforms focused on early detection, biomarker analysis, wearable data integration and structured preventive care. No other Swedish preventive HealthTech funding rounds were reported in this specific sample, situating Loovi within a broader but geographically dispersed European trend towards data-driven, proactive healthcare models. “We want to shift the focus from reacting to diagnoses to acting on early signals. There are more health services available than ever before, but few that take the full health picture into account. Our ambition has been to bring together multiple sources of health data, interpret them in a medical context, and guide users over time, not only through technology, but also through human interaction and educational support,” adds Kevin Najafi, MD and co-founder of Loovi. Founded in 2025 by Joel Grajcer and Dr Kevin Najafi, Loovi offerswhat it describes as Europe’s first end-to-end digital platform for longevity and preventive health. By combining medical analysis, physical testing, wearable data integration, and personalised guidance, Loovi enables individuals to better understand their health and work proactively over time. The company’s mission is to shift healthcare from reactive treatment to structured, data-driven prevention. According to Loovi, nmuch of today’s healthcare remains reactive. Early warning signs of lifestyle-related conditions are often detected long after they should have been addressed, and when risk markers are identified, long-term follow-up and behavioural support are frequently limited. At the same time, large amounts of health data are generated through tests, clinical visits, and wearable devices, yet the information is often fragmented and difficult to translate into actionable insights. Loovi combines medical analysis with physical testing and integrates blood markers, test results, and lifestyle data into a single, structured platform. By analysing multiple data sources simultaneously, the platform creates a comprehensive health overview that forms the basis for personalised recommendations. Results are monitored over time and adjusted as new measurements are added. An AI-powered intelligence layer helps users understand how different factors interact and influence their health over time. Unlike traditional health check-ups, Loovi is designed as an ongoing programme rather than a series of isolated assessments. The focus is on continuity, realistic lifestyle adjustments, and sustainable habits that can be maintained in everyday life. Today’s funding will be used to further develop the platform, strengthen medical and technical capabilities, and support a broader market rollout. The post Stockholm-based Loovi secures €1 million to scale preventive health and longevity platform appeared first on EU-Startups. |

12/02/2026 04:10 PM | 6 | |

| 52,489 | 12/02/2026 02:13 PM | Imperial College founders raise €2.8 million for The Compression Company; a satellite data compression platform | imperial-college-founders-raise-euro28-million-for-the-compression-company-a-satellite-data-compression-platform | 12/02/2026 | UK and US-based SpaceTech startup The Compression Company is announcing a €2.8 million ($3.4 million) pre-Seed round to tackle limited satellite bandwidth with AI-driven compression that runs directly onboard satellites, reportedly reducing file sizes by over 95% and enabling each one to transmit far more data to Earth during each short ground-station pass. The round was led by Long Journey (early backers of SpaceX, Uber and Anduril). The new funding will be used to expand the engineering team and support further commercial rollouts with satellite operators. “There’s been huge investments in capturing more data from space, but far less attention paid to how that data actually gets back to Earth,” says Michael Stanway, co-founder and CEO of The Compression Company. “Until now, the answer has been to launch more satellites. We’re taking a different approach – using software to compress data in orbit, so operators can bring down more useful information from existing satellites and unlock more value from the data they’re already capturing.” Recent EU-Startups coverage shows sustained SpaceTech investment across 2025–2026, spanning infrastructure, Earth observation and onboard compute. In November 2025, France’s Infinite Orbits secured €40 million to scale satellite servicing capabilities, while Reflex Aerospace raised €50 million to strengthen satellite manufacturing and infrastructure. France-based U-Space raised €24 million to advance high-cadence satellite launches and constellation deployment. In Spain, Kreios Space secured €8 million to develop very low Earth orbit satellite technology, while UK-based Spaceflux raised €6.1 million to expand its satellite-tracking network. On the Earth observation side, Germany’s Marble Imaging raised €5.3 million to scale its very-high-resolution EO constellation. Belgium’s EDGX secured €2.3 million to boost onboard AI compute for satellites, Italy’s Astradyne raised €2 million for ultralight solar panels, and Finland’s Vexlum secured €10 million to scale semiconductor laser manufacturing for quantum and space applications. Together, these rounds amount to approximately €148 million in disclosed funding across the sector. Within this context, The Compression Company’s €2.8 million pre-Seed round represents a comparatively smaller but strategically aligned raise focused on software-layer optimisation. While much of the recent capital has flowed into satellite manufacturing, launch capability, servicing and onboard hardware, the company’s AI-driven compression platform addresses the downstream constraint of data transmission. “AI compression unlocks a huge opportunity with Earth Observation data. Operators have always had to make trade-offs about what gets sent,” adds Joe Griffith, CTO of The Compression Company. “When more of the data you collect can actually make it to the ground, those trade-offs change and you can be far more selective about what you throw away, and far more ambitious about the services you build on top.” Founded in 2025, The Compression Company is a data compression platform designed to optimise the storage and transmission of earth observation and geospatial data. Its technology uses AI-driven compression to reduce the size of data directly on satellites and on the ground, enabling operators to send significantly more information back to Earth through limited bandwidth. By prioritising the most valuable parts of each image, The Compression Company helps satellite operators lower costs, reduce delays, and deliver usable data faster without changing existing workflows. The company was founded by Michael Stanway (CEO) and Joe Griffith (CTO), who met while studying neurotechnology at Imperial College London. Stanway’s research focused on keeping brain tissue alive outside the body – work that required handling massive imaging datasets. Griffith studied how the brain itself compresses information, developing neural network approaches to data compression. Griffith left his PhD to co-found the company after the pair recognised that the same techniques could solve bottlenecks far beyond neuroscience, and identified space as the clearest opportunity. The Compression Company emerged from Entrepreneurs First, an international talent investor, with strong early traction and has shipped its first orbital deployment, scheduled to go live in Q1 2026. “Space has become a data industry, but the ability to move and work with that data has lagged badly behind its generation,” says Lee Jacobs, Managing Partner and Founder, Long Journey. “The Compression Company is tackling one of the most fundamental constraints in the ecosystem with a software-first approach that’s both technically ambitious and immediately useful to operators. Michael and Joe pair deep, original thinking with real builder instincts, and we’re excited to back them as they create a new layer of infrastructure for the space data stack.” According to the company, the volume of data generated in space is staggering and rapidly growing. The EU’s Copernicus Sentinels alone produce 20 terabytes daily, and leading commercial constellations generate several times that. Over the next decade, more than 5,400 additional EO satellites are expected to launch – nearly triple the previous ten years. Every new satellite adds to the volume of imagery and sensor data captured about the Earth – data that can inform everything from climate monitoring and disaster responses to defence, agriculture, and global logistics. Satellite operators can capture extraordinary levels of detail, but getting that data back to Earth remains a fundamental challenge. Satellites operate with limited bandwidth and typically have only a few minutes per pass to transmit data when they come within range of a ground station – an antenna on Earth that receives satellite data. As a result, only 2% of the data recorded by each satellite makes it back to Earth, while the rest is delayed, degraded, or discarded, despite its potential value and the high cost of collecting it. The Compression Company reduces the size of the data directly on the satellite, reportedly shrinking the size of files without compromising accuracy or usability. Rather than using blanket compression, the platform applies different levels of compression within each image. Cloud cover, which accounts for nearly 60% of satellite imagery, is compressed far more heavily, since it returns little value for users. In maritime surveillance, detected ships are preserved at full fidelity while the surrounding ocean is compressed more aggressively. The principle is the same: save bandwidth for high-value data. This allows operators to download far more data during each transmission window, reduce storage and transmission costs, and deliver usable information faster and more frequently. As satellites are increasingly launched with more onboard compute, including graphics processing units (GPUs), the company is able to deliver this capability as a software-only solution, deploying advanced compression directly in orbit without requiring new hardware. “We’re at an inflection point,” adds Michael. “Once data transmission is no longer the bottleneck, the pace of innovation across Earth observation and its applications can increase dramatically. Our goal is to make that possible.” As the space economy continues to expand, the company believes intelligent compression will become a foundational capability, supporting operators to capture more, deliver insights faster, and provide new products without launching new hardware. The post Imperial College founders raise €2.8 million for The Compression Company; a satellite data compression platform appeared first on EU-Startups. |

12/02/2026 03:10 PM | 6 | |

| 52,491 | 12/02/2026 02:00 PM | Eclipse backs all-EV marketplace Ever in $31M funding round | eclipse-backs-all-ev-marketplace-ever-in-dollar31m-funding-round | 12/02/2026 | 12/02/2026 05:10 PM | 7 | ||

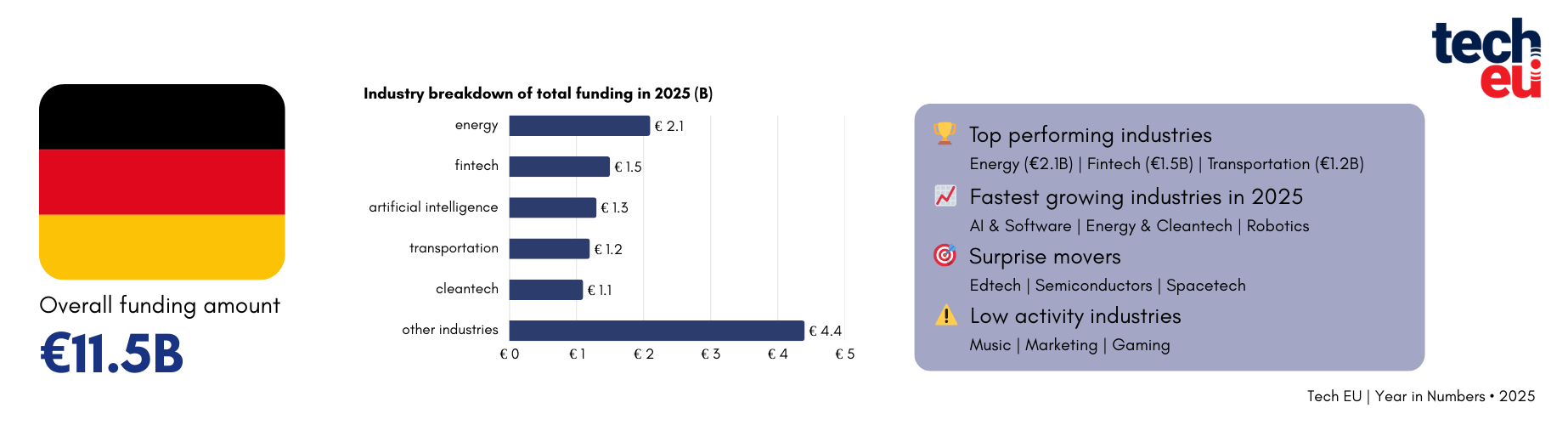

| 52,488 | 12/02/2026 01:45 PM | From industrial depth to strategic growth: the German tech ecosystem | from-industrial-depth-to-strategic-growth-the-german-tech-ecosystem | 12/02/2026 | In 2025, European tech companies raised approximately €72 billion in total funding. Germany secured €11.5 billion across 539 deals, accounting for around 16 per cent of the total capital invested and ranking second among European countries by total amount raised. Within Germany, the tech ecosystem was shaped less by overall deal volume and more by the size and concentration of capital flowing into a limited number of core sectors. The year was marked by several large financing rounds, particularly in energy, climate, mobility and artificial intelligence, giving the market a notably infrastructure-focused profile. Energy attracted the highest level of investment at around €2.1 billion, followed by fintech at approximately €1.5 billion, artificial intelligence at €1.3 billion, transportation and mobility at €1.2 billion, and cleantech at €1.1 billion. This distribution highlighted Germany’s continued strength in capital-intensive, industrial and real-economy innovation.

Overall, 2025 reflected a scale-driven and high-conviction investment environment, with funding concentrated in technologies considered strategically important for long-term economic transformation and infrastructure development (for more detailed analyses of the European technology ecosystem, check out Tech.eu’s annual report: European Tech 2025–The Big Picture). Here are the 10 companies that raised the most in 2025.

|

12/02/2026 02:10 PM | 1 | |

| 52,486 | 12/02/2026 12:15 PM | UK government adviser and military commander land €12 million to scale Electric Twin’s synthetic audience platform | uk-government-adviser-and-military-commander-land-euro12-million-to-scale-electric-twins-synthetic-audience-platform | 12/02/2026 | London’s Electric Twin, an AI platform building synthetic audiences that model how people think and behave in real life, is announcing that it has raised €12 million ($14 million) to fuel their global expansion and support continued development. This includes a €8.5 milliom ($10 million) round led by Atomico, backed by LocalGlobe, Mercuri and Samos Investments, and joined by a raft of leading angels including: Marc Andreessen; co-founder and CTO of Slack, Cal Henderson; former Kantar CEO, Eric Salama; COO of Entrepreneur First, Tom Shinner; and Executive Vice President, UK and Europe, at Palantir, Louis Mosley. This funding follows on from a previously undisclosed €3.5 million ($4 million) pre-Seed. Alex Cooper, co-founder and CEO of Electric Twin, says: “Electric Twin was born from our experience leading through crisis, where we spotted a common problem: too many decisions had to be made with incomplete information. We wanted to build a solution that allows leaders to understand their audiences better than ever before – to speak to them instantly, ask them anything, and predict how they will behave. This investment will enable us to scale our vision and put synthetic audiences at the heart of business strategies.” In the emerging field of AI-driven market research and synthetic audience modelling, several European startups have secured fresh capital in 2025. UK-based Artificial Societies raised €4.5 million in Seed funding to scale its platform for simulating human behaviour and delivering rapid audience feedback – notably from the same country as Electric Twin. Cologne-based experial secured €2 million in pre-Seed funding to develop AI-powered digital twins for market decision-making. Denmark’s Propane attracted €1 million to build an AI-driven customer intelligence platform, while Copenhagen-headquartered GetWhy raised an additional €17 million to expand its generative AI consumer insights platform. In Belgium, Trendtracker secured €5.9 million to scale its AI-powered strategic intelligence technology. Taken together, these disclosed rounds amount to over €30 million flowing into adjacent AI-enabled consumer insights and behavioural simulation platforms across Europe in 2025. Against this backdrop, Electric Twin’s €12 million raise positions it among the larger individual funding rounds in this segment, reflecting sustained investor interest in technologies that aim to automate and accelerate understanding of customer behaviour, strategic decision-making and market testing. Ben Blume, Partner at Atomico, adds: “Companies are desperate to understand their customers, but still lack the tools to unlock insights cost-effectively and at scale. Electric Twin is forging a genuinely new path, bringing science and machine learning to the clunky, static world of market research and opening up a new era of deeper, more accurate and far faster insight generation. Their product is already market leading in this rapidly emerging space and will only grow more powerful. Alex and Ben bring unique experience in making critical decisions at scale, and we are proud to partner with them and the team as they continue their rapid growth journey.” Founded in 2023, Electric Twin builds synthetic audiences so organisations can understand their customers. Using AI, machine learning and social science research, the tech simulates how real audiences behave, so companies can test ideas, messaging, and campaigns and get feedback in minutes instead of weeks. Electric Twin was founded by Dr Ben Warner, a physicist and the former Chief Adviser on Digital and Data to the Prime Minister, and Alex Cooper, a former military commander who established the UK’s mass testing response during the COVID pandemic. The Times and Lebara are among those already using the platform. By taking real-world survey data and combining it with LLMs, social science research and machine learning, the platform creates ‘synthetic audiences’ that can predict how real people will respond to messaging, product launches, or proposed strategies. The company has already run over 40,000 evaluations of populations covering 155 countries worldwide to train its prediction engine. Academic research, conducted in collaboration with Professor Michael Muthukrishna from the London School of Economics, found Electric Twin’s technology reportedly delivers insights 10,000 times faster than traditional research methods with 95% accuracy. As the company scales, it will continue to deepen its synthetic audience models and extend the range of scenarios that organisations can test for – putting advanced decision-making technology into the hands of all businesses. The post UK government adviser and military commander land €12 million to scale Electric Twin’s synthetic audience platform appeared first on EU-Startups. |

12/02/2026 01:10 PM | 6 | |

| 52,485 | 12/02/2026 11:35 AM | Stop talking to AI, let them talk to each other: The A2A protocol | stop-talking-to-ai-let-them-talk-to-each-other-the-a2a-protocol | 12/02/2026 |  Have you ever asked Alexa to remind you to send a WhatsApp message at a determined hour? And then you just wonder, ‘Why can’t Alexa just send the message herself? Or the incredible frustration when you use an app to plan a trip, only to have to jump to your calendar/booking website/tour/bank account instead of your AI assistant doing it all? Well, exactly this gap between AI automation and human action is what the agent-to-agent (A2A) protocol aims to address. With the introduction of AI Agents, the next step of evolution seemed to be communication. But when communication between machines… This story continues at The Next Web |

12/02/2026 12:10 PM | 3 | |

| 52,487 | 12/02/2026 11:11 AM | German GenAI startup Blockbrain lands €17.5 million to advance enterprise-grade AI agents | german-genai-startup-blockbrain-lands-euro175-million-to-advance-enterprise-grade-ai-agents | 12/02/2026 | Blockbrain, a GenAI agent platform out of Stuttgart that helps enterprises secure Europe’s knowledge expertise, has raised €17.5 million (£15.2 million) in Series A funding to strengthen its platform’s security and governance, advance specialised AI agents, and expand across Europe and the UK The round is led by Alstin Capital and 13books Capital, with participation from the HARTING Family Foundation. Existing investors Giesecke+Devrient Ventures, Landesbank Baden-Württemberg Ventures, and Mätch VC have also increased their financial commitment. The company’s total funding to date amounts to €23 million. “Companies lose valuable know-how every single day – not out of negligence, but because knowledge and complex decision-making logic have rarely been captured in a systematic way. With Blockbrain, we make tacit expertise permanently accessible and create a robust foundation for productivity and competitiveness. The successful Series A funding round gives us the momentum to scale this approach across Europe,” says Antonius Gress, co-founder and CEO of Blockbrain. In the context of Blockbrain’s Series A raise, several other European AI and agent-oriented startups have secured notable funding in 2025–2026. For example, EvoluteIQ (Swedish AI platform) secured a €44 million minority growth capital round to accelerate global expansion of its agentic AI automation platform, targeting end-to-end business workflow orchestration. PolyAI (London‑based enterprise conversational AI) raised €73.2 million in Series D to scale its enterprise voice agent technology for customer service applications. On the security and supervision side, Overmind (AI agent security infrastructure) closed a €2.3 million seed round to build supervision layers for deployed AI agents, while Equixly (Verona‑based agentic API security) raised €10 million to scale its agentic platform for automated API security testing. Additionally, Qevlar AI (Paris‑based agentic SOC platform) secured €9.1 million to advance autonomous AI-driven security operations. Taken together, these rounds illustrate a broader European funding trend in enterprise AI and agent-centric technologies throughout 2025 and into early 2026. While there are large scaleups like PolyAI and EvoluteIQ attracting substantial growth capital, smaller Seed and Series A rounds in adjacent niches such as agent security (Overmind), API protection (Equixly), and autonomous SOC platforms (Qevlar AI) signal diversified investor interest across both automation and safety-oriented segments. Blockbrain’s Series A fits within this mid-range cluster of enterprise-focused AI funding, emphasising secure knowledge and governance capabilities that complement broader trends toward agentic, operational, and compliance-centric AI deployments in European organisations. “Quality and reliability at Blockbrain do not simply arise from choosing a particular AI agent,” adds Mattias Protzmann, co-founder and CTO of Blockbrain. “From day one, we have focused on security, data sovereignty, and compliance. This strategy gives our customers control through full transparency. In a corporate context, simply relying on promises and the power of a model is, in our view, not enough.” Founded in 2022, Blockbrain is an AI platform that enables companies to securely digitise expertise, processes, and decision-making logic and make them usable across the organisation. The company was founded by Antonius Gress (formerly Bosch), Mattias Protzmann (serial entrepreneur and co-founder of Statista), and Nam Hai Ngo (formerly Antler, WHU alumnus). The aim is to counteract the shortage of skilled workers and structural inefficiencies in companies with an easy-to-use, no-code-based AI platform and to make internal know-how systematically usable, augmentable, and automatable. In 2025, Blockbrain recorded a fivefold increase in revenue. Customers include Roland Berger, Bosch & Bosch Rexroth, Kärcher, fischer, Harting, Eberspächer, Bardehle Pagenberg, CHG Meridian, Domcura, and Seifert Logistics Group. The platform is tailored to the industry-specific needs of customers, from faster onboarding of new employees, more efficient sales processes, and automation of knowledge work in all indirect process areas and manufacturing, to the elimination of manual knowledge documentation. “In industry, expert knowledge determines quality and speed. If it is lost, costly productivity losses threaten. Blockbrain makes internal know-how from documents and team expertise quickly usable as Knowledge Bots, without complex programming and in compliance with GDPR. The team, practical benefits, and feedback from leading industrial companies convinced us. That’s why we are delighted to lead this round as lead investor,” says Benjamin Kleinschnitz, Senior Investment Manager at Alstin Capital. When experienced employees leave a company, more is lost than just a position: expertise, decision-making logic, and established processes disappear and must be painstakingly rebuilt. Blockbrain offers a platform solution that enables companies to make this knowledge permanently available, augmentable, and automatable with AI agents. With Blockbrain’s solution, digital knowledge twins can be created within just a few weeks. They store information from experts and specialists, map ways of thinking, decision-making logic, and methodological knowledge, and make it scalable as needed. These so-called Knowledge Bots then make the stored experiential knowledge permanently available across teams and locations. Existing customers such as Axel Frey, CEO of Seifert Logistics Group, report weekly time savings of up to 15% through the use of their digital twin. Hallucinations and misinformation are also reportedly eliminated due to the technical architecture behind the agents. “We invested in Blockbrain because they combine advanced AI technology with the highest standards of security, compliance, and reliability. Their platform delivers real value to companies, potentially serving as a catalyst for Europe to gain more power and resilience in an era of uncertainty. At 13books Capital, we believe Blockbrain is shaping the future of responsible AI in all critical and regulated sectors, from financial services to manufacturing and energy,” explains Meera Bissoondeeal, Principal at 13books Capital. With the fresh capital, Blockbrain is investing specifically in further expanding the security, compliance, and governance of its platform. At the same time, the company is advancing the development of specialised knowledge and AI agents – including features such as a fallback mechanism for AI models to increase the availability and reliability of answers, as well as new agent and research workflows to automate knowledge building and research processes. The company is expanding its presence in Europe and the UK and strengthening its team with Forward-Deployed AI Engineers – specialised experts who closely support companies in the introduction and use of AI agents and their integration into existing systems, either remotely or on-site. Targeted investments are also being made in further developing the platform and researching new application areas around AI-supported knowledge management. The post German GenAI startup Blockbrain lands €17.5 million to advance enterprise-grade AI agents appeared first on EU-Startups. |

12/02/2026 01:10 PM | 6 | |

| 52,483 | 12/02/2026 10:29 AM | Swedish pet insurtech Lassie raises $75M Series C after hitting $100M ARR | swedish-pet-insurtech-lassie-raises-dollar75m-series-c-after-hitting-dollar100m-arr | 12/02/2026 |  Imagine the moment you bring a new dog or cat into your life. That mix of excitement and responsibility. Vet visits, vaccines, learning what food suits them, managing check-ups, and always wondering how to keep them healthy as they grow. Most pet insurance only steps in after a costly accident or illness. It doesn’t help you avoid the situation in the first place. Lassie’s product is built around a different insight: giving owners the tools to look after their pets every day, not just when something goes wrong. Now, Stockholm-based insurtech Lassie has secured $75 million in a Series C… This story continues at The Next Web |

12/02/2026 11:10 AM | 3 | |

| 52,484 | 12/02/2026 10:21 AM | Chronic rhinitis solution NEUROMARK secures €62.5 million as Irish startup Neurent Medical closes Series C | chronic-rhinitis-solution-neuromark-secures-euro625-million-as-irish-startup-neurent-medical-closes-series-c | 12/02/2026 | Galway-based Neurent Medical, the company behind NEUROMARK, a minimally invasive solution to treat chronic rhinitis, today announced the successful close of its oversubscribed Series C financing, raising €62.5 million ($74 million) to drive commercial expansion, broaden clinical evidence, and advance its product and indication pipeline. The financing was led by MVM Partners, with significant participation from Sofinnova Partners, and included continued support from existing investors EQT Life Sciences, Atlantic Bridge, Fountain Healthcare Partners and Enterprise Ireland. “I am delighted to welcome MVM Partners and Sofinnova Partners to the Neurent Medical team, two global leaders in MedTech investing,” says CEO of Neurent Medical, Brian Shields. “This Series C financing will support our commercial expansion and help bring NEUROMARK to the patients and physicians who need it most.” In the European HealthTech and MedTech funding landscape in 2025–2026, a number of startups have secured significant capital to advance clinical technologies and healthcare solutions:

Set against that context, Neurent Medical’s €62.5 million Series C places it at the higher end of European MedTech fundraising in this period, highlighting investor confidence in companies developing clinically validated devices and treatments for chronic conditions where existing options are limited. “Millions of patients suffer from chronic rhinitis, and posterior nasal nerve ablation represents a powerful tool to provide proven relief,” adds Kyle Dempsey, Partner at MVM Partners. “In this rapidly emerging category, Neurent has set a new standard with a best-in-class solution, powered by a proprietary impedance control system that delivers real-time feedback, giving clinicians greater treatment confidence, control, and predictability during every procedure.” Founded in 2015, Neurent Medical is dedicated to transforming the treatment landscape for chronic inflammatory sinonasal diseases. Its flagship NEUROMARK System utilises proprietary Impedance Controlled Radiofrequency technology to gently disrupt hyperactive posterior nasal nerves, reportedly delivering durable symptom relief from chronic rhinitis with minimal downtime and a strong safety profile. According to the company, chronic rhinitis affects millions of people worldwide and is characterised by persistent symptoms including nasal congestion, rhinorrhea (runny nose), sneezing and postnasal drip that can significantly diminish quality of life. NEUROMARK’s proprietary Impedance Controlled Radiofrequency technology targets the overactive posterior nasal nerves (PNN) that drive these symptoms, providing clinicians with a differentiated and durable treatment option designed to “address the root cause, not just manage symptoms“. Neurent Medical also welcomed Kyle Dempsey, Partner at MVM Partners, and Cedric Moreau, Partner at Sofinnova Partners, to its Board of Directors. “Chronic rhinitis is a widespread and often overlooked condition affecting millions of patients with limited effective treatment options. Neurent Medical has developed a truly differentiated approach supported by a growing body of clinical evidence demonstrating meaningful and durable patient benefit,” adds Cedric Moreau. “We also see significant potential to expand this platform into additional indications, and we are confident in our partnership with Neurent Medical at this pivotal stage of commercial growth.” The post Chronic rhinitis solution NEUROMARK secures €62.5 million as Irish startup Neurent Medical closes Series C appeared first on EU-Startups. |

12/02/2026 11:10 AM | 6 | |

| 52,481 | 12/02/2026 09:36 AM | Understanding the valuation of intangible assets in tech deals | understanding-the-valuation-of-intangible-assets-in-tech-deals | 12/02/2026 |  In a technology M&A deal, whether you are acquiring or selling a tech or software business, valuation rarely hinges on a single dimension. Financial performance, growth efficiency, and cash flow durability remain the backbone of any transaction. In practical terms, this means metrics such as revenue and ARR, retention as a proxy for revenue quality, margin structure, and capital intensity continue to anchor how buyers price risk. However, alongside these tangible indicators sits another layer of value, one that does not always surface cleanly in financial statements and may even remain invisible if it is not properly understood or articulated:… This story continues at The Next Web |

12/02/2026 10:10 AM | 3 | |

| 52,482 | 12/02/2026 09:29 AM | The EU-Startups Podcast | Interview with Fridtjof Berge, Co-founder and Chief Business Officer at Antler | the-eu-startups-podcast-or-interview-with-fridtjof-berge-co-founder-and-chief-business-officer-at-antler | 12/02/2026 | This week on the EU-Startups Podcast, we sit down with Fridtjof Berge, Co-founder and Chief Business Officer at Antler, one of the world’s most active early-stage venture capital firms! Since launching in 2017, Antler has backed more than 1,650 startups globally and, according to recent data, has now made over 1,800 investments across six continents, supporting founders from day zero. Operating in 27 cities worldwide, the firm has built one of the most distributed early-stage investment platforms globally. Its growth has been rapid, scaling from deploying €5.4 million across 44 startups in 2019 to launching a €30 million Nordic fund in 2021 and a €150 million Nordic fund in 2023. In the interview, Fridtjof reflects on his journey from McKinsey and Harvard Business School to building a global VC platform and shares insights into what sets exceptional founders apart today. We also discuss Antler’s latest report, “The Anatomy of Greatness”, which analyses a decade of unicorn creation from 2014 to 2024. The findings point to a sharp acceleration in billion-dollar company formation, the rise of AI, shifting founder demographics, the continued globalisation of innovation well beyond Silicon Valley, and much more! Key Points

This episode of the EU-Startups Podcast is brought to you by Vanta. The trust management platform helps more than 12k companies, including Nando’s, Allica Bank and Granola, start and scale their security programmes while building trust with buyers. It saves security teams time and improves programme visibility by automating over 35 compliance frameworks, such as SOC 2 and ISO 27001, as well as GRC workflows like risk management. Click here to learn more! This episode of the EU-Startups Podcast is brought to you by Vanta. The trust management platform helps more than 12k companies, including Nando’s, Allica Bank and Granola, start and scale their security programmes while building trust with buyers. It saves security teams time and improves programme visibility by automating over 35 compliance frameworks, such as SOC 2 and ISO 27001, as well as GRC workflows like risk management. Click here to learn more!

The post The EU-Startups Podcast | Interview with Fridtjof Berge, Co-founder and Chief Business Officer at Antler appeared first on EU-Startups. |

12/02/2026 10:10 AM | 6 | |

| 52,479 | 12/02/2026 09:00 AM | Demoboost closes €2.8M to turn product demos into revenue intelligence | demoboost-closes-euro28m-to-turn-product-demos-into-revenue-intelligence | 12/02/2026 | Warsaw-based Demoboost, a platform that enables B2B software companies to deliver scalable, data-driven product demos, has raised €2.8 million in funding to support further product development and international expansion. The round was co-led by Digital Ocean Ventures and Rafał Brzoska’s family office RIO, with participation from B-Value. As B2B software sales cycles lengthen and conversion rates decline, companies are looking for ways to improve sales efficiency. Industry benchmarks indicate that only a minority of sales-qualified leads convert, leading to significant time and resources being spent on opportunities that do not generate revenue. A key challenge is the gap between buyer expectations and traditional sales processes. Many buyers seek greater flexibility and responsiveness, yet often encounter structured and rigid sales journeys. This can result in longer sales cycles, lower win rates, and increased pressure on presales teams that spend considerable time preparing repetitive demo materials. Demoboost addresses these challenges by helping B2B software companies standardise and scale their demo processes. Its platform enables sales, presales, and revenue teams to create, personalise, and share product demos that buyers can explore independently at an early stage or use during live sales interactions. These range from guided product tours to more complex, interactive sessions. AI-supported tools allow teams to reuse and adapt demo environments efficiently, reducing manual preparation and turnaround times. In addition to streamlining demo creation, the platform treats demos as a source of behavioural insight. It tracks how stakeholders interact with content, including what is viewed, shared, or revisited, generating data that can inform sales strategy. This approach turns demos into an ongoing source of revenue intelligence, helping teams prioritise opportunities, allocate resources more effectively, and improve conversion performance across the funnel. Demoboost plans to use the new funding to support continued investment in AI-driven demo creation and revenue intelligence capabilities, alongside team expansion across key functions. |

12/02/2026 09:10 AM | 1 | |

| 52,475 | 12/02/2026 08:10 AM | Bracket closes $7M round to expand treasury intelligence platform | bracket-closes-dollar7m-round-to-expand-treasury-intelligence-platform | 12/02/2026 | London-based Bracket, an FX, treasury, and cash management platform for mid-market businesses, has raised $7 million in seed funding. The round was led by Macquarie Group’s Commodities and Global Markets business and Blackfinch Ventures, with participation from existing investor Failup Ventures. Demand for modern treasury infrastructure has grown among mid-market companies, many of which continue to rely on spreadsheets and manual processes to manage FX exposure, cash visibility, and bank connectivity. These limitations have increased the need for more integrated and automated solutions. Founded in 2024 by FX and treasury industry leaders Alex Charles, Pierre Anderson, and Martin Lee, Bracket was established to address these challenges. The company’s AI-enabled platform centralises bank accounts, automates FX workflows, and provides real-time treasury insights, reducing reliance on manual processes that still dominate many finance teams’ operations. In addition to serving corporate clients directly, Bracket has developed a bank distribution model, licensing its platform to global banks and financial institutions to help them deliver modern treasury tools to their mid-market customers. Commenting on the funding, Pierre Anderson, Co-CEO and Co-founder of Bracket, said that mid-market companies are often expected to meet the same standards as large corporates without access to equivalent tools, leaving many dependent on outdated systems. He explained that Bracket’s platform automates treasury operations using AI and provides finance teams with real-time visibility and control over bank data within a single system. The new investment will support further product development and Bracket’s next phase of growth, including plans to open offices in Europe and Australia and expand its workforce over the coming year. |

12/02/2026 08:10 AM | 1 | |

| 52,477 | 12/02/2026 08:00 AM | Electric Twin expands AI audience platform with $14M round | electric-twin-expands-ai-audience-platform-with-dollar14m-round | 12/02/2026 | Electric Twin, an AI platform developing synthetic audience models designed to simulate real-world human thinking and behaviour, has raised $14 million in funding. The total includes a $10 million round led by Atomico, with participation from LocalGlobe, Mercuri and Samos Investments, as well as several angel investors, including Marc Andreessen, Cal Henderson, Eric Salama, Tom Shinner and Louis Mosley. The funding follows a previously undisclosed $4 million pre-seed round. Founded by Dr Ben Warner and Alex Cooper, Electric Twin develops tools to help organisations better understand their audiences and inform decision-making. By combining real-world survey data with large language models, social science research and machine learning, the platform creates synthetic audience models designed to estimate how people may respond to messaging, product launches or strategic proposals. This approach is positioned as an alternative to traditional research methods, which can be time-consuming and costly and are often limited by fixed questionnaires and sample sizes. Such constraints can leave decision-makers with incomplete insights. Electric Twin seeks to address these limitations by transforming static research inputs into dynamic digital audience models, enabling faster analysis and broader scenario testing. The platform enables organisations to explore audience perspectives in greater depth and evaluate ideas more efficiently. Commenting on the company’s origins, Alex Cooper, co-founder and CEO, said that their experience leading during a crisis highlighted how often important decisions had to be made with limited information. He explained that Electric Twin was created to equip leaders with tools to better understand their audiences, interact with them in real time and anticipate likely responses or behaviours. The funding will support Electric Twin’s international expansion and continued development of its prediction technology. As the company grows, it plans to enhance its synthetic audience models and expand the range of scenarios organisations can analyse, with the aim of making advanced decision-support tools more widely accessible. |

12/02/2026 08:10 AM | 1 | |

| 52,476 | 12/02/2026 08:00 AM | Rivage raises €2.6M to expand payroll software across accounting firms | rivage-raises-euro26m-to-expand-payroll-software-across-accounting-firms | 12/02/2026 | Paris-based Rivage has closed a €2.6 million pre-seed funding round to support the rollout of its payroll software across accounting firms. The round includes Partech, alongside business angel investors from the technology and accounting sectors, including the founders of Skello, Hexa, Quarksup, and Teledec. More than half of employees in France rely on accounting firms or outsourcing providers for payroll and social security declarations. As a result, payroll software plays a central role in a large market that remains largely dominated by legacy systems, many of which are not fully aligned with the ongoing digital transformation of firms and their small and medium-sized business clients. In response to these challenges, Rivage is developing an open, interoperable payroll software platform designed to increase the productivity of payroll managers and position payroll data as a tool for broader HR advisory services. The solution is already being deployed across eight partner firms. Founded in July 2025 by Ayoub Saidane, Hector Vergeron, Paul Lemoine, and Tancrède d’Hauteville (CEO), Rivage aims to offer a modern, scalable alternative focused on interoperability. The platform is designed to adapt to evolving regulatory requirements at scale while reducing the administrative burden on payroll managers through the automation of complex and time-consuming tasks. In a segment that has seen limited technological innovation, the company positions itself within a market where advances in AI are creating new opportunities to improve efficiency for firms. Commenting on the challenges facing the sector, Tancrède d’Hauteville said:

The funding will support two main priorities: continued development of the platform to improve the efficiency and reliability of each stage of the payroll cycle, including HRIS integrations, simplified advanced configuration, and enhanced auditability of payroll and DSN calculations; and the expansion of collective agreement coverage, with plans to broaden the number supported by the platform by the end of the year. |

12/02/2026 08:10 AM | 1 | |

| 52,480 | 12/02/2026 07:47 AM | Paris-based Lifeaz raises €13 million to democratise defibrillator access and save 1000 lives within five years | paris-based-lifeaz-raises-euro13-million-to-democratise-defibrillator-access-and-save-1000-lives-within-five-years | 12/02/2026 | Lifeaz, a Paris-based startup specialising in the democratisation of defibrillators for individuals and businesses, today announced that it has raised €13 million in funding to accelerate its growth and prepare its European rollout. Existing investor Mutuelles Impact (a fund initiated by La Mutualité Française and managed by XAnge in partnership with Impactivist, formerly called Investir&+) supported this round, with participation from new leading investors, including BNP Paribas, GO CAPITAL and Mirova (an affiliate of Natixis). Johann Kalchman, co-founder and CEO of Lifeaz, said, “Over the past ten years, Lifeaz has continuously demonstrated the need to democratize access to defibrillators. Our vision is that tomorrow, wherever you are, there will be a defibrillator less than one minute away and people who feel confident to step in and save a life – whether at home, in a restaurant, a hotel, a gym, a medical practice or at work. “This fundraising, therefore, marks a major milestone: the renewed trust of our historical investors and the arrival of new leading partners now give us the means to scale. After more than 100 lives saved, our ambition is clear: to multiply our impact by saving 1,000 lives within five years, in France and across Europe.” During 2025-2026, EU-Startups has covered several hardware and software-based cardiovascular HealthTech funding rounds. Most recently, in Jaunary 2026, Bordeaux and Tours-based FineHeart, a clinical-stage medical device company developing technologies in the cardiovascular space, announced the completion of a €35 million first closing of its Series C financing round. In July 2025, Oxford-based Ultromics, an innovator in AI-driven cardiology diagnostics solutions, announced it had raised €48 million through its Series C funding round. In June 2025, Bordeaux-based DESKi closed a €5.2 million Seed round to support the U.S. and global market launch of its FDA-approved cardiac imaging software, HeartFocus. Again in June 2025, Helsinki-based AIATELLA secured €2 million in funding to scale its AI-powered cardiovascular imaging technology and prevent 100 million strokes Founded in 2015 by Johann Kalchman, Martial Itty, Timothée Soubise, and Jonathan Levy-Bencheton, Lifeaz’s mission is to enable all citizens to save lives in the event of cardiac arrest. To achieve this, the startup developed the first defibrillator designed for home use and later introduced a version for businesses. Its defibrillator is called Clark and is designed in Paris and manufactured in Honfleur, Normandy. By offering an easy-to-use defibrillator equipped with connected technology enabling remote monitoring and maintenance through daily technical self-tests, Lifeaz ensures that the device is fully operational in case of emergency. It also offers training programmes, delivered via an app, video sessions and in-person training, that enable everyone to learn life-saving actions and feel confident to act in an emergency. Together, these measures enable Lifeaz to make sure it democratises access to defibrillators. The company offers these solutions through a business model, a turnkey rental solution combining the defibrillator, connected maintenance, consumables replacement and training. With this fresh capital, Lifeaz aims to increase the number of lives saved from 100 to 1,000, grow from 25,000 to over 100,000 customers, initiate European expansion, and strengthen its teams with around 20 new hires starting in 2026. The post Paris-based Lifeaz raises €13 million to democratise defibrillator access and save 1000 lives within five years appeared first on EU-Startups. |

12/02/2026 09:10 AM | 6 | |

| 52,478 | 12/02/2026 07:45 AM | London fintech Tangible raises $4.3M in seed funding | london-fintech-tangible-raises-dollar43m-in-seed-funding | 12/02/2026 | A London-based fintech which helps companies access and manage debt finance has raised $4.3m in a seed funding round. The funding round in Tangible was led by Pale Blue Dot with participation from MMC, Future Positive Capital, Unruly, SDAC, Prototype Capital, and Aperture. It follows a £4m ($5.45m) funding round Tangible carried out last year. Tangible helps tech companies access and manage debt financing. It helps the likes of robotics, climate, mobility and data centre companies or what it calls “hardtech” companies with financing. Tangible works with a broad range of lenders, from private credit and hedge funds to equipment financiers and traditional banks. It says “hardtech” firms don’t fit into the defined VC playbook, and the companies need well-structured debt alongside equity financing. It says most "hardtech" companies struggle to obtain scalable debt financing until they are deemed mature or “institutional-ready”. Tangible says its AI-powered platform and finance experts standardise the data, documentation, and ongoing reporting that lenders need. It says this reduces underwriting time and cost for lenders, and enables founders to run structured facilities without building an in-house structured finance team. Tangible, which employs 13 people, says it will use the funds from the round to expand its team and develop new products. William Godfrey, co-founder & CEO, Tangible, said: "As hardtech companies scale at speed, investors need modern infrastructure to deploy capital just as fast. And legacy processes that are reliant on bespoke documentation and manual coordination no longer cut it. This is the exact problem we’re trying to solve with Tangible - we provide the financial infrastructure that makes hardtech easy to diligence for institutional credit to allow companies to raise asset-backed financing faster, and with less friction.” |

12/02/2026 08:10 AM | 1 | |

| 52,474 | 12/02/2026 07:00 AM | Lifeaz raises €13M to further its efforts to improve access to life-saving interventions | lifeaz-raises-euro13m-to-further-its-efforts-to-improve-access-to-life-saving-interventions | 12/02/2026 | Lifeaz, a France-based company focused on improving access to defibrillators for individuals and businesses, has closed a €13 million funding round. The round includes continued participation from existing investor Mutuelles Impact, initiated by La Mutualité Française and managed by XAnge in partnership with Impactivist, as well as new investments from BNP Paribas, GO CAPITAL, and Mirova, an affiliate of Natixis. Founded in 2015, Lifeaz develops defibrillators designed for use in both home and business environments. The devices are designed to be easy to operate and provide step-by-step visual and audio guidance to assist users, including those without prior training. Connected technology enables remote monitoring and maintenance through regular automated self-checks, helping ensure the devices remain operational in emergency situations. In addition to providing equipment, Lifeaz offers training resources through a free mobile application and in-person workshops to support awareness and preparedness for life-saving interventions. Commenting on the funding, Johann Kalchman said the company aims to improve the availability of defibrillators and ensure that individuals feel prepared to respond in emergencies across both private and professional settings. Looking ahead, the company plans to expand its customer base, increase the number of lives saved through its solutions, begin a broader rollout across Europe, and strengthen its organisation by adding new team members to support its next phase of growth. |

12/02/2026 07:10 AM | 1 | |

| 52,472 | 12/02/2026 06:00 AM | Nocomed raises seed funding to address healthcareʼs biggest emissions blind spot | nocomed-raises-seed-funding-to-address-healthcares-biggest-emissions-blind-spot | 12/02/2026 | Nocomed, a Dublin-based sustainability software company, has raised €650,000 in seed funding to support the continued development and expansion of its platform, which focuses on supply chain-related emissions in the healthcare sector. The investment came from independent medtech investor Barry Comerford (Founder of Sauleen Holdings and Cambus Medical), software angel investor Edmund Wilson (Co-Founder of Titian Software), and Enterprise Ireland. Healthcare is responsible for more than 4 per cent of global carbon emissions, exceeding the aviation sector. More than 70 per cent of these emissions occur outside hospital facilities, primarily through purchased goods, manufacturing, and logistics. As health systems across Europe strengthen climate and procurement requirements, suppliers face growing expectations to provide credible, auditable emissions data and demonstrate measurable progress over time. Founded through the Dogpatch Labs Founders Talent programme, Nocomed has built a platform for life sciences and healthcare organisations to measure, report, and reduce emissions, automating data collection and applying region-specific factors aligned with the Greenhouse Gas Protocol. Designed to integrate into the day-to-day operations of healthcare organisations and suppliers, the platform functions as an ongoing system rather than a standalone carbon accounting tool or one-off reporting solution. Customers use it to continuously collect emissions data, maintain auditable baselines, and update reduction plans as suppliers, operations, or energy sources evolve. Rosemary Durcan, CEO and co-founder of Nocomed, said that while healthcare aims to improve human health, the sector’s emissions and pollution are increasingly contributing to related health challenges.

Many suppliers continue to rely on fragmented spreadsheets or one-off, project-based approaches that can be costly and may not provide full visibility into underlying data or assumptions. Nocomed positions its platform as an in-house alternative designed to retain data ownership, build institutional knowledge over time, and streamline recurring reporting requirements. Co-founder and CTO Dónal Adams said the platform is intended to serve as an ongoing system, enabling customers to build on existing data when tenders, audits, or reporting deadlines arise rather than starting from scratch. The new funding will support further product development and commercial expansion as the company grows customer adoption. Nocomed plans to expand its presence across Ireland, the UK, and wider European markets, while continuing to enhance the platform’s capabilities to support healthcare and life sciences organisations in managing supply chain emissions. |

12/02/2026 06:10 AM | 1 |