Switch Dataset:

Startup News

We are collecting the most relevant tech news and provide you with a handy archive. Use the search to find mentions of your city, accelerator or favorite startup in the last 1,000 news items. If you’d like to do a more thorough search, please contact us for help.

Search for any keyword to filter the database with >10,000 news articles

Filter

Filter search

Results

| id | date | title | slug | Date | link | content | created_at | feed_id |

|---|---|---|---|---|---|---|---|---|

| 52,632 | 20/02/2026 12:30 AM | Nvidia deepens early-stage push into India’s AI startup ecosystem | nvidia-deepens-early-stage-push-into-indias-ai-startup-ecosystem | 20/02/2026 | 20/02/2026 01:10 AM | 7 | ||

| 52,631 | 19/02/2026 11:18 PM | An FBI ‘Asset’ Helped Run a Dark Web Site That Sold Fentanyl-Laced Drugs for Years | an-fbi-asset-helped-run-a-dark-web-site-that-sold-fentanyl-laced-drugs-for-years | 19/02/2026 | A staffer of the Incognito dark web market was secretly controlled by the FBI—and still allegedly approved the sale of fentanyl-tainted pills, including those from a dealer linked to a confirmed death. | 20/02/2026 12:10 AM | 4 | |

| 52,630 | 19/02/2026 09:45 PM | Second and last chance for innovators to win scaling perks: Belden extends nomination window | second-and-last-chance-for-innovators-to-win-scaling-perks-belden-extends-nomination-window | 19/02/2026 | 19/02/2026 10:10 PM | 7 | ||

| 52,629 | 19/02/2026 08:47 PM | Why these startup CEOs don’t think AI will replace human roles | why-these-startup-ceos-dont-think-ai-will-replace-human-roles | 19/02/2026 | 19/02/2026 09:10 PM | 7 | ||

| 52,628 | 19/02/2026 08:45 PM | Donald Trump Jr.’s Private DC Club Has Mysterious Ties to an Ex-Cop With a Controversial Past | donald-trump-jrs-private-dc-club-has-mysterious-ties-to-an-ex-cop-with-a-controversial-past | 19/02/2026 | The Executive Branch has a reported membership list that includes Trumpworld elites like David Sacks. A WIRED review of corporate filings reveals an under-the-radar player: a notorious former DC police officer. | 19/02/2026 09:10 PM | 4 | |

| 52,624 | 19/02/2026 07:59 PM | ‘Pew Pew’: The Chinese Companies Marketing Anti-Drone Weapons on TikTok | pew-pew-the-chinese-companies-marketing-anti-drone-weapons-on-tiktok | 19/02/2026 | On TikTok, Chinese manufacturers are advertising signal-blocking weapons with the breezy cadence of consumer lifestyle advertising. | 19/02/2026 08:10 PM | 4 | |

| 52,625 | 19/02/2026 07:53 PM | Inside the Rolling Layoffs at Jack Dorsey’s Block | inside-the-rolling-layoffs-at-jack-dorseys-block | 19/02/2026 | Workers describe a deteriorating culture at Block, the company behind Square and Cash App, where layoffs continue and employees are expected to use AI tools daily. | 19/02/2026 08:10 PM | 4 | |

| 52,626 | 19/02/2026 07:30 PM | Code Metal Raises $125 Million to Rewrite the Defense Industry’s Code With AI | code-metal-raises-dollar125-million-to-rewrite-the-defense-industrys-code-with-ai | 19/02/2026 | The Boston startup uses AI to translate and verify legacy software for defense contractors, arguing modernization can’t come at the cost of new bugs. | 19/02/2026 08:10 PM | 4 | |

| 52,627 | 19/02/2026 07:12 PM | Perplexity’s Retreat From Ads Signals a Bigger Strategic Shift | perplexitys-retreat-from-ads-signals-a-bigger-strategic-shift | 19/02/2026 | The AI search startup once predicted advertising would be a massive business. Now it's betting on a smaller, more valuable audience. | 19/02/2026 08:10 PM | 4 | |

| 52,623 | 19/02/2026 03:45 PM | German AI infrastructure startup Cognee lands €7.5 million to scale enterprise-grade memory technology | german-ai-infrastructure-startup-cognee-lands-euro75-million-to-scale-enterprise-grade-memory-technology | 19/02/2026 | Cognee, a Berlin-based AI infrastructure company, today announced a €7.5 million funding round to accelerate the development of its structured memory layer for AI systems and agents. The round was led by Pebblebed, with participation from 42CAP as a follow-on investor. Existing and new angel investors also participated. “AI systems today don’t fail because they aren’t powerful enough,” says Vasilije Markovic, Founder and CEO of Cognee. “They fail because they don’t remember. We’re building the memory layer that allows AI to understand context, not just retrieve text.” Recent reporting by EU-Startups shows continued investor appetite for AI infrastructure and adjacent layers across Europe in 2025–2026. In the UK, SurrealDB secured €19 million to scale its multi-model database for AI applications, while London-based Overmind raised €2.3 million to develop a supervision and security layer for AI agents, and Toyo attracted €3.6 million to build secure AI agent workflows. In Germany, Offenburg-based happyhotel raised €6.5 million to develop AI agents for hotel revenue management, providing a same-country comparison point for Berlin-based Cognee. At a larger scale, Finland’s DataCrunch secured €55 million to expand AI cloud infrastructure aimed at strengthening Europe’s compute capacity. Together, these disclosed rounds represent approximately €86.4 million in funding across AI databases, agent supervision and security, workflow orchestration, vertical AI agents and cloud infrastructure. Within this broader 2025–2026 context, Cognee’s €7.5 million raise positions it among a cohort of European startups focused on foundational AI layers, as capital continues to flow into infrastructure that supports production-grade deployment rather than solely end-user applications. “Europe has a strong tradition in building deep infrastructure,” Vasilije adds. “Our ambition is to contribute a core building block to the global AI stack – not another application, but infrastructure that many AI systems can rely on.” Founded in 2024, Cognee is building core AI infrastructure designed for a global developer and enterprise audience. Its technology aims to address one of the most fundamental limitations of today’s AI systems: the lack of long-term, structured memory. The company explains that AI systems rely on stateless approaches such as file-based retrieval or short-term context windows. While effective for simple use cases, these methods break down as workflows become more complex, long-running, and business-critical. Cognee addresses this gap by transforming unstructured data into a persistent, structured memory layer, built on knowledge graphs and semantic representations. This enables AI systems and agents to retain context over time, reason across connected information, and significantly reduce hallucinations in production environments. Cognee originated as an open-source project and has seen rapid adoption within the global developer community. Thousands of engineers already use Cognee to build and operate AI-native applications that require reliable memory and context handling. Today, more than 70 companies are running Cognee in live environments, particularly in knowledge-intensive and regulated domains. The new funding will be used to:

While Cognee’s roots are in Berlin, the company is focused on building foundational AI infrastructure for a global market. The team operates across Europe and the United States and is working closely with developers and enterprises worldwide. The post German AI infrastructure startup Cognee lands €7.5 million to scale enterprise-grade memory technology appeared first on EU-Startups. |

19/02/2026 05:10 PM | 6 | |

| 52,621 | 19/02/2026 03:00 PM | Reload wants to give your AI agents a shared memory | reload-wants-to-give-your-ai-agents-a-shared-memory | 19/02/2026 | 19/02/2026 03:10 PM | 7 | ||

| 52,622 | 19/02/2026 02:43 PM | Co-founders behind Reface and Prisma join hands to improve on-device model inference with Mirai | co-founders-behind-reface-and-prisma-join-hands-to-improve-on-device-model-inference-with-mirai | 19/02/2026 | 19/02/2026 03:10 PM | 7 | ||

| 52,619 | 19/02/2026 02:05 PM | Lightspeed leads $23M investment in AI startup for accounting departments Stacks | lightspeed-leads-dollar23m-investment-in-ai-startup-for-accounting-departments-stacks | 19/02/2026 | A London-headquartered AI startup targeting accountancy departments, set up by a former Uber and Plaid executive, has raised $23 million in a Series A round, led by new investor Lightspeed. The Series A in Stacks also includes returning investors EQT Ventures, General Catalyst, and S16VC. The new round follows 12 months after its $12m seed round. It has raised $35m in total. Stacks, founded in Amsterdam but headquartered in London, is an AI platform for enterprise accounting teams. Its tech is remedying the challenge of scattered data in enterprise finance. It says that transaction-level detail is scattered across ERPs, spreadsheets, data lakes, and legacy systems, forcing teams into manual workarounds because core platforms are slow, difficult to integrate, and not built for AI. Stacks says it has built a data layer that connects directly to finance systems and creates a single, consistent financial view across them. It says it has also built machine-learning tooling required to make automation reliable at enterprise scale and is deploying agents that automate workflows across the finance stack. Its 30 clients include the publisher Future and audio firm Epidemic Sound. Stacks was set up by CEO Albert Malikov, who, before founding Stacks, held product leadership roles at Uber and Plaid, where he worked on scaling Plaid’s European business. Alex Schmitt, partner at Lightspeed, said: "Stacks is uniquely positioned to tackle some of the toughest challenges in enterprise finance. The team’s mix of technical and finance expertise from Uber and Plaid, along with the company’s remarkable traction, gives us strong conviction that they will lead the AI shift inside the Office of the CFO.” |

19/02/2026 02:10 PM | 1 | |

| 52,620 | 19/02/2026 01:24 PM | Google’s new music tool, Lyria 3 is here | googles-new-music-tool-lyria-3-is-here | 19/02/2026 |  Google’s announcement that its Gemini app now writes music for you isn’t just one of those “blowing my mind” product updates. It feels like a symbolic surrender to a long-standing refrain from Big Tech: creative work is now just another checkbox for a machine. If you don’t know what I am talking about, yesterday Google […] This story continues at The Next Web |

19/02/2026 02:10 PM | 3 | |

| 52,612 | 19/02/2026 01:10 PM | Giggle raises funding to expand flexible staffing platform | giggle-raises-funding-to-expand-flexible-staffing-platform | 19/02/2026 | Budapest-based Giggle, a staffing platform connecting blue-collar workers with shift-based roles, has raised an undisclosed funding round to support its expansion into the Romanian market. The round was led by OXO Labs, part of O3 Partners and the family fund of Romania’s Catalyst NXT Ventures, headed by former Hungarian finance minister Peter Oszkó, alongside three additional investors. Founded in April 2022 by Ádám Birizdó and Ádám Sebestyén, Giggle operates a mobile-first workforce marketplace that connects businesses with pre-screened gig workers for short-term, shift-based roles. The platform is designed to address labour shortages and fluctuating staffing needs, particularly in sectors such as hospitality, retail, and logistics. Through the app, employers can post individual shifts with transparent pay and scheduling details, while workers can browse opportunities and apply in just a few clicks. Giggle’s model breaks traditional jobs into discrete, on-demand shifts, helping companies reduce recruitment time and costs while giving workers greater flexibility over when and how they work. The platform integrates ratings, profile verification, and full administrative support to streamline workforce management and improve matching quality between employers and candidates. Positioned within the growing gig economy, the company aims to modernise temporary staffing across Central and Eastern Europe by combining marketplace technology with workforce management tools.

said co-founders Ádám Birizdó and Ádám Sebestyén. The model has gained traction, with 180,000 users registered within three years and nearly €5 million in transactions completed in 2025. According to company data, 70 per cent of workers on the platform are seeking supplementary income, reflecting broader trends driven by economic uncertainty and rising demand for flexible work across the region. With the new funding, Giggle plans to strengthen its presence in its existing markets over the next two years while preparing for broader regional expansion. |

19/02/2026 01:10 PM | 1 | |

| 52,613 | 19/02/2026 01:01 PM | Scopely takes majority stake in Pixel Flow! at $1B valuation | scopely-takes-majority-stake-in-pixel-flow-at-dollar1b-valuation | 19/02/2026 | Scopely, one of the world’s leading mobile gaming companies, has reached a definitive agreement to acquire a majority stake in the Istanbul-based studio behind Pixel Flow!, marking a new unicorn success story from Türkiye. Financial terms were not disclosed, but the multi-year, performance-based deal is reported to value the company at over $1 billion. Launched at the end of 2025 by founders Kübra Gündoğan (CEO) and Emre Çelik (CTO), the hybrid-casual puzzle game Pixel Flow! has gained significant traction within its first year, supported by its puzzle mechanics and hybrid monetisation model, combining in-app purchases and advertising. The game quickly surpassed 10 million players and, over the past 12 months, has been the only casual title to rank among the top 20 highest-grossing mobile games in the United States on a monthly basis. Tim O’Brien, Chief Revenue Officer at Scopely, highlighted the team’s creative approach, rapid iteration cycles and early commercial traction, noting that the investment aligns with Scopely’s strategy of partnering with high-performing studios worldwide. Studio CEO Kübra Gündoğan said the game was built on a vision to deliver a genuinely original experience and noted that strong player feedback has been a key motivator for the team.

she said. The approximately 20-person team will continue operating from Istanbul, further reinforcing Türkiye’s position as a dynamic game development hub in the EMEA region. The studio previously completed a seed funding round with participation from Arcadia Gaming Partners and e2vc. Akın Babayiğit, Managing Director of Arcadia Gaming Partners, described the transaction as one of the most notable success stories in the Turkish gaming sector in recent years. Overall, the partnership is viewed not only as a successful exit but also as a signal of the Turkish gaming industry’s expanding presence on the global stage. |

19/02/2026 01:10 PM | 1 | |

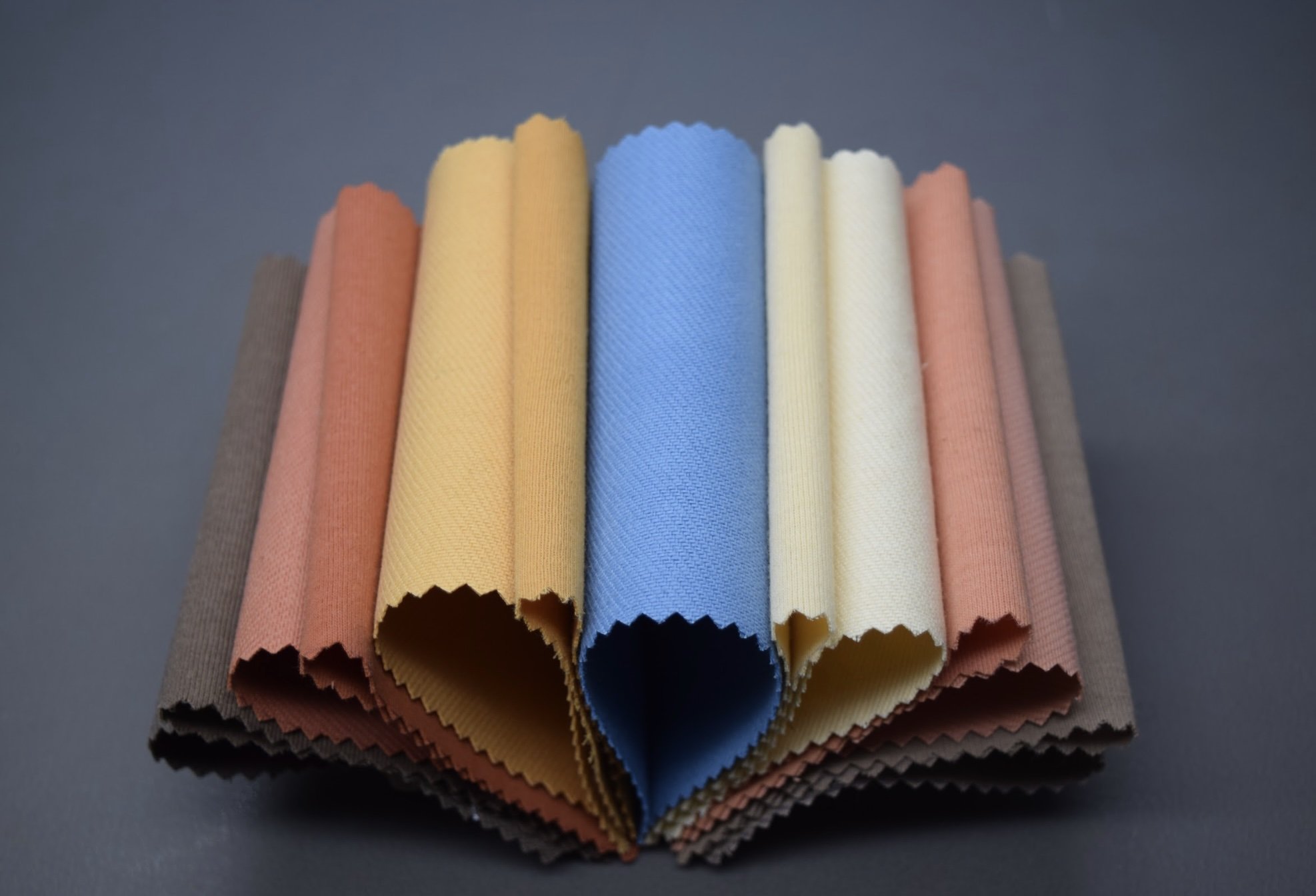

| 52,614 | 19/02/2026 12:43 PM | Can Everdye clean up one of fashion’s dirtiest processes? | can-everdye-clean-up-one-of-fashions-dirtiest-processes | 19/02/2026 | Behind every brightly coloured garment lies a largely invisible cost. Dyeing synthetic fibres can account for up to 60 per cent of the total energy used in textile production, while the global dyeing industry is responsible for nearly 20 per cent of water contamination and around 5 per cent of greenhouse-gas emissions. In a sector built on heat-intensive petrochemical chemistry, French startup Everdye believes it has found a radically different path. The company has developed a new dyeing process that can cut energy consumption by up to 8x — without requiring dye houses to overhaul their machinery. I spoke to CEO Philippe Berlan and CTO Dr Amira Erokh to learn more. From discovery to industrial opportunityEverdye’s founding traces back to the doctoral research of co-founder Dr Amira Erokh. During her PhD, conducted across universities in Tunisia, Portugal, and France, she participated in a NATO-backed project to develop fabrics resistant to biological attack. CEO, Philippe Berlan, explains:

After completing her PhD, Erokh worked in the paint industry in Tunisia before relocating to France for personal reasons. There, she joined an entrepreneurship programme that helped her translate scientific insight into an industrial opportunity. Through extensive conversations with textile industry collaborators, she realised her chemistry could be adapted for dyeing. She began experimenting at home — literally in her laundry room — building the first working prototype there. Everdye was formally founded in 2021, secured early funding in 2022, and began structuring its industrial development soon after. From investor to CEOBerlan initially joined the company as an investor before stepping in as CEO.

Why does conventional dyeing consume so much energy?Traditional textile dyeing relies on forcing chemical bonds between dye molecules and fibres. These strong carbon bonds do not form spontaneously. To make the reaction happen, manufacturers use high heat — often around 130°C — along with petrochemical-based auxiliaries. Deep colours such as black can require six to seven hours of processing. Berlan explained:

The environmental burden is therefore twofold: high emissions from heating, and water pollution from chemical discharge. A magnet-like mechanism at room temperatureEverdye’s process takes a fundamentally different approach to traditional dying. During the standard bleaching step — required before dyeing — fibres naturally develop negatively charged sites. Instead of counteracting that chemistry, Everdye harnesses it. Everdye’s pigment functions almost like a magnet. A pretreatment creates negatively charged anchoring points on the fibres' surfaces; the pigment, which carries a positive charge, instantly locks onto these points. Through electrostatic attraction, the pigment naturally attaches to the fibre at room temperature. Then, during the drying stage — already part of any dyeing process — polymerisation locks the pigment permanently into the fibre. The final attachment strength is comparable to that of conventional dyeing, without the need for prolonged high heat or toxic chemical additives. "The industry needs disruption, not nostalgia”Before petrochemical dyes, textiles were coloured using natural pigments derived from plants, insects, and minerals. While these methods were less industrially intensive, they were difficult to scale and often lacked durability. Berlan is clear that Everdye is not attempting to revive historical techniques.

The environmental and economic valueEverdye’s modelling shows energy reductions of 80–90 per cent compared to conventional dyeing. Production cycles can be three to four times faster. Toxic wastewater treatment is largely eliminated. Depending on the benchmark process, greenhouse-gas emissions can be reduced by 60 per cent to nearly 99 per cent. Unlike conventional methods that rely on hours of high-temperature treatment, Everdye’s process works rapidly at ambient temperature, significantly reducing both energy costs and greenhouse-gas emissions. All pigments developed by the company are bio-sourced, produced exclusively from plant-based or mineral raw materials. The result is almost clean water at the end of the dyeing cycle. This delivers several major advantages:

Long-term, cost parity is central to the strategy. “Our objective is cost parity,” explained Berlan.

The total process becomes competitive, not just environmentally but financially. Easy incorporation into existing production linesThe startup’s primary customers are dye houses. The market is highly fragmented globally, so the company is focusing first on Europe to strengthen the technology and gain operational experience before expanding. A critical advantage is that no new capital equipment is required. Berlan explains:

The company also collaborates directly with apparel brands facing increasing pressure to decarbonise supply chains. Technical complexity and measured scaling

Textile dyeing is among the most technically complex manufacturing processes. Different fibres, colours, and machine types each represent separate technical variables that must be validated independently. “Textile dyeing is extremely complex. You have different fibres, colours, and machinery types — each combination is a separate technical challenge,” says Berlan. Everdye currently offers primary colours, enabling a wide range of shades. Deep black — one of the most technically demanding pigments — remains under development. The pigments are already ready for cellulosic fibres such as cotton, hemp, and linen. Polyester — the world’s most widely used fibre — is in advanced development. The company supports garment dyeing and roll dyeing, while a soluble pigment format for jet dyeing is being developed with strategic partners. The focus is on reliability over speed.

According to Berlan, the biggest barrier facing the sector is cultural and financial rather than technical.

But the environmental and social cost of current dyeing practices is becoming impossible to ignore. Many communities are directly harmed by toxic discharge. The pressure to transform is increasing from regulators, brands, and consumers, and EverDye offers a viable way forward. Lead image: Everdye CEO Philippe Berlan and CTO Dr Amira Erokh. |

19/02/2026 01:10 PM | 1 | |

| 52,616 | 19/02/2026 12:33 PM | Enterprise finance platform Stacks raises €19 million to streamline reporting and month-end workflows | enterprise-finance-platform-stacks-raises-euro19-million-to-streamline-reporting-and-month-end-workflows | 19/02/2026 | Stacks, a British agentic platform for enterprise finance, has raised a €19 million ($23 million) Series A – introducing their new reporting and analysis suite, at the core of which sits their new offering; AI Flux Analysis. The round was led by Lightspeed, with EQT Ventures, General Catalyst, and S16VC doubling down. The round comes less than a year after Stacks’ €10 million ($12 million) seed financing, as covered by EU-Startups. “We started with the most manual and foundational workflows in finance: accounting and the close,” says Albert Malikov, Founder and CEO of Stacks. “From day one, we focused on solving the core problem: fragmented data. By building an AI-ready data layer, we’re unlocking what’s needed to bring AI agents into operational finance, shifting CFO teams from process execution to higher-value analysis and decision-making.” Recent EU-Startups reporting shows continued investor appetite for enterprise AI and adjacent data infrastructure across 2025 and early 2026. Stockholm-based Agaton secured €8.4 million in Seed funding to scale its agentic AI platform focused on converting customer conversations into revenue insights, while Germany’s Blockbrain raised €17.5 million in a Series A round to advance enterprise-grade AI agents that capture and operationalise organisational knowledge. In the UK, London-based SurrealDB announced a €19 million Series A extension to scale its multi-model database infrastructure for AI applications, marking additional British activity in AI-focused enterprise software. Together, these adjacent rounds amount to approximately €44.9 million in disclosed funding, rising to roughly €63.9 million when including Stacks’ €19 million Series A. Collectively, the funding reflects sustained capital flowing into platforms that address fragmented data, enterprise automation and AI deployment within core business functions, situating Stacks’ raise within a broader 2025–2026 enterprise AI investment cycle. “Stacks is uniquely positioned to tackle some of the toughest challenges in enterprise finance,” adds Alex Schmitt, Partner at Lightspeed. “The team’s mix of technical and finance expertise from Uber and Plaid, along with the company’s remarkable traction, gives us strong conviction that they will lead the AI shift inside the Office of the CFO.” Founded in 2024 by former leaders from Uber and Plaid, Stacks is an AI platform for enterprise accounting teams. The company uses AI agents to automate operational finance workflows, including reconciliations, journal entries, flux analysis, and the month-end close. Stacks is used by more than 30 enterprise customers globally, including Volt, Motorway, Cleo and Bloom & Wild, and reportedly reduces close cycles by as much as 50% and saves finance teams over 100,000 hours annually by automating reconciliations, journal entries, and the month-end close. “The time savings are material. We were surprised just how quickly the value showed up,” says Jack Nottage, Head of Finance at Motorway, the online used car marketplace, whose finance team reconciles several thousands of payments weekly and was able to cut time spent handling reconciliation by 40 hours per month within weeks of integrating with Stacks. The company believes that fragmented data remains one of the biggest structural barriers in enterprise finance. Transaction-level detail is scattered across ERPs, spreadsheets, data lakes, and legacy systems, forcing teams into manual workarounds because core platforms are slow, difficult to integrate, and not built for AI. As a result, finance teams spend more time reconciling numbers than operating with real-time visibility. Stacks built its platform by solving this foundation first. The company developed a data layer that connects directly to finance systems and creates a single, consistent financial view across them. It has also built deterministic machine-learning tooling required to make automation reliable at enterprise scale. On top of that foundation, Stacks has deployed agents that automate operational workflows across the finance stack. “With Stacks, we’re saving a noticeable amount of time on the finance close, and as a result we can produce the management accounts faster each month,” said Andy Murray, Head of Finance at Cleo, the AI-native personal finance assistant, who onboarded with Stacks to improve the team’s critical workflows. Cleo now reports 80% faster journal entry processing and the ability to pull data between systems to produce enhanced financial reports within seconds. The company today introduced a new reporting and analysis suite aimed at moving finance teams beyond manual reporting and toward automated business explanation. At the centre of the launch is AI Flux Analysis, a product that automates variance analysis and replaces spreadsheet-based commentary with explainable, account-level investigation. Flux identifies variance drivers across transactions, pulls historical context across periods, and generates explanations that finance teams can review and refine. Stack is also introducing a leadership-ready executive summary, which represents the first layer of a broader intelligence suite for enterprise finance. “We slashed our monthly close time by eight days,” said JP, Global Head of Accounting at global jewelry trading platform, Nivoda. “Journal postings went from days to minutes, and we automated 95% of reconciliations.” The post Enterprise finance platform Stacks raises €19 million to streamline reporting and month-end workflows appeared first on EU-Startups. |

19/02/2026 01:10 PM | 6 | |

| 52,618 | 19/02/2026 12:30 PM | This VC’s best advice for building a founding team | this-vcs-best-advice-for-building-a-founding-team | 19/02/2026 | 19/02/2026 01:10 PM | 7 | ||

| 52,615 | 19/02/2026 12:10 PM | TrueLayer lands eBay "strategic investment" | truelayer-lands-ebay-andquotstrategic-investmentandquot | 19/02/2026 | eBay has made a “strategic investment” in UK open banking fintech TrueLayer, the UK fintech announced today. eBay has made the investment through its VC arm, eBay Ventures, joining existing TrueLayer investors Stripe, Tiger Global, Tencent and Temasek. TrueLayer did not provide details about the size of the investment. TrueLayer said: "For TrueLayer, it represents both a commercial and strategic leap forward - one that underscores how execution and innovation continue to set the company apart.” TrueLayer last publicly raised in 2024, raising a $50m round, in a funding round that lost it its unicorn status, according to reports. Today's investment was announced as TrueLayer announced an open banking payment partnership with eBay at online checkout, as an alternative to card payments. TrueLayer's other merchant partners include Amazon and Ryanair. Francesco Simoneschi, CEO and co-founder, TrueLayer, said: "By integrating directly into eBay’s checkout, we’re enabling instant, bank-authenticated payments at scale that allows merchants to benefit from a faster and more streamlined payment experience. This is another step towards a real-time payments ecosystem that aligns with modern consumer expectations.” Avritti Khandurie Mittal, vice president of product for eBay services, said: “Pay by Bank represents an important step in diversifying our payment mix with a secure, real-time way for buyers to pay directly from their bank accounts.” In the year ending 2024, TrueLayer’s revenues came in at £20.3m, compared to £12.4m in 2023. TrueLayer made a pre-tax loss of £38.6m in 2024, a reduction on the £55.6m loss it made in 2023. |

19/02/2026 01:10 PM | 1 | |

| 52,617 | 19/02/2026 11:31 AM | Stockholm-based Agaton secures €8.4 million to turn customer conversations into revenue insights | stockholm-based-agaton-secures-euro84-million-to-turn-customer-conversations-into-revenue-insights | 19/02/2026 | Emerging from stealth, Agaton, a Swedish agentic AI platform identifying and actioning sales opportunities based on customer conversations, today announced it has raised €8.4 million ($10 million) in total Seed funding. The Seed round was co-led by Inception Fund and Alstin Capital, with participation from seed+speed Ventures and Foundry Ventures. The rounds also attracted investments from Peter Sarlin (Silo AI), Kieran Flanagan (CMO at Hubspot and investing as a scout for Sequoia Capital), Sebastian Knutsson (co-founder of King), Lukas Saari (co-founder of Tandem Health), and angel investor Guillermo Flor. Andreas Kullberg, CEO and co-founder of Agaton, says: “We’re delivering AI-powered sales superiority. The companies winning today aren’t those with the biggest sales teams; they’re those with the smartest ones, augmented by AI that transforms every customer interaction into strategic intelligence. This funding accelerates our mission: making enterprise sales and service teams genuinely unstoppable.” In the context of European AI and enterprise software funding in 2025–2026, Agaton’s €8.4 M Seed round adds to a series of investments into AI-powered business tooling:

Together, these rounds – spanning approximately €27 million – illustrate continued investor interest in enterprise AI applications and automation tools across Europe, with Agaton’s funding round contributing to that broader trend by advancing agentic AI specifically tailored to sales conversation and revenue intelligence. Erik Lindblad, Partner at Inception Fund, adds: “Andreas, John and the Agaton team have built something rare: an AI product that solves a critical enterprise pain point with immediate, measurable impact. Their ability to sign millions in ARR within a year, while maintaining fanatical customer focus, speaks to both the founders’ execution and market demand for true revenue intelligence.” Founded in 2024, Agaton builds secure, domain-specific AI agents that integrates seamlessly with existing enterprise systems, delivering both human augmentation and full AI automation designed for revenue growth and operational excellence. Agaton’s co-founders Andreas Kullberg (CEO) and John Kristensen (COO), alongside the company’s CTO Yi Fu, bring decades of experience in enterprise AI transformation for sales and customer service. Their combined expertise and the team’s experience spans scaling global sales operations at EF Education First, driving tech-enabled growth at UK’s largest insurer Aviva, H&M, Volvo Cars and Tele2 as well as building AI and data capabilities at leading technology companies including Tink, King, and Gillion. Today’s investment will accelerate the company’s go-to-market strategy, AI capabilities, and product development. In the year ahead, Agaton plans to more than double its team size and establish additional global hubs to meet the needs of an expanding international client base. Benjamin Kleinschnitz, Senior Investment Manager at Alstin Capital, adds: “Agaton’s software delivers something many competitors simply don’t: it doesn’t just understand what customers say, but how they say it and can therefore detect real buying and churn signals. It turns millions of real customer conversations into concrete next steps for service and sales teams, with a direct impact on revenue and retention. This product edge was a key factor in our decision to lead the round as lead investor.” According to the company, enterprises base internal and external decision-making on imperfect data and sampling, market research or data analytics fraught with assumptions. By correlating quantitative and qualitative insights across all customer interactions, the platform enables companies to identify buying signals, tailor offerings in real time, and uncover opportunities that traditional tools miss. It lays the foundation and automates how you support, train, and develop your human and AI agents to best serve your customers, guides your product and pricing strategies, and ultimately how you achieve sales superiority in hyper-competitive markets. Unlike conventional conversation intelligence solutions that simply transcribe calls, Agaton says their proprietary AI sales intelligence engine detects sentiment shifts, identifies buying signals in real time, delivers AI-powered coaching that scales elite sales performance across entire teams, automates quality and sales assurance, and uncovers value from unstructured customer data. In just over a year since founding, Agaton has secured millions in signed ARR, now powering sales for leading Nordic enterprises across telecom, financial services, and utilities – including Telenor, Telia, Lendo, and Axo Finans. The company has also partnered with Foundever, the world’s third-largest business process outsourcer with 150,000 agents globally. To date, Agaton has:

The company specifies that they do not collect, store, or sell customer data. Instead, the platform empowers organisations to securely unlock the value of their own data, turning everyday conversations into actionable intelligence while maintaining full ownership and control. The post Stockholm-based Agaton secures €8.4 million to turn customer conversations into revenue insights appeared first on EU-Startups. |

19/02/2026 01:10 PM | 6 | |

| 52,608 | 19/02/2026 11:00 AM | Inside the Gay Tech Mafia | inside-the-gay-tech-mafia | 19/02/2026 | Gay men have long been rumored to run Silicon Valley. WIRED investigates. | 19/02/2026 11:10 AM | 4 | |

| 52,610 | 19/02/2026 10:50 AM | “From Germany, for the world” – Plato secures €12.2 million to automate sales and ERP workflows in distribution | from-germany-for-the-world-plato-secures-euro122-million-to-automate-sales-and-erp-workflows-in-distribution | 19/02/2026 | Berlin’s Plato, an AI-based operating system for wholesale distributors, today announced the successful closing of its €12.2 million ($14.5 million) Seed funding round in order to transform the €2.5 trillion ($3 trillion) global trading industry through AI. The round was led by European VC firm Atomico, with prior investors, including Cherry Ventures, who doubled down. This follows their 2024 €6 million pre-Seed round, as covered by EU-Startups. “We saw the problems first hand in my familyʼs distribution business and developed Plato with top-tier technologists to rethink the way the industry operates. Weʼre building the AI operating system for distributors, starting with intelligent sales automation. With this funding, weʼre scaling Plato to build a tech champion for the trade economy – from Germany, for the world,ˮ says Benedikt Nolte, CEO at Plato. In the 2025–2026 period, EU-Startups has reported several funding rounds in adjacent segments to Plato’s AI-enabled wholesale operating system. In February 2026, Berlin-based Andercore secured €33.5 million to scale its AI-driven industrial trade platform across Europe, expanding digital supply and demand workflows in complex industrial categories; notably, like Plato, Andercore is headquartered in Germany. In June 2025, Amsterdam’s Delfio raised €1.5 million in pre-Seed funding to develop its automation platform for the international wholesale market, focusing on streamlining procurement and aggregating demand. Meanwhile, London-based Platter closed a €411k pre-Seed round to build an all-in-one wholesale food platform aimed at reducing inefficiencies in ordering and supply. Taken together, these rounds amount to approximately €35–36 million in disclosed funding flowing into AI-enabled trade, wholesale and B2B operational platforms across Europe during 2025–2026. Within this context, Plato’s €12.2 million Seed round aligns with a broader pattern of investment into vertical software solutions targeting distribution, procurement and sales automation, with Germany emerging as one of the active hubs in this segment. “What convinced us most about Plato is the rare quality of the founding team. This team truly has a ‘right to win’ in this space, a burning passion for distributors and trade. They bring deep, first-hand industry expertise together with strong technical execution and the ambition to build a category-defining vertical AI company. Wholesalers are urgently looking for industry-specific AI software to solve operational challenges, and Plato is the solution,ˮ adds Andreas Helbig, Partner at Atomico. Founded in 2023, Plato develops AI-native software that automates core workflows in sales, quoting and ERP operations for distribution businesses. Plato outlines that this is an industry that touches every 5th dollar of the global production output, yet remains critically underserved by modern software. The company was founded by Benedikt Nolte, Matthias Heinrich Morales and Oliver Birch. They initially built the platform within Benedikt’s family wholesale distribution business, which had been struggling with legacy software systems and labour shortage. According to the company, the distribution sector is under increasing pressure due to labor shortage, low margins, stagnating economy and the digital expectations of modern B2B buyers. Plato looks to replace manual sales and ERP workflows with agentic AI that directly drives revenue and efficiency.

Their solution empowers sales teams with an AI copilot, reportedlyboosting profits, and increasing sales efficiency via AI agents. The platform unlocks hidden ERP data and automates manual tasks so sales teams can move from reactive to proactive selling. Plato has achieved early success, closing distribution businesses with 6-figure average contract values (ACV). The funding will enable Plato to expand its vertical product offering into customer service and procurement, while supporting its international expansion. Key platform capabilities include:

The post “From Germany, for the world” – Plato secures €12.2 million to automate sales and ERP workflows in distribution appeared first on EU-Startups. |

19/02/2026 12:10 PM | 6 | |

| 52,611 | 19/02/2026 10:30 AM | Why European startups are sleepwalking into a talent crisis | why-european-startups-are-sleepwalking-into-a-talent-crisis | 19/02/2026 | European tech has a hiring problem that nobody wants to talk about. While founders obsess over landing senior engineers and AI specialists, they are quietly abandoning the pipeline that produces them. The numbers are stark. According to Ravio’s 2025 Tech Job Market Report, entry-level positions in European tech have seen a 73% decrease in hiring rates over the past year. That’s not a dip. That’s a collapse. And while overall hiring rates have declined by only 7%, the bottom of the funnel has essentially disappeared. Founders making hiring decisions today are creating problems they will not feel for another three to five years. By then, the mid-level talent gap will be impossible to fill at any price. The entry-level experience paradoxSomething strange has happened to junior roles. According to TalentUp’s analysis, many positions labelled “entry-level” now require three to five years of experience. Unrealistic prerequisites now gatekeep junior roles that once trained and developed raw talent. The dynamics vary across Europe. Germany maintains strong apprenticeship models in traditional trades but lacks a scalable equivalent for tech. France’s government-sponsored training programmes often fall short of connecting talent to real jobs. In the UK, inflation limits startup hiring budgets. In Scandinavia, title inflation masks the issue, as junior positions are rebranded with mid-level expectations. Meanwhile, ATS and AI-driven recruitment systems scan CVs for keywords, filtering out applicants without prior experience before they are even seen by a human. The result is a bottleneck of frustrated young professionals across Europe, holding degrees in computer science and data analytics but unable to get their foot in the door. The AI paradox making things worseAI tools are accelerating the problem. Senior engineers using AI assistants can now handle tasks that would previously have gone to juniors. The temptation to skip entry-level hiring entirely has never been stronger. But this logic has a fatal flaw. As AWS CEO Matt Garman put it: “That’s like one of the dumbest things I’ve ever heard. How’s that going to work when ten years in the future you have no one who has learned anything?” Garman’s point cuts to the heart of the issue. Juniors are not just cheap labour for repetitive tasks. They are the training ground for tomorrow’s senior engineers, engineering managers, and CTOs. Skip that layer, and you are not saving money. You are borrowing against your future leadership pipeline. The SignalFire State of Talent Report found that new graduates now make up under 6% of startup hires, down more than 30% from pre-pandemic levels. The share of new graduates landing roles at major tech companies has dropped by more than half since 2022. The compounding cost of inactionThe talent shortage is not abstract. Jobbatical’s research projects that Germany alone will face a shortage of seven million skilled workers by 2035. EU-based companies already report labour shortages as a challenge at a rate almost 30% higher than their counterparts in North America and Asia. For founders, this creates a vicious cycle. Senior talent becomes more expensive and harder to find. Competition for experienced engineers intensifies. And the pool of mid-level candidates who might have grown into senior roles simply does not exist because nobody hired them five years ago. The Ravio report captures it well: “If you don’t hire and nurture young talent now, what will your mid-level and leadership positions look like in five years? We’re heading towards some very difficult and expensive recruitment to fill that gap.” What smart founders do differentlyThe founders, thinking long term, are treating junior hiring as R&D investment, not overhead. They understand that the economics of building senior talent internally almost always beat the economics of competing for it externally. This means structured graduate programmes, hire-to-train models, and rotational roles that develop raw talent into company-specific expertise. It means pairing junior hires with AI tools rather than replacing them with AI tools, recognising that the juniors who learn to work alongside AI will become the most valuable senior engineers of the next decade. It also means rethinking job requirements. The “entry-level experience paradox” is a self-inflicted wound. Companies that remove unrealistic prerequisites and invest in onboarding access talent pools their competitors have written off. The European startup ecosystem has matured dramatically. The founders building companies today face more sophisticated competition for talent than any previous generation. Those who recognise that today’s juniors are tomorrow’s senior pipeline will be the ones still scaling five years from now. The rest will be wondering where all the mid-level talent went. The post Why European startups are sleepwalking into a talent crisis appeared first on EU-Startups. |

19/02/2026 12:10 PM | 6 | |

| 52,605 | 19/02/2026 10:05 AM | Tingit raises €1.5M to scale AI-powered repair platform across Europe | tingit-raises-euro15m-to-scale-ai-powered-repair-platform-across-europe | 19/02/2026 | Tingit, a startup transforming how we repair fashion and electronics, has raised €1.5 million investment round to take its AI-driven repairs platform across the European Union. Led by Coinvest Capital and joined by Firstpick, NGL Ventures, and previous investors Heartfelt (Germany), BADideas (Latvia), and Purpose Tech (Czech Republic), the funding marks a major step toward making high-quality repair a seamless daily habit rather than a logistical headache. Tingit’s mission is to make repairing items a seamless daily habit. The company’s primary technological focus is an AI-driven algorithm that automatically detects damage in a user-uploaded photo, instantly matches it with the right expert, and provides an accurate price and timeline estimate. With Tingit, a user simply uploads a photo or video of the damaged item and receives a repair quote after the AI and craftsmen have evaluated the work. Items are sent via parcel lockers using a label generated by the platform. "We want users to get offers even for very niche repairs anywhere in the EU. We’re starting to collaborate with fashion brands and e-commerce platforms so that Tingit becomes a natural part of the commercial infrastructure — it is what we call a ‘longevity protocol’ for your belongings," says Indrė Viltrakytė, CEO and co-founder of Tingit. She shares that the idea for Tingit was born in the ultimate startup fashion - at a café:

Since its launch in 2024, Tingit has raised a total of €2.02 million in external funding. In its first year, the platform successfully established itself in Lithuania and expanded into France; its network now connects over 100 skilled makers across Lithuania, France, and Poland. To date, more than 14,000 customers have used the platform to appraise items valued at over €9 million — ranging from €20 sneakers to a €15,000 Hermès handbag. While shoe and handbag restorations are currently the most popular, Tingit is seeing a surge in requests for household appliances, audio equipment, eyewear, and luggage. The founders encourage professional repairers interested in growing their businesses to join the network. Viktorija Trimbel, Managing Director of Coinvest Capital, shared:

Tingit’s mission is both environmental – preventing overconsumption – and emotional. While repairing saves money and reduces the carbon footprint, users often simply want to preserve items tied to meaningful memories. |

19/02/2026 10:10 AM | 1 |