Switch Dataset:

Startup News

We are collecting the most relevant tech news and provide you with a handy archive. Use the search to find mentions of your city, accelerator or favorite startup in the last 1,000 news items. If you’d like to do a more thorough search, please contact us for help.

Search for any keyword to filter the database with >10,000 news articles

Filter

Filter search

Results

| id | date | title | slug | Date | link | content | created_at | feed_id |

|---|---|---|---|---|---|---|---|---|

| 51,086 | 17/11/2025 04:12 PM | French Spacetech startup Infinite Orbits lands €40 million for satellite servicing growth | french-spacetech-startup-infinite-orbits-lands-euro40-million-for-satellite-servicing-growth | 17/11/2025 | Infinite Orbits, a Toulouse-based pioneer of in-orbit servicing, today announces securing an oversubscribed €40 million financing round to deploy its GEO inspection and life-extension satellite fleet and expand its pan-European operational footprint. The European Innovation Council Fund, along with Matterwave Ventures, Wind Capital, Balnord, IRDI and Newfund Capital, have taken part in this financing round. “This financing round illustrates how the coordinated mobilisation of European private capital can strategically support the emergence of a leader in in-orbit servicing. With its positioning, the relevance of its service offering, and the excellence of its technical expertise, Infinite Orbits clearly stood out as the ideal European candidate, earning the confidence of customers and investors,” said Adel Haddoud, CEO of Infinite Orbits. In 2025 the European SpaceTech ecosystem has seen a scattered but meaningful set of funding flows across niches like in-orbit servicing, satellite inspection and infrastructure, propulsion systems and space-traffic awareness. France’s Look Up raised €50 million to expand its radar-based space-traffic management network. Belgium’s EDGX secured €2.3 million to advance onboard edge-computing capabilities for satellites, and Spain’s Kreios Space closed an €8 million Seed round to develop propulsion systems for very low-Earth orbit. The UK’s Spaceflux raised €6.1 million to scale its satellite-tracking network, and Germany’s HyImpulse Technologies attracted €45 million to support work on launch and propulsion systems. These rounds sum to around €111 million of disclosed investment in these adjacent segments. A recent EU-Startups article noted that the UK’s share of SpaceTech funding remains modest compared with continental Europe, where France and Germany continue to dominate headline investment in sovereign-capability areas. This suggests that while the broader servicing and orbital-logistics vertical is gaining traction, much of the capital remains concentrated in a handful of geographies and sub-sectors. The EIC Fund added: “We warmly congratulate Infinite Orbits on this successful funding round. Their pioneering in-orbit servicing technology – extending the life of satellites and enhancing the sustainability of space operations – embodies the kind of breakthrough innovation Europe needs.” Founded in 2017, Infinite Orbits is a NewSpace company that is innovating In-Orbit Services with spacecrafts powered by its Rendez Vous solution, an autonomous vision-based navigation software. Backed by a €150 million order book to be delivered in the next 3 years, a key factor in securing investors’ confidence, Infinite Orbits is pursuing a growth strategy designed to build a pan-European footprint. Its goal is to strengthen Europe’s space sovereignty. In line with its pan-European growth strategy, Infinite Orbits also aims to replicate the trusted partnerships it has established with the French sovereign institutions, working closely with other European sovereign counterparts to strengthen cooperation and resilience in orbit. Wind Capital shared: “The quality of the team was one of the strongest reasons that led us to invest in Infinite Orbits. It’s rare to see a young team that combines such deep scientific expertise with strong commercial acumen. We’re excited to support Infinite Orbits in its mission to strengthen space resilience and sustainability as well as European sovereignty; a perfect fit with Wind’s investment thesis.” The company is preparing an expansion of its geographical footprint, with new offices being opened in Luxembourg, Spain, UK, Germany and Poland. At the same time, this financing round will help the company accelerate the deployment of its fleet of satellites dedicated to inspection and life-extension of critical GEO assets to ensure security and sustainability of orbital operations. Matterwave Ventures added: “We were impressed by Infinite Orbit’s pragmatic focus on serving commercially relevant satellite operator use cases in GEO orbits. And the dual use applicability of their capabilities bodes well for the inclusion of Infinite Orbit’s servicers into Europe’s growing sovereign space defence infrastructures.” The funding follows 2024’s €12 million raise to build the first life extension satellite “Endurance” – as reported by EU-Startups. This new round marks the beginning of a new phase for Infinite Orbits, set to significantly increase its backlog and open the market to new space use cases beyond 2030. The post French Spacetech startup Infinite Orbits lands €40 million for satellite servicing growth appeared first on EU-Startups. |

17/11/2025 05:10 PM | 6 | |

| 51,087 | 17/11/2025 03:27 PM | €99 million Series D fuels Artios’ expansion of precision cancer treatment pipeline | euro99-million-series-d-fuels-artios-expansion-of-precision-cancer-treatment-pipeline | 17/11/2025 | Artios Pharma Limited, a British biopharmaceutical company committed to realising the therapeutic potential of targeting the DNA damage response (DDR) in cancer, today announced the successful close of an oversubscribed €99 million ($115 million) Series D financing. The investors who supported the round include Andera Partners, Avidity Partners, EQT Life Sciences, Invus, IP Group plc, Janus Henderson Investors, M Ventures, Novartis Venture Fund, Omega Funds, Pfizer Ventures, Piper Heartland, RA Capital Management, Sofinnova Partners, Schroders Capital, and SV Health Investors. “This Series D accelerates our potential path to registration for both alnodesertib and ART6043, broadening development for the next generation of DNA damage response (DDR) therapeutics to indications among the highest of unmet need across pancreatic, colorectal, and breast cancers, where median survival is often measured in months,” said Mike Andriole, Chief Executive Officer of Artios. In 2025, several European oncology-focused or adjacent BioTech startups secured notable funding rounds alongside Artios Pharma’s €99 million Series D. Germany’s Tubulis raised €308 million to advance its antibody-drug conjugate platform, while France’s Adcytherix secured €105 million to progress its novel ADC pipeline. The UK also saw activity through T-Therapeutics, which extended its Series A to approximately €78.2 million for next-generation TCR-based therapies, and CHARM Therapeutics, which raised €68.5 million to develop treatments for resistant cancers. Switzerland’s NUCLIDIUM closed an €84 million Series B for its radiopharmaceutical platform, and France’s Exeliom Biosciences raised €2.85 million to advance immuno-oncology development. Together, these financings represent roughly €646.6 million of capital flowing into European oncology and adjacent BioTech fields in 2025. Artios’ €99 million raise represents a significant addition to this sector and places it in the upper echelon of funding rounds raised this year. Nikola Trbovic, Managing Partner, SV Health Investors, added, “We are thrilled to have supported Artios’ evolution, from an early-stage DDR pioneer when we founded the company to the established company it has become, distinguished by a promising and differentiated pipeline. We look forward to continuing to do so as it deploys the Series D proceeds to drive late-stage development of alnodesertib as well as its pipeline.” Founded in 2016, Artios is innovating next-generation approaches in the (DDR) field through its comprehensive anti-cancer approach and the deep experience of its team of DDR drug developers. The company’s clinical-stage candidates, ATR inhibitor alnodesertib and DNA Polymerase theta (Polθ) inhibitor ART6043, as well as its pre-clinical programs, including DDRi-ADCs, are designed with differentiated pharmaceutical properties and novel biological approaches to precisely eliminate a cancer cell’s remaining survival mechanisms. The Series D proceeds will expand the clinical evaluation of Artios’ lead program, alnodesertib, to enroll additional ATM-negative patients in each of second-line pancreatic cancer and third-line colorectal cancer, for which the programme was recently granted U.S. FDA Fast Track Designation. At the AACR meeting in April 2025, Artios reported that alnodesertib, in combination with low-dose irinotecan, demonstrated a 50% confirmed overall response rate in patients with ATM-negative solid tumors at the recommended Phase 2 dose in the STELLA Phase 1/2a trial. There are currently no approved therapies specifically for patients whose tumors harbor ATM-deficiency, a population where alnodesertib has demonstrated durable responses across eight different solid tumors. The proceeds from the financing will also be used to initiate a Phase 2 randomised clinical trial for Artios’ second potential first-in-class candidate, ART6043, in patients with BRCA-mutant HER2-negative breast cancer who are eligible to receive a PARP inhibitor. The DNA polymerase Theta (Polθ) inhibitor, ART6043, demonstrated an attractive tolerability profile, expected PK/PD activity, and promising clinical signals in data from a Phase 1/2a study presented at the ESMO Congress in September 2025. The company is also advancing a first-in-class and highly differentiated DDR inhibitor-Antibody Drug Conjugate (DDRi-ADC) program and expects to name a lead candidate in Q1 2026. Jake Simson, Partner, RA Capital Management, commented, “We are excited to co-lead this financing round to advance the next generation of DNA damage response therapeutics. Artios’ differentiated clinical programmes, alnodesertib and ART6043, together have the potential to meaningfully expand the impact of DDR-targeted therapies. “The rate and durability of responses observed to date for alnodesertib across a range of solid tumors and the early clinical results with ART6043 underscore the strength of Artios’ approach and ability to deliver novel, potentially first-in-class treatments for patients while building significant long-term value.” The post €99 million Series D fuels Artios’ expansion of precision cancer treatment pipeline appeared first on EU-Startups. |

17/11/2025 05:10 PM | 6 | |

| 51,088 | 17/11/2025 02:33 PM | Jeff Bezos reportedly returns to the trenches as co-CEO of new AI startup, Project Prometheus | jeff-bezos-reportedly-returns-to-the-trenches-as-co-ceo-of-new-ai-startup-project-prometheus | 17/11/2025 | 17/11/2025 05:10 PM | 7 | ||

| 51,089 | 17/11/2025 02:03 PM | Luminal raises $5.3 million to build a better GPU code framework | luminal-raises-dollar53-million-to-build-a-better-gpu-code-framework | 17/11/2025 | 17/11/2025 05:10 PM | 7 | ||

| 51,084 | 17/11/2025 02:00 PM | MCP AI agent security startup Runlayer launches with 8 unicorns, $11M from Khosla’s Keith Rabois and Felicis | mcp-ai-agent-security-startup-runlayer-launches-with-8-unicorns-dollar11m-from-khoslas-keith-rabois-and-felicis | 17/11/2025 | 17/11/2025 02:10 PM | 7 | ||

| 51,082 | 17/11/2025 01:30 PM | Artios raises $115M Series D to accelerate first-in-class cancer therapies | artios-raises-dollar115m-series-d-to-accelerate-first-in-class-cancer-therapies | 17/11/2025 | Biotech company Artios today announced the successful close of an oversubscribed $115 million Series D financing. Artios is pioneering next-generation approaches in the DNA damage response (DDR) field through its comprehensive anti-cancer approach and the deep experience of its team of DDR drug developers. Artios’ mission is to develop new classes of medicines that exploit DDR pathways with the aim of improving outcomes for patients with hard-to-treat cancers. The company’s clinical-stage candidates, ATR inhibitor alnodesertib and DNA Polymerase theta (Polθ) inhibitor ART6043, as well as its pre-clinical programs, including DDRi-ADCs, are designed with differentiated pharmaceutical properties and novel biological approaches to precisely eliminate a cancer cell’s remaining survival mechanisms. There are currently no approved therapies specifically for patients whose tumours harbour ATM-deficiency, a population where alnodesertib has demonstrated durable responses across eight different solid tumours. The round was co-led by founding investor SV Health Investors and new investor RA Capital Management, with participation from new investor Janus Henderson Investors and broad support from Artios’ existing investors. Other investors who supported the Series D round include Andera Partners, Avidity Partners, EQT Life Sciences, Invus, IP Group plc, M Ventures, Novartis Venture Fund, Omega Funds, Pfizer Ventures, Piper Heartland, RA Capital Management, Sofinnova Partners, and Schroders Capital. The Series D proceeds will expand the clinical evaluation of Artios’ lead program, alnodesertib, to enroll additional ATM-negative patients in each of second-line pancreatic cancer and third-line colorectal cancer, for which the program was recently granted US FDA Fast Track Designation. The proceeds from the financing will also be used to initiate a Phase 2 randomised clinical trial for Artios’ second potential first-in-class candidate, ART6043, in patients with BRCA-mutant HER2-negative breast cancer who are eligible to receive a PARP inhibitor. “This Series D accelerates our potential path to registration for both alnodesertib and ART6043, broadening development for the next generation of DNA damage response (DDR) therapeutics to indications among the highest of unmet need across pancreatic, colorectal, and breast cancers, where median survival is often measured in months,” said Mike Andriole, Chief Executive Officer of Artios.

Nikola Trbovic, Managing Partner, SV Health Investors, added:

Jake Simson, Partner, RA Capital Management, commented:

Lead image: Freepik |

17/11/2025 02:10 PM | 1 | |

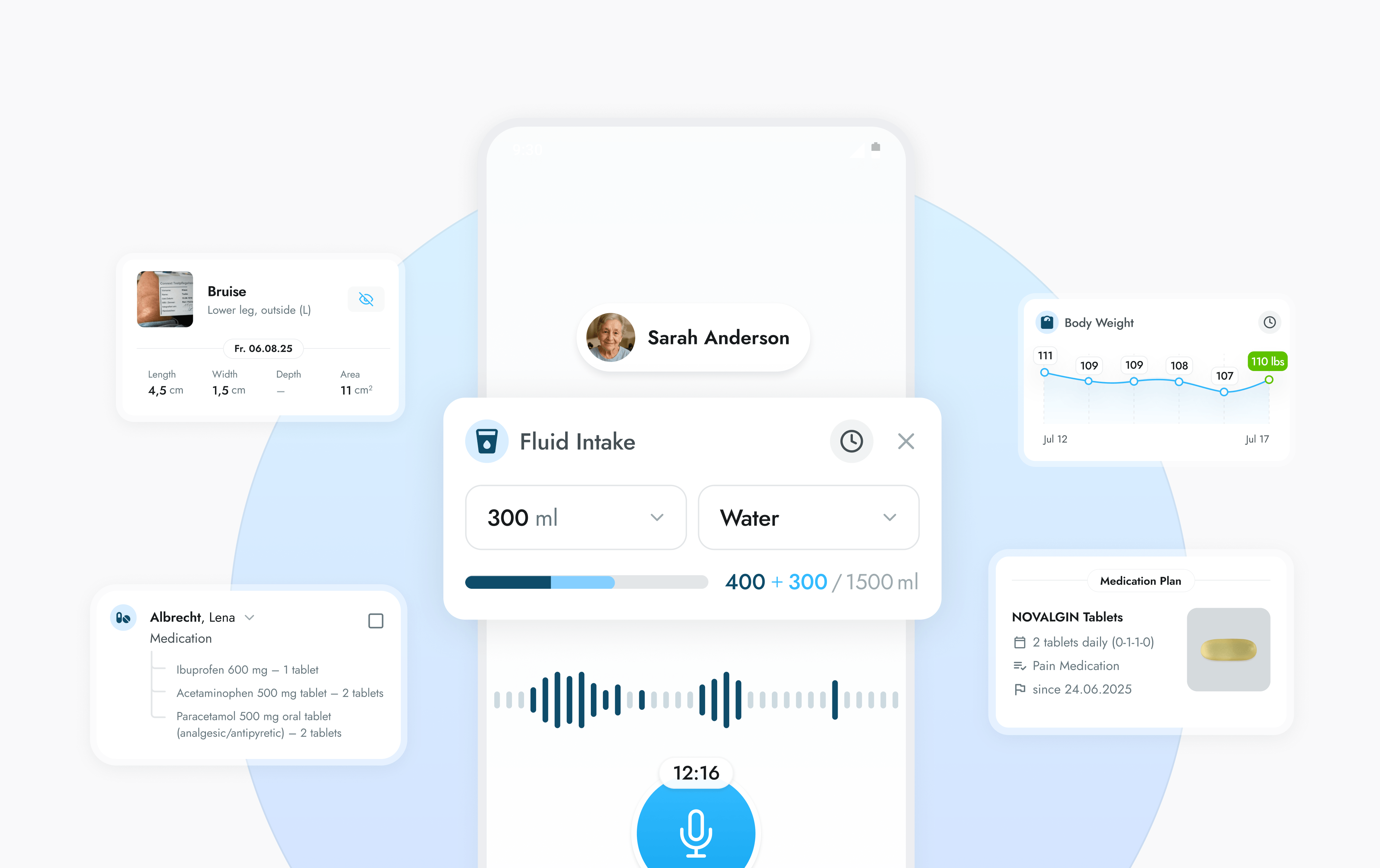

| 51,083 | 17/11/2025 01:18 PM | Berlin’s voize raises €43 million to use their AI companion to give nurses time for what matters most; care | berlins-voize-raises-euro43-million-to-use-their-ai-companion-to-give-nurses-time-for-what-matters-most-care | 17/11/2025 | voize, a company out of Germany building an AI companion for the nursing care sector, has raised €43 million ($50 million) in Series A funding to expand in Europe and enter the US – advancing its mission to eliminate administrative burdens in healthcare. The round was led by Balderton Capital, with participation from existing investors HV Capital, Redalpine and Y Combinator. Fabio Schmidberger, co-founder and CEO of voize, says: “Nurses enter the profession to care for people, and leave it because of all the admin work. For too long, they’ve had little technology designed to truly support them. At voize, we’re building AI that redefines what it means to care, where technology works in the background, and people come first.” In 2025, European investment into digital healthcare tools has been steady, with several companies raising capital in areas adjacent to voize’s focus on reducing administrative burdens in nursing care. Austria’s XUND secured €6 million to expand its AI-powered SaMD platform, while Germany-based aiomics raised €2 million to advance its clinical documentation automation tools. In elder care, Spain’s Qida brought in €37 million to scale its technology-enabled home-care services. Meanwhile, Germany’s Clinomic closed a €23 million Series B to grow its AI-supported ICU assistant solution. With roughly €68 million in sector-adjacent funding this year – and two notable rounds coming from fellow German startups – voize’s €43 million raise sits within a clearly active and well-capitalised European HealthTech landscape. “Seeing this come to life already across care homes and hospitals and hearing how nurses rediscover the joy in their jobs has been incredible. With the backing of Balderton and our brilliant investors, we’re ready to bring this technology to nurses across the world,” adds Schmidberger. Founded in 2020 by twin brothers Fabio Schmidberger (CEO) and Marcel Schmidberger (COO), alongside Erik Ziegler (CTO), voize was inspired by the brothers’ experience when their grandfather entered a nursing home. Seeing firsthand how much time nurses lost to admin sparked a mission to return time to frontline care. Developed hand-in-hand with nurses over tens of thousands of hours in care homes, voize’s AI companion documents and assists nurses. Seamlessly integrated with Electronic Health Records, voize fits into nursing workflows, keeping nurses focused on patients, not paperwork. voize’s proprietary AI models are purpose-built for nursing, developed entirely in-house. They reportedly capture complex medical language, understand regional dialects, and support non-native speakers. voize also runs locally on smart phones with constant internet connection required. Daniel Waterhouse, General Partner at Balderton, shares: “Nurses are the backbone of every healthcare system – yet too often, they’re overwhelmed by administrative tasks that pull them away from patients. voize recognised this disconnect and built a solution born from listening and understanding.” voize is adamant that the global nursing shortage has reached crisis point. The WHO predicts a global deficit of 4.5 million nurses by 2030, as aging populations and rising care demands stretch teams thin. Europe alone is short 1.2 million healthcare workers, whilst the US has an expected deficit of up to 450,000 nurses a year. By multiplying the total estimated hours spent on nonclinical administrative tasks, over 5.5 billion hour annually, voise has calculated that nurses lose 30% of their time to admin work, costing €212 billion ($246 billion) in labour across the US and Europe. The result: burnout, high turnover, and less time for patients – the heart of care. Today, 1,100 care facilities in Germany and Austria, and more than 75,000 nurses save up to 30% of their time each shift thanks to the AI. The company even says certain care homes now feature voize in job ads. “Their AI companion doesn’t replace human care; it restores it, removing friction from documentation and empowering nurses to spend more time where they’re needed most. Care homes are even using it as a recruitment tool, such is the power of what voize has built. This blend of empathy and execution reflects the best kind of innovation. We’re excited to support voize as they scale this mission globally,” adds Waterhouse. The post Berlin’s voize raises €43 million to use their AI companion to give nurses time for what matters most; care appeared first on EU-Startups. |

17/11/2025 02:10 PM | 6 | |

| 51,085 | 17/11/2025 01:00 PM | Bone AI raises $12M to challenge Asia’s defense giants with AI-powered robotics | bone-ai-raises-dollar12m-to-challenge-asias-defense-giants-with-ai-powered-robotics | 17/11/2025 | 17/11/2025 02:10 PM | 7 | ||

| 51,080 | 17/11/2025 12:00 PM | voize lands $50M to bring AI where it’s needed most: the nursing frontline | voize-lands-dollar50m-to-bring-ai-where-its-needed-most-the-nursing-frontline | 17/11/2025 | Nursing care company voize has raised $50 million in Series A funding led by Balderton Capital, with participation from existing investors HV Capital, Redalpine and Y Combinator. The global nursing shortage has reached crisis point. The WHO predicts a global deficit of 4.5 million nurses by 2030 While many companies have built AI scribes for physicians, nurses — the backbone of healthcare — have been left behind. Their workflows are fundamentally different and too often overlooked, leaving them jotting vital notes on scraps of paper mid-shift. voize is changing that. Founded in 2020 by twin brothers Fabio (CEO) and Marcel Schmidberger (COO), alongside Erik Ziegler (CTO), voize was inspired by the brothers’ experience when their grandfather entered a nursing home. Seeing firsthand how much time nurses lost to admin sparked a mission to return time to frontline care. Developed hand-in-hand with nurses over tens of thousands of hours in care homes, voize’s AI companion doesn’t just document, it assists. voize listens as nurses speak during care, understands their notes, and handles admin like documentation and scheduling in real time. Seamlessly integrated with Electronic Health Records, voize fits naturally into nursing workflows, keeping nurses focused on patients, not paperwork.

voize’s proprietary AI models are purpose-built for nursing, developed entirely in-house. They accurately capture complex medical language, understand regional dialects, and support non-native speakers, empowering every nurse to document with confidence. As well, unlike most AI models, voize’s system is so efficient that it runs locally on smartphones, with no constant internet connection required. This ensures high data protection and continuous, reliable care, even when wifi connectivity fails — a first in healthcare AI. Today, 1,100 care facilities in Germany and Austria, and more than 75,000 nurses save up to 30 per cent of their time each shift thanks to the AI. The impact is so profound that care homes now feature voize in job ads — making voize not just a tool, but a reason nurses choose where to work. Fabio Schmidberger, co-founder and CEO of voize, said:

Daniel Waterhouse, General Partner at Balderton, said:

The investment will accelerate voize’s expansion in Europe and entry into the US, and advance its mission to eliminate administrative burden in healthcare, giving nurses more time for what matters most: care. Lead image: voize founders: Erik Ziegler, Fabio Schmidberger, and Marcel Schmidberger. Photo: uncredited. |

17/11/2025 12:10 PM | 1 | |

| 51,081 | 17/11/2025 11:06 AM | French DeepTech Hummink secures €15 million to bring surgical-level precision to microelectronics manufacturing | french-deeptech-hummink-secures-euro15-million-to-bring-surgical-level-precision-to-microelectronics-manufacturing | 17/11/2025 | Paris-based Hummink, a DeepTech startup tackling manufacturing imperfections, has raised €15 million to expand deployment of its High-Precision Capillary Printing (HPCaP) technology, which enables manufacturers to print metals and functional materials with record-level accuracy and repair microscopic defects in real time. The latest funding round, supported by historical investors Elaia Partners, Sensinnovat and Beeyond, was joined by the French Tech Seed fund managed on behalf of the French government by Bpifrance as part of France 2030, Cap Horn and KBC Focus Fund, and backed by the European Innovation Council Fund. “Our mission is to bring precision where it has never been possible before,” said Amin M’Barki, co-founder and CEO of Hummink. “Microelectronics is at the heart of the AI revolution, and every micron matters”. During this year there have been similar and notable funding rounds active in the advanced manufacturing / micro-electronics tooling space – useful in understanding the sector Hummink is operating raising funding in:

Together, these rounds total approximately €50 million. In this context, Hummink’s €15 million funding slots into a growing wave of DeepTech investment in Europe’s advanced manufacturing and hardware-tooling sector. The pattern shows investors backing companies that address critical manufacturing infrastructure – from metrology (Wooptix) to design-for-manufacturing (Encube), to cooling (Corintis) and finishing (Holdson). Hummink’s focus on sub-micron printing and defect repair complements these adjacent plays. It is also noteworthy that none of the four comparators are France-based, meaning the company adds a strong French voice to this landscape. “With HPCaP, we give manufacturers a practical way to improve yields, cut waste, and make advanced technologies more sustainable,” adds Pascal Boncenne, co-founder and COO. As microelectronics underpin the rise of artificial intelligence and high-performance computing, the smallest manufacturing imperfections have become billion-euro problems. Each defect at the sub-micron scale can derail an entire batch of chips or displays. Founded in 2020 as a spin-off from the École Normale Supérieure – PSL and the CNRS, Hummink was created by materials scientist Amin M’Barki and hardware startup operator Pascal Boncenne to tackle this precise issue. With a team across the United States, Taiwan, Japan, and South Korea, Hummink expects to double its workforce by 2026 and double its revenue by year-end. Its technology works like the world’s smallest fountain pen, writing at the nanoscopic level with a controlled flow of material. The process allows manufacturers to build and correct circuitry directly at the sub-micron scale, opening new frontiers for semiconductor packaging, next-generation memory, and advanced displays. The company outlines that traditional lithography remains the workhorse of electronics production, but even the best processes generate flaws that lead to yield losses and material waste. In comparison, the company says their printing tools act as “surgical instruments at the micronic level“, complementing lithography by identifying and correcting those flaws. The result is allegedly higher output, lower scrap rates, and reduced environmental impact across the industry. “Yield improvement is becoming one of the most critical levers in advanced manufacturing,” said Francois Charbonnier, Investment Director at Bpifrance. “Hummink’s combination of precision, speed, and scalability makes it a foundational technology for the next generation of microelectronics.” Hummink’s first integration use case focuses on next-generation OLED displays for smartphones and laptops, where up to 30% of production is discarded each year due to microscopic defects – representing around €16 billion in losses and enough wasted material to cover 6,000 football fields. The company’s technology can correct most of these defects, helping manufacturers recover output that would otherwise be lost. Revenue today comes from sales of Hummink’s NAZCA demonstrator, a first-generation printing machine designed for R&D labs. NAZCA brings Hummink’s high-precision printing technology to research environments, helping democratize access to sub-micron fabrication and repair. The company also produces tailor-made conductive inks. Hummink’s NAZCA systems are already installed in laboratories and research centers across Europe, Asia, and the United States, including Duke University, where researchers recently used the technology to produce the first fully recyclable, sub-micrometer printed electronics. The company is now under qualification with major display manufacturers in Asia whose factories discard large portions of production due to microscopic flaws. Early tests suggest Hummink’s solution could boost yields by around 10%. Nuno Carvalho, Investment Director at KBC Focus Fund commented: “Hummink stands out as an exceptional DeepTech company that bridges academic excellence with industrial relevance. Their HPCaP technology is not only a breakthrough in nanofabrication – it’s a game-changer for defect repair in OLED and semiconductor manufacturing, where sub-5 micron precision is critical and unmet. “We’re proud to support Hummink’s journey from lab to fab, and believe their scalable business model and strong team position them to become a key enabler of next-generation electronics manufacturing.” The latest funding round will accelerate the development of Hummink’s industrial printing module and prepare the technology for full integration inside semiconductor and display fabs. As the complexity of chips and displays continues to climb, the industry’s success will depend on technologies that can operate at the same scale as the challenges they face. Hummink’s vision is to embed its sub-micron printing process directly within manufacturing lines worldwide, transforming how the smallest details in advanced electronics are produced and repaired for years to come. “Breakthroughs like Hummink’s redefine what’s possible in manufacturing,” said Flora Coppolani, Partner at CapHorn. “Their ink-based nanoprinting platform unlocks a new paradigm of control and scalability, bridging the gap between research and industrial scale, a true cornerstone for the next wave of DeepTech innovation.” The post French DeepTech Hummink secures €15 million to bring surgical-level precision to microelectronics manufacturing appeared first on EU-Startups. |

17/11/2025 12:10 PM | 6 | |

| 51,078 | 17/11/2025 11:00 AM | OpenAI's Fidji Simo Plans to Make ChatGPT Way More Useful—and Have You Pay For It | openais-fidji-simo-plans-to-make-chatgpt-way-more-usefuland-have-you-pay-for-it | 17/11/2025 | As OpenAI expands in every direction, the new CEO of Applications is on a mission to make ChatGPT indispensable and lucrative. | 17/11/2025 11:10 AM | 4 | |

| 51,077 | 17/11/2025 10:17 AM | Flatpay anointed as the latest Danish unicorn | flatpay-anointed-as-the-latest-danish-unicorn | 17/11/2025 | Danish fintech Flatpay has become the country’s latest unicorn, after securing $170 million in funding. Flatpay co-founder Rasmus Hellmund Carlsen said Flatpay has become the fastest firm in Denmark to reach unicorn status, reaching the milestone in three years. Flatpay is now valued at $1.7bn following the funding round, it said, with the latest round led by AVP, the European and North American investor and Smash Capital, the backer of consumer internet and software firms. Other investors in the round were existing investors Hedosophia, Seed Capital, and Dawn Capital. The Danish fintech, which provides payment software for SMBs, last raised funds in 2024, when it secured a €45m ($52m) Series B round two years after its founding in 2022. Flatpay offers businesses a point of sale and payment solution. It says its no setup fees for terminals, no subscription fees, flat rate for all card types, alongside its data dashboards, sets it apart from rivals. Flatpay, which says it has more than 60,000 customers and employs more than 1,500 staff, says it is on track to hit $500m in ARR by the end of next year. Carlsen added: “Three years ago, Flatpay was an idea shaped by a clear ambition: build a payments company that puts small businesses first — with simple pricing, great service, and a product experience that removes friction rather than adds it. “Since then, the momentum has been extraordinary. From our early days in Denmark to fast growth in Finland, Germany, Italy, the UK, and France, more than 60,000 merchants now rely on Flatpay every day.” The funds will be used to expand its presence in European markets, as well as to target new markets. |

17/11/2025 11:10 AM | 1 | |

| 51,079 | 17/11/2025 10:08 AM | With over €4 billion in AUM, France’s Sofinnova closes Fund XI at €650 million to double down on MedTech magic | with-over-euro4-billion-in-aum-frances-sofinnova-closes-fund-xi-at-euro650-million-to-double-down-on-medtech-magic | 17/11/2025 | Paris-based VC firm Sofinnova Partners has closed its latest flagship fund, Sofinnova Capital XI, at an impressive €650 million – a haul that surpasses its original target and reinforces its position as a major player in life sciences investment. Backing for the new fund came from a global pool of top-tier institutional investors, including sovereign wealth funds, pharmaceutical giants, insurance firms, foundations, and family offices. Among the contributors is the British Business Bank, which confirmed a €30 million commitment to the fund. This investment is aligned with the UK government’s Life Sciences Sector Plan. Antoine Papiernik, Managing Partner and Chairman of Sofinnova Partners, said: “This fundraising marks a pivotal moment for Sofinnova. It gives us the firepower to double down on early-stage opportunities and reinforces our uniquely collaborative, science-driven investment approach. We’re excited to continue backing visionary entrepreneurs and advancing the next wave of breakthroughs in science and medicine to bring them to patients worldwide.” In 2025, EU-Startups reported several notable life-sciences and health-focused funding rounds across Europe, providing useful context for Sofinnova Partners’ €650 million fund close. France’s Adcytherix secured €105 million to advance its antibody-drug-conjugate cancer therapy into clinical development, while Sweden’s Cellcolabs raised €10.3 million to scale manufacturing of mesenchymal stem cells. In Switzerland, arcoris bio closed a €6.7 million Seed round to develop and commercialise its biomarker detection technology. Altogether, these disclosed rounds amount to roughly €121 million – substantial activity at the startup level, yet still far below the scale of Sofinnova’s newly closed vehicle. With another French company (Adcytherix) featured among the recent rounds, the data also points to a particularly active period for French life-sciences innovation in 2025. Papiernik added: “Achieving this milestone in today’s volatile fundraising environment speaks to the strength of our model and the confidence our investors continue to place in us.” Founded in 1972, Sofinnova Partners has carved out a strong legacy over five decades, with offices in Paris, London, and Milan, and a portfolio that spans more than 500 companies. With over €4 billion in AUM, the firm is recognised for its science-driven investment approach and hands-on company building throughout the life sciences value chain. The fund aims to power early-stage biopharmaceutical and MedTech startups tackling unmet clinical needs across Europe and North America, signalling a continued appetite for scientific innovation in challenging times. Sofinnova Capital XI is already deploying capital into select companies, continuing the firm’s active participation in both initial and follow-on funding rounds. The fund’s focus aligns with its long-standing mission to translate groundbreaking research into impactful therapies and technologies. Mark Andrews, Investment Director, Funds, Life Sciences, British Business Bank, said, “Sofinnova is a key player in life sciences venture. Our commitment to them will create further investment into UK life sciences and help solidify the manager’s connection to the UK. We are pleased to formally welcome Sofinnova to the Bank’s portfolio and look forward to seeing the breakthroughs that come from this fund.” The launch of Sofinnova Capital XI further solidifies Sofinnova’s role as a cornerstone investor in early-stage BioTech and MedTech ventures – just this past year, the total capital raised across Sofinnova’s platform has reached €1.5 billion. With a fund size well above expectations and continued international investor support, the firm is poised to accelerate scientific advances and commercial success for the next generation of healthcare innovators. Christine Hockley, Managing Director and Co-Head of Funds, added: “We are highly active in the UK life sciences sector, investing in innovative companies both through funds and directly. We want all high potential companies to be able to access the capital they need from initial innovation to full expansion and maturity. For that, we need more funds with deeper pools of capital to be investing in the UK and providing funding at the all-important growth stage. Sofinnova Capital XI will do exactly that.” The post With over €4 billion in AUM, France’s Sofinnova closes Fund XI at €650 million to double down on MedTech magic appeared first on EU-Startups. |

17/11/2025 11:10 AM | 6 | |

| 51,076 | 17/11/2025 10:00 AM | Inside a Wild Bitcoin Heist: Five-Star Hotels, Cash-Stuffed Envelopes, and Vanishing Funds | inside-a-wild-bitcoin-heist-five-star-hotels-cash-stuffed-envelopes-and-vanishing-funds | 17/11/2025 | Sophisticated crypto scams are on the rise. But few of them go to the lengths one bitcoin mining executive experienced earlier this year. | 17/11/2025 10:10 AM | 4 | |

| 51,074 | 17/11/2025 09:33 AM | Guidoio raises €3.5M to scale its digital platform for driving licenses | guidoio-raises-euro35m-to-scale-its-digital-platform-for-driving-licenses | 17/11/2025 | Milan-based Guidoio, the first fully digital driving school in Italy, has closed a €3.5 million seed round. The round was led by European venture capital fund 360 Capital, alongside Azimut Libera Impresa SGR S.p.A. Founded in 2023 by Lorenzo Mannari and Giuseppe Cavallaro, Guidoio is developing a fully digital model for obtaining a driving license. The company’s platform is designed for digital-native learners and digitalises the entire process, from enrollment to exams. Guidoio’s service is built around accessibility, transparency, and flexibility. Through the app, candidates can manage each step of the process via smartphone: enrollment, documentation, medical appointment scheduling, practical lessons with certified instructors, and personalised theoretical study supported by AI. Two features are central to the experience:

This model gives candidates greater control over their learning journey while providing support when needed.

explains Lorenzo Mannari, Co-founder and CEO of Guidoio. The new funding will be allocated across three main areas: commercial expansion, product development, and team growth. The company aims to bring its driving school model to more than 30 Italian cities by the end of 2026 and plans to hire new team members in key roles to support this expansion. On the product side, investments will focus on strengthening the e-learning platform to improve preparation for theory and practical exams, developing new digital tools for instructors, and further advancing the AI-based features already integrated into the platform. |

17/11/2025 10:10 AM | 1 | |

| 51,075 | 17/11/2025 09:10 AM | Hummink raises €15M to bring micronic precision printing to advanced manufacturing | hummink-raises-euro15m-to-bring-micronic-precision-printing-to-advanced-manufacturing | 17/11/2025 | Paris-based deeptech Hummink has raised €15 million to expand the deployment of its patented High-Precision Capillary Printing (HPCaP) technology, which enables manufacturers to print metals and functional materials with high accuracy and address microscopic defects in real time. The round was co-led by KBC Focus Fund, Cap Horn, and Bpifrance, with follow-on support from Elaia Partners, Sensinnovat, and Beeyond, and additional participation from the French Tech Seed fund managed by Bpifrance as part of France 2030 and the European Innovation Council Fund. As microelectronics support the growth of artificial intelligence and high-performance computing, small manufacturing defects have become increasingly costly. Imperfections at the sub-micron scale can compromise entire batches of chips or displays. Founded in 2020 as a spin-off from École Normale Supérieure - PSL and CNRS, Paris-based deeptech company Hummink focuses on this challenge. Co-founded by materials scientist Amin M’Barki and hardware startup operator Pascal Boncenne, the company has developed a technology that operates like a miniature fountain pen, depositing material at the nanoscale in a controlled manner. This process enables manufacturers to create and adjust circuitry directly at the sub-micron level, with applications in semiconductor packaging, next-generation memory, and advanced displays. While traditional lithography remains central to electronics manufacturing, it still produces defects that contribute to yield loss and material waste. Hummink’s printing tools are designed to complement lithography by detecting and correcting such defects at the micronic level, with the aim of increasing output, reducing scrap, and lowering environmental impact. Hummink’s initial integration focus is on next-generation OLED displays for smartphones and laptops, where up to 30 per cent of annual production is reportedly discarded due to microscopic defects, equating to an estimated €16 billion in losses and significant material waste. The company’s technology is designed to correct many of these defects, enabling manufacturers to recover output that would otherwise be scrapped.

said Amin M’Barki, Co-founder and CEO of Hummink. Hummink currently generates revenue by selling its NAZCA demonstrator, a first-generation high-precision printing system for R&D labs, along with custom conductive inks. NAZCA is already installed in labs and research centres across Europe, Asia, and the United States, including Duke University, where it was used to create fully recyclable, sub-micrometre printed electronics published in Nature Electronics. The new funding will be used to further develop Hummink’s industrial printing module and prepare its technology for integration into semiconductor and display fabrication lines. |

17/11/2025 10:10 AM | 1 | |

| 51,072 | 17/11/2025 09:00 AM | European tech weekly recap: €736M in deals and October's highlights | european-tech-weekly-recap-euro736m-in-deals-and-octobers-highlights | 17/11/2025 | Last week, we tracked more than 60 tech funding deals worth over €736 million, and over 10 exits, M&A transactions, rumours, and related news stories across Europe. Click to read the rest of the news. |

17/11/2025 09:10 AM | 1 | |

| 51,073 | 17/11/2025 07:50 AM | Funding the AI economy: Strengthening Europe’s investment capacity | funding-the-ai-economy-strengthening-europes-investment-capacity | 17/11/2025 | The new EU report Funding the AI Economy by the StepUp StartUps Consortium explores Europe’s fast expanding AI investment landscape and makes recommendations to strengthen its capital base, corporate engagement and ecosystem connectivity. AI technologies’ substantial capital needs are redefining the global investment landscape. Over the past decade, AI has evolved from a niche technology into a central focus for global investors, accounting for nearly 50% of total global VC funding in the first half of 2025. The EU has made strong progress, with AI’s share of total European venture capital rising to 27%, reflecting a growing recognition of AI’s strategic value and Europe’s strong pool of AI talent. The new report shows that Europe’s AI investment ecosystem still faces major challenges despite progress in recent years. While total venture activity is expanding, the scale, structure, and distribution of AI funding remain fragmented and modest compared to key global competitors. Between 2020 and 2025, the US dedicated 34% of its €1.33 trillion in VC funding to AI, while Europe allocated 18% of €252 billion, underscoring the need to strengthen both its investment base and the share of AI investment within it. The scale challengeWhile EU investors provide the majority of funding for EU AI startups in early investment rounds (under €10 million), their participation falls to 26% in AI deals above €25 million. Most late-stage capital comes from the US and UK. While international funding helps the EU’s AI startups expand, it also raises concerns about Europe’s ability to retain control and value over its most valuable AI assets and ensure that innovation benefits stay in the EU. Corporate investment: an opportunity to be seizedA second challenge lies in the limited AI investments of established European corporates including their Corporate Venture Capital (CVC) funds. European corporates have a 25% share of VC capital invested in the EU but only 15% in AI. This gap between Europe’s industrial base and its AI innovators is an opportunity for European CVC funds to seize. Enhanced investments of European corporates could also accelerate the adoption of AI in industrial core sectors – such as CleanTech, mobility, and advanced manufacturing – where Europe is a global leader. This would also underpin the EU’s Apply AI strategy. A fragmented ecosystemGeographically, over two-thirds of AI venture capital is captured by just ten metropolitan hubs, led by Paris (€8 billion between 2020-2025), Stockholm, and Berlin. AI funding is also reaching emerging ecosystems in Central and Eastern Europe, including Poland, Lithuania, and Romania. Nevertheless, areas outside of capitals and major regional hubs attract less than 1% of EU AI VC investments. A more widespread distribution and connected landscape would help ensure that innovation benefits are shared across regions and that Europe’s diverse pools and different specialisation areas are fully mobilised for AI competitiveness. Key RecommendationsTo boost competitiveness and secure its role in the global AI economy, the report highlights three sets of strategic actions for Europe:

This AI investment focused analysis will be complemented by the next report in the ‘StepUp StartUps’ series, Untapped Opportunities for European Venture Capital: Pension funds and Sovereign Wealth funds, whose publication is expected in mid-November 2025. The post Funding the AI economy: Strengthening Europe’s investment capacity appeared first on EU-Startups. |

17/11/2025 09:10 AM | 6 | |

| 51,071 | 17/11/2025 07:45 AM | Danish startup FlatPay joins the club of European fintech unicorns to track | danish-startup-flatpay-joins-the-club-of-european-fintech-unicorns-to-track | 17/11/2025 | 17/11/2025 08:10 AM | 7 | ||

| 51,070 | 17/11/2025 06:19 AM | Sofinnova Partners secures €650M to back breakthroughs in biopharma and medical technology | sofinnova-partners-secures-euro650m-to-back-breakthroughs-in-biopharma-and-medical-technology | 17/11/2025 | Life sciences venture capital firm Sofinnova Partners today announced the close of its latest flagship fund, Sofinnova Capital XI, at €650 million ($750 million), greatly exceeding its initial target. Based in Paris, London, and Milan, Sofinnova Capital XI will back a new generation of pioneering biopharmaceutical and medical technology companies addressing urgent unmet clinical needs. Sofinnova Capital XI is actively deploying capital, with investments already made in a few portfolio companies, including Latent Labs, BioCorteX, and Amolyt. In keeping with Sofinnova’s multi-strategy platform model, Capital XI draws on the strength of its experienced team, including Partners Maina Bhaman, Anta Gkelou, Karl Naegler, Antoine Papiernik, Henrijette Richter, and Graziano Seghezzi. Sofinnova Capital XI attracted strong support from a global base of blue-chip institutional investors—among them sovereign wealth funds, leading pharmaceutical companies and other corporates, as well as insurance companies, foundations, and family offices. Commitments came from across Europe, North America, Asia, and the Middle East, with a majority of returning LPs and a significant number of new top-tier investors. This reflects enduring confidence in Sofinnova’s disciplined strategy and long-standing track record. Antoine Papiernik, Managing Partner and Chairman of Sofinnova Partners, said:

The fund will continue to support early-stage biotech and medtech ventures across Europe and North America, participating in both initial and follow-on rounds. |

17/11/2025 07:10 AM | 1 | |

| 51,069 | 15/11/2025 10:01 PM | JPMorgan doesn’t want to pay Frank founder Charlie Javice’s legal bills | jpmorgan-doesnt-want-to-pay-frank-founder-charlie-javices-legal-bills | 15/11/2025 | 15/11/2025 10:10 PM | 7 | ||

| 51,068 | 14/11/2025 08:00 PM | Chinese Beverage Chains Spread Across the US, Challenging Starbucks' Dominance | chinese-beverage-chains-spread-across-the-us-challenging-starbucks-dominance | 14/11/2025 | Luckin Coffee, Chagee, and other Chinese brands are targeting US consumers with Instagram-worthy drinks sold through sleek mobile apps. | 14/11/2025 08:10 PM | 4 | |

| 51,067 | 14/11/2025 05:36 PM | Zilch nets $175M, Backed VC closes $100M Fund III, and nd Ukraine’s LIFT99 emerges even stronger after a missile attack | zilch-nets-dollar175m-backed-vc-closes-dollar100m-fund-iii-and-nd-ukraines-lift99-emerges-even-stronger-after-a-missile-attack | 14/11/2025 | This week, we tracked more than 60 tech funding deals worth over €736 million and over 10 exits, M&A transactions, rumours, and related news stories across Europe. In addition to this week's top financials, we've also indexed the most important/industry-related news items you need to know about. If email is more your thing, you can always subscribe to our newsletter and receive a more robust version of this round-up delivered to your inbox. Either way, let's get you up to speed. ? Notable and. big funding rounds

?? Zilch nets $175M as eyes "strategic" M&A ?? FMC raises €100M as it unveils new class of memory chips for the AI era ?? Aily Labs grabs $80 million in one of 2025’s biggest Series B rounds for female-led AI startups ?? Uber competitor Grab invests up to $60M in Vay ???? Noteworthy acquisitions and mergers?? Purple announces merger with Splash Access

? Interesting moves from investors?Backed VC closes $100M Fund III and marks 100th investment milestone ? Oyster Bay closes €100M Fund II for next-gen food startups ? Vendep Capital raises €80M to back the next wave of AI-era SaaS founders ? Ada Ventures unveils Deck Genius to give founders VC-level feedback powered by AI ?️ In other (important) news? Healthtech dominates European VC in a €8.3B October ? Locai Labs launches the UK’s first foundational LLM to rival GPT-5 and Claude ?? Founders and investors slam UK “exit tax" ?? "Exit tax" on founders axed, according to reports ?? Lithuania’s Sentante achieves transatlantic first in remote robotic stroke intervention ?? Finland’s first EV virtual power plant goes live ? Recommended reads and listens

?? Missiles hit Kyiv startup hub LIFT99 — it only made Ukraine's tech community more determined ?? Japan’s €33B bet on Europe: deeptech & AI lead as cross-border investment surges ? Epidemic Sound launches Studio, an AI tool that auto-soundtracks creator videos in seconds ?? Europe’s biggest landlords team up to build a proptech scaling machine ? European tech startups to watch?? Edtech company Nuela closes a €620,000 investment round ?? Spiich Labs gets €600,000 backing from Tandem Health and Creandum founders ?? Enteral Access Technologies secures £500,000 to scale DoubleCHEK ?? Quantum receives €161,000 to build scalable next-gen quantum hardware ?? Journalist to founder: Monty Munford’s HomeTruth emerges from stealth to solve a £60B problem |

14/11/2025 06:10 PM | 1 | |

| 51,065 | 14/11/2025 05:00 PM | Inside the Multimillion-Dollar Plan to Make Mobile Voting Happen | inside-the-multimillion-dollar-plan-to-make-mobile-voting-happen | 14/11/2025 | Political consultant Bradley Tusk has spent a fortune on mobile voting efforts. Now, he’s launching a protocol to try to mainstream the technology. | 14/11/2025 05:10 PM | 4 | |

| 51,064 | 14/11/2025 04:48 PM | Denmark doubles down on startup ambitions with €800k to TechBBQ | denmark-doubles-down-on-startup-ambitions-with-euro800k-to-techbbq | 14/11/2025 | TechBBQ has just received a 6 million Danish kroner (approx €800,000) grant from the Danish Board of Business Development. It follows an earlier grant in May this year and is part of a larger investment round (122 million DKK) from the Danish Board for Business Development. Denmark is increasingly backing the startup ecosystem, investing in initiatives, accelerators, hubs, and programs that reflect its commitment to fostering entrepreneurship. The TechBBQ Summit serves as a central meeting place for the entire startup community, offering matchmaking with investors, talent, speakers, media, and knowledge sharing among startups, corporates, and research institutions. The grant will ensure that TechBBQ can continue to host its annual international startup and entrepreneurship summit at the end of August, as well as year-round activities that provide access to networks, capital, knowledge, and new markets for startups and scaleups across Denmark. “We are incredibly grateful for the support and trust from the Danish Board of Business Development and Beyond Beta,” says Benjamin Rej Notlev, CIO & CCO at TechBBQ.

At TechBBQ 2025, around 10,000 participants took part, including 3,500 startups and scaleups and 1,700 investors. The summit also featured over 350 speakers, 160 members of the press, and numerous partners and community contributors. The new grant will enable the summit to further develop into an even stronger pan-European meeting place, with more curated exhibition areas, themed stages, and international exposure for the most forward-thinking tech companies. “TechBBQ’s mission is to join efforts for entrepreneurship. Our overarching goal with the annual summit is to show the world that the Nordics are creating unique companies worth watching. At the same time, we’re helping position Copenhagen as a European capital where innovation and new jobs are thriving,” adds Benjamin Rej Notlev. TechBBQ 2026 will take place at Bella Center Copenhagen, August 26–27, 2026. |

14/11/2025 05:10 PM | 1 |