spektr combines automation, continuous compliance monitoring, and case management within a single system designed to keep organisations structured and audit-ready beyond initial onboarding. Built by the founders of HelloFlow, a no-code onboarding platform acquired by Trulioo in 2022, the company addresses the broader operational challenges of ongoing compliance. Since its foundation in 2023 spektr has raised around €5 million in funding to develop its platform and expand adoption among companies managing complex regulatory requirements.

Switch Dataset:

Startup News

We are collecting the most relevant tech news and provide you with a handy archive. Use the search to find mentions of your city, accelerator or favorite startup in the last 1,000 news items. If you’d like to do a more thorough search, please contact us for help.

Search for any keyword to filter the database with >10,000 news articles

Filter

Filter search

Results

| id | date | title | slug | Date | link | content | created_at | feed_id |

|---|---|---|---|---|---|---|---|---|

| 52,362 | 05/02/2026 09:33 PM | Loyalty Is Dead in Silicon Valley | loyalty-is-dead-in-silicon-valley | 05/02/2026 | Founders used to be wedded to their companies. Now, anyone can be lured away for the right price. | 05/02/2026 10:10 PM | 4 | |

| 52,363 | 05/02/2026 09:28 PM | a16z VC wants founders to stop stressing over insane ARR numbers | a16z-vc-wants-founders-to-stop-stressing-over-insane-arr-numbers | 05/02/2026 | 06/02/2026 12:10 AM | 7 | ||

| 52,361 | 05/02/2026 06:26 PM | The Rise and Fall of the World's Largest Gay Dating App | the-rise-and-fall-of-the-worlds-largest-gay-dating-app | 05/02/2026 | The new book The Wall Dancers explores the uneasy relationship between Chinese internet users and a government that is always watching. | 05/02/2026 07:10 PM | 4 | |

| 52,360 | 05/02/2026 04:10 PM | Last chance to apply for this year’s EU-Startups Pitch Competition! | last-chance-to-apply-for-this-years-eu-startups-pitch-competition | 05/02/2026 | With applications closing on 8 February, early-stage founders now have their final opportunity to secure a spot in one of Europe’s most competitive startup pitch competitions. As previously announced, this competition now features a prize package exceeding €1 million, making this year’s edition the most attractive to date! Taking place on 7 and 8 May in Malta, the competition will bring fifteen selected startups onto the main stage of the EU-Startups Summit, where they will pitch live in front of an experienced jury and a large audience of investors, corporates, media, and fellow founders. With more than 1,600 applications expected, competition for the finalist spots is stronger than ever.

What is at stake:The winning startup will benefit from, among other things:

A high-calibre investor juryThe 2026 EU-Startups Summit Pitch Competition jury includes experienced investors. Below, we list the three jury members, but of course, many more investors will be in the audience during the pitch competition finals.

Who can apply and how it works

Fifteen finalists will be selected to pitch live on the main stage in Malta, in front of an experienced investor jury and a large audience of founders, investors, corporates, and media. You can apply via this link… After that, we will carefully sift through all of the applications and hand-pick the finalists who will join us on the main stage at this year’s EU-Startups Summit on May 7-8 in Malta, where they will pitch for 3 minutes in front of our jury and a huge audience of investors, media, and startup enthusiasts. Applications close on 8 February, so make sure to apply in time! OUR EVENT SPONSORS

Malta Enterprise is Malta’s economic development agency, facilitating economic growth, investment, and innovation by offering a range of support services for local and foreign enterprises setting up a productive presence in Malta. As a key player in Malta’s economic landscape, it contributes to the nation’s prosperity by attracting investments, supporting businesses, and driving innovation, thereby reinforcing Malta’s position as an attractive destination for entrepreneurs and investors alike. Malta Enterprise actively cultivates a vibrant startup ecosystem, playing a pivotal role in fostering a conducive environment for startups and offering tailored support and incentives to empower emerging businesses.

M. Demajo Group is a leading business player in Malta, with a successful history spanning 115 years. The Group’s growth and diversification have resulted in a wide coverage of business sectors through a commitment to long-term results. M. Demajo Group’s workforce is 500 strong, and their various activities have been developed through organic growth, acquisitions, partnerships, and startups. Its strong financial situation and ethical standards, its business reputation, and its renowned track record as a business partner are all key factors in its continued expansion. The IONOS Cloud Start-up Program provides young companies with up to €100,000 in cloud credits for up to five years after their founding. Start-ups benefit from a sovereign IT infrastructure “Made in Germany,” offering 100% GDPR compliance and full legal certainty. IONOS Cloud guarantees technological freedom without vendor lock-in. Long-term support is also ensured: exclusive discounts after the first year enable a seamless transition into the IONOS Cloud ISV Partner Program. In this way, digital sovereignty becomes a strategic competitive advantage from founding to scaling. The post Last chance to apply for this year’s EU-Startups Pitch Competition! appeared first on EU-Startups. |

05/02/2026 05:10 PM | 6 | |

| 52,358 | 05/02/2026 03:45 PM | As new Swiss and EU energy regulations take shape, enshift raises €18.5 million to scale integrated energy-transition solutions | as-new-swiss-and-eu-energy-regulations-take-shape-enshift-raises-euro185-million-to-scale-integrated-energy-transition-solutions | 05/02/2026 | Zug-based CleanTech company enshift has successfully raised €18.5 million (CHF 17 million) in a Series A funding, positioning it as Switzerland’s fastest-growing solar financing partner and one of the most active private operators of renewable-energy solutions. The round was led by Swiss Solar Group – bringing total funding to €25.5 million (CHF 23.5 million). “2025 was a breakthrough year for enshift,” says Pierre Bi, CEO and founder. “With our Series A funding we’ve laid the foundation to accelerate our mission: decarbonising large real estate portfolios – efficiently, economically, and with leading-edge technology. Our model proves that the energy transition is not only environmentally necessary, but also financially compelling.” In the 2025–2026 funding landscape, enshift’s Series A can be contextualised against a broader flow of capital into European clean-energy deployment and financing models. In France, Spark Cleantech raised €30 million in a Series A round to scale low-carbon energy solutions for heavy industry, while fellow French company ECAIR secured €11 million to expand financing products for solar installations and home renovations. At the infrastructure end of the market, Estonian clean-energy provider Sunly closed close to €85 million to develop four large solar parks in Latvia. On the residential side, Sweden’s Elvy announced €500 million in debt financing to roll out subscription-based solar, heat-pump and battery systems for households. Taken together, these rounds represent more than €630 million flowing into clean-energy production, financing and deployment models across Europe during 2025–2026, providing a backdrop for enshift’s latest raise. “In 2026, we will continue to scale our business model and establish enshift as one of Europe’s leading providers of integrated energy-transition solutions,” says Pierre Bi. “We are investing in software, in new markets, and in strategic partnerships—laying the groundwork for our next chapter of growth.” Founded in 2022, enshift delivers fully integrated energy-transition solutions for commercial, industrial, and residential real estate across Europe. The company covers analysis, simulation, financing, installation, and operations – all from a single source – and finances installed technologies over their full lifecycle. enshift employs around 50 people from more than 15 countries and works closely with ETH Zurich and EMPA. With growth exceeding 300% and the successful delivery of projects totalling €65 million (CHF 60 million) in financing, enshift’s business model has allowed them to capitalise on burgeoning demand in the European building sector for clean energy solutions, particularly in heating, solar, and storage. This demand has been driven by a combination of new requirements to reduce CO₂ emissions, geopolitical developments, and the trend toward localised supply chains. To meet growing operational expansion in 2025, enshift significantly increased the size of its team, from 30 to 50 employees. This includes specialists in energy trading, software development, CleanTech engineering, and sustainable construction. The company also enhanced its proprietary energy-management and energy-trading platform, boosting both project efficiency and scalability. Looking ahead to 2026, enshift plans further expansion across Europe and the rollout of additional digital platform features. Heating solutions, battery storage, and charging infrastructure will be further integrated into the existing system architecture. The company also expects additional growth through new commercialisation opportunities driven by ongoing regulatory developments – such as the introduction of the Local Electricity Communities (LEG) regulation in Switzerland at the start of 2026 and similar frameworks in other countries. The post As new Swiss and EU energy regulations take shape, enshift raises €18.5 million to scale integrated energy-transition solutions appeared first on EU-Startups. |

05/02/2026 04:10 PM | 6 | |

| 52,357 | 05/02/2026 03:00 PM | Fundamental raises $255 million Series A with a new take on big data analysis | fundamental-raises-dollar255-million-series-a-with-a-new-take-on-big-data-analysis | 05/02/2026 | 05/02/2026 03:10 PM | 7 | ||

| 52,359 | 05/02/2026 02:42 PM | Dutch FinTech startup Duna raises €30 million to expand compliant AI for business identity and onboarding | dutch-fintech-startup-duna-raises-euro30-million-to-expand-compliant-ai-for-business-identity-and-onboarding | 05/02/2026 | Amsterdam-based Duna, an identity FinTech founded by two Stripe alumni, today announced a €30 Million Series A funding round to build global trust infrastructure by providing a digital passport for every business. The round was led by CapitalG, Alphabet’s independent growth fund. Existing investors Index Ventures, Puzzle Ventures and Snowflake Chairman Frank Slootman also participated in the round. This latest fundraise brings Duna’s total funding to more than €40 million. “Duna is addressing one of the internet’s biggest unsolved problems: identity,” says Duna founder Duco van Lanschot. “Compliance and identity now consume up to 10-20% of a bank’s total costs. The expensive and manual legacy systems lead to billions lost in fraud, friction, and fines, as well as lost income from refusals of legitimate customers. This makes it an ideal use case for AI automation.” Across 2025–2026, EU-Startups has reported a steady flow of funding into the European digital identity and identity-adjacent FinTech sector, spanning biometric authentication, regulated identity verification and payment-linked identity services. In the UK, OneID raised €19.1 million to scale its bank-verified digital identity offering, while London-based Yaspa secured just over €10 million to expand payment and identity services for regulated sectors such as online gambling. Earlier-stage rounds include Amsterdam-based Ver.iD, which raised €2 million to grow its digital identity verification SaaS in line with new EU regulation, and London-based Keyless, which announced a €1.9 million round focused on privacy-preserving biometric authentication. In adjacent applications, Latvian startup Handwave raised €3.6 million to develop palm-based biometric payments and identity technology. Collectively, these rounds represent roughly €36–37 million invested into the sector over the period, excluding Duna itself. Against this backdrop, Duna’s €30 million Series A – following its €10.7 million Seed round reported by EU-Startups in 2025 – stands out as one of the larger single raises in the European identity space, and notably one of the few focused specifically on AI-native business identity infrastructure. The presence of another Amsterdam-based identity company, Ver.iD, underlines the Netherlands’ emerging role in this segment. “The need for a secure business identity has never been more urgent: AI has many benefits, but it also enables an acceleration in the velocity and sophistication of fraud. Duna will help companies root out this fraud,” adds Duna founder David Schreiber. “We are turning a decades-old compliance cost center into a core revenue driver.” The company was launched in 2023 by Duco Van Lanschot, who was head of Benelux and DACH at Stripe for three years, and David Schreiber, who spent six years at Stripe where he ran the company’s largest global business unit, including the core card payment platform. Duna’s mission is to build global trust infrastructure by providing a digital passport for every business. Over time, this will evolve into a network for shareable identity and one-click onboarding. Today Duna’s AI-native business identity platform serves large banks, FinTechs, platforms and financial institutions. Customers include large enterprises such as Plaid, CCV (Fiserv), Moss, Bol and SVEA bank, with companies allegedly reporting 10.6x faster onboarding and 4.8x productivity gains. “Duna is building the internet’s missing ‘one click’ identity network. Most new business relationships start with a painful, manual, and time-consuming exchange of documents which amount to a massive hidden tax on the B2B economy,” said Alex Nichols, CapitalG General Partner and longtime investor in fintech leader Stripe. “Duco and David are the perfect founders to solve business identity for the internet. As former leaders at Stripe, they possess not only deep founder-market fit but also the leadership skills to build a high-ownership, talent-dense culture to achieve such an ambitious vision.” Over time, Duna’s aim is for their digital passport to evolve into a network for shareable identity and one-click onboarding. “We have seen strong traction with leading enterprise customers,” continues Duco. “The funding will be used to further expand our enterprise capabilities with compliant, auditable AI, while maintaining the high regulatory standards required by banks and large enterprises.” The post Dutch FinTech startup Duna raises €30 million to expand compliant AI for business identity and onboarding appeared first on EU-Startups. |

05/02/2026 04:10 PM | 6 | |

| 52,354 | 05/02/2026 02:08 PM | Bound secures $24.5M Series A to expand FX hedging tools | bound-secures-dollar245m-series-a-to-expand-fx-hedging-tools | 05/02/2026 | London-based Bound, an automated FX risk management platform, has closed a $24.5 million Series A funding round led by AlbionVC, with participation from Notion Capital and GoHub Ventures, alongside continued support from existing investors. The funding comes amid heightened geopolitical instability, trade uncertainty, and policy-driven volatility in global currency markets, which have increased the financial risks faced by internationally operating businesses. Sudden exchange-rate movements can materially affect revenues, margins, and cash flow, while many legacy FX systems and traditional brokerages struggle to respond effectively to these rapid shifts. For UK and European companies, a single political announcement or policy change can significantly alter costs or reduce the real value of sales, potentially turning profitable contracts into loss-making ones. Businesses with global exposure, including fashion companies with international supply chains, venture capital firms investing across regions, and production companies operating in multiple locations, are particularly exposed to these currency risks. Founded in 2021 by Seth Phillips (CEO) and Dan Kindler (CTO), Bound provides automated FX hedging solutions designed to help businesses manage currency risk. Its platform enables finance teams to implement best-practice hedging strategies that operate continuously in the background, reducing exposure to market volatility without the need for manual intervention or specialist trading expertise. Seth Phillips, co-founder and CEO of Bound, said the global environment remains highly unstable, with elevated currency volatility increasingly affecting businesses. He noted that even well-performing companies can see margins impacted by sudden exchange-rate swings triggered by minor events.

Phillips said. Bound will use the new funding to pursue regulatory authorisation in the European Union as it expands its European presence, building on nearly $2 billion in trading volume in 2025. The capital will also support continued product development, including further innovation of its perpetual FX hedging solutions. |

05/02/2026 02:10 PM | 1 | |

| 52,356 | 05/02/2026 01:30 PM | From Copenhagen and beyond: 10 of the most promising Danish startups to watch in 2026 | from-copenhagen-and-beyond-10-of-the-most-promising-danish-startups-to-watch-in-2026 | 05/02/2026 | Denmark is widely recognised for its high quality of life, shaped by strong public infrastructure, sustainability-driven urban planning, and a culture that prioritises long-term thinking. From bike-friendly cities and clean coastlines to digitally advanced public services, these foundations create an environment that supports both talent attraction and entrepreneurial ambition. This mindset is also reflected in Denmark’s startup ecosystem. Over the past decade, the country has developed a well-connected and resilient environment for founders, supported by strong digital infrastructure, access to skilled talent, and close collaboration between startups, corporates, universities, and public institutions. Copenhagen remains the centre of gravity for much of this activity, with growing strength across sectors such as AI, SaaS, ClimateTech, FinTech, and DeepTech. In this article, we highlight 10 promising Danish startups founded from 2022 onwards that are contributing to the next wave of innovation in the country. Presented in no particular order, the selection focuses on young companies that have already demonstrated early momentum through product development, funding activity, and initial market traction as Denmark’s tech ecosystem continues to evolve toward 2026.

Founded in 2024 and based in Copenhagen, Alice Tech is an EdTech startup developing an AI-powered study platform designed to help students turn their own course materials into personalised learning and exam preparation resources. Users can upload notes, textbooks, or slides, which the platform then processes to generate structured summaries, topic overviews, flashcards, tailored exercises such as multiple-choice questions, full exam simulations, and an AI chat that responds specifically based on the uploaded content rather than generic knowledge. The platform also tracks progress in real time, identifies knowledge gaps, and includes social learning features that allow students to study collaboratively or competitively. Alice Tech has raised €4.2 million in seed funding, which it is using to further develop its adaptive learning tools and expand adoption among students seeking more personalised and data-driven digital education solutions.

Founded in 2024 and headquartered in Herlev, in Denmark’s Hovedstaden region, Blackbird Coffee develops automated beverage systems designed for workplace consumption. The company offers an all-inclusive coffee service for offices, combining professional coffee machines, continuous coffee supply, and ongoing service and maintenance within a single contract. The business operates on a fixed monthly price-per-cup model, aiming to provide cost transparency and reduce complexity for companies managing office services. Blackbird Coffee has landed €4 million in funding, which is supporting the expansion of its subscription-based coffee service and further development of its automated workplace offering.

Founded in 2024 and based in Copenhagen, Complir is an AI-driven startup developing a platform to simplify product compliance for brands operating under EU regulations. The company focuses on challenges such as fragmented product data, inconsistent reporting standards, and increasing regulatory complexity, which often force compliance teams to rely on manual processes and external consultants. The platform is designed to reduce time to market while helping teams improve oversight of supplier performance, product quality, and long-term risk management. Complir has raised €1.7 million in funding and is already working with major Nordic retailers as it continues to expand its automated approach to product compliance management.

Founded in 2023 and based in Copenhagen, deepdots is an AI-powered startup developing a platform for analysing customer feedback at scale. The company consolidates user reviews and feedback from multiple channels into a single system, helping businesses break down data silos and gain a more structured view of customer sentiment. Using proprietary AI, the platform identifies patterns in qualitative feedback and connects insights to metrics such as NPS, CSAT, and revenue. Its tools include AI-driven surveys that interpret responses in real time and adapt follow-up questions, alongside reporting features designed to surface cause-and-effect relationships and generate actionable recommendations. deepdots has secured €6.7 million to support further product development and market expansion.

Founded in 2023 and based in Odense, Dropla Tech is a deep-tech startup developing AI-powered drones and robotic systems for detecting unexploded ordnance (UXO) and supporting land clearance operations. The company focuses on autonomous drone technology that combines multiple sensing and data analysis capabilities to identify explosive hazards below ground. Its drone systems integrate multispectral sensors, machine learning models that fuse data from different sources, and high-resolution 3D mapping to generate georeferenced risk maps highlighting hazardous and safe areas. Designed to significantly speed up land surveys compared to traditional methods, the technology is developed in close collaboration with de-mining organisations to address real operational needs. Dropla Tech has raised €2.4 million to further develop its platform and support deployment in affected regions.

Founded in 2025 and based in Copenhagen, Fortiv is a startup developing an AI-native platform focused on business continuity and operational resilience. The company aims to reduce the manual workload typically associated with resilience planning and compliance by automating key processes within Business Continuity Management systems. The platform uses AI agents to interpret regulatory requirements and guide organisations through the implementation of compliant continuity frameworks more efficiently. Fortiv has secured around €3 million in funding, which it is using to further develop its product and support organisations seeking more automated and structured approaches to managing operational risk and regulatory complexity.

Founded in 2025 and based in Frederiksberg, Grand PMS is a hospitality tech startup developing an AI-powered, all-in-one property management system for hotels and venues. The platform combines core hotel operations with event and group booking management, sales tools, and CRM functionality within a single system designed to remain straightforward to use. Grand PMS integrates booking and calendar management, sales and catering workflows, and AI-assisted proposal creation with automated follow-ups and legally binding signatures. It also includes a dedicated guest portal for group bookings, a booking engine for selling meeting rooms and packages directly via venues’ websites, and an operations app supporting housekeeping, internal communication, and task management. The startup has raised €1.5 million to support ongoing product development.

Founded in 2024 and based in Copenhagen, Kiku is an HR tech startup developing an AI-driven hiring platform focused on high-volume frontline recruitment. The platform automates tasks such as candidate outreach, screening, interview scheduling, and initial assessments, helping organisations handle large applicant volumes in a more structured and consistent way. Kiku’s AI agents operate around the clock and support hiring in more than 100 languages, enabling companies to engage candidates across different regions and time zones. Positioned as a support tool rather than a replacement for recruiters, the platform is designed to free up time for human judgment and final decision-making. Kiku has secured €4.4 million in funding to further develop its technology and scale its approach to frontline recruitment automation.

Founded in 2024 and based in Copenhagen, Parahelp is a startup developing an AI-powered support agent for software companies, designed to handle customer support tickets end-to-end. The platform is built to manage not only routine requests but also more complex cases, such as refunds, operating continuously alongside human support teams. Parahelp integrates directly with existing tools, including Zendesk, Intercom, Front, Stripe, Slack, and Linear. Its setup process is designed to require minimal technical effort, using an internal AI agent to configure workflows, procedures, and communication style. To date, Parahelp has raised around €19 million, supporting further development of its AI-driven approach to automating full customer support workflows within software organisations.

By the way: If you’re a corporate or investor looking for exciting startups in a specific market for a potential investment or acquisition, check out our Startup Sourcing Service! The post From Copenhagen and beyond: 10 of the most promising Danish startups to watch in 2026 appeared first on EU-Startups. |

05/02/2026 03:10 PM | 6 | |

| 52,355 | 05/02/2026 12:47 PM | London-based risk management platform Bound secures €20.7 million to support EU regulatory approval and growth | london-based-risk-management-platform-bound-secures-euro207-million-to-support-eu-regulatory-approval-and-growth | 05/02/2026 | Bound, an automated British FX risk management platform helping businesses protect themselves from currency volatility, today announced a €20.7 million ($24.5 million) Series A funding to pursue regulatory authorisation in the EU, building on the nearly €1.6 billion ($2 billion) it traded in 2025. The round was led by AlbionVC, with participation from Notion Capital and GoHub Ventures, and continued support from existing investors. Seth Phillips, co-founder and CEO of Bound, says, “The world is in a genuinely volatile state, and we don’t believe we’re heading back into a period of stability anytime soon. Exchange rate volatility has never been higher, and most businesses feel that whether they realise it or not. One of the most immediate ways that instability shows up is through currency markets. You can be running a healthy UK business with U.S. customers, and overnight, a social media post can cause currencies to fluctuate and significantly impact your business’s margins.” Recent activity throughout 2025 and 2026 shows continued investment into European FinTech platforms focused on risk management, compliance, analytics and financial infrastructure, providing context for Bound’s Series A. In 2026, Stockholm-based Bits raised €12 million to deepen automation across FinTech compliance and AML workflows. In 2025, Geneva-based Allasso secured €2.5 million to develop AI-ready analytics for options trading and broader risk analysis, while Amsterdam’s Factris obtained a €100 million funding facility to scale its SME financing platform across Europe. Also in 2025, Dublin-based Teybridge Capital Europe secured a €50 million funding line to expand working capital solutions, and London-headquartered Coremont raised €34 million to accelerate its institutional analytics and risk management platform. Together, these rounds represent roughly €198 million in disclosed funding moving into adjacent European FinTech and risk-focused infrastructure over the past two years. “We believe all businesses can be protected against this risk. Managing FX well has traditionally been complicated, time-consuming, and intimidating. Our goal is simple: make it easy. Businesses should be able to protect themselves from currency risk without becoming FX experts, and we’ll be using this round to expand our mission across Europe,” adds Seth. Founded in 2021 by CEO Seth Phillips and CTO Dan Kindler, Bound looks to help businesses protect themselves from unwanted currency risk through automated FX hedging. The platform allows finance teams to set up hedging strategies that run continuously in the background, automatically managing exposure to market volatility without the need for manual intervention or specialist trading expertise. Built for modern, internationally operating companies, Bound reportedly makes professional-grade FX hedging fast, transparent, and accessible – without the complexity, opacity, or manual effort traditionally associated with banks and brokers. By enabling businesses to design and run simple, best-practice hedging strategies in the background, Bound helps protect revenues, margins, and cash flow in an increasingly volatile global economy. Itxaso del Palacio, General Partner at Notion Capital, says, “We backed Bound early on in their journey, recognising that the only consistency in exchange rates has been their inconsistency. Gone are the days of steady currency valuations. Seth and Dan were among the first founders to build for this new reality, and since our initial investment, Bound has evolved rapidly by embracing AI at its core. “Today, Bound is becoming the right hand of CFOs, advising them on all aspects of FX decision-making. We’ve had such confidence in Bound that we’ve backed them since shortly after the Seed round and are excited to continue investing in their business. We’re looking forward to their further success as they expand into Europe and beyond.” The funding comes as geopolitical instability, trade uncertainty, and political decision-making have increasingly triggered sudden and material swings in global currency markets, directly impacting the revenues, margins, and cash flow of international businesses. Many legacy FX systems and traditional brokerages are unable to keep up in this new environment. For many UK and European companies, a single political announcement or policy shift can significantly increase overheads or reduce the real value of sales. A sudden move in exchange rates can turn profitable contracts into loss-making ones, without any change in customer demand or operational performance. Fashion companies with large global purchasing footprints, venture capitalists investing across regions, or production companies with global location requirements could all be severely impacted. Jay Wilson, Partner at AlbionVC explains: “Currency volatility has become a structural challenge for modern businesses, not a short-term anomaly. What impressed us about Bound is its clear understanding that FX risk management shouldn’t be reserved for multinational corporates with specialist treasury teams. FX risk management is an industry reliant on many legacy systems and is therefore ripe for disruption. “Bound is building essential financial infrastructure that allows growing businesses to protect margins, plan with confidence, and operate internationally in an increasingly unstable world. We’re excited to support Seth and the team as they scale this capability to a much broader market.” The post London-based risk management platform Bound secures €20.7 million to support EU regulatory approval and growth appeared first on EU-Startups. |

05/02/2026 02:10 PM | 6 | |

| 52,352 | 05/02/2026 11:55 AM | UK legaltech Lawhive raises $60M as looks to crack US | uk-legaltech-lawhive-raises-dollar60m-as-looks-to-crack-us | 05/02/2026 | A UK-founded legaltech startup looking to democratise legal services for consumers has raised $60 million in funding, with the funds geared towards speeding up its US expansion. The Series B funding round in Lawhive was led by Mitch Rales, co-founder of conglomerate Danaher Corporation, with participation from TQ Ventures, Google’s investment arm GV, Balderton Capital and Jigsaw. The investment comes within a year of Lawhive's $40 million Series A funding round. Lawhive is targeting the consumer legal market, resolving everyday issues such as family law, landlord/tenant disputes and employment law, which it says are slow and cumbersome to resolve. Lawhive has developed its own AI operating system, which is used by lawyers, which it says reduces the time, cost and administrative burden associated with these everyday legal matters. Startups competing in this area include the likes of Robin AI, Legora and Harvey, though they have differing business models. After initially launching in the UK, Lawhive launched in the US last year and now operates in 35 US states, with an office in Austin and one soon to open in New York. Pierre Proner, CEO and co-founder of Lawhive, said: "Everyday legal matters remain costly and unpredictable for millions of people, while lawyers are held back by manual processes that limit their efficiency and scale of their legal practices. "AI is finally making it possible to achieve a breakthrough in delivering consumer legal services with the speed and consistency people expect. "The reaction from lawyers and clients in the US has been exceptionally strong and this funding allows us to build on US momentum and scale our model.” |

05/02/2026 12:10 PM | 1 | |

| 52,353 | 05/02/2026 11:31 AM | UK LegalTech startup Lawhive secures €50 million to scale AI-driven consumer law firm model | uk-legaltech-startup-lawhive-secures-euro50-million-to-scale-ai-driven-consumer-law-firm-model | 05/02/2026 | Lawhive, a London-based LegalTech company transforming how consumer legal services are delivered, has raised €50 million ($60 million) in Series B funding to accelerate its expansion across the US and scale its model of building an AI-native consumer law firm. The round was led by Mitch Rales, co-founder of Danaher Corporation, with participation from TQ Ventures, GV (Google Ventures), Balderton Capital, Jigsaw, Anton Levy and LTS. The investment comes within a year of Lawhive’s €37.9 million Series A. Annual revenue now exceeds €29 million ($35 million), having grown sevenfold in the past year. Pierre Proner, CEO and co-founder of Lawhive, says: “The pace of growth over the past year reflects the scale of the problem we are tackling. Everyday legal matters remain costly and unpredictable for millions of people, while lawyers are held back by manual processes that limit their efficiency and scale of their legal practices. “AI is finally making it possible to achieve a breakthrough in delivering consumer legal services with the speed and consistency people expect. The reaction from lawyers and clients in the US has been exceptionally strong, and this funding allows us to build on US momentum and scale our model.” Activity across 2025 and early 2026 shows sustained investor interest in AI-driven LegalTech, spanning both enterprise legal workflows and consumer-facing services. Large growth rounds include Legora, which raised €70.6 million in Sweden to scale its collaborative AI platform for law firms and legal teams, and Orbital, which secured €50 million in London to expand AI-powered real-estate law workflows. Mid-stage activity includes Italy-based Lexroom, which raised €16 million to grow its generative-AI legal services offering. At the earlier end of the spectrum, funding rounds highlight a widening range of legal AI applications: Denmark’s Pandektes raised €2.9 million to automate legal research and legislative navigation; London-based Augmetec secured €2.4 million for its AI investigation platform; Switzerland’s Ex Nunc Intelligence raised €1.8 million pre-Seed for its legal AI infrastructure; Amsterdam-based Saga collected €1.5 million to expand its lawyer-centric AI platform; and Madrid’s iPNOTE raised €857k to scale its AI-powered IP services. Taken together, these rounds represent approximately €146 million invested into European LegalTech over this period. Against this backdrop, Lawhive’s €50 million Series B places it among the largest recent raises in the sector and is notable for its consumer-law-firm-as-a-platform model, contrasting with many peers that focus primarily on tooling for law firms or in-house legal teams. Vidu Shanmugarajah, partner at GV, adds: “For too long, consumer legal services have been expensive, slow and out of reach for many people. Lawhive is changing that by using technology to make high-quality legal help more accessible without compromising on standards. That focus on access and outcomes for consumers is why we’ve continued to support the company as it scales across the US.” Founded in 2021, Lawhive is an AI-native law firm that uses agentic AI to transform the delivery of consumer legal services. Its platform combines a network of lawyers with AI-powered workflow tools that automate routine tasks, improve operational performance and make everyday legal services more accessible. The company is targeting one of the largest and most underserved segments of legal services. According to figures provided by Lawhive, the consumer legal market in America generates €169 billion ($200 billion) revenue annually, yet research suggests that up to €848 billion ($1 trillion) in legal needs go unmet annually because of cost, backlog and highly manual processes. Lawhive believes that everyday issues such as family law, landlord/tenant disputes and employment law remain slow, costly and unpredictable for many, while consumer lawyers are constrained by administrative work and legacy systems. Mitch Rales, co-founder of Danaher Corporation, says: “Lawhive is democratising legal services by providing access to high quality and transparent consumer legal services. I’m excited for my business building firm, New Bearing, to partner with Lawhive’s talented management team to build operational excellence into everything that Lawhive does for consumers and lawyers. Pierre, his co-founders and I share a mindset that we are building Lawhive for the next decades ahead of us.” To date, Lawhive has helped tens of thousands of clients navigate family law, landlord and tenant disputes, property transactions, civil disputes, and consumer rights matters. Demand is being driven both by consumers who want faster, more affordable access to their legal rights, and by lawyers who want to be more productive, profitable and efficient by leveraging AI to scale their legal practices. The company now operates in 35 states, making the US its fastest growing market. In addition to Lawhive’s Austin office, a New York office is being opened to support this next stage of US growth. In 2025 Lawhive completed the acquisition of Woodstock Legal Services in the UK. Lawhive now plans to expand their model in the US, where the consumer legal market is highly fragmented and dominated by thousands of small firms that lack modern infrastructure. Lawhive’s technology supports lawyers and back-office teams by automating tasks such as document drafting, research, case management, client intake and payments. Lawhive’s AI paralegal, Lawrence, works alongside lawyers and support staff to collaborate on casework and administrative tasks. Schuster Tanger, co-founding partner of TQ Ventures, said: “What sets Lawhive apart is its business model scales as quickly as its technology and operating leverage improves. Cutting-edge agentic AI, strong fundamentals and a clear opportunity to capture a fragmented market are rare. We believe Lawhive, with its remarkable pace of domination thus far, is on track to be the global champion of consumer law.” The post UK LegalTech startup Lawhive secures €50 million to scale AI-driven consumer law firm model appeared first on EU-Startups. |

05/02/2026 12:10 PM | 6 | |

| 52,348 | 05/02/2026 11:00 AM | How iPhones Made a Surprising Comeback in China | how-iphones-made-a-surprising-comeback-in-china | 05/02/2026 | Huawei’s and Xiaomi’s flagship devices are packed with impressive features, but Apple is dominating the Chinese smartphone market again—for now. | 05/02/2026 11:10 AM | 4 | |

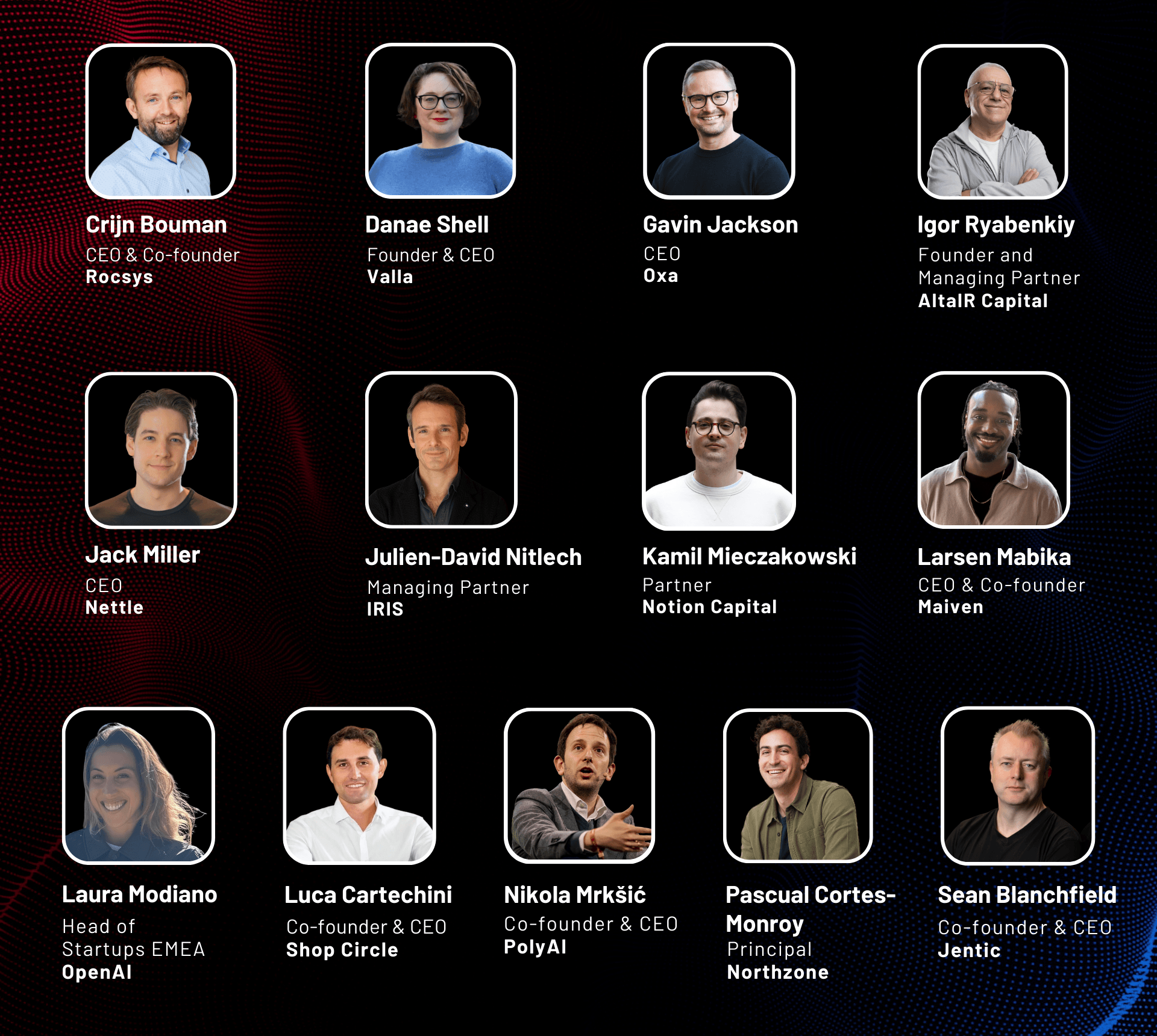

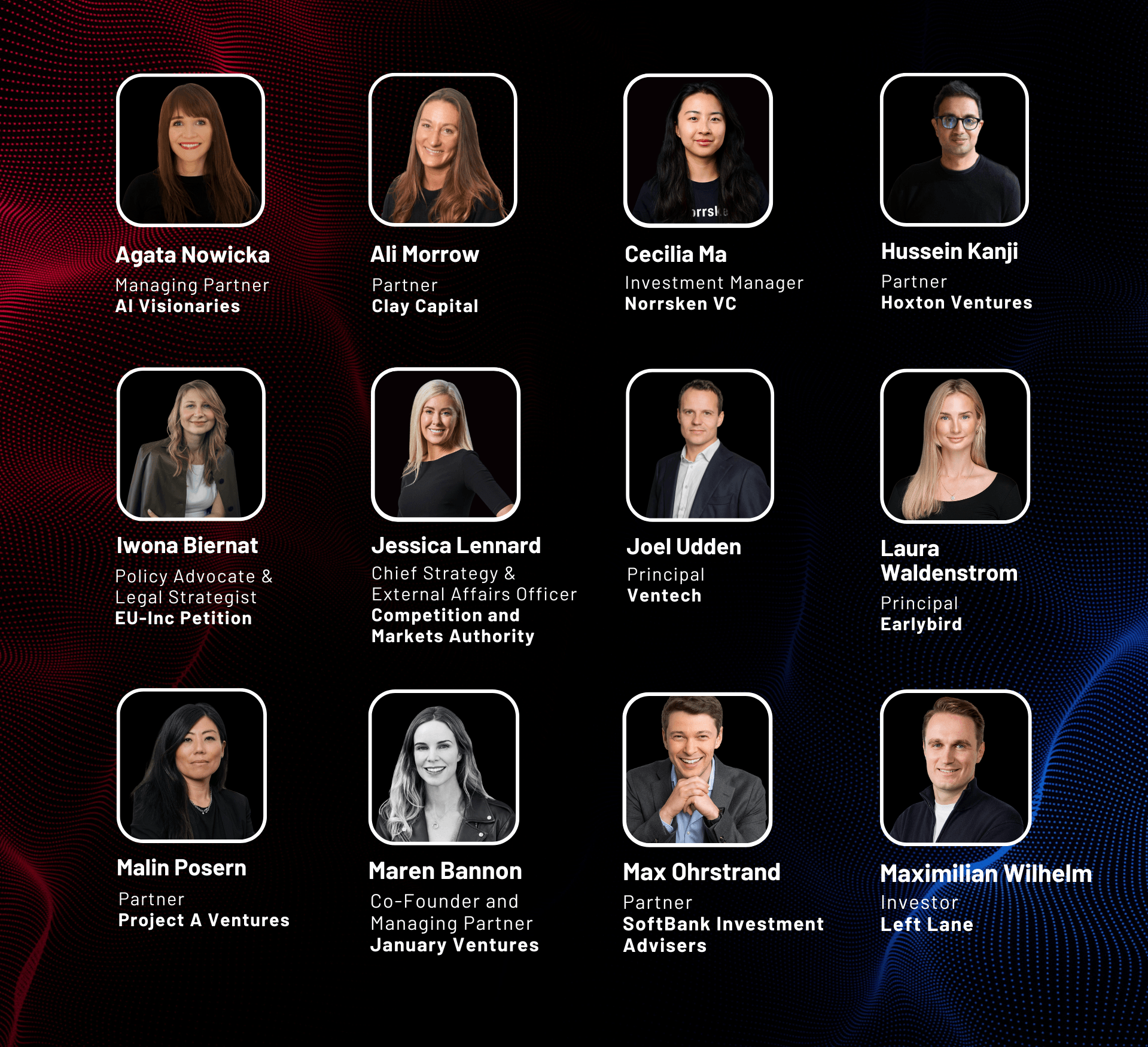

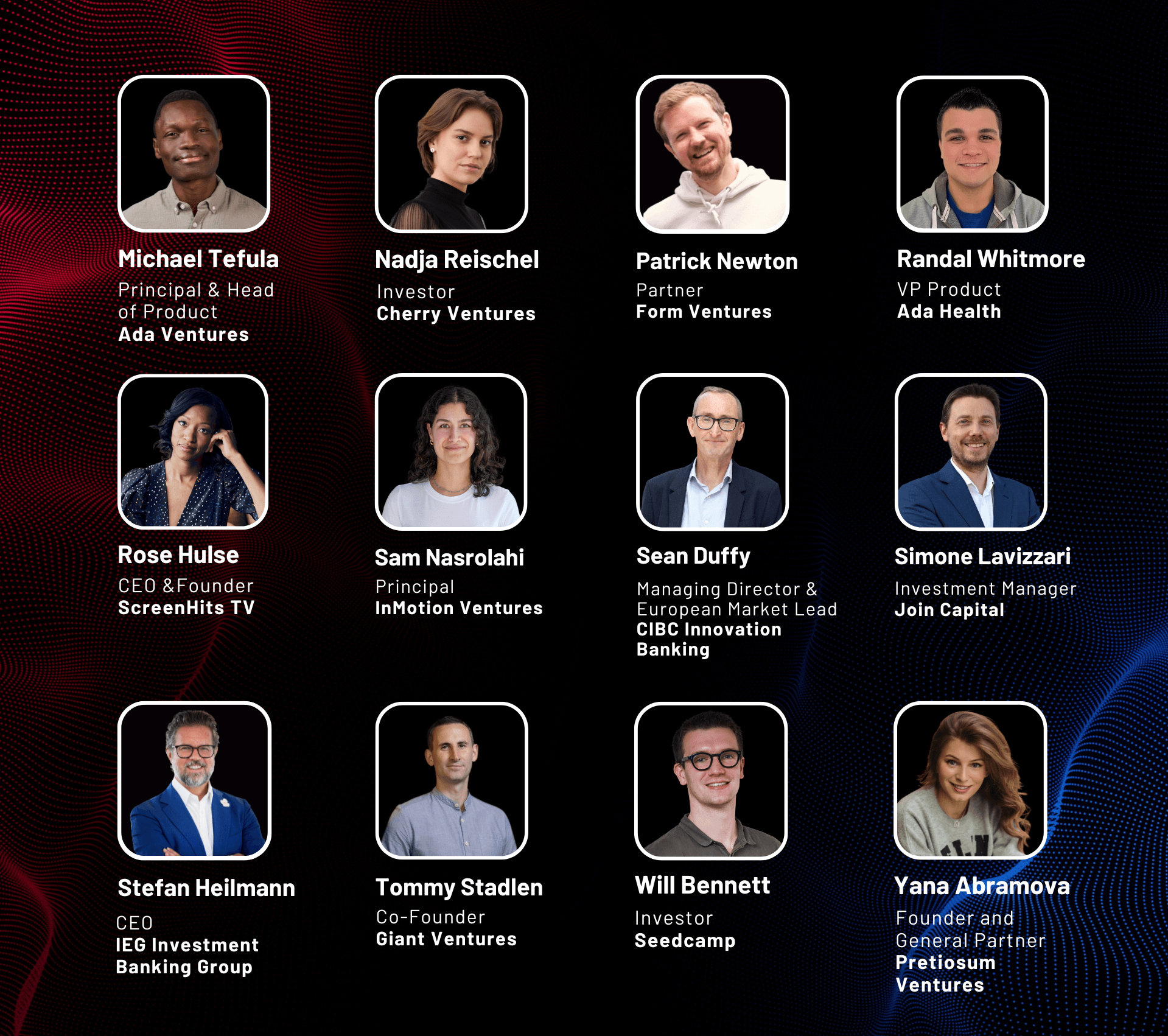

| 52,345 | 05/02/2026 11:00 AM | New speakers for the Tech.eu Summit London 2026 announced: Leaders from OpenAI, Notion Capital, PolyAI, Oxa and many more... | new-speakers-for-the-techeu-summit-london-2026-announced-leaders-from-openai-notion-capital-polyai-oxa-and-many-more | 05/02/2026 | Following our previous announcements, we are delighted to reveal newly confirmed speakers for the Tech.eu Summit London 2026. The event will take place on 21-22 April 2026 at the Queen Elizabeth II Centre in London, bringing together senior leaders, founders and investors who are actively shaping the future of technology across Europe and beyond. This newly announced group of speakers further strengthens the summit’s focus on practical, real-world innovation, with voices representing global AI leaders, fast-scaling startups and some of Europe’s most active venture capital firms - including executives from OpenAI, AltaIR Capital, Oxa and a wide range of other technology-driven organisations. Newly announced speakers

Here are the speakers we have previously announced for the Tech.eu Summit London 2026.

What to expect at the summitThe two-day summit will dive deep into the trends and innovations driving global change across business, society and technology. Across keynote sessions, panels and in-depth discussions, attendees will hear directly from leading investors, startup founders and technology executives about how they are navigating today’s market realities - from the deployment of advanced AI systems and autonomous technologies, to sustainability-driven business models and the next generation of financial infrastructure. The programme is designed to go beyond high-level vision and focus on execution: how companies grow internationally, how capital is deployed in more selective markets, and how Europe can remain competitive in an increasingly global and geopolitically complex tech landscape. Get your ticketEarly Bird tickets are now available for a limited time. Secure your place and be part of one of Europe’s leading gatherings for founders, investors, operators and ecosystem leaders. Start networking before the summitAll attendees will receive access to the Tech.eu Events App, allowing you to start networking ahead of the summit, schedule meetings in advance, browse the agenda once it is published and receive real-time event updates. More updates coming soonAdditional speakers and the full programme agenda will be announced in the coming weeks as we continue to build a strong and diverse speaker lineup for the Tech.eu Summit London 2026. We look forward to welcoming you in London this April for two days of insight, inspiration, and meaningful connections. |

05/02/2026 11:10 AM | 1 | |

| 52,346 | 05/02/2026 10:46 AM | InnoEX and Hong Kong Electronics Fair (Spring Edition) will open in April 2026 [Sponsored] | innoex-and-hong-kong-electronics-fair-spring-edition-will-open-in-april-2026-sponsored | 05/02/2026 | The Hong Kong Trade Development Council (HKTDC) will host two prominent exhibitions from 13-16 April 2026 — InnoEX and Electronics Fair (Spring Edition) at the Hong Kong Convention and Exhibition Centre, presenting global innovation and technology (I&T) achievements, latest electronics products and advanced technology solutions. Industry professionals, investors, buyers, and technology users from different sectors, including SMEs are encouraged to attend the fairs. In 2025, the two fairs successfully brought together more than 2,800 exhibitors from 29 countries and regions, and attracted around 88,000 industry buyers from 148 countries and regions.

InnoEX is a core event of the Business of Innovation and Technology Week, driven by the Innovation, Technology and Industry Bureau of the HKSAR Government and the HKTDC, showcasing cutting-edge technologies and global innovations. Under the theme of “Innovate • Automate • Elevate”, InnoEX 2026 will spotlight five dynamic areas: AI+, Robotics, Low-altitude Economy (such as unmanned aerial vehicle and electric vertical take-off and landing aircraft), Property Technology, and Retail Technology. Last year, the fair successfully helped buyers and exhibitors establish important partnerships. Philippine buyer Digital Pilipinas and International Digital Economies Association signed a distribution agreement with the United Kingdom’s exhibitor Unifi.id to introduce its smart card system for buildings to the Philippines, with hopes of expanding into other emerging markets in the future. Xi’an Meinan Biotechnology Co. Ltd also signed a strategic cooperation agreement with H & Y Building Decoration Electrical Engineering (HK), aiming to enhance the quality of construction projects in Hong Kong and internationally by utilising Meinan’s waterproof mortar technology, promoting sustainable development.

Entering its 22nd edition, the Electronics Fair (Spring Edition)continues to connect international exhibitors with buyers worldwide, displaying groundbreaking electronics products and solutions aligned with evolving tech trends. The 2026 fair will spotlight on products and solutions in the sectors of Smart Home & Solutions, Health Tech & Gadgets and Pet Intelligence. The fair will host over 20 product zones, including the Hall of Fame that will feature more than 500 global renowned electronics brands and their creation; the Tech Hall will showcase next-generation electronics and modern lifestyle solutions; the Immersive Experience Zone willoffer visitors hands-on experiences with wearable technology and interactive games;and the Start Up Zone will highlight the latest innovations and creative ideas from entrepreneurs. Other thematic product zones will cover categories such as Energy Storage & E-mobility, Home Appliances, Audio-Visual Products, Computing & Gaming, Automotive & In-Vehicle Electronics, and more. Shenzhen Antop Technology Co. from Chinese Mainland, exhibitor of last year’s Electronics Fair stated, “We have made contact with many potential buyers from India and South America at the exhibition, and in the first two days, we received about 50 potential leads, with at least one third showing significant collaboration potential." The company was also discussing a contract for an order valued at approximately USD2.5 million. Additionally, Hong Kong medical technology exhibitor CYBERMED, discussed business deals with two buyers from Mainland China and the Middle East, with each order valued at approximately USD200,000.

The two fairs will also introduce the RoboPark, unveiling robots’ potential and innovations through immersive scenario-based demonstrations and live robotics performances. From humanoids and robotic arms to quadrupeds and autonomous mobile robots, visitors can explore how robotics is reshaping business, daily life, healthcare, and industries today.

During the fair period, forums, presentations, and other events will be held, inviting experts to share insights and provide valuable networking opportunities for industry professionals. Additionally, start-ups will have excellent platforms to promote innovative ideas, seek support from investors, and gain advice from experts on business development. The fairs will be held in EXHIBITION+ hybrid model, complemented by the "Click2Match", an online smart business matching platform that will operate from 6 to 23 April, providing a convenient and efficient platform for traders to connect. In addition, the "Scan2Match" function also enables offline-to-online connections. By using the HKTDC Marketplace App, buyers can scan the dedicated QR codes of exhibitors to bookmark their favorite exhibitors, browse product information, view e-floor plans, and chat with exhibitors even after the fair to continue the sourcing journey. Register Now for Free Admission: https://tinyurl.com/r9h48j65 For more details, please visit our fair website: HKTDC Hong Kong Electronics Fair (Spring Edition): https://www.hktdc.com/event/hkelectronicsfairse/en 13 – 16 April 2026 Hong Kong Convention and Exhibition Centre 6 – 23 April 2026 Click2Match (Online) Follow us on social media for the latest updates: Facebook: https://www.facebook.com/HKTDC.Exhibition Instagram: https://www.instagram.com/hktdclifestyle/ |

05/02/2026 11:10 AM | 1 | |

| 52,349 | 05/02/2026 10:20 AM | ElevenLabs’ €424 million raise values the company at €9.3 billion and marks one of Europe’s largest AI funding rounds this year | elevenlabs-euro424-million-raise-values-the-company-at-euro93-billion-and-marks-one-of-europes-largest-ai-funding-rounds-this-year | 05/02/2026 | ElevenLabs, a leader in AI voice generation and text-to-speech technology, has raised €424 million ($500 million) in a Series D funding round – valuing the British company at €9.3 billion ($11 billion), more than tripling its valuation from one year prior, and bringing total funding to €662 million ($781 million) across five rounds since its founding in 2022. The round is led by Sequoia Capital with Andrew Reed joining the board. Andreessen Horowitz quadrupled down while ICONIQ tripled down. New investors Lightspeed Venture Partners, Evantic Capital, and BOND are joining the round. Existing investors – BroadLight, NFDG, Valor Capital, AMP Coalition and Smash Capital are also continuing their support along with additional investor participation expected to be disclosed later in February. This follows 2023’s €17.3 million Series A, 2024’s €73 million Series B, and 2025’s $180 million Series C. “We started by building a voice that could sound human – and we did. Today we are building foundational models across the full audio stack – text to speech, transcription, music, dubbing and conversational models with a world-leading research team. And we take the models even further by optimising them for the best product experiences that we believe will redefine the benchmarks,” says Piotr Dabkowski, co-founder of ElevenLabs. In the 2025–2026 period, coverage shows that European AI funding has largely concentrated on early-stage and highly specialised applications, in contrast to the scale of ElevenLabs’ €424 million Series D. London-based Polaron raised €6.7 million in February 2026 to develop an AI intelligence layer for materials science, targeting engineering use cases in energy and automotive industries. In Central Europe, Czech startup Ranketta secured a €1 million pre-Seed round in late 2025 to build a platform measuring brand visibility within large language model outputs. Sweden-based Redpine raised approximately €1.1 million in Seed funding in September 2025 to address hallucinations in AI systems through licensed and structured datasets. Meanwhile, UK startup Jam announced a €312k Seed round in 2025 to develop an agent-based AI marketing platform focused on enterprise workflows. Collectively, these rounds amount to roughly €9 million, underscoring how ElevenLabs’ latest raise sits at the extreme upper end of European AI funding during this period, with most capital deployed into narrowly defined AI infrastructure and application layers rather than large-scale, multimodal foundation platforms. “Mati and Piotr are exceptional founders and leaders. They have built ElevenLabs into one of the most successful and most impactful companies in the global AI ecosystem. From world-leading research to mind-bending creative tools to enterprise voice agents at scale, ElevenLabs is changing how people communicate and interface with technology, with organisations and institutions, and with each other. It’s an honour to join their board,” adds Andrew Reed, Partner at Sequoia. Founded in 2022, ElevenLabs began by developing a human-like AI text to speech model. Since then, the company has expanded beyond voice, advancing state-of-the-art research across speech to text, sound effects, dubbing, music and conversation. ElevenLabs brings these models together with integrations, orchestration, and enterprise-grade infrastructure to deliver production-ready platforms for businesses, creators, and developers:

“The intersection of models and products is critical – and our team has proven, time and again, how to translate research into real-world experiences. This funding helps us go beyond voice alone to transform how we interact with technology altogether. We plan to expand our Creative offering – helping creators combine our best-in-class audio with video and Agents – enabling businesses to build agents that can talk, type, and take action. “When we started ElevenLabs, we couldn’t have imagined the scale and impact we’ve reached today, with an incredible team doing the best work of their lives. Yet we stay hungry, knowing how early this space still is, as we build toward IPO and beyond,” said Mati Staniszewski, Co-Founder of ElevenLabs. ElevenLabs plans to use this funding to continue to expand research and product, and continue its international expansion across London, New York, San Francisco, Warsaw, Dublin, Tokyo, Seoul, Singapore, Bengaluru, Sydney, São Paulo, Berlin, Paris and Mexico City with locally embedded go-to-market teams to support enterprise adoption of ElevenAgents and ElevenCreative worldwide. For decades, humans have adapted to machines by clicking buttons and navigating menus. ElevenLabs believes the next phase of computing will reverse that dynamic – with technology adapting to how people naturally communicate. The post ElevenLabs’ €424 million raise values the company at €9.3 billion and marks one of Europe’s largest AI funding rounds this year appeared first on EU-Startups. |

05/02/2026 11:10 AM | 6 | |

| 52,347 | 05/02/2026 10:19 AM | QT Sense raises €4M to advance a quantum sensing platform | qt-sense-raises-euro4m-to-advance-a-quantum-sensing-platform | 05/02/2026 |  QT Sense, a deep-tech biotech startup building tools to study living cells, announced it has secured €4 million in funding to accelerate its Quantum Nuova platform, a technology that lets scientists observe cellular processes in real time and reveal biochemical activity linked to disease. The funding includes a €3 million seed investment led by Cottonwood Technology Fund, with follow-on backing from existing investor QDNL Participations and an angel investor. In addition, the company received €600,000 from the ONCO-Q programme to support cancer research and €400,000 through the Quantum Forward Challenge for collaborative deployments with research partners. Most traditional lab methods… This story continues at The Next Web |

05/02/2026 11:10 AM | 3 | |

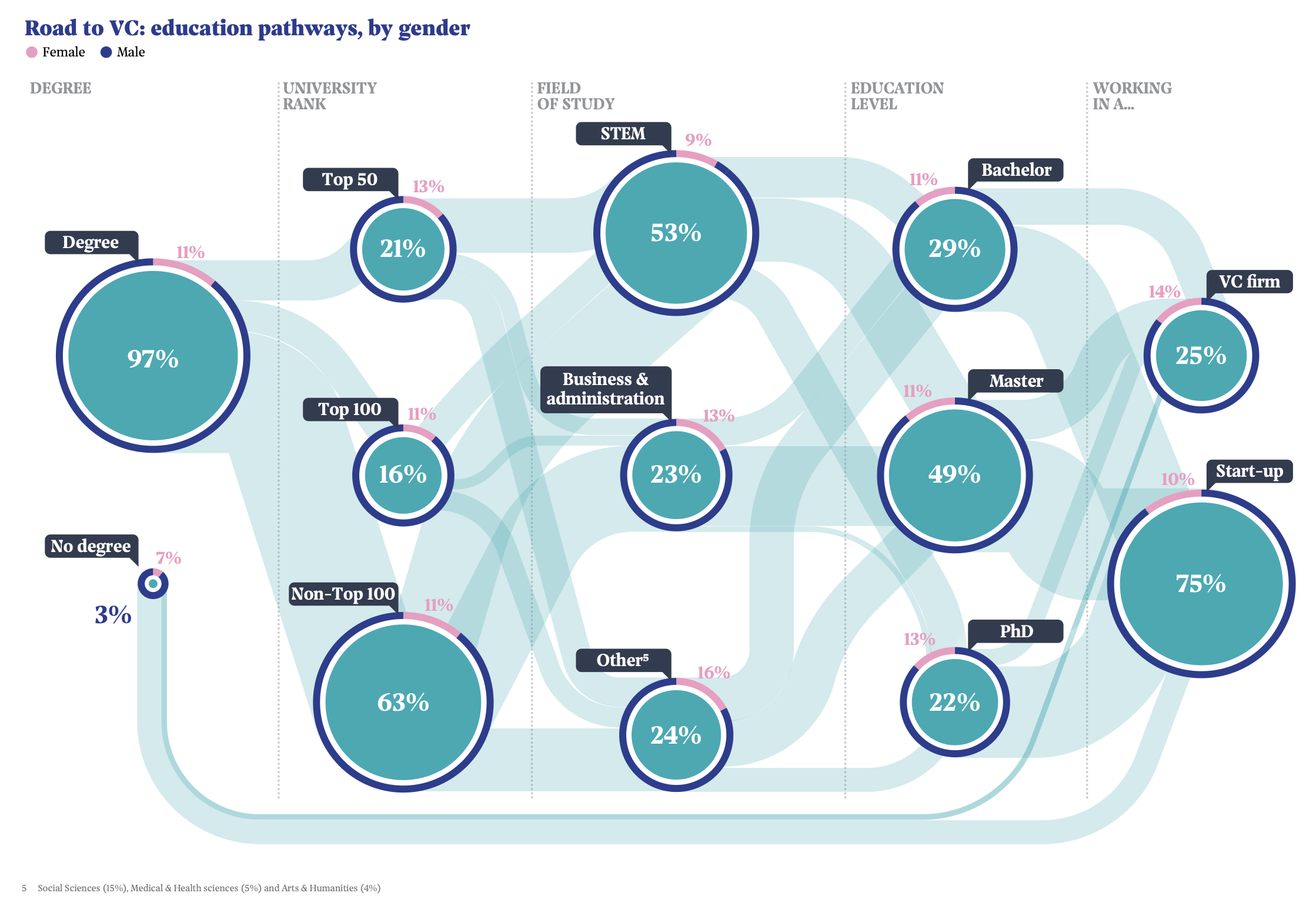

| 52,341 | 05/02/2026 10:05 AM | Invest Europe and EIF report: How gender and geography shape Europe’s VC ecosystem | invest-europe-and-eif-report-how-gender-and-geography-shape-europes-vc-ecosystem | 05/02/2026 | Invest Europe, in collaboration with the European Investment Fund (EIF), has published a new report titled TheVC Factor: Skills Edition. The report analyses Europe’s venture capital landscape, with a focus on cross-border startup funding and the influence of education and gender on funding outcomes and startup development. Beyond mapping current investment volumes, the Skills Edition draws conclusions with implications for investors, founders, and policymakers. The findings suggest that VC hubs which foster strong local connections are also more likely to attract investment from outside their immediate regions, potentially serving as a strategic reference point for both startups and ecosystem builders. The analysis shows that European venture capital activity is organised around “clans” of VC hubs - interconnected but regionally defined networks that include Benelux, the British Isles, Central and Eastern Europe (including Greece), DACH, France, the Iberian Peninsula, Italy/Malta, and the Nordics/Baltics. While the data highlights growing integration across the European VC ecosystem, national and regional investment patterns remain clearly visible. VC flows across Europe also exhibit signs of “preferential attachment”, whereby well-connected hubs tend to attract a growing share of capital over time:

Eric de Montgolfier, CEO of Invest Europe, commented:

Education and gender: Women founders are highly qualified, but receive less funding The report emphasises that the European venture capital ecosystem is shaped not only by capital flows and geographic hubs, but also by the skills, experience, and backgrounds of the individuals involved - namely, entrepreneurs and investors. Against this backdrop, it examines funding dynamics through the lenses of education and gender. While educational background alone does not determine access to venture capital, university prestige is shown to influence funding size:

The report also notes rising female participation among younger generations of founders, indicating gradual progress towards a more diverse entrepreneurial landscape in which skills, talent, and ambition may play an increasingly important role in funding decisions.

At the same time, the analysis indicates that startups founded by women face structural challenges, including smaller founding teams and later access to initial funding. These factors explain only part of the observed investment gap. Startups with predominantly female founding teams receive, on average, €700,000 less per investment than those led mainly by male founders, despite women founders tending to have higher educational attainment and greater representation among graduates of highly ranked universities. The remaining gap appears to be associated with factors that consistently advantage predominantly male teams, pointing to persistent imbalances in how opportunity and capital are distributed across the ecosystem. |

05/02/2026 10:10 AM | 1 | |

| 52,350 | 05/02/2026 10:00 AM | The EU-Startups Podcast | Interview with Tessa Clarke, Co-founder and CEO of Olio | the-eu-startups-podcast-or-interview-with-tessa-clarke-co-founder-and-ceo-of-olio | 05/02/2026 | This week on the EU-Startups Podcast, we sit down with Tessa Clarke, Co-founder and CEO of Olio, a community-powered platform built to redistribute surplus food and household items at scale. Founded in 2015, Olio connects neighbours and local communities to share surplus food and non-food items that would otherwise go to waste. Alongside peer-to-peer sharing, the platform works with major food retailers and organisations, including Tesco, Sainsbury’s, Pret and Compass Group, to safely redistribute surplus food through a large volunteer network. Today, Olio counts over 9 million users globally and has helped redistribute more than 135 million meals, rehome 15 million household items, and prevent around 300,000 tonnes of CO₂e, combining social impact with measurable environmental outcomes. Tessa’s journey into entrepreneurship began long before Olio, shaped by growing up on a dairy farm in Yorkshire and later by senior roles at companies such as Dyson and Wonga. In the interview, she reflects on the moment that sparked Olio’s creation, the realities of building a purpose-led startup, the power of volunteer-driven models, why household food waste, which accounts for roughly half of global food waste, remains one of the hardest challenges to solve at scale, and much more! Key Points

This episode of the EU-Startups Podcast is brought to you by Vanta. The trust management platform helps more than 12k companies, including Nando’s, Allica Bank and Granola, start and scale their security programmes while building trust with buyers. It saves security teams time and improves programme visibility by automating over 35 compliance frameworks, such as SOC 2 and ISO 27001, as well as GRC workflows like risk management. Click here to learn more! This episode of the EU-Startups Podcast is brought to you by Vanta. The trust management platform helps more than 12k companies, including Nando’s, Allica Bank and Granola, start and scale their security programmes while building trust with buyers. It saves security teams time and improves programme visibility by automating over 35 compliance frameworks, such as SOC 2 and ISO 27001, as well as GRC workflows like risk management. Click here to learn more!

The post The EU-Startups Podcast | Interview with Tessa Clarke, Co-founder and CEO of Olio appeared first on EU-Startups. |

05/02/2026 11:10 AM | 6 | |

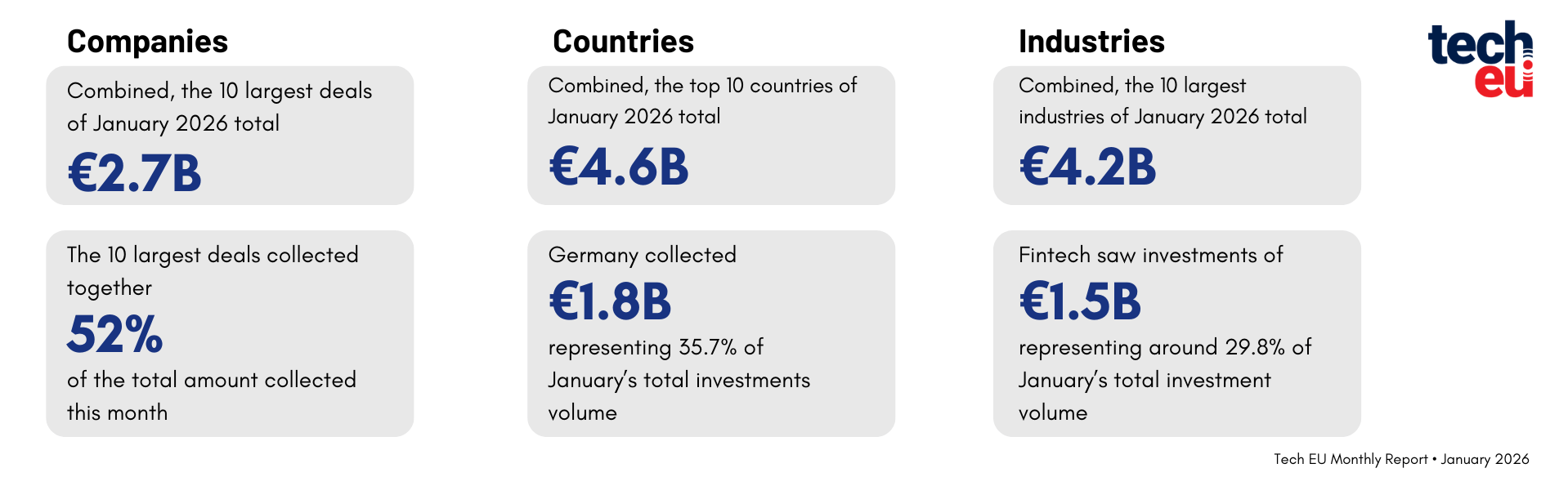

| 52,342 | 05/02/2026 10:00 AM | January 2026's top 10 European tech deals you need to know about | january-2026s-top-10-european-tech-deals-you-need-to-know-about | 05/02/2026 | European tech startups raised €5 billion across 265 deals in January 2026, marking a 9 per cent drop in deal volume and a 24 per cent decline in funding compared with the same month year before. Regionally, Germany stood out, with startups raising €1.8 billion, reinforcing the country’s growing share of European funding despite the broader slowdown. Sector activity remained fragmented, with fintech attracting €1.5 billion during the month.

Ion Hauer, Principal at APEX Ventures, commented on the January numbers within the European tech investment landscape in our January Tech.eu Pulse, a compact version of the monthly report:

For his more detailed review and more in-depth analyses of the European tech ecosystem, including industry and country performance, exit activities, and more, check out our January report.

Here are the 10 largest tech deals in Europe from January, accounting for 52 per cent of the month’s total funding.

|

05/02/2026 10:10 AM | 1 | |

| 52,343 | 05/02/2026 09:37 AM | Synthesia and Flatpay founders back Pluto.markets in $6M raise | synthesia-and-flatpay-founders-back-plutomarkets-in-dollar6m-raise | 05/02/2026 | Danish tech luminaries, including leaders from Synthesia, Pleo and Flatpay, are backing Pluto.markets, a Danish YC-backed investment platform looking to disrupt the brokerage market in the Nordics, in a new funding round. Danish challenger neobroker Pluto.markets was founded in 2021 by Joakim Bruchmann, a former base metals trader at Goldman Sachs, and Oscar Vingtoft, a software engineer. The $6m funding round, which Bruchmann says is a seed round, was led by Danish VC firm Seed Capital with participation from existing investors and Thomas Delaney, the Danish professional footballer. The round also features a host of Danish unicorn founders. These include Jeppe Rindom, Pleo co-founder, Sander Janca-Jensen and Rasmus Busk, Flatpay co-founders, Victor Riparbelli and Steffen Tjerrild, Synthesia co-founders, Andreas Sachse, Podimo co-founder, Alex Aghassipour, Zendesk co-founder, as well as Lars Fløe Nielsen and Michael Seifert, Sitecore co-founders. This new funding brings the total capital raised to nearly $10m since the startup's inception in 2021. Pluto.markets offers users commission-free trading in fractional stocks, ETFs, and cryptocurrencies. The challenger is looking to replicate the success of the likes of Robinhood and Trade Republic across the Nordics. The startup, which secured an EU-wide investment license before it started major fundraising, began onboarding its first customers 14 months ago. Bruchmann said the funds will be used to move into new markets and launch new products. He said: "Our next move is to disrupt the ETF - for both individuals and businesses - and already this quarter, we will launch products that the European market hasn't seen before. "Securing support from nearly every Danish unicorn founder of the last decade is the ultimate seal of quality. They know what it takes to disrupt established industries at high speed. With their help, we are ready to make Pluto the preferred investment platform across Europe and reinvent asset management.” The startup says it has more than 10,000 users in Denmark, its first market. Its focus is on the millions of Europeans living in countries that have their own local currencies, like the Nordics. |

05/02/2026 10:10 AM | 1 | |

| 52,344 | 05/02/2026 09:32 AM | Kembara closes €750M first close to fuel growth of European deep tech startups | kembara-closes-euro750m-first-close-to-fuel-growth-of-european-deep-tech-startups | 05/02/2026 |  Europe’s largest dedicated deep tech growth fund has taken a major step forward after closing the first tranche of its fundraising effort at €750 million. The fund, known as Kembara Fund I and managed by Spain-based Mundi Ventures, is aiming for a €1 billion target. It will invest in European companies developing breakthrough technologies in areas such as clean energy, AI, quantum computing, advanced materials, robotics, and space tech. A cornerstone of the fundraising so far is a €350 million commitment from the European Investment Fund, part of the EU’s attempt to strengthen local growth capital. Additional backing comes from… This story continues at The Next Web |

05/02/2026 10:10 AM | 3 | |

| 52,340 | 05/02/2026 09:00 AM | Gardia secures €8.5M to scale its mobile emergency system for seniors | gardia-secures-euro85m-to-scale-its-mobile-emergency-system-for-seniors | 05/02/2026 | Healthtech startup Gardia has closed an €8.5 million Series A round to support the expansion of its mobile fall-detection emergency system for seniors. The round was led by European venture capital firm Peak, with participation from amberra, the corporate venture studio of Germany’s Cooperative Financial Group, and the butterfly & elephant accelerator by GS1 Germany. Existing business angels and investors BONVENTURE, Dieter von Holtzbrinck Ventures, and Beurer also reinvested. The funding comes as demographic change continues to reshape healthcare needs across Europe. The EU is home to around 97 million people aged 65 or older, a number expected to exceed 110 million by the mid-2030s. In Germany, where most seniors live independently in private households, the preference to age at home increasingly coincides with a shortage of care workers. This development has intensified demand for independent safety solutions. Millions of older adults in Germany experience falls each year, and in many cases are unable to call for help. Delayed assistance increases the risk of serious injury and long-term care dependency, placing additional strain on healthcare systems. Gardia has developed a mobile emergency system specifically designed for seniors. The solution centres on a discreet wristband with automatic fall detection that works both at home and on the go, without requiring a smartphone. Hardware, software, application, and AI are developed in-house and tailored to the needs of older users. Marlon Besuch, co-founder and CEO of Gardia, explained that reliable fall detection depends on highly advanced and precise technological development:

The company has a five-figure active user base across the DACH region, supported by strong retention and reimbursement through German health insurance. With the Series A funding, Gardia plans to scale further across the DACH region, expand internationally, and strengthen its B2B activities in the care and healthcare sectors. |

05/02/2026 09:10 AM | 1 | |

| 52,351 | 05/02/2026 08:22 AM | Why modern brands use micro-influencer marketing platforms to drive scalable growth (Sponsored) | why-modern-brands-use-micro-influencer-marketing-platforms-to-drive-scalable-growth-sponsored | 05/02/2026 | Over the past decade, digital influence has shifted from celebrity-style endorsements to a more personal, community-driven ecosystem. While macro-influencers once dominated, many brands now see diminishing returns: audiences are more sceptical of polished sponsorships, engagement often lags behind expectations, and a single branded post can be hard to justify against uncertain outcomes. At the same time, micro creators have become the backbone of modern influencer marketing, focusing less on follower counts and more on trust, relevance, and consistent performance. This is also why the micro-influencer marketing platform has grown in importance: brands need ways to find niche creators, run campaigns at scale, streamline operations, and measure results reliably. Why has macro influence weakenedMacro creators can offer reach, but reach does not automatically equal influence. When the same high-profile accounts promote unrelated products, sponsorship fatigue sets in quickly, and audiences can spot inauthentic messaging immediately. Common macro-campaign issues include:

For brands seeking scalable, repeatable growth, micro creators often deliver more dependable outcomes. Why micro communities win on trustMicro influencers tend to serve specific interest groups, such as skincare beginners, ethical fashion audiences, runners training for their first marathon, book reviewers, tech hobbyists, and sustainability advocates. Their audiences may be smaller, but they are typically more engaged and more closely aligned with the creator’s niche. They build trust because:

Micro creators frequently outperform macro-influencers on engagement-to-cost efficiency. Instead of spending a large budget on a single post and hoping it converts, brands can collaborate with many micro creators, generating more touchpoints, more content, and more opportunities for conversion, along with a deeper pool of usable UGC. High engagement plus manageable costs equals a model that scales. What micro-influencer marketing platforms actually doMany marketers assume a micro-influencer marketing platform is simply a creator database. In reality, strong platforms manage the full campaign lifecycle: discovery, outreach, collaboration, contracting, payments, and performance reporting, allowing creator programmes to scale without turning into spreadsheet chaos.

This level of targeting is difficult to achieve manually.

What once took days can become a repeatable workflow.

Why micro influencers scale betterMicro creator programmes are adaptable, diversified, and easier to optimise over time: How to choose the right micro-influencer marketing platformEvaluate platforms based on:

The Bottom line is that micro influencers represent a more authentic, cost-efficient, and scalable form of digital advocacy, especially when paired with a modern micro-influencer marketing platform. The strongest brands do not rely on one-off viral moments; they build repeatable systems. Micro creators combined with platform automation offer one of the clearest paths to making influencer marketing measurable, scalable, and sustainable. The post Why modern brands use micro-influencer marketing platforms to drive scalable growth (Sponsored) appeared first on EU-Startups. |

05/02/2026 11:10 AM | 6 | |

| 52,335 | 05/02/2026 08:05 AM | Plato closes $14.5M round to scale AI tools for distributors | plato-closes-dollar145m-round-to-scale-ai-tools-for-distributors | 05/02/2026 | Plato, an AI-based operating system for wholesale distributors, has closed a $14.5 million seed funding round led by Atomico, with participation from existing investors including Cherry Ventures. The distribution sector is under increasing pressure from labour constraints, low margins, economic uncertainty, and rising digital expectations from B2B customers. Plato aims to address these challenges by replacing manual sales and ERP workflows with AI-driven automation designed to improve operational efficiency and commercial performance. Founded by Benedikt Nolte, Matthias Heinrich Morales, and Oliver Birch, Plato develops AI-native software that automates core workflows across sales, quoting, and ERP operations for distribution businesses. By unlocking and structuring data within legacy ERP systems, the platform reduces manual work and enables sales teams to operate more proactively, supporting efficiency and revenue growth. Key capabilities include AI-driven sales intelligence to identify customer risks and opportunities, automation of repetitive processes such as order handling and internal communication, and industry-specific software tailored to wholesalers managing large and complex product portfolios. Commenting on the company’s origins, CEO Benedikt Nolte said Plato was built after experiencing the challenges faced by distribution businesses firsthand, leading the team to rethink industry workflows in collaboration with experienced technologists. He added that the company is developing an AI operating system for distributors, starting with intelligent sales automation. Plato has gained early traction, signing several large European distribution companies with six-figure average contract values. The new funding will be used to expand the platform’s functionality into areas such as customer service and procurement, as well as to support international expansion. |

05/02/2026 08:10 AM | 1 |