Switch Dataset:

Startup News

We are collecting the most relevant tech news and provide you with a handy archive. Use the search to find mentions of your city, accelerator or favorite startup in the last 1,000 news items. If you’d like to do a more thorough search, please contact us for help.

Search for any keyword to filter the database with >10,000 news articles

Filter

Filter search

Results

| id | date | title | slug | Date | link | content | created_at | feed_id |

|---|---|---|---|---|---|---|---|---|

| 52,249 | 31/01/2026 01:23 AM | a16z partner Kofi Ampadu to leave firm after TxO program pause | a16z-partner-kofi-ampadu-to-leave-firm-after-txo-program-pause | 31/01/2026 | 31/01/2026 03:10 AM | 7 | ||

| 52,248 | 30/01/2026 06:56 PM | Uber is literally in the driver’s seat when it comes to AV bets | uber-is-literally-in-the-drivers-seat-when-it-comes-to-av-bets | 30/01/2026 | 30/01/2026 07:10 PM | 7 | ||

| 52,247 | 30/01/2026 05:05 PM | Weekly funding round-up! All of the European startup funding rounds we tracked this week (Jan. 26-30) | weekly-funding-round-up-all-of-the-european-startup-funding-rounds-we-tracked-this-week-jan-26-30 | 30/01/2026 | Friday is here with a new edition of our weekly VC funding overview for our CLUB members. Below you’ll find this week’s overview of all the (equity) funding activities we tracked from across Europe. Funding rounds in France

Funding rounds in Germany

Funding rounds in Poland

Funding rounds in Spain

Funding rounds in Sweden

Funding rounds in the Netherlands

Funding rounds in the United Kingdom

Funding rounds elsewhere in EuropeAustria:

Belgium:

Denmark:

Finland:

Ireland:

Italy:

Switzerland:

This article is visible for CLUB members only. If you are already a member but don’t see the content of this article, please login here. If you’re not a CLUB member yet, but you’d like to read members-only content like this one, have unrestricted access to the site and benefit from many additional perks, you can sign up here. The post Weekly funding round-up! All of the European startup funding rounds we tracked this week (Jan. 26-30) appeared first on EU-Startups. |

30/01/2026 06:10 PM | 6 | |

| 52,246 | 30/01/2026 04:37 PM | Uber puts another chip on the self-driving roulette table | uber-puts-another-chip-on-the-self-driving-roulette-table | 30/01/2026 | 30/01/2026 05:10 PM | 7 | ||

| 52,243 | 30/01/2026 04:00 PM | After Minneapolis, Tech CEOs Are Struggling to Stay Silent | after-minneapolis-tech-ceos-are-struggling-to-stay-silent | 30/01/2026 | Silicon Valley’s power brokers spent the past year currying favor with President Trump. Two deadly shootings in Minneapolis are now exposing the price of that bargain. | 30/01/2026 04:10 PM | 4 | |

| 52,242 | 30/01/2026 03:27 PM | RobCo raises $100M, 2150 closes €210M Fund II, and reinventing the lightbulb | robco-raises-dollar100m-2150-closes-euro210m-fund-ii-and-reinventing-the-lightbulb | 30/01/2026 | This week, we tracked more than 70 tech funding deals worth over €710 million and over 15 exits, M&A transactions, rumours, and related news stories across Europe. Alongside the week’s top funding rounds, we’ve also curated the most important industry stories you need to know. If email is more your thing, you can always subscribe to our newsletter and receive a more robust version of this round-up delivered to your inbox. Either way, let's get you up to speed. ? Notable and big funding rounds?? RobCo raises $100M in Series C funding ?? Sokin eyes major expansion with £70M debt funding ?? Funnel secures $80M debt facility ???? Noteworthy acquisitions and mergers?? Sword Health is acquiring the Munich-based health startup Kaia Health for US$285M ?? finanzen.net group snaps up AI investing startup Vickii ??. Scoro acquires Envoice to close the project cost visibility gap ?? Belgium-based team.blue acquires Windsor.ai ? Interesting moves from investors? 2150 closes €210M Fund II, lifts assets to €500M to back urban and industrial climate tech ? Voyager Ventures closes $275M Fund II, reaching $475M in AUM ? Footprint Firm closes €76M Article 9 deeptech Fund for the green transition ? b2venture closes €150M Fund V at hard cap to support the next generation of European tech leaders ?️ In other (important) news? Qilimanjaro launches EduQit, a modular build-your-own quantum computer for education and research ⚖️ Legaltech Luminance unveils its biggest platform upgrade in a decade ??. Estonian Startup Awards 2025 show an AI comeback and DefenceTech momentum ??. Spotify confirms Turkish office opening ? Recommended reads and listens⚡. Northvolt former CEO: "Emotionally tough" raising funds for new venture +? How Distance Technologies is giving armoured vehicle crews x-ray-like vision ??. More European SPAC IPOs to come, says Einride boss ?? $1M+ raise for construction startup Arctis AI led by former fencing champion Dila Ekrem ??. How Redwerk built a global software business without middle managers or venture capital ?. Reinventing the light switch as Europe’s missing energy interface ? European tech startups to watch?? Pallma AI closes $1.6M pre-seed round for AI agent security ?? InsiderCX fuels its AI-powered patient experience platform with €1.5M investment ?? Mos Health secures $1.1M to expand personalised health offerings ?? Opportunity Health raises €334,000 ??. Carne Group secures strategic investment from Permira at a €1.4B valuation |

30/01/2026 04:10 PM | 1 | |

| 52,241 | 30/01/2026 03:00 PM | Last 24 hours to grab your +1 pass at 50% off to TechCrunch Disrupt 2026 | last-24-hours-to-grab-your-1-pass-at-50percent-off-to-techcrunch-disrupt-2026 | 30/01/2026 | 30/01/2026 03:10 PM | 7 | ||

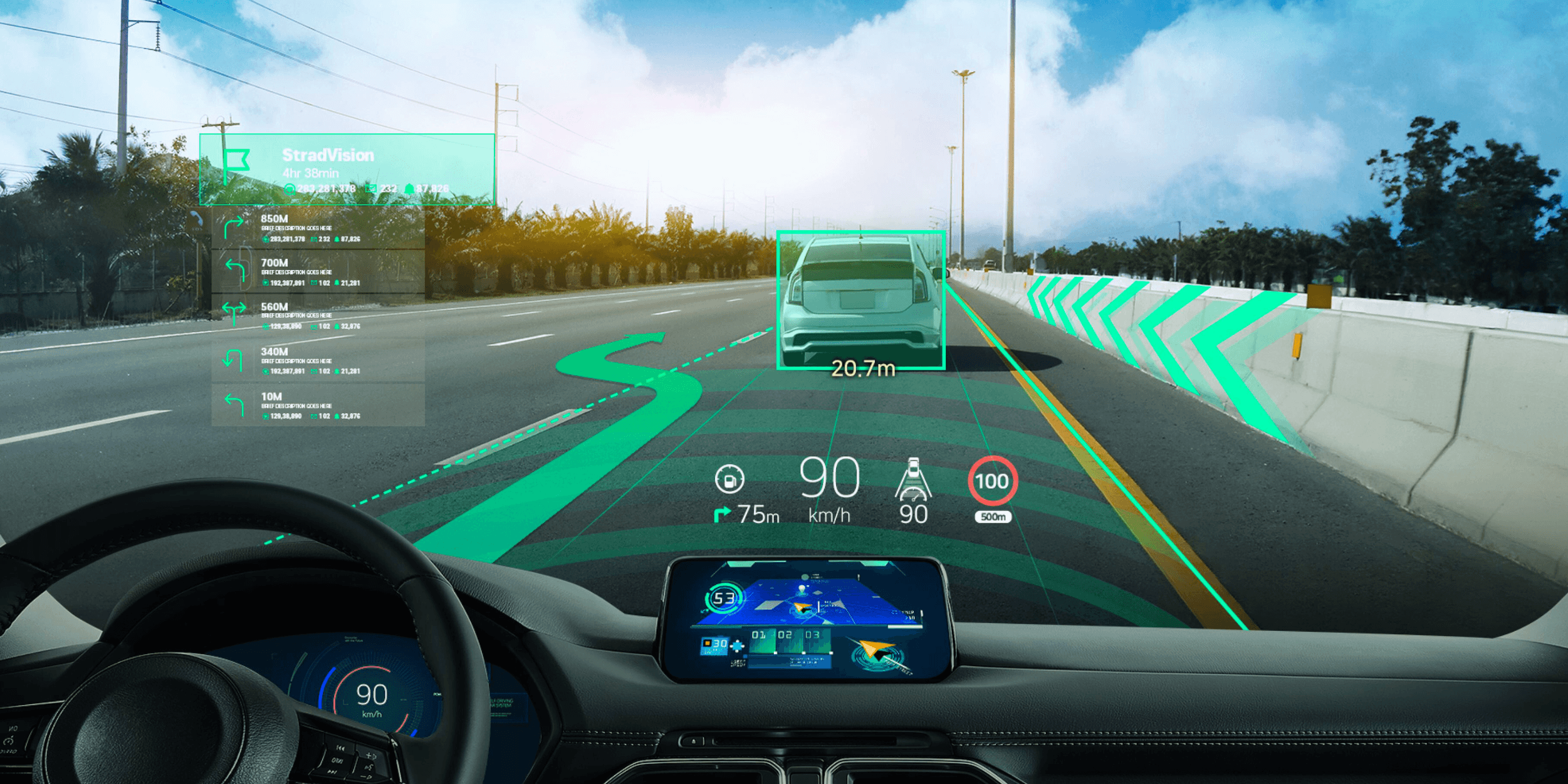

| 52,238 | 30/01/2026 02:00 PM | How Distance Technologies is giving armoured vehicle crews x-ray-like vision | how-distance-technologies-is-giving-armoured-vehicle-crews-x-ray-like-vision | 30/01/2026 | As defence shifts toward data-driven operations, digital terrain models, simulations, and sensor inputs are becoming central to how forces train, plan, and coordinate. Yet the interfaces used to access this information remain largely two-dimensional and siloed. So, how do you accurately perceive and understand what’s happening outside a vehicle —such as a tank — in real time? Mixed-reality visualisation offers a way forward by embedding complex, real-time spatial data directly into the user’s field of view. Distance Technologies is a Finnish startup pioneering glasses-free mixed reality, transforming transparent surfaces into augmented-reality displays. Its technology turns entire panes of glass into headset-free windows for next-generation XR using a computer-generated 3D light field that seamlessly blends with the real world. The approach is designed to enhance user experiences across automotive, aerospace, and defence by delivering immersive 3D visuals without the need for headsets or glasses. I spoke to Distance Technologies CEO Urho Konttori and CMO Jussi Mäkinen to learn all about it. From cars to combat vehiclesFounded in 2024, Distance Technologies develops light field-based head-up display technology. According to Mäkinen, the company has developed a waveguide-based system — think of it like a flip-down sun visor on your car.

While applicable across a broad range of applications, the company began to focus more heavily on defence in early 2025 after a practical realisation: automotive head-up displays are difficult to integrate into tanks, which typically lack windshields altogether. It now runs field trials roughly every two weeks with different partners. This includes tests in the UK on the Ajax armoured fighting vehicle platform, collaboration with Patria to develop a unique solution for use in low-visibility battlefield environments such as darkness or smoke, as well as trials with the Finnish Defence Forces. The company is collaborating with US-based Aechelon Technology on a full global 3D map at centimetre-level resolution that aims to enable real-time, in-flight mixed-reality training and defence applications that go beyond traditional ground-based simulators or VR goggles, including immersive cockpit overlays for pilot training, battlefield intelligence, and target analysis. “One of the beauties of this is that it’s fully real-time updatable,” explains Konttori.

Aechelon is also leading a broader industry collaboration called Project Orbion, alongside Niantic Spatial, ICEYE, BlackSky, and Distance Technologies, to create a continuously refreshed 3D reconstruction system. The consortium deployed the system for the first time at the US Coast Guard Aviation Training Centre. “You can have drone data feeds updating it, or satellite data from providers like ICEYE or BlackSky,” Konttori adds. “It’s essentially a 3D digital twin of the Earth that can be refreshed continuously.” According to Konttori, the team has also showcased its first field-operator HUD behind closed doors: a head-worn system designed to be easily applied across different operational contexts, whether the user is inside or outside the vehicle.

That growing volume of real-time data is also where AI shines. Konttori argues that aligning humans and AI will be a recurring theme across both the automotive and defence sectors.

Ukraine is redefining battlefield realityMäkinen asserts that most armies in the world have not faced the battlefield reality of Ukraine:

Konttori cautions that white sandboxing locally is great, “You cannot go to Ukraine unprepared, and you cannot waste anybody's time in there toying around with unready prototypes. It needs to be battlefield-ready.” Check out our interview with the Defence Innovation Network Finland (DEFINE). Why Distance Technologies is iterating its way to the battlefield’s next capabilityI wondered how you measure success when you’re creating capabilities that haven't existed before. Konttori asserts:

In response, the company focuses on faster iteration cycles with field trials, “so we can dare to try things and dare to fail," explained Konttori.

Edge computing over fragile connectivityDistance Technologies designs its systems with the assumption that connectivity on the battlefield is uneven, unreliable, and often absent. As a result, the company tries to perform as much processing as possible at the edge, within the vehicle itself, rather than relying on constant network access. Jussi Mäkinen explained, that the UK has the Bowman system deployed in around 27,000 vehicles today, which includes relatively decent, reliable communications and blue-force tracking as an integral part.” In aviation, this level of connectivity has existed for decades. But Mäkinen notes that connectivity reality drops off sharply once you move away from aircraft and armoured platforms. “When we go to infantry, they might be lucky if one team has a single radio,” he says.

That contrast is a key reason Distance Technologies focuses first on vehicles rather than individual soldiers. “Almost all vehicles have decent communication channels,” Mäkinen explains. Vehicles also have power budgets measured in kilowatts, enabling onboard compute and local AI that simply isn’t feasible at the individual soldier level today. Looking ahead, Mäkinen believes the digitisation of the individual soldier will come, but much later than the transformation now underway in vehicles and command systems. “Going to infantry will be a much longer period of change. Maybe in a decade, they’ll all be fully connected. I do see that transition,” he says. Central to that shift, he argues, is scale. Distance has been discussing future battlefield connectivity with Nokia, which has formed a dedicated defence entity and is pushing 5G — and eventually 6G — technologies into military environments.

Until that industrial-scale connectivity exists, however, defence systems must be designed to function in a fragmented communications landscape. For Distance Technologies, that means prioritising edge computing, vehicle-based platforms, and interfaces that continue to provide situational awareness even when networks degrade — rather than assuming a fully connected battlefield that, for now, remains more aspiration than reality. From defence to automotive OEMsBeyond defence-specific applications, Distance Technologies sees strong opportunities in sectors such as aviation and automotive. Konttori notes that it is a huge market and that the company currently has a strong partner helping to push its technology to market. The technology has strong potential in China, with a program requiring that all civil aircraft operating in the country be equipped with HUDs, and discussions of mandating HUDs for all autonomous vehicles. “If you have a self-driving car, you want to keep your eyes on the road,” Konttori explained.

Licensing the future of automotive HUDs

In terms of its business model. Distance Technologies plans to license its technology to Tier One automotive suppliers. “We license and work with Tier One to build the final hardware product, help them certify it, and provide the licenses, patents, and software needed to run it. This is very much computational optics, so the software and compute element are a huge part of the equation. That becomes a license-based revenue model for us,” Konttori said. One challenge and opportunity for Distance Technologies is leveraging the scale of the automotive side. Konttori explains that while you can’t use exactly the same supply chain, you want to be as close to economies of scale as possible. The company is working with a manufacturing partner that has facilities across the USA and Europe, including France, Sweden, Finland, the UK, and Ireland.

Defence buys capabilities, not componentsDefence, however, is different. In this sector, customers rarely buy components; they buy capabilities. “Even major integrators such as General Dynamics do not want to build every capability in-house if they can avoid it. They prefer to integrate capabilities from multiple providers into a powerful combined system,” explained Konttori. In this context, Distance Technologies would deliver more than just the HUD: it would also provide the compute platform to run it, the sensors needed for thermal and night-vision capabilities, and the software interfaces into the vehicle’s command communications systems. This shifts the model towards a combined hardware-plus-license offering. Europe lacks the ability to scale defencetech supply chainsFor Mäkinen, the issue is not just technology maturity but industrial capacity. He contrasts the current European defence supply model with the mass-scale production now visible in other parts of the world. “This is one area where defence in Europe, including the UK, is simply not at industrial scale today,” he says.

That mismatch, he warns, could become a strategic vulnerability if adversaries can field networked systems and sensors at mass scale and speed. “This will be one of the big challenges for Europe to realise by the end of this decade: we need to start going industrial scale,” Mäkinen says.

Looking ahead to the next iteration of Distance’s product roadmap, Konttori says the priority is moving from prototypes to early production.

|

30/01/2026 02:10 PM | 1 | |

| 52,244 | 30/01/2026 02:00 PM | What Series A founders get wrong about hiring | what-series-a-founders-get-wrong-about-hiring | 30/01/2026 | You just closed your Series A. The wire hit last week, and now you’re staring at a hiring plan that calls for tripling your team in eighteen months. Most founders treat this moment as a signal to start calling recruiters. That instinct, while understandable, often leads to the most expensive mistake of the scaling journey. Recruitment costs can quietly consume 15-20% of a round before anyone notices. Agency fees of 20-25% per placement add up fast when you’re hiring across engineering, product, and go-to-market. Factor in the lost productivity from extended searches and the compounding cost of bad hires, and the true expense of getting hiring wrong dwarfs what most founders budget. Mistake one: treating hiring as an event rather than a functionMost early-stage founders approach recruiting transactionally. A role opens, they engage an agency or post on LinkedIn, they fill it, and they move on. This works at seed stage when you’re hiring a handful of people you probably already know. It breaks completely when you need to hire 30 people in a year. Companies that scale efficiently treat talent acquisition as an infrastructure. They build employer brand assets before they’re desperate. They create interview processes that can be delegated without losing quality. They establish relationships with candidates months before roles open. None of this happens when hiring is treated as a series of isolated emergencies. According to the Atomico State of European Tech report, early-stage companies experienced a 35% drop in hiring rates in 2025, as founders opted for leaner, more intentional teams. The signal is clear: the best European founders are being more deliberate about every hire, building capability rather than just filling seats. Mistake two: optimising for speed over repeatabilityWhen your first engineering hire takes three months, the natural response is to throw resources at making the next one faster. Founders bring in multiple agencies, pay premium fees for exclusive searches, and compress interview processes to move quickly. This often works for individual hires while making the overall problem worse. The issue is that speed through brute force doesn’t compound. Each hire remains just as expensive and uncertain as the last. What compounds are building a recruiting engine: sourcing channels that reliably produce qualified candidates, interview loops that accurately predict performance, and compensation frameworks that close offers without endless negotiation. Embedded recruiting models have gained traction precisely because they address this gap. Rather than paying agencies per placement, companies bring in dedicated recruiters who work exclusively on their hiring, building institutional knowledge and repeatable processes. Mistake three: ignoring European talent dynamicsEuropean founders building remote-first companies sometimes assume they can hire anywhere, so regional dynamics don’t matter. This assumption collides with reality when they try to build engineering teams in Berlin, Amsterdam, or Zurich. The Atomico report found that the proportion of new hires in AI/ML roles grew 88% in 2025 compared to the previous year. Every funded startup building AI capabilities is now competing for the same limited pool of engineers with production experience. Meanwhile, net inflow of senior tech professionals to Europe is edging toward zero as Big Tech continues recruiting experienced engineers with substantial compensation packages. These market realities shape everything from timelines to offer structures. German candidates expect a three to six months’ notice period before starting. European engineers generally value equity less than their US counterparts, making total compensation packages more complex to structure. Understanding these dynamics before you need to hire is the difference between building a strong team and watching top candidates accept competing offers while you’re still scheduling final interviews. What the best founders do differentlyThe founders who navigate Series A hiring successfully share a counterintuitive trait: they start building recruiting capability before they think they need it. They designate someone on the founding team to own talent, even part-time. They invest in employer brand content and candidate pipelines during quieter periods. They establish relationships with recruiting partners who can scale with them rather than engaging agencies ad hoc. This approach requires spending money and attention on hiring infrastructure before the pain becomes acute. It feels premature in the moment. But the alternative is reaching the steep part of the growth curve and realising you’re trying to build the plane while flying it. The European startup ecosystem has matured dramatically. The founders raising Series A rounds today face more sophisticated competition for talent than any previous generation. The ones who treat hiring as infrastructure rather than an afterthought will be the ones still scaling two years from now. The post What Series A founders get wrong about hiring appeared first on EU-Startups. |

30/01/2026 04:10 PM | 6 | |

| 52,240 | 30/01/2026 01:52 PM | Apple buys “Silent Speech” AI startup for $2B, because talking is so 2025 | apple-buys-silent-speech-ai-startup-for-dollar2b-because-talking-is-so-2025 | 30/01/2026 |  Apple confirmed this week that it has acquired Israeli AI startup Q.ai in a deal valued at close to $2 billion, making it one of the company’s largest acquisitions ever, second only to the $3 billion purchase of Beats in 2014. But check your assumptions: this isn’t Beats 2.0. There’s no new headphone brand to flex. Instead, Apple is paying top dollar for tech that might let your devices understand you without you ever saying a word. These days we put our phones on silent so they won’t disturb us; soon the phone will put us on silent so it… This story continues at The Next Web Or just read more coverage about: Apple |

30/01/2026 02:10 PM | 3 | |

| 52,239 | 30/01/2026 01:45 PM | More European SPAC IPOs to come, says Einride boss | more-european-spac-ipos-to-come-says-einride-boss | 30/01/2026 | The CEO of Swedish autonomous truck startup Einride believes more European startups will follow Einride and go public via a SPAC. Einride is going public on the New York Stock Exchange via a SPAC (Special Purpose Acquisition Company), a vehicle which is designed as an alternative route for companies to go public. The SPAC IPO values Einride at $1.8bn. SPAC firms raise capital via an IPO to acquire a private company and take it public. A SPAC listing is seen as attractive to startups as they can fast-track a listing, without the expense, time and hassle of going through a conventional IPO. SPAC IPOs leaped in popularity in 2020, but then fell out of favour, amid falling stock prices and big investor losses. Einride CEO Roozbeh Charli said: "There’s definitely more SPACs looking for target companies. I think it will naturally be the case that you will see more European companies going down that path as well. It has been an attractive path for a number of companies." Lorenzo Roversi, managing director UK & Nordics, IonQ, which went public via a SPAC, who also sits on the Einride board, agreed. He said: “There are more and more mentions of SPACs in Europe. It seems to be that some of the deeptech companies are really embracing this.” Examples of European firms going public via a SPAC include Lilium, the German flying taxi startup, which shut down in 2025 and Cazoo, the UK online car retailer. The pair of executives, speaking to Tech.eu at the GoWest VC conference in Gothenburg, also discussed why Einride chose to IPO via a SPAC instead of a traditional listing or carry out further private fundraising. Charli said: “I think the combination of being at an inflection point as we are as a business, having accumulated contracts, getting into the next step of scaling with customers, so we really need to push to scale with those customers, combined with how the US capital markets are and having access to that capital and where we see our peers going in the US public markets, I think for us it makes good sense.” Roversi said: “We are a public market company. We are delivering value already at such a significant level that going through another private round of a Series D doesn’t make sense. The capital requirements we have, the returns we are giving to investors, are at that level.” On the challenges of a SPAC listing, Roversi said: "The added complexity of a SPAC is ensuring you manage not only attracting new investors into the company but manage the expectations of those people who are already invested in the listed entity. “So we want to really minimise those redemptions The best way to do that is not only to show the initial value of the listing is going to be higher but the growth journey is there.” While redemption rights help incentivise investors by ensuring they have a money-back guarantee, if a large number of shareholders exercise their redemption rights, it can significantly reduce the cash available for the combined entity moving forward. The SPAC merger between Einride and blank-check firm Legato is expected to be completed in the first half of this year. But Roversi said there could be a pushback on the timeline- citing last year’s US government shutdown, which delayed financial market activity. He said: “Obviously, the timeline was impacted a little bit by the government shutdown because we are listing in New York. We were aiming for the first quarter but that may now slip out to September. "A lot of this is dependent upon the backlog the New York Stock Exchange has and where we are with other listing processes. Internally, we are in a really strong position to keep our initial timeline.” |

30/01/2026 02:10 PM | 1 | |

| 52,245 | 30/01/2026 01:20 PM | Not letting context collapse: from Series A growth to Series B readiness | not-letting-context-collapse-from-series-a-growth-to-series-b-readiness | 30/01/2026 | Series A is often described as a slingshot, but for many founders it feels more like a centrifuge. The centre wobbles, momentum increases, and yet outcomes can feel oddly misaligned. Roughly half of startups stall or fold after Series A, not because they fail to grow, but because growth alone does not create organisational alignment. Series A tends to validate demand. Series B, by contrast, tests whether a company can operate as a coherent system under sustained pressure. The transition between the two is less about speed and more about structure. What follows are five principles that helped bridge that gap, moving from execution-driven growth to operational readiness for scale. From feature expansion to structural leverageMany Series A companies grow by adding features to a working product. This is often effective in the short term, but it can also reinforce hidden constraints in the underlying model. In our case, we realised that incremental feature development would only scale output within the limits of existing delivery mechanisms. The inflexion point came from asking a different question: what needs to be built so that value can be delivered repeatedly, across contexts, without proportional increases in complexity? Shifting from feature thinking to infrastructure thinking forced a reassessment of priorities, trade-offs, and internal coordination. For founders, the takeaway is simple: Series B readiness often depends less on what you add and more on what you redesign underneath. Build a mission that constrains decisionsAt scale, ambiguity is expensive. A mission that works in early stages as inspiration must evolve into something operational: a system that constrains choices and accelerates decision-making. We found it necessary to define success in concrete, measurable terms that aligned teams across product, engineering, and partnerships. This reframing changed how decisions were made. Instead of asking what to build next, the question became what capabilities must exist for the company to win in the environments it operates in. A mission that functions as a pressure system is not motivated by aspiration alone. It reduces cognitive load and forces trade-offs in the right direction. Protect focus by editing aggressivelyFocus is often framed as rejecting bad ideas. In reality, the hardest discipline at Series A and beyond is turning down good ones. As opportunities multiply, it becomes tempting to pursue adjacent wins. But not every promising initiative strengthens a company’s core advantage. Treating strategy as a thesis rather than a roadmap helped clarify this. Anything that did not reinforce the central argument was removed, even if it looked attractive in isolation. For founders, this means shifting from being feature approvers to becoming editors. The goal is not breadth, but coherence. Introduce ownership at the level of outcomesAs systems grow, coordination costs tend to rise faster than headcount. Traditional organisational structures often push decisions upward just as speed becomes critical. One effective response is to create roles with clear, end-to-end ownership of outcomes rather than functions. These operators sit close to real-world signals, monitor performance in practice, and coordinate directly across disciplines to resolve issues quickly. The key is not hierarchy, but proximity to feedback. Decisions improve when they are made by those closest to the consequences. Treat communication as infrastructureContext collapse is one of the most common and least visible failure modes in scaling companies. When shared understanding erodes, assumptions diverge, and errors propagate quietly. At this stage, communication cannot be left to habit. It needs to be designed. That means measuring clarity, reducing latency, and codifying decisions so they persist beyond meetings. In practice, this often involves stripping communication down, moving more decisions into asynchronous documentation, and being explicit about trade-offs. The payoff is not just speed, but resilience. Teams regain deep work time, decisions stick, and system-level understanding remains intact as the organisation grows. Series A can prove that something works. Series B asks whether it can work reliably, repeatedly, and at scale. For founders navigating that transition, growth validates demand, but system design determines whether the company can endure it. The post Not letting context collapse: from Series A growth to Series B readiness appeared first on EU-Startups. |

30/01/2026 04:10 PM | 6 | |

| 52,237 | 30/01/2026 12:35 PM | The tech gender gap in the UK will not be equal until 2060 | the-tech-gender-gap-in-the-uk-will-not-be-equal-until-2060 | 30/01/2026 | The UK loves to congratulate itself on innovation.

A sobering verdict

A new report published this week by The Entrepreneurs Network, produced in partnership with Barclays, delivers a sobering verdict. On current trends, female academic entrepreneurs in the UK may not reach parity with their male counterparts in spinning out companies until 2060. Blind to realities faced by womenSuccessive governments have recognised this, pressuring universities to demand less equity, reduce bureaucratic drag and make it easier for academics to commercialise their work. Some progress has followed. But as this report makes clear, it has been too incremental, too uneven and too blind to the realities faced by women trying to navigate the system. In 2023, fewer than 8% of UK spinouts had all-women founding teams, while more than three-quarters were all-male. Mixed teams filled the remaining gap. Those numbers have improved slightly in recent years, partly due to the Government’s Independent Review of University Spin-Out Companies, but the underlying structure remains unchanged. Caring responsibilties narrow opportunitiesThis ‘time poverty’ is not accidental. Much of the spinout ecosystem is built around evening networking, informal investor access and an assumption of uninterrupted availability. For founders with caring responsibilities, rarely men, this quietly but effectively narrows what feels possible. None of this is radical

None of this is radical. All of it is overdue. The central message is simple. The UK does not have a shortage of female academic talent. It has a system that still treats commercial ambition as an optional extra, and a risky one, particularly for women. |

30/01/2026 01:10 PM | 1 | |

| 52,232 | 30/01/2026 12:10 PM | Carne Group secures strategic investment from Permira at a €1.4B valuation | carne-group-secures-strategic-investment-from-permira-at-a-euro14b-valuation | 30/01/2026 | Carne Group, Europe’s largest independent third-party management company and a provider of fund regulation and governance services, has agreed to sell a significant minority stake to funds advised by Permira at an enterprise valuation of €1.4 billion. As part of the transaction, Vitruvian Partners will exit its minority stake acquired in 2021, alongside several other minority shareholders. Carne’s founder, management team, and employees will retain a majority ownership in the group, with founder and CEO John Donohoe continuing to lead the business. Founded in 2004, Carne provides services across the fund lifecycle, supporting asset managers in areas including risk management, compliance, oversight, and governance. The investment represents a new phase in Carne’s development, with Permira providing capital and industry expertise to support continued growth. Since the investment from Vitruvian in 2021, the group has expanded its operations and strengthened its position across Europe. Commenting on the transaction, John Donohoe said the partnership with Permira marks an important milestone in Carne’s long-term development, aligning with the company’s growth plans as the industry evolves, while allowing it to expand its reach, continue serving clients, and maintain its independence. Permira’s backing is expected to support further investment in Carne’s technology platform, Curator, including product development, commercial capabilities, and advancements in areas such as AI and automation, while enabling the company to scale its services globally in response to growing demand for outsourced solutions. |

30/01/2026 12:10 PM | 1 | |

| 52,233 | 30/01/2026 11:35 AM | Mos Health secures $1.1M to expand personalised health offerings | mos-health-secures-dollar11m-to-expand-personalised-health-offerings | 30/01/2026 | Mos Health, a Polish-American startup developing an AI-based health platform for personalised protocols and supplements, has raised $1.1 million in a pre-seed round co-led by SMOK Ventures and Movens Capital, with participation from Tomasz Karwatka, Piotr Karwatka, Anna Lankauf, and others. Mos Health is a preventive health and lifestyle wellness company focused on making health solutions practical for everyday use. With only 25 per cent of U.S. adults meeting recommended activity levels and many diets failing due to low adherence, the company aims to address an execution gap by combining personalised guidance with tools that support consistent action. The platform is built around two integrated components. The AI Health Partner app analyses data from sleep, nutrition, lab tests, and wearable devices such as Apple Watch and Oura to generate personalised health protocols. This is complemented by a proprietary line of supplements produced with a U.S.-based manufacturing partner, designed to support implementation of the app’s recommendations. Patrycja Brzozowska, founder and CEO of Mos Health, said the company was created out of her own challenges with maintaining consistency.

Brzozowska said. Mos Health is launching in the US with a B2B2C model that enables employers to offer personalised health protocols and supplements as part of their employee benefits. Commenting on the US launch, Paweł Chrzan, co-founder of Mos Health, said the market enables faster adoption of innovation by companies and users.

Chrzan added. The company plans to use the funding to develop its MVP, advance its core technology, and begin initial deployments in the US. |

30/01/2026 12:10 PM | 1 | |

| 52,235 | 30/01/2026 11:30 AM | Silicon Valley Tech Workers Are Campaigning to Get ICE Out of US Cities | silicon-valley-tech-workers-are-campaigning-to-get-ice-out-of-us-cities | 30/01/2026 | Even as Big Tech CEOs curry favor with President Trump, Silicon Valley employees are calling on their bosses to use their influence to help stop his immigration policies. | 30/01/2026 12:10 PM | 4 | |

| 52,234 | 30/01/2026 11:27 AM | EU commits €10M to accelerate Ukraine's digital integration with Europe | eu-commits-euro10m-to-accelerate-ukraines-digital-integration-with-europe | 30/01/2026 | The European Union has allocated €10 million to support the development of digital public services in Ukraine and their alignment with European standards. According to Oleksandr Bornyakov, Acting Minister of Digital Transformation of Ukraine, cooperation with the European Union and the Academy of Electronic Management is a long-standing success story that laid the foundation for our digital sustainability.:

Diia is a single-state portal developed over the last few years that includes over 70 digital services — you can become an entrepreneur in Ukraine in just 2 seconds and found a limited liability company in 30 minutes. Over 1,000,000 private entrepreneurs and more than 14,000 companies have already used the service. The partnership with the European Union on Ukraine's digital transformation has been ongoing for almost a decade. The funding will support the following key areas:

The project is implemented by the Academy of Electronic Management (Estonia). The Academy of Electronic Management has been working with Ukraine since 2012, supporting the country's digital transformation through reforms, crises, and, now, a full-scale war. According to Hannes Astok, Executive Director, Academy of Electronic Management, this long-term partnership proves that digital solutions are not only technology, but also trust, sustainability and the state's ability to serve its citizens under all circumstances.

|

30/01/2026 12:10 PM | 1 | |

| 52,236 | 30/01/2026 11:20 AM | GuestReady’s acquisition of Lightbooking lifts Spanish portfolio by 200+ units, taking global total beyond 4,000 | guestreadys-acquisition-of-lightbooking-lifts-spanish-portfolio-by-200-units-taking-global-total-beyond-4000 | 30/01/2026 | GuestReady, a Swiss short-term rental management company, is expanding into the Canary Islands with the acquisition of Lightbooking, a Spanish vacation rental management and distribution operators. This strategic acquisition will add more than 200 units to GuestReady’s Spanish portfolio and brings the group’s overall portfolio to over 4,000 units globally, evolving its position in the European hospitality market. “This acquisition marks an important step in GuestReady’s European journey. Expanding into the Canary Islands strengthens our position among Europe’s leading professional hospitality operators. Under Gustavo’s leadership, Lightbooking has built a truly market leading platform in the Canary Islands, with deep local expertise and a strong reputation with both owners and guests. We’re proud to welcome such a strong team and portfolio into GuestReady,” says Alexander Limpert, CEO and co-founder of GuestReady and guest writer for EU-Startups. In the wider European short-term rental, hospitality and property management landscape, recent activity from 2025–2026 shows continued capital flowing into technology-led operators adjacent to GuestReady’s model. In Switzerland, Azuro raised €5 million to develop a user-owned portfolio of smart vacation homes, reflecting growing interest in alternative ownership and professionally managed holiday accommodation. In Germany, Berlin-based Buena secured €49 million to digitise and automate residential property management workflows using AI. At the larger end of the market, Dutch hospitality software provider Mews raised €255 million in January 2026 to expand its automation and payments platform for hotels and serviced accommodation. While none of these announcements relate directly to a Spanish short-term rental operator, together they indicate approximately €309 million invested into hospitality and PropTech platforms across Europe over the period. Against this backdrop, GuestReady’s acquisition of Lightbooking appears consistent with a broader shift towards scale, consolidation and technology-driven operations in the European short-term rental ecosystem. “What impressed us most about GuestReady was the professionalism of their operating model and the strength of their technology platform. RentalReady is truly best-in-class, and we see a strong opportunity to scale our portfolio under a unified management approach while delivering outstanding value to both owners and guests,” adds Gustavo Guevara, CEO of Lightbooking. Founded in 2016 and 2015 respectively, GuestReady and Lightbooking operate in closely aligned markets with shared objectives, making the acquisition a natural strategic fit within the short-term rental ecosystem. Already operating in key Spanish urban markets such as Barcelona, Madrid, and Valencia, GuestReady offers a fully integrated vacation rental management solution and currently operates in seven countries across Europe and the Middle East, managing more than 4,000 properties in over 50 cities with an average occupancy rate of 78%. Lightbooking complements this footprint with a strong presence in Southern Europe, particularly the Canary Islands and Andalucía, providing end-to-end services ranging from multi-platform listings and dynamic pricing to guest communication, check-in processes and property maintenance, all aimed at maximising returns for owners while ensuring a smooth booking experience for travellers. This acquisition is GuestReady’s 12th since the company was founded, and the third completed over the last 12 months – it also represents a major milestone for GuestReady, nearly doubling the company’s presence in Spain. GuestReady now manages approximately 400 active apartments nationwide. The company now operates close to:

In the Canary archipelago, the portfolio is spread across Gran Canaria, Tenerife, Fuerteventura, Lanzarote, La Palma, El Hierro, and La Gomera. In Andalusia, GuestReady operates in key cities and destinations including Seville, Cádiz, Málaga, Granada, Huelva, and Córdoba. In terms of asset mix, approximately 70% of the portfolio consists of entire buildings, while 30% is owned by individual landlords. “In the short term, our focus is on integrating teams and building a shared culture, as both organisations come from different backgrounds. In the medium term, our goal is to optimize resources, grow sustainably, and become a leading reference for professional property management in the Canary Islands, while delivering a consistent, high-quality service to both owners and guests,” shares Lorenzo Ritella, Country Manager, GuestReady. As many owners explore alternatives to traditional tour operator models, which often reduce flexibility and limit profitability, GuestReady looks to offer a professional and adaptable approach. GuestReady will bring its technological platform and scalable processes, including:

Looking ahead, GuestReady aims to reach 600 active apartments in Spain by 2026, combining organic growth, portfolio expansion, and strategic transactions such as the acquisition of Lightbooking. The Canary Islands are expected to play a central role in this strategy, particularly through the management of entire buildings and bungalow-style complexes, which allow for more efficient and sustainable scaling. EU-Startups has followed GuestReady over several years through editorial contributions, event participation and coverage of key growth milestones. In 2025, GuestReady’s CEO and co-founder Alexander Limpert appeared as a guest writer on EU-Startups with three in-depth opinion and insight articles:

The company has also been a recurring presence at the EU-Startups Summit, first participating in a 2020 panel discussion on the future of Airbnb management and short-term rentals (panel announcement), and later featuring again when Limpert was announced as a speaker for the 2025 edition of the Summit (speaker announcement). From a company-building perspective, EU-Startups has also reported on GuestReady’s financing and expansion, including its €700k funding round in 2016, its $3 million raise alongside the acquisition of Easy Rental Services in 2017, and its 2018 acquisitions of Oporto City Flats and We Stay In Paris. Beyond the EU-Startups brand, Limpert has also participated as a speaker at the 2025 FutureTravel Summit (speaker profile), the former sister brand of EU-Startups. The post GuestReady’s acquisition of Lightbooking lifts Spanish portfolio by 200+ units, taking global total beyond 4,000 appeared first on EU-Startups. |

30/01/2026 12:10 PM | 6 | |

| 52,230 | 30/01/2026 11:08 AM | Spotify confirms Turkish office opening | spotify-confirms-turkish-office-opening | 30/01/2026 | Spotify has confirmed it will open its office in Turkey, saying the country is a “priority market”, following a spat between the streaming giant and the Turkish government. Spotify said it will open an office in Istanbul by the end of June, saying “opening an office in Istanbul is not a symbolic move for Spotify, it’s a structural one". It added: "Turkey is a priority market for us, and deepening our presence reflects our long-term commitment to the country’s music ecosystem, its creators, and its culture.” The Turkish government has previously confirmed the opening of the office. The Swedish streaming giant has also appointed long-term Spotify executive Akshat Harbola to oversee its Turkish operations and said that its Turkish office will scale this year, appointing new staff. Spotify pointed to figures showing that Turkish music was seeing strong growth, with 52m users outside Turkey listening to Turkish-language tracks in 2025, with export streaming up over 160 per cent since 2020. Spotify, which launched in Turkey in 2013, has also pledged to amplify the voices of female and emerging artists in Turkey. Spotify's commitment to Turkey follows last year's spat between Spotify and the Turkish government, which saw Spotify threaten to pull out of Turkey in a row over playlists that ridiculed president Erdogan’s wife and, in particular, her claimed lavish spending. The Turkish government accused the streaming platform of hosting “content that targets our religious and national values and insults the beliefs of our society”. It also accused Spotify of not supporting local music. The Turkish government demanded that the Swedish streaming company open a physical office in the country and the competition authority opened an investigation into whether Spotify engaged in anti-competitive practices. However, the spat appeared to have been resolved following a meeting between the Turkish government and Spotify executives. |

30/01/2026 11:10 AM | 1 | |

| 52,231 | 30/01/2026 09:35 AM | UK’s WealthAi closes €837k pre-Seed to automate workflows for private banks and family offices | uks-wealthai-closes-euro837k-pre-seed-to-automate-workflows-for-private-banks-and-family-offices | 30/01/2026 | London-based WealthAi, a FinTech company and the first AI-driven OS designed specifically for wealth managers, family offices and private banks, has raised an initial €837k ($1 million) pre-Seed. The round was led by Fuel Ventures and Founders Factory. “WealthAi is built for a new era of wealth management – one where AI is not bolted on, but embedded at the core of how firms operate,” says Jason Nabi, founder and CEO of WealthAi. “The wealth industry is about 12 months behind the legal profession in terms of AI adoption. In 2024, there was growing interest but little real action, this all started to change last year. I believe we are launching WealthAi at the perfect time as the industry looks to adopt AI over the coming years to enable scale and better performance.” In a broader European context, WealthAi’s pre-Seed round comes amid continued funding activity across WealthTech, FinTech and AI-driven financial software in 2025. In France, Finary raised €25 million in a Series B round to scale its AI-powered wealth management platform across Europe. In the UK, Clove secured €12 million at an early stage to build a digital wealth management platform, making it a geographically relevant comparison to London-based WealthAi. Adjacent to wealth management, Stockholm-based Grasp raised €6 million to develop AI productivity tools for financial analysts and consultants, while UK FinTech Coremont attracted €34 million in growth funding to accelerate its institutional analytics platform. Taken together, these 2025 funding rounds represent more than €77 million invested into AI-enabled and software-led financial services platforms, providing a backdrop to WealthAi’s smaller, early-stage raise. “As wealth managers move from experimentation to implementation, the ROI on AI is becoming clearer,” adds Andrea Guzzoni, Sector Director at Founders Factory. “By automating manual processes and eliminating spreadsheet-driven workflows, platforms like WealthAi are helping firms reduce cost, improve productivity and scale without adding complexity.” WealthAi was founded in 2023 by Jason Nabi, a FinTech operator who has launched and scaled platform businesses for institutions including BNP Paribas and Paxos, alongside co-founder Paul de Gruchy, who has held senior roles across major global financial institutions and industry bodies. The platform, which went live in 2025, replaces fragmented legacy infrastructure with a modular AI layer that enables firms to deploy, test and scale AI-driven workflows without large-scale system overhauls or vendor lock-in. WealthAi combines a desktop assistant, specialised AI agents, deterministic workflows for regulated processes and a pre-integrated marketplace of wealth management services, helping advisers automate administration, strengthen compliance and deliver personalised client service at scale. “The team at WealthAi stood out to us immediately as the first we’ve met that is entirely focused on not only improving working lives for this extremely unique set of customers but doing so in an entirely AI-centric way,” says Mark Pearson, founder of Fuel Ventures. According to data provided by WealthAi, one in three wealth management professionals rely on 10 or more separate systems in their daily work with client information fragmented across platforms that don’t communicate to one another. As a result, advisers are forced to manually rekey data, consuming valuable time, increasing operational risk and driving up costs. Despite acknowledging their digital immaturity, the company says digital transformation for wealth managers, private banks and family office managers has been slow. These individuals consistently cite the cost, complexity and risk of disrupting day-to-day client service as key barriers to overhauling core system. WealthAi’s single, AI-native OS looks to eliminate wealth managers, family offices and private banks’ fragmented systems. The platform combines built-in connectivity, shared data and access to tools across the tech stack, all surfaced through WealthAi Assistant – an agentic AI interface that supports managers, compliance and operations teams in their day-to-day work. WealthAi Assistant orchestrates workflows, automates tasks end-to-end and understands the context of each task, pulling in the relevant systems and data for that user’s role. “Not only is WealthAi building AI that underpins a marketplace platform that truly understands the specific pain points that wealth managers face, they are constructing it on an entirely modular architecture. This means that firms don’t have to test their mettle by overhauling their systems entirely. Instead they can pick, adopt and adapt to distinct, individual modules at a pace that suits them and their clients,” Mark. WealthAi also offers a marketplace of pre-integrated services coordinated by AI agents, all of which allow end-to-end processes to run as one connected system. The platform integrates with established providers including Morningstar, Capital Economics, MDOTM, PlannerPal and Axyon, and is supported by a developing data aggregation capability that will provide access to data from more than 200 custodian banks, supporting front-, middle- and back-office use cases. WealthAi’s OS is available on a wholly modular basis. Clients typically adopt one or two agent modules initially, such as Suitability (Agent-driven AI to demonstrate strong regulatory control and confidence), CRM Automation (Agents interrogate CRM data more quickly and effectively, helping advisers make insightful recommendations with greater efficiency), or Investments (an agent-orchestrated workflow to research investments, structure portfolios through to issuing trading instructions). Clients then expand their use of the OS, adding more modules to their workflows. The post UK’s WealthAi closes €837k pre-Seed to automate workflows for private banks and family offices appeared first on EU-Startups. |

30/01/2026 11:10 AM | 6 | |

| 52,228 | 30/01/2026 09:00 AM | Spain’s rising tech scene: 10 of the most promising startups driving change in 2026 | spains-rising-tech-scene-10-of-the-most-promising-startups-driving-change-in-2026 | 30/01/2026 | Following our series of country articles, today we turn our attention to Spain’s innovation landscape, exploring the factors shaping its startup ecosystem and highlighting the momentum behind a new generation of fast-growing technology companies. Spain has strengthened its position as one of Southern Europe’s most dynamic startup hubs, supported by an expanding investor base, a strong talent pool, and increasingly international ambition. Cities such as Barcelona and Madrid act as the main engines of this growth, with emerging hubs in Valencia and Bilbao contributing to the ecosystem’s diversity. Innovation is particularly strong across AI, fintech, healthtech, robotics, and cybersecurity, reflecting Spain’s broad-based approach to digital transformation. In this article, we take a closer look at the Spanish entrepreneurial landscape by highlighting 10 promising startups, all founded between 2024 and today.

Founded in 2024 and headquartered in Tórtola, Accountable is a fintech startup building a real-time financial verification standard for both traditional and crypto-native markets. Its platform enables institutions to continuously prove assets and liabilities without disclosing sensitive information, addressing one of the key trust gaps in tokenised and on-chain financial products. At the core of the platform is the Data Verification Network, a privacy-preserving infrastructure that verifies on-chain and off-chain activity in real time and powers all Accountable products. These include Proof of Solvency, Vault-as-a-Service for structuring tokenised yield and credit products, and YieldApp, a marketplace surfacing verifiable yield opportunities backed by continuous proof. The platform already verifies more than $2 billion in assets across over 100 blockchains and 75 data sources. Accountable has raised €8.2 million to scale its verification network and expand adoption among financial institutions and asset managers.

Founded in 2024 and based in Barcelona, Biorce is a medtech startup developing an AI-native platform designed to accelerate and optimise clinical trials without compromising regulatory compliance. Its platform supports protocol design, feasibility analysis, and regulatory planning within a single workspace, helping clinical teams reduce complexity, cut costs, and shorten development timelines. Trained on more than 560,000 clinical trials, Biorce’s AI enables faster trial preparation, fewer protocol amendments, and earlier patient access to new treatments, while remaining compliant with global regulatory standards such as those of the FDA, EMA, and PMDA. Built by former CRO professionals, clinicians, regulatory experts, and AI specialists, the company has raised €8.5 million to develop its platform further and support pharmaceutical, biotech, and CRO partners across global markets.

Founded in 2024 and based in Barcelona, Kabilio is an AI-powered platform designed to automate accounting, tax, and invoicing processes for SMEs, freelancers, and accounting firms in Spain. Its solution simplifies digital invoicing, enables compliance with Verifactu and Spain’s anti-fraud regulations, and streamlines collaboration between businesses and their tax advisers by sharing financial data automatically. Kabilio’s AI layer automates repetitive tasks such as invoice processing, bank reconciliation, and accounting entry generation, helping firms reduce manual workload, errors, and operational bottlenecks. Fully integrated with existing accounting software, the platform is built to scale across advisory firms managing large client portfolios. The company has raised €4 million to expand its product offering and support the digital transformation of accounting and tax services in Spain.

Established in 2025 and headquartered in Bilbao, Lookiero Outfittery Group operates in the online personal shopping and fashion e-commerce space. The group combines data-driven styling with personalised recommendations to deliver curated fashion experiences to customers across Europe. By integrating technology, logistics, and human stylists, the company aims to optimise inventory management and customer satisfaction at scale. Lookiero Outfittery Group has raised €17 million to support growth, platform development, and international expansion.

Founded in 2024 and based in Barcelona, Murphy AI develops an AI-powered debt collection platform designed to replace manual collection work with autonomous, compliant AI agents. The platform enables financial institutions to execute end-to-end debt servicing strategies across 100% of eligible portfolios, operating continuously and at scale without the operational constraints of traditional call centre or agency-based models. Murphy AI is built with compliance, auditability, and brand protection at its core, allowing clients to fully define conversation paths, tone, and decision logic while ensuring every interaction is tracked and logged. Operating across more than 30 countries and multiple languages, the platform supports banks, debt collection agencies, NPL funds, and fintechs seeking higher recovery rates at lower cost. To date, they have secured €12.6 million to develop their AI agents further and expand international deployments.

Founded in 2025 and based in Madrid, Omnia is an AI engine search optimisation platform designed to help brands improve their visibility across AI-powered search engines and assistants. As discovery increasingly shifts towards systems such as ChatGPT, Perplexity, and Google AI Overviews, Omnia enables companies to monitor how their products and services appear in AI-generated responses. The platform tracks prompts and topics users search for in AI engines, analyses brand visibility and share of voice against competitors, and identifies where AI systems source information from. By converting this data into actionable insights, Omnia helps brands optimise content placement and strategy for AI-native discovery channels. The company has raised €3.5 million to develop its platform and support brands adapting to the next generation of search and digital visibility.

Founded in 2025 and based in Madrid, Orbio is an AI-native HR platform designed for enterprises and large workforces. The company develops autonomous AI agents that automate end-to-end HR processes, from recruitment and onboarding to employee insights and retention analysis, helping organisations reduce manual work and improve hiring efficiency at scale. Orbio’s platform combines an AI-driven recruitment agent with built-in applicant tracking, multilingual candidate engagement, and real-time workforce insights. Designed to integrate with existing HR and enterprise systems, it enables faster time-to-hire, improved candidate matching, and data-driven decision-making across the employee lifecycle. The company has raised €6.4 million to expand its AI agents and support enterprise deployments across multiple markets.

Founded in 2024 and based in Madrid, Ringr.ai is a conversational AI platform designed to automate and optimise phone-based interactions across customer service, sales, and operational use cases. Its technology enables organisations to handle large volumes of inbound and outbound calls simultaneously, using highly natural, multilingual voice AI tailored to each brand’s tone and requirements. Ringr.ai goes beyond traditional voice bots by combining conversational AI with deep analytics, campaign management, and system integrations, allowing calls to trigger actions such as CRM updates, appointment scheduling, or follow-up messages. The platform supports more than 30 languages and is used across sectors, including healthcare, insurance, tourism, retail, and debt collection. Certified under ISO 27001 and fully GDPR-compliant, the company has raised €4.2 million to further develop its voice AI technology and accelerate expansion across Europe.

Founded in 2024 and based in Valencia, Voltrac is a robotics company developing an autonomous, fully electric tractor platform designed to operate in demanding environments. Its flagship product, THOR, is built for continuous operation in harsh conditions and features a modular, all-wheel-drive electric architecture that reduces mechanical complexity and maintenance requirements compared to conventional tractors. Designed for both agricultural and frontline logistics use cases, THOR supports long operational cycles, heavy cargo transport, and autonomous navigation across challenging terrain. In agriculture, the platform addresses labour shortages and operational efficiency, while in logistics, it enables supply transport and support missions without risking human operators. Voltrac has raised €9 million to scale production, further develop its autonomy system, and expand deployments across Europe.

Founded in 2024 and based in Barcelona, Zynap is a cybersecurity startup developing an agentic AI workflow platform designed to help organisations move from reactive defence to proactive threat prevention. Its platform acts as an operational layer for security teams, unifying tools, data sources, and workflows into a single, automated security ecosystem. Zynap enables security operations teams, enterprises, and managed security service providers to automate large parts of the cybersecurity lifecycle, from threat intelligence and detection to response and remediation. Using context-aware AI agents and low-code workflows, the platform reduces manual work, accelerates incident analysis, and improves threat relevance without requiring organisations to replace their existing security stack. The company has raised €11.7 million to further develop its agentic AI platform and expand adoption across enterprise and MSSP environments. By the way: If you’re a corporate or investor looking for exciting startups in a specific market for a potential investment or acquisition, check out our Startup Sourcing Service! The post Spain’s rising tech scene: 10 of the most promising startups driving change in 2026 appeared first on EU-Startups. |

30/01/2026 09:10 AM | 6 | |

| 52,229 | 30/01/2026 08:06 AM | Polish-American startup Mos Health raises nearly €920k for its AI-powered preventive health and wellness platform | polish-american-startup-mos-health-raises-nearly-euro920k-for-its-ai-powered-preventive-health-and-wellness-platform | 30/01/2026 | Mos Health, a Polish-American startup building an AI Health Partner that combines personalised health protocols with matched supplementation, has raised nearly €920k ($1.1 million) in a pre-Seed round to build its MVP, develop its core technology, and initiate its first U.S. deployments. The round was co-led by SMOK Ventures and Movens Capital, with participation from Tomasz Karwatka, Piotr Karwatka, and Anna Lankauf, among others. “Mos Health was born from my own struggle to stay consistent. I realised that generic advice isn’t enough; we need a system that acts on our data and removes the friction of execution. We are building the partner I wish I had – one that guides you step-by-step,” said Patrycja Brzozowska, founder and CEO of Mos Health. Founded by Brzozowska, Mos Health is a preventive health and lifestyle wellness company. Previously, Brzozowska was the COO and founding team member of Wellbee, a Polish mental health platform for employees, which was acquired in 2024 by Benefit Systems. Brzozowska is joined by Paweł Chrzan (co-founder of Wellbee) and Paweł Sobkowiak (former CTO at Booksy). “As soon as I heard that Patrycja and Paweł were building a new startup, I immediately knew it would be a fit for SMOK. Serial entrepreneurs with a successful exit in Poland and ambitions for a much larger global win—that’s practically our investment template. We decided to back Mos Health within days of meeting the founders, and we’re keeping our fingers crossed for their success in the U.S. market,” said Borys Musielak, Partner at SMOK Ventures. According to Mos Health, today, only 25% of US adults are sufficiently active, and most diets fail due to a lack of sustainable routine. The company claims to close this “execution gap” by providing a system that goes beyond recommendations and offers the physical tools to do it. Its system comprises two key pillars. One is the AI Health Partner (App), which is a dashboard that analyses sleep, diet, lab results, and wearable data (Apple Watch, Oura) to generate personalised health protocols. The second component is proprietary supplementation: a line of supplements manufactured with a partner in the United States, intended to serve as the physical “execution layer” for the application’s recommendations. The company is launching in the U.S. using a B2B2C model, enabling employers to offer “health-as-a-service” to their teams. According to Mos Health, it allows companies to provide access to personalised protocols and supplements as part of a modern benefits package. Early market validation is already underway, with the team signing its first LOIs with Bay Area tech startups. “We’re starting in the U.S. because it’s a market where innovation reaches companies and users much faster. The employee benefit model is a natural fit for us. We spend most of our day at work, and that’s where it’s easiest to introduce lifestyle changes that actually stick,” said Paweł Chrzan, co-founder of Mos Health. The team is supported by external advisors, including commercial advisor Misa Beach, formerly of OpenAI, and clinical advisor Dr Oliver Zolman, a longevity specialist and co-creator of the Blueprint Protocol with Bryan Johnson. The post Polish-American startup Mos Health raises nearly €920k for its AI-powered preventive health and wellness platform appeared first on EU-Startups. |

30/01/2026 09:10 AM | 6 | |

| 52,227 | 30/01/2026 05:42 AM | Amsterdam’s Proba raises €1.25 million to scale fertiliser-related Scope 3 reductions across agri-food supply chains | amsterdams-proba-raises-euro125-million-to-scale-fertiliser-related-scope-3-reductions-across-agri-food-supply-chains | 30/01/2026 | Proba, an Amsterdam-based startup certifying Scope 3 reductions in the agri-food supply chain, has raised €1.25 million to expand into the United States and Brazil. Existing investors Future Food Fund, Yield Lab Europe, and Value Factory Ventures participated in this round. “Our ambition is to make fertiliser-related Scope 3 reductions standard practice in global agri-food supply chains. This funding accelerates that mission by enabling us to operate in the regions that matter most to our customers, particularly the United States and Brazil,” said Sijbrand Tieleman, CEO and co-founder of Proba. Founded in 2022 by Sijbrand Tieleman and Rutger Been, Proba turns fertiliser emission reductions and other climate interventions into certified Scope 3 results. According to the Dutch startup, agriculture is a significant contributor to climate change, with emissions related to nitrogen fertilisers alone accounting for approximately 5% of global greenhouse gas emissions. The company notes that expanding across the Americas presents an opportunity to deliver Scope 3 reductions at scale, in regions where a large share of the world’s food is produced. Proba states that for many staple crops, fertiliser emissions, both from production and in-field use, account for a major portion of their total carbon footprint. While proven low-carbon fertiliser solutions are already available, adoption has been limited due to the cost involved and misaligned incentives across the value chain. According to Proba, it enables agri-food companies to overcome these constraints by making fertiliser-related emission reductions measurable, financeable, and credible across supply chains. Proba delivers certified Scope 3 impact for the agri-food supply chain by converting fertiliser-related emission reductions and other climate interventions into certified Scope 3 results through Impact Units. Impact Units are traceable certificates that quantify, verify, and finance fertiliser-related emission reductions linked to the practices they’re connected to. Each Impact Unit represents one tonne of carbon dioxide equivalent (1 tCO₂e) of verified emissions reduction. According to the company, every Impact Unit is recorded in a blockchain-secured registry and is verified by independent third-party auditors before issuance. “Proba’s approach is designed for credible Scope 3 accounting, aligned with the Science Based Targets initiative (SBTi) and the GHG Protocol (FLAG guidance), with independent verification and a registry that supports traceability,” mentioned the company in the press release. The company’s approach includes identifying high-impact supply chain opportunities and quantifying GHG savings using its science-backed methodologies. The results are then verified by independent auditors in line with SBTi, GHG Protocol (FLAG), and International Carbon Reduction and Offset Alliance (ICROA) standards, after which certified Impact Units are issued. The company then connects the issued certificates to buyers with Scope 3 goals. According to Proba, its blockchain registry and monitoring, reporting, and verification (MRV) tools ensure credible climate claims. Kim Wagenaar, Investment Director at Future Food Fund, commented, “Proba addresses one of the most material and under-accounted sources of emissions in the agri-food sector. Their approach combines strong scientific grounding with a practical pathway for companies to act on Scope 3. We see significant potential for their model as companies face increasing pressure to deliver verified results.” Apart from being used for market expansion into the United States and Brazil, the fresh capital will also help the company strengthen its ability to support global agri-food companies in delivering compliant, traceable, and scalable fertiliser-related emission reductions across major crop value chains, including coffee, corn, potatoes, and sugar. In February 2025, Proba raised €1 million in funding led by Future Food Fund and Yield Lab Europe, with continued support from Value Factory Ventures. Last year, Proba received Conditional Endorsement from the ICROA for its carbon crediting programme. The company claims that its system is audited annually to meet the ICROA Code of Best Practice. The post Amsterdam’s Proba raises €1.25 million to scale fertiliser-related Scope 3 reductions across agri-food supply chains appeared first on EU-Startups. |

30/01/2026 07:10 AM | 6 | |

| 52,225 | 29/01/2026 07:00 PM | A Yann LeCun–Linked Startup Charts a New Path to AGI | a-yann-lecun-linked-startup-charts-a-new-path-to-agi | 29/01/2026 | As the world’s largest companies pour hundreds of billions of dollars into large language models, San Francisco-based Logical Intelligence is trying something different in pursuit of AI that can mimic the human brain. | 29/01/2026 07:10 PM | 4 | |

| 52,226 | 29/01/2026 06:58 PM | Apple buys Israeli startup Q.ai as the AI race heats up | apple-buys-israeli-startup-qai-as-the-ai-race-heats-up | 29/01/2026 | 29/01/2026 07:10 PM | 7 |